- EM stocks soared 4% last week, driven by Asia. MSCI EM returns are now nearly double the S&P 500 YTD

- US macro data is pointing towards a continuation of EM outperformance, and a weaker USD

- Israel launched targeted strikes in Doha

- The US will urge its G7 allies to impose tariffs as high as 100% on China and India for their purchases of Russian oil

- Seoul unveiled a KRW 284trn relief package to cushion tariff shock

- Vietnam’s Prime Minister has ordered ministries and local authorities to accelerate public investment disbursement

- Mexico announced import tariffs from China

- Moody's affirmed Romania's 'Baa3' rating but kept the negative outlook.

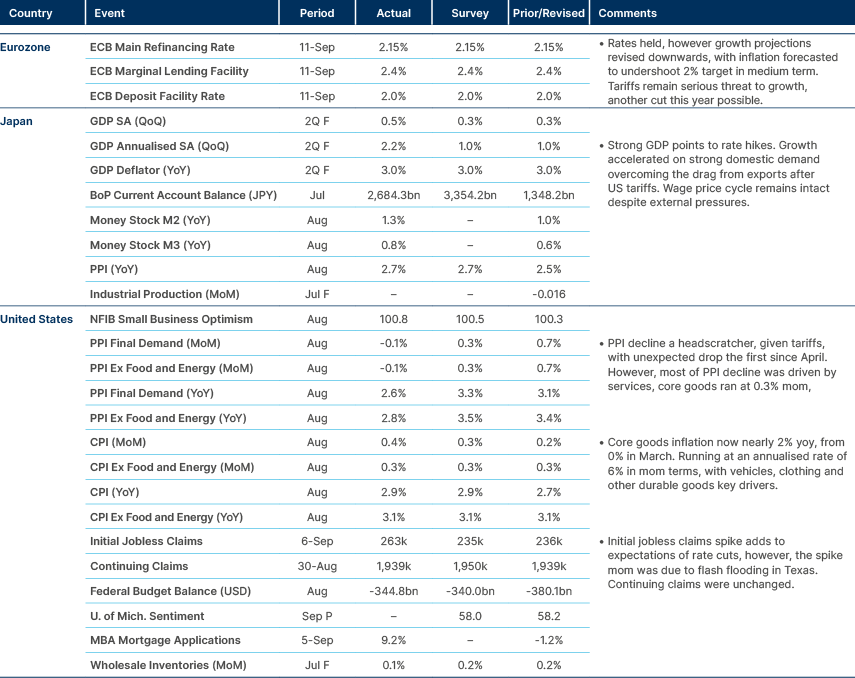

Last week performance and comments

Global Macro

Capital expenditures of US hyperscalers reached 72% of operating cash flow in Q2 2025, a record high. This incredible commitment of capital to long-term projects with uncertain profitability is a feature, not a bug of the artificial intelligence (AI) race – one that not all players will win. However, US tech sector credit spreads are currently the tightest since 1997. This picture reflects the extreme AI hype shared between both US corporates and US investors.

