Emerging Market assets resilient as US ‘safe haven’ status falls further

- Donald Trump piled further pressure on Jerome Powell and the Fed to cut rates.

- Trump aide Kevin Hasset said Trump’s team were looking at the possibility of firing Powell.

- Dollar index fell to its lowest since 2022 and the UST curve steepened further, while equities underperformed.

- The House narrowly passed the Senate-modified budget resolution, meaning only a 51-vote majority required in Senate for final approval.

- JD Vance landed in Delhi for a four-day visit to talk trade.

- Javier Milei said there would be no official FX market intervention unless the ARS strengthens to the floor of the new currency band at USD/ARS 1,000.

- Egypt and Saudi Arabia signed four investment agreements to strengthen cooperation.

- Ghana’s Finance Minister reaffirmed commitment to conditions of the current IMF programme.

- New poll showed South Africa’s ANC trailing the DA in support for the first time, with 29.7% compared with 30.3%.

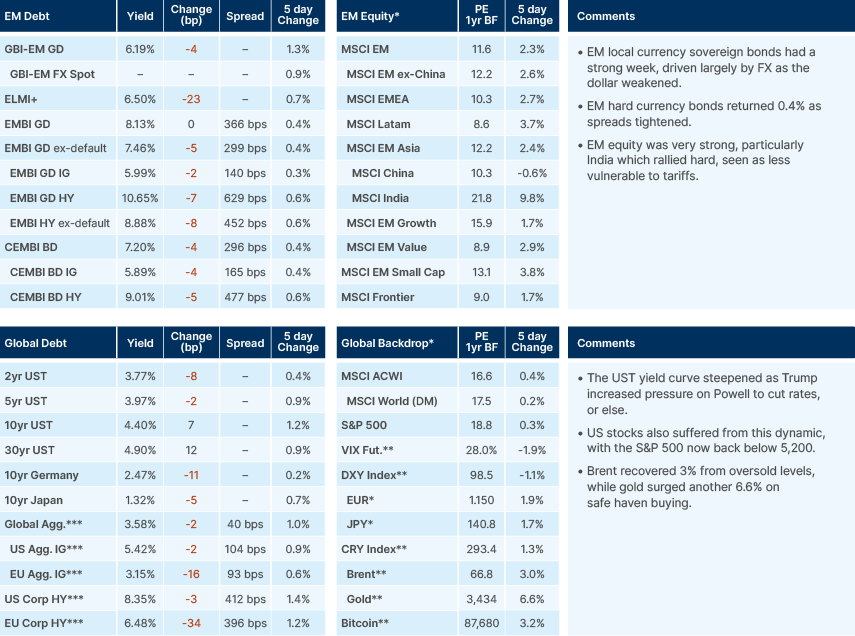

Last week performance and comments

Global Macro

US Federal Reserve (Fed) Chair Jerome Powell’s statement last week suggested the Fed’s ‘put’ is still well out of the money. Powell reemphasised the need to make sure a “one-time price increase does not become an ongoing inflation problem.” While interest rates were much higher then, it is worth remembering that in September 2024, the Fed cut rates by 50 basis points with the stock market at record highs, while the Atlanta Fed’s GDP now model was forecasting +3% US GDP growth for the quarter. The Fed is now determined not to cut rates after a 20% market plunge, and the Atlanta Fed GDP model is forecasting a running growth rate of -3%.

President Donald Trump was far from pleased at the hawkish tone and tweeted that the termination of Powell’s chairmanship “cannot come fast enough.” Council Director Kevin Hasset said Trump’s team was investigating how they might be able to legally fire Powell. Currently, the Fed Chair could be fired for ‘cause,’ which is understood to mean prolonged misconduct, not a policy disagreement. However, Trump’s team will be exploring whether an argument could be made to fire Powell over his policy mistake of viewing post-COVID inflation as “transitory,” which arguably led to a longer period of high rates than necessary.

