The situation on the ground in Ukraine continues to suggest a protracted war of attrition for longer as gas flows to Europe get disrupted. Gustavo Petro won the presidential race in Colombia but will have to govern with a minority in parliament. Covid-19 cases declined in China as the economy recovered further. Brazil hiked policy rate by 50bps to 13.25% and kept the door open for further rate increases. Argentina hiked rates by 300bps. Saudi Arabia hiked rates by 50bps, less than the Fed. Inflation surprised to the downside in India and Thailand extended price caps in essential goods. Suez Canal receipts increased in Egypt but the country struggles with higher wheat and energy prices. In global macro matters, in our view the Fed is on course for its second policy mistake in two years by targeting short-term inflation that is mostly dependent on the war in Ukraine and supply chain disruptions will keep inflation elevated over the next year.

Emerging markets

Russia-Ukraine: Recent developments on the ground continue to suggest a long and protracted war of attrition as Russia pushes to annex areas not previously occupied and outside Donbas, including Kherson and Zaporizhzhia in the south. Lithuania announced a blockade in the Russian exclave of Kaliningrad. Russia had sent LNG ship containers to the region in advance, preparing for such event, but it is not clear how much stock of food and energy the region has. A shortage of food could put Russia in collision with a member of the North Atlantic Treaty Organisation (NATO).

The NATO Chief Jens Stoltenberg said the Ukrainian war may last for years as a delivery of “modern weapons” from the West will enable Ukraine to drive Russian troops out of Donbas. Ukrainian President Volodymyr Zelensky claimed not to give up territory and said Ukraine would do all it could to ensure grain supplies. At least 80% of all Ukrainian grain exports are constrained by their inability to access seaports, either due to Russian control (Mariupol) or due to sea mines installed by the Russians in the Black Sea. The shortages of grain can be exacerbated by the shortage of fertilisers from Russia in large producers like Brazil, US, and India.

