- The collapse of US private credit-backed First Brands and Tricolour raised risk management concerns.

- The oil curve (1m12m) shifted from backwardation to contango.

- Trump retracted willingness to supply Ukraine with Tomahawk missiles after speaking with Putin.

- Israel-Hamas ceasefire broke down on Sunday with Israel striking targets in Rafah following the shooting of two Israeli soldiers.

- September’s credit data highlighted continued weakness in China’s loan demand.

- South Korea launched new real estate curbs, designating the capital as a ‘speculative overheating zone’

- US Treasury confirmed plans of up to USD 40bn support for Argentina, comprising a USD 20bn swap and additional USD 20bn facility.

- Mexican government proposes significant increase in excise taxes.

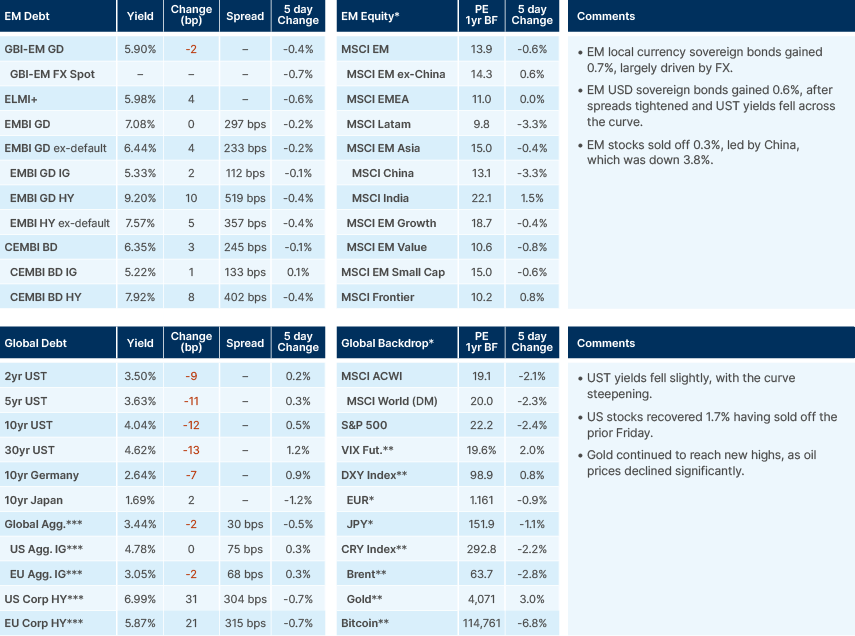

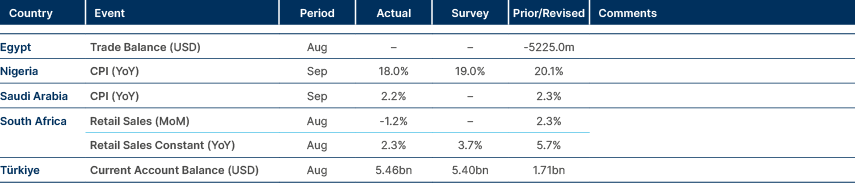

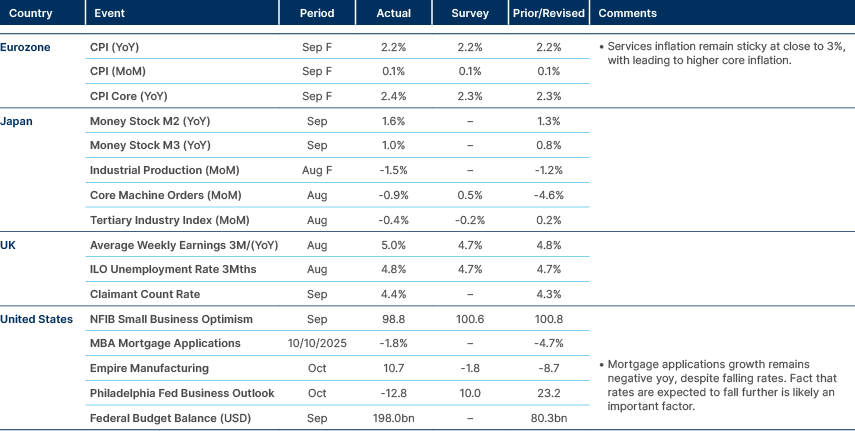

Last week performance and comments

Global Macro

The collapse of two US firms last week, First Brands and Tricolor, both of which were heavily financed through private credit and other non-bank lending structures, sent jitters through debt markets. The private credit market in the US has expanded rapidly to around USD 1.7 trn, but it remains small relative to the USD 11 trn corporate bond market. Tight corporate credit spreads and intense competition among direct lenders have driven narrower spreads on new loans. In Q3 2025, a growing share of loans to private-equity-backed borrowers were priced at 500 bps or less above US Treasuries, suggesting that underwriting standards may have weakened.

