Taiwan's export growth hit a 15-year high in July, led by US chip demand

- Donald Trump and Howard Lutnick suggested China will be granted another 90-day extension to make a trade deal before it is hit with a higher tariff.

- Lutnick suggested the US could generate USD 50bn a month “from now on” from tariffs, which, in our view, would lead to a fiscal consolidation.

- Trump is preparing to meet Vladimir Putin in Alaska next week to discuss Ukraine.

- Indonesia remains in tariff negotiations with the US, Korea granted a ‘most favoured nation’ carve out.

- Taiwan’s exports grew 42% yoy in July, and by 63% to the US, the fastest in 15 years.

- IMF and the Argentinian government agreed to lower Argentina’s net FX reserve accumulation target for 2025.

- El Salvador’s President Bukele dismissed criticism that recent constitutional reforms removing presidential term limits are undemocratic.

- Qatar’s Q2 real estate transactions rose 30% year-on-year to QAR 8.9bn.

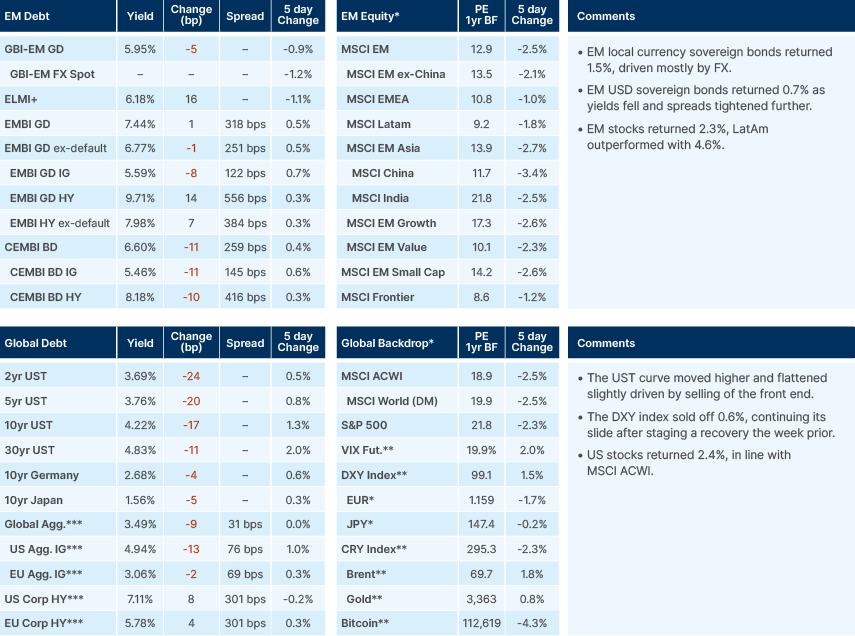

Last week performance and comments

Global Macro

Commentary from US Secretary of Commerce Howard Lutnick and President Donald Trump last week indicated the current 90-day tariff ‘truce’ with China will probably be extended beyond the current deadline of 12 August. China’s current tariff rate is 30%, 10% as the baseline tariff plus 20% fentanyl-related tariff. Trump wants to speak to China’s President Xi Jinping, which is still yet to happen, at least publicly, and there is now the added complication of whether to charge China an additional tariff related to its purchase of Russian oil, as with India.

