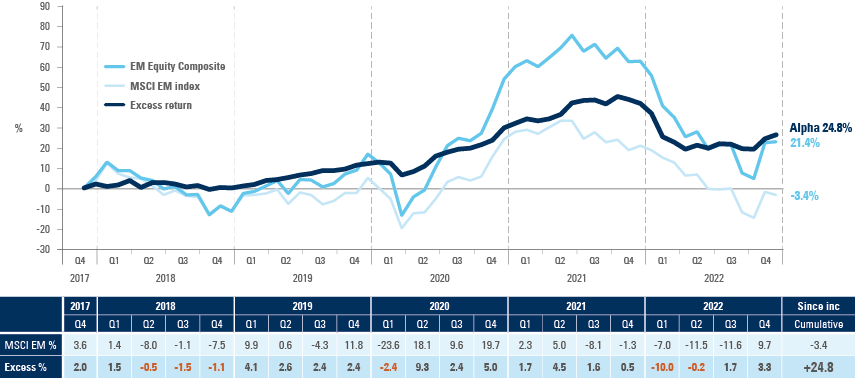

The past 5 years in Emerging Markets (EM) have been challenging, impacted by a series of global macroeconomic shocks triggering elevated market volatility and gyrations in market leadership. This was exemplified by the MSCI EM returning close to 0%, albeit including an over 90% positive move as well as witnessing its most protracted drawdown in history.

Our EM Equity strategy successfully navigated this backdrop, demonstrating the rigour of our approach that identifies companies with structural competitive advantages which can sustainably compound their earnings. The systematic nature of our process enabled us to exploit market volatility to our advantage; while our well-diversified portfolio, complemented by our overlay of macroeconomic and quantitative tools, saw us perform in a disciplined and consistent manner. The outcome was significant and sustained alpha generation reflected in top decile peer performance.

We look forward to the next cycle, which we expect to be more supportive for EM, with the portfolio invested in a compelling range of stock opportunities. The risk of recession in the developed world would naturally be a headwind, although we also see several strong positive inflections for EM:

- China policy actions have reversed course and are now pro-business and focused on prioritising economic growth.

- After a period of significant monetary tightening, EM policy is anticipated to reverse providing positive impetus to activity levels and liquidity.

- Valuation multiples trade at discounted levels and earnings expectations are prudent providing the basis for positive inflection driven by an EM economic growth recovery.

This paper provides some of the key features of the strategy performance and positioning over its 5-year track record.