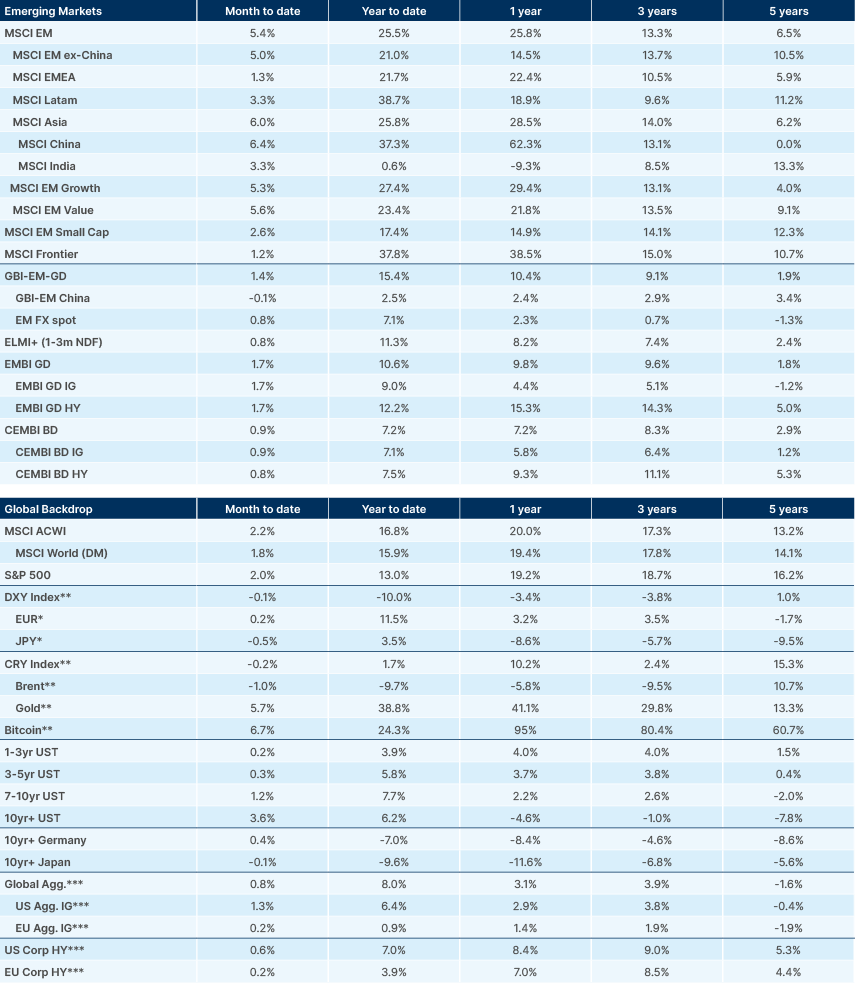

On the surface, US dominance in the industry global investors are most excited about should be supporting further US equity outperformance, and incoming rate cuts should help. Yet it isn’t. Year-to-date (YTD), the MSCI EM index is up 26%, double the S&P 500’s 13%. The underperformance of the USD against emerging market (EM) currencies has driven some of this rally. But even in Euro terms, the YTD outperformance is still evident: the MSCI EM is up 9%, while the S&P 500 is down 2%.

Macro data points towards a continuation of this outperformance, with the probability we are entering a ‘goldilocks’ environment for EM assets increasing in recent weeks, in our view. The US economy is showing signs of weakness, particularly in the labour market. This opens the door for the Federal Reserve (Fed) to cut rates, which it is expected to do this week. However, the immediate risk of recession remains low. Labour market weakness has been offset by a stagnant labour force, so unemployment levels are still contained, and economic activity is still growing, although tepidly. Meanwhile, EM growth remains resilient, particularly on an ex-China basis. At the same time, China is now showing early signs of exits from deflation, and these green shoots have helped drive very strong performance of Chinese stocks YTD, up 37%.

The Fed cutting rates into a soft, but not currently recessionary, US economy is likely to weaken the Dollar. Inflation remains elevated, and is expected to trend higher as tariffs continue to push up goods prices. This is compressing US real yields, reducing the appeal of US bonds. Recent flows into EM debt reflect this shift, with local bond funds attracting inflows. Against this backdrop, the skewed risk profile for further US rates and USD downside from here creates an environment where EM central banks will be able to cut rates, creating a compelling mix of potential FX gains, duration returns, and still-strong carry in EM local currency bonds.

Last week’s US data helped clarify this picture. Consumer price index (CPI) inflation was close to expectations at around 2.9%. Services inflation was buoyed by a one-off increase in housing inflation, and core goods inflation has risen to around 1.7% yoy, due to tariffs. However, tariffs continue to be less inflationary than expected, and not enough to deter the Fed from rate cuts at this juncture. Producer price index (PPI) inflation, a leading indicator for CPI, fell to -0.1% mom, just 2.6% higher yoy. This was lower than expectations and driven by services. Goods PPI was higher, at around 0.3% mom. Should services inflation resume its downward trend in coming months, offsetting the uptick in goods inflation driven by tariffs, then multiple Fed cuts in coming months becomes more likely.