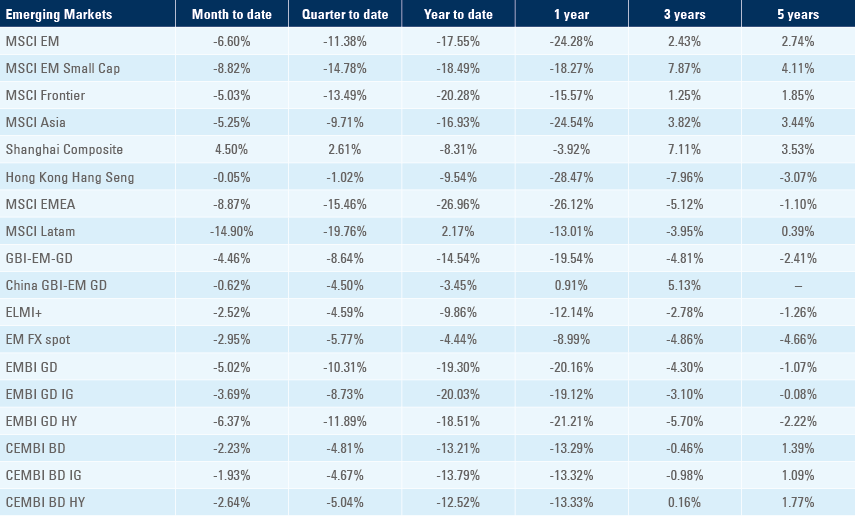

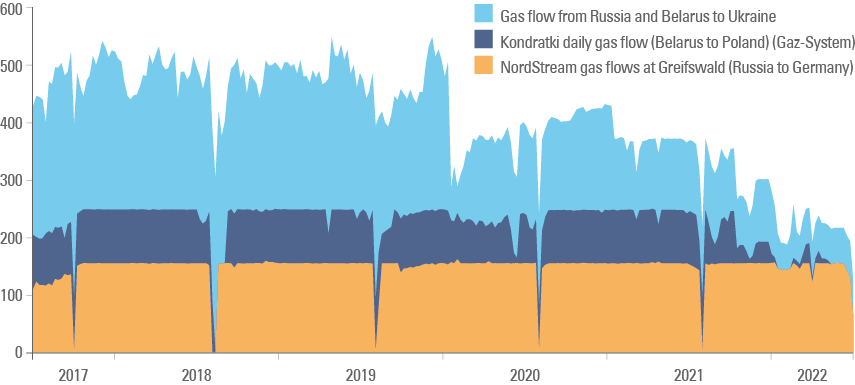

Last week the Italian Prime Minister, German Chancellor and French President visited Ukraine and pledged to accelerate the country’s accession to the European Union. Russia retaliated by lowering the volumes of natural gas by 59% in Gazprom`s Nordstream pipeline to 64 million cubic meters (mcm)/day from 156 mcm/day one month ago, as per Figure 1, with Gazprom alleging lower volumes are a result of repair works. The Yamal pipeline from Belarus to Poland was halted earlier as flows from the Brotherhood pipeline to Ukraine were significantly reduced, giving an increased importance to Nordstream flows. The lower volumes led to a sharp spike in natural gas prices in Europe, forcing Germany to announce emergency measures, including reverting to coal-fired power plants for manufacturing sector to save gas.

Figure 1: Gas flows from Russia to Europe (selected pipelines) in mcm/day

Colombia: Gustavo Petro won the run-off with 50.5% of votes against 47.3% for Rodolfo Hernandez and will take office on the 7th of August. Colombian local markets are closed today. Petro’s economic plans include halting new oil exploration, a pension reform and tax reform aiming to raise 5% of GDP mostly from the wealthy. However, most likely his economic policy will be moderated by the political reality that Petro’s alliance has only a minority position in Congress, in our view. Last week Petro announced his short list of possible finance ministers containing reputable names and includes former finance ministers with an orthodox track record.1 The finance minister will play a key role in adapting Petro’s populist reforms to reality and supporting the economy.

In other news, Fitch affirmed Colombia’s `BB+` sovereign rating with a stable outlook due to a sound economic track record, but below investment grade on elevated debt levels and fiscal deficits. Economic data remained significantly stronger than expected as the yoy rate of manufacturing production rose to 13.5% (10.3% consensus and 12.3% in March), retail sales surged to 23.3% yoy (19.1% consensus and 12.0% in March), and industrial production increased to 9.1% yoy (8.2% in March). The trade deficit narrowed to USD 485m in April from USD 1,520m in March, in line with consensus.

China: Economic data surprised to the upside. The yoy rate of industrial production rose 0.7% in May (consensus -0.9% yoy) from -2.9% yoy as retail sales dropped 6.7% yoy (consensus -7.1% yoy) from -11.1% yoy in April and fixed asset investment slowed to +6.2% yoy (consensus 6.0% yoy) from +6.8% yoy in April. The PBoC left the 1-year MLF rate at 2.85%, in line with expectations. In the housing market, the volume and value of new home sales improved marginally to -31.8% yoy and -37.7%, respectively, in May from -39.0% and -46.6% in April, due to some pent-up demand for homes. Land sales volumes improved to -43.1% yoy in May from -57.3% in April, while value growth deteriorated to -40.4% in May from -28.3% in April, as developers’ funding conditions remain challenging.

In other news, the Chairman of Power Construction Ding Yanzhang said China will start building c. 200 pumped hydro stations with a combined capacity of 270 gigawatts (GW) by 2025. If confirmed, this would be a significant increase from the 120GW target in the 14th Five Year Plan for energy development. In pandemic related news, covid-19 cases declined to 5 cases in Beijing and 19 cases in Shanghai over the weekend as several cities in the Jiangsu province eased restrictions for people traveling from Shanghai. The director of National Centre of Infectious Diseases Zhang Wenhong said only 0.065% of the c. 30k sampled hospitalized Covid patients in Shanghai developed severe illness in latest Omicron outbreak, and all of them were over 60 years old with underlying medical conditions or weakened immune systems.

Brazil: The Brazilian Central Bank (BCB) hiked its policy rate by 50bps to 13.25%, in line with consensus, an accumulated 1,125bps of hikes since Q1 2021. The BCB kept the door open for further rate hikes, albeit at lower magnitude, should inflation remain under pressure because of deteriorating external conditions and de-anchored inflation expectations. Last Friday Petrobras increased gasoline prices to BRL 4.06 per litre (from BRL 3.86) and diesel prices to BRL 5.61 (from BRL 4.91) and came under political pressure by the leader of the Congress, threatening to double tax on the company’s profits. In other news, the trade surplus declined to USD 4.9bn in May from USD 8.1bn in April, surpassing consensus as exports accelerated.

