- US CPI inflation showed tariff pass-through still muted in most sectors, although goods inflation rose to 1.3yoy, from negative territory in March, indicating an upwards trend.

- China’s July economic activity data weaker than expected, with industrial production and retail sales growth both below consensus. Stocks rallied.

- Trump met with Putin in Alaska on Friday, Zelenskyy and European leaders travel to Washington today.

- The International Energy Association (IEA) pronounced a record oil supply glut in 2026.

- S&P upgraded India’s sovereign rating to ‘BBB’ from ‘BBB-’.

- Japanese five-year government bond auction demand fell to its weakest since 2020.

- Moody’s upgraded Pakistan’s sovereign rating to ‘Caa1’ with a stable outlook.

- Brazil’s July inflation slowed more than expected, with prices rising 5.2% yoy. The moderation gives the central bank more room to consider gradual easing later this year.

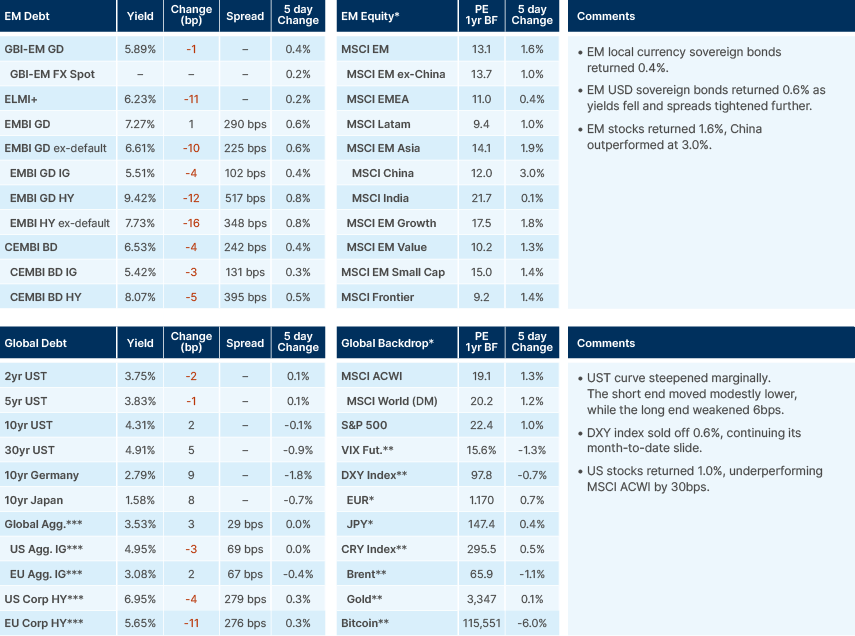

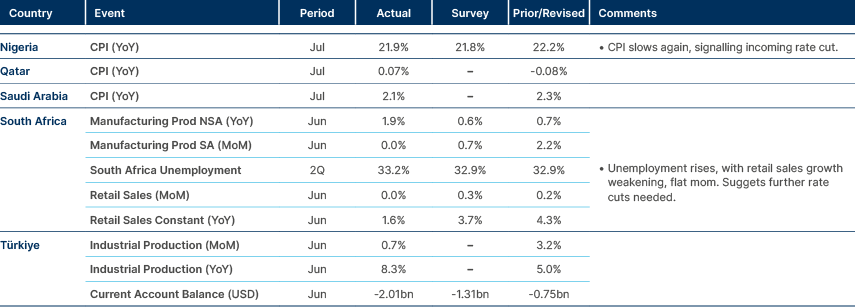

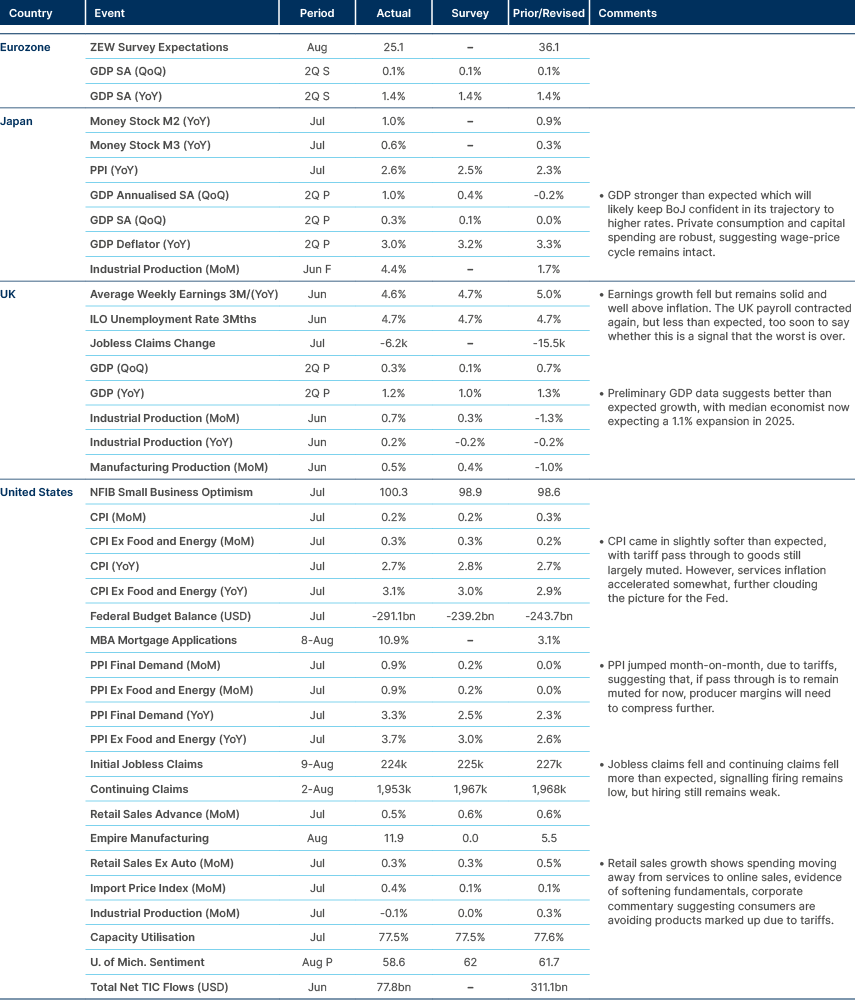

Last week performance and comments

Global Macro

The Citi Economic Surprise index rolled over to the negative side for China last week. Data for both industrial production and retail sales surprised to the downside, dropping from 6.8% to 4.8%, and from 5.7% to 3.7%, respectively. Fixed asset investment also fell to the lowest since early 2020. However, the MSCI China index rose 3% in the week, and the Shanghai Composite Index, which tracks Chinese A and B shares traded onshore, has now risen past 2021 levels to a decade high.

