- China issued dual tranche 3- and 5-year bonds, both trading tight to US Treasuries.

- Other Eurobond issuers were Laos, Nigeria, Jordan, Brazil, and…

- … the Republic of Congo, which tapped the international market for the first time since 2007

- US government shutdown appeared close to a resolution.

- Challenger Report showed job cuts surged to 153k in October.

- Democrats posted a series of strong electoral wins.

- Trump declared Venezuelan President Maduro’s “days are numbered”.

- European carmakers showed signs of a bounce-back with fewer profit warnings.

- Argentina’s Milei said the currency-band FX regime will remain in place through the 2027 elections.

- Ghana’s inflation fell to 8.0% yoy, reaching the central bank target for the first time since 2021.

- Vietnam adopted new regulations to remove the state monopoly on gold.

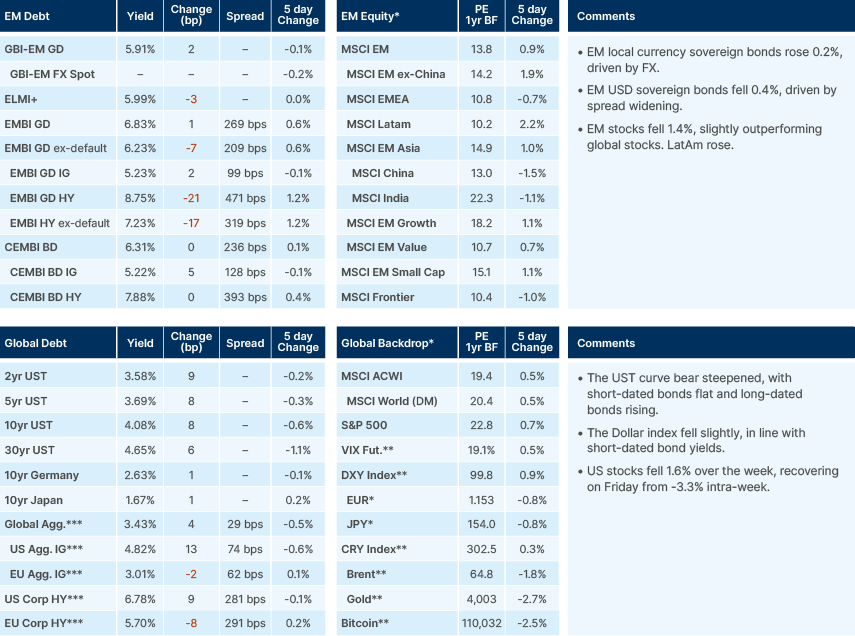

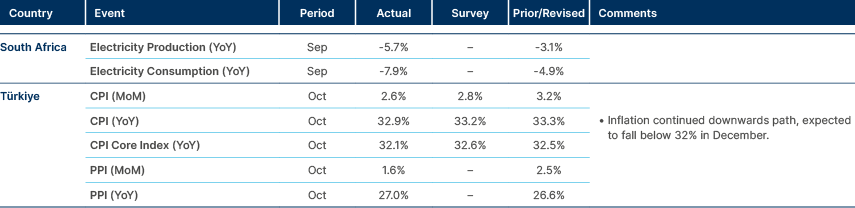

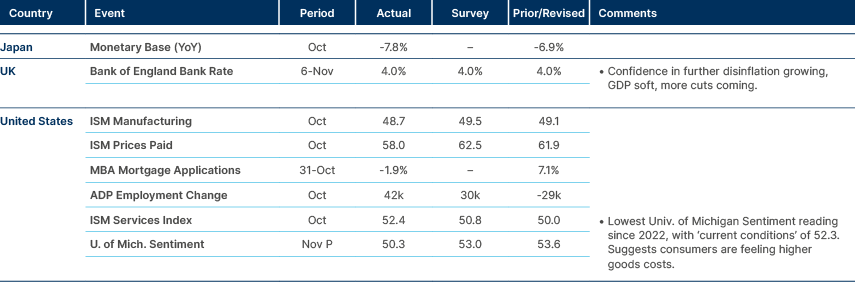

Last week performance and comments

Global Macro

The US government shutdown – already the longest on record at 41 days – appears to be getting closer to a resolution. The Senate passed a vote over the weekend supporting a funding package that would allow the government to reopen, with eight Democrat Senators supporting the vote. The package includes a stopgap funding measure to keep the government open until at least January 2026.

The bill still needs to pass through the Lower House, before being returned to the Senate for final approval. Nevertheless, equity markets responded positively to the news, with risk assets rebounding broadly on Monday. Last week saw the weakest performance for US equity markets since the ‘Liberation Day’ selloff in April, with the S&P 500 falling some 3% from last Monday to Friday, before recovering to close the week down around 1.6%.

This decline was led by artificial intelligence (AI)-related companies, as the AI hype narrative hit a wall of worry. Talk of an AI bubble is now everywhere, and Nvidia CEO Jenson Huang’s comment that “China will win the AI race” in a recent interview did not help assuage increasingly skittish sentiment around the US-tech momentum trade. The company’s share price fell as much as 13% over the week, before recovering on Friday.

Bubble talk is unlikely to subside in the near term. However, US earnings remain strong. With 91% of the S&P 500 having reported third quarter earnings, 82% have beaten earnings-per-share (EPS) estimates and 77% have beaten on revenue. Q3 blended EPS growth is at 13.1% yoy, with blended revenue growth at 8.3%. Given lofty valuations, price reactions have been asymmetric, with positives rewarded less than average and negatives punished more.

