Bashar al-Assad falls in two weeks after a 13-year Civil War in Syria

- The impact on EM and global macro of the fall of the Bashar al-Assad regime in Syria

- Ukraine cease-fire discussions ongoing.

- Global PMI shows sentiment to manufacturing in EM improving

- The Politburo vowed to stabilise real estate & equities and moved to an easier monetary stance

- The Reserve Bank of India cut its reserve requirement but kept rates unchanged

- South Korean president faces an impeachment, in a lengthy process

- The EU-Mercosur reached an historical agreement

- Colombia has a new finance minister

- Ghana has a new president with a stronger mandate to implement reforms.

- Nigeria Eurobond issuance repriced its yield curve lower.

- In DM, Waller signals a rate cut in December and Barnier was ousted in France

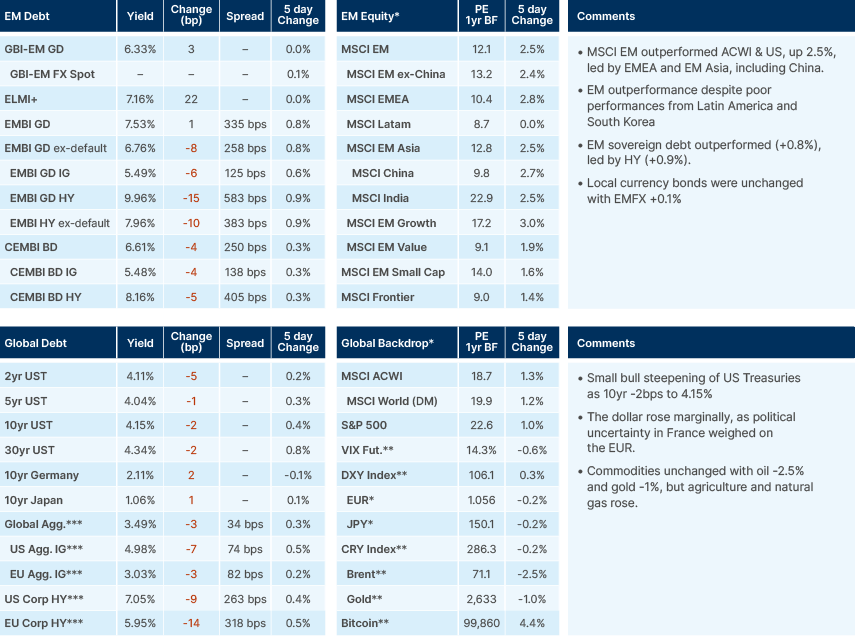

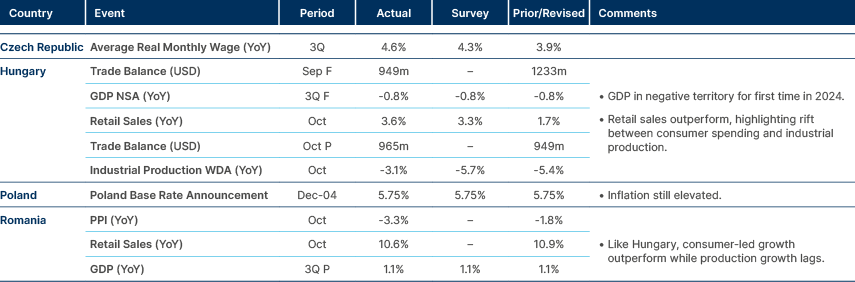

Last week performance and comments

Global Macro

Geopolitics

In a dramatic turn of events, Bashar al-Assad fled Damascus to Russia as rebels captured the Syrian capital. This marked a significant shift in the 13 year-long civil war, which saw Assad's regime collapse in just two weeks. The fall of Damascus has profound implications for the Middle East, particularly increasing Iran's isolation.

President-elect Donald Trump commented on the situation, suggesting that Russia had abandoned Syria, and that the US should refrain from intervening. One can speculate on whether Russia realised its air support would be ineffective without Hezbollah's ground forces, or maybe a deal involving Türkiye, Israel, and the US had influenced Russia's decision. On Sunday, Israel launched multiple airstrikes targeting former Syrian government military and security sites in and around Damascus, as well as in the southwestern province of Quneitra.