Fig 1: 5 years is a long time in EM investing

Performance summary

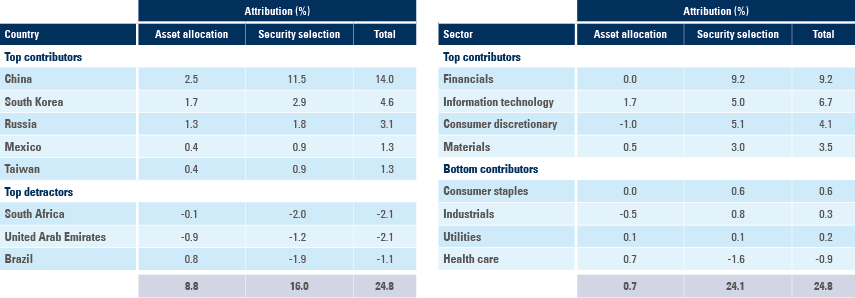

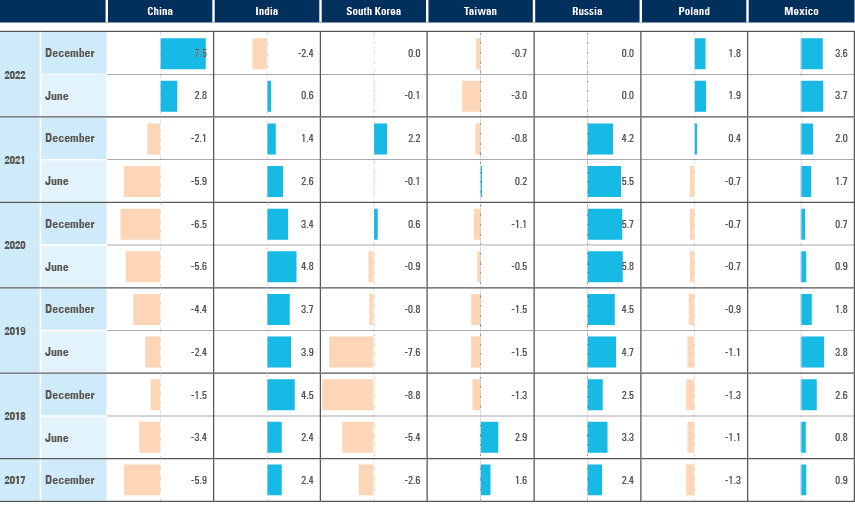

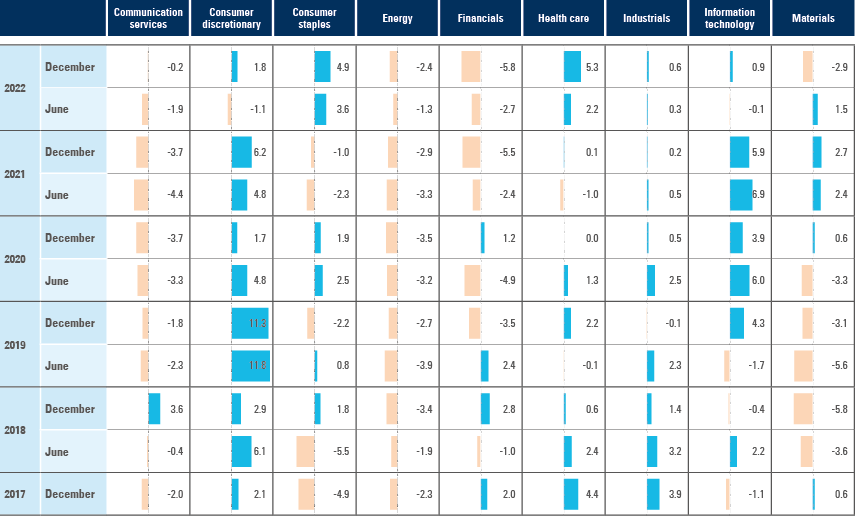

Since strategy inception 30 November 2017 to 31 December 2022, our EM Equity Strategy has generated alpha 65% from stock selection and 35% from country allocation. This is consistent with our long-term expectations and our portfolio risk composition. Alpha was generated across a wide spectrum of EM countries and sectors reflecting portfolio diversification, the broad opportunity set and our investment expertise in EM.

Fig 2: Country and sector attribution

The period witnessed a series of global macroeconomic headwinds triggering market dislocation and investment opportunities. Our disciplined process is designed to minimise drawdowns and to use them to our advantage, thereby enabling the portfolio to recover from prior losses.

Trade wars

During the mid-2018 US-China trade wars several of our Chinese and Taiwanese stocks corrected on elevated headline risk.

We reappraised stock fundamentals which were in most cases broadly unchanged, and the higher upside led us to upgrade our Stock Ratings and in turn to add to positions. These actions were well rewarded; for example, our holding in Silergy, a Taiwanese manufacturer of analogue circuits.

Covid

In early 2020, our macroeconomic process highlighted resilience and expectations of a sharp recovery in North Asia, whilst signalling that Latin America may struggle.

At a sector level, there were significant uncertainties and challenges for Financials, whilst Technology was well placed to benefit from additional demand. These views were reflected in the portfolio.

We also added to several existing holdings that had been unfairly punished in the sell off, e.g. Sinbon, a Taiwanese cable assembler. The ‘V’ shaped market rally that followed, including a profitless ‘tech frenzy’, meant our valuation discipline and focus on cash generating firms were key to ensure we only paid for fundamental reality rather than hype. This saw us take profits and trim our exposure to expensive outperformers, for example in China technology.

Russia

As the probability of conflict in Ukraine increased, we reduced our exposure and reallocated energy exposure to the Middle East and Brazil. Our exposure to neighbouring Kazakhstan (e.g. high-quality digital payment company Kaspi) and Poland (e.g. Dino Polska, a supermarket operator) also

sold off. This was despite these companies continuing to announce strong results and to execute well. We added exposure to the latter which was rewarded over 2H 2022.

China and global growth

At the beginning of 2022, the operating environment in China became more challenging for consumer-facing businesses, whilst stocks exposed to global cyclicality such as semiconductors were likely to encounter weakening demand.

We revisited our Focus List and reappraised Stock Ratings which led us to rotate away from Chinese consumption to internet-related opportunities, and to reduce our Korean and Taiwanese semiconductor exposure.

Meanwhile we added to consumer staples (primarily in Indonesia, Poland and South Korea) which had de-rated on transitory operating and cost pressures.

