- Unwind of crowded positions dominated price action over the last two weeks.

- G-20 OECD leading indicator revisions show a weaker-than-expected cycle.

- Discussions for a ceasefire in Ukraine intensified.

- Heightened risk of conflict between Iran and Hezbollah while ceasefire in Gaza negotiated.

- India unveiled a prudent budget: infrastructure investment elevated and deficit declining.

- Paraguay and Azerbaijan sovereign debt ratings were upgraded to investment grade.

- Venezuela’s Maduro claimed election victory with 51.2% of votes, disputed by the opposition.

- Gabon was downgraded to CCC+.

- The Central Bank of Türkiye repaid a USD 5bn deposit from Saudi Arabia.

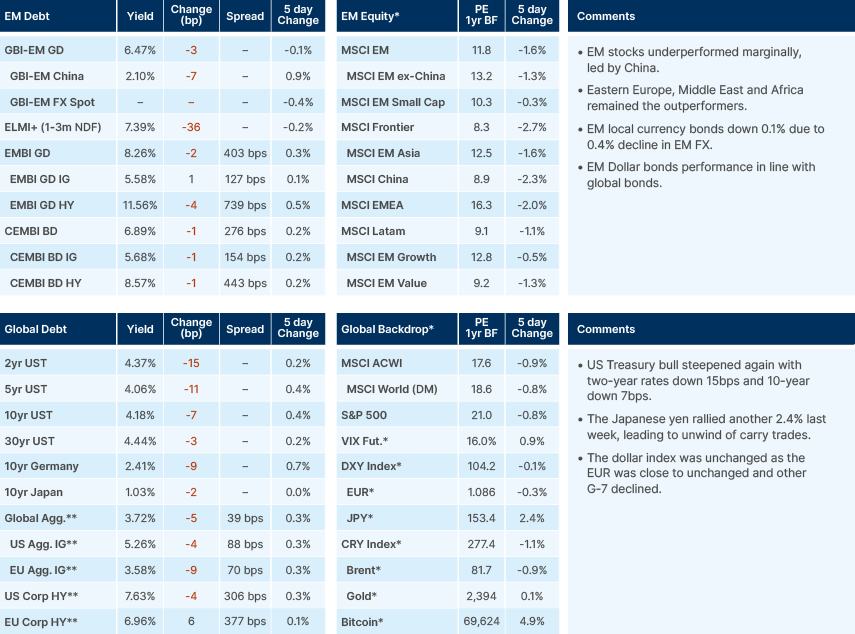

Last week performance and comments

Global Macro

There was an overwhelming reduction in ‘crowded’ positions over the last two weeks. The world’s favourite funding currency for carry trades – the Japanese Yen – rebounded 5% from its lows. Over the same period, the Nasdaq sold off 9% from its highs, as US small cap stocks rallied 11%.

Bulls have argued the recent market correction is healthy, noting that key levels across asset classes and investment grade spreads are holding. However, risk premiums are very low as investors had fully priced in the Federal Reserve (Fed) cutting rates in September. A Bank of America survey of global managers released last week showed 68% of investors expected a soft landing. It is hard to pinpoint the specific catalyst triggering the rotation, but the combination of higher uncertainty about the outcome of the US election on 5 November, the global easing cycle and weaker economic activity than expected were all candidates.

This week is key to determining whether the rotation led to a mere correction or becomes a more pronounced risk-off event. Interest rate futures price a 6bps hike (60% odds of a 10bps hike) by the Bank of Japan (BoJ) and c. 70% odds of a 25bps cut by the Bank of England, and no hikes by the Fed. US labour market data (JOLTS and payrolls) will be closely monitored alongside the earnings of four of the largest seven companies in the S&P500: Microsoft, Meta, Apple, and Amazon.

