EM central banks ease as DM diverges: ECB on hold, BoJ tightens

- ECB left policy rate unchanged; officials see cutting cycle most likely complete, while the BoE cut by 25bps.

- BoJ hiked rates by 25bps, in line with expectations.

- EM central banks eased with rate cuts in Thailand, Chile and Mexico.

- Trump administration announced USD 11bn arms package for Taiwan.

- EU approved EUR 90bn joint loan for Ukraine in 2026-27 to be raised via capital markets.

- US imposed naval-backed blockade on Venezuelan oil flows, escalating tensions.

- Argentina’s central bank (BCRA) announced a new FX and monetary programme

- Ivory Coast: Fitch upgraded from ‘BB-’ to ‘BB’, outlook stable.

- Oman: Fitch upgraded from ‘BB+’ to ‘BBB-’, outlook stable.

- Paraguay: S&P upgraded sovereign rating from ‘BB+’ to ‘BBB-’, outlook stable.

- Argentina: S&P upgraded long-term FC rating from ‘CCC’ to ‘CCC+’.

- Colombia: Fitch downgraded long-term FC rating from ‘BB+’ to ‘BB’.

Last week performance and comments

Global Macro

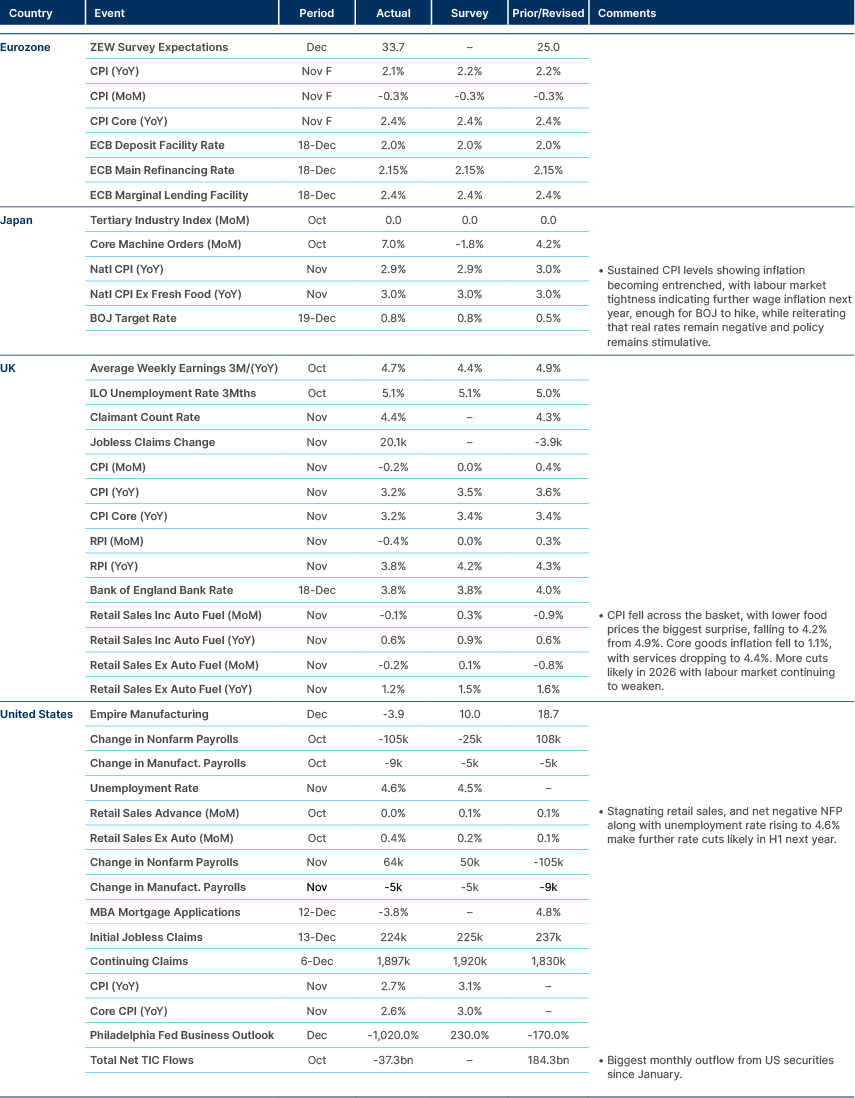

Last week’s global macro data strengthened our conviction that the direction of interest rate differentials between the US versus the EU and Japan will support continued USD weakness in the coming quarters, giving more space for emerging market (EM) central banks to cut rates. Indeed, last week we saw rate cuts in Thailand, Chile, and Mexico.

