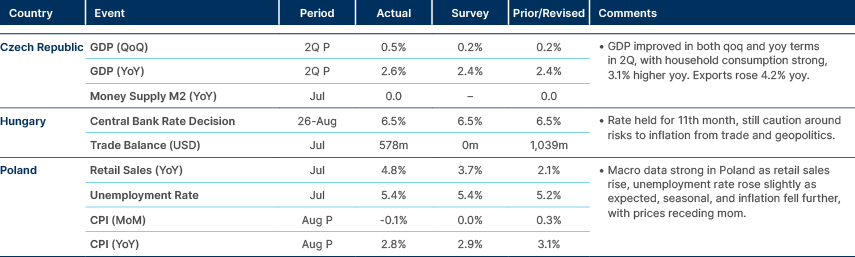

- US macro data stable last week. Fed and market focus turns to this week’s employment data.

- US appeals court ruled ‘reciprocal tariffs’ illegal, but Supreme Court may decree otherwise.

- India and China reaffirmed commitment to developmental partnership at the Shanghai Cooperation Organisation Meeting.

- Ukraine intensified its campaign against Russian refineries.

- Political protests in Jakarta and other major hubs drew between 10,000 and 50,000 workers.

- Thailand’s Prime Minister dismissed by the Constitutional Court over an ethics violation.

- August inflation data showed Brazil’s first monthly deflation since July 2023.

- Türkiye’s annualised GDP growth accelerated to 4.8% in Q2 from 2.3% in Q1.

- Central Bank of Egypt cut policy rates by 200bps at its August meeting.

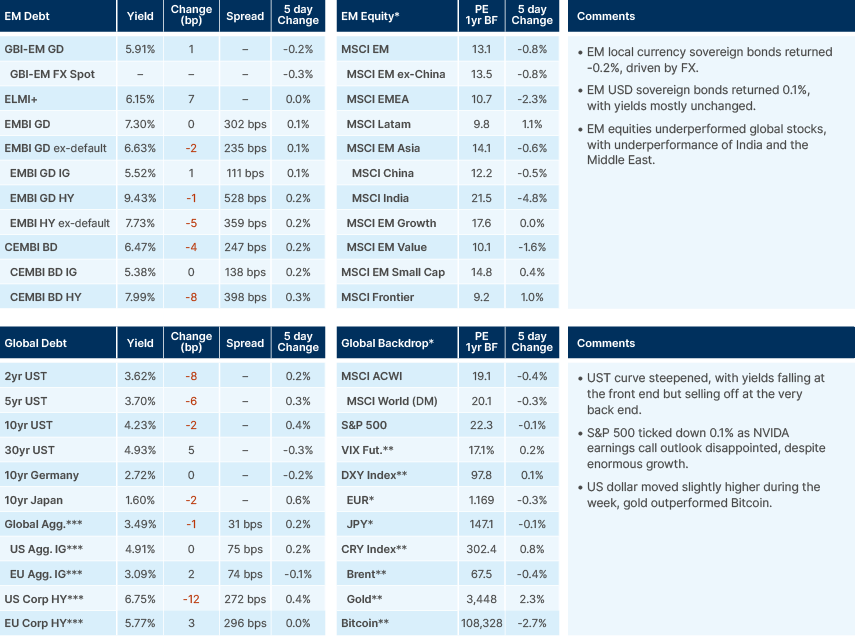

Last week performance and comments

Global Macro

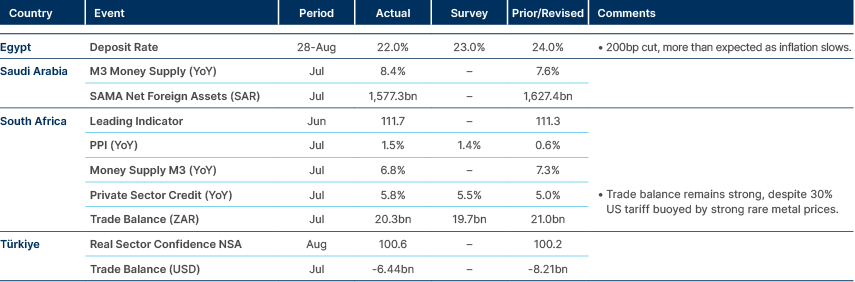

US data last week didn’t change the picture much. Q2 GDP came in at 3.3%, a sharp rebound from the -0.5% GDP reading in Q1. Frontloading of imported goods had driven a large trade deficit in Q1, which weighed on GDP even as the resulting build of inventories offset some of this effect. In Q2, this reversed, with the trade deficit lower than usual, due to the unwind of the inventory buildup. US consumer spending rose 1.3% over the period, weak, but fixed capital investment rose 3.5% yoy, a sign that business confidence is still decent. However, a lot of this was likely driven by AI capex.