The squaring of positions is natural and should be expected, in our view. During these periods, the volatility of Emerging Market (EM) assets increases. Many cross-over investors have been forced to unwind long EM currency exposure – such as the Mexican peso – against their short in JPY. As a result, EM equities have been performing broadly in line with global stocks (MSCI ACWI), albeit outperforming the Nasdaq and S&P500. The important element for long-term EM investors is that economic fundamentals are improving. Last week, Moody’s upgraded Paraguay and Fitch upgraded Azerbaijan to investment grade (IG) levels. In both cases, the countries will be eligible for inclusion on the main IG benchmarks once a second agency upgrades them. Both countries were flagged as upgrade candidates in Fig. 5 of our recent publication on rating changes.1

Cyclical picture

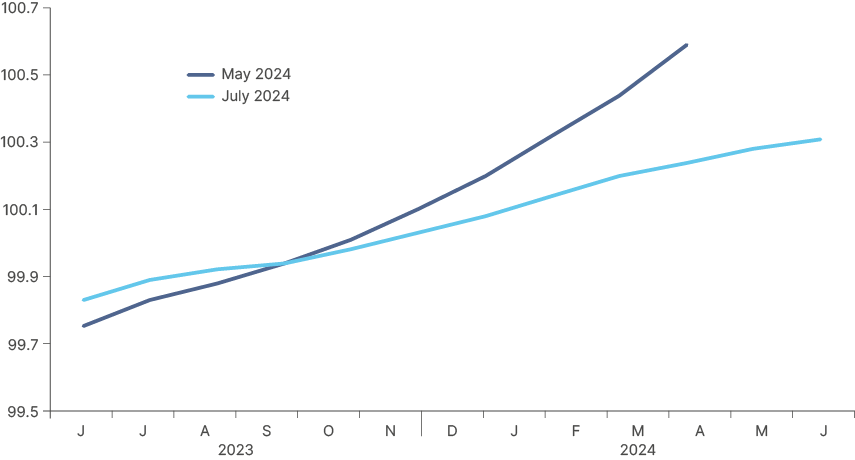

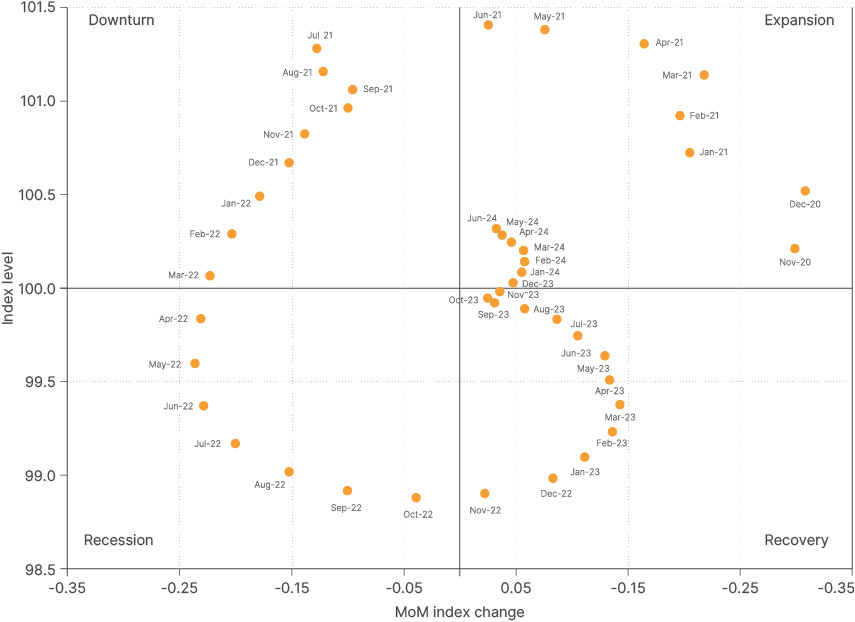

Downward revisions to the OECD G-20 leading indicator data show that overall economic activity, including the labour market, is softer than initially thought. This indicates the global economy is moving from expansion into a downturn. Highly cyclical luxury stocks LVMH and Kering have both sold off around 25% since March and reported disappointing second quarter results. These stocks serve as a good bellwether for excess liquidity and optimistic consumer behaviour in the real economy: aspirational shoppers are now pulling back from extravagance.

