Some light shed on big 2023 divergences, as geopolitical risks remain elevated

Economic data and price action last week highlighted some of the big macro divergences from 2023. Geopolitical risks increased again in the Middle East. Taiwan poll of polls showed voting intentions for a third candidate ahead of next week’s ballot as China increased political pressure for reunification. In China, wages for new hires declined the most since 2016. The Argentinian President announced a large reform package, including large hikes in fuel prices. Mexico placed a jumbo Eurobond deal early in the year. Türkiye hiked rates again to 42.5% as inflation declined in sequential terms.

Global Macro

Our 2024 outlook piece: ‘Resilience, Tails, and Inflections’ explained the source of resilience within Emerging Market (EM) debt and argued that the tail (global macro) scenarios (i.e., hard landing or no landing) had a higher likelihood of playing out than a soft landing.1 This was a non-consensus view, since in early December (when the piece was published) stocks and rates seemed to be pricing a very high likelihood of a soft landing scenario. This prediction must be monitored and updated, since this is a dynamic question yet to be resolved. There are three key data and market price dispersions that need monitoring to assess the economic (and markets) path within 2024. The gaps between manufacturing and service sector leading indicators (PMIs), the gap between coincident and lagging (hard) data vs. surveys (soft) data, and the relationship between stocks and bonds. The first week of the year brought important data that already warrants some thoughts.

Manufacturing vs. Services

The global manufacturing sector has been at negative levels (PMIs below 50) over most of the last 18 months, particularly in developed markets and the leading manufacturing developing countries (Taiwan, South Korea, and China). However, the service sector has remained strong, supported by tight labour markets and the lagged effects of the end of Covid policy restrictions. In recent quarters, the leading indicators to global manufacturing (Taiwan and South Korean exports) have rebounded sharply, partially because of the longer than usual inventory cycle. In the United States (US), the ISM Manufacturing survey improved to 47.4 points (pts) in December from 46.7pts prior, while the service sector declined 2.1pts to 50.6pts over the same period. Moreover, the ISM Services Employment index plunged from 50.7pts to 43.3pts. This matters, as the service sector is the largest employer in all large, industrialised economies. During most cycles, the manufacturing sector leads the service sector and the decline of the latter comes with a higher unemployment rate. If this relationship holds, this will be a powerful catalyst for a deeper economic contraction than most expected, potentially leading to more rate cuts than priced.

Soft vs. Hard Data

Another important element is the relationship between leading indicator surveys (soft) vs. activity-based (hard) economic data. It is a widely held view that a higher degree of political polarisation has been impacting the quality of the surveys. For example, in the US, Republican voters held a persistently bleaker view on the economy than the reality, while Democrats gave more optimistic views on the economy in surveys. This should lead the centre of the survey to be in the ballpark of where activity is, unless the economic agents answering the questions (purchasing managers in large companies and c-level executives in small/medium companies) are mostly Republicans or Democrats. The same is true in Brazil, for example, where the elite tends to favour libertarian policies espoused by the previous administration than progressive policies by the current one. So far, a weaker manufacturing PMI has not been observed in the hard data (industrial production or GDP), at least not in the US or Brazil, where both economies surprised to the upside. However, the latest details of the payroll report in the US suggests the labour market has continued to cool down – the three-month moving average of private sector non-farm payrolls continued to decline to close to 100k in December. If the hard data keeps converging to the soft data, this will add more weight to the soft landing thesis.

Stocks vs. Rates

December was a boon for risk assets, mostly as traders priced in a near-perfect ‘goldilocks’ scenario where the US Federal Reserve (Fed) would right-size its aggressive hikes (cut rates, but not sharply), as inflation keeps declining, allowing the economy to avoid a hard landing. In this environment, company earnings could rise after the small decline in 2023 (soft landing). Seasoned investors will remember that this is not how the relationship between stocks and rates typically operates. From the late 1990s until the Covid shock, the correlation between stocks and rates was most of the time in negative territory. In other words, higher rates typically came together with a strong economy (rate hikes) and higher stocks prices, while lower yields preceded a weaker economy (rate cuts) and stock prices declined. This relationship broke down in 2022 as the Fed’s repricing of real interest rates led to a sharp decline in the valuation of low profit tech companies, and the anticipated earnings recession of 2023 knocked down the valuation of even the top tech companies (Magnificent Seven). A persistent positive correlation between stocks and rates would bring the end to balanced (60/40) portfolios and risk parity strategies relying only on stocks and rates.