The future of Syria now lies in the hands of the rebels. An interview with CNN revealed their intent to control the narrative in the US. Türkiye's foreign minister, Hakan Fidan, announced that millions of Syrians living in Türkiye could now return home, signalling a potential shift in regional dynamics.

The New York Times reported that the Turkish military had attacked US-supported Kurdish forces over the weekend, adding another layer of complexity to the situation.

It also puts Israel and the US in a good position to push for further sanctions to pressure for a regime change in Iran. While investors are expecting lower oil prices on the back of a surge of production under Trump, sequentially oil may drop first as OPEC+ postponed production increases and Iran exports may drop in Q1 2025.

The winners in this geopolitical reshuffle appear to be Israel, Türkiye, Lebanon, and the US, while the Kurds, Russia, and Iran find themselves on the losing side.

A tripartite meeting between Trump, French President Emmanuel Macron, and Ukrainian President Volodymyr Zelenskyy, indicated progress towards a ceasefire. Zelenskyy expressed a collective desire for the war to end swiftly and justly, emphasising the need for peace for the Ukrainian people.

Commodities

OPEC+ has kept oil production frozen for December, with plans to increase output delayed by another four months of weak Asian demand. Compliance among members is improving. Oil prices may face downside risks in 2025 due to Trump's push for higher production and pressure on Iran, but higher EU natural gas prices and the return of maximum sanctions on Iran are likely to bring oil prices higher in the short term. Chinese demand has been recovering recently and non-OPEC+ supply (US and Brazil) is underperforming. Market positioning remains light, which also suggests the oil price may be due for a short-term rebound.

