A sudden break in the clouds over Emerging Markets, thanks to liquidity and inflation relief

Softer inflation data and the feel-good factor from China create a positive confidence shock. Emerging Markets (EM) debt issuance jumps to USD 34bn in a single week. Central Europe, India and Mexico post better inflation numbers. Brazil’s Finance Minister offers a plan to limit the risk of fiscal slippage. China walks back some tech sector regulation. Egypt moves to float the Egyptian pound. Pakistan receives strong support for flood damage relief from international donors.

The week ahead

China’s Q4 gross domestic product (GDP) (consensus: 1.6% yoy), December retail sales and industrial production (IP) come out on Tuesday, but won’t tell us much about the impact of recent decisions to re-open the economy. We’ll continue taking the pulse of inflation with December's core consumer price index (CPI) in Poland, and for South Africa and Malaysia. On Thursday, the central banks of Turkey, Indonesia (consensus: +0.25% to 5.75%) and Malaysia (consensus: +0.25% to 3.00%) hold their monetary policy committee meetings. In developed markets, the US is on holiday on Monday and the economic calendar is fairly light – The Bank of Japan (BoJ) meeting and the US retail sales data will take top billing. Several US Federal Reserve (Fed) officials, including Vice-Chair Lael Brainard, are scheduled to speak this week and will share their thinking ahead of the 1 February Federal Open Market Committee (FOMC) meeting.

Emerging Markets

The top theme in EM last week was the improving relative growth prospects for 2023 versus developed markets (DM), a favourable setup for EM asset prices despite general pessimism for global growth in 2023. This was illustrated again by the latest World Bank Global Economic Prospects report, where DM growth is forecast to fall to 0.5% in 2023 from 2.5% in 2022, while EM growth is forecast to remain at 3.4%. Of course, the picture is not homogenous, and several low-income countries remain exposed to multiple challenges. However, China’s re-opening has changed the conversation: China’s de-correlation with the global business cycle, which was a drag for the region and for EM in 2021 and 2022, is now becoming a potential tailwind. The World Bank’s report forecasts China growth at 4.3% in 2023, up from 2.7% in 2022.

Another important theme last week was the ebullient form of the EM debt primary market. EM credit saw USD 34.3bn of primary issuance last week alone, the highest weekly issuance volume in two years. This has taken the year-to-date (YTD) total to USD 63.4bn, or 18% of the whole of last year’s (2022) total supply. The recent rally in US Treasuries – and firm environment for credit spreads – opened a window of opportunity to tap the market, which many investment grade issuers were more than happy to jump through. New issues were met with strong demand from managers of funds and exchange-traded funds (ETFs) that were starved of paper last year, so overall index spreads tightened last week, even though the volume of issuance has caused investment grade spreads to lag since the start of the year.

The global macro backdrop has been increasingly supported by falling headwinds from (energy) price inflation. In its Global Risks Report published last week, the World Economy Forum (WEF) gave top billing to the global ‘cost-of-living crisis’, and there will be much talk of this at its annual gathering in Davos this week. While we do not minimise the impact of inflation on real incomes and food security, the market is looking past that. Lower energy and commodity prices, already observable for a few months, are now coming through the data. The most eye-catching example was the negative sequential inflation recorded in the US for December: owing to a 4.5% sequential decline in energy prices, the US ‘headline’ price index was down 0.1% mom, the first negative of many this year. But the good news goes beyond energy costs: significant progress was recorded in core CPI, which came in (in line) at 0.3% mom, despite the acceleration in shelter price inflation (0.8% mom vs. 0.6%). Excluding shelter, services sector inflation has been very muted and has only averaged 0.1% mom in the three months of Q4 2022, a mere 1.2% annualised rate of increase. These positive signs will not be lost on the FOMC when they consider when to end the tightening cycle.

Elsewhere, inflation data were also better than expected last week, particularly in Europe, where the warmer-than-expected weather and the high level of gas in storage (at c. 80% of capacity) allowed wholesale gas prices to fall below pre-Ukraine war levels. The final Euro-area inflation number for December, due on Wednesday, should confirm CPI decelerated to 9.2% yoy from 10.1% yoy in November. Energy prices was the main driver of the decline, falling 6.5% mom in December, notably thanks to new price caps in Germany. European wholesale gas prices were 45% lower mom in December thanks to the mild weather – they are another 20% lower since the start of the month. These prices impact CPI with a lag, so energy prices are only just starting to push headline inflation lower in Western and in Central Europe, discussed below.