Whether or not it is possible to fire Powell without ‘cause’ may hinge on an ongoing Supreme Court investigation into the legal recourse of the White House to remove board members of independent agencies at will, as Trump has already done this year. Some lawyers argue this case may not apply to the Fed, as the central bank is in a category of its own from other independent agencies. If this case goes in the way of the fired agency chiefs, it will clearly benefit Powell. But even if it goes against them and executive power is broadened, this does not necessarily mean Powell can be fired. A final decision is not anticipated on this case until at least June.

The dollar and US assets continue to be the biggest victim of these developments. A threat to the Fed’s independence is terrible for America’s status as a ‘safe haven’ for capital, and has led to further outflows from equity markets, a further sell-off in bonds, and the Dollar index now below 100. The EUR/USD is now above 1.15 for the first time since 2021, even as interest rate differentials move in the US’s favour after the European Central Bank (ECB) delivered a widely expected 25bps cut last Thursday. Gold prices have risen to USD3500 as asset allocators look for new safe havens, with EM/European stocks and Bitcoin also catching bids.

The Bank of America Fund Manager Survey showed the fifth most bearish sentiment reading in 25 years for US equities. Previous lows, March 2001, October 2008, June 2019 and October 2022, all led to rallies. Policy and profits have determined whether this rally is a bear market bounce or the beginning of a new bull market. 2001 and 2008 were bear markets, whereas 2019 and 2022 were bull market rallies. Currently, policy is not pointing towards a new bull market, unless Trump and the Fed change their tune rather quickly. This is especially true given investors are very ‘emotionally’ bearish but are yet to shift their positioning in a big way. Foreign inflows to US equities have slowed this year, but we are yet to see net outflows, with foreign investors still holding around 18% of US stocks. This will change if tariff, fiscal or monetary policy do not shift to set up better conditions in the US for the second half of the year, as many investors are still expecting.

For investors hoping the ‘big, beautiful’ budget this summer will prove a deus-ex-machina for US markets, there was at least some good news recently. The House of Representatives on April 10th narrowly passed the Senate-modified budget resolution (216–214). All Democrats opposed, while two Republican Senators also voted no. The resolution passing the filibuster now clears the way for budget reconciliation in the Senate with a simple 51-vote majority (the Republicans have 53 Senate seats). The Republicans hope this can be achieved by late May. The key modification was that the original House budget required USD 2trn in spending cuts to offset tax cuts beyond Tax Cuts and Jobs Act (TCJA) extensions. The Senate version redefined TCJA extensions as part of the baseline, meaning the Senate scrapped the USD 2trn requirement, instead allowing USD 1.5trn in new tax cuts if just USD 4bn in agency cuts are made. House Speaker Mike Johnson assured fiscal conservatives that USD 1.5trn in savings will still be found, which would make further tax cuts budget neutral. However, the key here is that tariff revenues are excluded from the budget due to uncertainty, but the Tax Foundation estimates 15% tariffs could raise USD 1.8trn over 10 years. So even with USD 1.5trn in new tax cuts, this setup would still result in a net tax increase under current assumptions, irrespective of spending cuts.

Treasury Secretary Scott Bessent hinted at using “buybacks” as a fiscal tool during a Bloomberg interview. The Treasury could buy long-duration bonds and issue more T-bills, “twisting” the yield curve without increasing net issuance, or involving a Fed balance sheet expansion. This means there is congressional appropriation needed.

Trump said he expects to reach a trade deal with the European Union (EU), although he also highlighted, he is in no hurry to finalise an agreement. Trump also said negotiators made "big progress" in trade talks with Japanese representatives, although the Japanese continue to point out it is unclear what the US actually want. US Interior Secretary Doug Burgum expressed confidence Trump will successfully negotiate a tariff deal with China. Lastly, Vice-President JD Vance expressed optimism about reaching a beneficial trade agreement with the UK. But despite these positive signals, the lack of detail and inconsistency continues to feed investor caution and prevent any significant retracement higher in global markets. China’s Ministry of Commerce threatened to retaliate against nations aligning with the US on trade policies during a press briefing in Beijing.