Core Personal Consumption Expenditure (PCE) data for July came in line with expectations, 2.9% yoy and 2.5% qoq on an annualised basis. Most of the pickup was driven by service price inflation, which ticked up from 3.4% to 3.5% yoy. The bulk of service price increases came from financial services and insurance, the first is likely due to higher asset prices. Services represent 72% of the core PCE basket, so has an outsized effect on the headline number. Durable goods inflation also picked up to 1.5%, from negative levels in March, reflecting tariff-related pressures.

With tariff pass-through to goods prices happening gradually, and services marginally higher but in the middle of the 3.35-3.75% range observable since May 2024, the short-term focus of the US Federal Reserve (Fed), as Chair Jerome Powell pointed out at Jackson Hole, is on the deterioration in the jobs market. Last week’s initial jobless claims and continuing claims improved slightly. However, attention turns to the job market data, including the non-farm payrolls and unemployment numbers released this Friday. Last month’s large negative revisions to previous numbers shook markets, and revisions may well be negative again this month. Indeed, Fed Governor Christopher Waller pointed out last week that job creation is far weaker than headline payrolls suggest.

Fed Governor Lisa Cook has filed a lawsuit against President Donald Trump to block her removal from the Fed Board, requesting an injunction that would allow her to remain in post while the case proceeds. An injunction ruling would be significant, as it would determine whether she can keep voting at upcoming Federal Open Market Committee (FOMC) meetings during litigation. Markets currently see little risk of her getting ousted; Polymarket prices a 79% chance Cook will still vote in September’s FOMC, and the yield curve is stable. However, the assumption that yields not selling off means the risk to Fed independence is not being priced, may be oversimplistic. If the Fed does become more influenced by the Executive, the likelihood is that we would see a greater level of policy interference. If confirmed, the price action on the direction of rates and the Dollar (both lower) is clear. The yield curve could be subjected to overt or covert forms of control, so the degree of steepness becomes ambiguous.

In other news, a federal appeals court ruled that many of President Trump’s sweeping tariffs—imposed under emergency powers, are illegal. However, the decision is stayed through mid‑October, giving the administration time to appeal to the Supreme Court. The ruling applies to tariffs enacted under the International Emergency Economic Powers Act (IEEPA), which include the wide ‘reciprocal tariffs,’ but not industry‑specific measures. The administration is exploring alternative legal avenues and remains confident of prevailing in the courts, particularly considering the majority of Supreme Court appointees originate from the Republican Party.

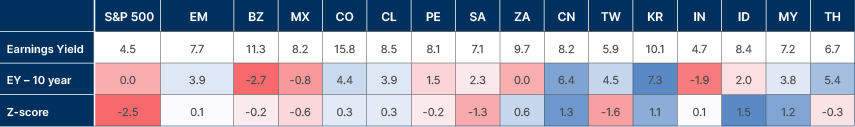

Chinese stocks have returned 27% year-to-date (MSCI China index), one of the highest performing stock markets in the world. However, the earnings yield of Chinese stocks - the inverse of the price to earnings ratio - remains at record highs versus Chinese government bonds. The table below shows these metrics in the US, in EM on average, and across the major emerging equity markets.

Fig 1: Stock Market earnings yields – 10yr government bonds

Geopolitics

India/China

India and China reaffirmed their commitment to act as development partners rather than rivals during high-level talks in Northern China, held against the backdrop of renewed US tariff pressure and lingering border tensions. At the Shanghai Cooperation Organisation summit, Prime Minister Narendra Modi and President Xi Jinping agreed to deepen trade, investment and cooperation on regional challenges while maintaining peace along the disputed Himalayan frontier. India pressed for measures to narrow its USD 99bn bilateral trade deficit. Both sides agreed to resume direct flights, ease visa and pilgrimage restrictions, and lift Chinese export curbs on rare-earths, fertilisers and tunnel-boring machinery. Xi stressed that border disputes should not define the relationship and urged collaboration between the “dragon and elephant,” while Modi voiced cautious optimism over border normalisation and called for ties built on mutual respect.