Private credit’s opacity adds to the concern. These loans are typically held in non-bank or off-balance-sheet vehicles and valued only periodically, making it harder to gauge portfolio risk in real time. As JPMorgan CEO Jamie Dimon cautioned this week, “if you see one cockroach, there is probably more.” The risk for markets is whether such defaults reflect broader fragility in private credit, where looser covenants and aggressive lending could amplify losses. While the sector is still modest in size, any loss of confidence could spill over to banks and institutional investors with direct or indirect exposures.

For now, there are no signs of systemic stress. The spread between the 90-day Ameribor rate and 13-week Treasury bills, a good barometer of interbank trust, remains narrow. But this is an important indicator to monitor if more “cockroaches” begin to emerge. Markets are paying extra attention to defaults in private credit due to fears the collapse of such firms could be a ‘canary in the coalmine’, in a market where risks premiums are currently very low. Year-to-date, there have been 123 global rate cuts, with the global stock market up USD 21trn. Rate cuts have also led to a compression of credit spreads globally, both sovereign and corporate. Should rate cuts continue, and long-end rates full further, it is more likely that stress building among borrowers can be contained, with loans refinanced at lower rates.

How far rates can continue to fall globally will depend in part on to how far they fall in the US. US growth is likely to remain soft in the coming quarters, so the key variable here is inflation. And on US inflation, the key variable remains tariffs. Last week, when asked if his recent 100% extra tariff on China will last, President Donald Trump said “no.” He admitted tariffs at these levels are unsustainable and emphasised he expects to reach a fair deal with China. His backtracking highlights the strength of China’s bargaining power on rare earths, but also probably reflect how important tariff revenues, particularly from China, have become for US fiscal accounts. An extra 30% tariff on China this year has already led to a 30% decline in Chinese exports to the US – raise tariffs much higher and tariff revenues from China may well decline.

Goldman Sachs recently estimated that 55% of tariffs cost will be being passed through to consumer prices by year-end, with the rest of the burden being shared between importers and foreign exporters. Goldmans analysis suggests that core Personal Consumption Expenditures (PCE) inflation is already up 0.44% due to tariffs and will rise by a further 0.6% due to tariffs by the end of February/March 2026. The counterweight is the deflationary effect that squeezed purchasing power on goods will have on services demand (deflationary) and the fact that wage inflation is declining. This makes it unlikely that goods inflation will translate into higher wage inflation. Lower oil prices and housing costs are also anchoring inflation levels and expectations.

Commodities

Oil

The oil curve (1m12m) has shifted from backwardation – when futures prices are lower than the current spot price – to contango (the opposite) for only the third time since OPEC+ created a structural backwardation in 2017, and the fifth time since 2008. The last shift to contango was in February 2020 at the start of COVID, was followed by a 50% drop in oil prices. A similar move in November 2018 saw prices fall 30% over the next six weeks. Historically, oil has usually fallen sharply after moving from backwardation to contango. Low inventories, in theory, should mean that storage economics sets a cap on the oil curve steepening too much. However, signs are emerging that the long-awaited supply/demand surplus is beginning to materialise. Western markets have been kept tight in recent months due to Chinese stockpiling of crude oil. However, at sea, a glut is building, with 1.3bn barrels currently amassed on the world’s tanker fleet, according to a Vortexa consultant. This is the biggest flotilla of oil on water since 2020. World inventories have been building at 1.9mn barrels a day (bpd) this year so far, according to the International Energy Agency (IEA). This glut of oil on water may be a sign that this will increase from here on; the IEA estimates the glut could reach 4mn bpd next year, which would break records.