On the jobs front, data continued to be weak, however, not weak enough to spark severe concerns over an impending recession. The revision to non-farm payrolls (NFP) between March 2024 and March 2025 was a record -911k. The revised numbers essentially show almost no job creation, overall, in the US economy over this period. ‘Education and Healthcare’ jobs rose by 884k (vast majority of which was healthcare), but ex-healthcare, the private sector lost 252k jobs over the period, about 0.1% of jobs. Factoring in the public sector, which added jobs over the period, the US payroll expanded by about 950k. The US labour force rose by about 2.5m over the period, so the unemployment rate rose, from 3.9% in March 2024 to 4.2% in March 2025.

Labour market data has been deteriorating in recent months. But with these revisions now factored in, an important question is, is the labour market getting that much worse? Current NFP data shows the private sector has added 290k jobs between April and August, shedding 39k jobs ex-education and healthcare. Further revisions are still to come, but as it stands, this is an improvement versus the 12 months trailing March 2025, albeit a negligible one.

What isn’t negligible is that the labour force stopped expanding over the period. From April to August, the US civilian labour force fell by about 350k, driven by a 1.5m decline in foreign-born labourers.1 This supply/demand factor means, all else equal, the unemployment rate should have declined. As it stands, the unemployment rate has risen just 10 basis points (bps) since April, from 4.2% to 4.3%.

Clearly, there are two sides to the US jobs market story. In our view, the risk is skewed to the downside for the US unemployment data, given the ongoing softening of economic activity post-tariff increase. Initial jobless claims spiked to their highest since 2021. However, this was not broad-based, with 21k claims from Texas largely related to June’s flash flooding. Rate cuts will be key in improving the outlook.

US rates have moved decisively lower in recent weeks, but the possibility of an IEEPEA2 tariff ban by the courts presents a significant risk. This would likely derail fiscal consolidation in 2025. However, rather than changing the long-term picture for US policy and debt, it would most likely mean a one-off increase in T-bills and the passing of tariffs via other routes, for example sectoral tariffs, which are legal.

In other news, it looks like Fed Governor Lisa Cook may be allowed to attend next week’s Fed Board meeting after a judge temporarily blocked President Donald Trump from firing her over an alleged mortgage fraud. Cook described an Atlanta property at the centre of a lawsuit over her attempted ouster as a “vacation home,” according to documents viewed by Bloomberg News. The records were first reported by Reuters, which cited two real estate experts who said the documents appear to contradict other records from Trump administration officials. This case will have tremendous implications, particularly if the Supreme Court must rule on the matter, which may set a precedent for other cases.

Geopolitics

Israel launched targeted strikes in Doha, aimed at senior members of Hamas’s political leadership. The move triggered widespread condemnation across the Arab world. Several Arab governments issued statements criticising the attack as a violation of Qatari sovereignty and a destabilising act that threatens to inflame regional tensions.

In response to the growing diplomatic fallout, US Senator Marco Rubio travelled to Israel to meet with Prime Minister Benjamin Netanyahu. Rubio delivered a message from President Trump expressing “unhappiness” over the decision to carry out the strike without broader regional consultation or coordination with Washington.

The US will urge its G7 allies to impose tariffs as high as 100% on China and India for their purchases of Russian oil to convince President Vladimiri Putin to end his war in Ukraine. Trump said on Friday that his patience with Putin was “running out fast” and threatened new economic sanctions. “It’ll be hitting very hard on with sanctions to banks and having to do with oil and tariffs also” he said in an interview on Fox News.

Ukraine carried out a major drone strike on the Kirishi oil refinery on Saturday evening. With a processing capacity of 355,000 barrels a day, it is one of Russia’s three largest refineries. The extent of the damage has not yet been confirmed.