Commodities

Gold prices are extending the rally, topping USD 3,500 today. A gold/S&P ratio below 1.5 is back to pandemic lows. The last two times S&P500/gold hit 1.5, we were already in recession.

Emerging Markets

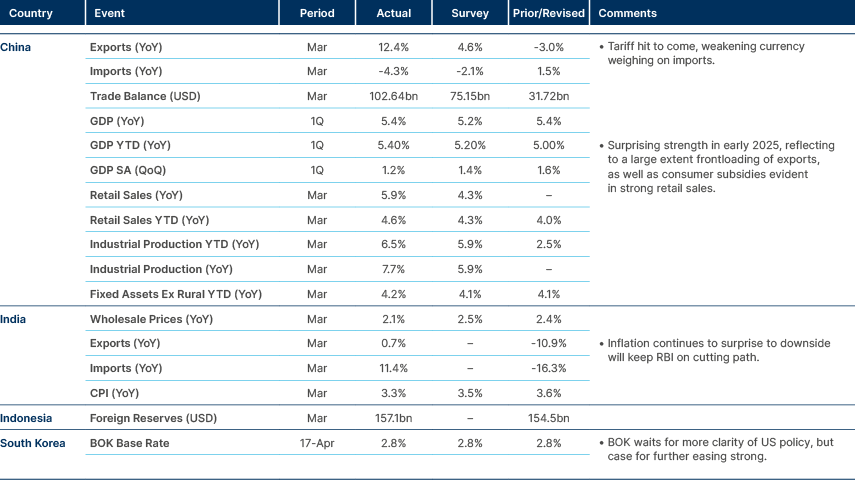

Asia

India: JD Vance landed in Delhi for a four-day visit amidst a global trade war. The US is threatening to increase tariffs on Indian exports from 10% to 26% if no deal is reached by the end of the 90-day pause. The visit will include a bilateral meeting with Indian Prime Minister Narendra Modi, with sector specific trade discussions and hopes for a quick deal to secure a reprieve from higher tariffs. Modi paid a goodwill visit to Washington after Trump’s return to the White House, and both leaders pledged to more than double bilateral trade to USD 500 bn from over USD 190bn currently.

South Korea: Exports fell sharply by 8.5% month-on-month (mom) in the first 20 business days of April, almost fully offsetting the increase in March.

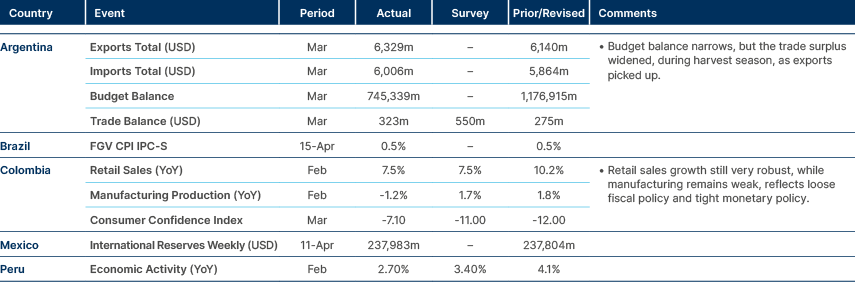

Latam

Argentina: President Javier Milei said there will be no official intervention in the foreign exchange (FX) market unless the Argentine peso (ARS) strengthens to the floor of the new currency band at USD/ARS 1,000. This comes as the ARS rapidly appreciated to 1,120 following the removal of FX controls and the introduction of a managed float within a USD/ARS 1,000–1,400 band.

Under this system, Argentina’s central bank (BCRA) can intervene at the edges of the band, but retains flexibility to act within it, particularly given FX reserve targets. Milei’s comments suggest the government supports further appreciation, aligning with bullish market sentiment driven by carry trade opportunities, peak agricultural export inflows, and the opening of portfolio investment to non-residents.

