- The US launched a major military operation in Venezuela. President Nicolás Maduro and his wife, Cilia Flores, were seized and flown to New York to face criminal charges.

- The AI trade has regained momentum.

- Kevin Hasset remains favourite to be Trump’s pick for the next Federal Reserve chair, which will be announced this month.

- Despite new sanctions, Russian crude exports remain robust, held up by Asia.

- Korea announced temporary tax incentives to encourage repatriation of overseas retail investments in a bid to support the Won.

- Argentina’s senate approved the first budget of the Milei administration.

- Fitch upgraded Ukraine’s FX rating to ‘CCC’ from restricted default following the restructuring of GDP warrants and agreement on a large EU loan package.

- Fitch downgraded Gabon to ‘CCC-’

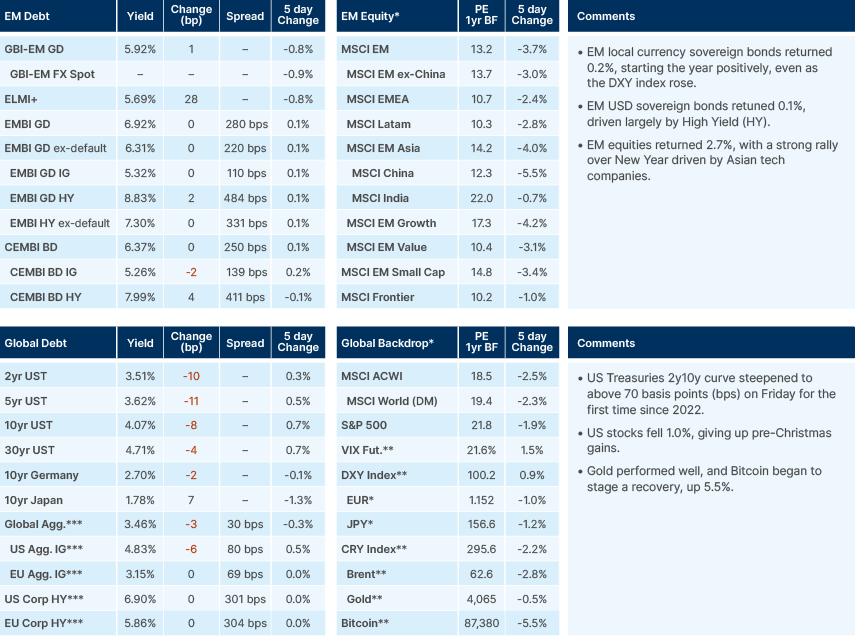

Last week performance and comments

Global Macro

The first full trading week of the year is upon us and after a very strong 2025, momentum behind emerging market (EM) assets remains positive. The MSCI EM index rose 34% in 2025 in total return terms and EM equities have started this year strongly. After a dip in December, Asian semiconductor stocks are trading particularly well, as sales continue to surge and investors become more optimistic on the length of the artificial intelligence (AI)-driven tech cycle. Korean data showed a 43% surge in December semiconductor exports yoy, underscoring that, despite jitters around AI overinvestment, spending continues to accelerate fast. Taiwan Semiconductor Manufacturing Company is due to report earnings next week, which will help further shape expectations on semiconductor demand globally over the coming quarter. Renewed optimism also helped the S&P 500 reach a new all time high on Boxing Day, boosted by strong Q3 GDP data, which showed 4.3% growth, above all estimates.

EM local currency sovereign bonds also performed well in December, rising for the fifth consecutive month, to post an annual gain of 19.3%. Strength has continued for the first two trading days of the year, with EMFX holding up well despite some Dollar strength against the Euro. EM USD sovereign bonds rose 14% in 2025, driven by a combination of duration returns as US Treasury (UST) yields fell, and significant spread tightening particularly among high-yield issuers. We attach our 2026 outlook for further detail on how we see strong EM cross-asset performance persisting this year.1

From a global macro perspective, the most important datapoint this week will be December’s US nonfarm payrolls coming on Friday. The timing and quality of labour market data in the past few months has been affected by the US government shutdown; however, the trend remains firmly negative. The unemployment rate is currently running at 4.6%, a four-year high. Payroll gains continue to be almost entirely driven by the education and healthcare sectors. Indeed, ex education and healthcare, private payrolls contracted in 2025. We think the impact of AI on various sectors in the US can bring further downside surprises to hiring throughout 2026, particularly in logistics and business services.

