- The US bombed Iranian nuclear facilities, now the world awaits Iran’s response.

- Price action since the strike indicates most investors believe the probability of a major disruption to oil supply remains low.

- US economic data is deteriorating more quickly, FOMC dot-plot still shows 2 cuts in 2025 as median expectation.

- China has pledged to eliminate tariffs on 98% of goods imported from all 53 African countries with which it maintains diplomatic ties

- Political instability in Thailand as ruling coalition splits.

- Brazil raised Selic rate 50bp to 15% and signalled no cuts for a ‘prolonged period.’

- Colombia increased its 2025 borrowing plan.

- Fitch upgraded Ghana’s credit rating to ‘B-‘.

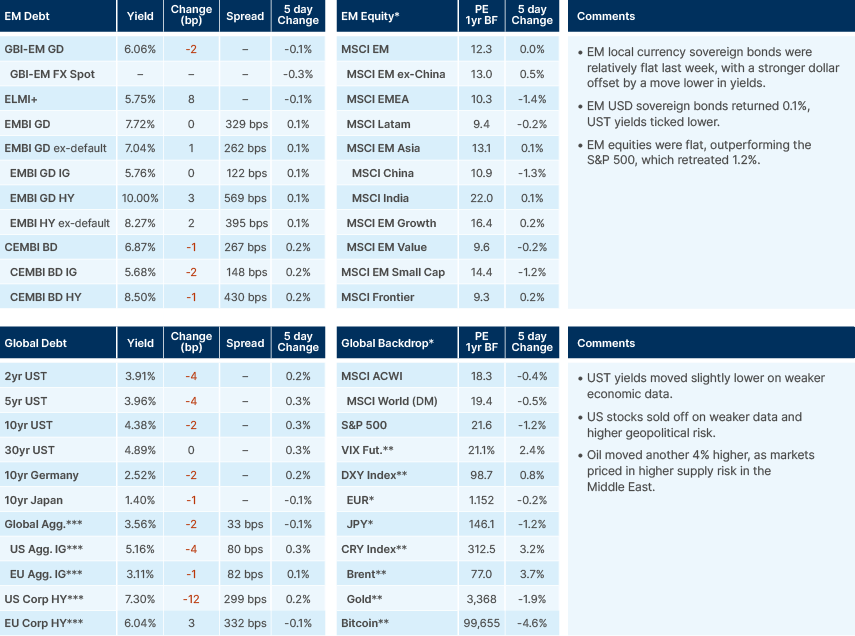

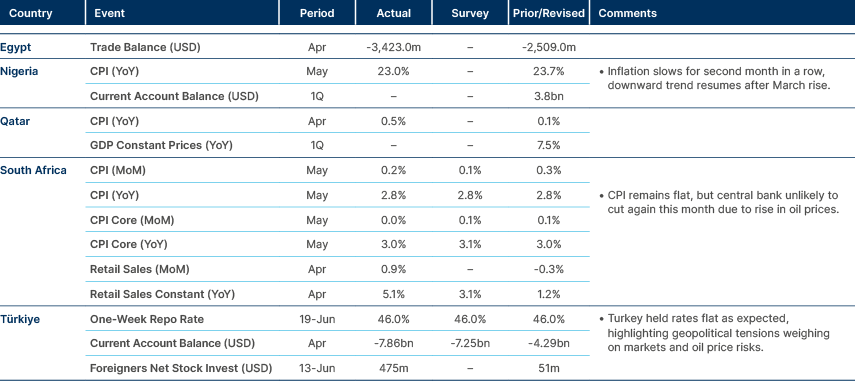

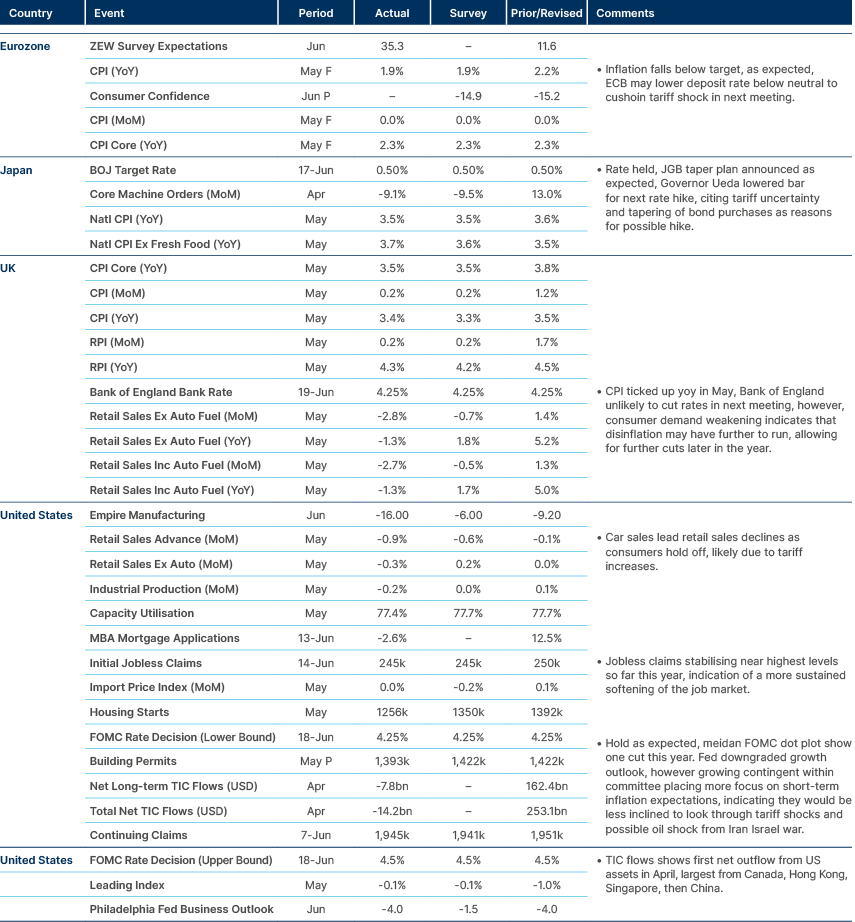

Last week performance and comments

Global Macro

The US carried out what President Donald Trump called a “total obliteration” of Iran’s nuclear infrastructure, striking key sites including Fordow on Saturday night, in a historic first joint military operation with Israel. Official US messaging stresses the strikes were limited, aimed at halting Iran’s nuclear ambitions, not regime change. Yet Trump’s own remarks suggest otherwise: “If the current Iranian Regime is unable to MAKE IRAN GREAT AGAIN, why wouldn’t there be a Regime change???”