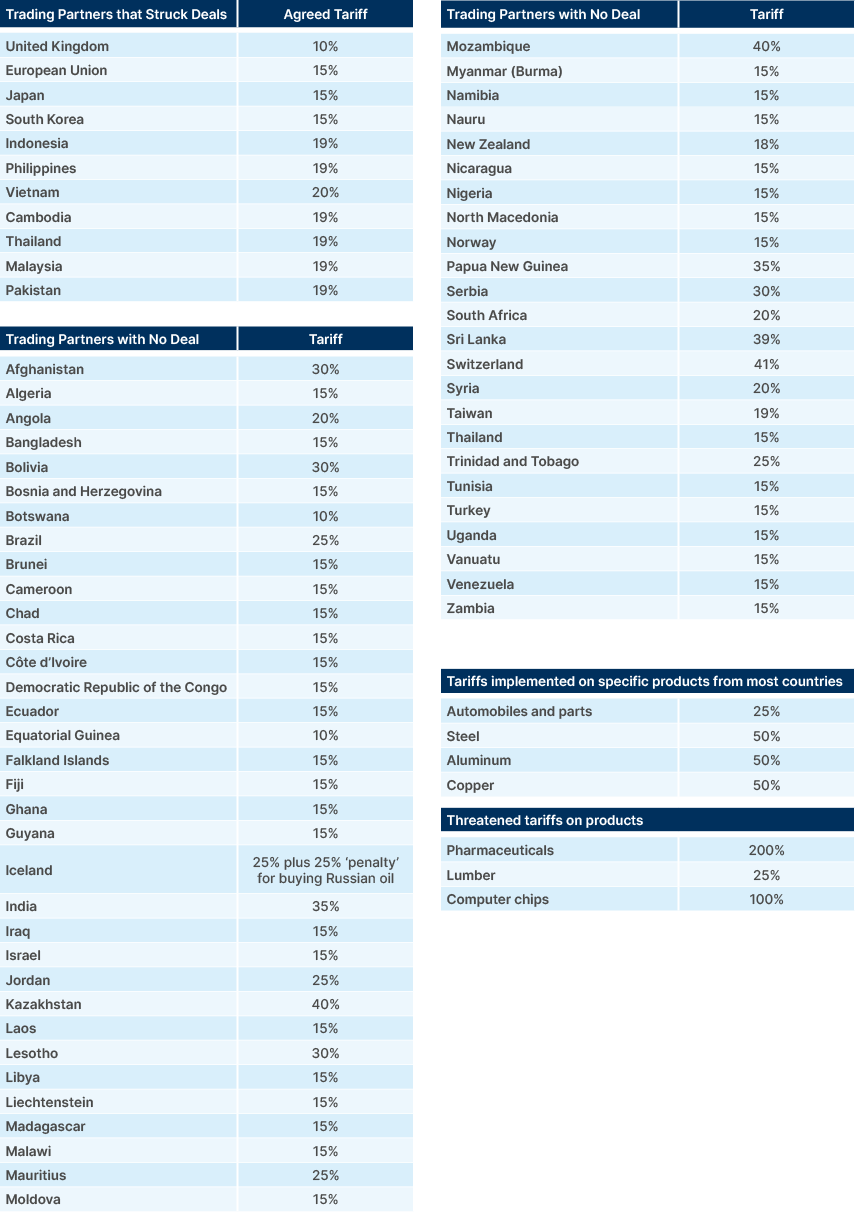

Now “reciprocal tariffs” have kicked in, alongside new rates for countries that managed to make a deal, Lutnick said the US is expecting USD 50bn a month in tariff revenues from “now on”, up from roughly USD 30bn last month. Most estimates suggest the average US tariff rate is now around 16%, rising from 8% in July. So, although Trump will undoubtedly continue to use tariffs as leverage in negotiations, should tariff revenue rise towards USD 50bn per month in the coming months, with the effective tariff rate remaining where it is, this is where it may end up settling. Sectoral tariffs – including on pharmaceuticals and semiconductors – are yet to kick in, but there are likely to be more carve outs and deals made in coming weeks, which may offset some of this hike. Tables on the next page show the current tariff levels.

Raising USD 50bn a month from tariffs translates to USD 600bn annually. If this policy shock does not push the US economy into recession, revenue this substantial would very likely lead to a meaningful fiscal consolidation.

Stephen Miran, Chair of the Council of Economic Advisers, was announced by Trump as an interim replacement for Federal Reserve (Fed) Governor Adrienne Kugler, who announced her resignation from the Federal Open Market Committee (FOMC) earlier than expected. Kugler was due to leave in January, so Miran will take over until then, if the Senate votes to swear him in. Although it is unlikely this will happen before the September FOMC meeting, given historical timeframes, it shouldn’t be discounted as a possibility. Miran would almost certainly vote for a cut, alongside the two Fed members who dissented in the July meeting when the rest of the board voted for a hold.

