Short on time? Download the two-page summary.

Introduction

Latin America (LatAm) was the worst performing region in emerging markets (EM) last year. The MSCI Latin America index fell 26% in USD terms, led by 27% and 29% downturns in both Mexican and Brazilian indices. Chile also flagged, down 6%. Colombia and Peru delivered solid returns (10% and 16%), but both have a small index weight. Argentina shot the lights out with a 118% return, as it became clear President Javier Milei’s economic shock therapy was working, but it remains an off-benchmark country for now, given its history of capital controls.

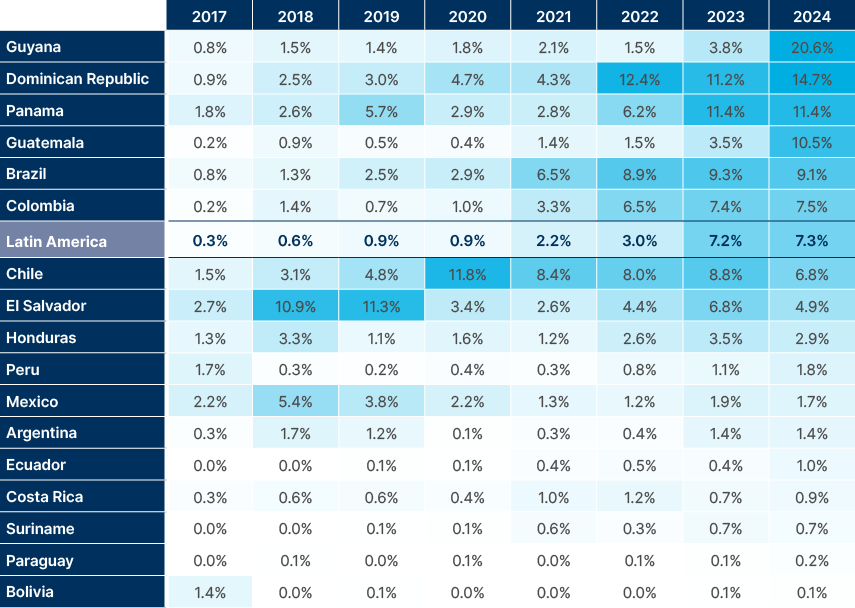

Midway through 2025, the mood has shifted. Latin American stocks are up 29% year-to-date (YTD) led by Colombia, the world’s best performing market, up 54%. It is followed by Mexico and Chile, both up 31%, Brazil and Peru, up 27%. Few investors were positioned for this kind of rebound, but it has historical precedent. LatAm tends to perform well towards the end of the political cycle, but especially when left-wing incumbent parties look increasingly likely to be replaced by a more market-friendly, centre-right administration. Currently, five out of the six major LatAm countries are being run by left-wing governments, where loose fiscal policies have supported growth but lowered investor confidence in economic stability. Four of these will go to the polls in the next two years. Last year proved a terrible one for incumbents, and polling data suggests 2025 and 2026 are likely to be no different. For investors, this presents a cyclical opportunity to enter a market which remains attractively valued and stands to benefit from various domestic and global tailwinds over the long term.

Valuations: Price is what you pay, value is what you get.

LatAm equities were relatively cheap at the beginning of the year. Price-to-earnings (P/E) valuations have been recovering but remain well below their historical levels. The S&P P/E, on the other hand, is close to its record highs.

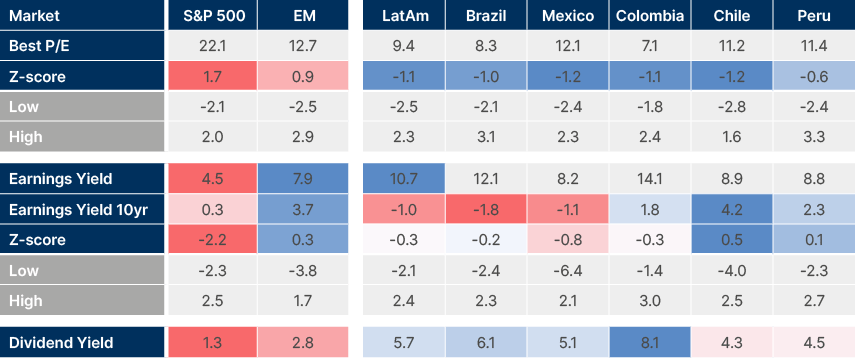

Fig 1. shows the S&P 500 forward PE valuation, at 22x earnings, is one standard deviation above its post-Global Financial Crisis (GFC) average. Earnings yields, flat to 10-year government bonds, are 2.5 standard deviations rich. By contrast, LatAm markets, despite a strong run-up in H1 2025, remain largely around one standard deviation below average, with earnings yield between 8.2% (Mexico) and 14.1% (Colombia), as per Fig. 1. Dividend yields are also highly attractive, with Brazilian and Colombian stocks offering higher income than the Global Aggregate bond index.

