A combination of events saw yields drop from elevated levels as stock prices benefited from lower real interest rates. South Korea’s short selling ban led stocks higher but will delay any upgrade to Developed Market (DM) status to 2025. Thailand’s external accounts improved more than expected. Brazil stayed the course and cut another 50bps and Colombia kept rates unchanged. Chile copper production increased. Costa Rica’s debt rating was upgraded to ‘BB-’. Ghana’s local currency rating was lifted to ‘CCC’ from ‘restricted default’ after a successful local government debt swap.

Global Macro

There were five key events last week driving government bond yields lower and asset prices higher. The Bank of Japan announced an end of its yield curve control (YCC) policy but said it would keep intervening in the bond market. The smooth YCC exit was followed by lower-than-expected inflation data from Europe and a more benign US Treasury refunding calendar on Wednesday. The size of US Treasury auctions will keep increasing, but longer-dated bonds issuance will rise at a more moderated pace. On Thursday, the Federal Open Markets Committee (FOMC) kept the Federal Reserve (Fed) policy rate unchanged and Chair Jerome Powell’s press conference suggested the bar for another hike is elevated. Finally, the US labour market data has softened considerably last Thursday and Friday. This morning, South Korea announced a ban on short selling until June 2024.

The positive news flow came at a time when both bonds and stocks were operating at oversold territory and the market is aware of the favourable seasonal period (November and December tends to be positive for stocks). Also, fiscal policies moved expansionist while liquidity increased due to technical reasons. In terms of fiscal announcements, Japan announced large subsidies to keep inflation low, China announced a RMB 1trn stimulus for environmental purposes and the US bundled the Ukraine assistance with more aid for Israel. On the liquidity side, the Treasury General Account was drawn by USD 100bn to USD 750bn, and reverse repo declined by USD 50bn to USD 1,090trn for the week ending 1 November.

On a forward-looking basis, the continuation of the move lower in yields will depend on fundamentals. The US will have to issue a much larger amount of bonds while the Fed quantitative tightening programme remains in place. For demand for bonds to increase at a lower level of yields, the fundamental macro backdrop needs to deteriorate, in our view. In other words, an economic slowdown would allow for lower interest rates. If the economy remains heated despite the known monetary policy lags (due to fiscal expansion, for example), the additional demand for bonds would likely take place at higher levels of yields.

Energy transition

As the world seeks to scale up its renewable energy capacity in line with net zero by 2050 targets, wind-powered generation, a critical enabler for this transition, has been stagnating over the past year. The difficulties facing wind power projects, including rising borrowing costs, supply chain inflation, and higher materials costs, have not been unique to the sector. However, it has resulted in more developers backtracking on power-sales or subsidy agreements on projects across the US and the UK. In the US, Østed announced large write-downs across projects and halted plans to continue the development of its Ocean Wind I and II projects in southern New Jersey, while in the UK, Swedish multinational Vatterndall cancelled projects under the Norfolk Borea scheme, saying the project was no longer viable given the price per megawatt agreed in June 2022.1 S&P placed Østed on negative credit watch on Thursday given the severity of the reported losses on its US offshore projects. Increased investment in the supply chain is likely to bring down costs in the medium to long term, but short-term pressures are deterring accelerated investment in the sector. This is taking place in the context of geopolitical uncertainties driving up the price of oil and valuations on oil majors at attractive levels.2

Emerging Markets

EM Asia

China: Both Caixin and the official manufacturing Purchasing Managers’ Indices (PMIs) contracted to 49.5 in October, about one point below consensus and prior. The decline was largely driven by the slower manufacturing activity combined with continued export weakness. The non-manufacturing official PMI declined by one point to 50.6 in September, significantly lower than consensus for an increase to 52.0, while the Caixin services PMI rose 0.2 to 50.4 in October, also below expectations of an advance to 51.0.

India: Services PMI contracted to 58.4 in October from 61.0 in September.

Indonesia: Manufacturing PMI decreased to 51.5 in October, from 52.3 in September. Consumer Price Index (CPI) inflation increased yoy in October by 2.6%, up from 2.3% yoy growth in September, slightly lower than expectations of 2.6% yoy growth.

Malaysia: The Bank Negara Malaysia kept its policy rate unchanged at 3.0%, in line with expectations. This diverged from the recent move by its regional peers, Indonesia, and the Philippines, which both hiked policy rates to shore up their respective currencies.