After the US Federal Reserve (Fed) cut by another 25 basis points (bps) at its December meeting, the European Central Bank (ECB) left its policy rate unchanged last week, with board members revising their growth and inflation estimations upwards. ECB President Christine Lagarde avoided signalling any near-term policy shifts but reiterated that all options remain open. Officials see the cutting cycle as most likely complete, and markets are now pricing in a larger probability of a hikes than cuts in 2026. Germany announced on Thursday that it will issue a record EUR 512bn in debt in 2026, up 20% year-on-year (yoy). The Finance Agency plans EUR 318bn in capital market auctions and EUR 176bn via money markets, including between EUR 16-19bn in green bonds.

The Bank of Japan (BoJ) raised rates by 25bps, as expected, bringing the policy rate to 0.75%, the highest since 1995. Policymakers reiterated that moderate wage and price growth will persist. With policy rates still stimulative (real rates remain deeply negative), further hikes next year are highly likely. The 10-year yield on Japanese Government bonds (JGBs) rose to its highest level since 1999, rising above 2%. The JPY is yet to catch a bid, moving 1% lower last week, with the weakness of the currency reflecting the still very loose monetary policy, and plans for wider deficits under the Takeichi administration. However, in our opinion the monetary policy looks set to slowly normalise next year. The BoJ remains highly independent and will likely respond to accelerations in inflation.

US unemployment rose by 20bps to 4.6%, its highest level in four years as non-farm payrolls for October and November showed a decline of 41k jobs over the two months, primarily driven by federal government layoffs showing up in the October data. US consumer price index (CPI) inflation data for November was warped by the government shutdown, with most areas of the basket excluded from the print as the data wasn’t collected. However, the figure still came in below expectations, falling to 2.7% (3.1% was expected), the lowest reading since 2021. Despite poor data quality, the market still saw the combination of softer CPI inflation and higher unemployment as enough to support further cuts, with interest rate forwards now pricing 60bps of cuts in 2026. Fed Governor Christopher Waller described monetary policy decisions in 2025 as “pre-emptive”, keeping emphasis on downside risk to the labour market as employment “continues to soften.” In his view, cuts can proceed “at a moderate pace” given inflation is still elevated, but the impact of tariffs as transitory, with no evidence of unanchored expectations. Waller argued that the policy rate remains 50-100bps above neutral, implying c. 3.0% neutral rate, versus a 3.25% median in the December dot-plot chart.

Geopolitics

US-Taiwan

The Trump administration announced a Taiwan arms package exceeding USD 11bn. The deals cover 82 HIMARS, 420 ATACMS, artillery systems worth over USD 4bn, and additional missile + drone sales. Washington said the sales support Taiwan’s self-defence and regional stability, in line with US law. China strongly condemned the move as violating bilateral agreements and warned it would heighten cross-strait tensions. The package comes as Taiwan plans to lift defence spending to 3.3% of gross domestic product (GDP) next year and to 5% by 2030, following US pressure for higher defence outlays.

Russia-Ukraine

Russia’s defence minister said controlled territory expanded by 6,000 sq. km in 2025. Russia claims control of Konstantinovka, opening access toward Druzhkovka-Kramatorsk-Slavyansk, and cited advances around Seversk (Kharkov region), and clearance operations in Svetloye, Grishino, Rodinskoye, plus encirclements near the Oskol left bank and Dimitrov. On 17 December, President Vladimir Putin warned Russia would expand its territorial gains and could accelerate offensive operations if peace terms are rejected. Ukraine reported levelling positions on the Lyman axis, destroying a Russian regiment, and damaging a Kilo II submarine in Novorossiysk using an unmanned underwater vehicle. EU leaders met on 18 December to debate using frozen Russian assets for Ukraine, while Ukraine President Volodymyr Zelenskyy floated dropping NATO membership in favour of Article 5-style bilateral security guarantees.

The EU approved a EUR 90bn joint loan for Ukraine for 2026-27, to be raised on capital markets under an EU budget guarantee, rather than backed by frozen Russian assets, ensuring funding to cover the International Monetary Fund (IMF)-estimated USD 63bn budget gap. Ukraine also completed a GDP warrant restructuring, with 99.1% of holders approving the deal, converting USD 2.6bn in warrants into mainly 2032 notes worth USD 3.5bn and fully retiring the instrument, avoiding potential payouts of USD 6-20bn over 2025-2041.