Fig 1: Selected valuation metrics: S&P 500, EM, and MSCI LatAm

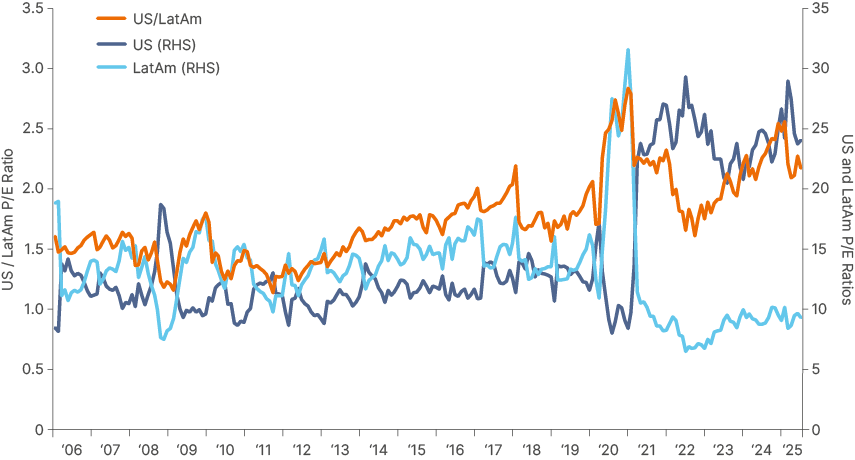

Fig. 2 below shows the ratio between the S&P 500 and MSCI LatAm PE valuations over time. After remaining largely rangebound between 1 and 1.5x, it jumped post-COVID to levels not seen since the 1990s.

Fig 2: S&P 500 / MSCI LatAm P/E ratios

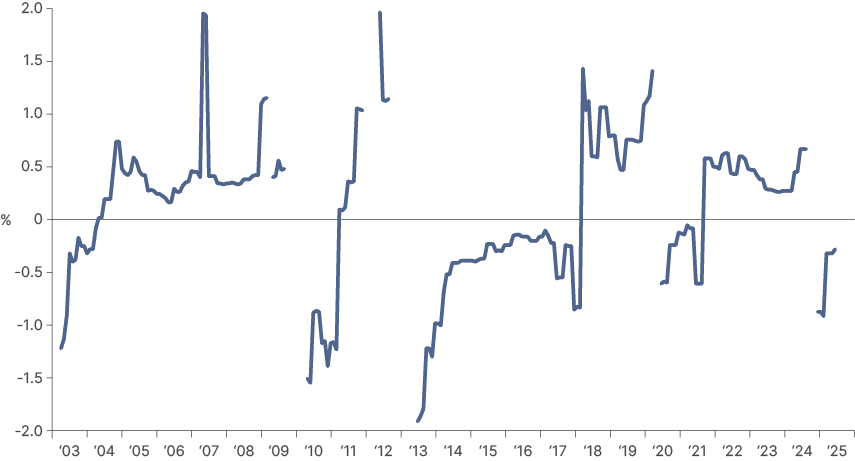

One explanation of the widening of the ratio could be the higher earnings per share (EPS) growth the S&P500 has had against the MSCI LATAM over the last 10 years. While the annualised EPS growth for the S&P500 and the MSCI LatAm since December 1999 has been similar (6.7% and 6.6%, respectively), the gap widened significantly after 2015 (7.6% vs 3.4%). While this can be partially explained by the incredible earnings growth of US big tech, the primary reason for this supernormal US earnings growth, in our view, has been the adoption of unsustainable pro-cyclical fiscal policies since 2017.1

Fig 3: Last three years annual EPS Growth S&P 500 / MSCI LatAm

Now, the Bloomberg consensus is estimating a convergence in 2024–2027 EPS growth, estimating 11.1% annual growth in the US and 10.0% annual growth in LatAm. This convergence aligns with our out of consensus view that the US will not be able to afford continuous fiscal expansion and will consolidate its deficit slowly over the next few years.

Whilst LatAm countries like Brazil and Colombia must also implement fiscal consolidation over the coming years, this is likely to lead to smaller risk premiums and lower interest rates within these countries. The actionable conclusion is that there is now a clear asymmetrical payoff between US and LatAm equities.