South Korea: The Financial Services Commission announced short-selling of stocks listed on the Kospi 200 Index and Kosdaq 150 will be banned, effective Monday 6 November until June 2024. The enforcement represents a reversal from the 2021 ruling where Korea began allowing short selling of stocks on the two indexes. The announcement came after retail investors’ positions in energy transition assets were suffering from targeted short-selling activities. The regulator claimed the move was designed to protect retail investors and said it needed to improve the systems to prepare regulators to handle these operations. South Korea is currently under reviews by MSCI to a potential upgrade itself to DM status from its current Emerging Market (EM) classification. The upgrade to DM status was reviewed but not approved by MSCI in June 2023, despite the implementation of numerous reforms aimed at increasing the accessibility of the equity market. We believe, the short selling ban confirms the market consensus that a potential upgrade to DM status is unlikely before 2025 as one of the criteria for inclusion is allowing short sales.

In economic news, retail sales rose by 9.5% yoy in September, up from 3.3% yoy in August. Industrial production grew 3.0% yoy in September, up from a revised 0.74% decline yoy in August, ahead of expectations of a further decline by 0.8% yoy.

Taiwan: Real GDP growth increased by 2.3% yoy in Q3 2023 from 1.4% yoy in Q2 2023, ahead of consensus at 2.0% yoy.

Thailand: The current account surplus improved to USD 3.4bn in September, from USD 0.4bn in August, more than consensus at USD 2.1bn. The trade surplus rose to USD 3.8bn from USD 1.2bn as exports rose by 1.0% yoy in September after -1.8% yoy in August and imports declined by 7.9% in September, up from -11.9% yoy in August. The yoy CPI inflation rate declined by 60bps to -0.3% (deflation) in October, below the median consensus of +0.1% yoy.

Latin America

Brazil: The Central Bank cut the Selic rate by 50bps to 12.25%, in line with consensus, and kept the forward guidance for another 50bp cut to the policy rate at the next meeting in December. Producer Price Index (PPI inflation rose by 0.5% mom in October, from 0.4% in September, but slightly below consensus, as the yoy rate of deflation rose to -4.6% over the same period. The unemployment rate was largely unchanged in September at 7.7%, in line with consensus. Industrial production rose by a yoy rate of 0.6% in September, in line with consensus, up from 0.5% yoy growth in August. Manufacturing PMI declined 0.5 point to 48.6 in October. The trade surplus increased to USD 9.0bn in October from USD 8.9bn in September.

Chile: Copper production increased in September with output up 4.1% yoy; down from the 5.3% yoy growth observed in August. Chile accounts for over 25% of global production, thus, the indication of a recovery in production takes place against a global market hit by mine setbacks (i.e., Panama last week) and dependent on low-quality ore. Other economic data was also better than consensus: Manufacturing production dropped by 1.1% yoy in September, from +0.5% yoy in August, ahead of expectations of a decline by 3.8% yoy. Industrial production increased by 1.5% yoy in September, up from 0.3% in August. The rate of decline in retail sales slowed yoy to 5.4% in September, above the 9.1% yoy decline observed in August, and the unemployment rate was unchanged at 8.9% in September. Economic activity rose by 0.6% mom in September, after declining 0.9% mom in August.

Colombia: The policy rate remained unchanged at 13.25% for a fourth consecutive meeting in line with expectations, but two policymakers advocated for a 25bp cut with five policymakers voting to leave it unchanged. Headline and core inflation continue to trend downwards, although both remain above target.

Cost Rica: Ratings agency S&P upgraded Costa Rica’s external debt to ‘BB-’ from ‘B+’, with a stable outlook due to the improvement in the country’s external debt balance and the favourable growth outlook from export conditions and nearshoring trends. A further vote of confidence was the approval of the fourth review of its Extended Fund Facility (EFF) which, pending board approval, would make available another USD 271m disbursement for the country.3

Mexico: GDP grew by 3.3% yoy in Q3 2023, 10bps above consensus, and lower than 3.6% in Q2 2023. Remittances rose by 11.4% yoy in September reaching USD 5.6bn.

Peru: CPI inflation increased by 4.3% yoy in October, down from the 5.0% yoy increase in September.

Venezuela: The Supreme Court ruled that all effects of the opposition party primary to select their presidential candidate for 2024 elections would be “suspended”. The Court required ballot organisers to give access to the vote documentation for further investigation. The inquiry comes after October’s primary elections, where candidate Maria Corina Machado took 93% of the vote in the polls. The vote was held without state support drawing 2.4 million people to vote. Under current conditions, Machado is disqualified from holding office for 15 years. The inquiry into her victory is the first test to the agreement for the relaxation of US sanctions on energy and metal industries in exchange for holding free and fair elections. Nevertheless, it seems unlikely to us that sanctions on secondary bond trading will be re-imposed, as OFAC (Office of Foreign Assets Controls) admitted it harmed US investors and did little to Maduro’s government.