Israel-Egypt, Israel-Germany

Israel’s Prime Minister Benjamin Netanyahu approved a USD 35bn natural gas export deal to Egypt, the largest gas agreement in Israel’s history, with deliveries over 15 years. Gas will be supplied by Chevron from offshore Mediterranean fields, with around 50% of proceeds expected to flow to Israel’s state coffers. Netanyahu said the deal strengthens Israel’s role as a regional energy power and supports regional stability amid strained Israel-Egypt ties during the Gaza war.

Separately, Germany approved an expansion of its Arrow 3 missile defence deal with Israel, raising its value from USD 3.5bn to USD 6.5bn, now Israel’s largest-ever defence export.

US-Venezuela

Tensions escalated sharply as US President Donald Trump ordered a “total and complete blockade” of sanctioned oil tankers entering or leaving Venezuela on 16 December, alongside the deployment of US naval and air assets in the region. On 17 December, the US military carried out a strike on a vessel in the Eastern Pacific, killing four people, while Trump formally designated the Venezuelan government a “terrorist organisation” and demanded the return of assets seized from US oil companies. The moves prompted Democrats in the House of Representatives to push for war powers votes amid rising concerns over military escalation. Despite the blockade, state oil company PDVSA stated that oil and product export operations continue normally.

Emerging Markets

Asia

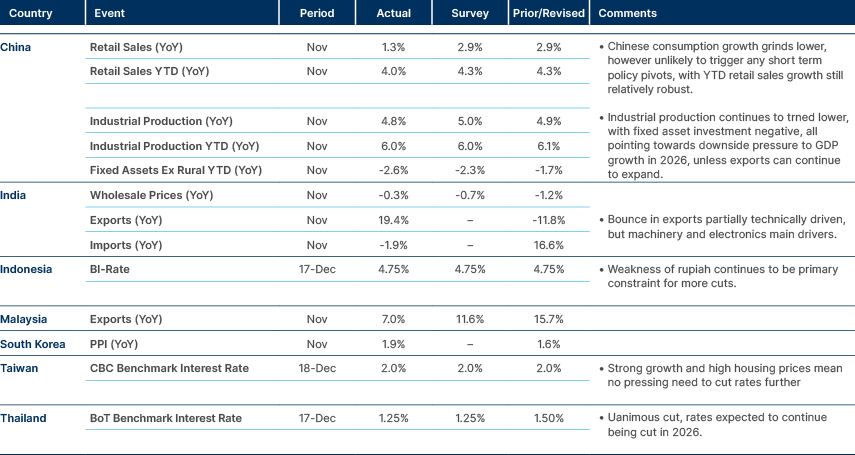

China: China’s slowdown deepened in November, with retail sales up just 1.3% yoy, down from October’s 2.9%. Industrial production rose 4.8% yoy, missing expectations and marking the weakest growth since August. Fixed asset investment fell 2.6% yoy, the sharpest decline since 2020 and worse than both forecasts and the January–October pace. Meanwhile, new home prices dropped 0.39% mom, underscoring persistently weak property demand despite government support.

India: Parliament passed the Sabka Bima Sabki Raksha (Amendment of Insurance Laws) Bill, 2025 on 17 December, raising the foreign direct investment (FDI) cap in the insurance sector to 100% from the current 74%. Prime Minister Narendra Modi signed a Comprehensive Economic Partnership Agreement (CEPA) with Oman on 18 December, marking what officials called a “watershed moment” in the millennia-old relationship between the two nations. This is all in India’s plan to accelerate Free Trade Agreements to cushion the impact of US tariffs.

Indonesia: Bank Indonesia held its benchmark interest rate at 4.75% to maintain currency stability. The rupiah has fallen 3.5% YTD, making it the second-biggest loser in Asia. Bank Indonesia’s Governor criticised banks for being slow to pass through rate cuts, with lending rates down just 24bps despite 125bps of policy easing this year. Credit demand remains weak, with loan growth at 7.74% in November, below Bank Indonesia’s 8–11% target, as firms rely on internal funding. To boost lending, Bank Indonesia expanded reserve requirement relief to up to 100bps and raised interest on excess reserves to 3.5%. The measures aim to improve policy transmission, support credit growth, and sustain GDP growth of 4.7–5.5% this year.

