- US reciprocal tariff week: Announcements expected 2 April.

- Trump voiced frustration over Russia/Ukraine ceasefire talks.

- Japan resumed talks on deepening trade relations with South Korea and China.

- China’s fertility rate continues to decline, but not because couples are having fewer children.

- IMF’s USD 20bn Argentina package to help power disinflation.

- Brazil’s Jair Bolsonaro to stand trial for alleged coup attempt.

- Colombia’s incoming Finance Minister called for "much more aggressive" monetary easing.

- Ghana’s public debt dropped to 61.8% of GDP in December 2024

- South Africa’s Democratic Alliance leader Steenhuisen said a budget agreement is close

- Massive rally held in Istanbul as crowds demanded the release of Erdoğan’s rival Ekrem Imamoğlu.

- Marine Le Pen found guilty of embezzling European Parliament funds.

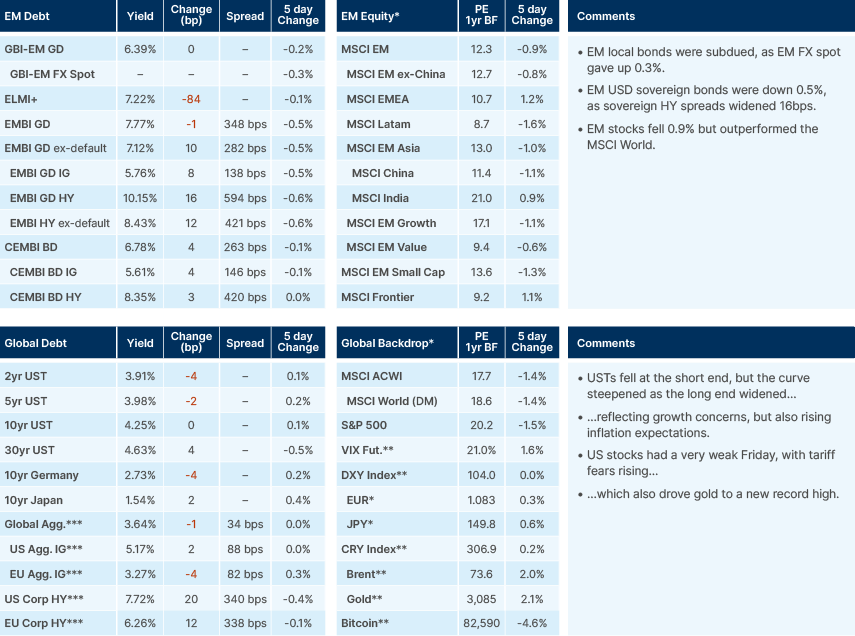

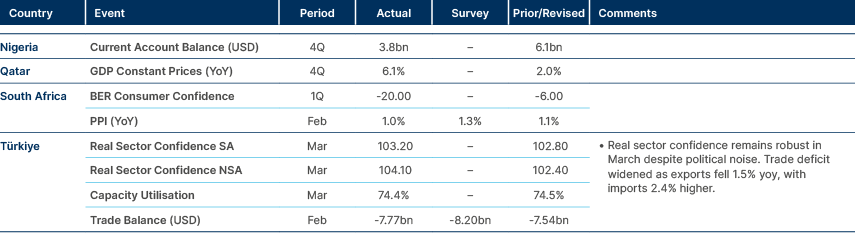

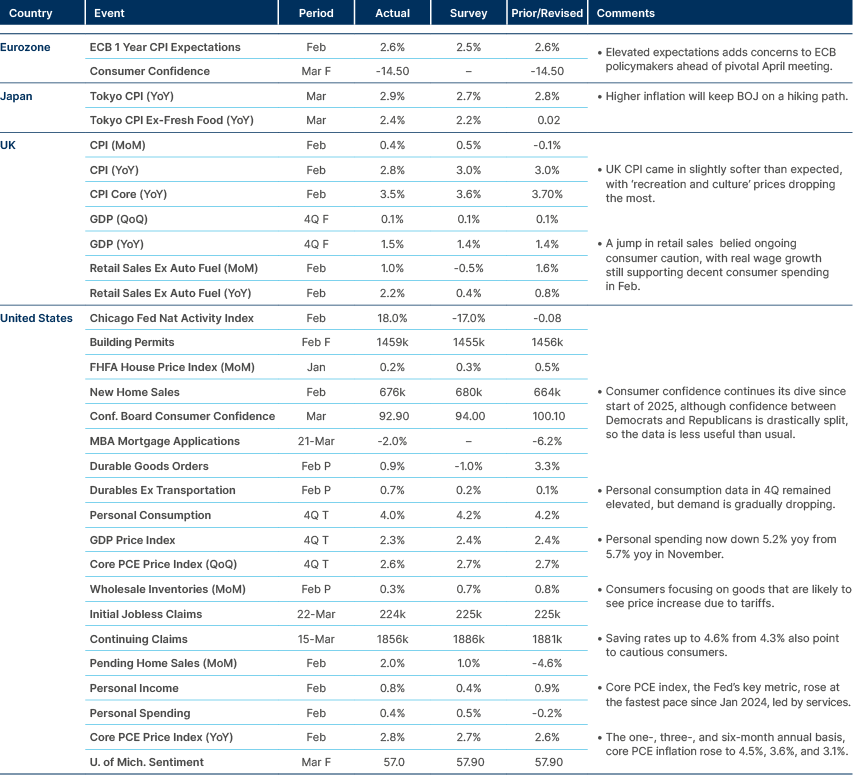

Last week performance and comments

Global Macro

This Wednesday (2 April), US President Donald Trump will announce his reciprocal tariff salvo. He said he would have done it on 1 April, but that is April Fool’s Day and he wants to avoid any confusion over his seriousness.

The average tariff rate today in the US is 6.6%, up from 2.4% last year and 1.4% in 2017. The jump reflects additional 20% tariffs on China, 25% tariffs on imports from Mexico and Canada that are non-compliant with USMCA1 minimum content rules, and a 25% tariff on steel and aluminium. If all his threatened tariffs are implemented, including a 25% blanket tariff on the European Union (EU), 25% tariffs on pharma and semiconductors and a comprehensive 25% auto tariff, the average US tariff rate would rise to around 14%. This should have an estimated impact on US gross domestic product (GDP) of -2.0% and the core personal consumption expenditures (PCE) index of +1.2%, according to Bloomberg.

