Noisy developed market politics does not mean long-end bonds won’t perform

- US government shutdown began on Wednesday; the market reaction has been limited.

- Weak ISM services data added to evidence of an increasingly ‘K-shaped’ US economy.

- Sanae Takaichi named Japan’s new Prime Minister. France’s PM resigns less than a month in office.

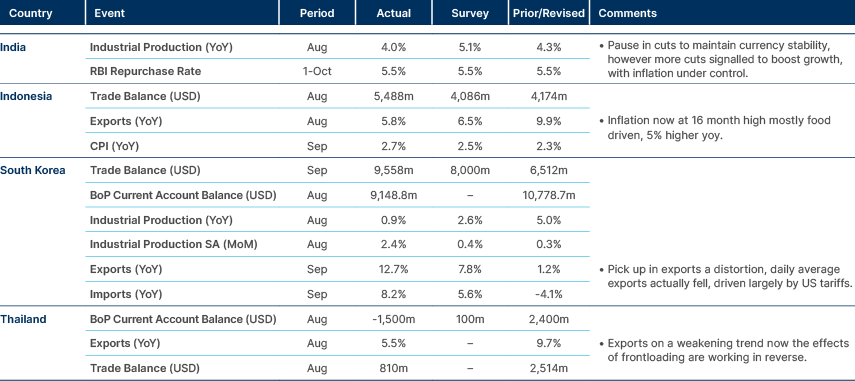

- The counter-effect of US frontloading of demand for Asian imports earlier this year begins to bite in the East.

- Hamas has agreed to parts of President Trump’s 20-point plan for a peace agreement in Gaza.

- China’s retail sales during holiday season much weaker than expected so far.

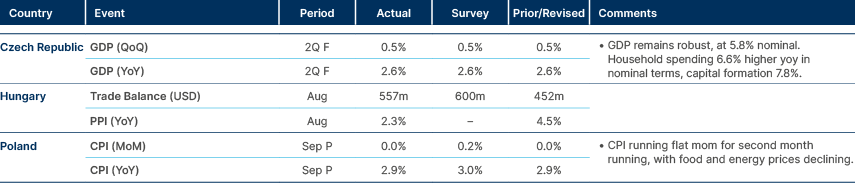

- Andrej Babis was elected Prime Minister in the Czech Republic.

- Nationwide protests in Morocco intensified, prompting the government to announce policy shift.

- South Africa’s ANC is facing another damaging corruption scandal.

