Pressure’s on: Russia shut down Nord Stream 1 pipeline for maintenance

Russia announced it will shut down the Nord Stream 1 pipeline for 10-days for maintenance. China brought forward local government special bonds issuance from 2023 to 2022, while keeping the zero Covid-19 policy, which resembles the “whack-a-mole” game. The Sri Lanka president resigned after protesters stormed his residence. Hungary hiked policy rate by 200bps and said it was close to an agreement to access EU funds. Czechia stepped up the pace of intervention in its currency. IMF’s Kristalina Georgieva held a constructive call with Argentina’s new economic chief. Better than expected inflation across Latin America, except for Mexico. In Japan the Liberal Party won a landslide victory after the shocking assassination of Shinzo Abe. Boris Johnson resigned as leader of the Conservative Party and Prime Minister of the United Kingdom.

Emerging markets

Russia-Ukraine:Russia announced it will shut off Nord Stream 1 entirely for 10 days starting today for annual maintenance of a key turbine. The gas flow had already been reduced by more than half of its capacity over the last weeks, increasing the energy security risks.1 It is unlikely that the shutdown of flows will lead to energy shortages in the near term as Europe has around 60 billion cubic meters (bcm) of gas stored (60% of its capacity) from 50bcm a year ago. Natural gas prices in Europe surged over the last weeks but have declined somewhat today after Canada allowed Siemens Canada to return a repaired turbine from Nord Stream 1 gas pipeline, after the German Economy Minister Robert Habeck campaigned publicly to return the embargoed key part. Canada said it would “grant a time-limited and revocable permit” to support Europe’s ability to access reliable and affordable energy in the transition away from Russian oil and gas. The intended consequence of the embargo was to increase the pressure on Russia’s exports, but it has accelerated the severe threat on Germany’s energy security.2

Ukraine’s defense minister asked Canada to reverse the decision after old Soviet artillery destroyed a residential building in the Donbas region, killing dozens of civilians. President Volodymyr Zelenskiy announced a cabinet reshuffle including a consolidation of Ukraine’s ministries to reduce waste and weed out corruption after the Ukraine reconstruction conference in Lugano. The ambassadors to Germany, Hungary and India were dismissed.

China: The leadership is still committed to the zero covid-19 strategy, which became like a game of whack-a-mole due to the high contagiousness of the new omicron variants. Over the weekend multiple cities, including Shanghai, announced mass testing for the coming week, and Beijing City dropped the vaccination mandate after a backlash, but Shanghai denied rumours of a new lockdown. Macau said it would shut casinos and other businesses for a week and Hong Kong’s health secretary said it was unreasonable to launch a full-blown reopening of the border with mainland China and the rest of the world, but the government is trying to reduce travel inconveniences. In economic news, the Caixin Service PMI surged 13.1 points to 54.5 in June, driving the composite PMI to 55.3. The yoy rate of CPI inflation rose 40bps to 2.5% due to higher food prices and PPI declined 30bps to 6.1% as metals and mineral prices declined. Both price indices were 10bps above consensus. The Ministry of Finance said local governments may be allowed to sell USD 220bn of special infrastructure bonds in 2H 2022 from the 2023 quota. The fiscal stimulus is likely to front load growth this year at the expense of lower GDP growth in 2023.

Sri Lanka: President Gotabaya Rajapaksa resigned over the weekend after protesters stormed into the presidential residence demanding his departure. The Rajapaksa clan bears responsibility for the country’s economic collapse after borrowing to boost infrastructure construction in expensive projects, many unnecessary, and in our view carried out with little transparency and overinflated cots. As a result, debt to GDP ballooned to 93.6% in 2019 and was projected to be at 118.9% of GDP in 2021 after the pandemic. The reluctance to implement fiscal austerity programmes and request international support by the current government led to capital flight, depleting foreign exchange reserves, and exacerbating the country’s problems as today Sri Lanka is running out of fuel and has serious food security concerns. The speaker of the house will act as President for 30 days. During this period, Parliament will select one of its members to serve as President for the remainder of the term and will appoint an interim government until new elections are prepared. In other news, the central bank hiked policy deposit and lending rates by 100bps to 14.5% to 15.5%, however, M1 has expanded 88.9% since December 2019 (31.4% per year) as the Central Bank expands the monetary base to fund the government.

