EM leads the H1 2025 race as equities climb another ‘wall of worry’

- EM assets outperformed again last week, driven by a weaker Dollar.

- Global equities look through geopolitical, trade, and public finances uncertainty.

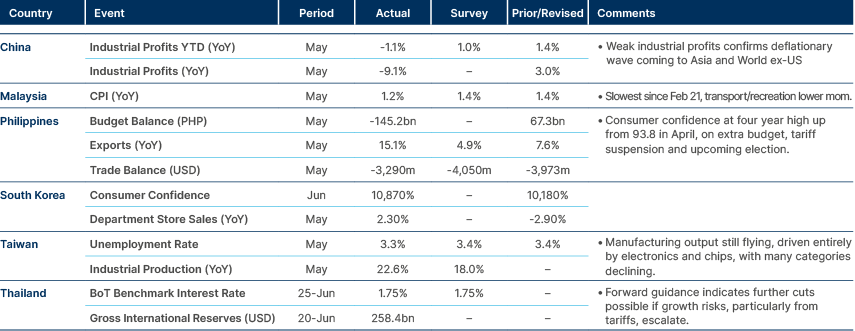

- Mixed data in China, softer CPI in Malaysia, and South Korea has a new finance minister

- Colombia downgraded; Mexican data softened somewhat despite upward GDP revisions.

- Brazilian fiscal concerns stay in place, in contrast with Argentina.

- Surprise result in Chile’s ruling coalition primary points to a polarised race.

- Eastern Europe must find budget room to expand defence spending to 5.0% of GDP particularly challenging for Romania.

- Good news across most of Middle East and Africa.