Investment in sectors with excess capacity, such as renewable energy infrastructure and electric vehicles (EVs), appeared to have declined the most. This is likely to be an early sign of China’s ‘anti-involution’ campaign kicking in. If successful, this policy direction will ultimately help address the deflation and malinvestment problem by curbing price wars and cutting production capacity across increasingly oversupplied sectors including green energy infrastructure and electric vehicles. Oversupply has contributed to persistent deflation and poor investment returns across many areas of the Chinese economy, which in turn has led to a slump in private credit growth, a pair of problems which tend to compound each other. However, while the ‘anti-involution’ process may help to pull the economy out of deflation in the long-term, while improving profitability for the most competitive companies, it will probably contribute to economic drag in the short term, given the secondary impact on suppliers to these industries, as well as the implied overall decline in output.

Weak retail sales growth probably partially reflect the fading effects of the consumer trade in goods programme, as well as generally weaker consumer confidence due to tariffs. A recent ruling by the Supreme People’s Court against permitting informal arrangements between companies and employees to opt out of social security payments could weigh on retail sales further in coming months. Bloomberg economists estimate this could reduce disposable income for 86mn employees by between CNY 310-520bn a year, equivalent to 0.6-1% of retail sales. Because the affected employees are generally low income with a high marginal propensity to consume, this could have close to a one-to-one effect on consumer demand.