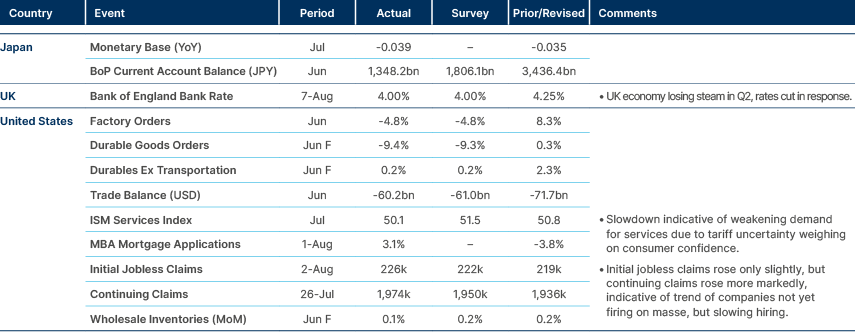

Inflation remains well above target and is set to rise via the goods channel over the coming months, due to tariffs. Services inflation has stabilised in recent months but is still elevated at 3.6% yoy, although it rose ran at an annualised rate of 2.9% in April, May and June. US CPI data for July is published tomorrow, and is expected to rise from 2.7% to 2.8%, with core inflation expected to hit 3.0%. So, whether voting to cut will remain a ‘dissenting’ vote in September will depend mostly on jobs-related data, in our view. Unemployment rising from 4.2% to beyond 4.5% would likely shift the Fed’s committee further towards focusing on the employment side of their mandate.

It is also important to consider that disruption in the labour force due to deportations and higher rates of migrant detention may be keeping the unemployment rate lower, by removing supply from the workforce. In fact, the US unemployment rate, had the May labour force participation rate been held constant, would now be at 4.9%, a rise which would almost certainly worry Fed Chair Jerome Powell and most FOMC members enough to cut rates, even with inflation remaining sticky in the services sector and rising in goods due to tariffs. This underlying weakness in the jobs market may explain part of the reason why the market is currently pricing a 90% probability of the Fed cutting rates in September, even with inflation still above target.

Fig 1: Actual tariff rate overview

Commodities

US Customs and Border Protection has reclassified 1kg and 100oz gold bullion bars under HS code 7108, making them subject to a 39% tariff. Although presented as a trade policy measure rather than a capital control, the impact is similar: it restricts a key physical channel for cross-border capital flows via gold. The tariff has driven gold futures to record highs above USD 3,500/oz and prompted a surge of physical gold shipments into US vaults, particularly at COMEX, as market participants rush to secure supply before costs rise further.

Geopolitics

Trump is preparing to meet Russian President Vladimir Putin, potentially as soon as next week in Alaska, to discuss the war in Ukraine. A three-way meeting with Ukraine’s President Volodimir Zelenskyy is under consideration, although Russia still refuses direct talks with the Ukrainian president. Zelenskyy has secured support from EU and NATO leaders to ensure Ukraine has a seat at the negotiating table.

European allies have made clear they reject any territorial “land swap” arrangements without Kyiv’s consent. However, various reports suggest Trump’s team has considered land swap proposals, sparking pushback from both Ukraine and European partners. Polish Prime Minister Donald Tusk has suggested a “freeze” in the conflict could be close, although critics caution that such an outcome could entrench Russia’s territorial gains.

Emerging Markets

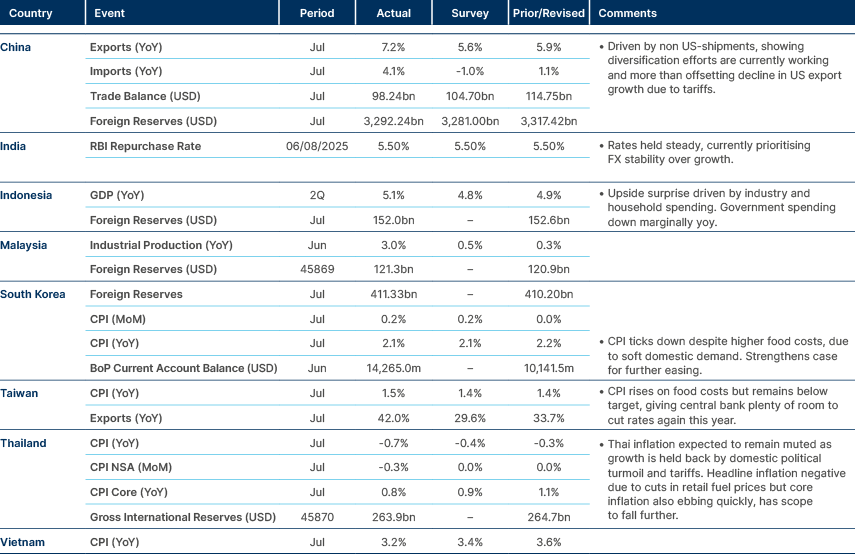

Asia

India: Prime Minister Narendra Modi took a firm stance after Trump imposed a 25% tariff on Indian exports and issued veiled threats over continued purchases of Russian crude. In public remarks, Modi urged citizens to buy local products and framed the moment as a call to deepen self-reliance through the “Make in India” campaign. No official directive has been given to state or private refiners to halt Russian imports, which still account for nearly one-third of India’s crude supply. Officials continue to maintain that sourcing decisions are commercial rather than diplomatic.