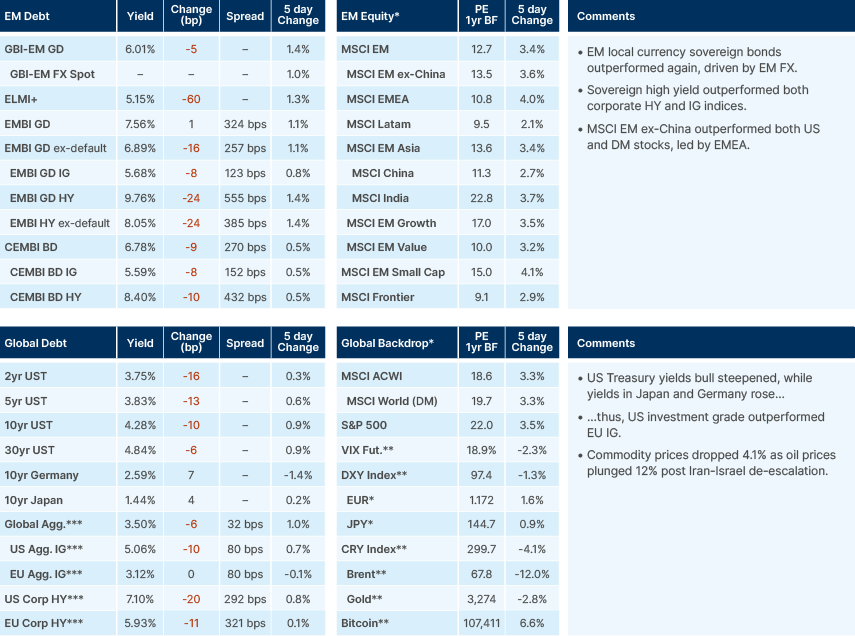

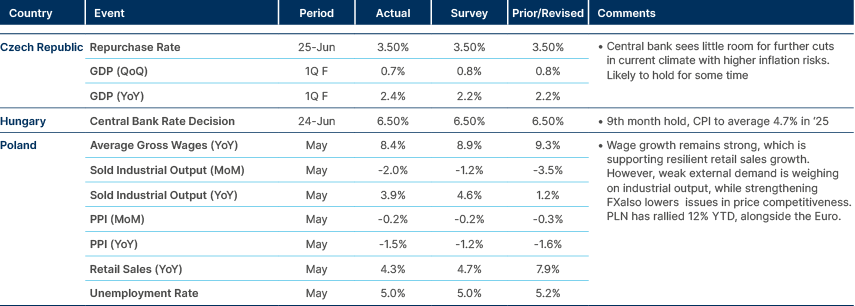

Last week performance and comments

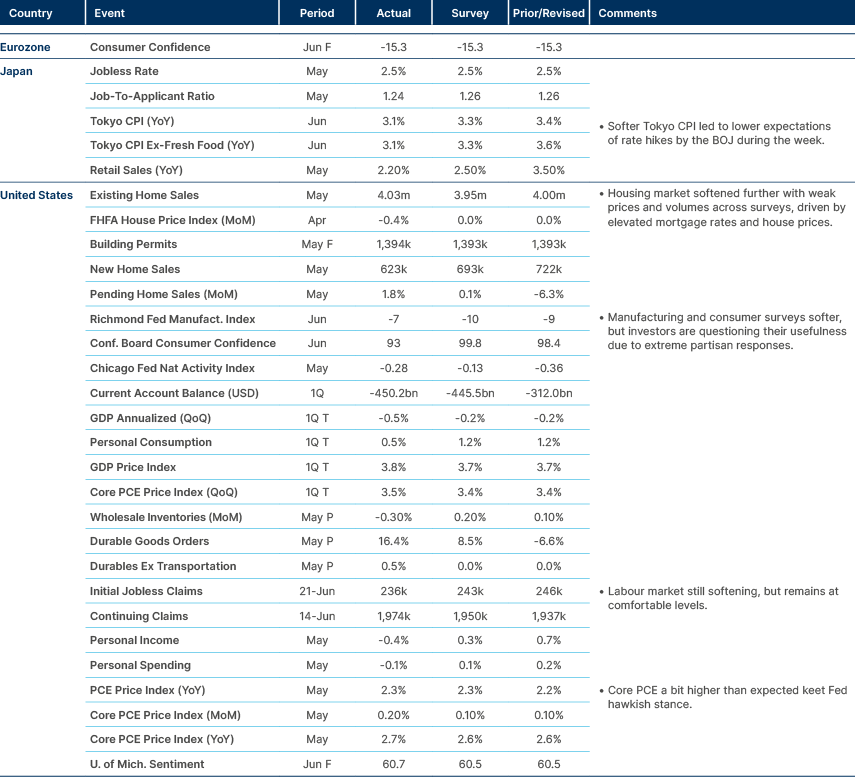

Global Macro

The de-escalation of the Israel-Iran conflict led to a strong rally for equity markets as oil prices plunged and soft – but not disastrous – economic data led US Treasury yields lower as the curve bull-steepened (front-end yields declined more than back-end yields).

