Turkey was hit by a disastrous earthquake a few months before a key presidential election. Brazil debates its inflation target as political pressure on its central bank increased. China’s credit creation was stronger than expected, boosting hopes for an accelerated economic recovery. Mexico hiked policy rates by 50 basis points (bps) to 11.0%, 25bps more than expected, echoing the more hawkish tone of Developed Market (DM) central banks. Foreign exchange reserves increased in several Emerging Markets (EM) countries, including Thailand, Philippines, India, South Africa, and Indonesia.

Geopolitics

Russia launched a heavy aerial attack on Ukraine energy infrastructure in several waves. Two cruise missiles were flown over Moldovan airspace before landing in Ukraine. The Prime Minister of Moldova Natalia Gavrilita resigned citing lack of broad support. The landlocked country located between Ukraine and Romania has been rattled by an economic crisis as well as the dilemma of freeing itself from natural gas shipped from Russia via Ukraine. The pro-European Union (EU) Moldovan government has been trying to pass ample reforms allowing it to fast-track its EU entry to defend itself against Russian influence. The country has a group of pro-Russian separatists across most of its border with Ukraine, which has been exploited by Russia to destabilise the region. Ukraine also claimed a further three Russian missiles crossed Romanian airspace. Romania is a key NATO ally with a large US military base.

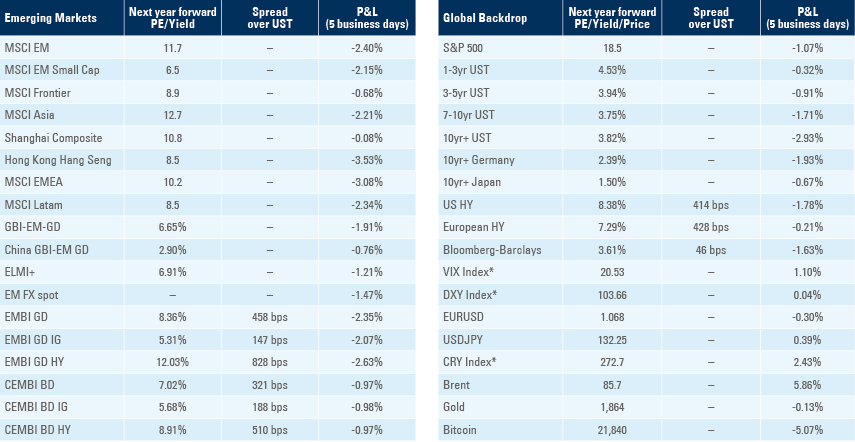

In parallel to the escalation, Russia said it would cut oil production by 500k barrels per day to retaliate against economic sanctions levied by the West, an unexpected move considering the aggressive discount Russia was ready to concede to sell oil to Asia. Ural oil prices have traded between USD 54 and USD 66 per barrel since the end of November, as Russia reshuffled the bulk of its supply from Europe to Asia, bringing the Russian benchmark to trade below the USD 60/barrel cap imposed by the West.

Figure 1: Brent vs Ural oil price (USD per barrel)

The United States (US) President Joe Biden hosted Brazilian President Luiz Inácio Lula da Silva in the White House in a show to defend democracy after the storming of the executive, legislative and supreme court houses in Brasilia last month, an event reminiscent of the storm of Capitol Hill in Washington D.C. two years before. Lula had a good relationship with Biden’s predecessor Barack Obama and both presidents share a common agenda in favour of redistribution of income and an accelerated energy transition. Lula lobbied for a lift of the economic embargo on Cuba and Venezuela, and is trying to create a group of counties including India, China, and Indonesia to mediate a peace agreement between Russia and Ukraine, an idea discussed with Germany’s Chancellor Olaf Scholz. Lula’s agenda highlights the pursuit of a multilateral agenda to dealing with conflicts but keeping a cordial relationship with the US.

The US would hope to persuade Brazil to take a more forceful stance in the Ukrainian conflict and try to re-establish its influence over the second-largest economy in the Americas. However, despite the cordial meeting, and the fact that the US and Brazilian administrations share many ideological principles, it appears as though the US will struggle to regain the clout it once had in Latin America. Most South American countries (with a few exceptions, such as Colombia and Ecuador) have a larger volume of trade with China – a smaller, but more open economy dependent on natural resources – than the US. Brazilian exports to China, for example, rose to more than twice the volume exported to the US over the last 20 years (as per Figure 2). Furthermore, perceived political interference during the period when many Latin American countries were led by authoritarian regimes friendly to Washington looms large in recent memory, suggesting most countries will favour a more multilateral approach, particularly in circumstances where most countries are governed by left-leaning politicians, as is the case today.