Either way, Tehran has vowed strong retaliation. Iran's retaliation is complicated by the degradation of its regional proxy network and the absence of viable targets that avoid massive escalation. Options range from symbolic strikes on US bases in Iraq or the Gulf or further missile fire into Israel – both of which could provide a platform for de-escalation – to more asymmetric responses such as attacks on Gulf energy infrastructure or an attempt to close the Strait of Hormuz, which the Iranian parliament has now authorised.

While Iran may threaten to shut the strait, a full closure would be difficult to maintain, as it would likely alienate China, significantly damage Iran’s own finances, and likely provoke a swift US and Israeli response. Deutsche Bank estimates oil could spike to USD 120 in such a scenario, but consensus remains that closure would be brief, if it happens at all. The market reaction so far has leant toward a benign outcome. Oil prices are up more than 20% since May lows, so some respite in the rally is not surprising. However, oil prices falling to from USD 80 back to USD 77 after US operation ‘Midnight Hammer’, and rising Gulf Cooperation Council (GCC) equity markets reflect a consensus belief that deeper US involvement in this conflict may ultimately stabilise the region. Foreign exchange (FX) markets echo this sentiment. Despite heightened geopolitical risk and the usual correlation between higher oil and a stronger dollar, the USD has not rallied, as FX hedging flows against USD assets, and capital re-allocation away from the US remain the driving forces.