Hungary: The Central Bank hiked its 1-week policy rate by 200bps to 9.75%, significantly above consensus for a 50bps hike. The aggressive stance did not prevent further HUF depreciation, but the currency stabilised after Minister Gulyas signaled talks to access EU funds were at "advanced stage" as Hungary accepted demands in four key areas, including tackling corruption and making bids for EU and national funding more transparent. CPI inflation declined to 1.5% mom in June from 1.7% in May leading to a 100bps increase in the yoy rate to 11.7%. In other news, the yoy rate of retail sales slowed to 11.1% in May from 15.7% in April, in line with consensus as industrial production rose 1.4% mom from -1.5% over the same period, slightly better than consensus

Argentina: The IMF Chief Kristalina Georgieva said she had a good call with Argentina’s new economy chief Silvina Batakis. Silvina will announce a full economic program this week. Interestingly, President Alberto Fernandez and Vice President Cristina Kirchner seem to have reached a truce with the VP blaming the former Finance Minister for the economic issues and asking for political unity within the Peronist Party. The Peronist party is lagging both Juntos por Cambio and the Liberal Party ahead of presidential elections in 2023 as polls suggests four in five Argentinians blame either the president or vice president for the current economic malaise.

Brazil: CPI inflation rose by 0.7% mom in June from 0.5% in May, taking the yoy rate 20bps higher to 11.9%, while core CPI was unchanged at 0.9% mom or 11.1% yoy in June, broadly in line with consensus. However, on a seasonally adjusted basis all but one core inflation components declined on a mom basis as the diffusion index declined to 66.6% from 72.4%. Furthermore, the measures approved by congress last week are likely to lead to an accelerated slowdown in inflation for the remainder of the year. The service PMI rose 2.2 points to 60.8 in June, but industrial production rose 0.3% mom in June from 0.2% mom in May, 30bps below consensus. Vehicle sales slowed to 178k in June from 187k in May, still significantly below the 225k average of the previous 10 years in June, but vehicle production was stable at 204k in June, close to the last 10 years average.

Chile: CPI inflation dropped to 0.9% mom in June from 1.2% in May, 20bps below consensus. Most inflationary pressures came from food and energy items as core CPI inflation dropped to 0.8% mom in June from 1.0% in May, bringing the yoy rate of core CPI inflation 90bps higher to 9.9%. Nominal wages rose by 9.6% in yoy terms in May from 8.0% in April.

Colombia: CPI inflation dropped to 0.5% mom in June from 0.8% in May, but the yoy rate rose another 60bps to 9.7% while core CPI inflation dropped by 20bps to 0.5% mom bringing the yoy rate to 6.8% over the same period, slightly below consensus.

Mexico: CPI inflation rose to 0.8% mom in June from 0.2% in May, lifting the yoy rate by 30bps to 8.0% while core CPI rose to 0.8% mom from 0.6% over the same period, taking the yoy rate 20bps higher to 7.5%. On the positive side for future inflationary pressures, wage inflation moderated to 6.7% yoy in June from 8.2% in May. In other news, the ratings agency S&P affirmed Mexico’s BBB foreign currency rating but revised the outlook from negative to stable. S&P said unexpected setbacks in discussions with USMCA partners on strengthening value chains and cross-border linkages or worsening of macroeconomic management, including higher government debt and deficits could lead to a downgrade. Moody’s downgraded Mexico’s sovereign rating one notch from `Baa1` to `Baa2`, the same rating level as S&P while moving the outlook to stable from negative.

Egypt: The whole economy PMI declined 1.8 points to 45.2. The Egypt PMI has a poor fit to its economic performance as it rarely increases above 50 even when the economy is doing well, but it was good at signaling previous crises particularly if it drops below 45. CPI inflation dropped 0.1% mom (deflation) in June from 1.1% in May, taking the yoy rate down 30pbs to 13.2%, but core CPI rose 130bps to 14.6% yoy. Foreign exchange reserves declined to USD 33.4bn in June from USD 35.5bn in May and USD 41bn in February.

Snippets

- Czechia: Foreign exchange (FX) reserves declined USD 10.5bn to USD 157.1bn in June. Most of the drop in FX reserves was due to interventions by the Czech National Bank.

- India: The service PMI rose 0.3 to 59.2 in June.

- Malaysia: Bank Negara Malaysia increased its policy rate by 25bps to 2.25%, in line with consensus. The yoy rate of industrial production dropped 50bps to 4.1% in May, 210bps below consensus.

- Pakistan: The central bank hiked its policy rate by 125bps to 15.0%, 25bps above consensus.

- Peru: The central bank hiked its policy rate by 50bps to 6.0%, in line with consensus, and kept the door open for further 50bps hikes.

- Philippines: The yoy rate of CPI inflation rose 70bps to 6.1% in June, 10bps above consensus.