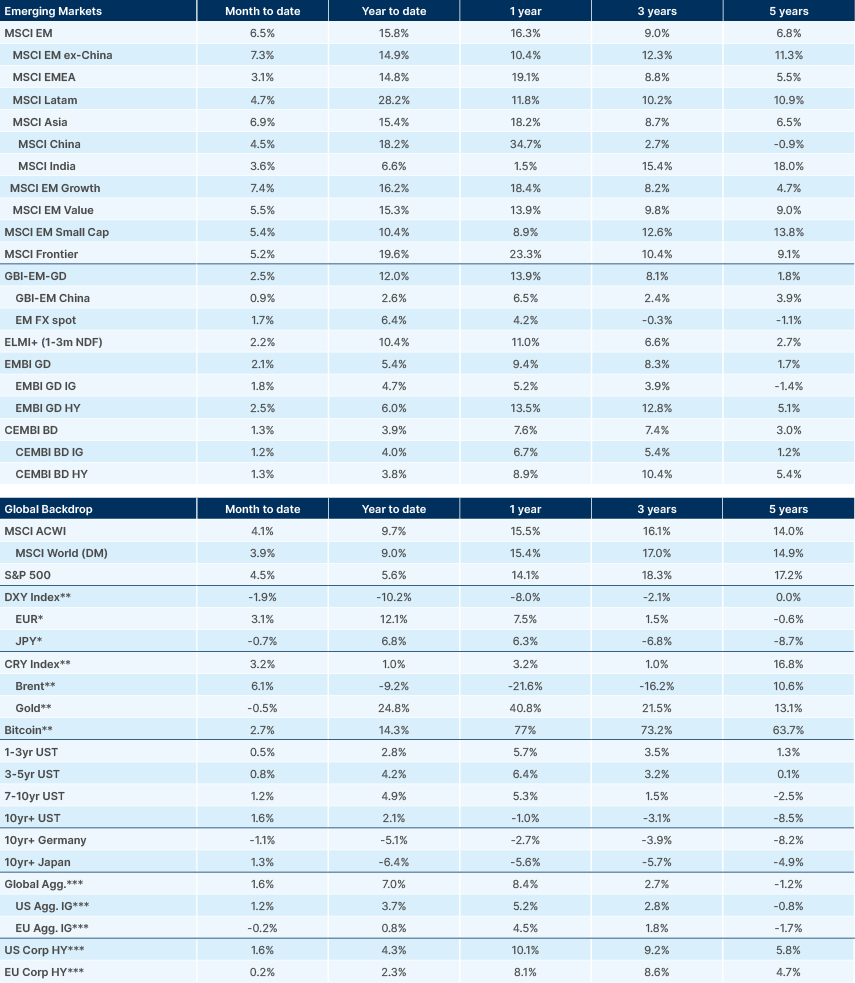

Notably, emerging markets (EM) ex-China equities continued to outperform both US and non-US developed markets. The strong rebound of the S&P 500 from its post-Liberation Day lows means the gap between the EM and US equity performance is much narrower, but it is hard to dispute that non-US equity markets have had significantly better risk-adjusted returns. The S&P 500 180-day realised volatility rose to 21.6% from 10.9% at its lows in July 2024, while the MSCI EM volatility stands at 17.0%, up 11.8% from last year’s lows.

The recovery of US stocks is again relatively narrow as most gains have taken place in stocks related to artificial intelligence (. Further, dealers continue to report increased retail volumes in stock options and levered funds as a red flag. The ‘pain trade’ may be higher as institutional investors remain overall underweight. The resolution of the trade war as well as the US budget will be the most important macro events of the summer. On the trade war, China confirmed it has reached a deal with the US and US Secretary of Commerce Howard Lutnick said a deal with 10 major countries is likely over the next weeks. The negotiation with the EU is going down to the wire as the 9 July deadline approaches next Wednesday. Market participants have not been focused on trade headlines, so negative surprises could lead to some volatility next week.

In Europe, Germany approved the 2025 budget draft and 2026–2029 fiscal benchmarks. The key highlights are the front-loaded investments with defence and infrastructure amounting to over €200bn in 2025, from below €150bn in 2024. The German budget deficit is forecast to rise above 3% of GDP in 2026. Bund yields moved wider, and the euro was stronger on the news.

The fiscal impulse from Germany and the US rates rally has been a strong factor driving global fixed income returns. The EMBI and CEMBI IG rose 4.7% and 4.0%, respectively, a strong outperformance over both US Agg IG and EU Agg IG, up 3.7% and 0.8%, respectively YTD. The later returns are for the EUR Agg IG index in euros. In USD unhedged terms, the same index rose 14.0%. In this regard, EM local currency (LC) bonds rose an impressive 12% year-to-date, of which 6.4% is down to EM currencies strength, as the dollar continues to weaken regardless of stock and bond market returns and the prevailing events and narrative. EM LC has significantly outperformed major fixed income indices made up exclusively of Dollar assets, and the Bloomberg Global Aggregate Index, up 7.0%, driven by currency contribution of 4.9%, as around 48% of the index comprises non-USD currencies. The winning positions for total return investors have been overweight in US front end rates and EM rates and a short USD against EUR and EM FX.

