- Yields rise on inflation, fiscal, and institutional risks...

- … but US equity markets still de-sensitised from tariff risks.

- China aims to curb excess capacity from its economy.

- Malaysia cuts policy rates by 25bps, Korea unchanged, as expected.

- Vietnam growth surprised to the upside in Q2 2025.

- US slaps 50% tariffs on Brazil due to political reasons.

- Colombia’s fiscal and political dynamics remain challenging.

- Romania announced a bold fiscal consolidation package and issued new Eurobonds.

- Azerbaijan and Oman upgraded to investment grade.

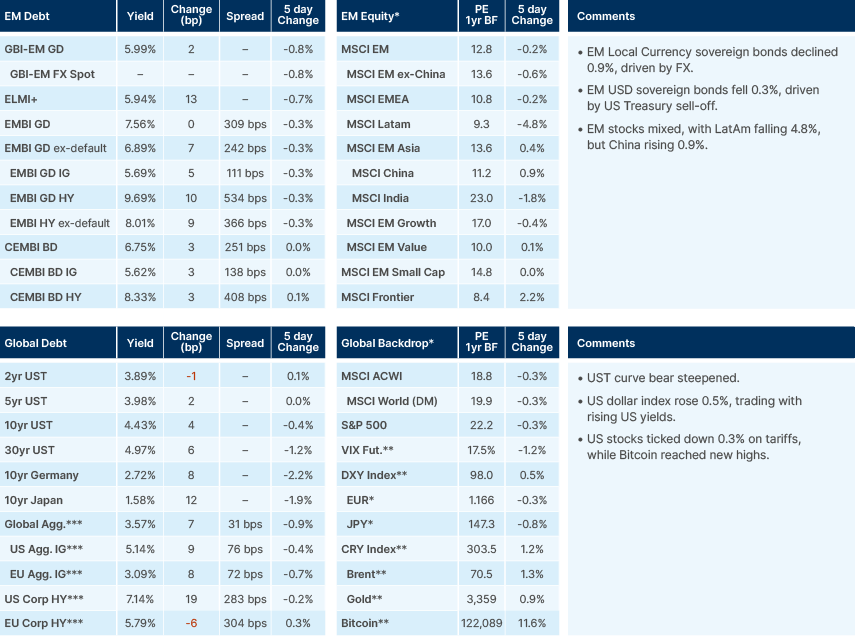

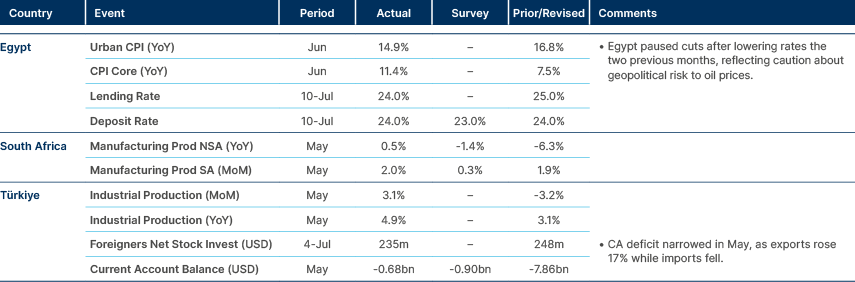

Last week performance and comments

Global macro

Trump threatened the EU with a 30% tariff over the weekend, to come into effect 1 August. The EU has said it will not retaliate and is seeking a deal. Mexico was also levied a 30% tariff against goods not covered by the USMCA free trade deal, but these are expected by Mexican officials to make up less than 15% of trade with the US this year. Mexico’s President Claudia Sheinbaum said she still believes a deal can be made with the US. Earlier last week, Donald Trump, with very little warning, announced 50% tariffs on copper, and threatened to add 200% tariffs on pharma. The spread between US and European copper futures widened to the largest on record.

Despite the clear re-intensifying of tariff talk from Trump, US stocks have not blinked, even as yields are rising. The S&P 500 recovery from April’s lows has been led by tech stocks, whose supply chains are likely to be largely exempt from tariffs. However, even the equal weighted SPX index has continued to rise, now only 1% below the record highs in December last year. Investors are looking through tariff risks to focus on the prospect of rate cuts in the Autumn. It is worth noting that in Euro terms the currency effects explain a lot of the recovery in US stocks. In Euro terms, the S&P 500 is down by 9.3% from its highs and the equal weight is down by 11.7%.