A continuation of this trend could bring more rate cuts in 2026 than the two that are currently priced, an outcome which will become more likely should US President Donald Trump appoint Kevin Hassett as new Federal Reserve (Fed) Chair later this month. Hassett remains the favourite in betting markets to assume the role from June 2026, when Jerome Powell’s term ends. The likelihood of Hassett assuming the role and moving the Fed in a more dovish direction has begun to be priced into the UST curve, with the 2y10y curve steepening to above 70 bps on Friday for the first time since 2022. An environment where the Fed continues a dovish bias is likely to weigh on the USD, particularly as the European Central Bank (ECB) seems unlikely to cut rates again this year, and the Bank of Japan (BoJ) is likely to hike rates further.

Despite a 20bp rise in the US10y yield over the past month, the US MOVE index, which calculates the implied volatility of US treasury yields over the next month, is currently at levels not seen since 2021. The VIX index, which does the same for US stocks, is also at muted levels - highlighting stable macro conditions as 2026 begins, underpinned by expectations of further monetary easing this year as US inflation moderates.

Inevitably, the world’s attention this Monday has converged around Venezuela after the US military and law enforcement forces seized Nicolás Maduro and his wife over the weekend from a compound in Caracas. They have now been extradited them back to the US to face trial. We cover Venezuela in more detail below in our Geopolitics section, including the potential implications for defaulted sovereign debt instruments.

Geopolitics

On 3 January, the US launched a major military operation in Venezuela. President Nicolás Maduro and his wife, Cilia Flores, were seized and flown to New York to face criminal charges, including alleged ties to narco-terrorism networks. This was a significant US intervention, with consequences that will unfold over time amid substantial political and operational uncertainty.

In a press conference, Trump suggested the US would “run the country” until a “safe” transition, with plans to direct “billions” in private investment to repair oil infrastructure and expand exports. Trump also cast doubt on opposition leader María Corina Machado returning to lead Venezuela, implying engagement with Vice President Delcy Rodríguez, rather than an immediate opposition-led transfer of power. Rodríguez was appointed de-facto president by the Venezuelan Supreme Court yesterday. She initially demanded Maduro’s immediate release, then later signalled more openness to working with the US. US Secretary of State Marco Rubio emphasised leverage through sanctions, constraints on oil and gas exports, and the illicit drug flows.

The surgical operation and smooth transition of power so far bode well for Venezuelan assets. The market is also likely to take comfort from the fact that Delcy Rodriguez was instrumental in increasing oil production to near one million barrels per day (bpd) despite sanctions due to a pragmatic approach to dealing with the private sector. Ongoing US involvement, potentially including US oil majors, could increase the odds of political-economic normalisation, allowing for a debt restructuring. We believe Venezuelan sovereign bonds (VENZ) and Petróleos de Venezuela, S.A. (PDVSA) debt will appreciate significantly in the near term. Early dealer runs indicate prices are up roughly 7–8 points in the first hours of London trading, a meaningful increase for bonds that traded last week in the high-20s to low-30s.

These defaulted instruments are priced largely on the probability and timing of a restructuring and ultimate recovery values. The events over the weekend mean both have improved. Importantly, downside scenarios, including a prolonged and disorderly conflict, appear less likely. Final recoveries will ultimately hinge on oil prices and production, key to economic recovery. JP Morgan estimates that production could rise by circa 250k bpd from a 2025 average of 950k bpd in the short term and reach circa 1.3–1.4 million bpd within two years. This could be a conservative estimate in our view, as Venezuela has produced as much as 3mn barrels of oil per day in the past.