Risk summary

Risk management is an integral part of our portfolio construction process. This includes:

- Calibrated risk limits and diversification which ensure that no single country, sector nor stock dominate.

- A focus on quality and valuation discipline, systematically appraised through our Stock Rating, which frames the bottom-up risk-return opportunity.

The outcome is: high active share; well diversified track error distribution; and high information ratios.

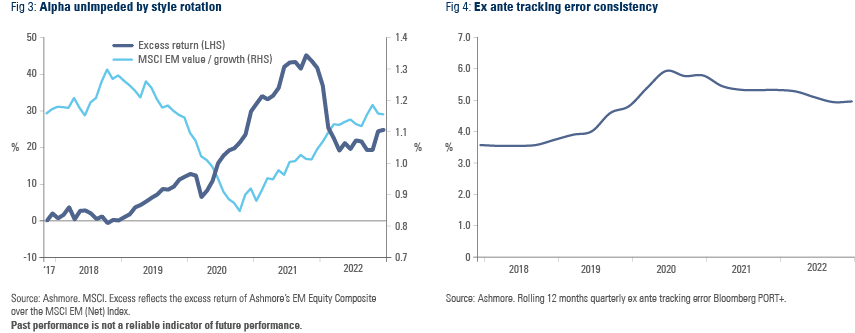

This approach has seen our alpha generation sustained over the 5 years, despite several gyrations in style market leadership. Towards the end of 2018 ‘value’ was in favour as the world recovered from the trade wars, only for ‘growth’ to dominate through 2019 and the first half of 2020. When Covid vaccines were introduced towards the end of 2020 ‘value’ overtook once again.

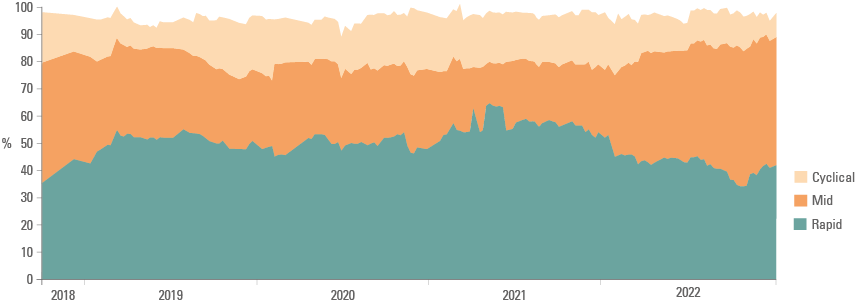

Moreover, while our approach consistently targets high quality and sustainable growth company attributes, we invest across companies with a range of different growth drivers: Rapid, Mid and Cyclical. This further diversifies our risk and returns.

- In 2018, cheaper valuations prompted our exposure to Rapid Growers to increase, especially in China following the significant sell off of higher growth stocks.

- Through 2020, our exposure to Cyclical Growers increased as the world recovered from Covid helping the portfolio to perform during the market shift to ‘value’ factors.

- In 2022, the more challenging and uncertain global backdrop led Cyclical Growers exposure to fall meaningfully and for our exposure to Mid Growers, where there is greater business stability, to increase.

- As we look forward, China reopening and a potential peak in global monetary tightening may offer a more constructive environment for Cyclical Growers.

Fig 5: Diversified growth drivers

Active management

Country positioning

We provide colour for some of our country position changes and their active weights below.

Fig 6: Country active weight position changes

China

Positioning has been dynamic to take advantage of significant volatility and changes in the operating environment. 2023 should see a strong economic rebound whilst valuations are at discounted levels. We are finding attractive investments in leading franchises in gaming, food delivery and e-commerce.

We are also attracted to consumer companies given our expectation for strong growth in retail sales and the service economy.

India

Our consistent overweight position reflecting the country’s strong economic growth and rich stock opportunity set. However, as we enter 2023, valuations are stretched and the economy is vulnerable to higher energy prices which has seen our exposure reduce.

Russia

We were significantly overweight position over much of the period due to the bottom up opportunity set for privately-managed and entrepreneurial companies trading at discounted valuations. This required significant adjustments in 2022.

Mexico

Despite a backdrop of sub par economic growth and rising regulatory risk, excessively discounted valuations created an opportunity for stock selection.

In 2023 and beyond, nearshoring presents Mexico with an opportunity for export share gains, whilst 2024 elections may bring some regulatory relief

Sector positioning

Our balanced portfolio was able to take advantage of the different industry cycles available from a range of sectors and industries.