Emerging Markets

Asia

Malaysia CPI inflation at slowest in five years. China’s industrial profits weak despite better PMI this morning.

China: Economic activity has been mixed with better purchasing managers’ index (PMI) data contrasting with signs of deterioration in the labour market, and no signs of improvement in industrial profits. This morning, the manufacturing PMI rose by 0.2 to 49.7 (49.6 consensus) as the non-manufacturing PMI rose by 0.2 to 50.5 (50.3 est.). The recovering new export orders and shipping data suggest exports may remain resilient in June while the rebound in construction PMI indicates improved infrastructure investment.

Pakistan: Foreign exchange (FX) reserves are expected to rebound towards the USD 14bn target after China reportedly refinanced USD 3.4bn in loans. The refinancing follows a sharp dip in reserves to USD 9.1bn due to the repayment of foreign commercial loans.

Philippines: The government laid out a clear plan to get its national budget in better shape over the next few years. The goal is to shrink the country's fiscal deficit, the gap between what the government spends and what it collects in revenue, from 5.5% of the total economy in 2025 down to 4.3% by 2028. The strategy relies on a combination of strong economic growth and measures to increase government income. The proposed budget for 2026 reflects this plan, increasing spending by 7.4% based on an optimistic forecast of 6-7% economic growth in the coming years.

South Korea: President Lee Jae-myung nominated veteran government official Koo Yun-cheol for the role of Finance Minister. Koo has signalled a focus on real-world issues, including stabilising the cost of living and managing public finances "like a corporation" as key priorities.

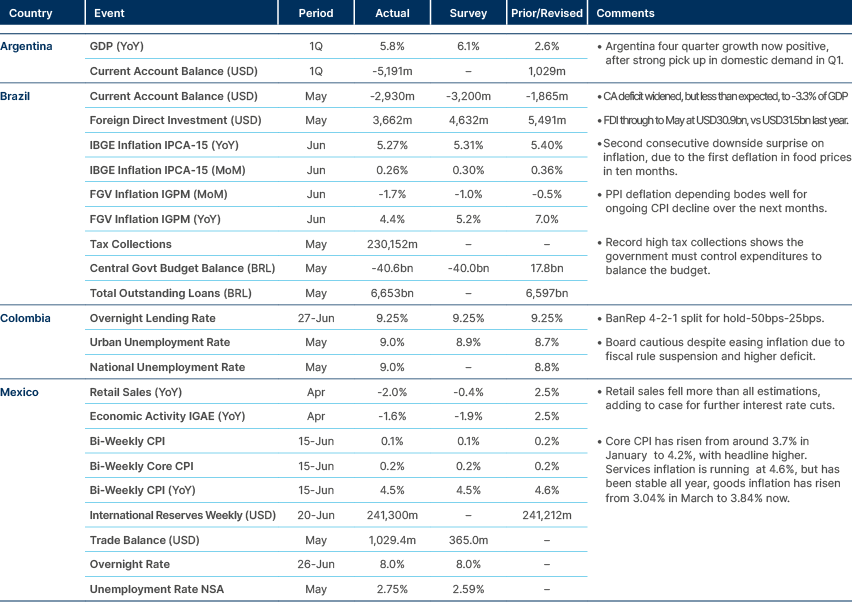

Latin America

Softer data in Mexico, inflation surprised to downside in Brazil again.

Argentina: The federal government posted a fiscal surplus of 0.3% of GDP for the first five months of the year, staying on track to meet its annual balanced-budget target. The surplus came despite a 0.2% increase in the unemployment rate to 7.9% in Q1 2025, primarily due to public sector layoffs and weak construction activity, despite an increase in informal private sector jobs. External accounts deteriorated as the current account moved to a USD 5.2bn deficit in Q1 2025, on increased Argentinian tourists spending abroad, driven by a strong real effective exchange rate (REER).

Nevertheless, the country’s financial position is still improving slowly. Net reserves plus government FX deposits fell to USD 1.1bn in May due to payments to international financial institutions but rose in June after a USD 2.0bn central bank repo and USD 1.5bn from a bond issuance. In political news, a rally was held for former President Cristina Fernández de Kirchner, who remains a prominent but potentially fading figure while serving a sentence under house arrest.