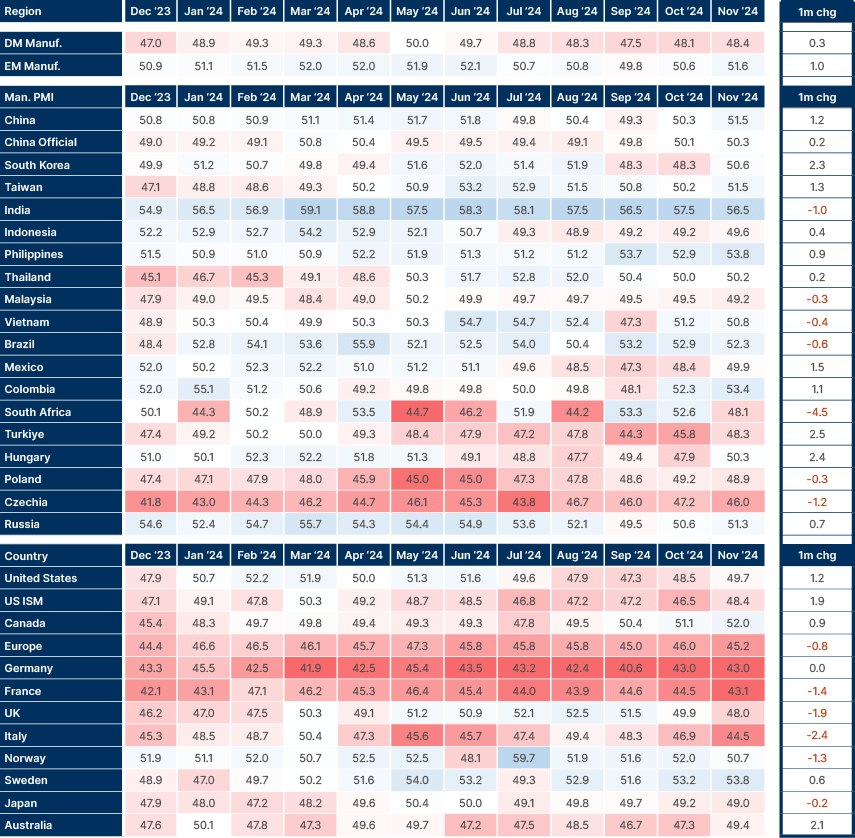

Global Manufacturing PMIs

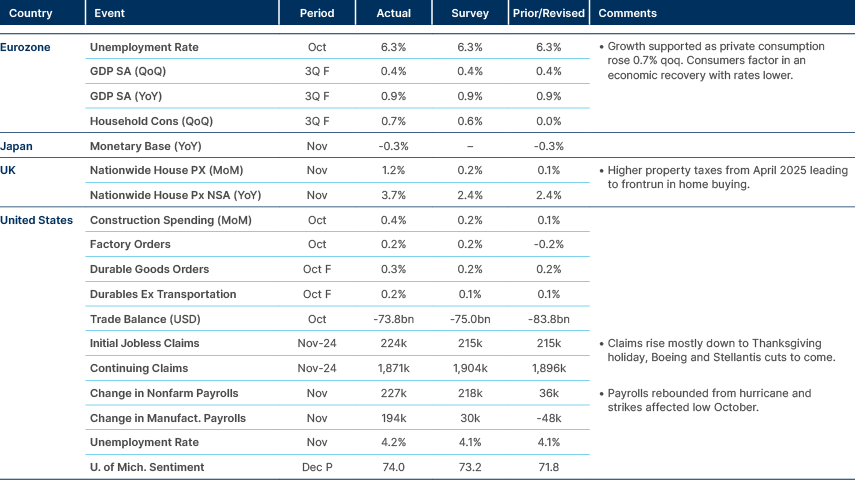

Emerging markets (EM) saw a one point rise to 51.6, driven by Türkiye, Hungary, Korea, Taiwan, China, Mexico, and Colombia. However, South Africa experienced a significant decline (-4.5), while India, Czechia, Brazil, and Vietnam showed moderation as per Fig. 1. Developed markets (DM) increased by 0.3 points, led by the US and Australia, though Italy, France and Germany remained very low.

In the US, the ISM Manufacturing Index rose by two points, with new orders up three points to 50.4, inventories up five points to 48, and employment up four points to 48. Prices paid decreased by 4.5 points to 50.3. The ISM Services Index fell by four points to 52, with prices paid unchanged at 58, activity and new orders down four points to 53.7, and employment down 1.5 points to 51.5.

Fig. 1: S&P Global Manufacturing PMIs and ISM Manufacturing

Emerging Markets

Asia

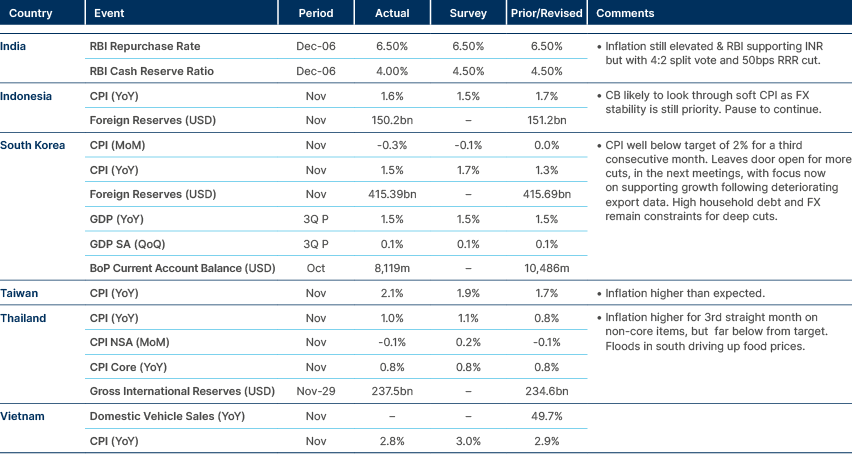

RBI kept rates unchanged, Indonesia, Thailand, Korea, and Vietnam inflation remain subdued.

China: As announced this morning, CPI inflation fell to 0.2% yoy, while producer prices slightly improved to -2.5%. Large cap Chinese shares listed in Hong Kong (H-shares) saw a 3% increase this morning after the Politburo vowed to stabilise property and stock markets. The Politburo, led by President Xi Jinping, shifted its stance on monetary policy for the first time in 14 years, adopting a "moderately loose" strategy and promising a "more proactive" fiscal policy.

India: The Reserve Bank of India (RBI) kept the repo rate unchanged at 6.5% due to high inflation, with two of the six directors voting for a 25bps cut. The RBI cut the cash reserve ratio by 50bps to 4.0%, releasing INR 1.26 trillion in banking liquidity. At the same meeting, the bank lowered its GDP growth forecast for FY2025 from 7.2% to 6.6%, while the CPI inflation projection was raised from 4.5% to 4.8%. The RBI's statement balanced inflation concerns with the need to monitor growth, emphasising that controlling inflation is crucial for medium-term stability. Additionally, the RBI announced increased interest rate ceilings for foreign currency non-resident bank deposits to attract USD inflows, reflecting active steps despite a healthy FX reserves import cover ratio.