Fig 1: OECD G-20 Leading Indicator Revisions

Fig 2: OCED G-20 Leading Indicator: Levels vs. MoM Index Change

Geopolitics

Ukraine: There are intense efforts by China to discuss a potential solution for the Ukrainian crisis. A Chinese spokesperson said Li Hui, special representative of the Chinese government on Eurasian affairs, will visit Brazil, South Africa and Indonesia from 28 July to carry out the fourth round of shuttle diplomacy on the Ukraine crisis.2 The shuttle diplomacy comes one week after the Ukraine Foreign Minister, Dmytro Kuleba, visited China, the first visit since the invasion, and a visit by the Saudi Arabia Foreign Minister to Kyiv. At the same time, Hungary’s Prime Minister Viktor Orbán has travelled several times to Kyiv, Moscow, Beijing, and paid a visit to Donald Trump. Public opinion within Ukraine also seems to be turning. A poll by the Kyiv International Institute for Sociology showed 55% of Ukrainians were opposed to territorial concessions to Russia in exchange for peace, down from 65% in February 2024 and 74% in December 2023.3 Importantly, Ukraine’s President Volodymyr Zelensky himself hinted at “ending the war as soon as possible to preserve people’s lives.”4

China-Philippines: Last week, the Philippines agreed to a “provisional arrangement” with China for resupplying its military outpost on a disputed South China Sea reef, which has become one of the region’s most dangerous flashpoints. If the agreement holds, it could help defuse a more than year-long spiral of violence during which China’s coastguard has disrupted trips by vessels commissioned by the Philippine armed forces to send supplies to the small group of marines stationed on the reef.

Israel: Fears of a broader regional conflict rose after a rocket exploded in the occupied Golan Heights on Saturday, killing 12 children and teenagers during a football game and injuring dozens, the worst civilian losses for Israel since 7 October. Israel said it was an act by Hezbollah, who denied responsibility. Israel attacked Hezbollah targets on Sunday and threatened further retaliation.

At the same time, negotiations for a ceasefire in Gaza have increased. Bloomberg News reported that David Barnea, Director of Mossad and principal ceasefire negotiator, flew to Rome on Sunday to meet with his CIA counterpart, William Burns, and Qatari Prime Minister Sheikh Mohammed bin Abdulrahman Al Thani.

Last week, Israel’s Prime Minister Benjamin Netanyahu said conditions for a ceasefire and a hostage deal with Hamas were “becoming ripe”. Netanyahu went to the US last week and met with President Biden and Vice President Kamala Harris, as well as former President Donald Trump. In a raucous speech to a joint session of Congress on Wednesday, Netanyahu promised “total victory” in the Gaza war.

Commodities

The base metals market experienced its worst weekly slump in nearly two years. Iron ore futures fell below USD 100 for the first time since April, and copper hit a three-month low after reaching a record high in May. This decline was attributed to a weak demand outlook in China, where refined copper exports more than doubled in June, leading to higher global inventories.

Emerging Markets

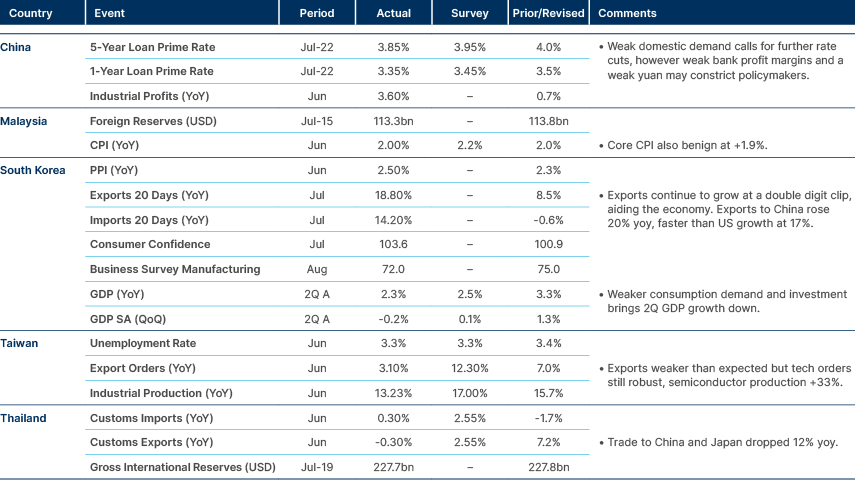

EM Asia

Weak domestic demand in Asia persists, with exports propping up economies.