Geopolitics

Trump/Putin/Zelensky

Presidents Putin and Trump spoke by phone on Thursday, after Trump appeared ready to give Tomahawk missiles to Ukraine . Ukraine’s current long-range weapons only have a limited reach of 300km, while Tomahawk missiles have a much longer range (around 900km) and could cause significant damage to drone factories deep within Russia, for example, or indeed Moscow. After the call, however, it seemed Putin had been successful in winning Trump over again. Trump posted on his Truth Social network:

“I just had a lengthy and highly productive phone call with President Vladimir Putin of Russia. We discussed Ukraine, the Middle East, Energy, Artificial Intelligence, the power of the Dollar, and various other subjects. We both reflected on the Great History of our Nations, and the fact that we fought so successfully together in World War II, remembering, that Russia lost tens of millions of people, and we, likewise, lost so many! We each talked about the strengths of our respective Nations, and the great benefit that we will someday have in working together. But first, as we both agreed, we want to stop the millions of deaths taking place in the War with Russia/Ukraine. President Putin even used my very strong Campaign motto of, “COMMON SENSE.” We both believe very strongly in it. We agreed to work together, very closely, including visiting each other’s Nations. We have also agreed to have our respective teams start negotiations immediately, and we will begin by calling President Zelenskyy, of Ukraine, to inform him of the conversation, something which I will be doing right now.”

Following this phone call, Trump met Ukraine’s President Volodymyr Zelenskyy in the White House to then refuse to provide Tomahawk missiles. This adds renewed pressure on Zelensky to give in to some of Putin’s demands, including surrendering the whole of the Donbas region or, according to media reports, in Trump’s words: “be destroyed by Russia.” Russia currently only controls around half of the Donbas region, so this would be a significant concession, likely unacceptable for the Ukrainian people.

Gaza

Trump recently made a statement on Hamas, “If they don’t disarm, we will disarm them”. However, Hamas appear very far from disarmament and are slowly taking back control of the enclave, including the recent public execution of members of ‘rival clans’ in the streets. The ceasefire broke down on Sunday, as Israel launched airstrikes in Southern Gaza, after Hamas operatives killed two Israeli soldiers in Rafah. Israel killed 44 people in response in the strikes but said it will now return to the ceasefire. The situation clearly remains far from stable, with the risks that a ceasefire breaks down again elevated.

Emerging Markets

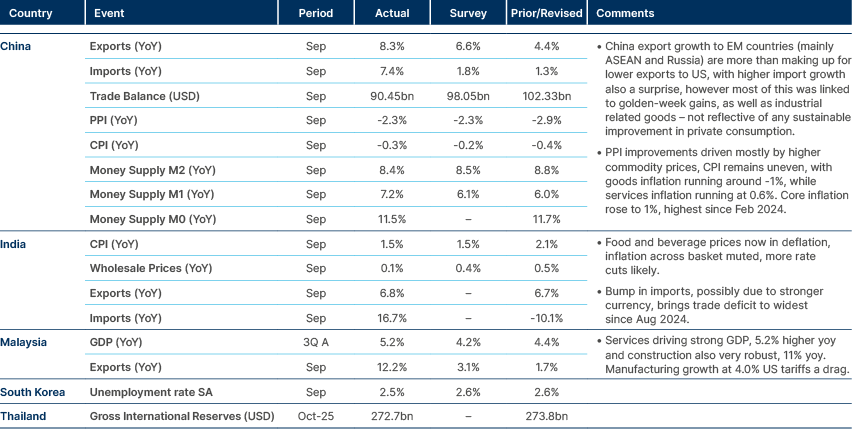

Asia

China: September credit data has highlighted continued weakness in China’s loan demand. New RMB loans totalled RMB 1.29trn, roughly in line with forecasts but below expectations, underscoring fragile credit appetite across households and businesses. Total Social Financing (TSF) slightly exceeded estimates, driven mainly by government bond issuance and off-balance sheet lending, rather than new bank credit. Loan growth remains constrained by weak private sector confidence, subdued property activity, and limited demand for working capital and consumer borrowing. Corporates are deleveraging amid excess capacity in manufacturing, while households remain cautious about housing and job prospects.

To boost borrowing, Beijing has introduced a consumer loan interest subsidy that lets local governments cover part of the interest (1% of interest rate, maximum RMB 3,000 per person per lender) on loans to buy home appliances, autos, and green products. The programme is designed to lower effective borrowing costs and revive discretionary spending, but early feedback suggests limited traction due to muted confidence rather than pricing alone. Looking ahead, loan demand is likely to stay sluggish through Q4, with modest support from infrastructure lending and policy-bank credit lines. Until household income expectations and corporate profitability improve, credit growth likely to remain driven by policy rather than market demand.