If Trump announces these measures on Wednesday, stocks will fall further. The dollar would probably strengthen, unless most trading partners retaliate against the US, which would make the USD impact much more ambiguous. However, we think it is unlikely all measures stick.

USMCA partners are unlikely to face 25% auto tariffs, due to the incredibly disruptive effect this would have on US automakers. We also do not think that the US will stick with a 25% tariff on EU imports, as this would go beyond the ‘reciprocal’ difference in tax structures and would have a significant effect on US growth (c. -0.7%) and prices (c +0.4%). More likely, in our view, is a more moderate EU tariff that will bring the average tariff rate to around 12%. This would be a significant revenue raiser, raising between USD 200bn and USD 300bn a year, depending on substitution impact. It would also have a likely 1% one-off impact on growth (lower) and inflation (higher). Unpleasant, but not unbearable.

Tariff policy will determine whether the correction in US stocks we have seen so far this year will extend into a larger sell-off. Valuations and earnings estimates are still elevated given the current macro environment, and earnings expansion has been driven by the Tax Cuts and Jobs Act fiscal expansion. A renewal of these tax policies is not an additional tax cut, and tariffs are a significant tax hike. Tighter tax policy, alongside the end of US big government, the start of EU fiscal stimulus, Japan hiking rates and China’s stated aim to boost domestic demand, are five vectors pointing asset allocation away from the US. That’s why, in our view, the Q2 2025 tariff noise is a great opportunity for asset allocators and long-term investors. They all point to a weaker dollar, which always boosts EM assets.