Brazil: Congress overturned President Lula’s IOF tax hike decree, a significant political defeat for the government, signalling strong resistance to future tax increases and putting more pressure on the government to cut spending instead. The government has escalated the fight to the Supreme Court. On the economic front, the central government primary deficit dropped to BRL40.6bn in May from BRL 60.4bn a year earlier, a cumulative surplus of BRL32.2bn YTD, driven by higher revenue and lower spending. Credit ratings agency Fitch recently confirmed Brazil's BB rating, acknowledging the country's large and diverse economy but also pointing to its high government debt as a key constraint.

Chile: Jeannette Jara, of the Communist Party and a former labour minister, won a decisive primary election victory with over 60% of the vote, easily defeating the more moderate candidate who was favoured to win. This makes Jara the official candidate for the "Unity for Chile" coalition in the November 2025 general election. She will face a tough fight against right-wing contenders who are currently leading in the polls. A major concern for her coalition is the very low voter turnout in the primary – only 9% of eligible voters participated, down sharply from 21% in 2021. Such low participation can be a warning sign of a party's difficulty in mobilising its supporters for the main election.

Colombia: Both S&P and Moody's have downgraded the country's debt, citing serious concerns about the government's deteriorating finances and its controversial plan to suspend a key law that limits government borrowing. S&P lowered the hard currency sovereign rating to BB from BB+ with a negative outlook and the local currency rating to BB+ from BBB-, bringing it together with Fitch. The decision knocked Colombia out of the Bloomberg Global Aggregate and the JP Morgan GBI EM GD IG. Analysts estimate the Global Agg. removal will lead to c. USD 3.8bn of outflows. The index removal takes place on the last business day of the month but today is a bank holiday in Colombia. This makes the rebalancing timing uncertain as passive investors dislike front-running index changes. Colombian bonds will leave the GBI EM GD IG only in two months, with a very limited impact due to a much smaller number of investors following it. Moody's downgraded its sovereign debt to Baa3 from Baa2 with a stable outlook. Amid these fiscal troubles, the government's controversial pension reform cleared another procedural hurdle in Congress, though it is not yet law.

Ecuador: The unemployment rate ticked up slightly to 4.1% in May. President Daniel Noboa has signalled his intention to strengthen economic and trade ties with China, following the implementation of a new Free Trade Agreement between the two countries earlier this year.

Mexico: The central bank cut its main interest rate by half a percentage point to 8.0%. The decision was expected but was not unanimous, with Jonathan Heath, a hawkish board member voting against the cut due to concerns about recent inflation data. In economic news, auto exports, a key driver of its economy, dropped 9% yoy in May, contributing to a slight decline in the country's total exports for the month. In other news, the national banking commission has stepped in to intervene at smaller banks that have been accused of involvement in money laundering.

Panama: President José Raúl Mulino took the decisive step of declaring a state of emergency to end disruptive roadblocks set up by striking banana workers. The move, which includes suspending some constitutional guarantees, is aimed at restoring order and ending the economic disruption caused by the protests.

Peru: The government announced it expects construction to begin this year on the highly controversial Tía María copper project. The project has faced years of delays due to strong opposition from local communities concerned about its potential environmental impact, but the energy minister has signalled a push to finally move it forward.

Central & Eastern Europe

All countries vowed to increase defence spending to 5% of GDP by 2035 to comply with NATO’s new direction of travel.

Czech Republic: In a major strategic shift, Prime Minister Petr Fiala announced the country is prepared to boost its defence spending to 5% of its economy by 2035 to meet new NATO requirements. The government is making plans to substantially increase its budget deficit for 2026, a move criticised by the opposition party, which is currently leading in the polls. This sets the stage for a dispute over the country's fiscal policy after the next election. The Czech National Bank kept its main interest rate on hold at 3.50%. Against this backdrop, the central bank's Governor stated that inflation pressures remain too high, and has ruled out any further rate cuts until the situation is under control.