Figure 2: Brazilian exports by destination (12-months) in USD bn

In other news, the US shot down four objects flying over US and Canada, including one identified as a surveillance balloon from China. The incidents led to another bump in the problematic relationship between the US and China. China claimed the balloon had civilian use.

Emerging Markets

Turkey: The earthquake shattering the South of Turkey and Northern Syria caused 33k deaths so far, according to CNN, and 16m people affected (13.4m in Turkey, or 15% of the country’s population), with a large population relocating to West Turkey. The destruction is equivalent to USD 84bn according to an estimate from the Turkish Enterprise and Business Confederation, or around 10% of GDP.1 The scale of the human impact goes far beyond the numbers, hitting a region that has already been experiencing hardship from poor macroeconomic management and civil war on either side of the border.

Turkey ordered the imprisonment of hundreds of contractors responsible for collapsed buildings as President Erdogan pledged to build thousands of seismically-safe buildings within a year, seeking to detach himself from responsibility for the humanitarian tragedy. Erdogan announced a three-month State of Emergency that gives him even broader powers ahead of the presidential election that must take place by June 2023, according to the constitution. The opposition coalition is likely to announce a unified candidacy this week.

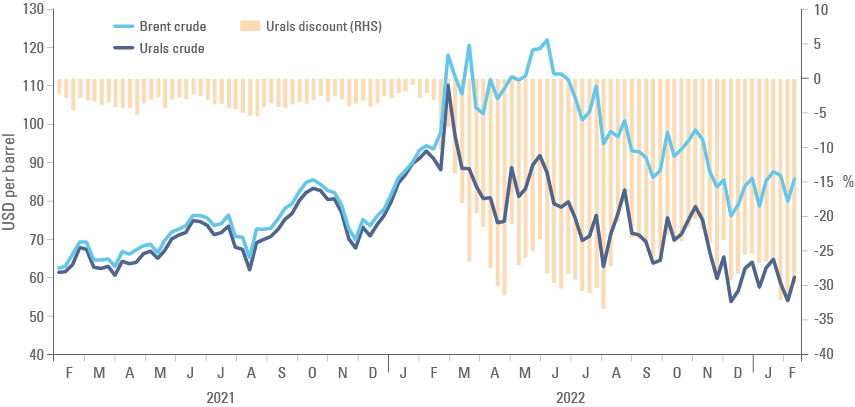

Brazil: The National Monetary Council (CMN in Portuguese), formed by the Central Bank Governor, the Ministry of Finance, and the Ministry of Development, meet on 16 February to decide the inflation target for 2025 and 2026. The CMN may also debate a potential increase in the 2023 and 2024 target, previously defined at 3.25% and 3.0% with a 1.5% tolerance band on both sides.

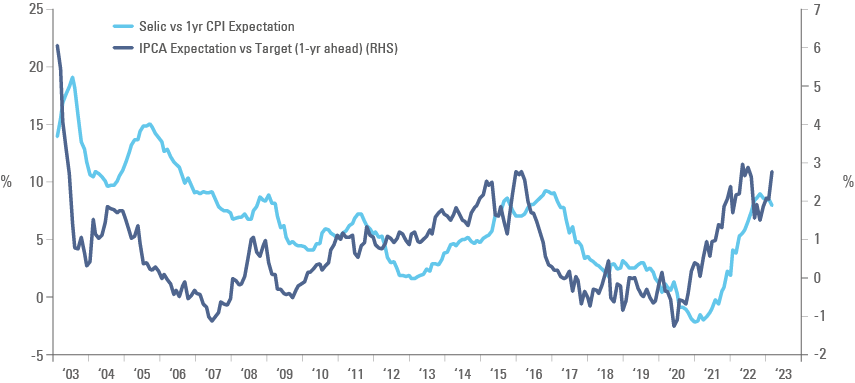

The meeting takes place against a backdrop of President Lula attacking the institution for pursuing too tight of an inflation target and keeping interest rates too elevated. The current policy stance, measured by the overnight policy rate (Selic) minus inflation expectations one-year ahead, is indeed as tight as during Ilan Goldfein’s (currently at the International Monetary Fund) governorship in 2016-17, but still not as tight as the level Henrique Meirelles imposed in 2003 to 2005, at the beginning of President Lula’s first mandate (Figure 3).

