Türkiye double upgrade showcases EM reforms. Milei stays on the ‘MAGA’ path

Türkiye double upgrade showcases EM reforms. Milei stays on the ‘MAGA’1 path

- Biden dropped out of US Presidential election and endorsed Kamala Harris.

- Trump signalled his preferred policies and chose his running mate.

- Sentiment to US stocks was bullish ahead of key events like the first Fed rate cut and US elections.

- China cut policy rates post-Third Plenum.

- Korean exports confirmed solid momentum in the semiconductor industry.

- Argentina intervened in the Peso, but its macro adjustment remained solid.

- Kenya cut expenditures after protests derailed tax hike plans.

- South Africa planned to cut red tape and boost infrastructure investments.

- Moody’s upgraded Türkiye by two notches to ‘B1’ and kept a positive outlook.

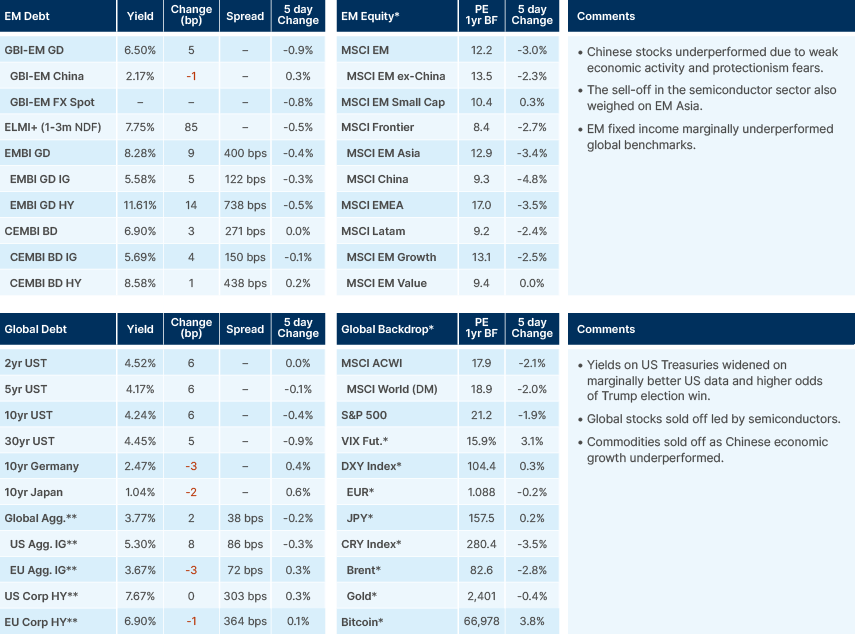

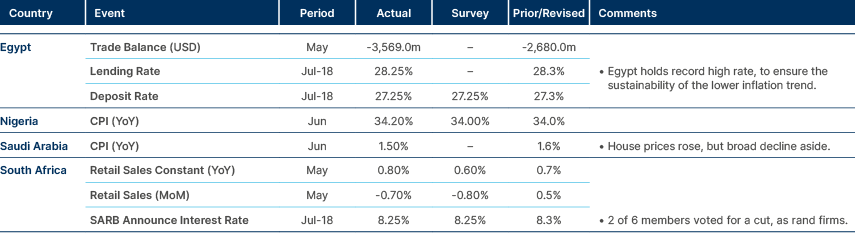

Last week performance and comments

Global Macro

US President Joseph Biden dropped out of the race. He endorsed Vice-President Kamala Harris, as did the Clintons, Alexandria Ocasio-Cortez, Gavin Newsom and Pete Buttigieg, but Barack Obama has not yet made an endorsement. Harris’s policies are unlikely to be significantly different than under Biden, but the odds of her defeating Trump are not high either. She is a better candidate than Biden, but has not been a great public speaker. She also polls poorly, even among women.2 The Democratic Party will announce the process, but a final decision is likely to come at the Democratic National Convention on 19-21 August.

In a Bloomberg BusinessWeek interview, Trump expressed concerns over the strength of the dollar against the yen and yuan, threatening tariffs if currency manipulation continues.

Key excerpts from the interview:

- On the Dollar: “So, we have a big currency problem because the depth of the currency now in terms of strong dollar/weak yen, weak yuan, is massive. They would fight it and I said (Trump in his first term), if you weaken it anymore, I’m going to have to put tariffs on you.”