Geopolitics

Trump threatened secondary tariffs on Russian oil exports. "I was very angry, when Putin got into Zelensky's credibility and started talking about new leadership in Ukraine," Trump told NBC's Welker in a telephone call. "If Russia and I are unable to make a deal on stopping the bloodshed in Ukraine, and if I think it was Russia's fault — which it might not be — but if I think it was Russia's fault, I am going to put secondary tariffs on oil, on all oil coming out of Russia."

Trump’s more confrontational stance to Russia does not mean Ukraine is off the hook. Ukrainian media reported the US minerals agreement draft suggests Ukraine should repay all received US aid. Volodymyr Zelensky said Ukraine will not accept a deal with the US that would jeopardise its EU accession. Zelensky also firmly rejected the classification of military aid as loans. Trump reacted by saying: “I see he (Zelensky) is trying to back out of the rare earth deal. And if he does that, he’s got some problems. Big, big problems”. French President Emmanuel Macron announced EUR 2bn of assistance to Ukraine, including air defence and anti-tank missiles. Macron reaffirmed support for Ukraine, insisting any peace deal must be solid, lasting, and backed by robust security guarantees. Macron also stressed European self-reliance and unveiled plans to significantly ramp up French defence spending and to accelerate reindustrialisation, without increasing taxes.

In the meantime, The Economist reported preparations are underway in Ukraine for the nomination of Zelensky for a second presidential term. Russia has been insisting elections in Ukraine are a pre-condition for a longer ceasefire, maybe due to hopes that Zelensky would be voted out, or due to the fact it could disrupt the process and break Ukraine’s unity due to its control of the Donetsk territories. Grigory Karasin, a member of the Russian delegation at the talks with the Americans, claims that a ceasefire will be possible only next year, a timeline that would allow for elections to take place.

In the Middle East, Iran rejected direct negotiations with the US administration. President Masoud Pezeshkian said: “They must prove that they can build trust regarding their decisions, and I hope this will happen. It’s the behaviour of the Americans that determines the future path of negotiations.” Trump threatened to “bomb Iran” if they wouldn’t come to the table.

In Asia, US Secretary of Defense Peter Hegseth said the US will upgrade Japan’s operations to a War-Fighting Command. This means more US ‘boots on the ground’ and will involve working closely with a newly-created Japanese military command with the objective to direct any initial US military response to a crisis in the region. The US and Japan will deepen their defence coordination, with Japan increasing its defence spending and the US committing to remain engaged in the region.

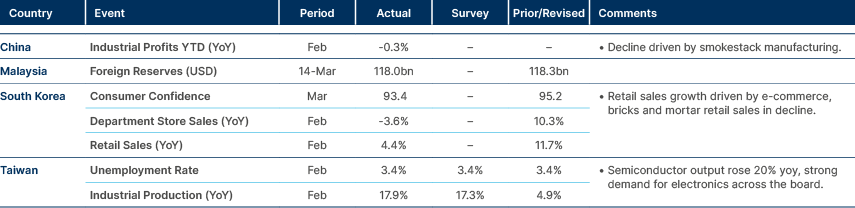

Despite the closer military alliance, Japan announced it has resumed talks on deepening trade relations with South Korea and China. That these countries are overlooking their deep historical scars in the name of free trade shows how focused the rest of the world is on opening to more trade as the US closes itself to the rest of the world.

Emerging Markets

Asia

China: China’s fertility rate is declining, but not because couples are having fewer children. Gavekal Research 2 found that the fall in China’s total fertility rate from 2.25 in 1990 to 1.3 in 2020 was driven primarily (90%) by delayed marriage, and secondarily by women staying in school for longer (22%). The marital fertility rate, or the number of births per married woman, rose over this period, offsetting some (12%) of the decline due to those other factors. Gavekal’s calculation indicates that the relaxation of tough official family-planning policies did indeed encourage families to have more children—just not enough to offset the effects of marriage being delayed for educational and other reasons.

China’s Premier Xi Jinping has encouraged global business leaders to push back against protectionism and promoted China as a reliable partner. Unlike in 2024, Xi invited reporters into the room when he gave a closing statement. Seven executives spoke in the meeting, including Aramco’s Amin H. Nasser, who pledged to expand investment in chemical production in China and praised the country for “becoming an oasis of certainty.” Executives of FedEx, Mercedes, Sanofi, HSBC, Hitachi, and SK Hynix were also present.