Arguably the current policy stance is even more restrictive than the one promoted by Ilan, considering Brazil’s current debt/GDP is more now than both those previous periods, the economy counts on much less subsidised lending from the National Development Bank (BNDES), meaning the impact of higher interest rates in the private sector is more pronounced. With such a restrictive policy, inflation expectations should be declining sharply, as they did between March and September 2022, when the gap between inflation expectations and the inflation target declined from 3.0% to 1.5%. However, since Lula’s election in October, the gap between expectations and target has widened by 90bps, reflecting the political and fiscal uncertainties.

The Brazilian Central Bank has constitutional autonomy, and the mandate of Governor Roberto Campos Neto remains in place until the end of 2024, but it is becoming more likely that the CMN agrees on an increase to the existing inflation targets for 2023 and 2024. An increase of the inflation target while maintaining central bank autonomy could be positive for confidence, as it is looking very unlikely the inflation targets of 2023 will be achieved. Therefore, the policy change should lead to less political pressure on the monetary authority.

Figure 3: Ex-ante real policy rate vs. gap between inflation expectations vs inflation target

Despite the large increase in inflation expectations, in our view it is very likely inflation will decline during 2023. The economy is likely to suffer as Brazil’s private sector has a much higher exposure to floating rate loans (particularly small- and medium-size companies) than other countries. However, the BRL has been much more resilient, thanks to a very attractive interest rate, better balance of payments and the prospect of an economic slowdown led by higher interest rates.

In other economic news, consumer price index (CPI) inflation dropped 10bps to 0.5% month-on-month (mom) in January, allowing the year-on-year (yoy) rate to remain stable at 5.8%. Vehicle sales declined to 143k in January from 216k in December, a slightly higher drop than suggested by seasonal considerations. Retail sales dropped 2.6% mom in December after a 0.9% decline in November, but the volume of services rose 3.1% mom after dropping 0.4% mom over the same period.

China: The yoy rate of CPI inflation rose 30bps to 2.1% in January, as producer price inflation (PPI) declined another 10bps to 0.8% deflation in yoy terms. Aggregate financing surged to RMB 6.0trn in January from RMB 1.3trn in December, RMB 0.5trn ahead of consensus as banks encouraged new loans. The current account surplus narrowed from USD 144.3bn in Q3 2022 to USD 106.8bn in Q4 2022.

Mexico: CPI inflation rose 0.7% mom in January from 0.4% mom in December, bringing the yoy rate up 10bps to 7.9%, while core CPI inflation rose 0.7% mom and 8.5% yoy over the same period. Nominal wages increased by a yoy rate of 10.9% in January, 240bps above December. The Bank of Mexico was more forceful in its response to stubbornly high inflation, hiking it policy rate by 50bps to 11.0%, 25bps more than consensus. Mexican President Andrés Manuel Lopez Obrador said he thinks that was the last hike. The yoy rate of industrial and manufacturing production rose by 3.0% and 2.7% respectively, the first 90bps above consensus, and the latter 60bps below.

South Africa: Gross foreign exchange reserves rose to USD 61.9bn in January from USD 60.6bn in December, while net reserves increased by USD 1.0bn to USD 54.8bn over the same period. Mining production rose 1.2% mom in December after declining 0.8% mom in November, but production remained 16.0% below the peak in April 2021 and 3.9% below the declining trend line over the last 20 years. For mining production to stabilise and rebound, South Africa needs to fix its energy crisis and stabilise the uncertain political environment.

Snippets

- Argentina: Industrial production declined by a yoy rate of 2.7% in December from +1.0% yoy in November.

- Chile: The trade surplus rose to USD 2.6bn in January from USD 1.8bn in December as exports were unchanged at USD 8.9bn despite a USS 1.3bn decline in copper exports to USD 3.0bn. Imports declined by USD 700m to USD 6.3bn over the same period. CPI inflation rose by 0.8% mom in January from 0.3% mom in December, but the yoy rate declined 50bps to 12.3% due to base effects.