- On tariffs: "I had it (tariffs on China imports) at 50% and I’ve never heard the 60%... Economically, it’s great. And man, is it good for negotiation."

- On Fed Chair Jay Powell: "I would let him serve it (his term ending in 2028) out especially if I thought he was doing the right thing."

- On Taiwan: "I know the people very well, respect them greatly. They did take about 100 percent of our chip business. I think, Taiwan should pay us for defence."

- On Iran: "I would have made a great deal with them - no nuclear weapons."

In other news, Trump named J.D. Vance, a 39-year-old Senator from Ohio with strong populist views, as his running mate. Vance is known for his criticism of Biden’s border policies and military aid to Ukraine, and his stance on China as the major threat of the generation.

Emerging Markets

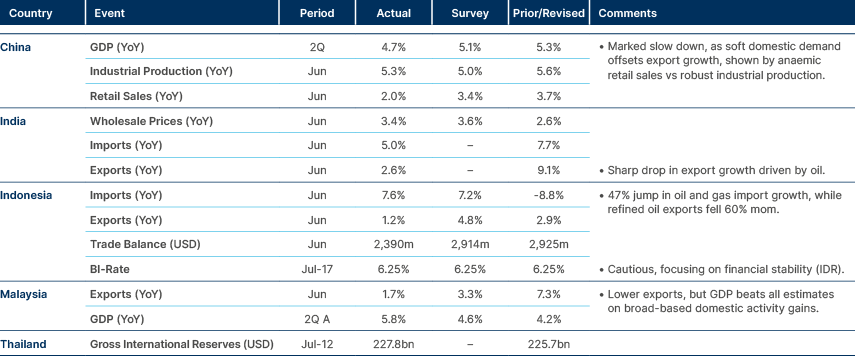

Asia

Softer GDP growth in China and softer exports from India, Indonesia and Malaysia.

China: Monday morning, the People’s Bank of China (PBoC) cut its seven-day reverse repo rate by 10 basis points (bps) to 1.7%. It was the first policy rate cut since August 2023. The repo rate has gained importance since last month, when the PBoC moved away from policies to control the quantity of money. The PBoC is trying to keep the yield curve steep to support financial stability. Further cuts are likely over the next months, but key for higher activity will be the increase in the annual government bond quota issuance, which could stimulate the economy in H2 2024, in our view.

The Third Plenum outlined key initiatives for coordinated reforms across major sectors, including fiscal, tax, and financial areas, with an emphasis on maintaining consistency in macro policy orientation. It also kept supply-side structural reform focus, including supply chain self-sufficiency, tech innovation and green infrastructure prioritised, alongside further institutional opening. Other policies included advancements in education, science and technology, and talent development, as well as integrated urban and rural development and land system reforms. A key change was to make it explicit that immigrants from the countryside to cities using the Hukou scheme to gain access to social security benefits will also retain their land rights.

Additionally, the communique spelt out the need to improve the income distribution system, enforce an employment-first policy, and enhance medical and healthcare systems. The reform tasks detailed in the resolution are slated for completion by 2029. Efforts will also be directed towards addressing key risks in the property sector and local government debts.

South Korea: This morning, Korea published its trade data for the first 20 days of July. Exports rose by 11.6% yoy in business days adjusted terms, or 18.8% unadjusted), buoyed by semiconductors exports, which rose by 57.5% yoy to USD 6.8bn and is now largest than the car industry (autos + parts) as shipments have picked up in recent months. Exports to China rose by +20.6% yoy; faster than to the US at +17.6% yoy. Korean and Taiwanese exports have in the past led the global manufacturing cycle and the earnings per share of Emerging Market (EM) technology sector, which today represents nearly one quarter of the MSCI EM Index.

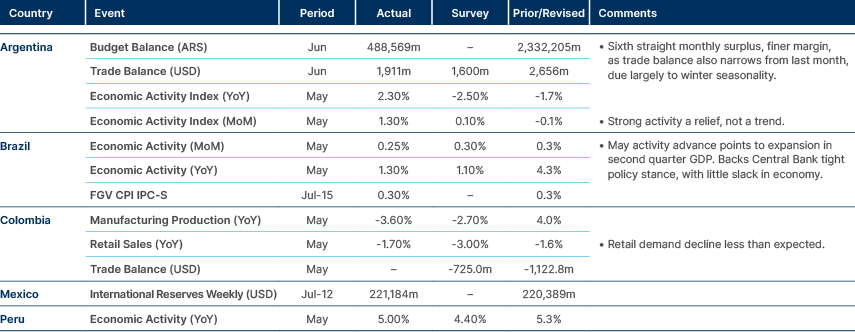

Latin America

Stronger economic activity than expected across the region, and another trade surplus in Argentina.