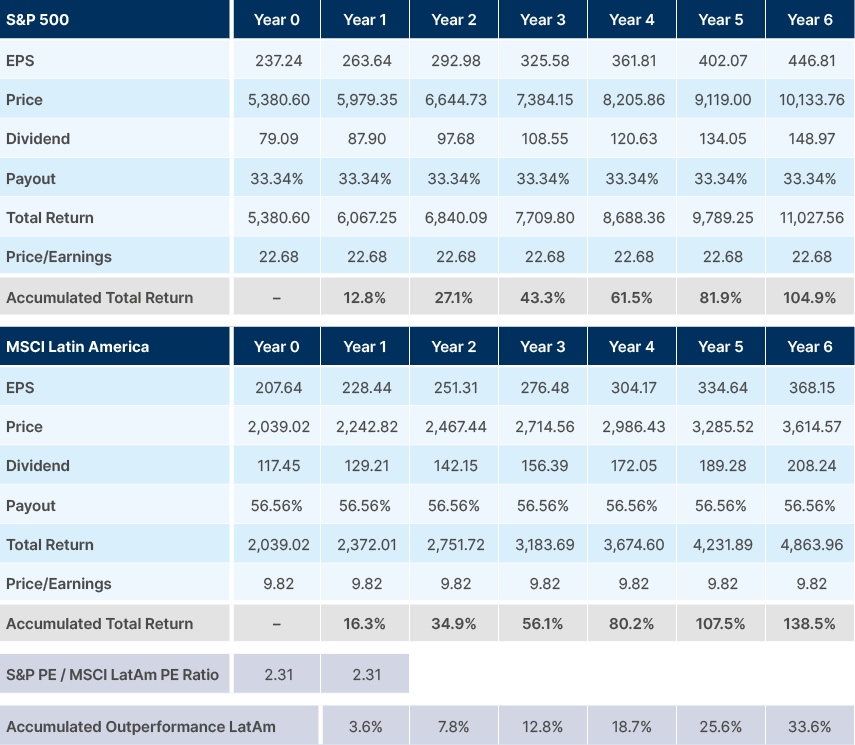

Fig. 4 shows that even with an unchanged US premium over LatAm (S&P500/MSCI LatAm PE ratio at 2.3x), Latin America would produce an accumulated outperformance of 26% in five years, mainly due to the compounding effect of the reinvested dividends. Despite higher earnings growth, the S&P500 dividend yield of 1.3% pales in comparison with the MSCI LatAm at 5.7%. Fig. 4 assumes a stable dividend payout over the period and EPS growth in line with the Bloomberg consensus, which implies that the LatAm EPS growth will be 90% of the S&P500 EPS growth.