But despite softer economic data, Chinese stocks are continuing their hot streak. US trade tensions continue to temper, and the government’s ‘anti-involution’ campaign gives hope that price wars among suppliers of various industries will moderate. This is evident in recent strong rebounds of stock prices in Chinese ‘involutionary’ sectors, including solar and batteries. Furthermore, there is a sense that ‘bad news is good news,’ for stocks, as weak consumer data will likely incentivise further monetary and fiscal stimulus. The MSCI China index, which captures a broad range of Chinese companies listed both onshore and offshore, is up 26% YTD. Still, the MSCI China index would need to gain another 35% to hit the levels it reached in 2021, when its forward price to earnings ratio was 21x, versus 14.5x now, according to Bloomberg data

US Treasury (UST) yields fell last Monday, as headline consumer price index (CPI) inflation for July came in at 2.7%, unchanged from June and 10 basis points (bps) lower than expected. Core inflation picked up from 2.9% to 3.1%, 10bps more than consensus estimations, but still showing relatively muted pass-through of tariff costs to goods prices. Core goods in the US are now 1.3% higher yoy. Goods prices were in deflation before tariffs kicked in in April, so this increase is significant. Still, the fact that a weighted average tariff rate now over 15% has so far led to either no change or a mild increase in goods prices, depending on the product, is assuaging some investors’ concerns about the ultimate severity of tariff pass-through to inflation overall and therefore continues to boost confidence that the US Federal Reserve (Fed) will cut rates in September.

In our view, any relief around the lack of goods inflation in the face of high tariffs is still very premature. As we noted last week, inventory drawdown in recent months has been significant after massive import frontloading in Q1, which has protected consumers. Tariffs have so far been largely absorbed in margins, particularly in the consumer staples sector, where according to Bloomberg data, profitability roughly halved in Q2 vs Q1, from over 10% to just 4.4%. However, in this period, the average tariff rate was only around 8%. It has now risen, as of early August, to somewhere between 15-20%.

Producer price index (PPI) data, which arrived later in the week, corroborated our view that margin contraction can only go so far before the burden of tariffs shifts further towards the US consumer. A 0.9% monthly increase in producer purchasing prices was the largest in three years. Some of this was driven by financial services margins, for which tariffs are somewhat irrelevant, however a 2% increase in margins of wholesale and retail companies, suggests that producers, on average, may be starting to pass through prices to consumers, as tariff levels are now becoming firmer for many products. This more hawkish data drove US bond yields back up on Thursday and Friday, undoing most of the lower move earlier in the week.

While higher goods prices in coming inflation readings could be expected, we reiterate that this does not necessarily make it less likely the Fed will cut rates in September. Monetary policy does not have the ability to control supply/tariff-driven goods inflation, but rather to influence the demand side of the economy, through the loosening or tightening of financial conditions. Whether or not higher consumer goods prices pass through to non-tradables prices, and causes widespread inflation, will be dependent on the health of the labour markets, which drive growth in disposable incomes. Disposable income growth has been sliding yoy, with sequential real earnings growth now running at an annualised rate of just 1.2% over the last three months. We believe that as goods prices increase, and inflation rises, real income growth will likely fall towards 0%, or even contract, which should minimise the pass-through to services.

Commodities

As OPEC+ continues to raise output, the International Energy Agency (IEA) projected a record oil supply glut in 2026, with inventories forecast to rise by nearly 3 million barrels per day (mbpd), surpassing the build-up during 2020. IEA and OPEC demand forecasts are very different, with the IEA expecting demand in 2026 to average 104.5mbpd, while OPEC expects 106.3mbpd. If OPEC is right in its demand forecasts, and the IEA’s supply forecast proves accurate, the market will still be in surplus by 1.2mbpd in 2026.

The spot Brent oil price, currently USD 66, is being supported by a convenience yield driven by still generally low inventories in both OECD and non-OECD countries and robust end-demand. For example, run rates at Chinese state-owned enterprise (SOE) refineries (in other words, capacity utilisation) have risen from 72% at the beginning of the year to 83% now and are approaching a five-year high. Chinese commercial diesel inventories remain low, below their 18-month moving average, while port crude oil inventories are approaching a five-year high. Inventory builds at Chinese ports, combined with high refinery run rates and low commercial inventories of diesel, suggest both strong end-demand and opportunistic buying of oil. And for now, the expectation of further rate cuts in the US and Europe, as well as European fiscal expansion, is keeping demand expectations robust, in our view.

Nevertheless, OPEC+ supply hikes appear to be set to push the physical oil market into a consistent surplus by Q3 this year. In our view, the most visible risk stopping oil traders from shorting the longer end of the curve more aggressively is the possibility of further sanctions on buyers of Russian oil.