Argentina: Last weekend, Argentina’s government announced a series of measures aimed at controlling the parallel exchange rate and curbing inflation, including the sale of foreign exchange (FX) reserves. While these measures are expected to narrow the gap between the parallel and official rates, there are concerns that dwindling international reserves could pose significant risks.

The measures will aim to sell FX purchased at the official FX rate in the blue-chip swap (BCS) market, with the aim to sterilise the Pesos injected into the economy through the Dollar purchases. Because the BCS rate is much weaker than the overvalued official rate, this means that the government are still accumulating dollars at the margin. However, the announcement signals the government will prioritise closing the gap between the official and BCS rate, rather than accumulating reserves.

Economic parallels were drawn with 2018, when then-President Macri opted to intervene on the currency market to keep the ARS stable ahead of the general election in the following year. However, there are significant differences from now to 2018, in our view.

The first difference is fiscal. Milei’s government has immediately moved to a fiscal surplus in 2024, while Macri was running a 4% deficit in the beginning of his mandate 2016-17. Furthermore, significant supply-side reforms and deregulation has not yet impacted the economy. When the reforms take effect, gross domestic product (GDP) is likely to be driven higher, further stabilising debt and fiscal dynamics.

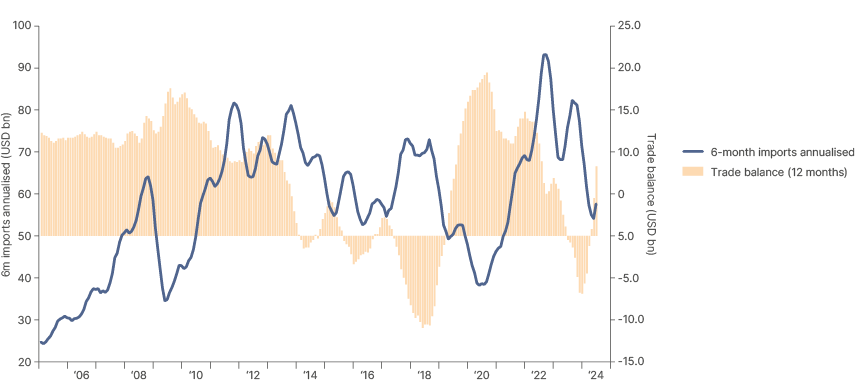

Exporters complain the currency is getting unattractive. Yet, the real-effective exchange rate (REER) is 45% below its post-2001 high in June 2003, according to the Bank of International Settlements. This is reflected in year-to-date imports, which are running close to the lowest level since 2010, excluding the pandemic drop, as per Fig. 1.

Fig. 1: Argentina Trade Balance (12m cumulative) and imports (6m annualised)

The trade balance is also rebounding, with the 12-month cumulative surplus of USD 8.3bn last month from a US 6.9bn deficit in December 2023. Again, this stands in contrast with 2018, when the country’s trade data reached a USD 11bn deficit in May 2018, from a USD 2.1bn surplus in December 2016. Stronger exports are being driven by a rebound in agriculture production and a boom in energy production. Despite these encouraging trends, sentiment remains quite negative (EMBI Argentina spreads around 1,600bps) today, compared to the euphoric times then (spreads hit a low of 346 in December 2017).

The key to sustainability will be whether Argentina manages to move to the second phase of its structural adjustment programme. After the significant fiscal consolidation and the approval of structural reforms, the economic team must finalise the renegotiation of short-term debt with banks to allow the central bank to hike policy rates back to positive levels. Alongside the large trade surplus, high real interest rates would re-anchor the ARS. The economic policy path and timing so far are in line with our expectations laid out at the beginning of the year.3

Uruguay: Uruguay maintained its policy rate at 8.5%, signalling the central bank’s commitment to keeping inflation at the midpoint of its 3-6% target. The bank forecasts inflation to stay within this band for the next 24 months.