Over the medium to long term, the key question is whether modern central banks aiming at inflation targets can navigate supply-side shocks such as those imposed by the pandemic and the Russian invasion of Ukraine. This is the first cycle where the thesis that inflation target regimes are all that matters is being tested. After suffering a great blow to their reputations in 2022, central bank policymakers are more encouraged by the fast disinflation in H2 2023. This thesis may be tested again (hence the tails) if geopolitical risks, populist fiscal policies, trade and tech wars and energy shortage risks related to the energy transition prove to be persistent.

In the short term, we believe that lower interest rates will remain positive to risk assets (stocks) as long as credit spreads are declining (as it was the case in December). Data from UBS last week showed that credit spreads are more relevant in determining whether stocks move higher or lower than rates.2 In terms of narrative, lower rates and tighter credit spreads (soft landing) is a boon to equities, while lower rates and wider credit spreads (hard landing) would be very bearish for stocks. The price action from the first week of the year suggests lower rates from here wouldn’t be something stock investors would cheer as they did in December.

Geopolitics

The leader of Hezbollah, Hassan Nasrallah, promised revenge in a televised speech on Wednesday, after Saleh al-Arouri, the deputy Hamas leader, was killed in an explosion in Beirut the day before. Tensions have been running high between Israel and Hezbollah since 7 October, with daily shelling across the Israel/Lebanon border. If Israel were responsible for this strike, it would be the first time the IDF had hit a target within Beirut since 2006, marking a considerable escalation in tensions. Nasrallah said that the act will “not go unpunished”. While Israel has not claimed responsibility for the attack, a senior Biden administrator told reporters a US-led diplomatic effort was now underway to manage rising hostilities on Israel's north border.

A couple of days later, Iran’s supreme leader Ayatollah Ali Khamenei vowed “a harsh response” to a bomb attack on crowds who had gathered on Wednesday in the Kerman province to mark the four-year anniversary of the killing in Baghdad of General Qasem Soleimani by the US. A total of 84 people were confirmed dead from two separate blasts. Oil prices rose 5% on the news. Hassan Nasrallah has blamed Israel for the explosions; however, the Islamic State since claimed responsibility. Later in the week, the US killed an Iraqi commander of an Iranian-backed militia in a strike in Baghdad in response to assaults on American troops in the country.

In related events, shipping costs surged globally as companies were forced to re-route ships amidst Yemeni Houthi attacks on cargos sailing in the Red Sea, while the Panama Canal is operating at low levels due to a drought.3 The US told Houthi rebels they would face consequences if they failed to stop the disruption in maritime trade. The events are a reminder of supply shock risks amidst higher geopolitical tensions.

Emerging Markets

EM Asia

China: The Caixin China manufacturing PMI rose by 0.1 points to 50.8 in December, while the Composite PMI rose from 51.6 to 52.6. The People’s Bank of China injected nearly USD 50bn worth of subsidised loans into policy banks last month, suggesting the central bank may be increasing the availability of funding for construction projects to support the economy. Meanwhile, Chinese workers in major cities saw the biggest quarterly drop in average wages (-1.3%) for new hires since 2016, underscoring the reality of persistent deflation. In November, consumer price index (CPI) inflation declined by 0.5% yoy, the most in three years.

India: Services PMI jumped from 56.9 in November to 59.0 in December, lifting the composite PMI from 57.4 to 58.5 over the same period.

Indonesia: The yoy rate of CPI inflation declined by 30bps to 2.6% in December, 10bps below consensus. The manufacturing PMI rose by 0.5 point to 52.2 over the same period.

Vietnam: The yoy rate of CPI inflation rose by 10bps to 3.6% yoy in November.

South Korea: The trade surplus softened to USD 3.8bn in December as imports fell by 10.8% yoy, while exports rose by 5.0% yoy.

