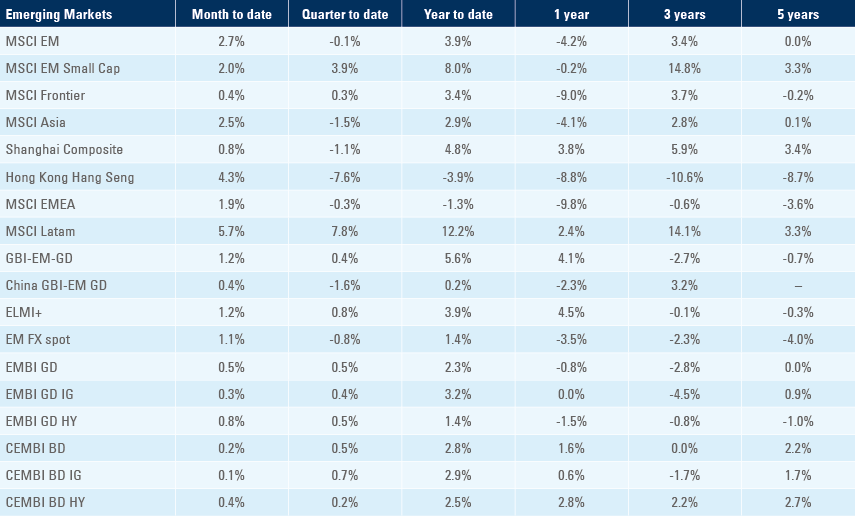

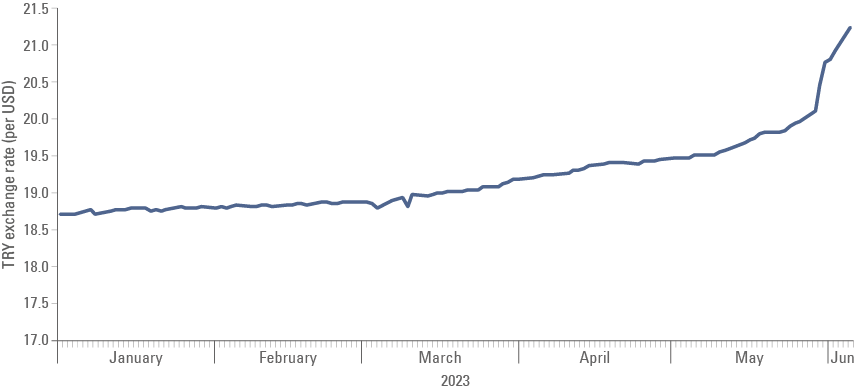

In Türkiye, President Erdogan throws an olive branch to the market by appointing an old friend. OPEC+ oil production cuts cause barely a ripple on Brent crude prices, as global inflationary pressures show signs of abating. In the United States (US), Congress approves an innocuous bi-partisan debt ceiling agreement. The VIX index falls to its lowest level since Covid struck. Asian manufacturing sector purchasing managers’ indices (PMIs) are cold in the North and hot in the South.

Global Macro

Türkiye: President Recep Tayyip Erdogan was sworn in for another five-year term and announced his new cabinet. Mehmet Simsek, a former Wall Street strategist and finance minister in past Erdogan governments, was appointed as Treasury and Finance Minister. Simsek is well-liked by market participants, and so far is saying all the right things. His first remarks signalled a possible return to more conventional macro policies: “Türkiye does not have any choice left other than returning to rational policy making. […] Transparency, predictability, consistency, and compatibility with international norms will be the core principles”.