Pakistan: Pakistan's central bank (SBP) cut its key rate to 10.5% on 15 December, below the 11.0% estimate, to support sustainable economic growth. The SBP said there is room to ease policy given a benign inflation outlook and a strengthening external position. Flood-related inflation and trade risks that previously kept rates on hold for four meetings were notably absent from the latest statement.

Thailand: The Bank of Thailand (BOT) cut rates by 25bps to 1.25% in line with estimates, the fifth cut in 14 months, and Governor Vitai Ratanakorn has left the door open to cut further if the need arises. The BOT kept its 2025 GDP growth forecast at 2.2%, but trimmed 2026 growth to 1.5%, citing weaker consumption and exports from income pressures and US tariffs, partly offset by a tourism recovery. Growth, in our view, is expected to improve in 2027, though remains below potential due to structural constraints. Inflation forecasts were revised down to -0.1% (2025), 0.3% (2026), and 1.0% (2027), with inflation expected to return to target by 2027, limiting deflation risk. The BOT signalled continued accommodative policy, close monitoring of the Baht, and a likely continuation of gradual rate cuts with limited room for further easing. The BOT has also proposed tighter controls on the gold trade to aim to curb Baht volatility, including requiring banks to provide details of gold trader foreign exchange (FX) forward transactions and asking gold shops to submit proof of sales with foreign counterparties.

South Korea: The government struck a new free trade agreement with the UK to safeguard GBP 2bn of British exports which were facing higher tariffs in January. South Korea’s government urged major exporters to step up FX hedging and cooperate to help stabilise currency markets, as USD/KRW hovers near 1,480, a multi-year low for the Won. Officials met with leading firms including Samsung, SK Hynix, Hyundai, and Kia, which agreed that FX stability is critical for business operations. Authorities are also seeking to curb spot dollar purchases by the national pension fund (NPS) as part of broader efforts to support the Won.

Latin America

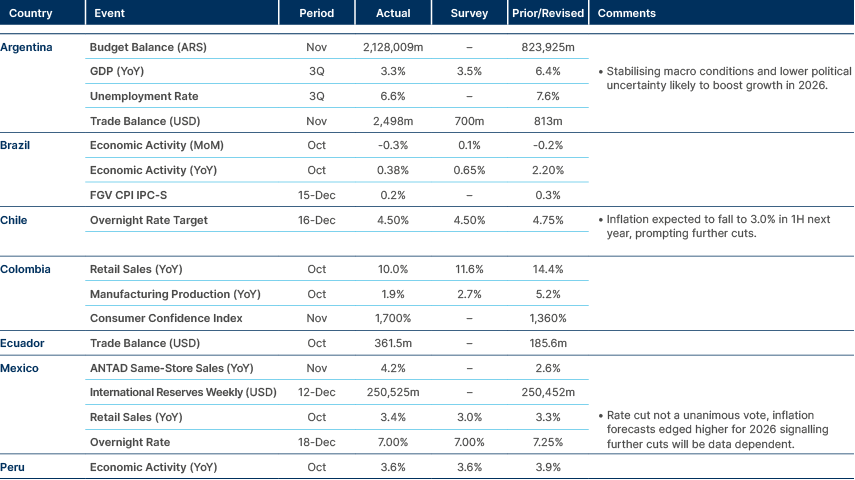

Argentina: Argentina’s central bank (BCRA) announced a new FX and monetary programme to rebuild reserves and strengthen capacity to pay. The FX band will now adjust to inflation from two months prior (starting January 2026, November inflation at 2.5%), allowing a gradual real depreciation. This is a shift from the previous policy, where the crawling peg was depreciating more slowly than inflation, leading to a strengthening of the peso in real terms and concerns around FX competitiveness. From January, BCRA plans to accumulate up to USD 10bn in reserves, consistent with money base growth to 4.8% of GDP (from 4.2%). Daily USD purchases will be capped at 5% of FX market volume (around USD 10–30m initially). Monetary policy remains contractionary, with BofA Securities seeing inflation falling to 17.4% in 2025 (from 31% in 2024).

S&P Global upgraded the country’s long-term foreign currency rating to ‘CCC+’ from ‘CCC’ on 18 December, citing stronger liquidity, easing economic vulnerabilities, sustained disinflation, and President Javier Milei’s mid-term electoral victory.