Kazakhstan: Germany is to cooperate with Kazakhstan on a major airport construction project designed to create a new transit hub between China and Europe. In the energy sector, Kazakhstan's state oil company signed a deal with China's CNOOC to jointly develop a new oil field, with the Chinese company funding the initial exploration work. In other news, the Ministry of Finance raised USD 2.5bn via Eurobonds. High demand allowed for yields of 5.0% for 7-year bonds and 5.5% for 12-year bonds, citing strong economic growth and low debt.

Poland: The government has raised about 75% of its 2025 funding needs through bond sales. This gives it flexibility and may even allow it to start pre-funding its needs for 2026. Poland's central bank announced it has completed a major gold-buying programme and now holds the 12th largest national gold stockpile in the world. For consumers, the government extended a cap on household electricity prices through the end of the year, hoping falling wholesale energy costs will allow for stable or even lower prices in 2026.

Romania: Former EU Funds Minister Marcel Bolos warned Romania risks losing EUR 7.8 bn in Recovery and Resilience Facility (RRF) funding due to slow reform implementation and fiscal fragility, despite an extended deadline for investments until August 2026. Despite these challenges, President Nicusor Dan stated Romania agreed to a 5%-of-GDP military spending commitment by 2035, noting that earlier achievement dependent on fiscal consolidation. Public trust in both NATO and the EU remains very high, 70% and 62% respectively, among Romanians.

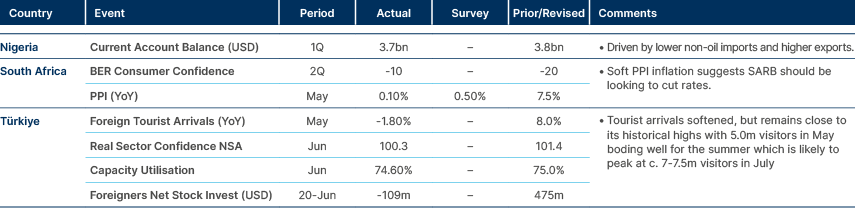

Türkiye: President Recep Erdoğan claimed US President Donald Trump supports Türkiye rejoining the F-35 fighter jet programme. Indeed, the US Ambassador has signalled that a resolution could be found by the end of the year. This would mark a fresh start after years of disagreement over Türkiye's purchase of the S400 Russian defence system. On the domestic front, the internal power struggle within the main opposition Republican People's Party (CHP) intensified as former leader Kemal Kilicdaroglu reportedly orchestrated "shadow manoeuvres" amid a judicial threat to the party's control, with a court ruling on the party's congress pending.

Ukraine: The country's gross external debt has risen to over 100% of its total economy, driven primarily by government borrowing to fund the war effort. President Volodymyr Zelenskyy firmly stated that Ukraine will not accept any ultimatums from Russia and expressed concern that growing tensions in the Middle East could divert international aid and attention away from Ukraine's fight.

Uzbekistan: Fitch upgraded Uzbekistan's sovereign rating to BB, from BB- with a stable outlook. The upgrade reflects the country’s improved fiscal position, accelerated reform progress and favourable medium-term growth prospects. These include measures to improve the credibility and transmission of monetary policy, advancement of privatisation plans, and enhancing the transparency of public institutions.

Middle East & Africa

Nigeria current account surplus and Türkiye’s tourism arrivals are resilient.

Egypt: Egypt successfully raised USD 1bn by selling an Islamic bond, known as a sukuk, to Kuwait's largest bank. This sale is part of Egypt's strategy to find diverse sources of funding as the proceeds from this new bond will be used to help repay a maturing USD 1.5 billion Eurobond, managing the country's debt obligations.

Gabon: Fitch has maintained a low CCC rating for the country, pointing to persistent financial challenges and a heavy reliance on volatile oil revenues. Gabon's government pushed back, arguing that the rating agency had overlooked recent political stability and the country's renewed commitment to fiscal reform. Meanwhile, the World Bank also warned of rising fiscal pressures in Gabon due to falling oil revenues and higher government spending.