Fig 4: Bloomberg best estimates: S&P 500 vs. MSCI Latin America

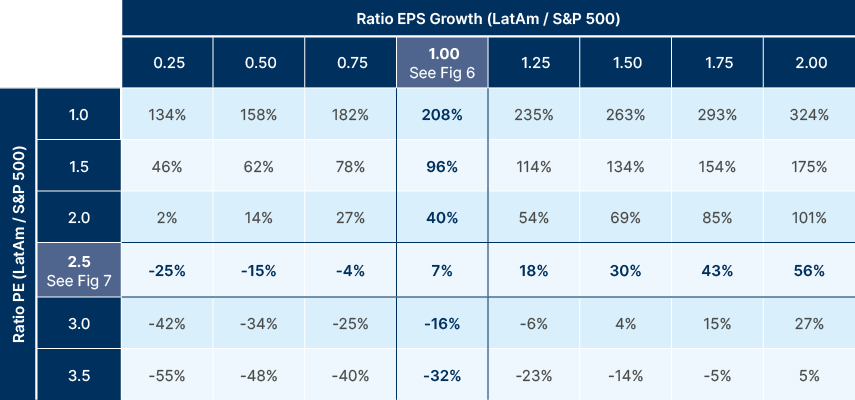

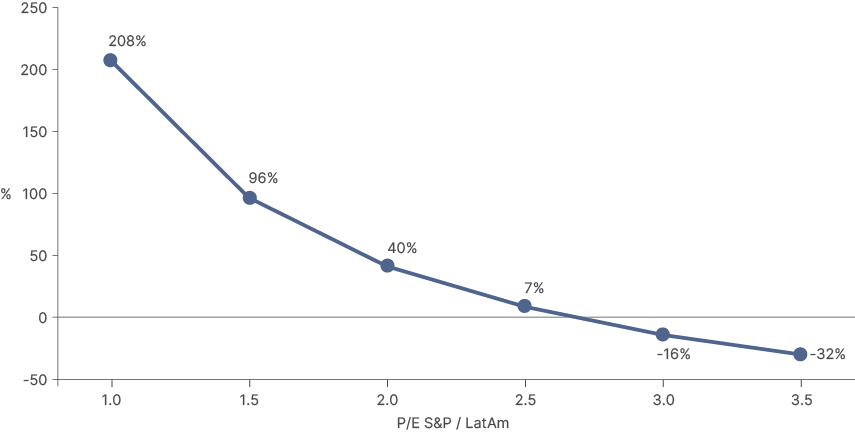

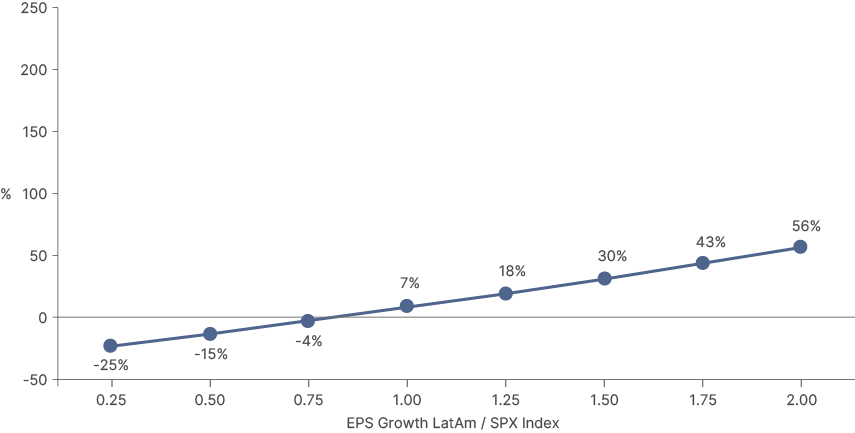

The asymmetry of three-year total returns is demonstrated in Figs. 5-7, which estimates the returns of a long MSCI LatAm, short S&P strategy, using different scenarios of the P/E ratio and different EPS growth ratios between indices. Fig. 6 shows the large potential LatAm outperformance if P/E ratios with the US began to converge. Notably, MSCI LatAm would have a small underperformance in the unlikely case of a renewed widening of valuations vs the US.

Fig 5: Relative return of MSCI Latin America vs. S&P 500 at different EPS and PE ratio differentials

Fig 6: Cumulative 3-year relative performance of MSCI LatAm vs. S&P 500 – for different P/E ratios, assuming similar EPS growth

Fig 7: Cumulative 3-year relative performance of MSCI LatAm vs. S&P 500 – for different EPS growth scenarios, assuming a similar P/E ratio differentials

This asymmetric return profile suggests that investors heavily weighted towards US equities should consider adding some exposure to LatAm. Over the past 20 years, LatAm stocks have exhibited a relatively low correlation with the S&P 500 (around 0.4) and a modest beta of 1.15x. This suggests they can deliver both diversification benefits and potential return enhancement. With higher dividend yields, historically low valuations and a converging EPS growth outlook, reallocating some US equity exposure to LatAm is compelling and timely.

A bird’s eye fundamental view

The mood around most LatAm markets was quite negative at the start of the year. Equity market valuations were trading at ‘crisis levels’ in several countries, with a lot of bad news priced in. Mexico faced the possibility of high tariffs from US President Trump, with growth already weak and markets concerned over institutional deterioration after a controversial reform of the judiciary. Chile was also facing risks from tariffs. Investor confidence in Brazil was very low, with President Lula’s fiscal indiscipline leading to capital flight, as inflation expectations became unanchored. Colombian assets were also under pressure from persistent fiscal slippage under President Petro, the country’s first left-wing president since the return of democracy.

These concerns have not fully dissipated. However, investors have been reassessing their positions given the positive skew in the risk/reward ratio of LatAm equities which trade at depressed levels, despite relatively resilient economic fundamentals and potential political turnaround ahead. Unemployment rates across major economies are close to, or below their long run averages. Growth has surprised to the upside across most countries for three consecutive years and again outperformed expectations in Q1 2025 despite elevated real interest rates across most countries.

Argentina stands out with 2025 growth projected at between 4.5%-5.5%, as the economy regains momentum after Milei’s ‘shock therapy’ fiscal rebalancing in 2024. Despite the Selic rate rising to 15%, Brazil’s economy expanded 2.9% year-on-year (yoy) in Q1, driven by strong agricultural exports and investment growth. Chile and Peru’s growth is expected to run between 2.5-3.0% this year. Colombian growth reached 2.5% in Q1, the fastest pace since 2023, driven by resurgent household spending.

A notable exception is Mexico, where the economy is slowing, with domestic consumption growth declining, and headline GDP growth only positive yoy due to resilient US demand for Mexican manufactured goods. With exports to the US now at 35% of GDP, Mexico is acutely exposed to tariffs uncertainty, which has weighed on Mexican activity so far this year. However, ‘peak tariff fear’ is behind us, in our view, and it now seems likely that Mexico’s free-trade agreement with the US will remain largely intact.

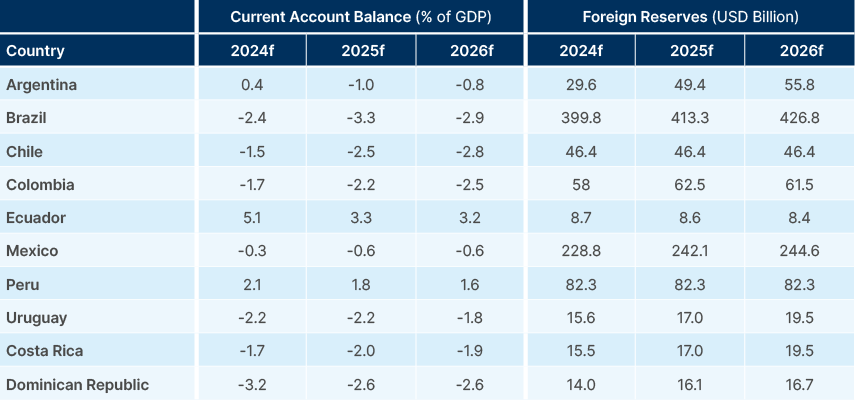

The better-than-expected GDP growth did not lead to material imbalances across the region. Inflation expectations have remained largely anchored (except Brazil), and current account balances remain at reasonable levels across the larger economies in the region, ranging from 3.3% of GDP deficit in Brazil to 3.3% of GDP surplus in Ecuador, as per Fig. 8.