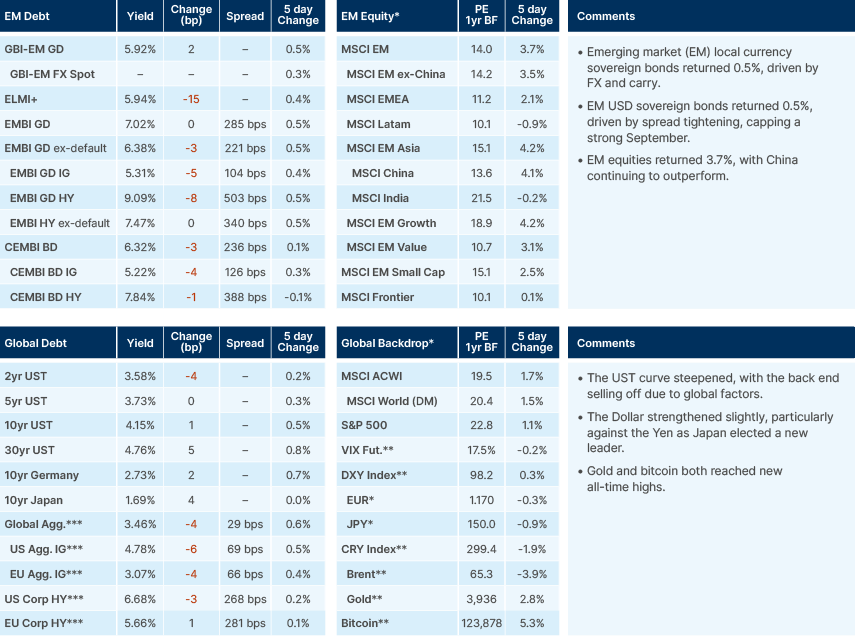

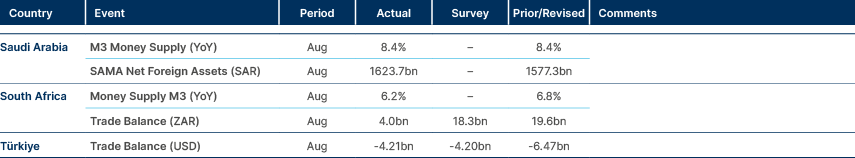

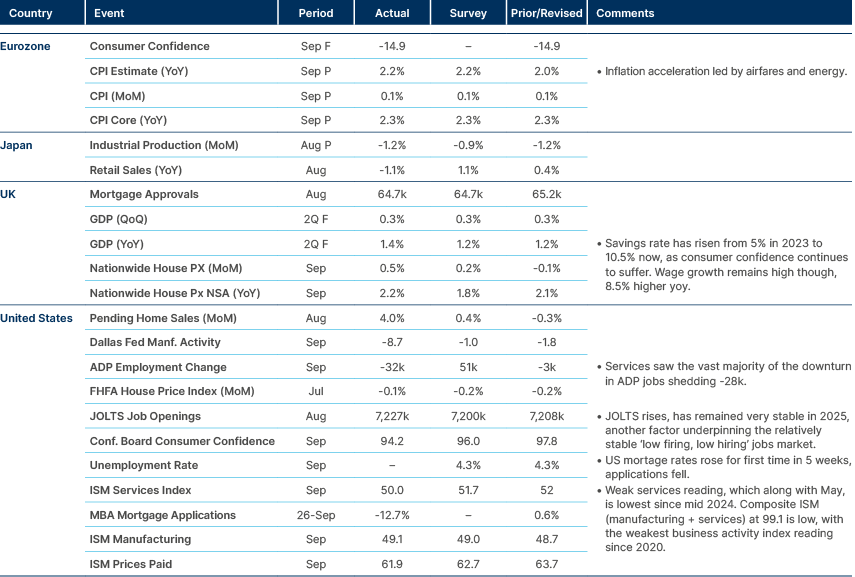

Last week performance and comments

Global Macro

A US government shutdown began on Wednesday, but so far, markets have shown little reaction. On the face of it, this may seem odd, but history suggests this is typical. In the past six government shutdowns, the S&P 500 has finished higher, largely because most of them were short-lived, between two weeks and a month. However, there is a risk this one might drag on for longer than usual. The main funding disagreement in the senate was around the expiration of Obamacare subsidies at year-end. Democrats are currently under intense pressure to be more combative in the Senate, and this policy is unpopular with their voter base for obvious reasons. Furthermore, polls currently show that more voters are blaming Republicans over the shutdown than Democrats. Therefore, there is an argument that it is in the Democrats’ political interest to prolong the standoff. Payday for the miliary on the 15th of October is the key milestone. The US government has never been late in paying its soldiers and would be for the first time if its shutdown persists beyond then.

The shutdown meant no non-farm payroll or unemployment data releases on Friday. However, September’s ADP employment data was published on Wednesday, and pointed to further softening in the labour market, particularly in the services sector. Services payrolls declined by 28k, contributing to an overall decline of 32k. Consensus estimates were for a 52k increase, so this came as a negative surprise.

Later in the week, ISM services index data further fuelled the narrative of a weakening services sector, finally succumbing to elevated rates and damage to economic confidence due to tariffs. A headline reading of 50.0 is the lowest since mid-2024. However, the most eye-catching reading was in the sub-indices. ISM services business activity, a closely followed indicator, fell below 50 for the first time since May 2020. At 49.9, this is now about two standard deviations below the 20-year average of 57.1.

According to the ISM index, US manufacturing has been contracting since 2022, with only a few sporadic positive readings above 50. The services sector has been more resilient, driven by internet companies and wealth-effect-driven consumer demand. However, cracks are now very apparent, and the US economy is looking increasingly ‘K-shaped’ with AI-related capex the main driver of US growth so far this year. Corporate commentary released alongside the ISM data confirmed that demand for AI infrastructure investment remains very strong, although this is clearly evident in almost every indicator conceivable.

Weak US data led to a five basis points (bps) decline in two-year US Treasury yields, while the pricing of the probability of the US Federal Reserve (Fed) cutting rates twice more this year rose. While cutting rates into a solid economy is counterintuitive, it takes only a brief look under the bonnet to see the US economy is far from solid and is being propped up by three factors: AI capex, healthcare sector hiring, and the wealth effect from stocks.

But despite the weaker data, long-end US yields rose slightly. This was probably driven by global factors, principally the election of Sanae Takaichi as the new leader of Japan’s ruling Liberal Democratic Party (LDP). This came as a surprise to markets. However, Takichi’s popularity with the electorate, aided by her more populist stance, likely swayed party members in the end, given the LDP’s low approval ratings.