Maldives: Moody’s affirmed the sovereign rating of the Maldives at ‘Caa2’, upgrading the outlook from negative to stable.

South Korea: Parliament quickly overturned President Yoon’s declaration of martial law. The Democratic Party had been considering impeachment due to alleged crimes committed by the First Lady. The threat of new investigations against the First Lady prompted Yoon to declare martial law. While the first impeachment motion last Saturday failed by a narrow margin, the confrontation between the ruling and opposition parties over the budget and impeachment is likely to continue, with mounting public anger in Seoul as Yoon’s approval rating nears single digits. Yoon’s allies are seeking a way for him to step aside quietly. The South Korean Prosecutors’ Office has opened a treason investigation into Yoon over his declaration of martial law. The leader of Yoon’s People Power Party, Han Dong-hoon, stated that the president will not be involved in any state affairs, including diplomacy, before his exit. This morning, Yoon has been banned from leaving the country amidst a second impeachment motion push by the opposition.

Yoon’s conservatives favour pro-business policies and a tough stance on North Korea, while the opposition supports a softer approach to Kim Jong Un, more cash handouts for citizens, and higher taxes for the nation’s wealthiest (chaebol) corporations.

If impeachment passes in the future, President Yoon would be suspended, and Prime Minister Han Duck-soo would be appointed as acting president. The Constitutional Court would have 180 days to decide whether to uphold the impeachment. If confirmed, snap elections would be held within 60 days of the court's decision. The Constitutional Court needs six votes to uphold the impeachment, but with three of the nine seats vacant, a unanimous vote of the present judges would be required. This situation is not surprising given South Korea's political history since independence.1

Latin America

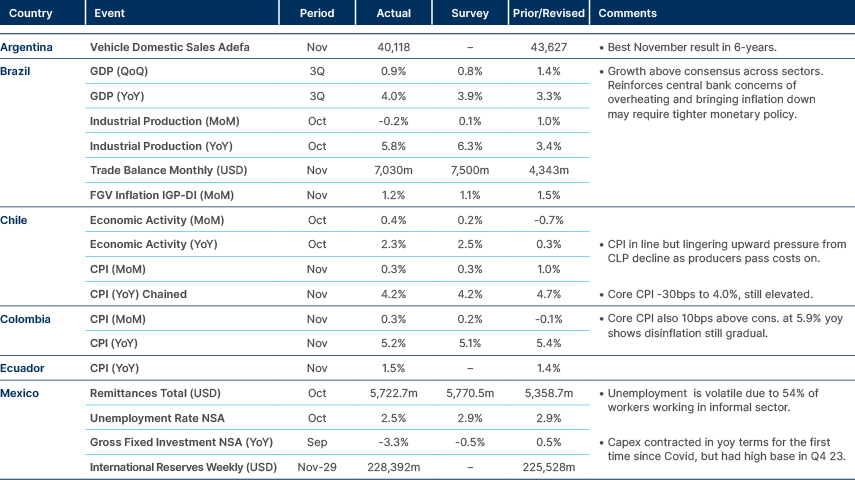

Brazil activity overheated. Chile and Colombia disinflation remain gradual.

Mercosur: European Commission President Ursula von der Leyen announced the EU-Mercosur trade agreement in Montevideo. The deal would eliminate high duties on industrial products, benefiting EU car exporters with the gradual removal of 35% tariffs. Brazil's Institute of Applied Economic Research projects agriculture-related exports to the EU could grow by USD 7.1 billion between 2024 and 2040.

However, some hurdles remain as French President Emmanuel Macron and Poland's Donald Tusk found the terms unacceptable and pledged to reject the deal. For approval, the agreement needs the support of at least 15 EU countries representing 65% of the population. Blocking it requires at least four countries with 35% of the population. The European Parliament must also consent, and agreements beyond EU institutions need ratification by national and regional parliaments.