Fig 8: Current account as % GDP

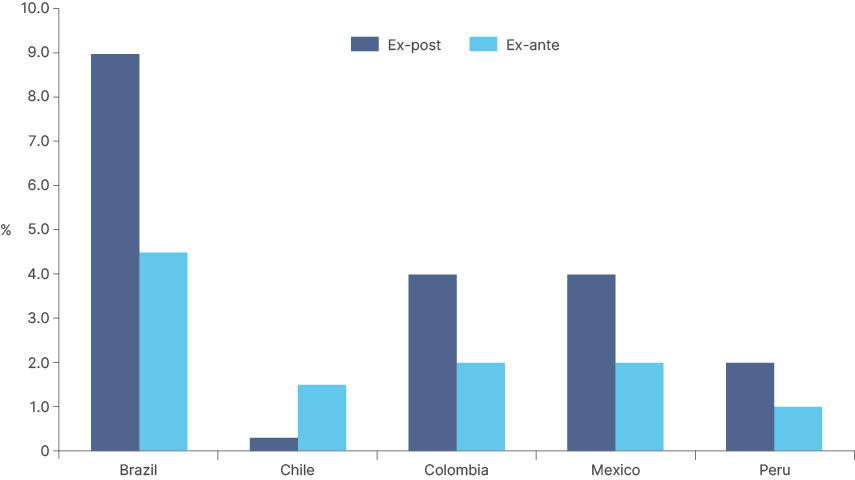

The dollar weakening in 2025 has led to stronger currencies across Latin America, which helped to soften inflation and support purchasing power. The currency anchor will help the region with the highest real interest rates in the world to soften its policy stance, which remains very hawkish as per Fig. 9.

Brazil has pole position in real rates and hiked the Selic to staggering 15% levels to contain rising inflation expectations and a sliding currency in Q4 2024. The central bank will have plenty of room to normalise rates as inflation softens anchored by a more stable BRL. Although Banxico has already cut 400 basis points (bps) since August, Mexican real rates remain at 4.5%, among the highest in EM. The space to cut further into softening growth contains the risk of degeneration into a deep recession.

Fig 9: Ex-ante and ex-post real policy rates

Politics: Steering to the right

The key element of the forward-looking analysis of LatAm fundamentals is politics. The region saw a ‘pink tide’ around four to six years ago that brought centre-to-far left politicians back to power. The combination of populist policies with deteriorating fiscal accounts was a huge blow to investor sentiment. Nevertheless, this tide started reversing two years ago when the fiscal conservative Javier Milei swung Argentina towards libertarian economic policies. The low approval rate across most governments in the region suggests the pink tide is receding. Milei has proven that a shock therapy pays off as the negative fiscal impulse is more than compensated by the confidence rebound and the return of ‘animal spirits’. Milei is likely to be successful in increasing the presence of his party in Congress in October and can “carry the flag” of libertarian economics across the region.

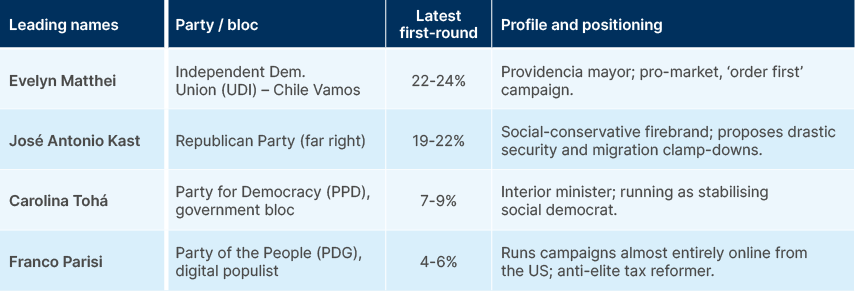

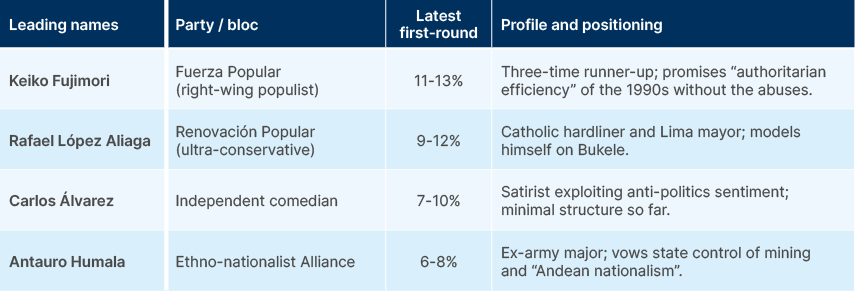

A quick glance at the political landscape and opinion polls for the next 18-month election cycle across the region shows a few common threads:

- Dissatisfaction with incumbents and the political system, leading to a fragmented contest: the leader of each races polls between 12%-24% across Chile, Peru and Colombia.