- Czech Republic: CPI inflation rose 6.0% mom in January after remaining unchanged in December, lifting the yoy rate by 170bps to 17.5% over the same period.

- Egypt: Ratings agency Moody’s lowered Egypt’s sovereign credit rating from ‘B2’ to ‘B3’ due to lower liquidity and foreign exchange (FX) reserves, the lowest level before the ‘C’ grade levels. CPI inflation rose by 4.7% mom in January after 2.1% mom in December, bringing the yoy rate up by 450bps to 25.8% as core CPI inflation rose by 680bps to 31.2%, due to a 42% depreciation of the EGP since March 2022.

- Hungary: CPI inflation rose to 2.3% mom in January from 1.9% mom in December, bringing the yoy rate 120bps higher to 25.7%. The trade deficit narrowed to EUR 165m in December from EUR 1.4bn in November.

- India: The Reserve Bank of India hiked its policy rate by 25bps to 6.5%, in line with consensus. FX reserves increased by USD 14.0bn to USD 576.8bn in January. The yoy rate of industrial production declined to 4.3% in December from 7.3% yoy in November, slightly lower than consensus.

- Indonesia: FX reserves increased by USD 2.2bn to USD 139.4bn in January.

- Peru: Peru’s central bank kept its policy rate unchanged at 7.75%, in line with consensus.

- Philippines: The yoy rate of CPI inflation rose by 60bps to 8.7% in January, 110bps above consensus as the unemployment rate inched up 10bps to 4.3% in December. FX reserves jumped USD 3.6bn to USD 99.7bn in January, up from USD 93.0bn in September as the central bank works to replenish its reserves.

- Poland: The central bank kept its policy rate unchanged at 6.75%, in line with consensus.

- Romania: The central bank kept its policy rate unchanged at 7.0%, in line with consensus. Retail sales rose 1.4% mom and 3.8% yoy (up from 3.4% yoy) in December. The trade deficit widened to EUR 3.1bn in December from EUR 2.6bn in November.

- South Korea: The current account moved from a USD 0.2bn deficit in November (revised from - USD 0.6bn) to a USD 2.7bn surplus in December. The trade deficit narrowed from USD 1.0bn (revised from USD 1.6bn) to USD 0.5bn.

- Taiwan: The trade surplus narrowed to USD 3.9bn in January from USD 4.8bn in December as imports declined by 16.6% yoy terms in January (from -11.4% yoy in December). Exports dropped but came in slightly better than expected.

- Thailand: FX reserves increased by USD 8.8bn to USD 225.5bn in January.

Developed Markets

United States: A light week in terms of economic data. The trade deficit widened to USD 67.4bn in December from USD 61.0bn in November. Mortgage applications rebounded 7.4% in the week to the 3 February after 30-year mortgage rates dropped by 103bps to 6.32%, but rates have since rebounded to 6.66%. Initial jobless claims rose by 13k to 196k, and continuing claims increased by 38k to 1,688k, both still too low for the US Federal Reserve (Fed) to relax its inflation stability pursuit, particularly considering the University of Michigan reported that one-year ahead inflation expectations rose by 30bps to 4.2% after declining by 150bps since April 2022. The Michigan survey reported current conditions improved by 4.2 points to 72.6 while expectations rose by a more muted 0.6 points to 62.3.

A revision on the seasonal adjustment methodology of the CPI index basket led to upward revision on December’s headline and core CPI numbers. Headline inflation was revised higher by 20bps to +0.1% mom, and CPI ex-food and energy was revised up 10bps to 0.4% mom, or 6.2% yoy and 5.5% yoy respectively. The declining trend for yoy inflation remains intact despite the revisions and is likely to have further legs this Tuesday when the January numbers will be published. However, the leading inflation is likely to rise as CPI inflation is expected to rise to 0.5% mom in January, which would bring the last three months’ annualised inflation up to 2.8% from 1.6%. Meanwhile, CPI ex-food and energy three months’ annualised (currently at 4.4%) is likely to rise to 4.8% should consensus for the third 0.4% mom prove correct. The large upward surprise on payrolls on the previous Friday, and the elevated CPI number on a mom basis, means the downside inflation surprise needs to be large, in our view, to change current market trends (higher US Treasury yield, stronger USD and weaker US stocks), particularly with gasoline prices and used car prices increasing again and the service sector likely to be buoyed by a strong labour market.