Russia/Ukraine

Ukraine intensified its campaign against Russian refineries, with 10% of refined capacity offline in early August, rising to 17% by 25 August and 22% by 27 August, after unmanned systems struck the Novokuibyshevsky and Afipsky facilities. The disruption has caused widespread petrol shortages in several regions including the Far East, southern Russia and Crimea, with reports of long lines at fuel stations. Moscow responded with export bans, curbs and price-stabilisation measures, announcing further restrictions between 27 and 31 August to prioritise domestic supply. Open-source reports have linked some successes to the new long-range ‘Flamingo’ cruise missile, although most damage so far has been attributed to drone attacks and independently verified links to Flamingo remain scarce.

Emerging Markets

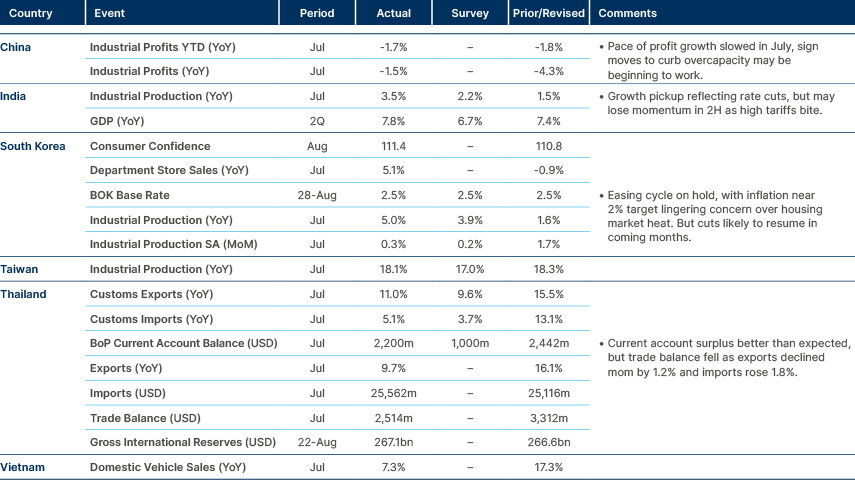

Asia

Chinese industrial profits slowed, Bank of Korea held rates.

India: The Trump administration formally outlined its plan to impose an additional 50% tariff on Indian goods starting 28 August, following the earlier 25% levy announced in early August. The move is designed to pressure New Delhi to halt Russian crude purchases. Modi responded by stressing India would resist external pressure and continue to build resilience. On the data side, industrial output accelerated to 3.5% yoy in July, led by stronger manufacturing activity.

Indonesia: Protests in Jakarta and other major hubs drew between 10,000 and 50,000 workers, led by Confederation of Indonesian Trade Unions, KSPI and the Labour Party. Demonstrators demanded an increase in the non-taxable income threshold to IDR 7.5m, the removal of taxes on bonuses and retirement savings, an end to outsourcing, and an 8.5–10.5% minimum wage hike. While the government has historically granted partial wage increases, no tax concessions were included in the 2026 budget, raising fiscal risks if demands are met.

In other news, inflation fell to 2.3% yoy in August, down from 2.4% in July and below expectations. Core consumer price index (CPI) inflation also eased to 2.17% yoy, compared with 2.32% forecast. The trade surplus improved to USD 4.2bn in July from USD 4.1bn in June, beating consensus of USD 3bn.

Pakistan: Private-sector credit growth accelerated to 14.6% yoy in July, with household loan growth reaching its fastest pace in nearly three years.

Philippines: The central bank cut its policy rate by 25 basis points (bps) to 5.0%, in line with expectations, while slightly raising its 2025 inflation forecast to 1.7%. The national government reported a budget deficit of PHP 18.9bn in July, narrowing 34.4% yoy as revenues outpaced projections. The merchandise trade deficit narrowed 17.0% yoy in July, with exports rising 17.3% yoy against import growth of just 2.3%.