- Centre-right, independents, and far-right candidates have the upper hand when looking at the sum of their candidates across races.

- Security and the cost-of-living crisis are common issues facing Latin Americans.

- The high social media penetration means that new and independent candidates are possible.

- Milei and Jair Bolsonaro’s popularity suggest anti-establishment candidates with a presence in national politics and social media is a powerful combination.

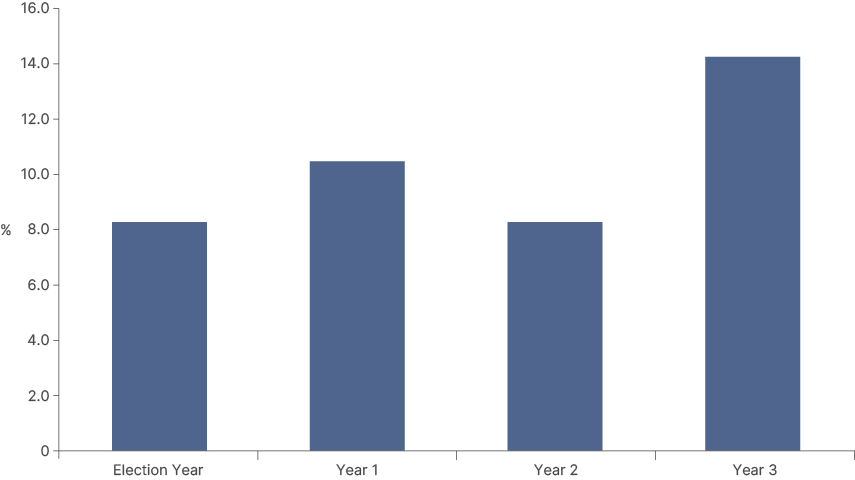

A simple quantitative analysis done by Ben Laidler of Bradesco shows that investors position ahead of elections. Fig. 10 takes the simple average return of the six main LatAm stock markets (Mexico, Brazil, Chile, Colombia, Argentina, Peru) in each year of their election cycles. The third year of the cycle has the highest average return by far, which demonstrates that investors tend to price in economic improvements coming from political change early. Mexico will not have another election until 2030, but 2025 is ‘Year 3’ for Brazil, Colombia and Peru, and election year for Chile.

Fig 10: LatAm: Price Return % – Average by year in political cycle

Returns are particularly impressive when the political shift happens from the left to the centre-right. Brazil, for example, has seen an average 50% return in the third year of a left-wing incumbent’s administration, as investors have positioned for a transition of power back to the right. This swing is the most likely scenario in each of these markets.

Chile: 23 November 2025

A May poll by CEP barometer shows President Gabriel Boric has a disapproval rating of 65%, while ‘undecided’ accounts for 52% of voters. A separate Criteria poll puts outright government rejection at 66%. Crime, cost-of-living and fatigue with the unsuccessful 2022 constitution revision process dominate concerns, and the most popular opposition candidates suggest the political pendulum has swung back towards the right. Centre-right candidate Evelyn Matthei has the upper hand so far and has a strong social media presence. The veteran mayor re-invented herself on TikTok with short “daily mayor” videos that racked up 14 million views; branding herself the “pragmatic mum” who can make Santiago safe. With a clear and detailed pro-business plan, Matthei is the most market-friendly candidate. José Antonio Kast is strongly pro-market, though brings some radical flavour, while Franco Parisi’s pledges to cut taxes would lead to questions around fiscal sustainability.

Fig 11: Chile Presidential Elections

Peru: 12 April 2026

President Dina Boluarte’s record-low 2% approval rating has produced Latin America’s starkest anti-politics wave. Independent comedian Carlos Alvarez is trying to replicate Zelenskyy's success in Ukraine with standup TikTok routines, while Keiko Fujimori is using social media to soften her image, tainted by her former-dictator father. She is a leading contender for the fourth consecutive election, having lost by a narrow margin in the second round in 2011, 2016, and 2021. If today’s field of candidates holds firm, markets would cheer a Fujimori win, cautiously welcome Rafael López Aliaga and view any revival of Hernando De Soto (not on the list), who advocates flat taxes and deregulation, as the most bullish scenario. However, any figure able to dominate social media feeds convincingly can still vault to a run-off place from here, a dynamic which will keep uncertainty high closer to the election.

Fig 12: Peru Presidential Elections

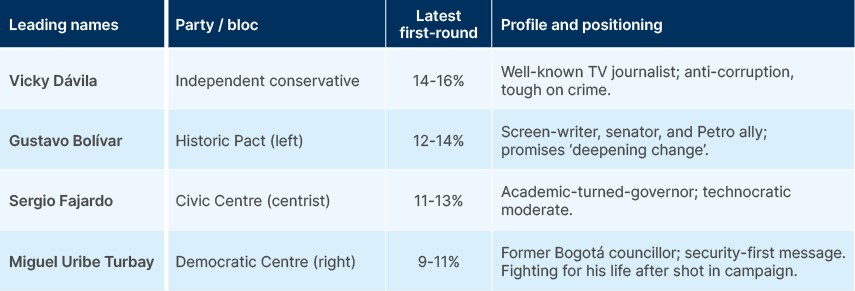

Colombia: 25 May 2026

An Invamer poll released on 18 June puts President Petro at 29% approval and 64% disapproval. Petro can’t run for a second term, and the odds of him approving a successor who then wins is tiny, as 89% of respondents say security has worsened in Colombia during his tenure. Soaring urban crime and a strong anti-establishment sentiment means three of the four front-runners are independents with thin party structures.