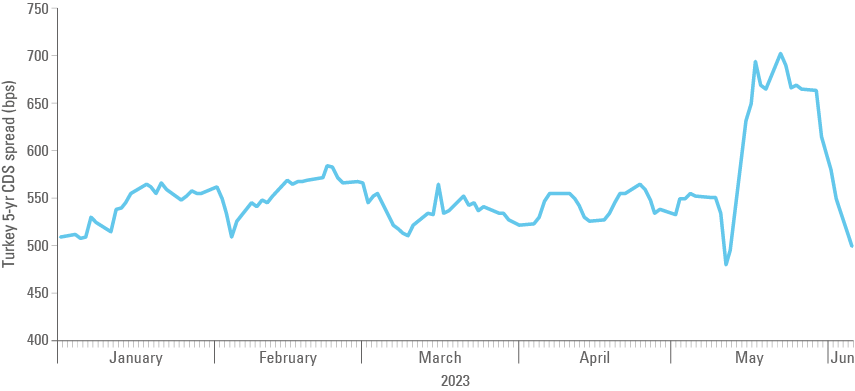

Time will tell whether Simsek is given the mandate to make the necessary changes, and the market remembers the short-lived adjustments under previous, technocratic finance ministers. But for now at least, this appointment has allowed the market to price out the worst-case scenario, and Turkish equities jumped on the news of the appointment, closing the week 12% higher. The sovereign credit default swap (CDS) for Turkey, which measures the cost of insuring against a sovereign default, tightened by around 200 basis points (bps) from its recent wides to less than 500 bps, as many market participants had short positions and hedges on Turkish assets. The Turkish Lira (TRY), which has been artificially maintained at an overvalued exchange rate by the central bank for two years, has been allowed to weaken since the election – an apparent encouraging sign that some degree of macro stabilisation is taking place. Türkiye's inflation rate came in at just 0.04% month-on-month (mom) in May, down from April’s 2.39%, owing to some price controls ahead of the election. There were also rumours over the last week that a former senior executive of the First Republic Bank in New York, a Turkish national working on Wall Street, may replace the current Governor of the Central Bank of Turkey.

Fig 1: the Turkish Lira (TRY) exchange rate demonstrates some degree of macro adjustment

Fig 2: Simsek’s appointment dramatically reduced Türkiye's sovereign risk (5-year CDS)

Commodities: At the OPEC+ meeting in Vienna over the weekend, the 13 member countries agreed to output cuts of 1.4 million barrels per day (bpd) (a 3.33% overall cut), starting January 2024. Saudi Arabia took a voluntary cut of 1 million bpd, starting as early as next month. Notably, some marginal oil-producing countries (including Nigeria and Malaysia) whose output is falling short of their quotas had to agree to lower quotas. Conversely, the United Arab Emirates (UAE) successfully negotiated with Saudi Arabia to have their quota increased.

Oil traded heavy last week amid weak macro data, notably out of China. It rebounded by 2.5% last Friday ahead of the OPEC+ meeting and is up 1.5% today to USD 77.30 per barrel of crude oil (bbl), but it has not broken out of its downward trend despite the production cuts announced.

Inflation: Global inflation pressure has been softening in recent weeks owing to lower input costs. This was notably apparent in the Euro-area, where core Consumer Price Index (CPI) inflation came in at 0.2% mom, the lowest since mid-2021. Headline CPI inflation was unchanged mom in May at 0.6%. This allowed the Euro-area year-on-year (yoy) CPI inflation to fall to 6.1% in May, down from 7.0% in April, the lowest level since February 2022 and below market expectations of 6.3%. In the US, the next CPI inflation report next is due out next Tuesday, one day ahead of June’s Federal Open Markets Committee (FOMC) meeting. The consensus forecast for May headline CPI inflation is 4.1% yoy (from 4.9% in April). Following the very mixed jobs report for May last week, the probability of a US Federal Reserve (Fed) rate hike in June stands at 30%, half the implied probability recorded one week ago.

Emerging Markets

Asia

China: China's Caixin Manufacturing PMI rose unexpectedly to 50.9 in May from 49.5 in April. This was in sharp contrast with the NBS Manufacturing PMI released a day earlier, which tumbled further into contractionary territory (48.8 in May, vs 49.5 in April). The latter survey covers 3,000 companies, vs just 500 companies for the Caixin survey, and is deemed to offer a better picture of the manufacturing cycle, which appears to be losing steam. In contrast, the health of the non-manufacturing sector showed in the Caixin Services PMI for May, which came in at 57.1, stronger than the 55.2 expected.