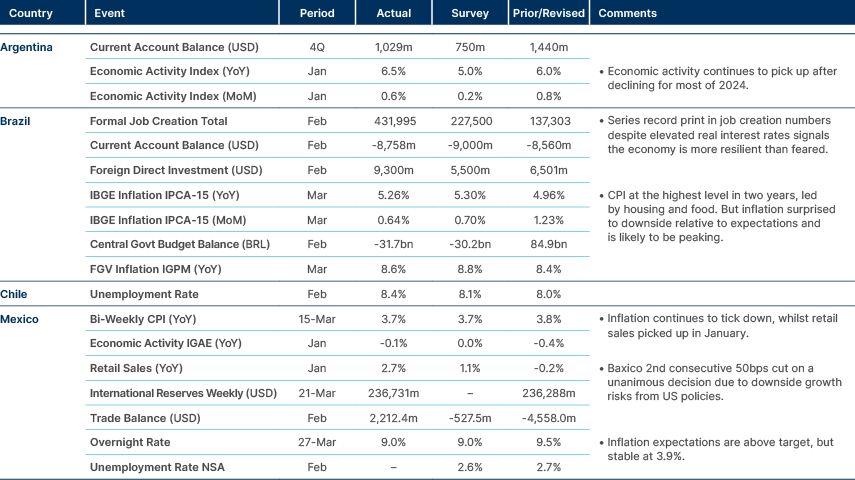

Latin America

Argentina: Federico Furiase, board member of Argentina’s central bank (BCRA) said analysis on the impact of the new USD 20bn International Monetary Fund (IMF) programme should focus on the central bank getting a capitalisation of the same amount and should not be netting out future IMF payments, according to comments made in an interview with the TV channel A24. The size of the programme was announced by Finance Minister Luis Caputo, but not yet confirmed by the IMF.

Furiase, who is part of Caputo's inner circle, said what really matters here is there will be a new USD 20bn coming into the BCRA's reserves, which will significantly strengthen the central bank's balance sheet. Furiase gave assurances this will power the disinflation process, help keep foreign exchange (FX) markets steady, and lead to further decline in country risk.

Brazil: The unemployment rate rose to 6.8%, as expected, but record high payrolls and real wage growth suggest economic activity remains more resilient than feared. The average real monthly wage rose by 8.6% yoy to BRL 3.4k in February, matching the growth pace in January and extending its near three-year streak of rises. This is the highest recorded average wage since the data series began in 2012, attributed to a decline in the informal job totals and an increase in formal employment.

In political news, the First Group of the Supreme Federal Court (STF), comprising five of the court's 11 justices, unanimously approved a criminal case against former President Jair Bolsonaro for an attempted coup. Bolsonaro and seven others are accused of an alleged coup attempt in the invasion of the Brazilian Congress on 8 January 2022, following President Luiz Inácio Lula da Silva's election victory.

The STF is working to conclude the case this year to avoid ruling close to the 2026 elections, but this remains uncertain due to potential appeals and legal delays available to the defence. Regardless of the trial's outcome, Bolsonaro remains ineligible to run for office until 2030. The criminal proceedings will now move forward with phases including evidence collection, witness testimony, interrogations, and final arguments before the final ruling.

Colombia: Incoming Finance Minister Germán Ávila called for "much more aggressive" monetary easing, saying recent interest rate decisions have been "too moderate". Ávila expects a "much more significant interest rate reduction" and will attend his first central bank policy meeting on 31 March.

The risks for policy interference are increasing, as the board is currently divided between three hawkish members and three very dovish ones (Avila alongside two new appointees). The ‘kingmaker’ is Olga Lućia Acosta, who has been dovish, but keeping an economically sound reasoning, suggesting policy remains independent.