Fig 7: Sector active weight position changes

Financials

The country specific nature of earnings drivers for banks means a highly selective investment approach was required; for example, we were persistently overweight Indian financials and underweight Chinese banks.

As we look forward, high interest rates, which buoyed margins for selective financials in 2022, may start to reverse. Meanwhile, in other economies, accelerating loan growth will likely offer alternative opportunities.

CASE STUDIES

ICICI bank

Through 2018 industry non-performing loan formation in India had peaked and private banks were well placed to take market share from poorly managed public banks.

ICICI is a leading private bank, whose quality of operations had undergone meaningful improvement which was undervalued by the market.

The company sustained strong loan growth and improving ROEs and remains a holding.

Edelweiss

Less successfully, we also invested in Edelweiss, which is a diversified financial with expertise in loan recovery and advisory services.

The business struggled post industry funding cost pressures in India caused by problems at peer ILFS.

We exited in 2019.

Tinkoff Bank (TCS)

A digital-only Russian financial technology company with a low cost and highly profitable model to take rapid market share.

We, alongside our Fixed Income colleagues, engaged with the company to help improve governance.

The collapse of the dual share classes, among other enhancements, helped drive significant market returns in 2H 2020 – 1H 2021.

Semiconductors

We have generally been overweight semiconductors primarily in South Korea and Taiwan.

This has often been expressed by investing in global leaders in niche technology hardware sub-segments in the most profitable segment of larger value chains. While the industry is underpinned by long term structural growth drivers, it behaves cyclically.

We are currently in one of the deepest cycle downturns in recent years, which we anticipate troughing in the near term. This will offer strong investment opportunities across an industry with multiple and diverse growth prospects.

CASE STUDY

Aspeed

Taiwanese semiconductor IC design firm with near 50% global share in BMC chips benefiting from server demand growth.

We invested in October 2018 during China trade tensions and exited in early 2022 post very strong performance and anticipation of a potential technology downturn.

Renewables/Green economy

We invested in global leaders within the EV and solar supply chain in South Korea and China.

These industries have seen rapid growth yet stock selectivity has been key given increased competition and evolving technological trends. Whilst penetration is low, competition is increasing and there is potential for more demand challenges as subsidy policies change, which imply an even more selective approach in future.

CASE STUDY

Solar modules and polysilicon

We assessed supply chain risks in the solar manufacturing process wary that polysilicon production is concentrated in the Xinjiang region of China which is at the epicentre of allegations of human rights abuses.

We find primary research key to identifying high risk suppliers, which in turn we map to module production companies and eliminate from the investment universe.

We also find engagement with management teams can help to promote: robust policies; third party verification audits; and a strategy of sourcing away from high-risk suppliers.

Telecommunications and utilities

In line with our focus on companies that compound earnings and avoiding low growth stocks, the portfolio has had minimal exposure to telecommunications and utilities. We do not forecast the growth outlook to change over the medium term and hence are unlikely to be adding meaningful exposure.

Healthcare

Overall, our exposure weighed on portfolio returns due to stock specific challenges. We continue to identify numerous compelling long term opportunities in the sector as healthcare remains underserved in EM and many businesses are taking share globally.

Consumer

Consumer brands and franchises have been an overweight as they take advantage of the tailwinds emanating from the secular rise of the EM consumer. Consumer sophistication and demands are increasing, whilst competition is ever present, meaning only the best brands and management teams will be able to take advantage of the opportunity.

Case studies

Anta

Chinese sportswear remains an underpenetrated segment.

Over the five years we have owned the stock, Anta has expanded their brand portfolio, enhanced direct to consumer offerings whilst also enhancing product quality and positioning.

We have adjusted position sizing in line with the stock volatility and operating environment and the stock has been a strong performance contributor.

XiabuXiabu

Less successfully, we also invested in XiabuXiabu, a Chinese hotpot QSR operator with attractive store economics.

The company has developed and scaled a new brand, CouCou, however, the business faced challenges due to management changes and Covid traffic disruptions.

We have managed the position actively and added to the position recently to benefit from China’s reopening.

Conclusion

Our EM Equity portfolio of best-in-class companies employs a systematic investment process to target high alpha.

Our investment approach has been thoroughly stress-tested over the past five years and has consistently demonstrated its discipline and core strengths. We are confident our track record will be sustained and continue to be enhanced over the next five years, and beyond.