India: The final budget for the year ending March 2025 was announced last week. The government plans to maintain capital expenditures at a record USD 133 billion. The fiscal deficit target is set at 4.9% of GDP, down from the current 5.1%. During the budget speech, the Nifty index fell after the government announced an increase in capital gains tax (CGT). The short-term CGT will rise from 15% to 20%, while the long-term CGT will increase from 10% to 12.5%. Additionally, 10-year government bonds fell to a two-year low due to plans to cut borrowing levels.

The Finance Ministry expects the economy to grow between 6.5% and 7% this year, lower than last year's 8.2% growth rate.

Indonesia: The government signalled efforts to reduce Chinese investment in nickel projects to help its industry qualify for tax breaks in the US. These tax breaks will be available from 2025 under Biden's Inflation Reduction Act. However, they will not apply to electric vehicles containing batteries and minerals sourced from ‘foreign entities of concern,' which includes companies with more than 25% Chinese ownership. This year, about 80% to 82% of Indonesia's battery-grade nickel output is expected to come from majority Chinese-owned producers.

Latin America

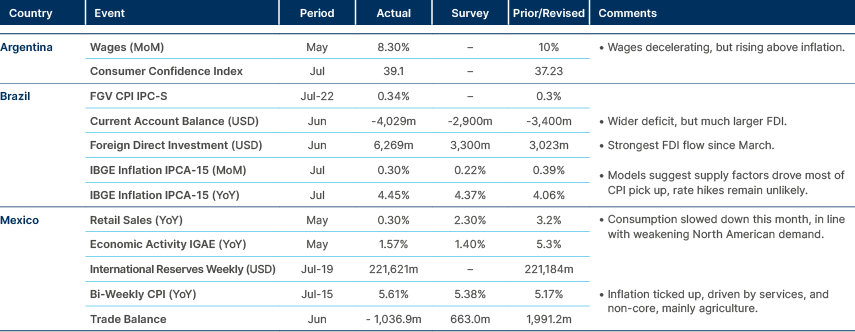

Strong FDI flows to Brazil, Mexico softens with North America.

Argentina: Finance Minister Luis ‘Toto’ Caputo met with the International Monetary Fund (IMF) Managing Director Kristalina Georgieva and US Treasury Secretary Janet Yellen at the G-20 meeting in São Paulo.

Paraguay: Ratings agency Moody’s upgraded the country’s sovereign debt rating to Baa3, the first IG level. The upgrade “reflects robust and sustained economic growth and a track-record of institutional reforms that has improved assessment of institutional and governance strength.” Both Fitch & S&P still have Paraguay rated BB+ with a stable outlook.

Venezuela: The country’s elections authority said President Nicolas Maduro won the presidential vote with 51.2% of the votes against 44.2% for opposition candidate Edmundo Gonzales. The turnout was 59% of eligible voters, higher than the 2018 vote, which the opposition boycotted, but below the more than 70% turnout in elections in 2006, 2012 and 2013. After hearing the results, Gonzales said: “The Venezuelans and the entire world know what happened.”

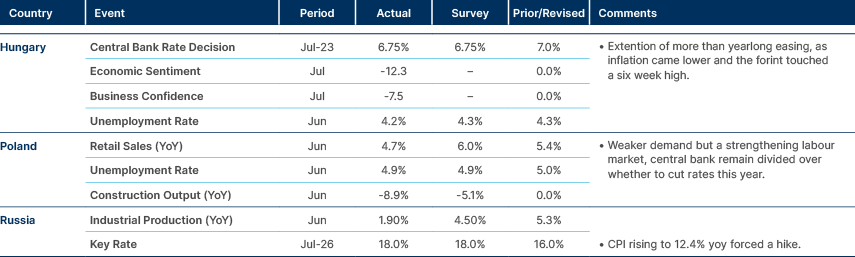

Central and Eastern Europe

Türkiye repays Saudi Arabia. South Africa close to a cut.