Chinese equities were supported after US Treasury Secretary Scott Bessent said he will aim to meet with Chinese officials in the coming weeks, following recent discussions where both parties agreed to ease tariff restrictions. Bessent said. “We had good meetings in Geneva, in London. We both approached it with great respect. I think there are things for us to do together if the Chinese want to do it. So, we will discuss whether we are able to move beyond trade into other areas.”

The risk of Trump removing Federal Reserve (Fed) Chair Jerome Powell increased last week. The US Office of Management and Budget chief, Russel Vought, sent a letter to Powell asking whether he had misrepresented facts to Congress regarding the renovation costs of the Fed’s HQ. Costs have reportedly run USD700m over budget. The Director of the Federal Housing Finance Agency, William Pulte, released a statement saying: “I’m encouraged by reports that Jerome Powell is considering resigning. I think this will be the right direction for America and the economy will boom.” It does not appear that markets are pricing this risk. The initial reaction, according to Deutsche Bank research, could be a 3-4% sell-off in the trade-weighted dollar, and a 30-40 basis points (bps) sell-off in long-dated US Treasuries. What happens next would depend on the new appointment, and whether the Fed Board coalesces around the institution’s independence. This would be particularly challenging if inflation rises in the coming months due to tariffs.

Some would argue stocks can do well in this environment (a claim on real assets). However, the likely curve steepening amidst an unstable institutional environment and elevated valuations would initially bring stocks down, in our view. Large external liabilities could make the US very vulnerable to such shocks. Against this backdrop, former Fed Governor Kevin Warsh said rates should be lower as tariffs are not inflationary. Warsh added that “bad economic policies” from the central bank are constraining growth and stressed the Fed needs “regime change,” including new personnel.

Indeed, fears of inflationary pressure and institutional instability contributed to US Treasuries widening. It does not help that yields are under pressure across the globe. So far in July, the yields on 30-year bonds are up by 20bps in the US, 16bps in the UK, 25bps in Japan, and 14bps in Germany.

European bonds will likely see more supply because of the German fiscal stimulus, whilst demand from some investors is declining. Dutch pension funds are expected to sell about EUR 125bn of long-dated European sovereign bonds (mostly German, Dutch, French) between now and 2028 as they migrate from defined benefit to the new Dutch defined contribution regime. Roughly half of those sales are likely to hit the market within the next six to 12 months, when the two biggest schemes switch. Japan yields are under pressure due to fears of further fiscal expansion following parliamentary elections this Sunday (20 July). Fears of fiscal deterioration have been in vogue in Britain since the Liz Truss debacle.

Emerging Markets

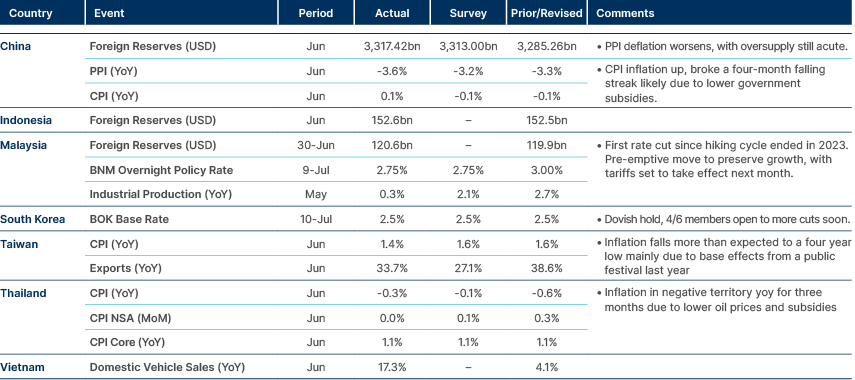

Asia

Malaysia cut rates, Korea held rates, Vietnam’s growth surged.

China: Chinese real estate stocks jumped more than 11%, the largest one‑day gain in nearly nine months, after unverified social media reports suggested a high‑level government meeting could be convened next week to shore up the struggling sector.