The IMF last estimated Venezuela’s nominal GDP at USD 82bn in 2025 versus around USD 100-120bn in 2024. These estimates are also seen as conservative, and we are likely to see meaningfully higher GDP numbers from these levels with increased oil production and investment, a broader normalisation of the economy, and improved data availability.

While a precise accounting of external debt is needed to more accurately estimate potential recovery values, we believe a range of USD 150-170bn is a reasonable starting point for gross external debt, noting that a significant portion is held locally by the public sector. The bonded debt principal stands at USD58bn, with estimated PDI (past due interest) approaching 80% of that. These numbers, while uncertain, illustrate why recovery values can be higher than implied by markets prior the weekend’s events.

Iran

Supreme Leader Ayatollah Ali Khamenei warned that “rioters must be put in their place” following a week of nationwide protests driven by economic distress, a signal widely interpreted as authorising a tougher security response. At least 15 people have reportedly been killed, according to human rights groups, and demonstrations show little sign of abating. The unrest has taken on a sharper geopolitical dimension after President Trump warned that the US would “come to the rescue” if peaceful protesters were violently suppressed, prompting angry reactions from Iranian officials, including threats against US forces in the region. Tensions were further heightened after the US military captured Venezuela’s President Maduro, a close ally of Tehran.

Commodities

Oil

Brent spot prices fell marginally from USD 61 on Friday to USD 60 on Monday morning, after news that the US military and law enforcement agencies had captured Maduro and would now take a more direct involvement in boosting Venezuelan oil production, facilitated by US oil companies. The news gives upside potential to long-term supply from Venezuela, which is currently producing around 1 million bpd. However, by the end of the day, prices had recovered. Bringing Venezuelan oil production capacity back towards its potential will be a long-term project which is unlikely to affect global oil supply/demand balances materially in the coming months, hence the muted price action. Venezuela has the largest untapped oil reserves in the world, but Venezuelan oil currently represents less than 1% of global supplies, and the market is already in the midst of a swelling supply glut.

Despite the expansion of sanctions and the expiration of the transition window on 21 November 2025, Russian crude flows into Asia have remained remarkably resilient, running at around 5.4 million bpd in early December, similar to last year’s levels. China and India continue to import substantial volumes of Russian crude, particularly from Rosneft, which has more than offset the reduction in Lukoil exports. Rosneft has developed a robust infrastructure to navigate the evolving regulatory environment, including a broad network of intermediaries, an extensive fleet, and well-established shipping chains. These strengths have supported the continued flow of Rosneft’s crude, even as Lukoil’s exports have declined. Türkiye is currently the only market closely following the new guidelines.

Emerging Markets

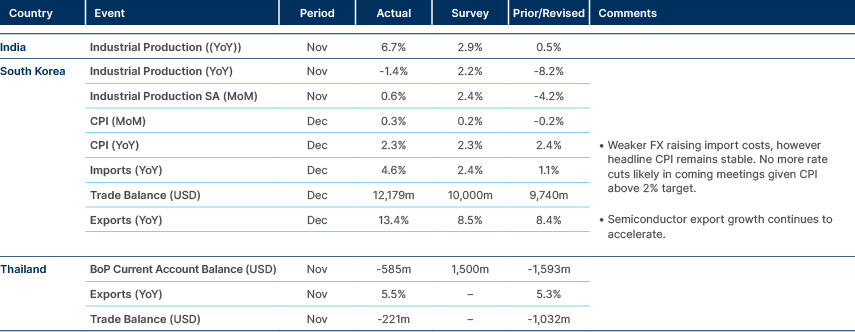

Asia

South Korea: The government announced temporary tax incentives to encourage repatriation of overseas retail investments, alongside verbal FX intervention to counter excessive Won weakness. The measures mark a shift toward directly targeting retail capital flows to stabilise the currency and support domestic markets, complementing steps by institutional investors to increase FX hedging.