Geopolitics

US President Donald Trump appeared outmanoeuvred by Russian counterpart Vladimir Putin at their Alaska summit on 15 August. In the weeks beforehand, Trump’s public statements suggested a firmer stance towards Moscow, emphasising the need for a ceasefire before broader peace talks and warning of consequences if Russia refused. Previously, Trump had even issued an 8 August ceasefire deadline, which passed without fanfare. By the end of the meeting, however, Trump argued that Ukraine should strike a deal and make territorial concessions because Russia is a “superpower” and Ukraine is not, and seemed to have moved away from the position that a ceasefire was a prerequisite for a long-term agreement.

Putin rejected a ceasefire to allow for talks, restated his maximalist demands and even extended them. These now include full control of Donetsk and Luhansk. This would cover several large cities still under Ukrainian control. He is also seeking formal recognition of Crimea as Russian. His current position is that he will freeze the current frontlines elsewhere only if these demands are met, as well as a permanent ban on Ukraine joining NATO.

For Ukraine and its European allies, such terms likely remain unacceptable. Zelenskyy and European leaders stress that abandoning territory defended for more than a decade would be politically indefensible and militarily dangerous, leaving Ukraine vulnerable to renewed aggression. Trump nevertheless claimed he and Putin had agreed on “most points” and appeared unwilling to challenge Russia’s territorial demands directly. Zelenskyy and senior European leaders meet Trump in Washington today. They will seek to reassert a ceasefire-first approach, press for stronger security guarantees, and reinforce commitments of financial and military support to Ukraine.

Emerging Markets

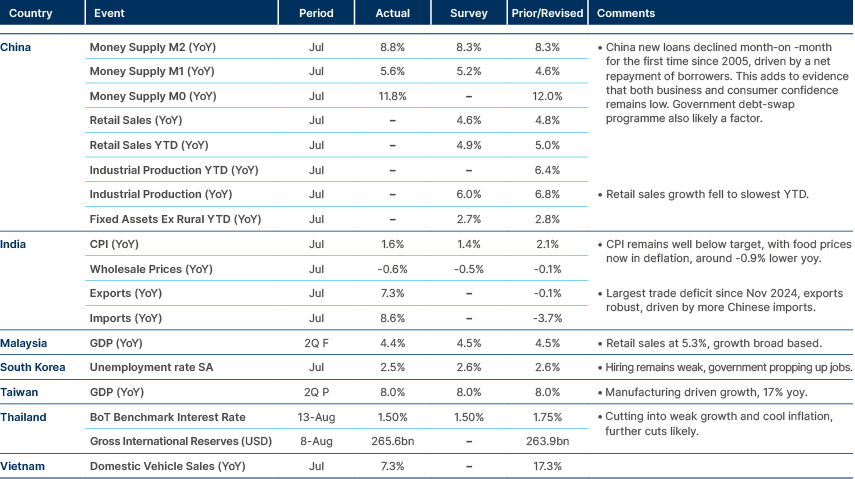

Asia

China: Trump confirmed that Nvidia and Advanced Micro Devices will pay the US government 15% of revenue from sales of H20 chips to China. The arrangement is framed as a tariff-like mechanism aimed at preventing circumvention of broader restrictions on advanced semiconductor exports. Beijing is expected to react cautiously, but the payment scheme could push Chinese firms to accelerate domestic chip development.

Separately, regulators are preparing to mobilise SOEs and distressed asset managers to buy unsold homes from developers, in a renewed effort to reduce housing inventory and stabilise the property market. The plan underscores Beijing’s concern about weak demand and financial stress in the real estate sector.

India: The Reserve Bank of India (RBI) was reported to have sold at least USD 5bn to support the rupee amid pressure from capital outflows and tariff-related uncertainty. In parallel, Standard & Poor’s (S&P) upgraded India’s sovereign rating to ‘BBB’ from ‘BBB-’, citing resilient economic growth, effective monetary policy and steady fiscal consolidation. The ratings agency expects growth to average 6.8% over the next three years, supported by infrastructure investment and domestic demand. The upgrade is expected to lower sovereign borrowing costs and encourage long-term capital inflows.