Central and Eastern Europe

Czechia: The Central Bank left the policy rate unchanged at 7% at the November meeting while 11 out of 21 analysts surveyed had expected a 25bps cut. In economic news, real GDP declined by 0.6% yoy in Q3 2023, unchanged from Q2 2023, below -0.3% yoy consensus. The manufacturing PMI increased marginally to 42.0 in September, up from 41.7 in August, below expectations of a rise to 42.4.

Hungary: PPI inflation declined yoy by 2.5% in September from -2.3% yoy in August. The manufacturing PMI improved to 50.5 in October, up from 47.4 in September, no change expected.

Poland: CPI inflation in October rose by 6.5% yoy, broadly in line with consensus, down from 8.2% yoy in September. Manufacturing PMI rose to 44.5 in August from 43.9 in September, broadly in line with consensus.

Romania: PPI inflation rose by 2.0% mom in September after dropping 0.7% mom in August. The unemployment rate remained unchanged in October at 5.4%.

Russia: Services PMI contracted from 55.4 in September to 53.6 in October.

Türkiye: The trade deficit narrowed to USD 5.0bn in September, from USD 8.7bn in the previous month, in line with consensus. The yoy rate of CPI inflation declined by 10bps to 61.4% yoy in October. In sequential terms, CPI rose 3.4% mom in October; from 4.8% mom in September. PPI grew by 39.4% yoy in October, down from 47.4% yoy growth in September.

Central Asia, Middle East, and Africa

Ghana: Ratings agency Fitch raised the country’s long-term local currency debt rating to ‘CCC’ from ‘Restricted Default’. The upgrade comes in response to the successful local government debt exchange programme, translating into substantial debt service reduction of GHS 52bn from local currency exchanges, and an additional GHS 5bn from the domestic USD exchange.

Saudi Arabia: The yoy rate of real GDP growth declined by 4.5% in Q3 2023 from 1.3% yoy in Q2 2023. The manufacturing PMI rose to 58.4 in October, up from 57.2 in September.

South Africa: The budget deficit narrowed to ZAR -14.6bn in September from ZAR -47.3 bn in August. The trade surplus rose to ZAR 13.1 bn in September (consensus ZAR 8.0bn), from ZAR 12.6 bn in August. The Absa manufacturing PMI decreased to 45.4 in October, from 46.2 in September and consensus at 47.3. Electricity consumption declined by 1.0% yoy in September, up from -6.4% yoy in August.

Developed Markets

United States: The Fed kept its policy rate unchanged at the 5.25%-5.50% level. Economic activity surprised to the downside. The Dallas Fed. Manufacturing activity declined by 5.7% yoy in September, from 2.0% in August. The house price index rose by 0.6% mom in August, from 0.8% mom in July. The Institute for Supply Management (ISM) manufacturing PMI contracted at the fastest monthly pace in over a year to 46.7 in October, below consensus expecting no change from September at 49.0. The ISM services PMI declined by two points in October to 51.8; estimated 53.0. Factory new orders came in stronger than expected, growing at 2.8% yoy in September, up from 1% yoy growth observed in August, ahead of expectations of a 2.3% yoy growth. The labour market softened as initial jobless claims rose by 5k to 217k in the week ending 4 November as continuing claims rose by 35k to 1818k in the prior week. Non-farm payrolls increased by 150k in October, down from 336k in September, and below consensus expectations of 180k. The unemployment rate increased 10bps to 3.9% in October, expectations were for it to remain unchanged at 3.8%.

Sweden: Bankruptcies have increased to the highest level since 1999 as 795 companies went bankrupt in October 2023, 18% higher than October 2022, and 77% higher than October 2021. Sweden has one of the highest private sectors to GDP ratio across large economies. The lower purchasing power due to higher inflation and the lower sentiment from lower house prices led to a sharp decline in retail sales, creating a vicious cycle for highly indebted companies.

United Kingdom: The Bank of England held interest rates at 5.25%, in line with expectations. The minutes from the meeting indicated a split within the Monetary Policy Committee (MPC) with three members advocating for a further 25bp hike and the remaining six in favour of maintaining interest rates at this level.

Eurozone: In data, CPI inflation slowed by 140bps to 2.9% yoy growth in October, the slowest pace of increase since July 2021, and 20bps below consensus. Consumer confidence and economic confidence both remained unchanged in October. The unemployment rate in September remained broadly unchanged at 6.5%, in line with expectations.

Japan: The unemployment rate declined by 10bps to 2.6% in September. The Bank of Japan revised its Q4 2023 GDP growth forecast upwards to 2.0% from 1.3% and their current Q4 2023 CPI inflation forecast to 2.8% from 2.5%.