Emerging Markets

Asia

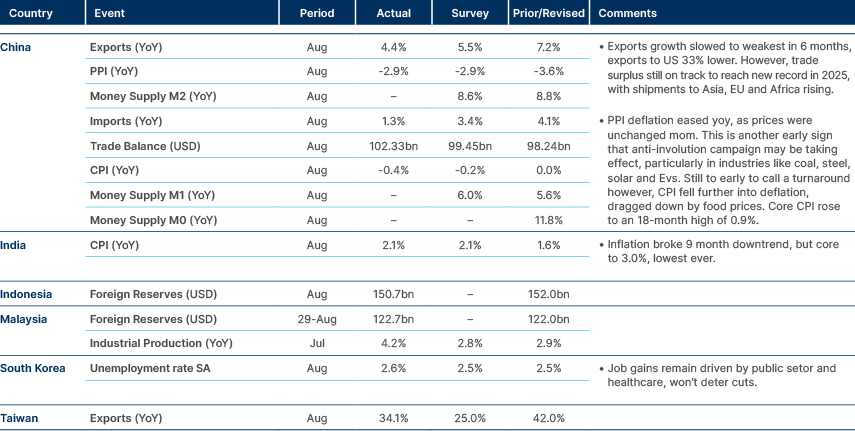

Higher inflation in China, despite soft economic data released this morning.

China: China’s Ministry of Commerce has launched a probe into US semiconductors. A ministry spokesperson said the US has imposed a series of restrictions on China’s integrated circuits sector in recent years, including Section 301 investigations and export controls. Such measures, the spokesperson added, were “protectionist practices” that discriminate against China and aim to suppress its development of advanced computing chips and high-tech industries such as AI. Shares of Chinese chip manufacturers gained by as much as the 20% daily limit.

Softer economic data was published this morning. Retail sales are now reflecting fading of tax cuts for durable goods, although some provinces are still issuing consumption vouchers supporting discretionary spending. Further short-term consumption stimulus announcements are expected after the 4th plenum. However, Beijing needs to tread carefully over the next couple of months in its efforts to handle the tricky divergence between the slowing economy and rising stock market euphoria. When stock market enthusiasm cools a bit, Beijing may step up its stimulus measures to arrest the growth slowdown.

India: Fitch raised its FY26 growth forecast to 6.9% (from 6.5%) on stronger consumption and services, following Q1 GDP growth of 7.8%. Momentum is supported by record PMIs and industrial output, but growth is expected to moderate from FY27. Moody’s assessed the new GST reform and income-tax relief as positive for near-term demand, but warned the revenue hit may exceed government estimates, highlighting India’s high debt burden. Both agencies flagged US tariff risks as a downside.

A late-2025 rate cut remains the base case with inflation inside target and transmission still working through. Goods exports, government capex and formal employment are holding up, but rural demand and import-intensive manufacturing are the key items to watch.

Indonesia: Purbaya Yudhi Sadewa, the newly-appointed Minister of Finance, adopted a market-friendly narrative, maintaining his predecessor’s budget guidelines for 2026 and pledging to maintain the 3% fiscal deficit ceiling. Purbaya also announced that close to half of state-owned companies’ dividend payments received by sovereign wealth fund Danantara – roughly IDR 200trn – will be deposited in state-owned banks, a move likely to boost local liquidity

Philippines: President Ferdinand Marcos Jr. vowed that no one, including his relatives and allies, will be exempt from the government’s probe into the misuse of public funds for flood control projects, as he voiced his support for anti-corruption protests. “Of course, they are enraged, of course they are angry. I am angry. We should all be angry because what is happening is not right,” Marcos said in a televised briefing on Monday. “If I wasn’t president, I might be out in the streets with them.”

South Korea: Seoul unveiled a KRW 284trn relief package to cushion tariff shocks: KRW 270trn of export-credit insurance plus KRW 13.6trn in Korea Development Bank loans. Caps were raised ten-fold and loan rates cut by 30bps to target small and medium-size enterprises and metals exporters, explicitly framed as job protection ahead of the 2026 political cycle. FX reserves rose 1.2% mom to USD 416bn, the first yoy gain since October 2024, giving the Korean won a buffer as trade headlines inject volatility.

South Korea has proposed an "unlimited" currency swap arrangement with the US during trade talks. However, there has been little sign of a breakthrough on an investment-trade deal. Seoul has pledged to invest USD 350bn in the US in return for cutting the 'reciprocal tariff' rate from 25% to 15%, but the details are now a sticking point, and US Commerce Secretary Howard Lutnick ruled out better trade terms after Japan committed larger investments to the US. Korean officials reported that Washington has asked for a greater share of the investment to be made in direct cash, something that will be politically challenging within Korea.