Azerbaijan: The ratings agency Fitch upgraded the country’s sovereign debt rating to BBB-, the lowest IG score, with a stable outlook. Moody’s and S&P have Azerbaijan rated Ba1 and BB+, one notch below IG. Moody’s had increased the country’s outlook to positive earlier in July. Azerbaijan proposed a document with principles of peace before a reaching a peace deal with its neighbour Armenia over the disputed areas of Nagorno-Karabakh.5

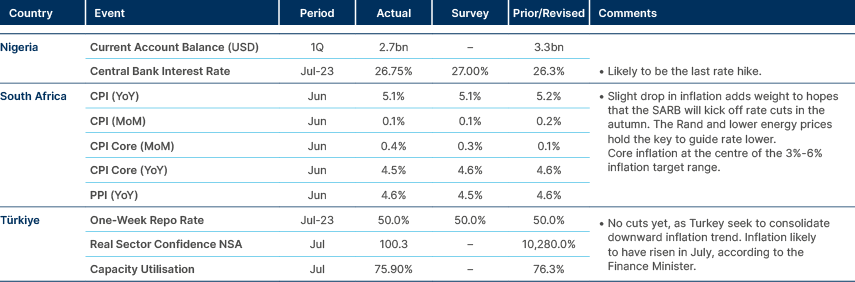

Central Asia, Middle East, and Africa

Data turning more dovish across the region.

Gabon: The ratings agency Fitch downgraded the sovereign rating from B- to CCC+ (outlook stable). The rating change reflected liquidity risks, deterioration of public finance metrics, expansionary monetary policy and high financing needs. The country’s bonds already reflected the lower rating as most risks were previously flagged by Moody’s which rates Gabon one notch below Fitch (Caa2) with a stable outlook.

Kenya: President William Ruto nominated John Mbadi, the opposition leader, as his new Finance Minister. This nomination is part of a cabinet that includes members of the opposition coalition, reflecting plans for a broad-based government. Ruto said on Wednesday he would also be proposing amendments to the country's anti-corruption and public procurement laws.

Türkiye: The Central Bank returned a USD 5bn deposit to Saudi Arabia, signalling confidence in Türkiye’s ability to restore its foreign exchange reserves without borrowing from allies. Since 31 March, foreign portfolio flows into Turkish equities and government bonds have reached USD 18bn.

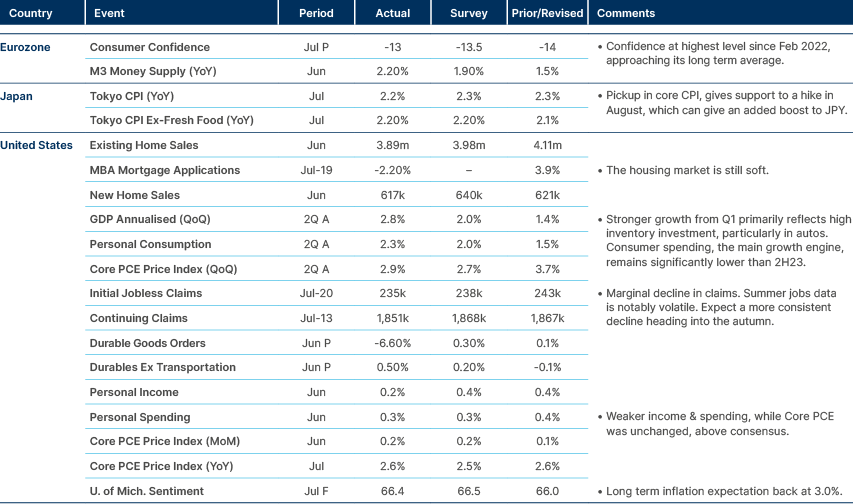

Developed Markets

US upside GDP surprise belies softening consumer data.

Canada: The Bank of Canada (BoC) reduced its key interest rate by 25 basis points to 4.5%, marking the second consecutive rate cut. BoC Governor Tiff Macklem indicated that further reductions may be forthcoming if inflation continues its expected downward trajectory. Additionally, the BoC downgraded its GDP forecast for 2024, highlighting risks related to oversupply.