Argentina’s fiscal position strengthened in November, with the primary surplus rising to 1.7% of GDP YTD (from 1.5% in October), pointing to a 1.5% surplus for 2025, despite expected December seasonality. Revenues fell 9.5% yoy amid one-off export tax changes and the removal of the FX transactions tax, while cumulative revenues declined to 14.4% of GDP. Spending discipline remained tight, with primary spending down 14.2% yoy, driven by cuts to subsidies, capital outlays, and operating costs. Overall, strong expenditure control has kept net financing needs very low, despite revenue headwinds.

Brazil: President Lula’s approval edged up to 48.8% in December (from 48.6%), but remained below 50.7% disapproval, according to an Atlas survey. Government ratings improved at the margin, with 46.5% calling it good/great, mainly from voters previously rating it as average, though pessimism on the economy persists despite better expectations. Lula remains the clear 2026 election frontrunner, holding double-digit leads over Flávio Bolsonaro and São Paulo Governor Tarcísio de Freitas, even as the right stays fragmented.

Brazil’s Senate approved a bill imposing a 10% cut to federal tax exemptions, expected to raise BRL 22.5bn in 2026 to help meet the 0.25% of GDP primary target, alongside higher taxes on fintechs, interest on equity (JCP), and online betting. Separately, Brazil’s central bank (BCB) raised its 2025 GDP forecast to 2.3% on stronger H1 activity and agriculture but kept 2026 growth at a subdued 1.6% due to tight monetary policy, low spare capacity, and weaker global demand. The BCB cut its 2025 inflation forecast to 4.4% on restrictive policy and downside food price surprises, projecting inflation back to 3.0% by Q1 2028. It also widened the 2025 current account deficit forecast to USD 76bn (3.4% of GDP), reflecting a weaker trade balance, and signalled policy will remain tight, with Selic cuts likely only from March.

Chile: The central bank (BCCh) cut its policy rate by 25bp to 4.50%, in a unanimous decision that matched expectations. The key shift was neutral forward guidance, with the monetary policy committee (MPC) dropping language signalling further convergence toward neutral, likely reflecting that rates now sit within the 3.5%-4.5% neutral range.

Jorge Quiroz, Chief Economic Adviser to president-elect José Kast, signalled a pro-business agenda focused on faster environmental permitting by easing the burden of issue identification on firms. Quiroz also said the new government plans to shift from sectoral loans to tax credits tied to hiring, aims to support growth across industries rather than targeting specific sectors.

Kast said he favours a “unity government” through coordination, not a formal coalition, focusing on crime, immigration, and the economy. While this looser setup may work initially, it risks alienating right-wing parties with presidential ambitions if they remain outside the government.

Columbia: Fitch downgraded its long-term foreign-currency rating to ‘BB’ from ‘BB+’ on 16 December, while maintaining a stable outlook. The ratings agency cited weak debt dynamics, rigid spending, and political limits on fiscal repair. Fitch expects the central government deficit at 6.5% of GDP in 2025 to widen to 7.5% in 2026, as higher primary spending (+13% in 2025) offsets temporary interest relief from debt buybacks.

Ecuador: Moody’s affirmed Ecuador’s ‘Caa3’ rating with a stable outlook, stressing the review was not a rating action. The agency flagged high re-default risk due to weak market access and financing gaps in 2026–27, despite IMF support. Moody’s raised 2025 growth to 3.2% on a post-crisis rebound but expects a slowdown to 2% in 2026, with financing risks still elevated.

Paraguay: S&P upgraded sovereign issuer by one notch to ‘BBB-’ with a stable outlook, stating growth, commitment to maintaining a low budget deficit and increasing central bank policy credibility.

Peru: Protests resumed in Peru’s Tambo Valley against the USD 1.8bn Tía María copper project in Arequipa after construction began in November. Around 200 farmers blocked the Pan-American Highway, citing environmental and water use concerns, with organisers warning of an indefinite strike from March 2026. The project, approved by the government in October and targeting production in H2 2027, revives a long-running conflict that risks weighing on investor sentiment if unrest escalates.

Central Eastern Europe

Mixed inflation prints in Romania, Czech, and Hungary.

Hungary: The central bank held rates at 6.5% on 16 December, in line with estimates, marking the 15th consecutive month with no change. It cut CPI inflation forecasts for 2025 and 2026 to 4.4% and 3.2%, respectively.