This environment is helping keep inflationary pass-through from the FX liberalisation limited, which can benefit the economy in the short term and ahead of October’s mid-term elections. However, sustained appreciation could be problematic, particularly beyond 2025. Argentina’s shallow financial system, external vulnerabilities, and ongoing structural reforms make it ill-equipped to handle an overly strong currency. The cost of living in USD terms being now far above other South American countries is a sign that the real exchange rate is becoming misaligned with economic fundamentals.

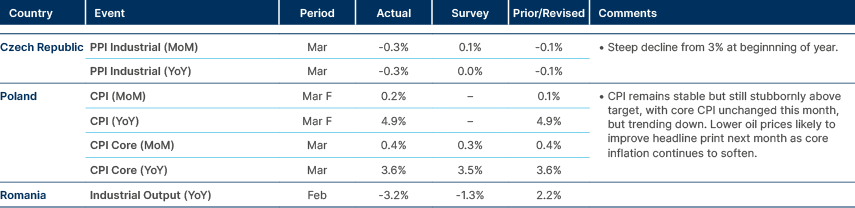

Central and Eastern Europe

Central Asia, Middle East, and Africa

Egypt: Egypt and Saudi Arabia signed four investment agreements to strengthen cooperation in key sectors as part of an ongoing process to heighten economic integration. The countries are also progressing on a power grid linkage project.

- Business City Group and GCC Capital Partners will attract foreign investment into Egypt’s poultry and farming sectors.

- ASAS Holding Group and Alcotech Engineering will build a 10,000m² aluminium cladding panel factory with 3.6m metres annual output.

- Nano Volt and Aamal Al-Yusr Company will collaborate on marketing, selling, and installing solar energy solutions in both countries.

- Yafl Real Estate and Horizon Capital will enhance real estate development and operations.

Ghana: Finance Minister Cassiel Ato Forson said the government has no intention of renegotiating the International Monetary Fund (IMF) programme, affirming its commitment to the programme’s goals.

Forson acknowledged missed targets under the previous administration, but highlighted new measures to improve expenditure control, budget performance, and debt sustainability. He also announced an audit, involving the auditor general and international firms, to assess payables accumulated before the election. The IMF noted a significant rise in these liabilities, contributing to a 2024 primary deficit of 3.3% of GDP, against a target surplus of 0.5%.

Türkiye: The central bank (CBRT) increased the policy rate to 46% and hiked the upper band to 49%, while increasing the lower band to 44.5% from 41.0%. This follows an increase in the upper band to 46% while keeping the policy rate at 42.5% in an interim meeting in March.

South Africa: A poll from South Africa’s Institute of Race Relations (IRR) showed the African National Congress (ANC) Party trailing the Democratic Alliance (DA) in support for the first time, with 29.7% compared with the DA’s 30.3%. The drop is largely attributed to widespread backlash over a proposed value-added tax (VAT) hike, which has alienated voters across all parties, including ANC ally the Congress of South African Trade Unions (Cosatu). The survey, conducted in February among 807 registered voters, reflects a growing focus on socio-economic concerns over party loyalty. Similarly, the Social Research Foundation (SRF) found about 10% of the electorate—former ANC loyalists—are now aligning with opposition views. Key reasons for their past loyalty, such as trust in former President Cyril Ramaphosa and fear of DA governance, are diminishing. Without Ramaphosa, ANC support could fall to 21%. The DA has notably tripled its support among black voters from 6% to 18%.

The Government of National Unity (GNU) appears to be stabilising following budget talks and a constructive ANC-DA meeting. Although unconfirmed by the finance minister, the ANC is reportedly willing to drop the approved 0.5% increase in VAT. Scrapping the hike, set for 1 May, would require offsetting ZAR 13.5bn through alternative revenue or spending cuts. While uncertainty remains, improved cooperation and ongoing reform discussions support market confidence.

Developed Markets

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.