Pakistan: The government secured USD 511.5m in foreign loans in November, driven by bilateral inflows from Saudi Arabia and China and strong issuance of Naya Pakistan Certificates, while multilateral disbursements lagged. Cumulative external borrowing remains well below annual targets, leaving planned bond and commercial bank financing still outstanding. Together with IMF inflows, the loans have helped lift FX reserves to their highest level since early 2022.

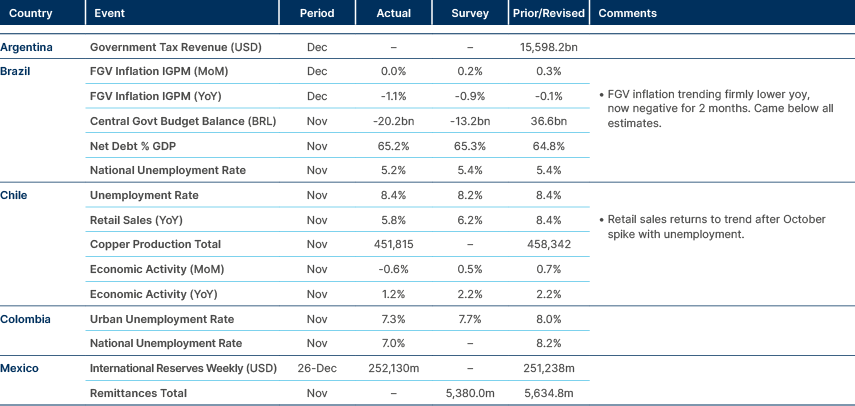

Latin America

Argentina: The Senate approved the first budget of the Milei administration, marking a shift from rule by decree toward legislative negotiation and helping anchor his austerity agenda in law. The budget passed with a wide margin after lawmakers added funding for universities and disability payments, concessions President Javier Milei accepted, while still implying real spending cuts across most ministries. Approval was a key IMF condition for continued support and comes alongside efforts to rebuild FX reserves, including a USD 10–17bn reserve accumulation plan for next year and a USD 20bn US-backed currency swap. Congress also passed a fiscal amnesty aimed at drawing undeclared cash back into the banking system, addressing chronic financial disintermediation. Despite a strong midterm showing, Milei remains short of a congressional majority, leaving him reliant on opposition support as he pushes more contentious reforms, notably labour market changes. Proposed labour reforms would cap severance pay, limit strikes in essential services, and promote alternative compensation schemes, which the government argues are critical for investment but have triggered union protests. With Congress reconvening in February for extraordinary sessions, labour reform now represents the key near-term test of Milei’s ability to translate shock-therapy economics into durable legislation ahead of the 2027 election cycle.

Colombia: President Gustavo Petro announced a 23% minimum wage hike, the biggest since the 1980s. This is meant to ensure those earning minimum wage will be receiving what is calculated to be a living wage, said Petro. At a time when fiscal pressures are acute, this policy is likely to increase stress on Colombian bond yields and the currency. The Constitutional Court will review Petro’s emergency economic decree only after its January recess, allowing new tax measures to remain in force temporarily despite a high likelihood of being struck down. The delay highlights acute liquidity pressures following Congress’s rejection of tax reform and increases policy uncertainty in early 2026.

Mexico: Non-oil exports rose 10.5% yoy in November, marking a third consecutive double-digit gain and pushing the 12-month trade balance into surplus for the first time since 2021. Strength was driven by non-auto manufacturing exports and resilient imports of intermediate goods, suggesting trade made a stronger contribution to late-2025 growth than expected. Separately, consumer price index (CPI) inflation slowed to 3.72% yoy in December, aided by non-core disinflation, but core inflation remains elevated, reinforcing concerns that convergence to the 3% target will take time.