Fig 13: Colombia Presidential Elections

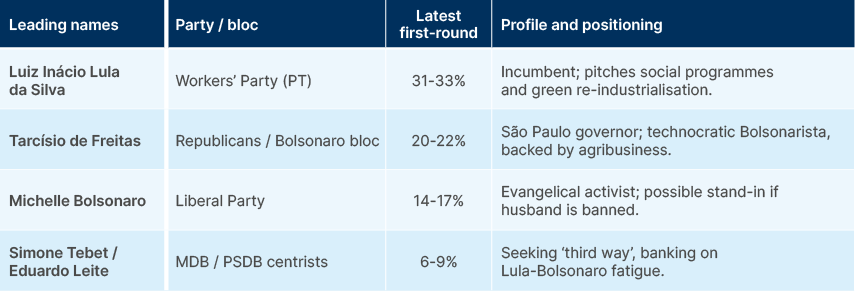

Brazil: 04 October 2026

A recent poll by Datafolha shows government approval at only 28%, against 40% “poor/terrible”. The same poll showed two-thirds of voters said neither Lula nor Bolsonaro should run. Bolsonaro is ineligible and is on trial in the Supreme Court for plotting a coup in case he would not get re-elected. Bolsonaro says he will wait until the last minute (March 2026) to announce who he will support. The vacuum is boosting Sao Paulo Governor Tarcísio de Freitas, who was Bolsonaro’s Infrastructure Minister and has earned plaudits in his current role. The support from Bolsonaro, who recently informally endorsed Tarcisio, the evangelic church as well as social media, are likely to be the defining features of this election.

Fig 14: Brazil Presidential Elections

Sectors

The relatively low correlation between LatAm and US equities comes down to sector composition. MSCI LatAm is dominated by real assets, financials, and cyclicals, unlike the tech-heavy US market.

Materials and energy lead: In Brazil, Vale and Petrobras make up over 30% of the Bovespa. Chile and Peru are even more concentrated in metals like copper, lithium, and silver, positioning the region to benefit directly from the energy transition and global infrastructure demand.

Financials account for 20–30% of most indices. Banks like Itaú, Bradesco, and Banco de Chile remain highly profitable, while fintech disruptors like Nubank are rapidly expanding financial access. Credit penetration has climbed sharply, with Brazil rising from under 40% of GDP in the early 2000s to over 70% today, and Chile close to 83%. Over 100 million people in the region have adopted digital financial services since 2020.

Consumer and utility sectors round out the index. Off-benchmark giants like Mercado Libre, excluded due to Argentina’s removal from MSCI indices, highlight the region’s growing consumer and tech story. Still, overall tech exposure remains below 5%, making LatAm far less sensitive to rate moves than developed markets. These equities are anchored in robust cash flows and supported by structural tailwinds like commodity demand and expanding financial inclusion.

Themes

The long-term investment case for LatAm equities is backed by structural drivers, which can propel EPS growth higher over time. Long considered a commodity driven market, Latin America remains a key exporter of metals, energy and agricultural products. But continued sector diversification, now means LatAm companies stand to capture value from a wider range of global themes, including technology and artificial intelligence (AI), and the diversification of global manufacturing away from China.

Energy Transition

The buildout of new clean energy infrastructure on a global scale will require an abundant supply of metal. Particularly key will be copper, which is essential for most electricity transmission equipment, and lithium, for batteries. Latin America is well placed to benefit from this structural demand growth. BHP, the world’s largest copper mining company, predicts global copper demand increasing by 70% over the next 25 years. In 2024, Latin America mined 35% of the world’s copper output, with Chile producing 24%, and Peru 11%.

Lithium is currently well supplied, and prices of the metal have declined back to pre-COVID levels, having spiked by nearly 1000% in 2021 and 2022 due to supply chain bottlenecks and rapid growth of electric vehicle (EV) sales. However, of all metals, lithium still has the fastest demand growth profile. The International Energy Agency (IEA) estimates that to meet global 2040 climate targets, lithium consumption will need to increase by 40x over the next 15 years. Chile produces 25% of the world’s lithium, with Argentina producing 5% and set to triple its output by 2030.

Silver will be another key metal in the energy transition, an important input into many electronic devices, but particularly into solar panels. Solar panel production growth alone lifted silver demand 20% in 2024, and this will continue rising as investment in solar energy continues to expand. Mexico is the world’s top silver supplier by far, while Peru and Chile are the third and fourth largest silver producers. Peru is thought to have the world’s largest untapped silver reserves.