The administration is preparing a four-pronged policy response to the now 50% US tariff hike, which puts USD 86.5bn of exports at risk. The plan focuses on market diversification towards Europe, Africa, and West Asia; shifting the export basket towards higher value, less tariff-sensitive goods; boosting domestic demand; and accelerating ease-of-doing-business reforms. These measures aim to strengthen long-term competitiveness, but exporters argue they do little to offset the immediate loss of market share. With Asian peers facing tariffs of 15–30% compared with India’s 50%, many are calling for short-term fiscal support, such as targeted subsidies and credit guarantees to prevent large-scale layoffs in sectors including textiles, gems and jewellery, leather, and electronics.

The Reserve Bank of India (RBI) kept the policy repo rate unchanged at 5.5% after cutting by a total of 100 basis points (bps) since February. Consumer price inflation fell to 2.1% in June, a 77-month low, with the fiscal year 2026 inflation forecast at 3.1%. Growth remains steady at 6.5% for fiscal year 2026, supported by rural consumption, capital expenditure, and services. The RBI paused to assess the impact of earlier rate cuts amid tariff and geopolitical uncertainty.

Indonesia: The government remains in negotiations with the US to reduce tariffs for certain products not manufactured domestically in the US. The country’s trade minister aims to conclude discussions by 1 September, but has not disclosed which products are under review. Current exemptions already cover copper concentrates and cathodes. Spending on the free school meal programme reached IDR 7.9trn by the end of July, exceeding the IDR 6trn forecast. The National Planning Agency expects sharp increases in expenditure through September to November, but the original IDR 171trn annual budget appears unlikely to be met due to the slow rollout in the first half of the year.

South Korea: The US granted most favoured nation status to South Korea for semiconductor exports under the late-July bilateral tariff agreement, covering both the semiconductor and biohealth sectors. Trade Minister Yeo Han-koo confirmed this means Samsung Electronics and SK Hynix will not face the 100% tariffs on chips that Trump had threatened in recent remarks. While the most favoured nation designation guarantees non-discriminatory treatment, the actual tariff rates have yet to be specified for countries holding that status. Yeo stressed that the agreement protects South Korea’s key technology exports while maintaining policy space in other trade areas.

Taiwan: Taiwan’s exports surged 42% yoy in July to USD 56.7bn, the fastest growth in 15 years and the third consecutive monthly record. Electronic components led the expansion, with semiconductor exports up 36% yoy to a record USD 18.4bn. The US was the main driver of demand, with shipments climbing nearly 63% yoy to USD 18.65bn. Strong US technology orders, particularly in advanced chips, underpinned the jump, reinforcing Taiwan’s central role in the global semiconductor supply chain.

Vietnam: The State Bank of Vietnam directed banks to stabilise deposit rates, reduce lending rates, and improve access to credit as part of efforts to meet the 8% gross domestic product growth target for 2025. Credit institutions must disclose lending rates, margins, and preferential programmes to improve transparency. Capital should be channelled to priority sectors, while lending to high risk areas remains restricted.

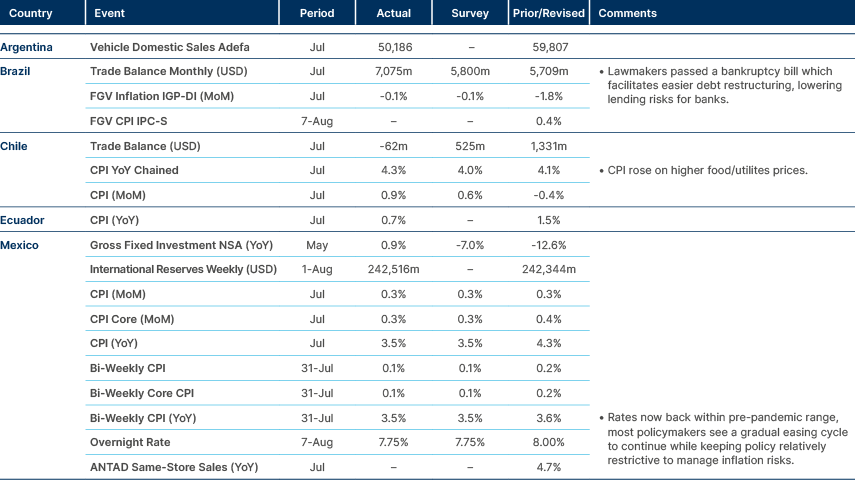

LatAm

Argentina: The International Monetary Fund (IMF) and the government agreed to lower the net foreign exchange (FX) reserve accumulation target under the Extended Fund Facility after missing the original mid-June goal. The new target calls for approximately USD 6bn in gross purchases by year end, boosting net reserves by around USD 3.4bn. Between May and July, USD 5bn was accumulated via repurchase agreements, US dollar bond sales, and Treasury block purchases. Market participants view reserve build-up as essential to tightening spreads and regaining access to debt markets.