The latest dot plot from the US Federal Reserve (Fed) maintained the median projection of two rate cuts in 2025, but the distribution was more hawkish. Seven of 19 Federal Open Market Committee (FOMC) members see no cuts at all, and two see only one. While Fed Governor Christopher Waller continues to strike a dovish tone, Fed Chair Jerome Powell’s press conference was notably more cautious, highlighting that the inflationary impact of tariffs may prove “more persistent” than previously expected. The Summary of Economic Projections reflected this shift, with growth revised down and inflation revised higher. The Fed appears to be showing strong conviction in an incoming inflation shock, so are keeping patient for now. Still, if labour market conditions deteriorate more sharply, the Fed is likely to pivot toward the growth side of its dual mandate.

The Citi Economic Surprise Index for the US has been in a clear downtrend since December 2024 and is now rolling over more sharply as downside surprises accumulate. Recent data show retail sales retreating month-on-month and initial jobless claims starting to tick higher, pointing to softening domestic demand. Meanwhile, the rest of the world, particularly Europe and parts of Emerging Market (EM) Asia, is consistently outperforming expectations, highlighting a growing divergence in global growth momentum. Historically, the US Surprise Index has shown a strong correlation with 10-year US Treasury yields. However, this relationship is less obvious so far in 2025: despite weaker data, yields have remained sticky due to persistent fiscal concerns and tariff-driven inflation risks.

Geopolitics

Ahead of the June 24–25 summit, NATO’s draft communiqué is expected to shift its language from a unified “we commit” to individual “allies commit” in reference to a 5% of GDP defence spending goal. The change comes amid resistance from several members, including Spain, which had previously opposed the increase and declined to comment on the revised formulation. The language adjustment reflects internal divisions on the feasibility of such a steep ramp-up in military outlays, especially among lower-spending members.

Meanwhile, Russian President Vladimir Putin stated that a new round of peace negotiations with Ukraine may resume after 22 June. He noted that the heads of the Russian and Ukrainian delegations have had recent contacts and that he is open to meeting any Ukrainian representative, including President Volodymyr Zelenskyy, though only to “put a dot” at the end of negotiations, not begin them. Nonetheless, Putin again cast doubt on the legitimacy of Zelenskyy as a negotiating party, claiming his presidential mandate expired last year, echoing Russia’s strategic line to weaken the Ukrainian government's international standing.

China has pledged to eliminate tariffs on 98% of goods imported from all 53 African countries with which it maintains diplomatic ties. The move extends duty-free access to middle-income exporters such as South Africa, Nigeria, Kenya, Egypt, and Morocco. Beijing aims to deepen supply chain integration, secure access to critical minerals and food, and bolster its global trade credentials just as the US and EU implement new protectionist tariffs. While the removal of tariffs enhances African exporters’ price competitiveness, structural challenges remain. Logistics bottlenecks, non-tariff barriers and compliance requirements may delay full implementation. Moreover, a persistent USD 62bn China–Africa trade deficit highlights the imbalanced nature of current trade flows, limiting the near-term impact of the measure.

Emerging Markets

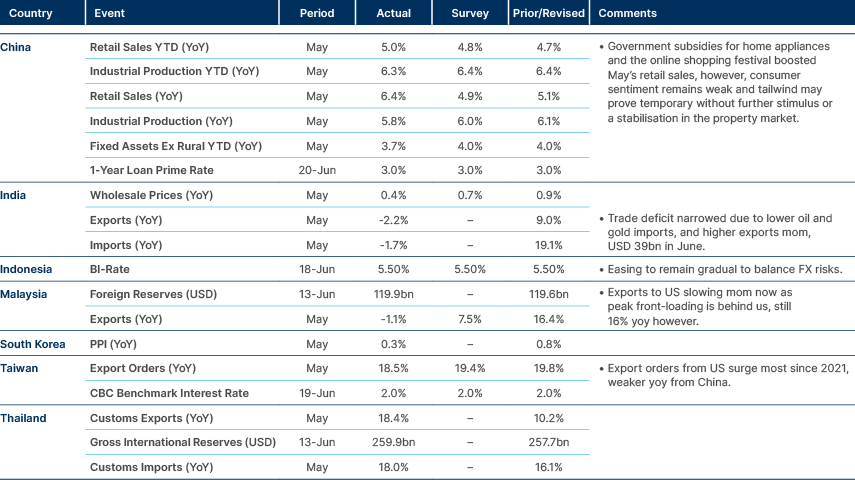

Asia

Retail sales boost in China, Taiwanese exports still surging.