Argentina: The central bank hiked its policy rate by 300bps to 52%, equivalent to an effective annualised rate of 66.5% (from 61.8%), thus keeping the benchmark rate above the 60.7% yoy CPI inflation in May (from 58.0%) but remained below inflation expectations (68.1%) and the last 3m annualised inflation at 92.0%. The gap between the parallel and official ARS exchange rates widened to 100%, from 75% at the end of May, signalling market concerns about the government’s economic policies after the IMF staff did not require a profound recalibration of the country’s programme.

Saudi Arabia: The Saudi Arabia Monetary Authority (SAMA) hiked its policy rate by 50bps to 2.25%, 25bps less than the Federal Reserve. The Saudi Ryal is pegged to the US Dollar, which would suggest the central bank would just replicate the Federal Reserve`s policies, but Saudi cut policy rates only to 1.0% during the covid-19 crisis and doesn’t suffer with the same levels of inflation observed in the US as CPI inflation remains close to 2.0%.

India: The yoy rate of CPI inflation dropped to 7.0% in May from 7.8% in April, slightly below consensus while wholesale prices rose by 15.9% yoy in May, from 15.1% in April. The trade deficit widened to USD 24.3bn in May from USD 20.1bn in April as the yoy rate of export growth declined by 10.1% to 20.6% and imports surged 31.8% to 62.8% yoy. In other news, India's purchases of Russian coal spiked recently, as traders offer discounts of up to 30%.

Thailand: Price caps on dozens of essential goods, such as rice, sugar, medicines, fertilisers and healthcare services, were extended for another year. Prime Minister Prayuth Chan-Ocha seeks to raise THB 25.5bn via a profit-sharing deal with refiners and use the proceeds to keep fuel subsidies for another three months.

Egypt: Suez Canal receipts rose by a yoy rate of 22% to USD 654m in May due to higher fees and a 11.9% yoy increase in volumes, setting revenues to increase to USD 7.0bn in FY 2022 from USD 5.8bn in FY 2021.2 On the other hand, the finance minister said higher wheat and oil prices may cost Egypt over USD 10bn, which is likely to reduce the country’s primary surplus from 1.5% of GDP last year.

Nigeria: The yoy rate of CPI inflation rose 110bps to 17.7%, 20bps above consensus with both food and core components rising. There were reports of a further weakening of the currency in the parallel market to NGN 610 per USD, a 45% discount to the interbank exchange of NGN 420. Petrol prices remains highly subsidised in Nigeria averaging USD 0.42 per litre, but diesel prices were deregulated and trade slightly above the global average at USD 1.58 per litre.

Snippets

- Czech Republic: PPI inflation declined to 1.9% mom in May from 2.3% in April, taking the yoy rate up 130bps to 27.9%.

- Ecuador: The news agency AFP reported President Guillermo Lasso declared a state of emergency in three provinces in response to protests led by indigenous people. Protests are much smaller today than in 2019, but Lasso appears to be exacerbating the problem by taking a hard line against protesters such as arresting the indigenous leader Leonidas Iza two weeks ago.

- Hungary: The central bank hiked its 1-week policy rate by 50bps to 7.25% (consensus unchanged).

- Indonesia: The trade surplus was slightly below consensus at USD 2.9bn in May after a record USD 7.6bn surplus in April due to softer exports.

- Malaysia: The trade surplus narrowed to MYR 12.6bn in May from MYR 23.5bn in April, significantly below consensus as imports rose to a record high due to a pick-up in economic activity while exports rose at a slower pace due to lower demand from China and the US.

- Peru: The unemployment rate in Lima dropped 110bps to 7.2% in May as the yoy rate of economic activity was 10bps lower at 3.7% in April

- Poland: The current account deficit widened to EUR 3.9bn in April from USD 3.0bn in March despite the trade deficit narrowing to EUR 2.5bn from EUR 3.2bn over the same period. Core CPI inflation rose.

- Philippines: Overseas remittances slowed to USD 2.4bn in April from USD 2.6bn in March.

- Romania: Industrial output dropped 0.7% mom in April after declining 0.9% in March, bringing the yoy rate to -6.9% from -4.1% over the same period as industrial sales slowed to a yoy rate of 20.0% in April from 28.9% yoy in March.