After a strong start of the year (up 8.2% in Q1), property sales slowed down to 3% yoy in May. State owned enterprises (SOEs) in the development space did better, recording sales growth of 22% yoy in May, but privately-owned developers (POE) saw sales decline by 18% over the same period. These disappointing numbers have seemingly spurred China’s government into action again. Press articles last week reported that regulators are considering reducing the down payment in some non-core neighbourhoods of major cities, lowering agent commissions, and further relaxing restrictions for residential purchases. We expect property sales will take more time to rebound, and that markets will remain sceptical until more decisive steps are announced at the central governance level, such as the 16-point plan unveiled last November.

Overseas investors sold USD 1.7bn worth of mainland China shares in May via Stock Connect, after selling USD 0.6bn in April. These outflows have been small in comparison to the large inflows worth USD 20.9bn that took place in January alone.

India: In contrast to North Asia’s grapples with a downcycle in manufacturing activity, India and most of ASEAN have been reporting very strong manufacturing PMI data. The S&P India Manufacturing PMI increased to 58.7 in May 2023 from 57.2 a month earlier, exceeding market forecasts of 56.5. This was the strongest improvement in factory activity since October 2020, boosted by strength of demand. Output growth was at a 28-month high; new orders expanded for the 23rd month running.

India’s gross domestic product (GDP) expanded 6.1% yoy in Q1, higher than an upwardly revised 4.5% in Q4 2022 and well above market forecasts of 5%. The growth surprise was led by fixed investments and higher services exports. However, private consumption weakened, and imports fell sharply, leading to a swing in the contribution from net exports to +1.4pp in Q1 from -0.2pp in Q4, i.e., accounting for nearly one-fourth of the Q1 headline growth.

Indonesia: The S&P Global Indonesia Manufacturing PMI fell to 50.3 in May from 52.7 in April, still in expansionary territory. Indonesia's CPI inflation rose 4% yoy in May, in line with the top-end of the central bank’s target inflation band and below the consensus estimate of 4.22%. Core inflation rose just 2.66% in May versus 2.83% in April.

Malaysia: The S&P Malaysia Manufacturing PMI declined to 47.8 in May 2023 from 48.8 in April, its steepest fall since January 2023 amid weakened demand. New orders moderated for the ninth month, with the latest slowdown being the sharpest in three months. As a result, production eased for the tenth month and by the greatest extent since January.

Malaysia saw its oil production quota shrink by 166,00 bpd to 401,000 bpd in 2024 as part of the OPEC+ deal reached over the weekend. This was the second-largest cut agreed at the meeting (-29.3%) after Equatorial Guinea (-42%).

South Korea: Export growth fell to -15.2% yoy in May from -14.2% in April, led by chips (-36.2%) and oil products (-33.2%), while auto vehicle exports remained strong at 49.4%. The trade deficit narrowed to USD2.1bn in May from USD2.7bn in April, reflecting a decline in energy imports.

The S&P South Korea Manufacturing PMI rose to 48.4 in May 2023 from 48.1 in April, the 11th consecutive reading below 50. Both output and new order volumes were scaled back at quicker rates than in April, as economic weakness at home and internationally continued to weigh on production and demand. That said, manufacturers signalled a further improvement in supply chains – the strongest in just over seven years. Price pressures also eased in May, as panel members signalled the softest rise in average cost burdens since September 2020.

Headline CPI inflation continued to soften to 3.3% yoy in May (consensus 3.4%), easing from 3.7% in April. The year-end inflation consensus forecast is at 2.8%, and the market is pricing in one rate cut to 3.25 by year-end.

Taiwan: The S&P Taiwan Manufacturing PMI fell to 44.3 in May 2023 from 47.1 in April, marking the twelfth consecutive reading below 50. Companies noted the steepest reductions in output and total new business since the start of 2023 amid reports of weaker customer demand.

Thailand: The S&P Manufacturing PMI dropped to 58.2 in May 2023 from April's record high of 60.4, its 17th straight month of expansion. Both output and new orders rose at the second fastest pace in the survey history. On prices, input cost inflation fell markedly to the lowest since August 2021, owing to better supply chain conditions.