Japan: The Ministry of Finance is reportedly urging the BoJ to gradually reduce its bond purchases, considering the limitations of local banks' capacity to hold bonds. The BoJ is expected to unveil its plan to cut bond buying at its policy decision meeting next week, marking the first step towards quantitative tightening after more than a decade of monetary easing. Economists predict that bond buying will initially be trimmed from JPY 50trn to JPY 32trn (approximately USD 426bn to USD 272bn) before eventually being halved over two years.

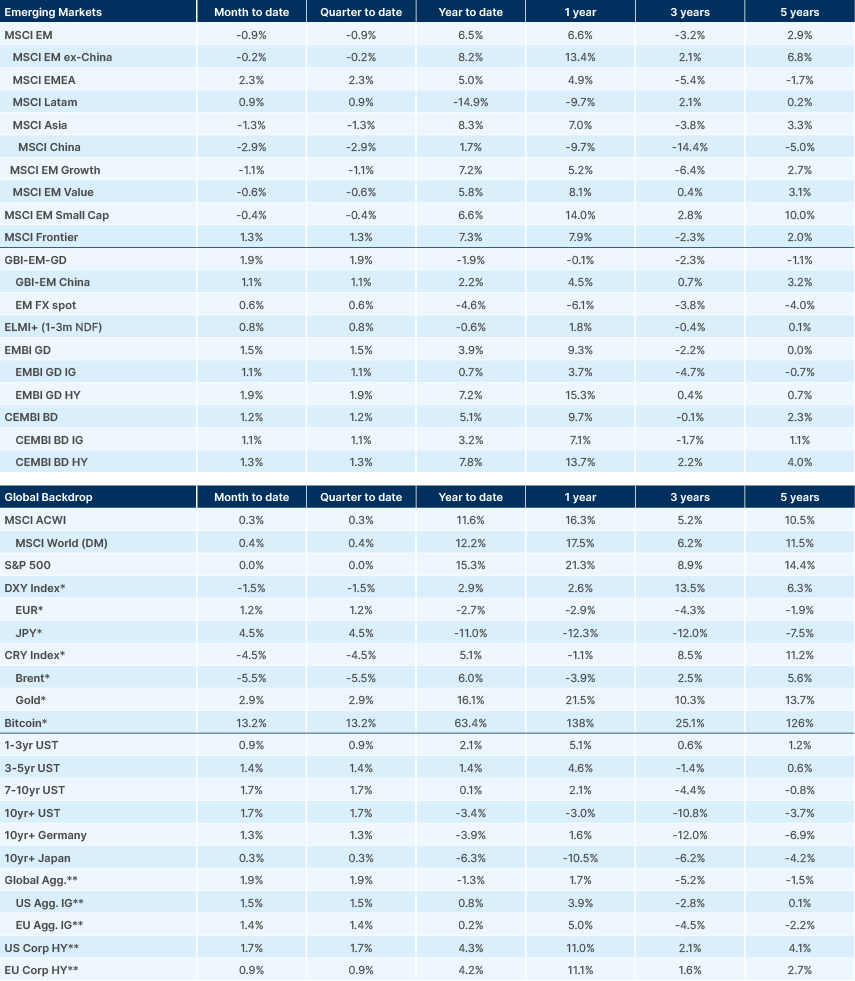

Benchmark performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

1. See – ‘The untold story of improving EM fundamentals’, The Emerging View, 27 June 2024.

2. See – https://english.news.cn/20240726/9fd39a378a7e4b7d8117a8cf75e030a3/c.html

3. See – https://kyivindependent.com/55-of-ukrainians-opposed-to-territorial-concessions-to-achieve-peace-poll-finds

4. See – https://edition.cnn.com/2024/07/20/europe/ukraine-zelensky-uncertainty-russia-negotiations-intl/index.html

5. See – https://www.reuters.com/world/asia-pacific/azerbaijan-proposes-document-principles-peace-before-full-deal-with-armenia-2024-07-21/?taid=669ce458f2c910000169c3e0&utm_campaign=trueAnthem:+Trending+Content&utm_medium=trueAnthem&utm_source=twitter