Central Europe: Inflation data in Central Europe has also started to reflect the decline in energy prices: in Poland, CPI edged up by 0.1% in December, down from 0.7% mom in November, and slightly below market estimates of a 0.2% rise. In Czechia, CPI rose 15.8% from a year earlier in December, significantly below the central bank’s 19.1% projection for the month. This was notably due to the impact of government energy subsidies and cheaper motor fuels. In Romania, CPI surprised lower in December at 0.37% mom vs. 0.5% expected and 1.25% prior. The biggest factor behind the drop in inflation was a 16% mom fall in liquid fuel prices. Core inflation came in at 1.0% mom vs. 1.6% in November.

India: In India, the December CPI came in at 5.7% yoy, from 5.9% in November and vs. 5.9% expected. The improvement came notably from a drop in vegetables prices (-15% yoy). So-called core-core inflation, which excludes all energy product prices including diesel, also declined to 5.8% yoy from 6.3% in November. The wholesale price index (WPI) inflation data released later this week is also expected to decline by 30 basis points (bps) to 5.5%.

Mexico: CPI inflation came down to 0.38% mom in December, vs. 0.43% expected and 0.38% in November. Year-on-year inflation was stable at 7.82% yoy in December (7.80% yoy in November), in line with expectations. Core inflation rate eased to 8.35% yoy from 8.51% in November, also in line with market expectations.

Brazil: Some positive news on Brazil’s fiscus: new Finance Minister Fernando Haddad took the opportunity last week to address and correct the (bad) impression given by the 2023 budget law and the ‘transition PEC’ (constitutional amendment) approved in December, which had created a BRL 145bn waiver to the federal spending cap and had allowed the primary deficit projections to run in excess of 2% of GDP. The new plan proposed a series of amendments designed to reassure the central bank and the capital markets. It is based principally on the update of revenue information, plus permanent and temporary revenue measures, and would theoretically add-up to 2.3% of GDP. However, since the timing and magnitude of these measures may not be known until later this year, Haddad remained conservative and estimated that the 2023 primary deficit would be c. 1.0% of GDP. In efforts to improve the picture further, Haddad mentioned the resumption of certain fuel taxes would be discussed after the new Petrobras board took office.

Meanwhile, the political drama provided by the storming of Brasilia’s Federal District last week has not gone away. Documents were found at the residence of former President Bolsonaro’s Justice Minister Anderson Torres, suggesting plans were being made to illegally alter the results of the presidential election. Theses included a decree drafted for the President to call a State of Emergency and overturn the results of the election. Bolsonaro himself was not directly implicated by the documents, but former minister Torres was arrested upon his return to the country following the January 8 riots. Later in the week, the Supreme Court Justice de Moraes granted the request by the Prosecutor General’s office to add Bolsonaro himself to the probe into the parties responsible for the riots.

IBGE inflation, the main consumer price index for Brazil, was up 0.62% mom in December, above consensus expectations of 0.45% mom. The December yoy inflation rate fell to 5.8%, its lowest reading since February 2021, but slightly above expectations and still some way above the central banks target’s upper band of 5%. The average of core measures accelerated from 0.33% mom in November to 0.66% mom in December.

Chile: Although his previous efforts to re-write Chile’s Constitution were voted down by referendum last year, President Boric has been determined to try again: last week Congress approved a bill charting the process for writing a new constitution, which will play out over 2023. The bill governs the election (on May 7, 2023) of a 50-strong Constitutional Council, assisted by a committee of experts formed of senators and house representatives. The new Constitution drafted by the Council is due to be submitted to a national plebiscite (referendum with compulsory voting) on December 17. In comparison to the similar process followed last year, the main political parties agreed on a series of guidelines that reduce the risk of radical ideas creating unnecessary noise and delays during the proceedings. The guidelines include matters that are particularly important to market participants such as an independent central bank, an independent judiciary, respect for property rights.

Ecuador: Ecuador will begin to reduce taxes on Special Consumption (ICE) and Foreign Exchange Outflows (ISD) as of February 1, 2023. The ISD, in particular, will be gradually reduced until the end of the year. In what we see as an encouragingly common-sense approach to policymaking, Economy Minister Arosemena declared: "We believe that the ISD was a mistake. It was put in place in the hope that the money would not leave. But what it achieved is that the money did not come in”.