Türkiye: Parliament approved a new tax package aimed at raising TRY 250bn in additional revenue, introducing new fees across sectors including jewellery, vehicle sales, healthcare documentation, precious metals, and livestock licenses. The law ends most rental income tax exemptions, raises social security service borrowing costs to 45% from 32%, and introduces new levies on vehicle transactions, while capping 2026 property tax value increases at 100%. The measures broaden the tax base and tighten enforcement, but increase costs for households and businesses amid already restrictive financial conditions.

Reports claim President Recep Erdoğan raised the option of returning Türkiye’s S-400 systems to Russia to ease tensions with the US and to regain access to the F-35 programme, though Ankara and Moscow have not confirmed this. Türkiye was removed from the F-35 programme and sanctioned under CAATSA in 2020, and US law requires ending possession of the S-400s for reinstatement.

Middle East & Africa

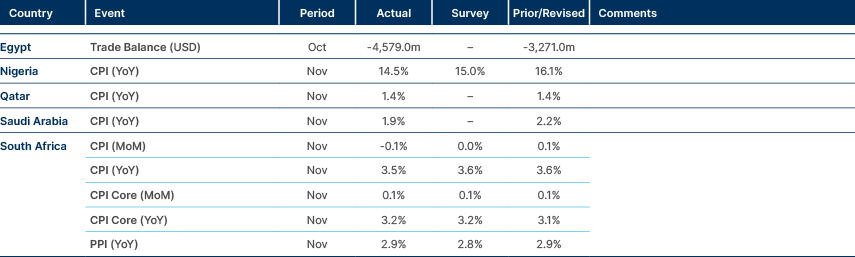

Ghana: The IMF completed its fifth review of Ghana’s USD 3.2bn extended credit facility programme, unlocking an immediate USD 385m disbursement and bringing total disbursements to USD 2.8bn. The IMF said programme reforms are delivering results, with growth beating expectations, inflation back within the 6-10% target range, stronger exports, and reserves exceeding targets. While the 2026 budget is aligned with programme goals, the IMF stressed the need for continued fiscal discipline, stronger revenue administration, and tighter oversight of state-owned enterprises to safeguard debt sustainability.

Ivory: Fitch upgraded the foreign-currency rating to ‘BB’ from ‘BB-’, citing political stability after President Alassane Ouattara’s re-election, policy continuity, and strong growth prospects. GDP is seen at 6.4% in 2025, rising to 6.5-6.6% in 2026-27, well above peers, with low inflation (<2%) supported by the XOF peg. Falling debt ratios, a narrowing current account deficit to 1.5–1.7% of GDP, and stronger reserves underpin the stable outlook.

Kenya: Kenya's cabinet approved the establishment of a national infrastructure fund and a sovereign wealth fund on 15 December, with a combined long-term mobilisation target of KES 5trn (approximately USD 39bn). Funds are intended to mobilise domestic and international capital for priority sectors including transport, energy, water and other large-scale public infrastructure.

Nigeria: Nigeria’s executive branch published its 2026-28 Medium Term Expenditure Framework, targeting a fiscal deficit of 3.6% of GDP in 2026 based on a USD 60/bbl oil price, USD/NGN 1,512, and oil output of 1.84 million barrels per day. The framework assumes inflation at 16.5% and GDP growth of 4.7%, with spending down 1% and revenues falling 16% in 2026. To plug the gap, the government plans NGN 17.9trn in new borrowing, with about 80% sourced domestically.

Oman: Oman and India signed a Comprehensive Economic Partnership Agreement (CEPA) on 18 December during Prime Minister Modi’s visit to Muscat, concluding talks launched in November 2023, as the Sultan awarded Modi Oman’s highest civilian honour. Regionally, Qatar and Oman signed two memoranda of understanding on 15 December to deepen trade and investment ties. Domestically, Oman rolled out the first phase of its “Maliya” unified government financial system, issued OMR 33.9m in treasury bills, held its annual central bank meeting with financial institutions, and launched the “Tamkeen” initiative to help SMEs compete for government tenders.

Saudi Arabia: Saudi Arabia's non-oil exports reached SR 307bn in the first half of 2025, marking the highest semi-annual growth on record, according to Minister Bandar Alkhorayef on 16 December. The Kingdom issued a record 6,986 investment licenses in Q3 2025, an 83% yoy increase and the highest quarterly total on record. Saudi Arabia's consumer prices rose 1.9% yoy in November.