India: Sanjay Malhotra, Governor of the Reserve Bank of India (RBI), suggested that if inflation outcomes come in below current projections, it could create policy space for a 25 basis points (bps) repo rate cut at the October Monetary Policy Committee (MPC) meeting. Malhotra noted that large variable repo rate (VRR) auctions are not an immediate objective and emphasised the importance of maintaining durable liquidity in the system. The cash reserve ratio (CRR) at 3% of reserves is viewed as adequate and is not expected to be used frequently as a tool for liquidity management. He also highlighted the significance of bond market transmission, stating that current yield levels remain supportive. On the currency front, the RBI reiterated its preference for smoothing volatility rather than managing the currency to any particular exchange rate level.

Indonesia: Loan growth has slowed, and with low inflation and a stable IDR, Bank Indonesia is likely to retain its easing bias, targeting at least a 5.0% policy rate. This path does not seem to be fully priced in by markets, with the two-year yield currently 67bps above the policy rate and 117bps above the implied terminal rate. Ex-post real rates remain high, close to 4.0%, while the 2s10s curve is compressed at 55bps, reflecting tight conditions.

Malaysia: Prime Minister Anwar Ibrahim confirmed that RON95 petrol prices will remain unchanged for now, suggesting a delay in fuel subsidy reforms due to elevated global oil prices.

Pakistan: Five bidders have shown interest in acquiring a majority stake of between 51% and 100% in Pakistan International Airlines (PIA), with the government aiming to finalise the sale by August 2025. In a rare diplomatic development, Donald Trump hosted Pakistan’s army chief at the White House, a move seen as a potential reset in bilateral ties. The Pakistan government secured a USD 1bn syndicated loan from Middle Eastern banks, partly guaranteed by the Asian Development Bank, which will help bolster FX reserves and mitigate near-term refinancing risks. Repatriated profits by foreign companies dropped 71.2% year-on-year in May to USD 264m, largely due to base effects from last year’s lifting of capital controls, though the monthly flow marked a six-month high. The State Bank of Pakistan kept its policy rate unchanged at 11%, citing increased external vulnerabilities from a growing trade deficit, and signalled that rates will remain steady for the foreseeable future.

Philippines: Central bank (BSP) Governor Eli Remolona stated that it stands ready to intervene in the FX market if the peso depreciates beyond acceptable levels, in order to contain imported inflation. The BSP also cut its benchmark policy rate by 25bps to 5.25%, citing slowing inflation and rising global economic headwinds.

Sri Lanka: The government signed a USD 390m debt restructuring agreement with France, extending maturities to 2042. This deal is expected to unlock the next tranche of International Monetary Fund (IMF) funding.

South Korea: The government proposed a supplementary budget of KRW 30.5trn (USD 22.2bn), now awaiting parliamentary approval. Of this, KRW 15.2trn is earmarked for stimulus and KRW 5trn for livelihood support, including direct vouchers of KRW 150,000 to 500,000 per person. The remaining KRW 10.3trn will cover corporate tax and VAT shortfalls. Approximately 65% of the package will be financed through additional bond issuance, with the rest funded by spending cuts, public funds, and FX stabilisation bonds. The stimulus aims to boost consumption amid weak retail sales. If passed, the fiscal deficit is expected to widen to 4.8–4.9% of GDP. The government also indicated a stronger KRW would be desirable to counter inflation and enhance household purchasing power.