The Central Finance and Economic Affairs Commission elevated supply‑side reform to a top priority, focusing on curbing disorderly low‑price competition and promoting the orderly withdrawal of obsolete production capacity. Although demand‑stimulating policies since September have aligned retail sales with GDP growth, consumer price index (CPI) inflation remains very low, and the producer price index (PPI) has been in deflation for 32 months. Restoring sustained inflation may require a playbook like 2015-16. Back then, industrial capacity utilisation fell from 80% in 2012 to 73% by 2015 even as the PPI stayed negative; the People’s Bank of China responded by cutting policy rates eight times, reducing the reserve requirement ratio seven times, and carrying out large shantytown renovation projects to absorb excess capacity.

Today’s overcapacity has shifted from upstream sectors—coal, steel, glass, and cement—to downstream consumer goods, driven by slower post‑COVID consumption recovery, government‑led overinvestment, and delayed exits due to weak M&A and bankruptcy processes. Historical evidence suggests that PPI inflation bottomed out within months after capacity reductions began, although capacity utilisation took roughly a year to recover. This month’s Politburo meeting is expected to bring a new policy framework for excess capacity reduction and regulations to restore healthy competition, with central and local governments coordinating voluntary production cuts, restricting price undercutting through accounts‑payable cycles, and supporting reduced working hours to rebalance supply and demand.

Malaysia: Bank Negara Malaysia (BNM) cut its policy rate by 25bps to 2.75%, citing growth concerns and risks from weaker global trade, subdued sentiment, and lower commodity production. BNM projected no further rate cuts this year, emphasising that while Malaysia’s economy remains on a “strong footing” with solid fundamentals, this adjustment provides a buffer against potential external headwinds and that inflation remains well‑contained.

Pakistan: China reportedly refinanced USD 3.4bn in loans to Pakistan, helping to rebuild foreign reserves that had fallen to USD 9.1bn following recent commercial debt repayments.

South Korea: The Bank of Korea held its policy rate at 2.50%, balancing growth concerns against financial stability risks from rising household debt and an overheating housing market. The decision was unanimous, although four of the six Monetary Policy Committee members saw potential for rate cuts in three months’ time. A second supplementary budget is expected to boost growth by 0.1%, matching the impact of the first budget. New mortgage restrictions were implemented, including a cap of KRW 600m on loans in speculative zones and tighter debt service ratios for borrowers. Exports rose 9.5% yoy in the first ten days of July, driven by a 12.8% increase in semiconductor shipments and a 13.3% jump in automobile exports.

Vietnam: GDP growth accelerated to 8.0% yoy in Q2 from 7.0% in Q1, the fastest pace since Q3 2022. Broad-based strength was evident across the services sector (8.5% growth), industry (9.0%) and agriculture (3.9%). Trade remained resilient despite global headwinds, with exports up 18.0% yoy and imports rising by 18.8% over the same period.

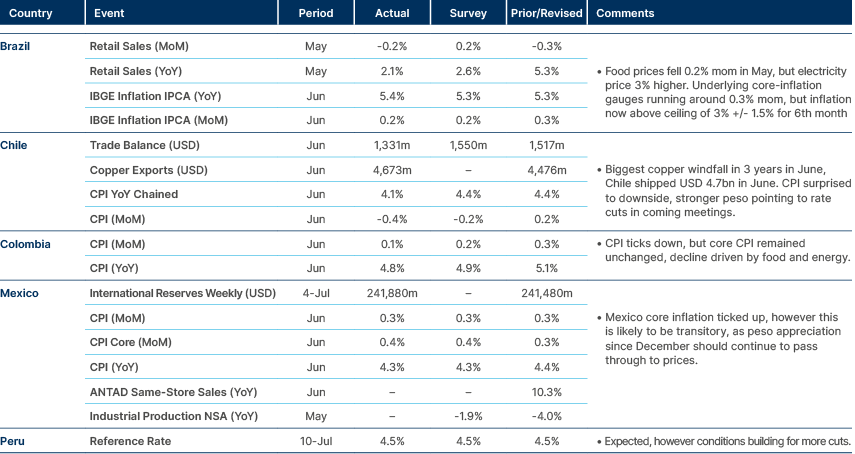

Latam

Brazil’s inflation a bit above consensus, Colombia a bit below. Peru held rates as expected.