- Russia: The yoy rate of real GDP growth was unchanged at 3.5% in Q1 2022.

- South Africa: Retail sales declined 0.2% mom in April after rising 0.8% mom (revised from -0.3%) in March, lifting the yoy rate growth to 3.4% from 1.7% over the same period.

- South Korea: The seasonally adjusted rate of unemployment rose 10bps to 2.8% in May.

- Sri Lanka: An IMF team will visit Sri Lanka on 20-30 June to discuss an economic programme. The IMF reaffirmed its commitment to support the island nation in line with its policies.

- Taiwan: The central bank increased its policy rate by 12.5bps to 1.5%, a smaller increase than 25bps consensus.

- Turkey: The current account deficit narrowed to USD 2.7bn in April from USD 5.8bn in March, significantly below consensus.

- Uruguay: Real GDP growth rose by 2.6% qoq in Q1 2022 after surging 8.3% yoy in Q4 2021 taking the yoy rate to 8.3% from 5.9% over the same period.

Global backdrop

United States: The Fed hiked the policy rate by 75bps to 1.75%, 25bps above consensus and in line with that suggested one day before the decision by a columnist in the Wall Street Journal. The journalist flipping his view in a matter of days suggested the decision was “leaked” to the press, so market participants priced the decision before the announcement. The hawkish shift came only three months after the FOMC was still actively purchasing bonds and mortgage-backed securities and guiding the market to an orderly hiking cycle, which does not help to lift the Fed’s credibility, in our view, as all the factors justifying last week’s decision were already present last quarter. Furthermore, the unemployment rate in the Fed’s projections remains too rosy and inconsistent with the current hiking pace and the severe tightening of financial conditions to the economy.

In the press conference following the meeting, Chairman Jerome Powell said, “interest rates, yield curve shape, credit spreads and equities are going to tell us how restrictive we are and how successful we are likely to be in slowing inflation down’’ and pledged to keep positive real rates across the entire curve to make the FOMC comfortable inflation will be slowing down. This is a problem because over the very short term, inflation is mostly dependent on energy and food shocks caused by the Ukrainian war. Considering the Fed’s decisions today affect inflation only after a 6 to 18 months lag, the Fed has already achieved the objective stated by Powell as the 1-year forward 1-year real interest rate is already at +1.0%, from -2.0% in December 2021 (and was positive before the decision). Tying short term real rates to a positive level means hiking policy rates all the way to the level of current inflation, something that would imply massive shock to the US and global financial systems and ultimately unachievable considering current debt levels, in our view.

All considered, the Fed set itself on course for the second policy mistake in two years, hiking aggressively into a weakening economy, in our view. The New York Fed model sees “the chances of a hard landing…as occurred during the 1990 recession are about 80%” while the probability of a “soft landing” in which gross domestic product remains positive over the next 10 quarters, is only 10%. Treasury Secretary Janet Yellen said the economy was likely to slow down and that inflation would remain elevated during the remainder of 2022 after admitting she was wrong in her 2021 prognostic that inflation was likely to be transitory.

Apropos, economic data weakened further as the Citibank Surprise Index dropped to -65.0 from -50.3, the 9th consecutive weekly decline. The diffusion index of future new orders from the Philadelphia Fed survey dropped to negative levels for the first time since 2008. PPI inflation rose 0.8% mom in May from 0.4% mom in April and the yoy rate declined 10bps to 10.8%. Retail sales declined 0.3% mom in May after rising 0.7% mom in April (revised down from 0.9%) while industrial production slowed to 0.2% mom in May from 1.4% mom in April (revised from 1.1% mom). Housing starts dropped to 1.55m in May from 1.81m in April (revised from 1.72m). The Empire Manufacturing survey improved to -1.2 in June from -11.6 in May, remaining at negative territory.

Switzerland: The Swiss National Bank (SNB) hiked its policy rate by 50bps to -0.25% and pledged to guide the CHF stronger if necessary.

Europe: The Governing Council (GC) of the European Central Bank (ECB) held an emergency meeting to address market fragmentation concerns. Executive Board member Isabel Schnabel said the ECB will not tolerate changes in financing conditions above fundamentals and that threaten monetary policy transmission, adding that “monetary policy can and should respond to a disorderly repricing of risk premia that impairs transmission”.