Zambia: IMF staff reached a staff-level agreement on Zambia’s final extended credit facility (ECF) review, unlocking USD 190m (pending IMF board approval) in January 2026, bringing total disbursements to ~USD 1.7bn. The IMF cited restored macro stability and debt restructuring progress, with a 2.2% of GDP primary surplus in 2025, growth averaging 5.6% in 2026–31, and inflation returning to the 6–8% target by 2027. Copper production rebounded in October to 76,520 tonnes from 69,940 tonnes in September, lifting January–October output to 746,687 tonnes, about 75% of the 1 million tonne 2025 target. Emerald output surged to 7,267kg and gold edged up to 352kg in October, supporting FX inflows. The pickup reflects ramp-ups at major projects including Kansanshi S3 and Lumwana, despite ongoing power constraints. The IMF still expects mining-led growth, projecting 5.8% GDP growth in 2025.

Developed Markets

Germany: Germany announced that it will issue a record EUR 512bn in debt in 2026, up 20% yoy, marking a new high. The Finance Agency plans EUR 318bn of capital-market auctions and EUR 176bn via money markets, including EUR 16–19bn in green bonds.

UK: UK inflation eased by more than expected in November, with CPI inflation at 3.2% yoy, below the 3.5% forecast and down from 3.6% in October, shortly after the Budget. Economic activity improved in December, as the services purchasing managers’ index (PMI) rose to 52.1% (from 51.3%) and the manufacturing PMI climbed to 51.2%, its highest since September 2024, signalling continued expansion across both sectors.

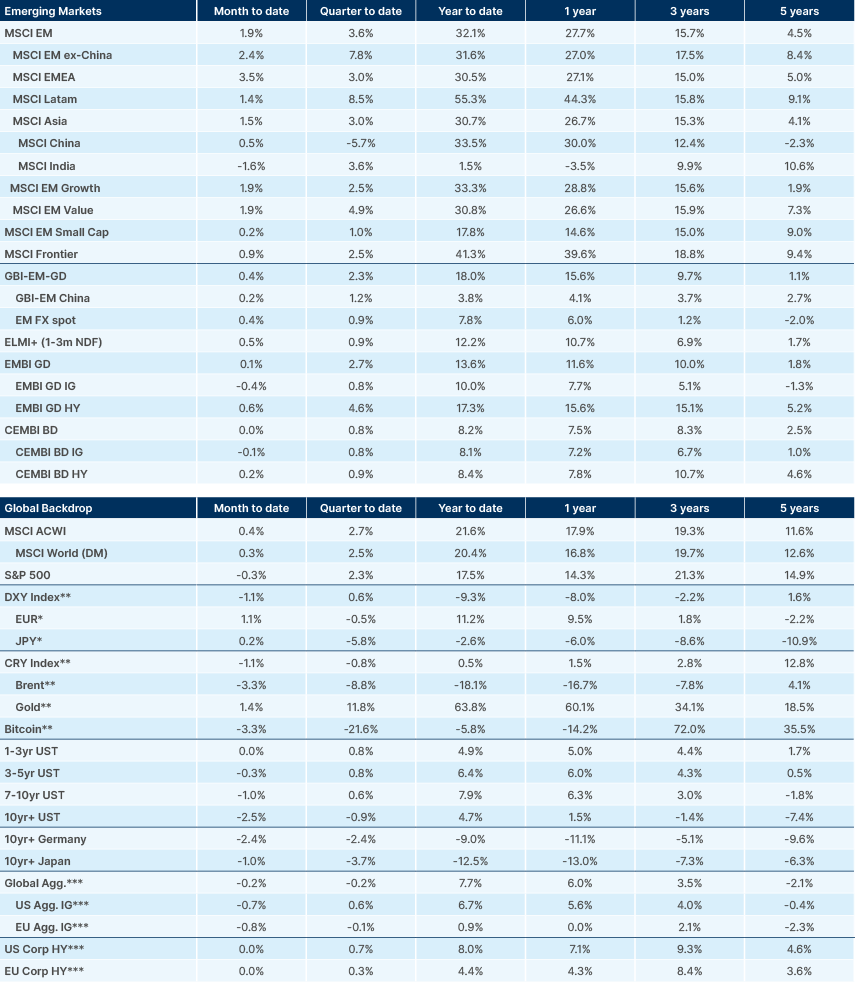

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.