Argentina: The central bank cut policy rates by 300bps to 32%. The decision goes against the IMF recommendation to bring interest rates to positive level in real terms. CPI inflation dropped to 2.8% mom in November, an annualised rate of c. 39%. President Javier Milei approval rating rose to 47% in November, from 43% in October driven by declining inflation and rising real wages.2

Brazil: The proposed tax reform aiming to raise the income tax exemption band from BRL 2,300 to BRL 5,000 has been delayed until 2026. The delay allows for thorough congressional review and ensures compensatory measures are in place to balance the budget. The government had proposed to increase taxes to the higher income segments, but most market participants deemed the tax revenue measures insufficient to compensate for the tax losses from the higher exemption band.

Colombia: President Gustavo Petro replaced Finance Minister Bonilla with Deputy Diego Guevara, who has been a key contact between Petro and Bonilla. As the window for reforms will close in the second half of 2025, ahead of the 2026 elections, execution risks for consolidating the fiscal deficit remain.

Colombia's fiscal position deteriorated in 2024 due to several factors, including the normalisation of oil revenues, expiration of income tax surcharges, intermittent economic activity, and frontloaded spending. Market concerns about the fiscal outlook have increased due to policy setbacks and global financial conditions. The administration's spending cuts are likely to lead to a marginal improvement in the fiscal deficit (to c. 6.0% in 2024 and c. 5.5% in 2025), but are probably insufficient to stabilise the debt-to-GDP ratio, which may approach 60% by the end of 2025.

Mexico: President Claudia Sheinbaum hopes to negotiate with President-elect Donald Trump to limit the number of third-country deportees Mexico receives from the US. A similar deal exists with the current administration to send deportees directly to their country of origin. Sheinbaum emphasised Mexico's solidarity with everyone but stated that Mexico's main function is to receive Mexicans.

Central and Eastern Europe

Economic activity held by retail sales as production remains negative.

Georgia: Pro-EU protesters have been rallying on the streets for 11 consecutive days. Initially peaceful, the protests have recently turned violent. Demonstrators are reacting to the government's decision to suspend EU membership talks, leading to clashes with police and numerous arrests.

Hungary: One week after Moody’s downgraded its Baa2 outlook to negative, Fitch affirmed its ‘BBB’ rating and moved outlook to stable from negative. The ratings are underpinned by “strong structural indicators, strong FDI inflows compared to its ‘BBB’ peers, offset by high government debt relative to peers, unorthodox policy actions and deteriorating governance indicators”, according to Fitch. The rating agency also highlighted “improved alignment between fiscal and monetary policies has significantly reduced macroeconomic imbalances, including a sharp decline in inflation and the return of a current account surplus.”3

Romania: The top court has cancelled the presidential election due to allegations of external meddling. The court found that one candidate received "massive exposure and preferential treatment" on TikTok, violating electoral laws. A re-run of the vote will likely take place in Q1-2025 and the election campaign will have to be re-run as well. This could see a new joint candidate from PSD-PNL emerge as the frontrunner candidate. Parliamentary election still going ahead this Saturday. Taken positively on stability and fiscal reforms.

Slovenia: S&P has affirmed Slovenia's sovereign rating at `AA-` and upgraded the outlook to positive. This rating is already one notch above Moody’s `A3` and two notches above Fitch’s `A` ratings. S&P's decision reflects the expectation that Slovenia's economic growth will remain resilient against external headwinds over the next two years.

Central Asia, Middle East, and Africa

Turkish disinflation moves on.

Bahrain: Bahrain issued a USD 1.25bn bond with a 5.875% coupon, due on June 5, 2032. The bond attracted over USD 3.5bn in orders, excluding joint lead managers' interest.

Ghana: Former President John Mahama won 57.6% of the votes counted in 75% of constituencies, marking the largest margin in over three decades. The opposition is also set to gain a majority in parliament. High living costs have thus led to the downfall of another ruling party. Citizens are now calling for the next administration to avoid vanity projects like the 5,000-seat National Cathedral.

Nigeria: Nigeria issued USD 2.2bn in Eurobonds, with USD 0.7bn maturing in 2031 and USD 1.5bn in 2034. The bonds were issued at 9.625% and 10.375%, tightening by 25bps and 50bps, respectively, from initial price indications. The long bond tightened by approximately 40bps after the new issuance, with no bonds trading above 10%. The new bonds traded between two and four points above the offer prices.