Colombia's fiscal deficit widened to 6.8% of GDP last year, the highest since the pandemic. The new Finance Minister was appointed after his predecessor tried to cut expenditures. However, Ávila has had a slightly better than feared approach to fiscal policies, acknowledging the fiscal risks and not acting as if Brazil can grow expenditures while controlling its deficit.

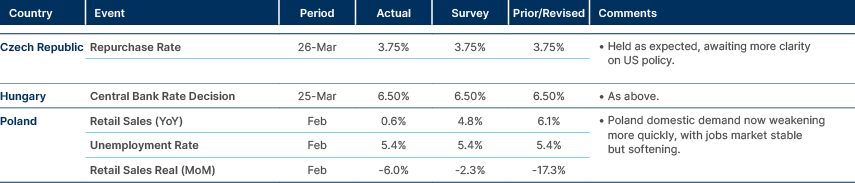

Central and Eastern Europe

Czechia: The Czech National Bank (CNB) adopted a more hawkish stance after unanimously deciding to hold the two-week repo rate steady at 3.75%. The CNB highlighted increased inflation risks, describing them as "inflationary," an escalation from the "modestly inflationary" assessment in February. The CNB also expressed caution regarding the potential impacts of US trade tariffs and noted that, unless defence spending is offset by savings elsewhere, inflation risks could rise. Governor Aleš Michl did not rule out future monetary policy tightening, though a final 25 basis point (bps) cut in May remains a possibility.

Romania: Romania’s Finance Ministry raised EUR 2.75bn in two tranches: EUR 2.25bn at 335bps spread to mid-swaps for a 2032 bond and EUR 0.5bn at 400bps above mid-swaps for a 2039 bond. Borrowing costs came under initial price target as demand was two times over issuance.

Central Asia, Middle East, and Africa

Arab Emirates: Abu Dhabi’s GDP rose by 3.8% in 2024, with the non-oil sector (55% of economy) expanding 6.2%.

Ghana: Public debt dropped to 61.8% of GDP in December 2024, from 68.9% in September 2024 and 96.1% in November 2022. External debt decreased by 6.6% yoy and domestic debt rose 20.4% yoy.

Foreign trade surplus surged to USD 1.6bn (1.9% of GDP) in the first two months of the year. Exports rose c. 50% yoy on higher (prices and volume of) gold and cocoa. Imports rose by 7.3% yoy driven by higher fuel imports. Foreign reserves rose to USD 9.4bn in February, covering 4.2 months of imports.

Ivory Coast: Ivory Coast issued USD 1.75bn in a 2036 Eurobond (10-year weighted average life) at 8.45% yield. This provides USD 1.0bn of new finance, in line with budget, with USD 0.7bn destined to repay other Eurobonds.

Kyrgyzstan: S&P initiated coverage with a B+, stable outlook rating. The ratings agency noted the successful reorientation of regional trade, and strong domestic demand has driven real GDP growth of 9% from 2022-2024. The Kyrgz Republic called this a “significant achievement, the result of large-scale structural reforms.” Moody’s currently rates Kyrgyzstan at B3 with a stable outlook, two notches below S&P’s rating.

Morocco: Morocco sold EUR 2bn Eurobonds in two tranches: EUR 0.9bn for a 4-year bond at 3.937% (155bps over mid-swap) and EUR 1.1bn 10-year bond at 4.843% (mid-swap + 215bps). Demand was over EUR 6.75bn, which allowed the country to issue tighter than Romania, despite BB+ rating vs. Romania’s BBB-, reflecting the country’s solid credit worthiness.

South Africa: Democratic Alliance (DA) leader John Steenhuisen suggested last Friday that a budget agreement is “closer than many think”. This suggests the African National Congress (ANC) may agree on some of the demands of its coalition partner. The DA is opposed to a value added tax (VAT) hike, but the most important issues lie outside of the budget itself. Parliament will vote on a fiscal framework on 2 April, the first big test for the Government of National Unity.