Taiwan: Presidential elections take place next weekend. In his New Year’s Eve speech, Chinese President Xi Jinping mentioned the “historical inevitability of reunification”. In the latest poll of polls, voting intentions for pro-China Kuomintang (KMT) candidate Hou Yu-ih declined to 29%, while Lai Ching-te, the frontrunner candidate from the incumbent Democratic Progressive Party (DPP), inched marginally up to 35%, albeit the gap varies between 3-11% depending on the poll. In a surprising development, Ko Wen-je, from the Taiwan People’s Party (TPP) gained 4% to 24% in less than one month, threatening the two-party system dominance. According to the Nikkei, Ko’s major shift took place when he started advocating for a free trade and services deal with China.4

Latin America

Argentina: Just before year-end, President Javier Milei sent a massive de-regulation ‘omnibus’ bill to Congress, spanning 664 articles over 350 pages. If approved, the bill would ratify Milei’s sweeping Urgent Decree or ‘DNU’ issued the previous week, and approve a two-year Public Emergency that would give the executive branch more powers to privatise public companies (such as YPF) and would whitewash the assets owned by Argentinian citizens. The dizzying number of changes introduced by this extensive liberalisation agenda has been met with both incredulity and anxiety in some parts of the population. The umbrella labour union General Confederation of Labour (CGT) has called for a general strike on 24 January. Meanwhile, Economy Minister Luis Caputo is already pushing to deal with the thorny issue of local debt maturities by introducing a ‘voluntary’ debt swap of as much as USD 71bn in peso bonds maturing this year (of which c. 60% is owned by public sector banks and agencies) for longer-dated instruments. Central bank foreign exchange (FX) reserves have increased by c. USD 3bn since last month’s devaluation, but inflation is expected to spike over the next few months. For illustration purposes, petrol prices increased 27% last week, on top of 35-45% mark-ups in the second week of December. Although this is entirely consistent with the “shock therapy” Milei presented during his campaign, reality is hitting consumer confidence hard. After years of slow erosion in their living standards, the shock therapy will be a harsh adjustment, suggesting Milei’s honeymoon period could be quite short. Milei is betting that his broad-range reforms will rekindle growth and the fiscal adjustment will bring down inflation in 2025.

Brazil: Brazil's current account deficit for November increased from USD 39m to USD 1553m (USD 430m expected). Foreign direct investment (FDI) for November increased more than expected over the same period, from USD 3.3bn to USD 7.8bn (USD 4.4bn consensus).

Colombia: The unemployment rate dropped by 20bps to 9.0% in December, the lowest level since 2018.

Ecuador: Finance Minister Juan Carlos Vega said the government intends to cut spending by up to 2.0% of GDP as President Daniel Noboa grapples with fiscal and debt crises. Vega has highlighted plans to reduce the number of public contractors and cut inefficiencies at state-run companies to win the support of the International Monetary Fund (IMF) for a new financing programme.

Mexico: The trade surplus rose to USD 629m, above consensus at USD 155m. The Finance Ministry announced its “largest debt placement in recent history” as it raised USD 7.5bn in dollar-denominated debt due in five, 12 and 30 years. Strong investor demand and lower US rates meant yields on the five and 12-year notes were 37bps and 30bps lower than a year ago, respectively.

Peru: Reports circulated on Thursday that Finance Minister Alex Contreras had resigned citing a lack of transparency in some government decisions. The speculation was fuelled after President Boluarte held meetings with two former ministers, Luis Carranza, and Jose Arista, on the previous day. However, on Thursday evening, Contreras denied reports of his resignation. The Peruvian sol recovered its losses after having sold off nearly 0.5% against the dollar on the rumours.

Central and Eastern Europe

Czechia: The budget deficit widened slightly, from CZK 269bn to CZK 288bn in November.

Hungary: The unemployment rate rose by 10bps to 4.2% in November.

Poland: CPI inflation fell to 6.1% yoy in December from November’s 6.6%, based on preliminary data. This was 0.4% below consensus expectations. The monthly inflation rate was just 0.1% mom vs. 0.7% expected. Economists still expect the central bank to keep its policy rate unchanged at 5.75% at its 9 January meeting.

Russia: The European Union (EU) imposed sanctions on Russia's state-run diamond enterprise Alrosa, as part of an import ban over the Ukraine war, in a bid to put further pressure on the Kremlin's finances. The state-owned enterprise is the world's largest diamond producer with a 30% market share and generated revenue of USD 4bn in 2022. In economic news, retail sales growth slowed in November, from 12.7% to 10.5%. Services PMI increased by 0.4 to 52.6 in December, in line with seasonal trends.

Ukraine: Ukraine's Foreign Minister Dmytro Kuleba told CNN that “We don't have a plan B. We are confident in plan A", implying that the west must continue to provide Ukraine with the resources necessary to win the war.