Takeichi is a follower of former President Shinzo Abe’s economics. She therefore is advocating for fiscal stimulus and looser monetary policies to support struggling households. The ‘Takaichi trade’, on the face of it, probably means higher equity prices and higher super long-bond yields. Bond yields have risen in Japan as a result - the 30-year bond yield in Japan now around 3.3%, 20bps higher than last week. This move helped lead long-end US Treasury yields higher.

However, in our view, the space for further widening in global long-end yields in the world’s largest government bond markets looks limited in coming months. The strength of Japan’s backstops for its yield curve - given its very large net foreign investment surplus and willingness of the central bank to intervene -means there is a high bar for yields to move much higher in the long end. Growth-boosting measures in Japan would also help the debt/GDP ratio to remain stable, even with a moderate expansion in government debt.

French Prime Minister Sebastien Lecornu resigned on Monday after less than a month in power, an event that should have caused further bond widening in France. Lecornu’s reason for his resignation was that President Emmanuel Macron had installed a new government around him that, in Lecornu’s words, meant “the conditions were not fulfilled for me to carry on as prime minister.” French bond yields have hardly moved since the news. Why? The French 10-year yield is already 50bps higher than this time last year, at 3.5%. It remains somewhat anchored by the European Central Bank (ECB’s) low policy rates, and the fact that if a new budgetary framework cannot be approved, the French will continue operating under their previous budget.

Elsewhere in Europe, Germany’s fiscal expansion is well understood and fairly priced into Bund yields, in our view. UK long-end bond yields are trading at levels not seen since the 1990’s, and it looks likely that the 2026 budget announced in November will include policies geared towards fiscal consolidation, which suggests bond yields could moderate in the coming months. This will likely be especially true if the Bank of England end upcutting rates more than priced – a very possible scenario considering only two cuts are currently expected by the end of 2026.

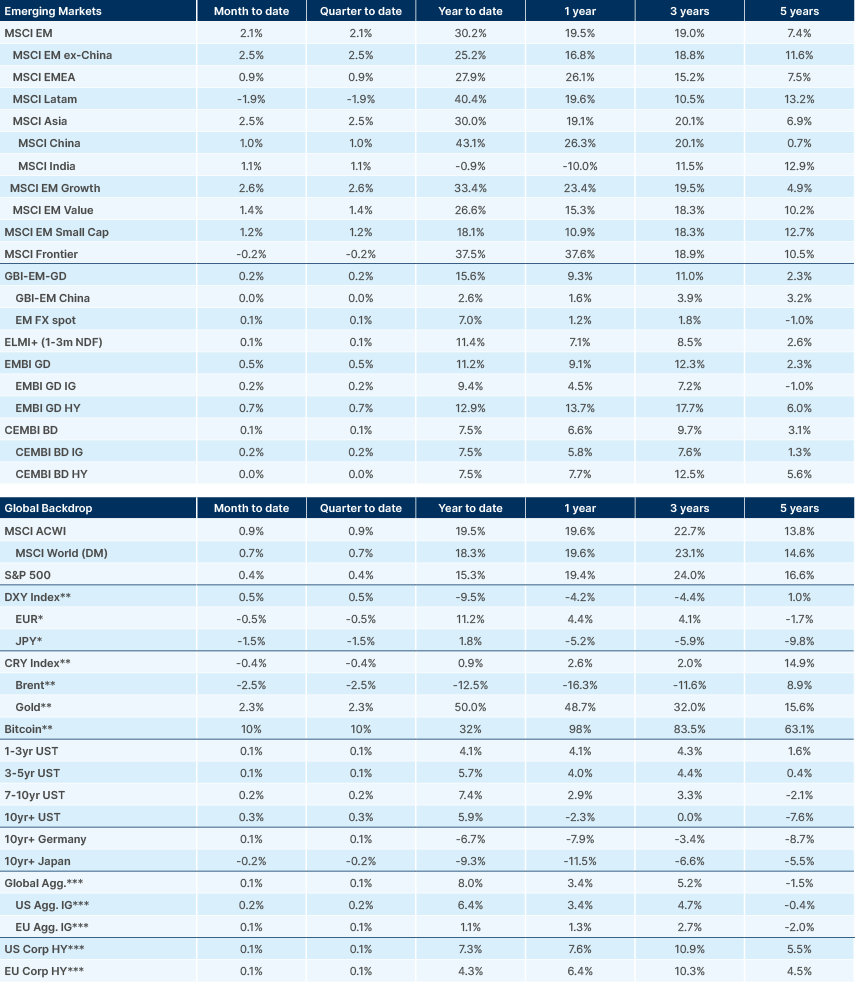

Given this backdrop in developed markets, we see the path of least resistance is for bond yields to move lower in the fourth quarter. This should be supportive for EM debt and will help to continue easing financing conditions across EM economies, which could in turn benefit EM equites also.