Thailand: Deputy Prime Minister Phumtham Wechayachai stated the ruling coalition remains intact following the exit of the Bhumjaithai Party. While a cabinet reshuffle is expected to address the political shift, the coalition now holds a narrow majority and could collapse if any other partner leaves. Investors appear to have priced in the instability, with the MSCI Thailand index down 21% year-to-date.

Vietnam: The central bank governor raised concerns over the credit-to-GDP ratio reaching 134%, warning of potential macroeconomic vulnerabilities from over-reliance on bank lending. Meanwhile, trade talks with the US have made considerable progress, although Washington continues to press Hanoi to reduce its sizable trade surplus.

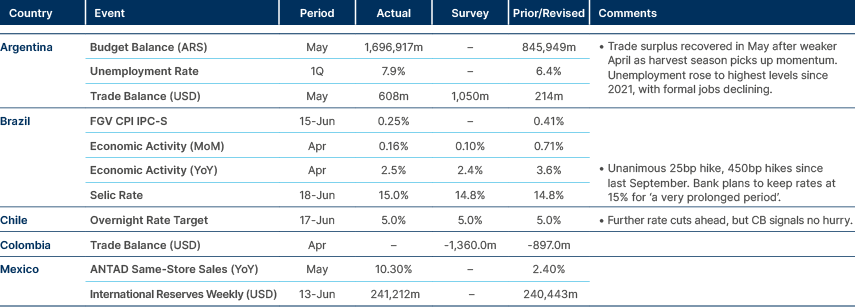

Latam

Brazil’s central bank signals ‘higher for longer’.

Argentina: Former President Cristina Kirchner addressed a peaceful rally via recorded message from house arrest, though her political influence appears to be waning. The central bank sold USD 810m in dollar-linked bonds to corporates with trapped profits, charging a 20% premium over the official exchange rate. Meanwhile, the federal government posted a fiscal surplus of 0.3% of GDP over the first five months of the year, keeping it on track to meet its balanced-budget goal for 2025.

Brazil: The central bank raised its benchmark Selic rate by 50bps to 15%, unanimously signalling the end of the tightening cycle while stressing that policy will remain “very” restrictive for an extended period. The Finance Ministry is planning a 10% across-the-board reduction in tax incentives to generate BRL 20bn in fiscal savings by 2026, amid increasing friction with Congress. Meanwhile, former President Jair Bolsonaro was indicted by federal authorities in connection with an illegal surveillance operation involving the national intelligence agency. On the data front, inflation forecasts for 2025 were revised down to 5.25% from 5.44%, following a stronger-than-expected May consumer price index (CPI) inflation print, reinforcing the case for a pause in rate hikes.

Chile: The Central Bank of Chile signalled a possible rate cut in the coming months, with the real policy rate expected to converge to a neutral range between 0.6% and 1.6%. First-quarter GDP surprised to the upside, driven by strong exports. Investment and private consumption are recovering steadily, though labour market conditions remain uneven, job creation is sluggish, unemployment is rising, yet wage growth remains firm. Slower headline and core inflation give the central bank more room to manoeuvre.

Colombia: The Finance Ministry increased its 2025 borrowing plan, raising domestic bond issuance to COP 58 trillion and foreign borrowing to USD 6bn to fund a wider fiscal deficit. Ratings agency Fitch noted the new deficit target of 7.1% of GDP marks a larger-than-expected deterioration, and warned that weak fiscal consolidation increases the risk of a sovereign downgrade. President Gustavo Petro’s approval rating fell to a record low of 36%, with sharp declines among core supporters and broad opposition to his reform agenda. He has also pledged to challenge a court ruling that suspended his referendum initiative, escalating tensions between the executive and judiciary. Colombia formally joined the BRICS New Development Bank, which should diversify infrastructure financing but may strain ties with the US.

Mexico: Mexico’s Foreign Minister said the country has fulfilled its US security obligations and is now seeking tariff relief ahead of the United States-Mexico-Canada Agreement (USMCA) review. President Claudia Sheinbaum has proposed a comprehensive migration, trade, and security pact with Washington in hopes of avoiding new tariffs. Separately, Sheinbaum confirmed that Mexico expects to sign the updated EU–Mexico Free Trade Agreement by early 2026, although some disagreements remain over geographical indication rules.