South Korea: The current account surplus widened to USD 6.5bn in August, above the USD 5.7bn consensus, as imports undershot expectations more than exports. The Bank of Korea left its policy rate unchanged at 2.50% at its 28 August meeting, citing rising property prices in parts of Seoul. Five members voted to hold, while one favoured a 25bps cut. GDP growth for 2025 was nudged up from 0.8% to 0.9%. Retail sales increased 2.4% yoy in July, supported by government consumption coupons and improved consumer sentiment. Industrial production rose 5.0% yoy, the fastest in three months, driven by a 15.3% surge in electronic component output. The government announced a 3.5% increase in spending for 2026, focused on R&D, AI and leading-edge industries. Domestic bond issuance will increase by KRW 900bn, while the FX bond issuance limit has been reduced to USD 1.4bn from USD 3.5bn in 2025.

Thailand: Prime Minister Paetongtarn Shinawatra was dismissed by the Constitutional Court over an ethics violation, with Acting Prime Minister Phumtham Wechayachai now leading a caretaker cabinet until parliament selects a successor. Support for Pheu Thai has slumped to 11.5% in the June NIDA poll, while the opposition People’s Party has surged to 46%, although its leader Natthaphong Ruengpanyawut is not eligible to be prime minister. Of the five eligible candidates, former Prime Minister Gen Prayut leads polls. An early election would likely favour the People’s Party but remains opposed by Pheu Thai and conservatives, with Chaikasem Nitisiri emerging as the most likely compromise candidate if the coalition holds.

Vietnam: The government ended the state monopoly on gold, allowing banks to produce and trade gold bars under a new licensing framework. Institutions will face strict requirements on capital, compliance and internal controls. To improve transparency and oversight, gold transactions above VND 20m per day must now be settled through bank accounts.

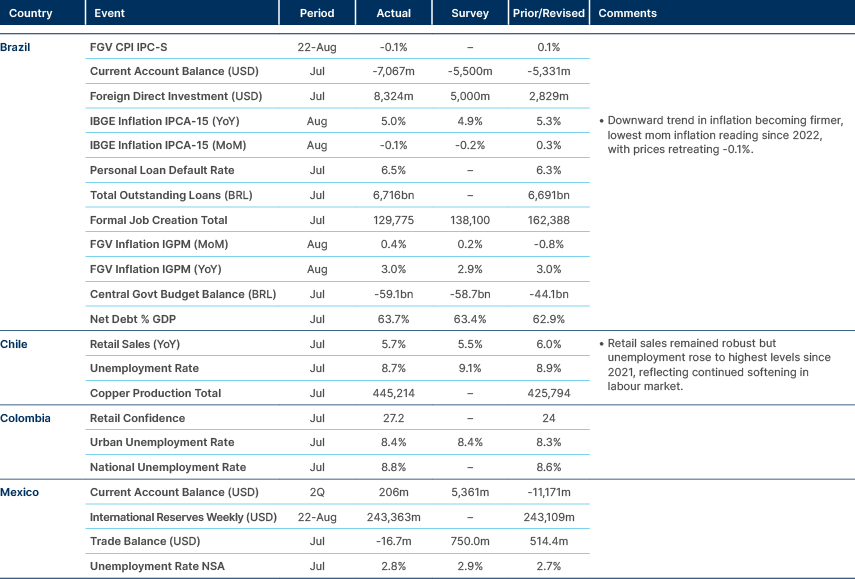

Latin America

Inflation softer in Brazil opens the room to monetary easing.

Argentina: President Javier Milei’s approval rating slipped to 43.8% in August from 45.1% in July, while disapproval rose to a record 51.1%, leaving him with a net rating of -7.3%, the second lowest of his term. Polling showed a sharp deterioration in consumer confidence, particularly regarding the macroeconomic outlook and labour market. Mentions of the economy as the country’s main problem climbed to 28%, overtaking corruption and unemployment. Despite weaker approval, Milei remains the best-rated political leader nationally, with Peronist opposition figures continuing to lose traction as their disapproval ratings rise.