Argentina: Congress passed pension reforms over government opposition, with the Senate approving the measures unanimously by a 52-0 vote; President Javier Milei has pledged to veto the legislation. The opposition threatens spending bills with total annual fiscal costs ranging from 0.7% to 2.5% of GDP, but Economy Minister Luis Caputo stated there is zero chance the government will validate these measures, as Milei plans vetoes and constitutional challenges. The risk is a bit larger this time, as provincial governors who initially helped ensure legislators upheld the president’s vetoes are now aligning with the broader opposition. Nevertheless, Argentina’s strong presidential system, and the government’s relatively high popularity, make it difficult for the opposition to derail Milei’s fiscal agenda, in our view.

Brazil: The US imposed a 50% tariff on goods as punishment for a “witch hunt” against ex-President Jair Bolsonaro over an alleged coup attempt following the 2022 election. Although this levy could disrupt certain Brazilian exporters, Brazil’s exports to the US account for just 1.7% of GDP and are dominated by raw materials, so the economic impact should be limited.

President Lula vowed a defiant response, stating on X: “Brazil is a sovereign nation with independent institutions and will not accept any form of tutelage,” and warning that any unilateral tariff increase would be met under Brazil’s Law of Economic Reciprocity. São Paulo Governor Tarcísio de Freitas met with US Chargé d’Affaires Gabriel Escobar in Brasília to discuss the tariffs’ impact on the state’s industrial and agricultural sectors and emphasised the need for fact-based negotiation while criticising the federal government’s ideological approach. He later conferred with Bolsonaro to coordinate efforts against the tariff decision.

In other news, Central Bank Governor Gabriel Galipolo maintained a hawkish stance, reaffirming his forecast that inflation will return to the target band of 3.0% plus or minus 1.5% by the end of Q1 2026, and noted that obstructions to monetary policy transmission such as subsidised rates will require higher rate hikes to ensure inflation converges to target. In fiscal policy, the Lower House approved a bill cutting tax benefits by 10% over two years, a measure expected to raise around BRL 20bn in additional revenue in 2026 if passed by year-end, according to Finance Ministry Executive Secretary Dario Durigan.

Chile: Polling data shows Communist Party candidate Jeannette Jara leading first-round scenarios with 39% support, although she would narrowly lose run-off contests against right-wing opponents by slim margins.

Colombia: Colombia’s external debt reached a nominal record of USD 208bn in April 2025, equivalent to 49.2% of GDP, driven primarily by increased public sector borrowing. With debt at historical highs, the government’s capacity to withstand future shocks appears to have diminished, making domestic policy outcomes more vulnerable to external market sentiment.

In other news, Congress banned the publication of presidential voting intention polls until 31 October and added new requirements that surveys include respondents from all cities with populations over 800k as well as a representative mix of smaller municipalities. The law passed with bipartisan support in the final hours of the congressional session without prior consultation with leading pollsters or media organisations. Critics warn the blackout will deprive the public of scientific electoral data and may fuel misinformation, while proponents argue it will level the playing field and reduce polling’s influence on voter behaviour. The bill seems to be motivated by political elites seeking to control the pre-campaign narrative. One day before the law’s approval, President Gustavo Petro tweeted that he “distrusts the transparency of the 2026 elections.” A Guarumo poll prior to that showed hospitalised candidate Miguel Uribe leading with 13.7%, followed by independent journalist Vicky Dávila at 11.5% and Historic Pact’s Gustavo Bolívar at 10.5%; Sergio Fajardo had 8.7%, Daniel Quintero had 8.1% and Claudia López had 5.3%, while roughly one-third of respondents did not reply.

Mexico: The board of the central bank indicated that no further 50bps rate cuts are planned, as Deputy Governor Jonathan Heath advocated for a pause in the easing cycle. The government is in talks with the US after Trump threatened a 50% tariff on Mexican copper imports and increased the tariff for goods not compliant with USMCA rules to 30%.

Peru: Peruvian tax collection rose by 12.7% yoy in June to PEN 12.3bn, driven by stronger economic activity and higher corporate profits.