Panama: President José Raúl Mulino signed a special pension reform bill for banana workers into law, ending weeks of protests and blockades in the Bocas del Toro region that had caused considerable economic disruption.

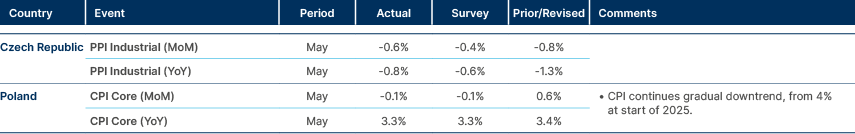

Central and Eastern Europe

Polish inflation continues gradual downtrend.

Romania: Investor sentiment improved markedly in May, buoyed by post-election optimism, although the country still faces serious fiscal headwinds, with the deficit currently at 9% of GDP, the highest in the EU. Pro-European parties appear close to forming a governing coalition that would focus on budget repair. Interim Social Democrat leader Sorin Grindeanu estimates an 80–90% probability that a four-party coalition will come together. President Nicușor Dan is expected to nominate a Prime Minister this week, they will then have 10 days to form a cabinet and secure a confidence vote in Parliament. The National Liberal Party has nominated Ilie Bolojan as its candidate for PM. The incoming administration is finalising a fiscal consolidation plan worth 1.5% of GDP, expected to include both tax increases and spending cuts, which will be presented to Brussels to avoid suspension of EU funding.

Ukraine: Ukrainian grain exports are down 19% year-on-year so far this season. The decline is expected to persist due to poor harvest conditions and the expiry of EU trade preferences, compounding fiscal and external pressures on the war-torn economy.

Central Asia, Middle East and Africa

Higher oil brings risk to stable CPI in South Africa, Turkey holds rates.

Egypt: Natural gas exports from Israel to Egypt have resumed, easing recent domestic shortages that had forced the closure of fertiliser plants to conserve energy. Meanwhile, Qatar is in advanced discussions for a USD 3.5bn tourism investment package, expected to be finalised by end-2025. The European Parliament also approved a EUR 4bn macro-financial loan to Egypt, forming part of a broader EU support programme.

Ghana: Fitch upgraded Ghana’s sovereign credit rating to ‘B-’ with a stable outlook, up from ‘Restricted Default,’ reflecting successful restructuring agreements with the majority of external commercial creditors and improving fiscal credibility.

Nigeria: Crude oil output rose 1.4% month-on-month in May to 1.54 million barrels per day, matching Nigeria’s OPEC quota, though still below the target embedded in the national budget. The Dangote Refinery is set to begin nationwide fuel distribution on 15 August, a move expected to lower logistics costs and reduce inflationary pressure in fuel markets.

Saudi Arabia: Saudi National Bank’s USD 1.25bn bond issuance was met with strong demand, attracting USD 4bn in orders. Separately, budget airline Flynas completed a USD 1.1bn IPO, the largest in the region so far this year, which priced at the top of its range, despite rising geopolitical tensions in the Gulf.

Senegal: The government approved a revised 2025 budget and a new three-year spending framework focused on boosting agricultural output and implementing land reform, in line with recent campaign promises.

South Africa: Early withdrawals under the “two-pot” pension system have totalled ZAR 58bn since September 2024, contributing ZAR 15bn in tax revenue windfalls. The Public Investment Corporation’s assets under management have surpassed ZAR 3trn, though over 40% of its unlisted investments are reportedly underperforming or distressed. The government is preparing an omnibus bill to streamline regulation and reduce bureaucratic barriers for businesses, expected before the fiscal year-end.

Türkiye: The current-account deficit widened to USD 7.9bn in April, driven by record-high portfolio outflows of USD 10.9bn and a sharp USD 25bn decline in FX reserves. On the fiscal side, the country posted a year-on-year improvement in its monthly budget surplus in May, though the cumulative deficit for the first five months of 2025 widened by nearly 38%, reflecting growing macro imbalances.