Central Asia, Middle East, and Africa

Nigeria: The S&P Global PMI increased to 52.7 in December, a significant move upwards from 48.0 in November.

Saudi Arabia: The current account surplus rose to USD 16.3bn in Q3 2023, from USD 15.3bn in Q2. Manufacturing PMI was unchanged at 57.5 in December.

Türkiye: The central bank raised its policy rates by 250bps to 42.5% in December, in line with consensus. The yoy rate of CPI inflation rose by 280bps to 64.8% yoy in December, nevertheless, inflation slowed in sequential terms as the mom rate declined from 3.3% to 2.9% over the same period.

United Arab Emirates: In a conference in Dubai on Wednesday, Diplomatic Advisor Anwar Gargash pledged to stick by a “strategic decision” to establish warmer ties with Israel. Gargash added that the UAE is working to support the Palestinians by raising the pressure on Israel to find a political solution.

Developed Markets

United States: The minutes of the December Federal Open Market Committee (FOMC) meeting stated: “Participants generally stressed the importance of maintaining a careful and data-dependent approach to making monetary policy decisions and reaffirmed that it would be appropriate for policy to remain at a restrictive stance for some time until inflation was clearly moving down sustainably toward the Committee’s objective…”. The FOMC noted the “clear progress” made in reducing inflation and expressed a willingness to cut rates in 2024, if appropriate. However, there was little to signal that this could happen as soon as March, as priced in the yield curve.

The labour market data remained solid with 216k jobs added in December, 50k above median survey expectations, and unchanged from November. December's unemployment rate was also unchanged at 3.8%. President Joe Biden tried to convert the strong data into votes after the news, saying “it had been a great year for American workers”, but former-president Trump is blaming Biden for the strong increase in inflation eroding workers purchasing power.5 Nevertheless, the survey details showed a more tepid labour market than suggested by the headline indicator, with the three-month moving average increase in private sector hiring declining to 104k, the lowest levels since Covid.

The ISM Non-Manufacturing survey results released later last Friday dropped 2.1 points to 50.6. Moreover, the ISM Services employment index plunged from 50.7 to 43.3, indicating softer payrolls over the next months. Right after, the probability of rate cuts in March rose to 80%, having fallen to 60% after the release of the non-farm payroll beat. The ISM Manufacturing index rose from 46.7 in November to 47.4 in December. In other economic news, US annualised GDP qoq growth slowed faster than expected in November, from 5.2% to 4.9%, while jobless claims rose slightly from 205k to 206k.

Eurozone: Germany's inflation rose by 50bps to a yoy rate of 3.8% in December, its fastest rate in three months, casting doubts over hopes that the European Central Bank will start cutting rates as early as March. Eurozone inflation also increased 50bps to 2.9% yoy in December, in line with consensus, as governments removed energy subsidies.

Japan:The JPY sold off by 3.0% last week, as a major earthquake shook Japan on New Years Day, leaving 94 dead and 22 missing. The Japanese government has mobilised JPY 4.7bn in reserve funds in relief efforts so far. As a result, the likelihood of a rate hike has decreased in the short term, as the central bank assesses the full extent of the damage on the economy. However, history suggests the market and economic impacts of natural disasters in well-prepared and well-insured countries like Japan tends to be short-lived. The main impact to monitor relates to policy. For example, the Fukushima nuclear disaster led to a sharp decline in investments in nuclear energy across both Japan and Germany, which – with the benefit of hindsight – now seems to many, like a policy mistake.

United Kingdom: UK retail sales grew 0.1% yoy in November, having declined -2.5% in October. Expectations were for another -1.3% decline. UK GDP grew 0.3% yoy, lower than expected. Nationwide house prices fell -1.8% yoy in November, more than expected. While not ruling out an election in May, Prime Minister Rishi Sunak said his “working assumption” was for the UK to go to the polls in the second half of the year. This comes as Labour shadow ministers have been playing up the prospect of a May election.