The export surge for Asian economies earlier this year due to tariff frontloading is now beginning to unwind. Various Asian exporters are already seeing negative year on year (yoy) export growth to the US. Taiwan is an obvious exception, given the boom in semiconductors. India, Indonesia, Thailand and Vietnam are all still exporting more to the US than they did last year, but growth is weakening. Given very high base effects that will kick in from November onwards (when frontloading really began) it is very likely that export growth to the US will be negative across Asia by year-end, apart from Taiwan which continues to ride the crest of the AI-capex wave.

Commodities

Oil prices have been declining on fears that higher supply is outpacing demand, particularly if China slows its oil imports. Against that backdrop, OPEC+ is moderating its planned output lift, and has now agreed to increase output by 137k barrels per day (bpd) in November, down sharply from plans to hike it by 537kbpd in October/November. Supply rose by around 330kbpd in September to 28.4mbpd, led by Saudi and the UAE. OPEC+ had already added around 548kbpd in August. Risks to oil prices from here remain two-sided, which explains, in part, why oil prices have been range-bound in recent months: geopolitics, member compliance, potential overproduction, and the balance between Saudi market-share strategy and Russia’s preference for moderation.

Geopolitics

Ukraine: Russia carried out its largest strike on Ukraine’s gas production facilities since the start of the war, targeting operations by Naftogaz and DTEK in Kharkiv and Poltava with 35 missiles and 60 drones. The strikes appeared aimed at disrupting Ukraine’s heating season and forcing more gas imports, just as Kyiv had begun exporting electricity to Europe. Russian President Vladimir Putin also threatened Ukraine’s nuclear plants, accusing Ukraine of shelling the occupied Zaporizhzhya facility. Ukraine countered that Russia caused outages to justify reconnecting the plant to its own grid. With nuclear energy accounting for over half of Ukraine’s domestic supply, further strikes raise the risk of blackouts and nuclear disaster.

Gaza: Hamas has agreed to several elements of President Donald Trump’s 20-point peace plan for Gaza, including the release of all remaining hostages in Gaza, alive or dead. Hamas has also agreed to hand over Gaza governance to Palestinian technocrats. However, is has yet to agree to disarmament, a key part of Trump’s plan or agreed to play no future role in Gazan governance. Delegations from Israel, Hamas and the US will be holding indirect talks today over the rest of the plan. If finalised, all hostages would be returned within 72 hours of Israel accepting the plan, after which Israeli forces would begin withdrawing from Gaza. Trump has said that Palestinians can remain there if they wish, with the region being redeveloped under the supervision of an international peacekeeping force.

However, Israel’s PM Benjamin Netanyahu has maintained his line that there can be no path to Palestinian statehood, under Hamas or otherwise. This remains a key condition for Hamas, and as such there is no guarantee a deal will be reached. Israel continued to hit targets in Gaza City over the weekend, despite Trump’s calls for restraint.

Emerging Markets

Asia

China: Sales at major retail and dining businesses rose only 3.3% yoy during the first half of the eight-day Golden Week holiday, well below expectations for double-digit growth and weaker than last year’s 4.5%. China is reportedly pushing the US administration to roll back national security restrictions on Chinese investments, offering a potential package of up to USD 1trn as part of the proposal. Negotiators are said to be seeking lower tariffs on imported inputs for any Chinese factories established in the US. The 4th Plenum of the Communist Party will take place on 20–23 October to draft the 15th Five-Year Plan (2026–2030), with the final version due at the National People’s Congress in March 2026. UBS economist Ning Zhang expects a GDP growth target of 4.5–5.0%, down from 5.0–5.5% in the current plan, noting that such an implicit target remains ambitious. An explicit focus on nominal GDP or a formal inflation target would be a positive surprise.

Pakistan: Advisers to army chief Field Marshal Asim Munir have reportedly approached US officials with a proposal to build and operate a port on the Arabian Sea, potentially giving Washington a strategic foothold in a highly sensitive region.

South Korea: Samsung and SK Group signed letters of intent with OpenAI to participate in its USD 500bn ‘Stargate’ AI infrastructure project. OpenAI’s projected memory demand could reach 900k DRAM wafers per month—more than double current global high-bandwidth-memory capacity and equivalent to around 40% of total global DRAM output.