Central and Eastern Europe

Hungary outperformed on the back of hopes for a better relationship between Prime Minister Victor Orbán with Donald Trump.

Central Asia, Middle East & Africa

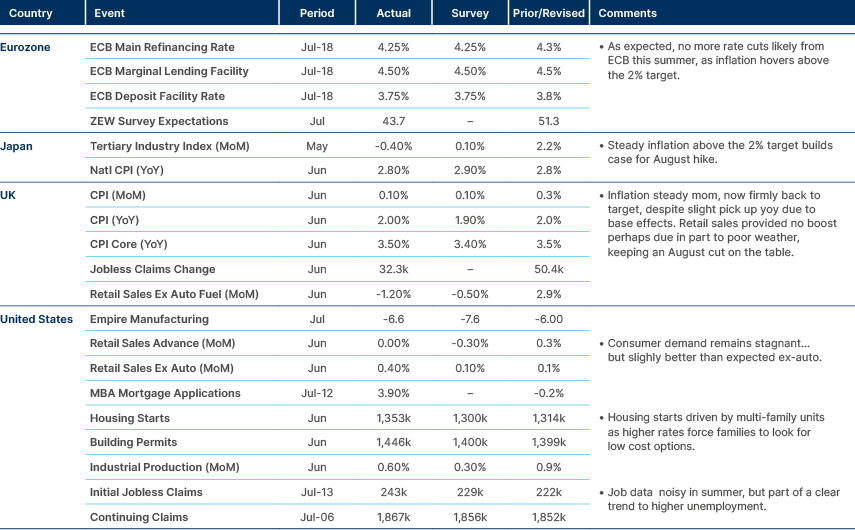

The European Central Bank (ECB) kept its policy rate unchanged, did not pre-commit to any specific path. Economic activity improved in the US, but the labour market kept softening at the margin.

Kenya: Following the withdrawal of tax hikes equivalent to 2% of GDP due to mass protests, Kenya’s Treasury indicated that the government plans to reduce 2024/25 spending by 0.7% of GDP. Revenues declined by only 1% of GDP, implying the government plans to raise revenues elsewhere, leaving the fiscal deficit 30bps wider at 3.6% of GDP in the revised budget. Importantly, the government announced a large cut in capital investments, which should be positive for external accounts and signal the commitment to adjust for the International Monetary Fund (IMF). Despite elevated debt/GDP, Kenya’s debt is likely to be on a sustainable path, assuming the country can keep its elevated growth profile, owing to its strategic position in East Africa.

Saudi Arabia: The IMF downgraded Saudi Arabia’s growth projections by more than any other major economy, due to the Kingdom’s decision to cut oil production. The IMF now forecasts a 1.7% growth rate for Saudi Arabia in 2024, a sharp decline from its previous estimate of 2.6% made in April. The 2025 estimate has been lowered from 6% to 4.7% for the same reason.

South Africa: In his first national address as head of the Government of National Unity (GNU), President Cyril Ramaphosa pledged to cut red tape that hinders skilled foreigners from obtaining work visas. Furthermore, plans are in place to overhaul dysfunctional municipalities to improve their efficiency and service delivery, increasing infrastructure investment, focusing on development projects across the country. The Minister of Public Works, Dean Macpherson from the Democratic Alliance (DA), will oversee these infrastructure projects and plans to attract ZAR 10bn (c. USD 547m) in private sector investment for new energy, communications, water, and transport infrastructure.

Türkiye: Ratings agency Moody’s upgraded Türkiye’s sovereign rating by two notches to B1 with a positive outlook. The three major rating agencies now have Türkiye at B+ with a positive outlook. “The key driver of the upgrade to B1 is improvements in governance, more specifically the decisive and increasingly well-established return to orthodox monetary policy”. Moody’s added that “the rating could be upgraded if the authorities managed to reduce inflation on a sustained basis, while also achieving lasting de-dollarisation and a stronger current account position.” The upgrade was expected, as Türkiye has been a key reform story as mentioned in our recent editorial piece to the Financial Times and the report on the improving EM fundamentals.4

Developed Markets

The European Central Bank (ECB) kept its policy rate unchanged, did not pre-commit to any specific path. Economic activity improved in the US, but the labour market kept softening at the margin.