Taiwan: August was another month of robust export growth, at +34.1% yoy (consensus +25.0%). This took exports to a monthly record of USD 58.5bn. Imports also grew at an above-consensus +29.7%. The monthly trade surplus came in at USD 16.8bn (consensus +USD 13.1bn).

Vietnam: Prime Minister Pham Minh Chinh has ordered ministries and local authorities to accelerate public investment disbursement, aiming to execute 100% of the 2025 plan. By August, only 46.3% had been disbursed, though this was ahead of last year’s pace. The government sees quicker spending as critical to sustaining growth, stabilising macro conditions, and supporting employment.

Latin America

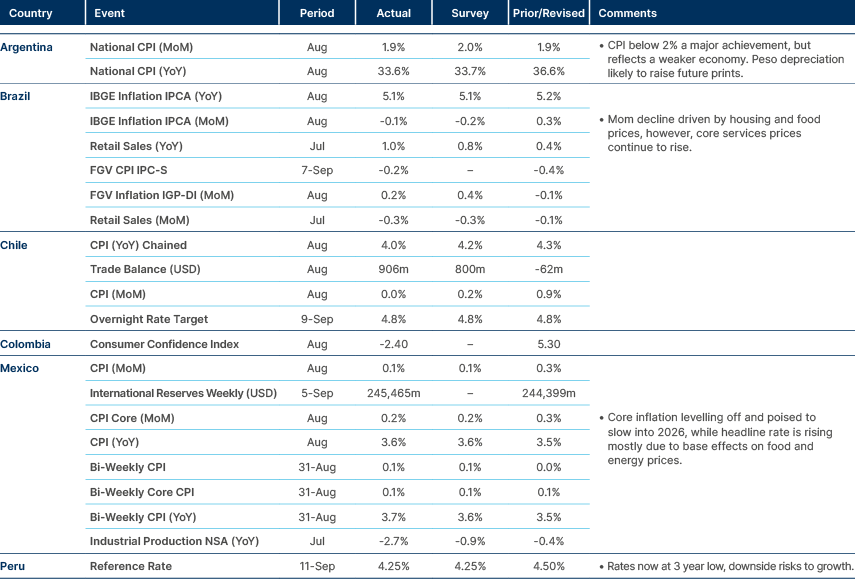

Inflation remains subdued in Argentina, Brazil, Chile, and Mexico.

Argentina: President Javier Milei vetoed an opposition-backed bill that mandated automatic transfers to provinces worth 0.1% of GDP, consistent with his strategy of refusing to authorise any fiscally costly measures. The move leaves him increasingly isolated from governors and congressional blocs, especially after weak results in the Buenos Aires mid-terms. However, the decision underscores his reliance on fiscal orthodoxy even at the cost of political capital.

Colombia: Ecopetrol’s Q2 net profit fell 46% yoy to COP 1.8trn, the lowest since early 2021, as drilling activity slowed and gas production hit a multi-year low. Investor concerns are heightened by governance changes: independent directors resigned after government reshuffles, and CEO Ricardo Roa is under investigation for campaign finance irregularities and conflicts of interest. Roa has also floated controversial projects, including a potential acquisition of Venezuela’s struggling Monómeros and a costly AI infrastructure initiative. The company’s outlook is now increasingly tied to the 2026 political cycle, with uncertainty over whether it will retain independence or be used as a policy lever.

Mexico: The government announced import tariffs from China, aligning itself with the US, in a measure that is expected to raise some USD 3.5bn in tax revenues (c. 0.2% GDP). China criticised Mexico’s decision to raise tariffs on imports such as vehicles, textiles, and auto parts, arguing it damages investment relations and reflects US pressure. Beijing has not yet signalled retaliation. Domestic auto-parts producers supported the move, citing job protection. Citibank analysts raised 2025 GDP growth forecasts to 0.5% from 0.2%, on resilience to tariffs and stronger early-year activity, though inflation remains sticky at around 4.0%. Banco de México is expected to cut rates in September, but board members remain divided given external headwinds and Pemex’s large refinancing needs.