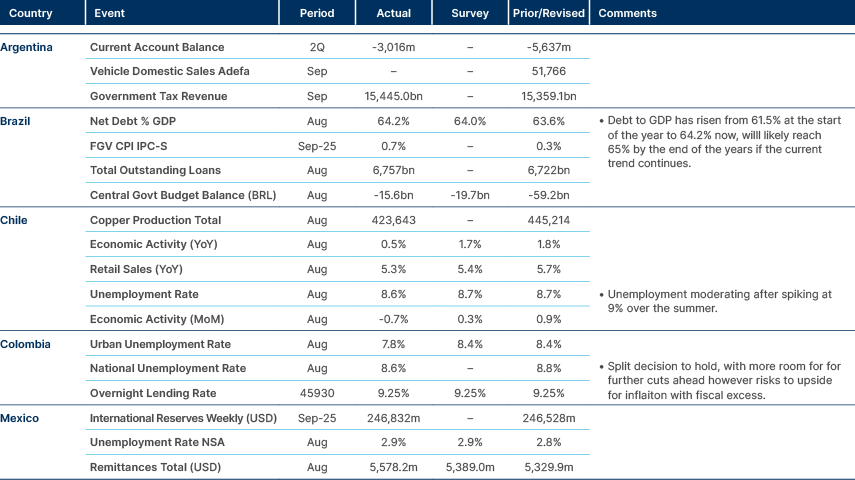

Latin America

Argentina: Congress overturned President Javier Milei’s vetoes on spending bills for universities and paediatric hospitals, adding fiscal costs of around 0.25% of GDP. The government plans to challenge the measures in court, but has largely lost the political narrative, as key allies have refused to defend the veto. The International Monetary Fund (IMF) warned that Argentina must build broader political consensus, maintain fiscal discipline, and re-establish a credible FX regime to rebuild reserves and restore market confidence.

Colombia: The Finance Ministry disclosed details of its USD 9.3bn total return swap, which requires repayment of CHF 7.5bn by July 2026. Proceeds were invested in Colombian global bonds, local TES bonds, and US Treasuries. However, the TRS structure increases liabilities when sovereign spreads tighten, creating a pro-cyclical fiscal risk. Analysts cautioned that the transaction resembles speculative positioning more than liability management, raising the prospect of a multibillion-dollar refinancing challenge as a new administration takes office.

Central and Eastern Europe

Czechia: Billionaire Andrej Babiš won the parliamentary election, pledging to reverse four years of austerity and scale back military aid to Ukraine. His ANO Party secured just under 35% of the vote, its best-ever result, compared with 23% for Prime Minister Petr Fiala’s coalition. Babiš is seeking to form a government with the populist Motorists and the anti-migration Freedom and Direct Democracy parties, which together would give him a parliamentary majority. He described initial talks with both groups as positive, but declined to disclose details. The outcome, while not unexpected, heightens concerns about fiscal loosening.

Central Asia, Middle East, and Africa

Morocco: Nationwide protests intensified as young demonstrators expressed frustration over corruption, weak public services, and heavy football world cup spending. The unrest left three dead and over 1,000 detained. In response, the government pledged revisions to the 2026 budget to prioritise health and education and indicated a willingness to engage with protesters. The demonstrations mark the largest wave of public discontent since the 2011 Arab Spring.

Nigeria: The Central Bank of Nigeria announced it will assume full control of fixed income market operations, including trading platforms and settlement. Pilot testing will continue through October, with full migration expected in November and a CBN-managed trading environment by December. Officials argue the move will enhance transparency and efficiency, though market participants warn it risks excessive concentration of market control in the central bank.

South Africa: The African National Congress (ANC) Party faces its most serious crisis since the state capture era following allegations of widespread police corruption. Suspended Police Minister Senzo Mchunu is under investigation by the Madlanga and ANC Integrity Commissions amid testimony linking senior officials to organised crime. The scandal deepened with the sudden death of former minister Nathi Mthethwa and the unexplained illness of a key witness. The ANC has admitted cartel infiltration and convened a special NEC meeting, further damaging its credibility ahead of the 2026 elections. Meanwhile, the government is drafting a new growth plan focused on industrialisation and job creation, including a proposed 25% tax on chrome ore exports and preferential electricity rates for smelters, according to the Sunday Times.

Developed Markets

Germany: Defence Minister Boris Pistorius called for greater state participation in the defence industry to safeguard domestic expertise and jobs. He argued that partial state ownership would help preserve strategic capabilities and support long-term industrial capacity.

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.