The Bank of Thailand (BOT) hiked its policy rate by 25bp to 2.00%, as expected. The vote was unanimous, and the BOT remains hawkish, citing upside risks to its 2023-24 GDP growth and inflation forecasts.

Latin America

Argentina: The central bank announced a resolution limiting the dollar access to provinces and municipalities to meet their dollar debt obligations. Argentine provinces have payment commitments of around USD 1.4bn in the second half of the year, and the new regulation would allow access to approximately USD 560m. Chinese officials approved Argentina tapping up to 70bn yuan (USD 9.89bn) of the swap line, up from a previous limit of about 35bn yuan.

Brazil: GDP growth for Q1 surprised positively, coming in at 4.0% vs. 3.1% expected (and 1.9% prior). The agricultural sector was the main highlight on the supply side, driven by this year’s record grain harvest. The sector rose an impressive 21.6% quarter-on-quarter (qoq) in Q1 2023, interrupting a series of negative prints since Q1 2022. Services rose mildly to 0.6% qoq, keeping the growth rate below 1.0% since Q3 2022. Industry declined for the second quarter at -0.1% qoq. The S&P Global Manufacturing index printed at 47.1 vs. 44.3, also showing signs of stabilisation. On the political side, with the Fiscal Framework on track for approval in Congress, the Government’s focus will move towards a broader overhaul of the country’s tax code. On the geopolitical front, Brazil held the South American Summit in Brasilia, with Venezuela’s President Maduro attending (Maduro is also travelling to Türkiye for Erdogan’s inauguration). Questionably, Brazilian President Lula defended Maduro, suggesting there is a “narrative” (authoritarianism and anti-democracy) created to attack him. Lula’s remarks drew rebukes from Chile’s and Uruguay’s presidents. Lastly, Lula appointed his personal lawyer Cristiano Zanin to the Supreme Court as widely anticipated. Zanin will have to go through a Senate hearing to confirm his appointment.

Colombia: The Finance Ministry recently announced changes to the budget amendment sent to Congress in February which point toward a lower level of fiscal expenditure. While details are still to be released, the proposal seems to have three main components: 1) a reduction in planned expenditures; 2) an adjustment to the accounting of payments for the fuel stabilisation fund (FEPC); and 3) a potential change in the way the outstanding FEPC debts will be paid. In summary, the reduction of the proposed 2023 expenditure addition to COP14.7trn from COP23.2trn should compensate for potential revenue losses and facilitate achievement of the fiscal deficit target. Separately, Trade Minister Umana said the government is considering whether to award more exploration contracts following the publication of a report showing Colombia’s crude oil and natural gas reserves are declining. On the data front, national unemployment rose to 10.7% in April from 10.0% in March.

Chile: Economic activity contracted by -1.1% yoy in April vs. -2.1% in March. The unemployment rate declined to 8.7% (from 8.8%) vs. an expected increase to 8.9%. On the political end, President Boric announced he will insist on the tax reform proposal and present it to the Senate by late July. The proposal was voted down in the Lower House earlier this year, and a new proposal was only due to be considered by the House next year. However, the administration opted to present the proposal to the Senate instead. Boric said the administration will have “all the conversations that are needed’ with lawmakers, the business community and labour unions. Regarding pension reform, Boric said it has been seven months since the administration presented its pension reform proposal and voting hasn’t started yet.

Dominican Republic: Governor Valdez Albizu suggested the weak GDP print in Q1 (+1.4% vs. +4.9% prior) coupled with the drop in inflation would likely justify the start of the easing cycle. Inflation in April had come down from a peak of above 10% in 2021 to slightly above 5%. This week, then, the central bank cut policy rates from 8.5% to 8.0%, one of the first Emerging Market (EM) countries to pivot to rate cutting.

Mexico: The S&P Global Mexico Manufacturing PMI edged down to 50.5 in May from 51.1 in April. The minutes of the May 18 Banxico policy meeting (in which it left rates unchanged at 11.25%) revealed that all members agreed to “pause” to assess the effectiveness of the monetary policy channel, but that rate cuts were not on the cards. The quarterly inflation report revised growth to 2.3% (from 1.6%), with a focus on sticky core prices and a tight labour market. Meanwhile, remittances for April continued to be strong with over USD 5bn of inflows.