Peru: The government has begun negotiations with the United Arab Emirates on a Comprehensive Economic Partnership Agreement, its first trade talks with a Middle Eastern partner. The agreement would remove tariffs on agricultural and agro-industrial products such as cocoa, coffee, quinoa, and pisco, while opening the door to Emirati investment in energy, infrastructure, tourism, and technology. The first round of talks is scheduled for late November in Lima. The government sees the pact as a chance to diversify trade away from its reliance on China and the US, while securing fresh foreign direct investment inflows to support growth.

Central and Eastern Europe

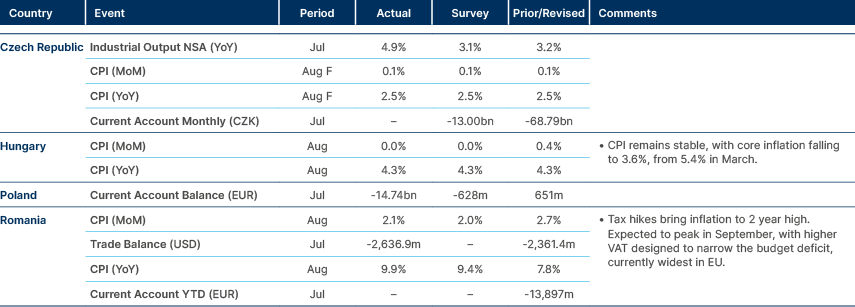

Romania’s tax hikes bringing inflation higher is a one-off factor.

Poland: Ireneusz Dabrowski, a member of Poland’s Monetary Policy Council who has backed rate cuts in the past, said policymakers may consider a “small” reduction by year-end, but will remain “very cautious”. “It may also be the case that there will be no further reductions this year,” Dabrowski told Bloomberg News in an interview.

The Polish military shot down drones that entered its airspace during a Russian attack on Ukraine, citing it as an “unprecedented violation.”

Romania: Moody's affirmed Romania's 'Baa3' rating, but kept the negative outlook. Romania remains at the lowest investment grade rating and on Negative outlook with all three major agencies

“Moody's has affirmed Romania's long-term issuer and senior unsecured ratings at Baa3. The decision to maintain the negative outlook reflects the significant implementation risks tied to the government's ambitious fiscal consolidation programme. The fiscal measures adopted by the government in July and September this year have materially improved Romania's fiscal outlook relative to our expectations when the outlook was changed to negative from stable in March this year. The combined consolidation measures exceed 3% of GDP in 2025 and 2026, with increases in value added tax and indexation of freezes of public sector wages and pensions being the main contributors. However, significant implementation risks remain, related to maintaining political backing for the programme, ensuring spending discipline and hitting revenue-raising targets as well as the risk that the negative growth impact of the package could undermine the fiscal consolidation effort.”

Ukraine: Russia escalated its attacks on Ukraine’s energy infrastructure, striking the Trypilska thermal plant near Kyiv and facilities in Odesa. On 7 September, a record 810 drones and multiple missiles targeted Kyiv, Kremenchuk, and Sumy, damaging government buildings, bridges, and power assets. The strikes raise serious concerns about grid reliability this winter, despite summer stabilisation and emergency imports. Ukraine has continued drone and missile attacks on Russian refineries and logistics to stretch Moscow’s repair capacity. President Volodymyr Zelensky renewed calls for tougher sanctions, warning that blackouts could worsen industrial output and weaken morale ahead of winter.