- Poland: The central bank hiked its policy rate by 50bps to 6.5%, 25bps below consensus.

- Romania: The central bank hiked its policy rate by 100bps to 4.75%, slightly above consensus. PPI inflation rose to 1.5% mom in May from -1.9% in April as the yoy rate declined 70bps to 46.6% on base effects. Retail sales increased 0.9% mom in May after rising 3.1% mom in April.

- Russia: The service PMI rose 3.2 points to 51.7 in June, 2.7 points above consensus. The yoy rate of CPI inflation dropped by 120bps to 15.9%, as core CPI dropped 70bps to 19.2% yoy over the same period, both below consensus.

- Saudi Arabia: The all-economy PMI rose 1.3 points to 57.0 in June.

- South Korea: CPI inflation rose by 0.6% mom in June, down 10bps from May, but 20bps ahead of consensus, driving the yoy rate 60bps higher to 6.0% as core CPI rose 30bps to 4.4% yoy over the same period. The current account moved to a USD 3.9bn surplus in May from a USD 80m deficit.

- Taiwan: The trade surplus rose to USD 4.6bn in June from USD 2.4bn in May, significantly above consensus. The yoy rate of CPI inflation rose by 20bps to 3.6%, in line with consensus as core CPI rose by 20bps to 2.8% yoy over the same period.

- Thailand: CPI inflation slowed to 0.9% mom in June from 1.4% mom in May, 10bps above consensus, leading the yoy rate up 60bps to 7.7%, while the yoy rate of core CPI rose 20bps to 2.5%.

- Turkey: The rating agency Fitch downgraded Turkey’s sovereign credit rating to `B` from `B+` and kept the negative outlook. CPI inflation rose to 5.0% mom in June from 3.0% in May leading the yoy rate up 520bps to 78.6% as core CPI rose 130bps to 57.3% and PPI rose 620bps to 138.3% over the same period. The current account deficit widened to USD 6.5bn in May from USD 3.0bn in April, broadly in line with consensus.

- Uruguay: The central bank hiked its policy rate by 50bps to 9.75%, in line with consensus. The committee is concerned about rigid inflation expectations while expressing confidence the monetary policy transmission channels are operating satisfactorily.

Global backdrop

United States: The Citibank Economic Surprise Index improved further to -56.7 from -75.8 in the previous week, the first weekly improvement in almost three months, thanks to better-than-expected labour market data. Non-farm payrolls rose by 372k in June a very similar pace to the 384k jobs created in May and 100k above consensus. The unemployment rate and average hourly earnings were both unchanged at 3.6% and 0.3% mom respectively, bringing the yoy rate of weekly hourly earnings down 20bps to 5.1%. The strong labour market led to a sharp increase in US Treasury yields as markets brushed away inflationary fears. It is worth reminding participants that labour market is a lagging indicator, often subject to sizeable reviews in the months following its publication, and as such has not been the best economic indicator to predict strong slowdowns or recessions. Other economic data was also marginally strong as factory orders jumped 1.6% mom in May from 0.7% in April (revised from 0.3%) and durable goods orders rose 0.8% mom in May after 0.7% in April. Initial jobless claims rose marginally to 235k in the week ending on 2 July while continuing claims rose by 50k to 1,375k in the previous week, slightly more than consensus. In other news, the ratings agency Fitch revised the US `AAA` sovereign rating outlook to stable from negative citing the improved near-term government debt dynamics driven by the strong post-pandemic economic recovery and buoyant government revenues and a decline in the debt to GDP ratio to 113%.

Japan: In a tragic event, former Prime Minister Shinzo Abe was killed by a gunman while campaigning in the small city of Nara last Friday. The suspect of Abe’s assassination carried a hand-made gun and said he planned the attack due to a personal grudge. The murder cast a shadow on parliamentary elections yesterday as sympathy votes swung the balance of a few constituents towards the ruling Liberal Democratic Party, which alongside its junior coalition partner Komeito won 76 seats, from 69 seats before the election and above the 56 seats they needed for a majority. Current Prime Minister Fumio Kishida is willing to take advantage of the strong mandate and three years without national election to push his “New Capitalism” plan aimed at sharing the fruits of growth more widely. We believe the first step to achieve a broader redistribution of income would be to reverse the weak JPY policy promoted by the Bank of Japan via negative policy rates and yield curve control.

United Kingdom: Construction PMI dropped to 52.6 in June from 56.4 in April, significantly below consensus. Boris Johnson resigned as prime minister following severe pressure from the Conservative Party. The British economy is hit harder by higher energy and food prices and labour shortages as Brexit increased the price of imported goods and reduced the flow of people from the EU.