India: The International Monetary Fund (IMF) said India must sustain c.8% growth to become a developed economy by 2047, and called for deeper structural and trade reforms, labour flexibility, and a better business climate. The IMF raised its FY26 GDP forecast to 6.6% but cut FY27 to 6.2%, citing tariff effects.

Indonesia: Finance Minister Purbaya Yudhi Sadewa is considering another IDR 250trn liquidity injection into state banks to lift money supply growth from 13% year on year (yoy) towards 20%. Earlier disbursements have been largely lent out, but officials worry slow M0 expansion could constrain credit.

South Korea: Seoul apartment prices rose 0.54% in the first two weeks of October, prompting new real estate curbs designating the capital as a ‘speculative overheating zone’. Household lending growth slowed to KRW 2trn month on month (mom) in September amid mortgage caps, while corporate loans rose KRW 5.3trn. Separately, the US and Korea are close to finalising a tariff deal within 10 days. Treasury Secretary Scott Bessent said a USD 350bn investment fund structure is being negotiated, although Trump insists Korea will pay upfront.

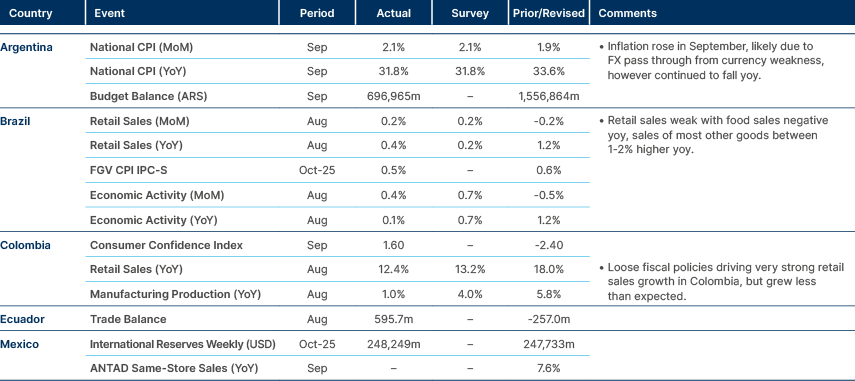

Latin America

Argentina: The US Treasury confirmed plans for up to USD 40bn in support, comprising a USD 20bn swap and an additional USD 20bn facility. Bessent said the US had again bought pesos and would back Argentina’s stabilisation efforts. The funding, if unrestricted, would cover all FX debt needs through 2027, though risks remain that funds are used to defend the peso rather than repay debt. Deregulation Minister Federico Sturzenegger also said a trade deal with the US was imminent, offering privileged access for selected sectors. Bessent said, “The United States stands with Argentina. Yesterday, Treasury bought pesos in the "Blue Chip Swap" and spot markets. Treasury remains in close communication with Argentina's economic team as they work to Make Argentina Great Again. Treasury is monitoring all markets, and we have the capacity to act with flexibility and with force to stabilize Argentina.”

Brazil: Central bank (BCB) Director Nilton David said inflation expectations were easing slowly, and data remains insufficient to begin rate cuts, suggesting the 15% Selic will stay through to year-end. Finance Minister Fernando Haddad warned of difficulties closing the 2026 budget after Congress let a Tax on Financial Operations (IOF) measure expire, losing BRL 17bn in planned revenue. The government may freeze BRL 7bn in congressional amendments, but faces credibility risks if the fiscal target is revised.

Chile: Far-right political candidate José Kast maintained a 10ppt lead over communist Jeannette Jara in runoff polling (45% vs 35%), with centrist Evelyn Matthei steady at 17%. Kast remains a 70% favourite, though analysts note poll herding and potential voter backlash against his hard-line stance.

Colombia: The Finance Ministry said external debt fell to 29% of total obligations—the lowest since 2013—after aggressive swaps and euro issuance. The complex structure, including total-return swaps backed by USTs, lowered yields but raised leverage and counterparty risk. The ministry hailed record debt management gains, though analysts warned that the underlying fiscal deficit and political uncertainty ahead of the 2026 elections still cloud sustainability.

Trump accused Colombian President Gustavo Petro of being an “illegal drug dealer” and said the country will no longer receive US aid. Trump posted on social media that drug trafficking “has become the biggest business in Columbia [sic], by far, and Petro does nothing to stop it, despite large scale payments and subsidies from the USA that are nothing more than a long term rip off of America.” Trump added, “AS OF TODAY, THESE PAYMENTS, OR ANY OTHER FORM OF PAYMENT, OR SUBSIDIES, WILL NO LONGER BE MADE”.