Peru: The clashes between security forces and supporters of former President Castillo, who was removed and charged for conspiracy by Congress in December, turned more violent. At least 47 people have died in the last five weeks, one third of that in the last week alone, and hundreds have been injured. This led Peru’s top Prosecutor’s Office to launch an inquiry into newly-appointed President Dina Boluarte and senior cabinet ministers. Boluarte, who is from the same leftwing party as Castillo – but evidently does not have the same appeal for the rural indigenous population of Peru – has insisted she will not step down. Boluarte received valuable support last Tuesday when her government won a vote of confidence in Congress by a wide margin (73 votes in favour, 43 against and six abstentions). But security forces proved unable to control the protests, which spread from Puno and Cusco to the national capital Lima later in the week. The state of emergency, declared by the government in mid-December was extended for another month.

China: Following a strong run since October, and increased investor interest this year, the Chinese real estate debt sector re-opened last week: Wanda Group’s property arm returned to the market after a 16-month absence, selling USD 400 million of US dollar bonds without a state guarantee. It placed the bonds at a yield of 12.4%. In another sign of support from the Chinese authorities, state news agency Xinhua reported that Beijing was planning to ease the "three red lines" policy designed to rein-in real estate debt. The authorities are considering 21 measures to offer USD 67 billion in funding to 30 "good quality" and systemically-important real estate developers – to complete housing projects and expand rental housing, according to the report. Few details have emerged, but it seems that in comparison to similar steps announced last year, a broader set of companies would be allowed to increase leverage again. House prices data for December shows that prices have not rebounded yet: new house prices were down 0.25% mom in December, and existing houses prices declined by 0.48% mom.

Equity investors were particularly focused on how China has been walking back two years of heightened regulation on the tech sector and internet companies. Already this week, ride-sharing company Didi has been allowed to register new users again. The relaxation of what appeared to be excessively tight controls over these sectors is full of promise and added USD 100bn in market capitalisation across Tencent and Alibaba alone since the start of the year. Yet, confidence in China’s capital markets may remain thin as long as the rationale for these moves are not made clear and remain associated with the whims of President Xi.

Inflation remains very subdued in China: the December CPI came in at 1.8% (from 1.6% in November), and producer price index (PPI) inflation was -0.7% (from -1.3%). Money aggregates continue to grow at a modest pace, with Total Social Financing (TSF) and M2 growth at 9.6% (from 10.0% in November) and 11.8% (from 12.4%). The People’s Bank of China left the one-year medium-term lending facility (MLF) rate unchanged at 2.75%.

Last year was a record year for China’s trade surplus, which increased by 31% to an all-time high of USD 877bn, as imports increased by just 1% in 2022, and exports expanded by 7%, helped by strong trade with Southeast Asian nations and an export boom in new energy vehicles.

Egypt: Last week, Egypt’s central bank let its currency (EGP) float more freely, in line with its commitment to the International Monetary Fund to manage a flexible foreign exchange (FX) regime. The FX moved to EGP 32 per US dollar at one point before settling down to EGP 29.5 as FX liquidity improved and the backlog of investors and trade partners waiting for FX began to clear. As the bulk of the expected realignment happened, pressure on EGP abated in the forward markets. This is a positive in the medium term, provided Egypt’s central bank does not yield to temptation to peg the currency again. Meanwhile, December CPI increased to 21.3% from 18.7% in November, because of recent currency weakness. The upswing was fuelled by a 37.2% increase in food and beverage costs.

Pakistan: At a United Nations-sponsored conference in Geneva last Monday, international donors committed over USD 9bn to help Pakistan recover from last year’s floods. This was a good result that exceeded Pakistan’s external financing goals. Pledges came from 40 countries and international financial institutions. Among the largest donors were the Islamic Development Bank (USD 4.2bn), the World Bank (USD 2bn), Saudi Arabia (USD 1bn), as well as the EU, China, France and the US. The United Arab Emirates also agreed to lend Pakistan a fresh USD 1bn, on top of rolling-over USD 2bn of existing commitments. Saudi Arabia’s Crown Prince met with Pakistan’s new army chief, and it was announced that the Saudi Fund for Development will finance Pakistan’s oil derivatives worth USD 1bn.

Snippets

- Argentina: Month-on-month inflation came in at 5.1% in December, lower than market expectations of 5.2% but higher than November (4.9% mom), due to food and hospitality prices. This took annual inflation to 94.8% yoy, its highest print since 1991.

- Chile: Chile’s trade surplus jumped to USD 1.85bn in December, from USD 417m in December 2021. This was the largest monthly trade surplus since April of 2021, and was mostly driven by a 17.7% fall in imports. Copper exports were down 13.2% yoy.