1. See – The Emerging View "2024 Outlook: Resilience, Tails, and Inflections", 5 December 2023.

2. See – https://neo.ubs.com/shared/d23XwGrXkdSxgYI/

3. See – https://blinks.bloomberg.com/news/stories/S6UH5PTP3SHS

4. See – https://www.taiwannews.com.tw/en/news/5070525 and https://asia.nikkei.com/Politics/Taiwan-elections/Ko-Wen-je-the-maverick-seeking-to-break-Taiwan-s-two-party-dominance

5. See – https://www.ft.com/content/1a88f644-2670-4a9c-8d67-1e269096be0b

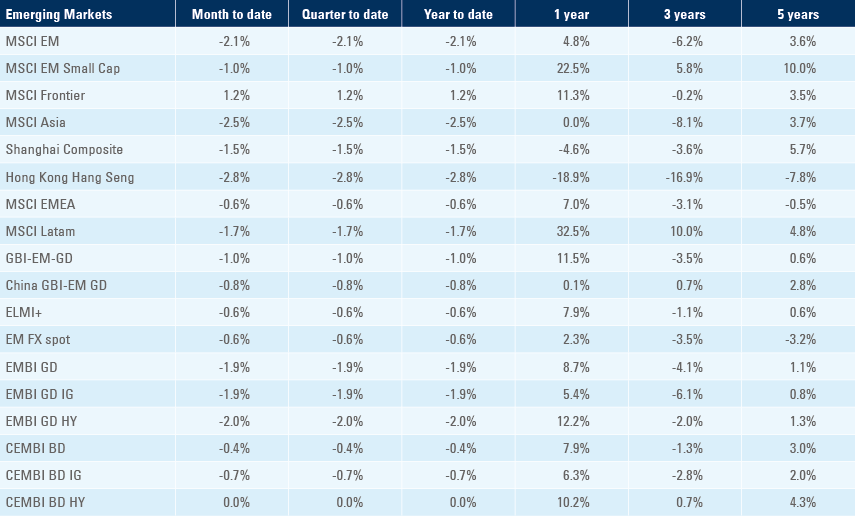

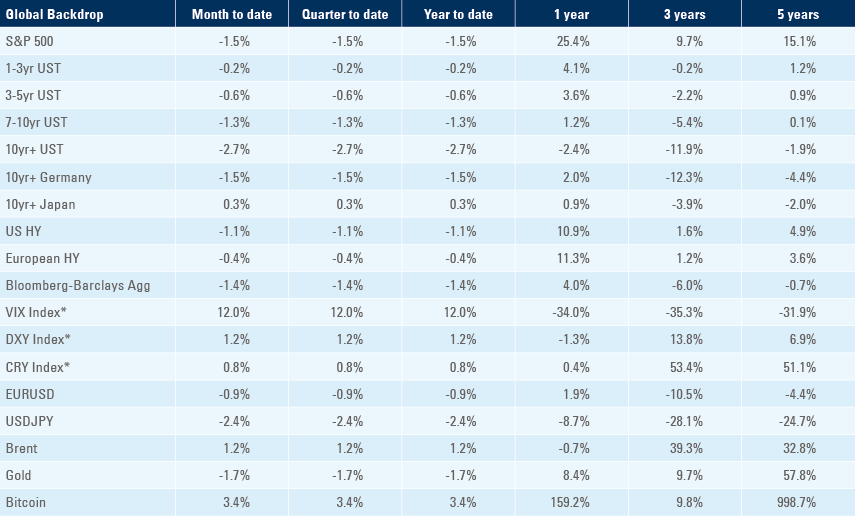

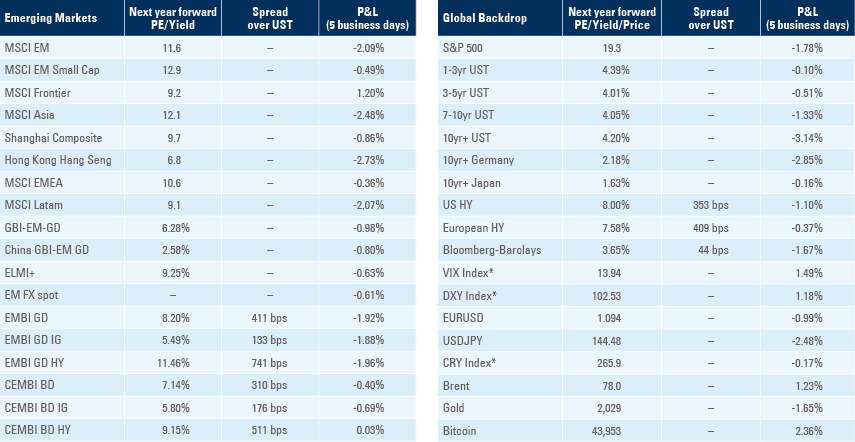

Benchmark performance