South Africa: Moody’s maintained the sovereign credit rating at Ba2, one notch above S&P and Fitch’s BB- rating.

Developed Markets

US non-farm payrolls broadly in line.

United States: Federal Reserve Governor Christopher Waller indicated a likely rate cut in December, while Chair Jerome Powell was more ambiguous. Despite stronger JOLTS and payrolls data, unemployment rose slightly. Bloomberg Chief Economist Anna Wong noted that the broader job surveys from October suggest labour market weakness extended beyond strikes and storms. This is corroborated by the fact that the six-month moving average of payrolls remains in a downtrend.

The Fed plans to lower rates by about 100 basis points in 2025 before stabilising. Currently, there is an 85% chance of a 25-basis point cut in December, with this week’s November CPI release being the final hurdle. Trump stated he has “no plans to replace Powell” and emphasised tariffs “will make America rich”.

Europe: In France, Prime Minister Michel Barnier was voted out, but Marine Le Pen signalled a budget compromise with a slower pace of fiscal deficit reduction. Le Pen emphasised the need to reduce deficits intelligently while supporting reindustrialisation and businesses.

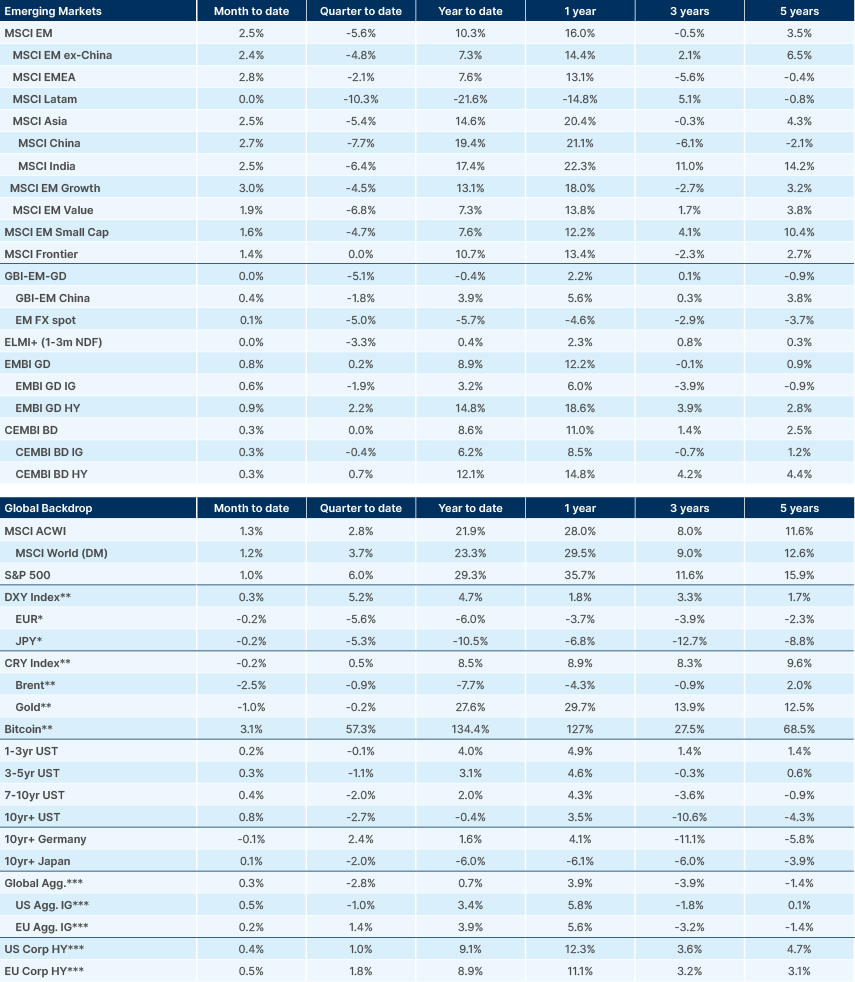

Benchmark performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

1. See – https://x.com/RealJakeBroe/status/1864106032353747027

2. See – https://batimes.com.ar/news/argentina/milei-gains-popularity-as-argentinas-economy-shows-sign-of-life.phtml

3. See – https://blinks.bloomberg.com/news/stories/SO591PBMZA4I