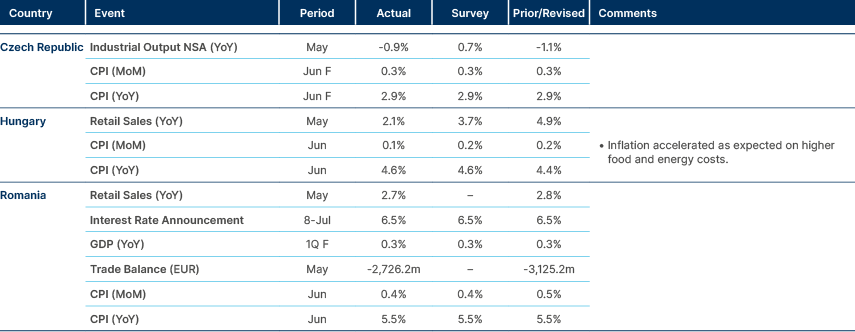

Central and Eastern Europe

Inflation higher in Hungary, unchanged in Czechia/Romania

Czech Republic: The Pirates party has proposed major increases in tax credits alongside a new 6.0% value added tax on basic foods, to be funded by CZK 24bn in additional tax revenues and subsidy cuts.

Romania: The finance ministry tapped foreign markets at strong demand, raising USD 3.75bn and EUR 1.5bn and bringing total foreign borrowing to EUR 10bn. In an emergency procedure that allowed the government to assume responsibility and bypass full parliamentary debate, officials approved the first fiscal package aimed at cutting the budget deficit to the target level. The final version of the bill broadened the base for healthcare contributions to include more pensioners and reduced subsidies for political parties by 40% compared with 2024. The government did not disclose the quantitative impact of these modifications. The original draft had envisaged RON 10.75bn (0.6% of GDP) in 2025 and RON 92.6 bn (4.45% of GDP) in 2026. Credit ratings agency Moody’s praised the measures but urged strict fiscal discipline, leading it to improve its deficit forecasts for both years.

Ukraine: The US resumed weapons supplies to Ukraine after President Trump personally approved transfers under NATO financing, marking his first authorisation under the Presidential drawdown authority.

Central Asia, Middle East, and Africa

Egypt paused rate cuts, Türkiye’s current account improved.

Azerbaijan: Moody’s upgraded Azerbaijan’s sovereign rating to ‘Baa3’, matching Fitch’s level and assigning a positive outlook. The upgrade reflected improved fiscal performance, successful diversification away from oil and gas revenues, and ongoing structural reforms in the monetary, fiscal, financial and governance arenas.

Egypt: The current account deficit halved quarter on quarter to USD 2.3bn in Q1, supported by an improving trade balance and robust tourism revenues.

Ghana: President John Mahama announced that FX reserves now cover six months of imports and potentially exceed USD 13.5bn, marking one of the highest reserve levels in the past 15 years.

Morocco: GDP growth accelerated to 4.6% yoy in Q2, driven by improved performances in services, construction and extractive industries, with agriculture contributing with 0.5% to overall growth.

Nigeria: Petrol imports fell to a record low in June as the Dangote Refinery increased its output to 252k metric tonnes, thereby reducing the country’s reliance on European fuel suppliers.

Oman: Moody’s raised the sovereign rating from ‘Ba1’ to ‘Baa3’ with a stable outlook, citing improved debt metrics and a reduction in the fiscal breakeven oil price to below USD 70 per barrel. This marks Oman’s second upgrade and brings it into the investment grade cohort of the JP Morgan EMBI Global Diversified index alongside Azerbaijan.

Saudi Arabia: Cabinet approved a new law allowing foreigners to own property anywhere in the Kingdom, expanding ownership rights beyond previously designated special zones to include major cities such as Riyadh and Jeddah.

South Africa: The African National Congress reported that its membership declined by 29%, from 691k in 2022 to 584k at the end of 2024, ahead of the 2026 local elections.

United Arab Emirates: Sales of properties priced at USD 10m or more in Dubai reached a record USD 2.6bn in Q2, an increase of 63% in yoy terms.

Zambia: The government allocated nearly half of its June budget (ZMW 11.0bn out of ZMW 22.9bn) to debt servicing costs, including ZMW 5.8bn on external debt and ZMW 4.7bn on domestic debt.

Developed Markets

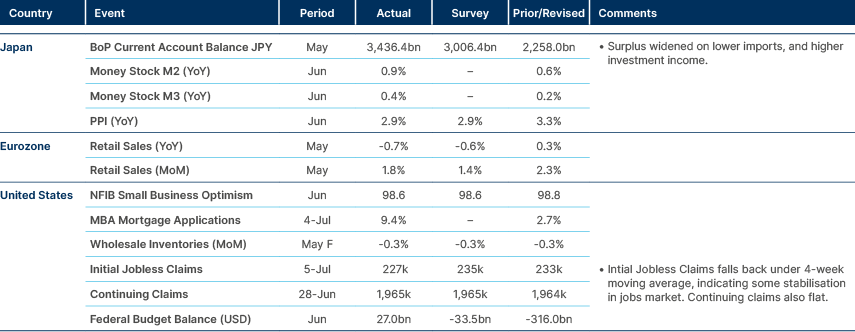

Japan’s current accounts surplus widened, US employment data stable.