In political news, the Morena Party asked its members to stop organising rallies in favour of presidential primary candidates. This came after a decision by the electoral body INE. Voters in the State of Mexico and in Coahuila will go to the polls this Sunday, 4 June, the former to elect a new governor and the latter to elect a new governor and a new local Congress. These will be the last major elections before the June 2024 presidential election and, as such, may provide some insight on how that race may shape up, particularly given the Morena ruling coalition has chosen markedly different electoral strategies in each state.

Peru: Lima CPI inflation was +0.32% mom in May, driving the yoy CPI inflation number to 7.9%, in line with expectations. Core inflation rose only 0.08%, showing signs of slowdown which could leave the central bank with room to cut rates later in 2023.

Uruguay: The unemployment rate stood at 8.8% in April, up from the 7.7% reported in the same month last year. However, the activity rate increased to 63.0% from 61.7% back in April 2022. Labour market participation has converged close to the 2011-2019 average (63.4%) following the decline observed during the pandemic period. The employment rate edged higher to 57.6%, 0.6 points above the same month last year. It’s noteworthy that on a seasonally-adjusted basis the employment rate stands at the highest level since September 2017. Meanwhile, Producer Price Index (PPI) inflation fell by 9.04% in May compared to -6.65% in April.

Central Asia, Middle East, and Africa

Nigeria: In his inaugural speech, President Bola Tinubu vowed to remove fuel subsidies and also announced plans to adopt a uniform exchange rate, another key market demand; This was followed by media reports that Nigeria’s central bank had devalued its currency the naira (NGN) by 26% to NGN 630 per USD, but this was promptly denied by the central bank, which confirmed that the exchange rate remained at NGN 465 per USD.

South Africa: The seasonally-adjusted Absa PMI fell to 49.2 points in May, from 49.8 in April. The latest reading pointed to the fourth consecutive month of contraction in manufacturing activity, amid a sharp deterioration in the business outlook to its weakest since early 2020, amid the ongoing power crisis in South Africa.

Central and Eastern Europe

Czechia: The S&P Global Czech Republic Manufacturing PMI was unchanged at 42.8 in May, compared to market expectations of 41.6. This marked the 12th straight month of contraction in manufacturing activity, mainly due to a sharp drop in output amid muted client demand and marked contraction in new orders.

Hungary: Just like Germany, Hungary went into a recession in the first quarter of the year. Hungary's GDP fell 0.3% qoq in Q1 2023, following a 0.6% qoq contraction in the previous period. Hungary is undergoing a major external rebalancing: it recorded a trade surplus of EUR 1.1bn in Q1, or circa 3% of GDP in annualised terms, a return to pre-Covid levels of external balance; This is in sharp contrast with the large deficit (around 8% of GDP in annualised terms) recorded at some point in 2022.

Poland: Polish inflation fell for a third consecutive month in May to 13% yoy (consensus 13.4%) from 14.7% in April. The S&P Global Poland Manufacturing PMI edged up to 47 in May 2023 from 46.6 in April, beating market expectations of 45.9. The reading was supported by output, new orders, and employment components. Input and output costs eased for the second month to their record lows due to cheaper raw materials and a stronger Zloty.

Developed Markets

United States: Following several days of intense negotiations between Republican Speaker of the House Kevin McCarthy and President Joe Biden, a bipartisan coalition in the House of Representatives passed a compromise bill that averted default by suspending the USD 31.4trn Federal debt ceiling for two years. If a good deal is judged by the number of people who oppose it on both sides, the bill was a success as hard-right Republicans and hard-left Democrats voted to reject it. The US Senate also voted to approve the legislation and sent the bill to President Biden for signature, several days before the ‘x-date’ at which the US government would have run out of money to pay its bills. Among other things, the bill also ended the three-year freeze on student loan repayments begun in March 2020, which will likely restrain economic activity as millions of borrowers will need to start making payments earlier than had been anticipated. It also makes significant changes to environmental laws that will accelerate renewable energy investments, institutes two years of spending caps and numerous other policy changes, while maintaining most of Biden’s legislative accomplishments.

