The Emerging View

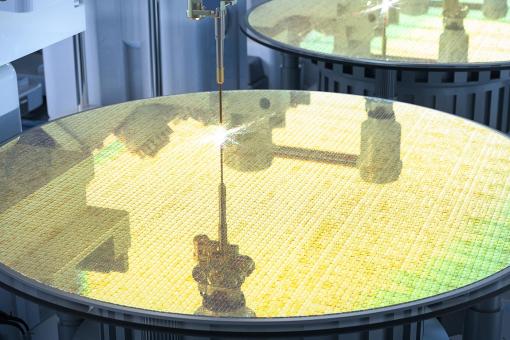

Latin America: Monroe Doctrine 2.0 amid a transition to the right

With politics shifting back towards the market-friendly right, earnings growth improving and the outlook for commodities becoming structurally bullish given the ongoing arms race for AI, defence and energy, Latin America is again back on investors’ radars