Indonesia: The government will begin negotiations with the US in September on tariff exemptions. Jakarta aims to secure zero tariffs on goods not produced in the US, including nickel, palm oil, cacao and coffee, while also seeking lower tariffs for labour-intensive sectors such as garments and footwear. The talks come after Indonesia agreed to a 19% tariff rate in an earlier deal, broadly in line with regional peers.

South Korea: Government borrowing from the Bank of Korea’s overdraft facility reached KRW 114trn in the first seven months of the year, a record pace that reflects pressure from supplementary budgets.

Although nearly all short-term borrowing was repaid by the end of July, reliance on this facility is expected to remain high due to weak tax revenues. Meanwhile, foreign investment fund inflows remained robust, with USD 4.8bn of net inflows in July, supported by optimism on semiconductors and demand for medium-term bonds.

Japan: Demand at the five-year government bond auction fell to its weakest since 2020, with a bid-cover ratio of 2.96 compared with 3.54 previously. The result reflects expectations of tighter monetary policy and concerns over market liquidity. Investors appear reluctant to add duration risk at current yields.

Vietnam: S&P affirmed Vietnam’s sovereign rating at ‘BB+’ with a stable outlook. Growth is forecast to moderate to 5.9% in 2025 after 7.1% in 2024, supported by foreign investment and manufacturing strength. The State Bank of Vietnam signalled it could pause further rate cuts if exchange rate pressures intensify, with Governor Nguyen Thi Hong warning of rising inflationary pressures from higher electricity tariffs, medical fees and rents.

Malaysia: Construction activity expanded strongly in Q2, with the value of work done rising 12.9% yoy to a record MYR 43.9bn. Growth was driven primarily by the private sector, while state-owned corporations posted their third straight quarterly decline. The government also reported MYR 3.29bn in new AI sector investments in H1 2025, part of a strategy to raise the digital economy’s share of GDP to 25.5% by end-2025.

Thailand: The Bank of Thailand cut its policy rate by 25bps to 1.50%, in line with expectations, as inflation remains subdued. Policymakers cited softening domestic demand and external headwinds as justification for the move.

Pakistan: Moody’s upgraded Pakistan’s sovereign rating to ‘Caa1’ with a stable outlook, citing an improved external position and reform progress under the International Monetary Fund (IMF) programme. The upgrade reflects stabilisation of reserves and fiscal consolidation efforts.

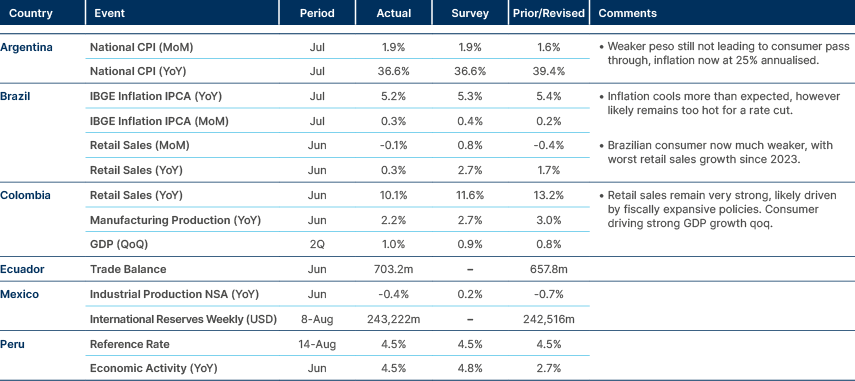

Latin America

Brazil: July inflation slowed more than expected, with consumer prices rising 5.2% yoy. The moderation gives the central bank more room to consider gradual easing later in the year. Analysts cut their 2025 inflation forecast for the 11th consecutive week, now at 5.05%, while trimming GDP growth expectations.

Finance Minister Fernando Haddad reaffirmed that alternative tax measures to the tax on financial operations (IOF) remain critical to fiscal targets, with BRL 31.4bn expected to be raised between 2025–26.

Argentina: A government delegation travelled to Washington to negotiate tariff exemptions and quotas. Buenos Aires is focusing on securing quotas for aluminium and steel, which currently face 50% tariffs. Officials acknowledge repealing the broader 10% tariff is unlikely, but limited quotas could be agreed since Argentina is not a dominant exporter. The US is pressing Argentina to strengthen patent protections, a politically sensitive issue that may complicate talks.