Raw material exports is not the only way that Latin America can benefit from the energy transition. In early 2024, we highlighted the very high levels of solar panel imports by LatAm countries from China. The large volumes have been leading to lower electricity costs, boosting manufacturing competitiveness in the region. Momentum continued in 2024, with LatAm and the Caribbean importing 7.3% of their total generating capacity in Chinese solar panels, almost identical to 2023. Energy supports all economic activity. This momentum is particularly powerful to enable the region’s re-industrialisation, which in turn is likely to support increased foreign direct investment (FDI).

Fig 15: Solar panel imports in MW as a % of total installed power generation capacity

Nearshoring (Industry and Commodities)

Mexico overtook China as the biggest trading partner of the US in 2023, as trade restrictions and deteriorating relations with the US reduced the appeal of China as an offshoring option for many businesses. Mexico has been double levered to this trend, with Chinese companies also looking to invest in Mexico to reroute products into the US. For example, over the last five years, nine Chinese car companies built factories in Mexico. This playbook had spread south as well. BYD, for example, invested in a new factory in Brazil in 2022, which is still under construction.

Tariff uncertainty has somewhat derailed this nearshoring narrative for the time being, reducing appetite for nearshoring investment from the US, and making Chinese ‘re-routing’ less viable, due to heightened scrutiny. Regional FDI surged to a decade high of USD 208bn in 2022, but slipped to USD 164bn in 2024, and will likely fall further this year.

However, once the tariff confusion begins to clear, given its geopolitical neutrality, competitive labour costs and supportive demographics, Mexico remains a prime candidate to continue benefitting from supply chain diversification. The renewal of the USMCA agreement on favourable terms will be very important for Mexican exports, and Mexican President Claudia Sheinbaum appears to be working with Donald Trump to implement policies around border control to ensure the renewal takes place.

Relative tariff winner

When it comes to tariffs, LatAm is a relative winner versus Asia. Trump’s ‘reciprocal tariff’ salvo gave LatAm countries the lowest level of tariff (10%), aside from Mexico, which currently has a 25% tariff on ‘non-USMCA goods’ which essentially covers only a small amount of goods not produced in Mexico. This is much lower than tariffs announced to China. Most South American countries (ex-Colombia) also have a much smaller share of exports to the US than most Asian countries.

Technicals – underinvestment

International investors remain structurally underinvested in Latin America. Despite contributing 6.0% of global GDP, the region’s weight in the MSCI ACWI has collapsed to 0.65%, down from 1.5% in 2010. Within EM, LatAm’s share has fallen from over 8% to below 5%, as global flows have concentrated in Asia, particularly China, India, and Korea.

Fund flows mirror this. EPFR data shows assets under management in LatAm-dedicated equity funds have dropped from over USD 60bn in 2011 to under USD 20bn today. Domestic investors are no exception. In Brazil, equities account for just 10–12% of household financial assets, compared to 40–50% in developed markets. The same pattern holds across Mexico, Chile, and Colombia, where wealth remains skewed toward cash and government bonds. Pension funds remain heavily tilted to fixed income.

Mexican Afores allocate close to 17% to equities, while in Peru and Colombia, allocations are routinely below 15%, far below developed market norms. But this isn’t a structural ceiling. This under allocation to domestic equities is predicated on elevated nominal interest rates across the largest economies in Latin America. But all countries (ex-Brazil) are already cutting interest rates, which increasingly make equity markets more attractive. Regulatory liberalisation, financial deepening, and generational shifts in risk appetite all point toward rising domestic equity participation over time.

The Mexican social security law reform has mandated a gradual increase in mandatory pension savings from 6.5% of salary to 15% from 2021 to 2030. As a result, the pension system has already grown from MXN 4trn in early 2020 to MXN 7.2trn today and is likely to double by 2035. The country's relatively young average working population (c. 30 year’s old) means most investments should be in long duration assets, which should lead to higher allocation to equities in Mexico, as well as in Latin America. The outflows from the large pension systems in Chile, Peru, and Colombia seem to be largely behind us as well, which allows investors to focus on long term performance, favouring equities, as well.

Conclusion

LatAm equities have rallied this year but remain undervalued, underowned and well positioned for potential further upside, in our opinion, supported by a shift toward more market-friendly governments in Chile, Colombia, Peru, and Brazil.

The region offers a rare mix of value, income and cyclical upside, backed by structural drivers like the energy transition, Mexico’s nearshoring boom and rising financial inclusion. Increasing domestic participation from retail investors and pension funds should further support valuations.

The ongoing U.S. dollar decline signals a shift in global allocations. Flows are starting to turn, with Brazil seeing $3.8bn of inflows in May, the highest since 2019, yet global portfolios remain heavily overweight the U.S. despite stretched valuations. With high dividends, cheap valuations relative to the S&P 500 and meaningful diversification away from tech-heavy U.S. markets, LatAm equities offer a potential opportunity that investors should no longer overlook.

1. See – “The inconvenient truth behind US exceptionalism”, The Emerging View, 31 January 2025.