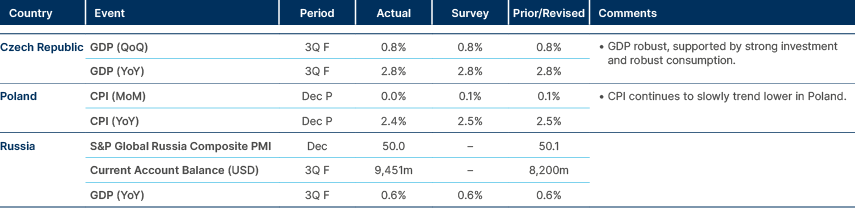

Central Eastern Europe

Hungary: Banking sector profitability rebounded sharply in November, with net profit almost doubling yoy as provisioning costs fell and net interest income returned to growth. While cumulative profits remain lower yoy, the November print suggests pressure on bank earnings may be easing as funding costs stabilise and loan growth remains solid. Separately, Márton Nagy, the Minister for the Economy, signalled that falling inflation has opened room for rate cuts in 2026, implicitly criticising the central bank’s tight stance and strong Forint bias. Nagy argued that high rates are increasingly a fiscal burden and reiterated the need for economic diversification beyond Germany and autos, while maintaining confidence in a cyclical recovery next year driven by new industrial capacity and strong real wage growth.

Kazakhstan: The government plans to issue USD 300–400m in panda bonds in early 2026 and a further USD 1.5bn eurobond next summer to help finance the budget deficit. The strategy reflects deepening financial ties with China alongside continued access to international capital markets, following USD 4bn of issuance in 2025. While issuance plans are not unusual for Kazakhstan, they underscore a more active external funding stance amid elevated fiscal needs.

Romania: Economic sentiment recovered sharply mom in November, almost reversing the prior month’s decline, driven mainly by improved hiring conditions. Inflation expectations continued to ease and FX depreciation expectations softened, but growth forecasts for 2025–26 remain below 1%, consistent with a prolonged and shallow exit from stagflation. Analysts marginally raised the 2025 deficit forecast to 8.4% of GDP, and see only gradual consolidation thereafter, with public debt expected to rise further but ratings broadly stable over the next year.

Ukraine: Fitch upgraded the sovereign’s FX rating to ‘CCC’ from restricted default following the restructuring of GDP warrants and agreement on a large EU loan package. With around 94% of commercial external debt now restructured, near-term debt service pressures are manageable and reserves remain adequate, though the rating continues to reflect substantial wartime risks. The upgrade improves Ukraine’s formal credit standing but does not materially change Ukraine’s dependence on official financing.

Middle East & Africa

Morocco: The government approved a 5% increase in minimum wages from 2026, in line with earlier tripartite agreements, taking cumulative private sector minimum wage increases to around 20% since 2021. With inflation currently low, the move should support real incomes and consumption, though it raises cost pressures for SMEs and agricultural employers. The policy reinforces the government’s broader social agenda while testing firms’ ability to absorb higher labour costs.

Gabon: Fitch downgraded Gabon to ‘CCC-’, citing widening fiscal deficits, liquidity strains and rising arrears following post-coup spending increases. Access to regional markets has deteriorated, domestic amortisations are large, and an IMF programme is viewed as unlikely amid policy slippage and political sensitivities. Public debt is projected to rise sharply above peer levels, while growth is expected to slow once the fiscal impulse fades.

Kenya: The Treasury released a draft 2026 Budget Policy Statement that reiterates commitment to growth-friendly consolidation but widens the deficit target to 5.3% of GDP due to weaker revenue performance. Budget execution through October shows significant revenue shortfalls and modest expenditure overshoots, with financing increasingly reliant on domestic borrowing. Medium-term plans emphasise tax compliance, non-tax revenue mobilisation and spending restraint, but declining revenue ratios and rigid recurrent costs underline the challenge of sustaining consolidation.

Sub-Saharan Africa (Regional): The Trump administration recalled 15 African ambassadors as part of a broader diplomatic shake-up, raising concerns about reduced US engagement on the continent. Analysts warn the move could weaken US influence at a time when China, Russia and Gulf states are expanding their presence, potentially altering geopolitical and financing dynamics for several African countries.

Developed Markets

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

1. See – “2026 Emerging Markets Outlook”, The Emerging View, 2 December 2026.