United States: Fed Chair Jerome Powell and Governor Christopher Waller indicated that the Federal Open Market Committee (FOMC) was nearing a decision to cut rates, bolstered by second-quarter readings that suggest inflation is nearing the 2% target, with a better balance in the inflation and labour market mandates.

Investors are showing confidence in several upcoming events, assigning a 100% probability to a Fed rate cut on 18 September, a 75% probability of Trump winning the US election on 5 November, and a 68% probability of a ‘soft landing’ for the economy, according to a global managers survey by Bank of America.

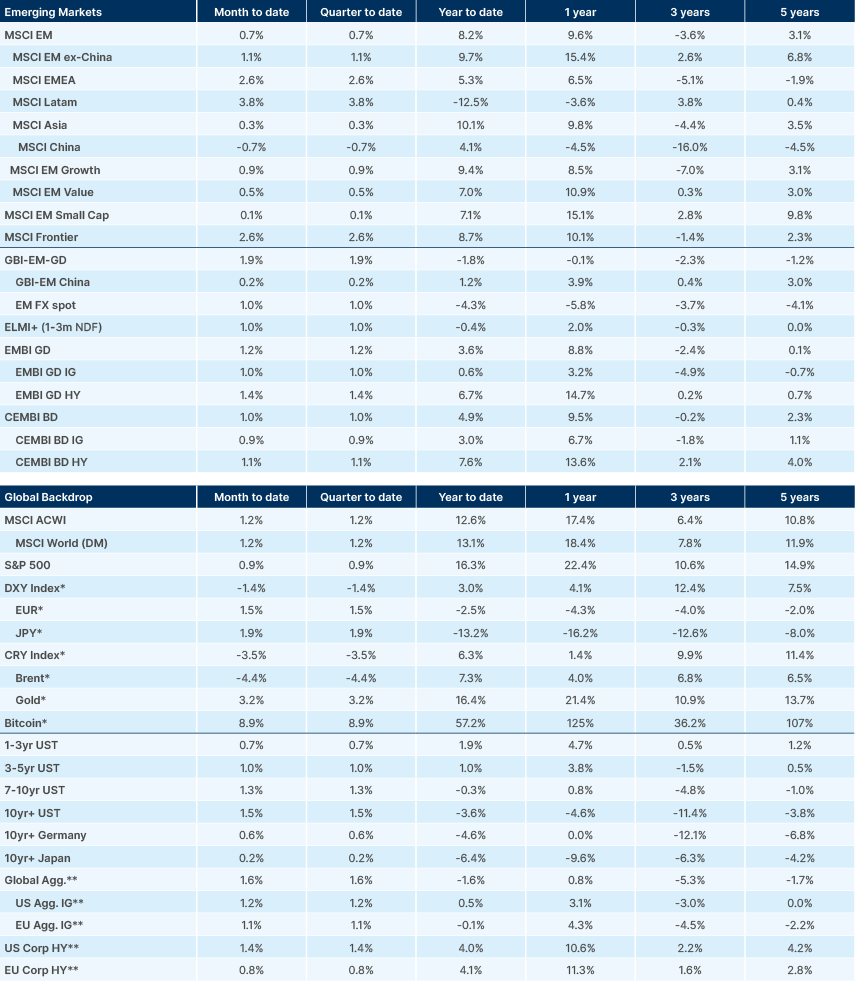

The bullish sentiment means assets where investors are overweight (like US equities) are at risk of corrections, particularly around key events, such as the likely first rate cut by the Fed on 18 September and the US elections on 5 November. Furthermore, following last week’s sell-off, the S&P500 is trading at levels where further negative price action would likely lead to a significant sell-off from systematic investors like CTA (Commodity Trading Advisors). This week, 137 companies in the S&P500 will report earnings, with highlights including Alphabet, Tesla, and LVMH.

Benchmark performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

1. See – Make Argentina Great Again.

2. See – https://today.yougov.com/topics/politics/trackers/kamala-harris-favorability

3. See – ‘The Last Tango: The Path to Make Argentina Great Again’, The Emerging View, 31 January 2024.

4. See – https://www.ft.com/content/3ce5b528-6969-4893-b0c7-cb553668600d and ‘The untold story of improving EM fundamentals’, The Emerging View, 27 June 2024.