Chile: Codelco resumed operations at its El Teniente mine after a tunnel collapse killed six workers and halted production for nine days. Output remains partially restricted, with the first full shift producing only half of normal volumes. The disruption is expected to weigh on annual guidance, as El Teniente accounts for around 30% of Codelco’s quarterly copper output.

Mexico: President Claudia Sheinbaum appointed María del Carmen Bonilla as Deputy Finance Minister. Bonilla previously oversaw a USD 12bn Pemex bond issue and is seen as a steady technocratic choice to balance less experienced members of the fiscal team. In parallel, the US confirmed plans to deport former Pemex director Carlos Treviño to face corruption charges in Mexico.

Peru: A judge ordered former President Martín Vizcarra to be jailed over corruption charges. The case reflects Peru’s ongoing institutional fragility, with former leaders frequently facing corruption proceedings.

Colombia: Senator and presidential candidate Miguel Uribe, who was shot at a rally in June, died age 39. His death could alter the electoral landscape, raising serious questions about further security risks in the upcoming campaign period.

El Salvador: The number of deportation flights from the US rose 40.8% yoy from January to July, nearly matching record levels. The increase reflects the Trump administration’s tougher migration enforcement, and although remittances have temporarily risen due to precautionary transfers, upcoming taxes and normalisation could pose risks to El Salvador’s external accounts.

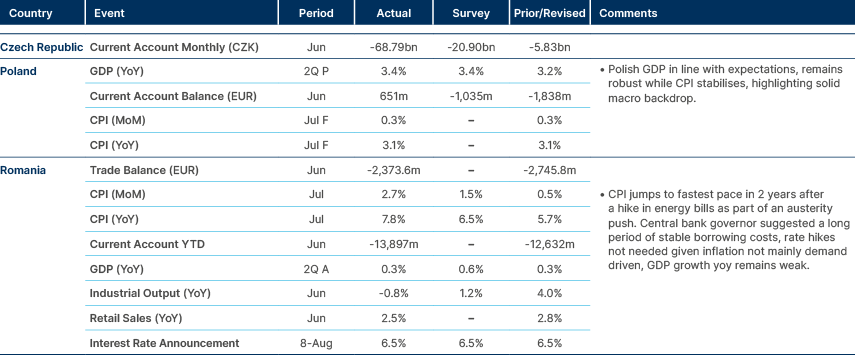

Central and Eastern Europe

Ukraine: President Volodymyr Zelenskyy reiterated Ukraine will not cede Donetsk in any ceasefire, warning that Russia would use concessions as a springboard for further incursions. His comments came as Trump prepared to meet Putin in Alaska, advocating “land swaps” that would trade eastern territories for some coastal concessions. Kyiv is also seeking stronger security guarantees from the US and Europe.

Poland: President Karol Nawrocki proposed exempting large families from income tax on earnings up to PLN 140,000. The measure could cost up to PLN 30bn annually, according to Finance Ministry estimates, and reflects efforts to address demographic challenges. Debate also continues over a windfarm bill that would extend household energy price freezes into late 2025.

Czech Republic: The Finance Ministry issued an unfavourable opinion on a proposed 5–7% public sector wage hike for 2026, citing fiscal constraints. While the opinion is non-binding, it could influence cabinet discussions in September. Trade unions are pressing for larger increases to offset prior inflation.

Romania: The Social Democrats outlined conditions to return to coalition talks, including scrapping privileges such as special pensions and continuing investment projects. Political divisions remain over the latest fiscal consolidation package, complicating budget negotiations.

S&P affirmed Romania’s sovereign credit rating at ‘BBB-/A-3’, maintaining a negative outlook, reflecting progress on fiscal consolidation, but warned that public debt sustainability and political uncertainty pose continued risks.

Kazakhstan: Kazakhstan diverted oil shipments from the Baku–Tbilisi–Ceyhan pipeline back to the Caspian Pipeline Consortium (CPC) route after reports of Azeri crude contamination. The rerouting underscores Kazakhstan’s continued reliance on CPC infrastructure, which handles over 80% of exports, but also shows that recent Russian security checks have not impeded flows.

Russia: VTB Bank reported a 49% fall in net interest income in H1 2025 compared with the previous year. Executives privately suggested the numbers understate the bank’s difficulties, as sanctions and the cost of war financing continue to weigh heavily on the sector.