Europe: The Eurozone services PMI rose 0.2 points to 53.0, broadly in line with consensus.

Australia: The Reserve Bank of Australia (RBA) hiked its policy rate by 50bps to 1.35%, in line with consensus, and signalled further hikes ahead.

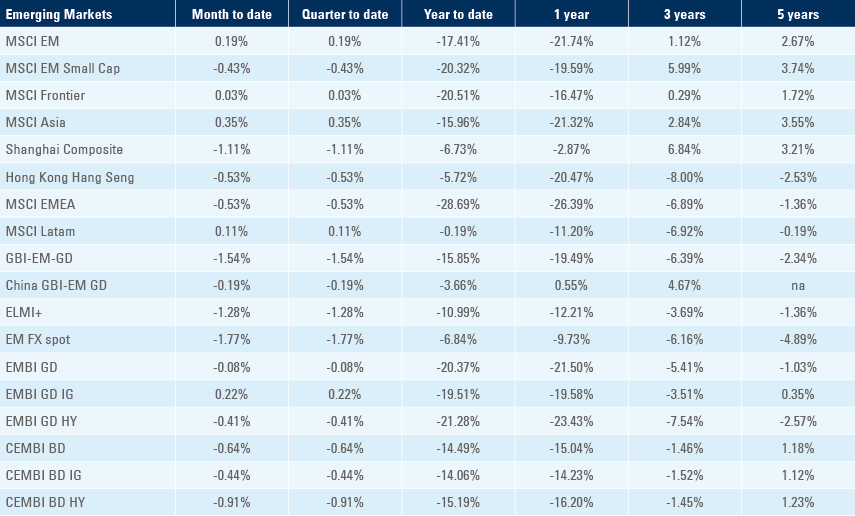

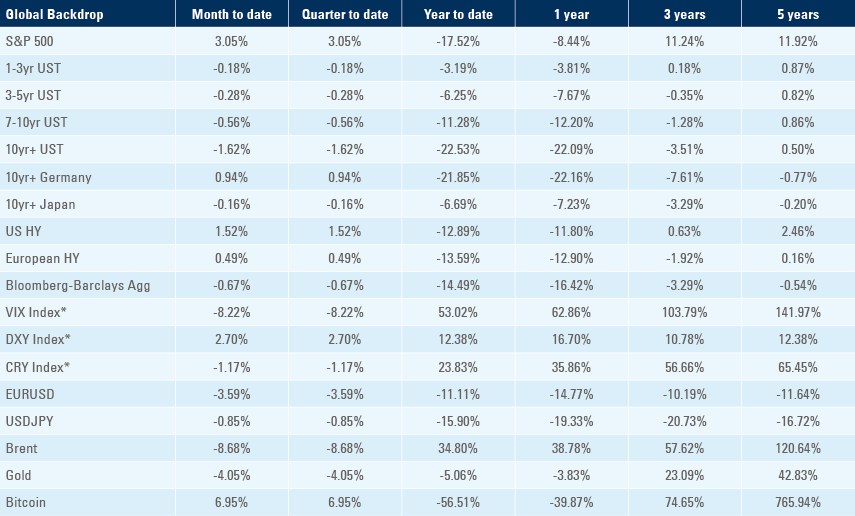

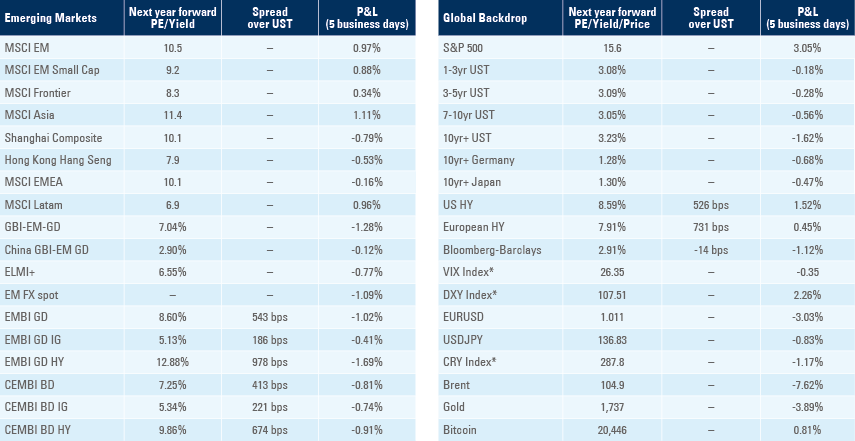

Benchmark performance