- Ghana: The government agreed with the unions to increase public sector employee wages by 30% in 2023. This is double the 15% increase included in the budget presented just six weeks ago, but around half the high rate of inflation recorded in December, which accelerated to 54.1% yoy from 50.3% in November as a result of the rapid depreciation in the Cedi in autumn.

- Malaysia: Industrial production grew 4.8 % yoy in November, up from 4.6 % in October, the fifteenth consecutive monthly increase. Production of electronic products was up 12.1% yoy.

- Philippines: The trade deficit fell to USD 3.68bn in November 2022, from USD 4.71bn a year earlier, helped by stronger exports as supply chain issues eased following the removal of tough COVID restrictions in many countries. This led to a sizeable increase in the trade surplus to USD 53.7bn in the first 11 months of 2022, vs. USD 37.2bn in 2021.

- Venezuela: US State Department spokesperson Rosales Kostrukova told Bloomberg that installing a diplomatic corps in Caracas had not yet been evaluated by the Biden administration, and pointed out that the priority remained the discussion of a free and transparent electoral process in 2024.

Developed Markets

The BoJ holds its first policy meeting this week since its surprise decision in December to broaden the bands of its Yield Curve Control (YCC) policy, effectively raising its ceiling on long-term rates by 25bps to 0.50%. The meeting will be of particular focus after the BoJ was again prominent in the bond market last week, buying JPY 9trn in Japanese Government Bonds to defend the YCC top band. The framework is viewed as increasingly unsustainable and it is expected that the BoJ will ditch the YCC policy altogether. The meeting will give important cues whether Governor Koruda is prepared to change his flagship policy before stepping down from office in April, potentially handing his successor a poisoned chalice, or whether the preferred strategy is to let his successor chart his own course out of the current situation.

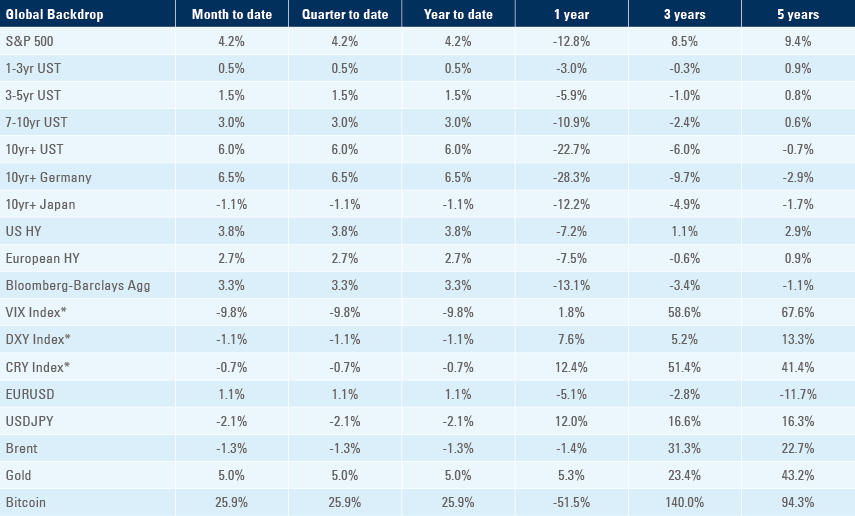

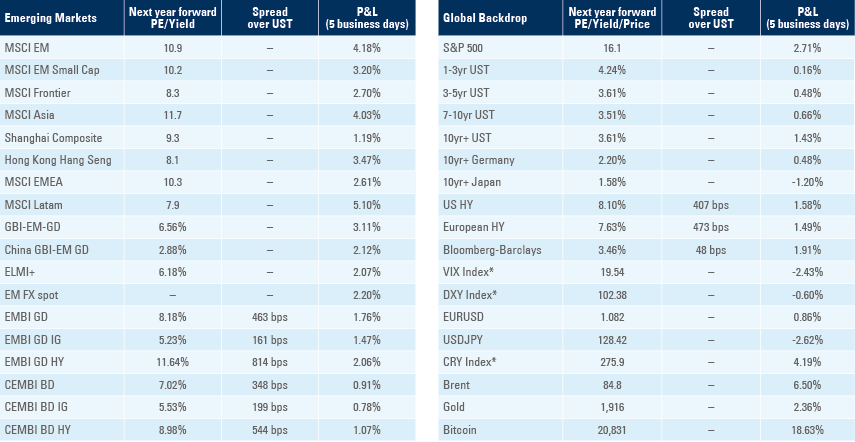

Benchmark performance