Europe: Retail sales dropped 2.7% mom in December after rising 1.2% mom in November, keeping the yoy rate unchanged at -2.8%. In Spain, CPI inflation rose 0.8% mom in January after declining 0.1% mom in December, lifting the yoy rate by 100bps to 18.6%. German inflation rose 1.0% mom in January as the yoy rate increased 10bps to 8.7% over the same period.

Japan: The President of the Bank of Japan (BOJ) Haruhiko Kuroda will be replaced on 8 March. His replacement is likely to be announced this week and the leading candidate is Kazuo Ueda, a highly credible policymaker in our view who has been a director of the BOJ in the past and has kept close contact in advising both the BOJ and the Treasury on strictly technical terms over the last years. Ueda is very likely to change current BOJ policies, which have led to a complete detachment between the value of Japanese Government Bonds and market prices on swaps, even if the timing of the change remains uncertain.

Australia: The Reserve Bank of Australia hiked its policy rate by 25bps to 3.35%, in line with consensus, but issued a hawkish statement.

Sweden: The Riksbank hiked its policy rate by 50bps to 3.0% last week, pointing to another hike of 25bps in April. Inflation has remained de-anchored with CPI rising above 10% and above 8% excluding energy.

1. See https://www.reuters.com/world/middle-east/earthquake-could-cost-turkey-up-84-bln-business-group-2023-02-13/

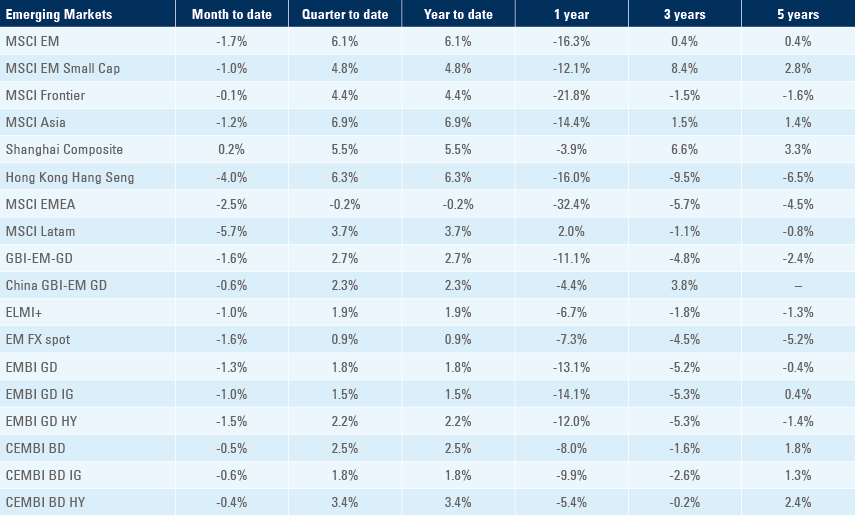

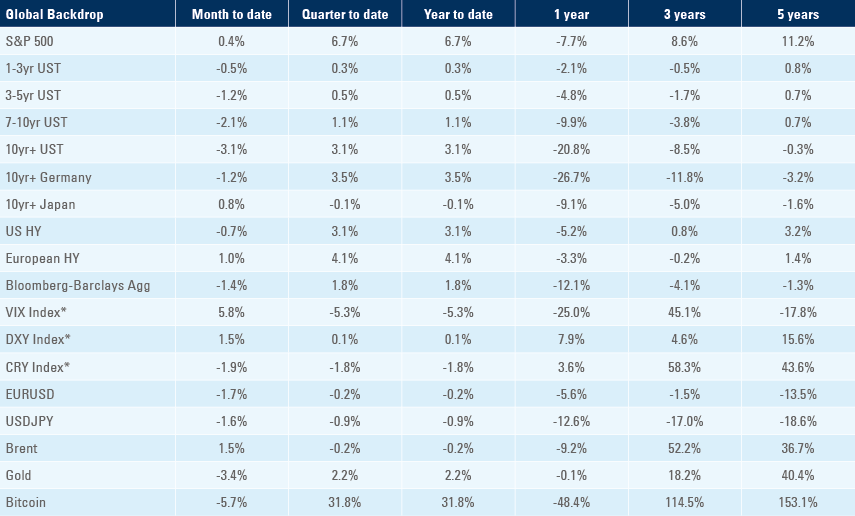

Benchmark performance