United Arab Emirates: Ratings agency S&P assigned the UAE an ‘AA’ sovereign credit rating with a stable outlook, citing the country's robust net asset position, ongoing fiscal prudence, and proactive policy framework as key credit strengths.

Zambia: Zambia is advancing negotiations in Rome over the development of the Lobito Corridor, a strategic rail and trade route for mineral exports supported by the EU and G7. Meanwhile, First Quantum Minerals called on the government to diversify the mining sector beyond its current concentration in copper and cobalt by expanding exploration into industrial minerals.

Developed Markets

Eurozone inflation falls below target, Fed holds rates as expected.

Japan: The Bank of Japan (BoJ) kept its policy rate steady at 0.5% and announced it would reduce monthly bond purchases by JPY 200bn per quarter beginning in April 2026, in line with prior guidance reported by the Nikkei. The statement contained no major surprises, though board member Naoki Tamura dissented on the revised Japanese Government Bond (JGB) buying plans. The BoJ noted a modest increase in inflation expectations and signalled flexibility to adjust its bond-buying operations at future policy meetings if conditions warrant. The central bank notably refrained from reducing purchases of long-end JGBs, with most of the taper focused on the 1–10 year maturity segment.

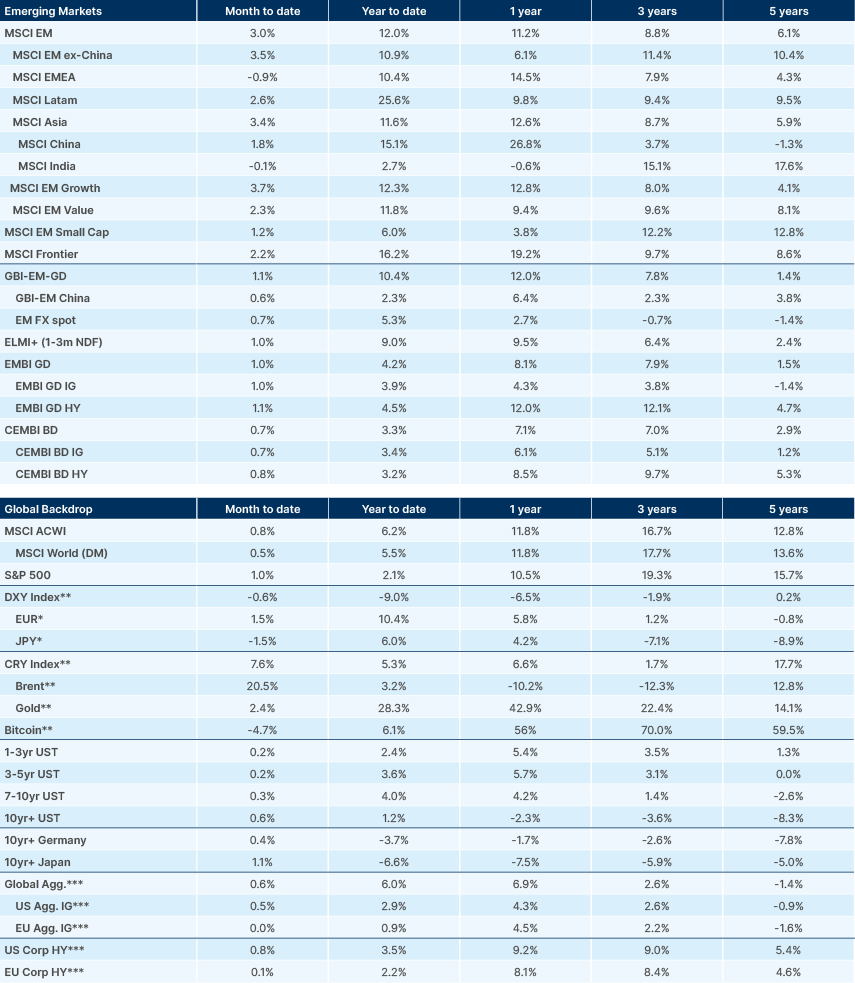

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.