In political news, Emmanuel Macron’s alliance of parties lost around 30% of its seats (245 seats down from 350 in June 2017) and no longer has the majority in the 577-seat parliament, challenging the implementation of the President’s economic agenda. The left NUPES coalition led by Jean-Luc Melenchon received 131 votes, Marine Le Pen’s RN 89 (up from 8 seats in 2017) and the centre right LR and allies won 74 seats (down from 136 in 2017) with 38 seats allocated to smaller and regional parties. It is the first time in 30 years that the president will not have a majority in parliament. The French president appoints the head of the government, but the Prime Minister and his cabinet needs parliament backing. Parliament also approves most domestic affairs, including taxes, spending and regulations. The NUPES leaders said they would submit a no-confidence vote when the parliament reopens in two weeks, but the centre-right said it would not vote to oust the government. In Spain the opposition Popular Party took more than half the seats in Andalusia’s regional parliament, allowing it to govern the region without a coalition and challenging Prime Minister Pedro Sanchez’s re-election next year.

In economic news, the trade deficit widened to EUR 32.4bn in April from EUR 16.4bn in March on the back of higher energy prices and supply chain disruptions, the worse monthly deficit level in 20 years.

United Kingdom: The Bank of England hiked policy rate by 25bps to 1.25%, but three out of nine directors voted for a 50bps hike, signalling an increased pace of hikes over the next meetings. The unemployment rate rose 10bps to 3.8% in April and the yoy rate of weekly earnings declined 20bps to 6.8%

Japan: The Bank of Japan kept all policies unchanged, including the 0.25% yield cap on 10-year bonds.

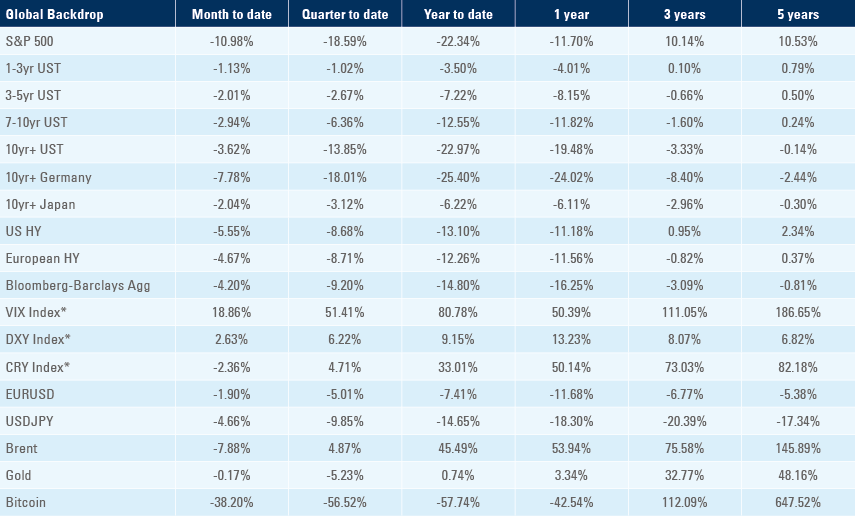

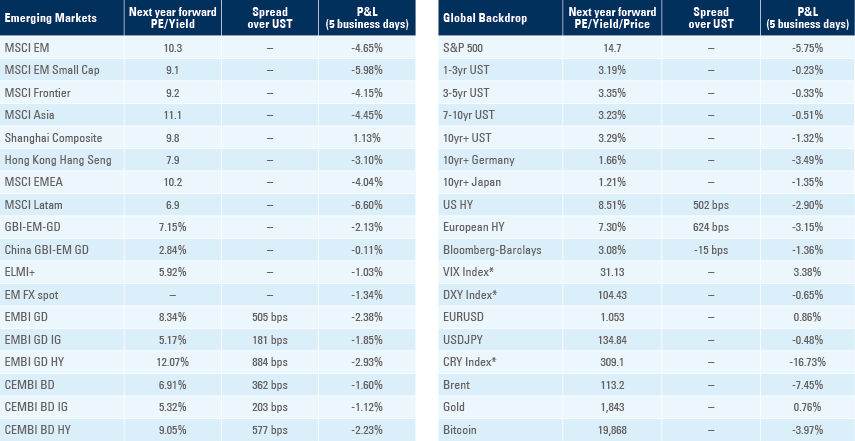

Benchmark performance