Brazil: The August Extended National Consumer Price Index 15 (IPCA-15) inflation data showed Brazil’s first deflation since July 2023, falling 0.14% mom on lower housing and food prices. This equated to yoy inflation declining from 5.3% to 4.95%. Not only has 12-month inflation started to decline (IPCA-15 peaked at 5.49% in April) but the 12-month median smooth market inflation expectation dropped from 5.74% on January to 4.34% in August. The central bank is still expected to hold the Selic rate at 15% in September, with policymakers cautious as the effects of recent tax reforms on inflation remain uncertain. However, if inflation data remains on trend, the BCB will likely begin rate cuts this autumn, especially if the US lowers rates, which will reduce pressure on the Brazilian Real.

Political tensions persisted as former President Jair Bolsonaro was placed under 24-hour police watch amid fears he might flee the country. Police reported finding a request for asylum addressed to Argentina’s president on his phone. Meanwhile, President Lula’s approval rating fell to 47.9% from 50.2% in July, according to an Atlas Intel poll. This indicates the boost in approval that Lula got after his defiance stance against US trade policy, may have been only short-lived.

Colombia: The Finance Ministry resumed issuance of local TES bonds, raising COP 15tn (USD 3.7bn) between 1 July and 26 August. According to the 2025 Medium-Term Fiscal Framework, additional financing needs amount to COP 56tn, with COP 12trn expected from TES and COP 43trn from Treasury operations such as short-term debt, repos and managed funds. The government is effectively buying time by paying higher yields now, betting on an improved economic backdrop by year-end despite concerns about the 2026 election cycle, fiscal pressures and a cautious monetary policy stance.

Dominican Republic: Economic activity accelerated in July, growing 2.9% yoy, driven by mining and free trade zone manufacturing. Mining output rose 21% yoy on stronger gold and silver extraction, supported by higher global metal prices and external demand. The central bank noted that DOP 32bn remains available through year-end, which should continue to support productive sectors.

Ecuador: The unemployment rate fell to 3.3% in July from 3.5% in June and 3.7% a year earlier, marking a second consecutive monthly improvement. Urban unemployment also declined to 4.2% from 4.5%. The informality rate edged up to 20.2%, while adequate employment improved to 38.6% from 35.9% in June. Despite progress, informality remains entrenched, limiting prospects for rapid labour market transformation. The central bank expects growth of at least 2.5% in 2025, which should gradually underpin further labour market gains.

El Salvador: The trade deficit widened to USD 1.1bn in July as imports surged 28.1% yoy, led by agriculture and manufactured goods, while export growth slowed to 11.5% yoy on weaker agricultural shipments despite gains in manufacturing and mining. For January–July, exports rose 7.3% yoy compared with a stronger 13.9% yoy increase in imports. External pressures remain elevated as the government continues negotiations with the US to remove the 10% tariff on imports.

Mexico: The government is set to raise tariffs on imports from China, including textiles, vehicles and plastics, under the 2026 budget plan. The move reflects US pressure and could reduce the risk of additional US tariffs on Mexican goods, with potential extensions to other Asian economies. The current account recorded a USD 0.2bn surplus in Q2, well below the USD 5.4bn consensus. Goods trade posted a USD 1.7bn surplus, offsetting the services deficit and demonstrating resilience to US protectionism. The transfers surplus fell 11% yoy on weaker remittances, while the income deficit grew 59% yoy despite a quarterly improvement.

Venezuela: The US deployed four navy warships to waters off Venezuela to combat drug cartel activity. Venezuelan armed forces were ordered to reinforce the Colombian border and deploy large vessels in territorial waters.

Central and Eastern Europe

Softer inflation in Poland points to 25bps cut in September.

Hungary: The Monetary Policy Council left the policy rate unchanged at 6.5% in August, in line with expectations. Officials signalled no near-term easing, citing persistent inflationary pressures and elevated global risks. Inflation is forecast to remain above the 4% upper target band for the rest of 2025, despite government-imposed price caps, with both corporate pricing power and household expectations still elevated.

Poland: Inflation slowed to 2.8% in July, below consensus of 3.1% and just above the 2.5% target. The softer print strengthened expectations for a 25bps rate cut in September. Political tensions continue as President Karol Nawrocki clashed with Prime Minister Donald Tusk over fiscal and investment policy. Nawrocki has pledged to veto tax increases despite the widening deficit and has already blocked several bills, raising the risk of policy gridlock and complicating fiscal consolidation efforts.