Chile: Communist Party candidate Jeannette Jara continues to lead first round polling for the 16 November presidential election with 25–33% support. Republican Party candidate Jose Kast remains close behind and would easily defeat Jara in a runoff, according to recent surveys. Both appear well placed to advance, while Evelyn Matthei’s share continues to decline, narrowing the contest to Jara versus Kast.

Ecuador: The government expressed surprise at the US decision to raise tariffs on Ecuadorian goods from 10% to 15% while negotiations to reduce them are ongoing. A fourth round of trade talks is now in progress.

El Salvador: President Nayib Bukele dismissed criticism that recent constitutional reforms removing presidential term limits are undemocratic. The reform, enabled by New Ideas’ (Bukele’s party) control of 57 out of 60 Assembly seats, passed rapidly and has drawn condemnation from non-governmental organisations and international media as an authoritarian step. Bukele argued that opposition is driven by prejudice against a “small and poor” country and accused critics of double standards. He remains focused on his security agenda, showing little concern for the “dictator” label so long as public safety results continue. Approval ratings remain high, though economic pressures in the second half of the year could pose a greater test than the reform itself.

Mexico: Gross fixed investment fell 7.1% year-on-year in May, marking the ninth consecutive contraction, as uncertainty continues to weigh on capital formation. The decline contrasts sharply with the double-digit growth seen up to early 2024 during the height of nearshoring optimism.

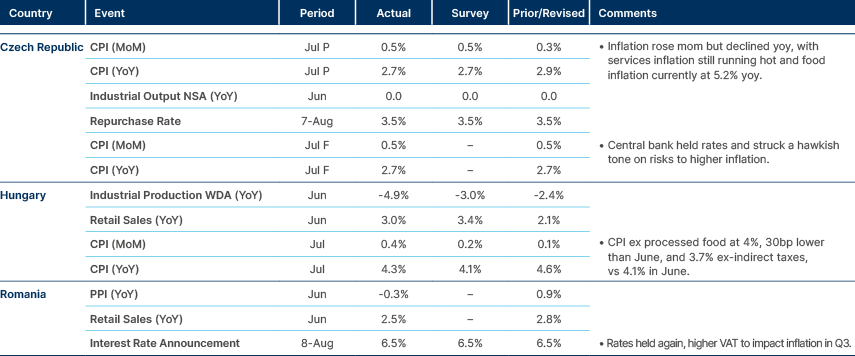

Central and Eastern Europe

Poland: The Finance Ministry plans to launch a personal investment product (OKI) in mid-2026 that will be exempt from capital gains tax for investments up to PLN 100,000. The minister expects PLN 100bn – approximately 2.5% of GDP – in private investment over three years. Consumer price inflation slowed to 0.9% year-on-year in July from 1.4% in June, the lowest reading since October 2019, mainly due to lower housing and utilities costs.

Ukraine: The National Bank of Ukraine eased several wartime capital controls, allowing dividend repatriation for 2023 (up to EUR 1m per month), expanding FX hedging tools, and easing cross-border transfers. Jewellery firms can now purchase precious metals in non-cash hryvnias. Borrowers from creditor pools including international financial institutions may repay all participants, and rules were relaxed for debt-to-equity conversions.

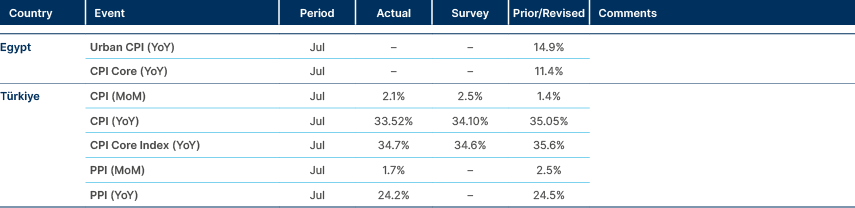

Central Asia, Middle East, and Africa

Qatar: Real estate transactions in the second quarter rose 30% year-on-year to QAR 8.9bn (USD 2.4bn), with residential sales accounting for 44% of deals.