Türkiye: The central bank’s August survey showed end-2025 inflation expectations steady at 29.6% yoy, while GDP growth is forecast at 2.9% this year and 3.7% in 2026. Markets expect rate cuts totalling 700bps by year-end, beginning with 250–300bps in September. Separately, the government proposed a 16% wage increase for civil servants in 2026, which unions rejected as insufficient.

Central Asia, Middle East, and Africa

Angola: S&P reaffirmed Angola’s long-term foreign-currency rating at B-, with a stable outlook, citing ongoing structural weaknesses such as high inflation and oil dependency that are balanced by strong foreign reserves and current account surpluses.

Oman: Oman and India completed negotiations on a free trade agreement, pending cabinet approval. The deal will lower tariffs across most goods and deepen economic ties, with bilateral trade exceeding USD 10bn last year.

Nigeria: Fuel consumption fell 16.4% mom in June to 48mn litres per day, the sharpest drop in years. Gasoline demand slumped nearly 50% as high prices weighed on consumers, while diesel and kerosene demand also declined. The regulator warned the downstream sector remains under pressure despite efforts to stabilise supply.

Tunisia: The powerful labour union UGTT called a mass rally for 21 August, accusing the government of orchestrating attacks against its members and eroding worker rights. The protest could escalate into a general strike, adding to political tensions under President Kais Saied.

Developed Markets

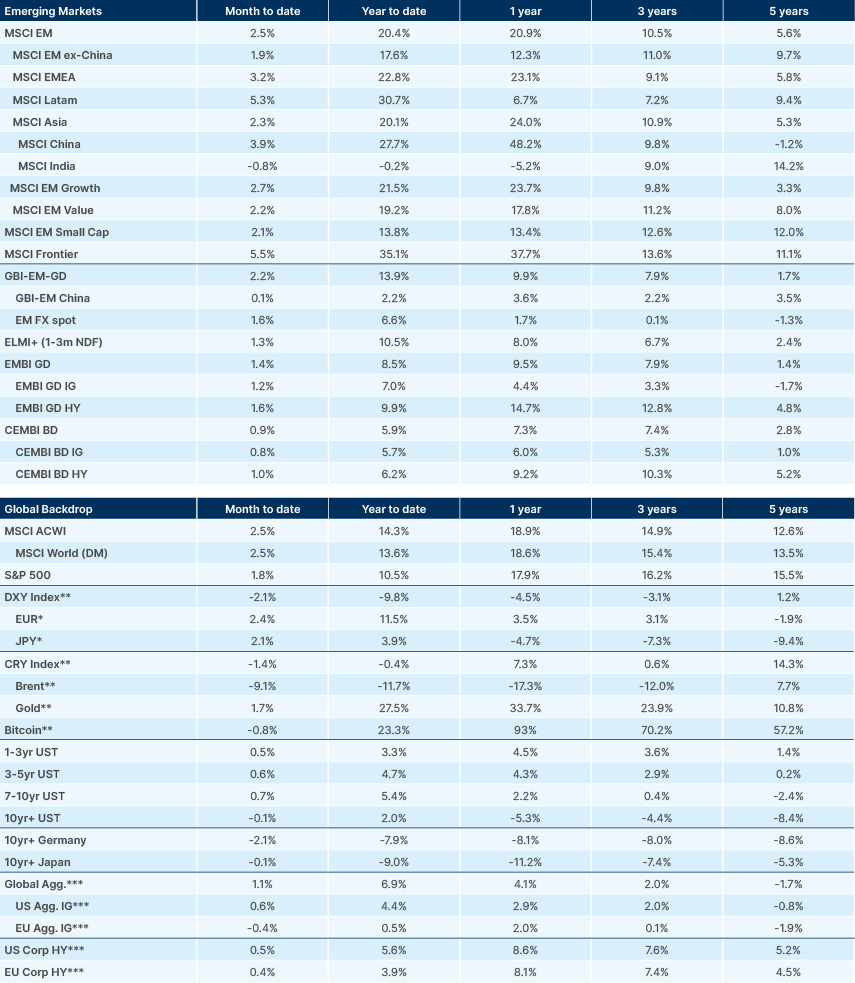

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.