Romania: The government’s budget gap widened to above 4% of GDP in January–July as both revenues and expenditures slowed. The official deficit target of 7% of GDP for 2025 is increasingly unlikely to be met.

Middle East and Africa

Egypt cut 200p, twice as much as expected.

Egypt: The Central Bank of Egypt cut policy rates by 200bps at its August meeting, lowering the overnight deposit rate to 22% and the lending rate to 23%. The move reflects policymakers’ growing confidence that inflation has peaked, with headline CPI inflation easing to around 28% in July from highs above 35% earlier in the year. The cut also aims to support activity after growth slowed below 3% in FY24 amid weak investment and FX shortages.

Officials stressed that real interest rates remain positive given the downward trajectory of inflation, providing scope to shift policy toward supporting growth while safeguarding price stability. The decision follows the successful conclusion of the International Monetary Fund (IMF) fourth programme review, which unlocked additional external financing and helped stabilise the currency after March’s large devaluation.

Türkiye: Annualised GDP growth accelerated to 4.8% in Q2 from 2.3% in Q1 (revised from 2.0%) and above the 4.1% consensus. The government announced the termination of the costly FX-protected deposit scheme (KKM), with the Central Bank of the Republic of Türkiye halting new account openings from 23 August. Existing deposits will be allowed to mature, after which related regulations will lapse. Introduced in December 2021 during the currency crisis, the scheme created a fiscal burden of around USD 60bn across the Treasury and the central bank. Approximately USD 11bn in balances remain outstanding, with the largest redemption of USD 4bn due in October. The external trade deficit narrowed 11.0% yoy to USD 6.4bn in July, with exports concentrated in manufactured goods and defence products boosting the share of high-technology sales.

Developed Markets

US GDP driven by unwinding of frontloading.

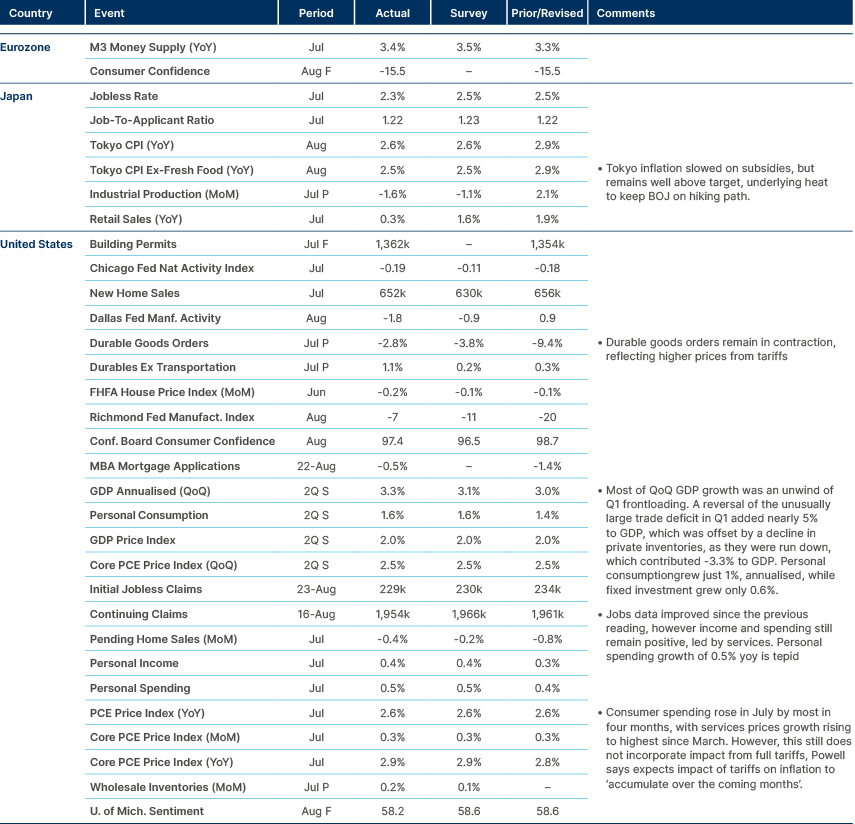

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.