Ghana: The government is set to launch a new "24-hour economy" policy in July, which aims to boost growth and reduce unemployment by improving production and supply chains. Ghana's parliament has approved a debt restructuring deal with its official creditors, which is expected to provide the country with USD 2.8bn in debt relief by 2026, freeing up funds for critical development projects.

Morocco: The country has just completed its first deal to package and sell off non-performing loans, creating a new market for what are essentially ‘bad’ debts. This will allow banks to clean up their balance sheets by offloading risky assets. In other news, the country's central bank surprised markets by keeping its key interest rate on hold, citing global uncertainty but also raising its economic growth forecast for 2025 to a strong 4.6%.

Nigeria: The Senate has given state-owned oil company NNPC a 10-day ultimatum to explain enormous discrepancies in its financial accounts, threatening serious consequences if it fails to comply. On the policy front, President Bola Tinubu signed a major tax reform package into law, which includes tax exemptions for low-income individuals and small businesses. He also launched a massive agricultural programme, distributing thousands of pieces of farming equipment with the goal of transforming Nigeria into a global agricultural powerhouse.

Saudi Arabia: The International Monetary Fund praised the country for its expanding non-oil sector, low inflation, and record-low unemployment rates among its citizens, all key goals of the Vision 2030 reform plan. The strong labour market is particularly notable for the significant increase in female participation and employment. To further boost its non-oil economy, the government has signed contracts worth nearly USD 600m to privatise cargo terminals at eight of its ports, aiming to attract private investment and enhance its logistics sector.

Senegal: The government announced new measures aimed at improving the financial management and governance of its public universities. The goal is to bring more transparency and better budget oversight to the higher education system, hoping to prevent the kind of disruptions that have historically affected the country's academic calendar and social stability.

South Africa: The ‘Government of National Unity’ is showing signs of significant strain. The coalition, formed after the last election, is being tested by deep ideological disagreements. The Democratic Alliance (DA), a key partner, is increasingly challenging the ruling ANC party, and while it has committed to staying in the coalition for now, it is also threatening a no-confidence vote, signalling a period of political instability ahead. In other news, South Africa has secured a USD 1.5bn loan from the World Bank, which will be used for much-needed reforms in the country's struggling energy and logistics sectors.

United Arab Emirates: The credit rating agency Fitch affirmed the country's AA- rating with a stable outlook, a high-grade rating that reflects international confidence. Fitch cited the UAE's low government debt, external asset position, and high income per person as key strengths, even as it noted the country's continued dependence on oil and gas revenues

Zambia: The economy continues to show several positive signs. Zanaco Bank is projecting economic growth of 5.0-5.5% for 2025, driven by slowing inflation, a stabilising currency, and good performance in the key mining and agriculture sectors. Inflation fell in June, though it remains above the central bank's target. The government is also benefiting from a new mineral royalty system, which has reportedly caused its earnings from mining companies to surge. However, the severe energy crisis has not been resolved, with the state-owned power utility implementing extreme ‘load shedding’, cutting electricity to residential customers to just five hours a day due to a power plant shutdown.

Developed Markets

US data remains soft overall, but hard data came in better than expected.

United States: US Federal Reserve (Fed) Chair Jerome Powell declined to commit to a July rate cut despite multiple chances during House testimony. He reiterated the Federal Open Market Committee (FOMC) is in no rush to adjust policy, as the US economy remains strong enough to wait for more clarity, stressing the tariff impact is a key uncertainty. Powell has, therefore, contradicted dovish signals from fellow FOMC members Christopher Waller and Michelle Bowman, who are open to cuts in July. Nevertheless, Powell also acknowledged rate cuts could happen “sooner rather than later” if inflation remains contained. His comments, alongside softer data, led the market to price more than 50 basis points (bps) in 2025. There is also increasing pressure from the Trump administration to cut rates as the president recently suggested the Treasury should stop issuing long term debt over the next nine months.

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.