Trump’s posts come just a day after the administration announced the two survivors of a US attack on a submarine he claimed was carrying illegal drugs in the Caribbean will be returned to their home countries of Colombia and Ecuador. Petro, who has clashed publicly with Trump, said Saturday in a social media post that US government officials committed a “murder” in the vessel attacks.

Mexico: The Mexican government is proposing a significant increase in excise taxes on sodas, tobacco, and other goods and tariffs for countries without a Free Trade Agreement (FTA). Higher excise taxes and tariffs help Mexico's fiscal consolidation efforts as they are a source of revenue (potentially 0.3% of GDP according to the government), and tariffs to China signal Mexico's commitment to the North America region. But they would also increase prices. Bank of America estimated a 27bps impact on headline inflation with upside risks in 2026. It noted, “In turn, higher inflation is a risk to Banxico call (6.0% terminal rate in 2026). But considering this is a one-off change, we think headline is likely to remain around 4%, and a stronger fiscal position supports Banxico cuts.”

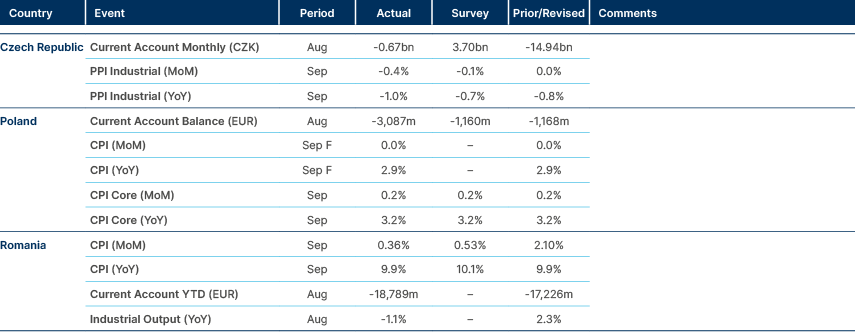

Central and Eastern Europe

Czechia: The Fiscal Council sharply criticised the 2026 budget bill for misclassifying CZK 20bn of transport spending as defence expenditure, underfunding the transport infrastructure fund by CZK 37bn, and arbitrarily inflating revenue assumptions. The Council’s chair, former CNB Vice-Governor Mojmir Hampl, warned the fiscal framework lacks credibility. The findings increase pressure on the outgoing government to revise the budget, emboldening opposition leader Andrej Babiš and raising political risk ahead of elections.

Central Asia, Middle East, and Africa

Botswana: Moody's downgraded Botswana to ‘Baa1’ from ‘A3’ and kept a negative outlook, mostly due to the structural downturn in the diamond industry. The industry contributes roughly 30% of GDP and 90% of goods exports, with the downturn resulting in economic contraction, weakened external buffers, and increasing government debt.

Egypt: The government aims to reduce debt-to-GDP to 75% within three years and extend maturities to five years, according to Finance Minister Ahmed Kouchouk. A new debt management strategy and further debt-for-investment swaps are due by December. The IMF sees debt declining to 82% of GDP by 2027, aided by growth and fiscal discipline. Separately, the Oil Ministry announced a USD 5.7bn programme to drill 480 oil and gas wells by 2030, with 101 set for 2026.

Nigeria: The IMF noted illicit financial flows as a key threat to fiscal stability, pledging stronger AML/CFT1 oversight and closer monitoring through Article IV consultations. IMF Managing Director Kristalina Georgieva said digital anonymity and poor governance drain public resources. The IMF urged Nigeria to strengthen fiscal management and prioritise infrastructure and education to consolidate macro stability.

Developed Markets

European Union: The European Union (EU) is preparing rules to make Chinese companies share technology with EU firms if they want to invest or operate within the bloc. The measure targets strategic digital and manufacturing sectors, requiring them to use a minimum number of EU-made components or labour, and to add value inside the EU rather than exporting finished goods. The goal is to protect EU industrial competitiveness and prevent China’s manufacturing dominance from overwhelming local producers. The plan is expected to be formally proposed in November.