The immediate impact of the bill’s passage will be a large ramp-up in issuance of T-Bills by the US Treasury, a necessary step to rebuild cash balances held with the Fed. Estimates point to bill supply of upwards of USD 1trn over the summer months as the Treasury looks to rebuild its Treasury General Account (TGA) to the USD 600-700bn range. Technically, a TGA rebuild can happen without a drain on bank reserves if money market funds absorb the new issuance by depleting their Reverse Repo (RRP) balances – RRP balances currently stand at USD 2,142bn.

Market consensus has tentatively pointed to a Fed ‘skip’ at June’s FOMC meeting after ten straight rate increases. Philadelphia Fed President Harker said the Fed “should skip a rate hike at [its] June meeting” while Vice-Chair nominee Dr. Phillip Jefferson pointedly said “skipping a rate hike…would allow the committee to see more data,” echoing Fed Chair Powell’s earlier comment that the Fed “can afford to look at data and ongoing outlook”.

Eurozone: The Eurozone Manufacturing PMI was 44.8 in May, up from 44.6 in April. However, the report’s components was more sobering: the output component declined the most since last November and new orders dropped at the quickest pace in six months.

Japan: Japan retail sales were down 1.2% sequentially in May, versus +0.5% expected. Industrial production also came in short of expectations at -0.4% mom vs 1.4% expected.

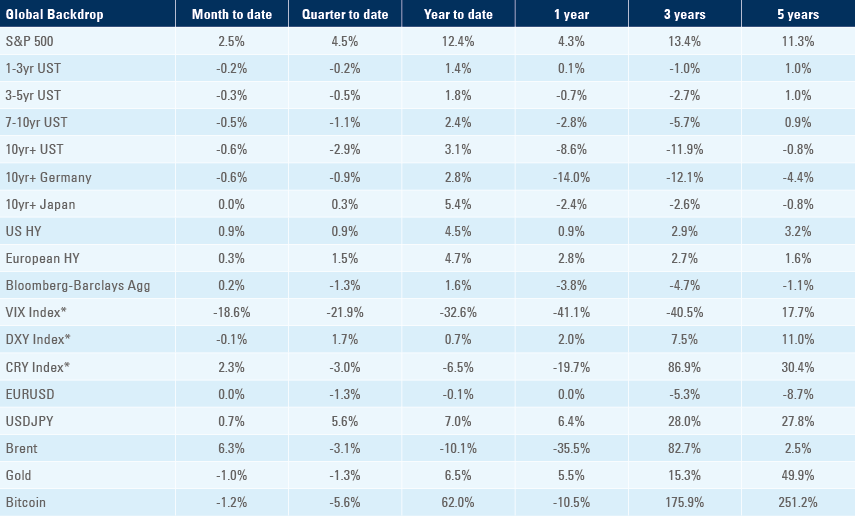

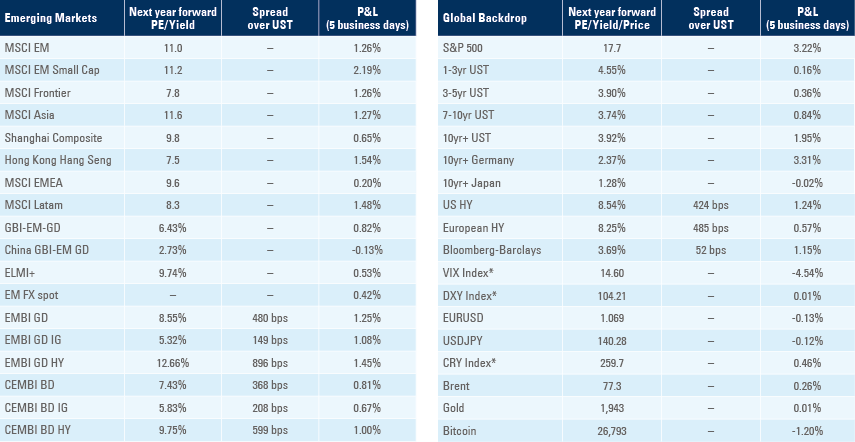

Benchmark performance