Middle East and Africa

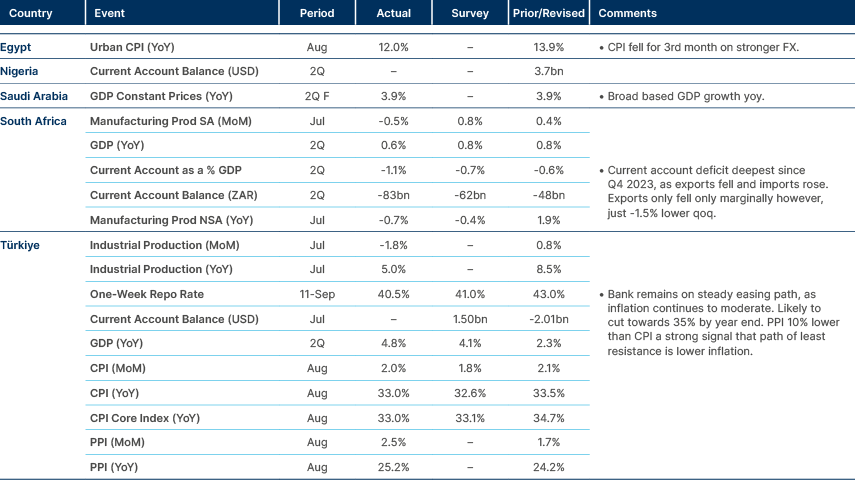

Türkiye cut policy rates by more than expected, despite higher political risks.

Botswana: The sovereign credit rating downgraded by S&P to ‘BBB’, from ‘BBB+’. The outlook remains negative.

Egypt: Cairo postponed its electricity tariff hike to January 2026, citing pound stabilisation and the need to smooth the inflation path. The move eases near-term pressure on households and small firms, but shifts subsidy costs back onto the budget until fuel and power price pass-through resumes.

Inflation surprised to the downside in August, with headline CPI inflation falling to 12.0% yoy from 13.9% in July. A downshift was expected due to favourable base effects, but the print was below the Reuters consensus of 12.7%. Food prices rose only 2.1% yoy. With real rates still high and external financing improved, the central bank can sequence easing cautiously as inflation drifts lower.

Kuwait: A domestic bond issue of roughly USD 4bn at five- to seven-year tenors drew heavy bank demand after passage of the new debt law. Proceeds will fund infrastructure and help bridge the fiscal gap while oil receipts normalise. The revival of a local yield curve should deepen liquidity and reduce the sovereign’s reliance on asset sales during oil downswings.

Türkiye: The Civil Court is due to rule on whether to annul the CHP’s national party congress and appoint a trustee. Until recently, markets had not viewed this as a major risk event, with many expecting the decision to be deferred once again to a later date. However, this changed after the 2 September precautionary decision from Istanbul’s Fourth Civil Court suspended the Istanbul CHP management’s powers and assigned Gursel Tekin (ex-member of the party) as the committee trustee. The announcement triggered an estimated USD 5bn in outflows from the Lira that day (our estimate based on Central Bank of Türkiye (CBT) data).

Tensions on the ground prompted another round of (slightly smaller) outflows during the earlier part of last week, before markets steadied ahead of last week’s CBT rate decision. The rate decision was preceded by headlines that Ankara’s Third Civil court had issued a non-binding ruling rejecting the Istanbul court’s precautionary ruling, further muddying the water into Monday’s decision. In our view, there is a meaningful chance that a trustee is appointed. However, after recent outflows, the market is well prepared to digest this outcome.

Developed Markets

ECB bias to keep policy rates unchanged going forward.

France: Fitch downgraded France to ‘A+’ (Moody’s Aa3; S&P AA). According to Fitch, the move “reflects France’s high and rising debt ratio, political fragmentation, weak fiscal record, high 2025 deficit, uncertain fiscal consolidation path, and fiscal rigidities.”

Japan: Bank of Japan (BoJ) officials may raise the policy rate again this year regardless of political instability, as economic conditions developed in line with expectations, according to sources. The US-Japan trade deal has removed a key source of uncertainty, but the BoJ is likely to keep its rate unchanged at 0.5% at its 19 September meeting, as officials are still assessing the economic impact of US tariffs both at home and abroad, according to the people. Officials believe the BoJ is on track for another rate increase after January’s move, with some seeing a hike as early as October.

Portugal: Fitch upgraded Portugal to ‘A’ (Moody’s ‘A3’; S&P ‘A+’).

Spain: S&P upgraded Spain to ‘A+’ (Fitch ‘A-’; Moody’s ‘Baa1’, both +ve outlook).

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

1. https://fred.stlouisfed.org/series/LNU01073395

2. International Emergency Economic Powers Act.