1. See – https://www.ft.com/content/f9d0f4f9-6d95-44a9-924b-d88627fd6485

2. See - https://www.ashmoregroup.com/insights/china-announced-fiscal-expansion-it-seeks-control-and-re-balance-local-government-debts

3. See – https://www.imf.org/en/News/Articles/2023/06/26/pr23240-imf-concludes-fourth-review-of-costa-rica-eff-and-the-first-review-rsf

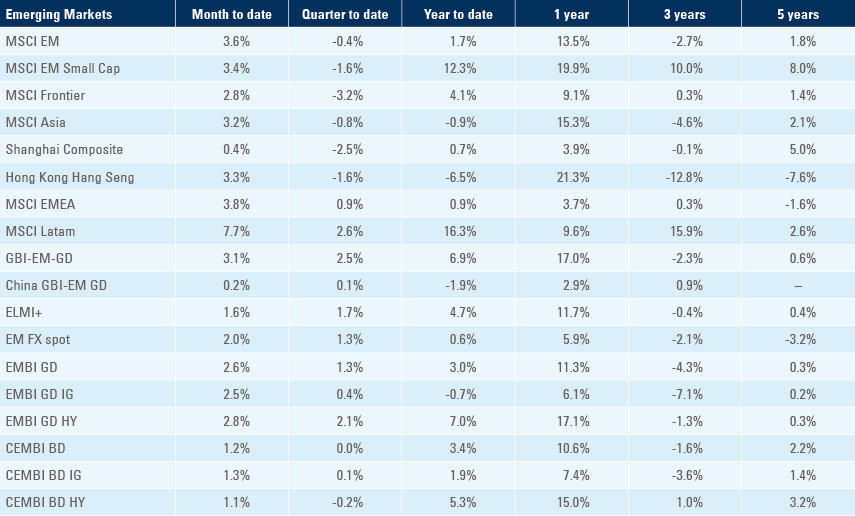

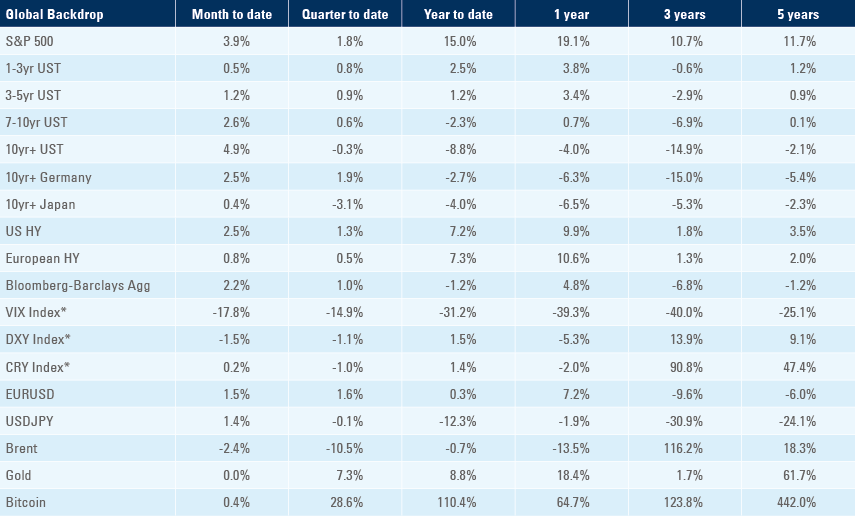

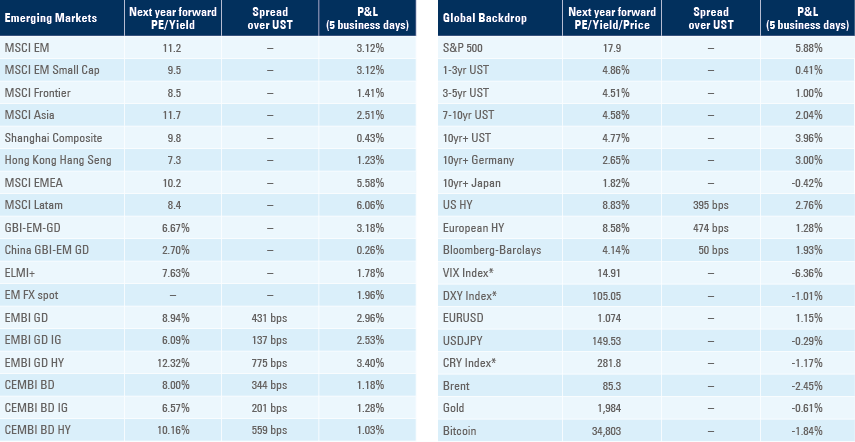

Benchmark performance