Japan: Spring wage negotiations produced an average pay increase of 5.25%, the largest rise in 34 years. However, real wage growth remains suppressed by high inflation, especially for staple goods such as rice, and by the weak JPY, which may prompt the government to pursue more expansionary fiscal policies. The combination of robust nominal wage gains and strong domestic consumption makes it easier for the Bank of Japan to consider raising interest rates in the future, but ongoing uncertainty over potential US tariffs clouds the near-term outlook.

There has also been ample speculation about a grand accord involving currency levels with the US. To defuse such rumours, Japanese Finance Minister Katsunobu Kato said last week he’s not planning to hold talks specifically on currencies with Bessent soon. He said he hasn’t decided whether to attend the G-20 Finance Ministers and Central Bank Governors’ meeting in South Africa next week.

United States: While tariff revenue did hit an all time high in June, rising to USD27bn, the USD27bn budget surplus recorded by the US in June is an unadjusted number, and does not reflect around USD100bn worth of outgoings that were pushed forward to the end of May, due to June 1st falling on a weekend.

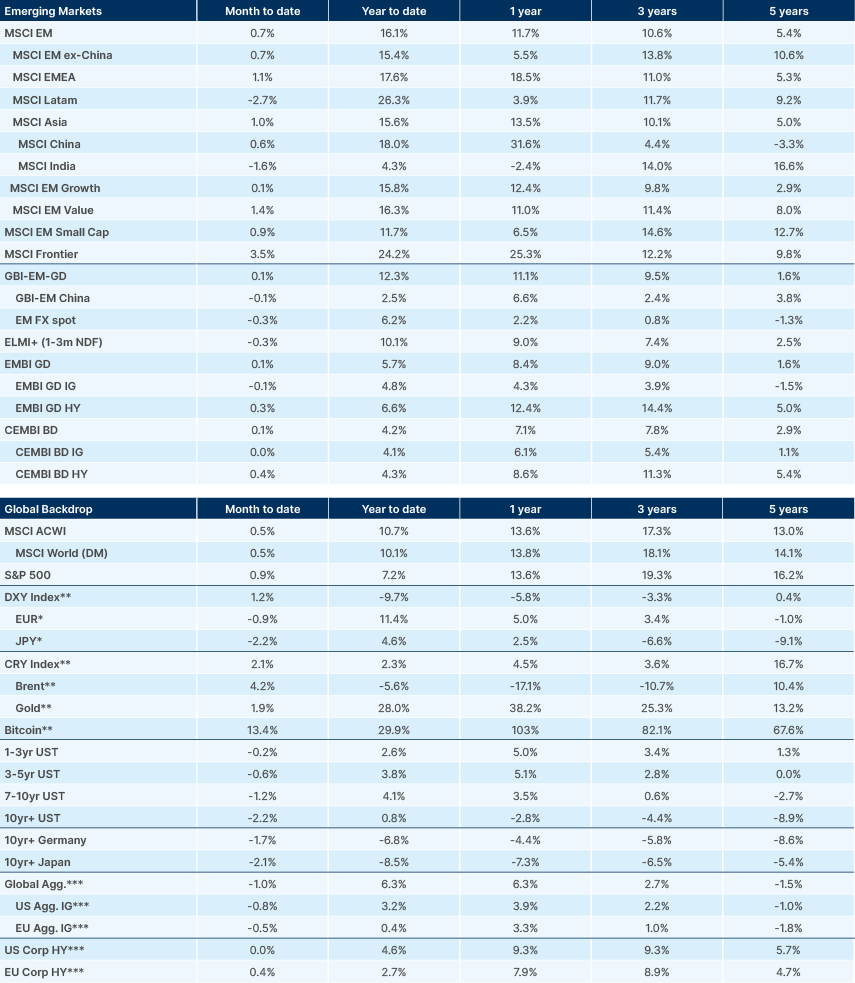

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.