Türkiye: A massive rally took place in Istanbul, as crowds demanded the release of Ekrem Imamoğlu. The CHP, Imamoğlu’s party, estimated as many as 2.2m attended the rally (not independently verified). The magnitude and intensity of protests are expected to decline due to public holidays and half-term school holidays this week. In other news, Swedish journalist Joakim Medin was arrested on a terrorism charge. Medin was the author of a 2023 book about the involvement of Türkiye in Sweden’s NATO ratification process.

Zambia: The government presented a draft of constitutional reforms to parliament. The Justice Minister presented 13 proposed amendments, which only includes issues deemed non-contentious. Amendments included expanding representation by increasing MPs, guaranteeing seats for marginalised groups, and enhancing constituency delimitation. Reforms to election laws are expected to save ZMW 264m plus ZMW 3.9m per candidate in by-election costs, with electoral petitions to be resolved in 90 or 14 days. Public consultations are scheduled for May-June 2025, with a final vote set for the end of July.

Developed Markets

France: National Rally leader Marine Le Pen was found guilty of embezzling European Parliament funds. She will be ineligible to run for elections for the next five years. Several polls had her as the strongest contender to succeed Emmanual Macron in 2027. This ruling now leaves Jordan Bardella, Marine Le Pen’s apparent successor and National Rally President, as the prominent far-right figurehead in France.

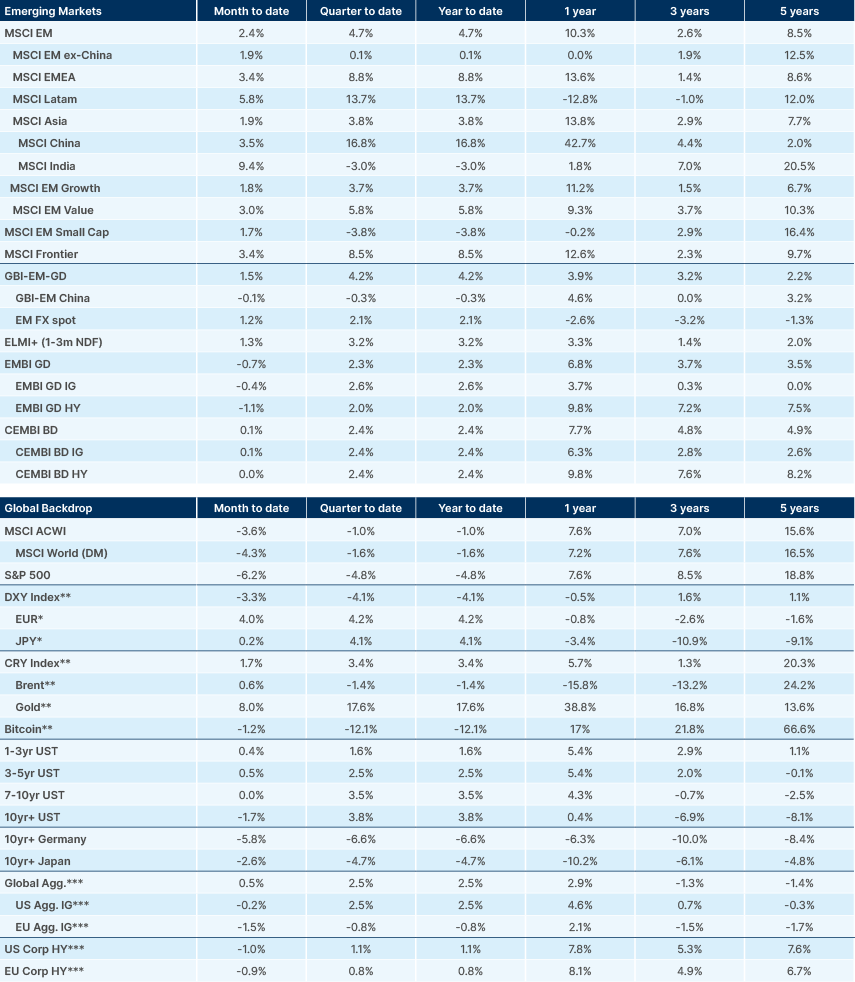

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

1. The United States-Mexico-Canada free trade agreement.

2. Source: https://research.gavekal.com (paywalled)