France: S&P downgraded France’s sovereign rating to ‘A+’, and issued the following statement, “Despite this week’s submission of the 2026 draft budget to the parliament, uncertainty on France’s government finances remains elevated. While, in our view, the 2025 general government budget deficit target of 5.4% of GDP will be met, we believe that, in the absence of significant additional budget deficit-reducing measures, the budgetary consolidation over our forecast horizon will be slower than previously expected. We expect gross general government debt to reach 121% of GDP in 2028, compared with 112% of GDP at the end of last year. As a result, we lowered our unsolicited sovereign ratings on France to 'A+/A-1' from 'AA-/A-1+'. The outlook is stable.” The downgrade came earlier than expected, as S&P’s review was originally scheduled for 28 November. S&P’s rating is now in line with that of Fitch, both one notch below Moody’s at ‘Aa3’, which is under review on Friday.

Japan: The ruling Liberal Democratic Party (LDP) and the opposition Innovation Party (Ishin) are reportedly set to sign a coalition agreement on Monday, clearing the path for LDP leader Sanae Takaichi to become the nation’s first female Prime Minister. The LDP has agreed to Ishin’s demand for a 10% cut in the number of parliamentary seats, clearing a major hurdle according to TV Asahi. Ishin will not take any cabinet posts for now, but plans to appoint its Diet affairs chief, Takashi Endo, as a senior adviser to Takaichi should she win Tuesday’s parliamentary vote for new prime minister, the broadcaster reported. Together, the two parties hold 231 seats in the Lower House, just two seats short of a majority. With no clear rival emerging from the rest of the opposition, Takaichi is almost certain to win that vote.

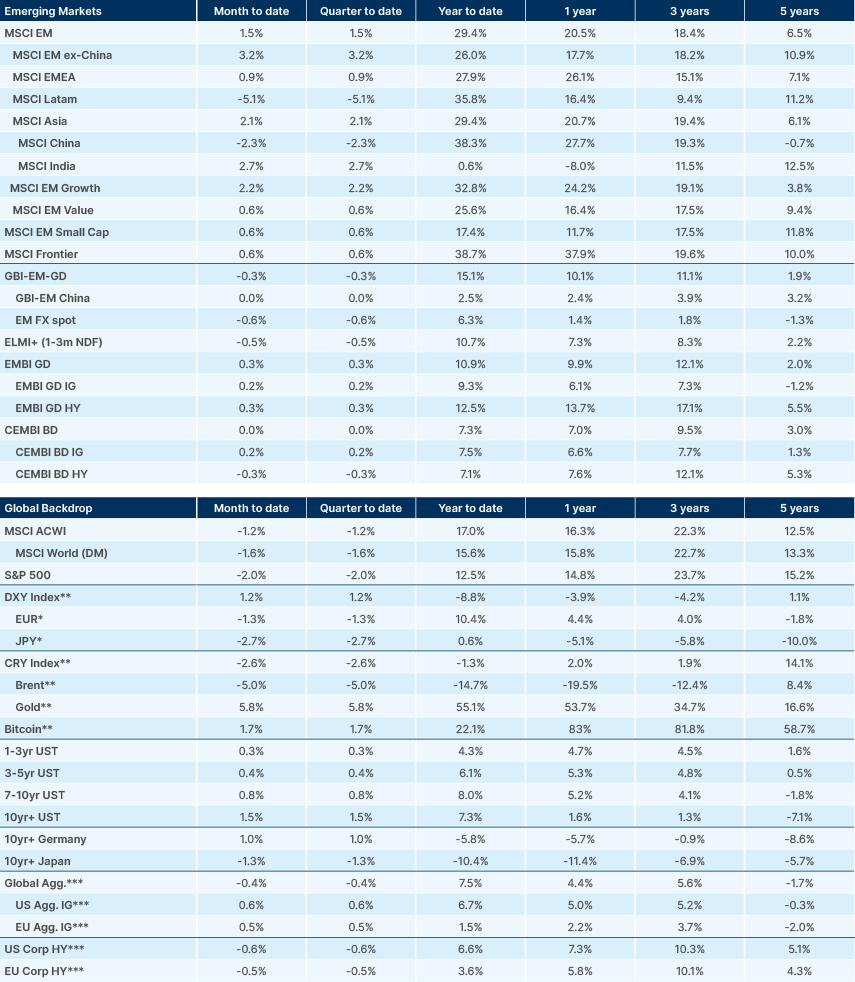

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

1. AML: Anti-Money Laundering, CFT: Countering the Finance of Terrorism.