Saudi Arabia: Saudi Aramco reported second quarter adjusted net income of SAR 92.04bn (USD 24.5bn), slightly above expectations but down from SAR 425.71bn a year earlier. Lower crude oil and chemical prices outweighed higher traded volumes, marking the tenth consecutive quarterly profit decline.

Nigeria: Oil production rose above 1.8m barrels per day (bpd) in July, including crude and condensates, with monthly average output at 1.78m bpd – up 5% from June’s 1.7m bpd. Crude-only output averaged 1.55m bpd per day in June, the highest since May 2020. The recovery, which brings Nigeria closer to its 2.06m bpd budget target, reduces the first-half 2025 shortfall of 70.7m barrels, estimated at USD 5.3bn in lost revenue. The Nigerian Upstream Petroleum Regulatory Commission attributes the gains to the “Project 1 million barrels per day” initiative, better coordination with operators, and improved production scheduling. Efforts are also underway to roll out new technologies in exploration, production, and decarbonisation, and to strengthen local supply chains.

South Africa: President Cyril Ramaphosa announced plans to seek tactical alliances with non-Government of National Unity (GNU) parties after the budget crisis saw two failed parliamentary votes. The Democratic Alliance remains in the GNU, but expansion to include ActionSA and the National Consultative Congress is under consideration. GNU priorities remain inclusive growth, poverty reduction, and building a capable state. The National Executive Committee ruled out expelling the Democratic Alliance, citing market stability concerns, and is preparing a reconfiguration of cabinet and deputy positions.

Developed Markets

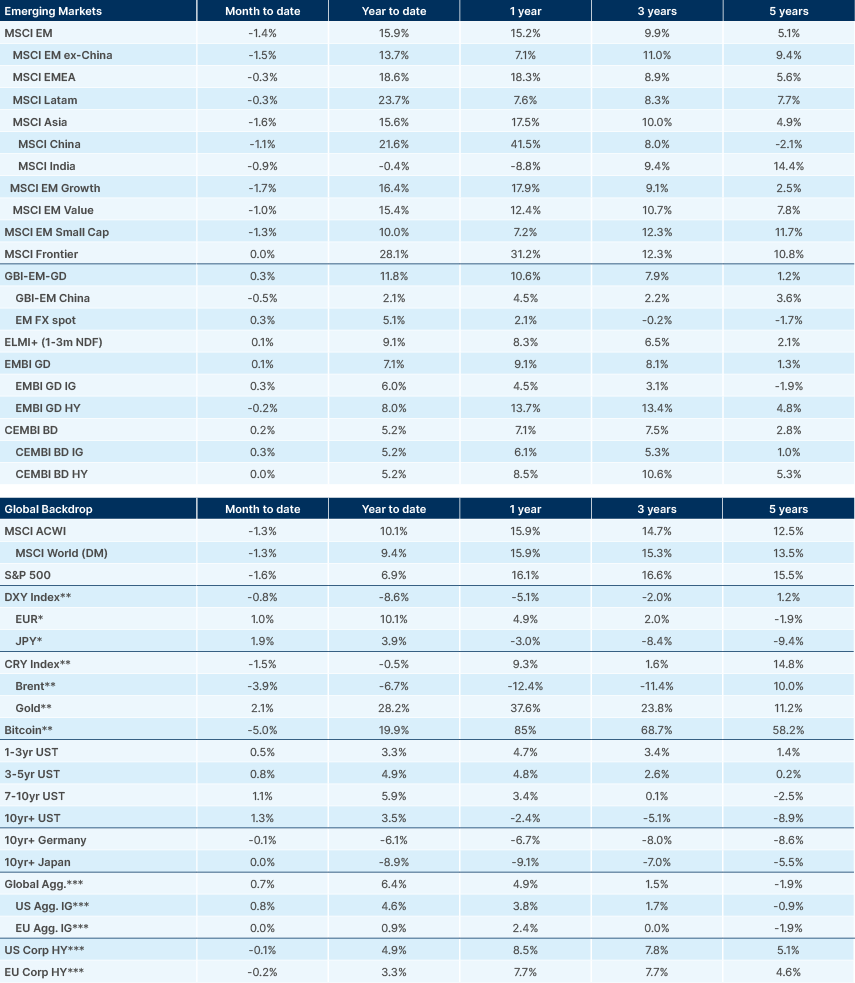

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.