What next for US stocks? With strong expectations for tech earnings already in the price, the fuel for this rally continuing into 2026 will be liquidity, in our view. The swallowing of the Treasury General Account due to the government shutdown has weighed on liquidity conditions in recent weeks, draining bank reserves. Bond yields have also risen, driven in part by the risk of President Donald Trump’s IEEPA1 tariffs being revoked by the Supreme Court, which would widen fiscal deficits. However, a scheduled end to quantitative tightening in December, and further rate cuts, should boost liquidity again and be supportive for risk amid favourable seasonals. Importantly, lower rates would also likely improve market breadth. The shutdown ending soon holds the key to lower risk premium into year-end.

If this bullish scenario plays out, emerging market (EM) stocks are primed to benefit disproportionately, in our view. Big returns from China, Taiwan and Korea in recent months – mostly driven by tech and semiconductor companies – confirms EM stocks are now seen as the most cost-effective way of gaining exposure to a bullish AI scenario given much less extended valuations in those countries. Furthermore, real rates remain elevated in many EM countries, with inflation largely under control. Further rate cuts next year could be the engine behind an extension of the rally in EM stocks into 2026.

US Labour Market

Research firm Challenger, Grey & Christmas reported that job cuts surged to 153k in October. The sectors most affected were warehousing (48k cuts), technology (33k cuts) and non-profits (28k cuts). Year-to-date (YTD), employers have announced 1.1m job cuts, up 65% from the 665k announced over the same period in 2024. Cost cutting was the main reason cited by laying off employees and AI the second. DOGE2 accounted for 294k direct and 21k indirect job cuts YTD. Employers also announced 488k planned hires YTD, down 35% from the 750k over this period last year.

We believe US labour market dynamics can be explained by the knock-on effects of AI intertwined with US policy measures. Labour-intensive sectors such as retail (such as Amazon, Walmart) and wholesale, are getting hit by tariff policy amid tight margins. In response, these firms are likely accelerating warehouse automation (possibly with AI) to cut costs and hold off price hikes to protect market share.

Similarly, the One Big Beautiful Bill Act (OBBBA) has accelerated the pace of AI expansion through providing tax rebates for capex and research and development spending. Tech job losses are an obvious AI casualty, with less labour needed as capital intensity increases. Today’s economy is growing almost solely due to the AI boom, making this casualty more prevalent. However, instead of hiring new employees, the major hyperscalers are laying people off as they automate large swathes of code and process management tasks.

Geopolitics

Venezuela-Trump

Donald Trump declared that Venezuelan President Nicolás Maduro’s “days are numbered”, signalling a hard-line US stance. At the same time, he emphasised the US was not seeking full-scale war with Venezuela, noting military action is “possible but not inevitable.” An interesting dynamic from this recent advance is the lack of a unified Latin American response to an attack on Maduro’s regime. This marks a stark contrast to 2018 when the region coordinated a response to the Venezuelan refugee crisis.

Emerging Markets

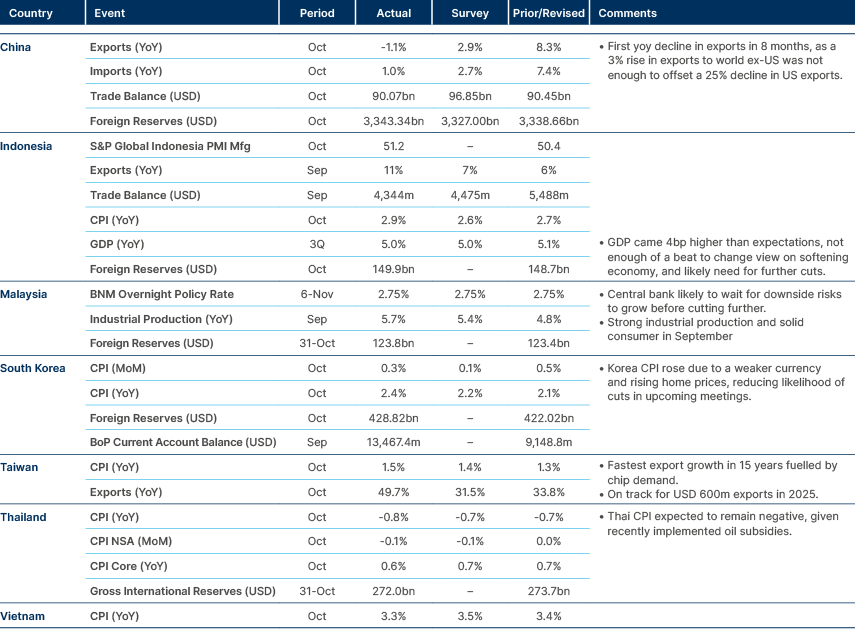

Asia

North Asian exports still strong, driven by the semiconductors.

China: Hui Shan, Chief China Economist at Goldman Sachs, upgraded China’s 2026 GDP forecast, from 4.0% to 4.8%. This was largely on the back of the Fourth Plenum and unveiled proposals for the 15th five-year plan as well as trade measures. The Fourth Plenum placed emphasis on upgrading technology and manufacturing, particularly building modern industrial systems and using AI and technology to boost profitability and competitiveness. Exports can strengthen from here. The late-October Trump-Xi meeting also resulted in a lower tariff rate into Chinese products. Leverage on rare earths and critical minerals mean the US won’t be able to raise tariffs to China over the next two years and potentially beyond. The combination of a double-down on manufacturing measures and Trump-Xi outcomes suggests exports will outperform expectations.

Shan also reported the Chinese government is considering how to achieve 4.2% annual GDP growth over the next 10 years to get to moderately developed economy status. The service sector is an area where China has a lot of room to catch up. The services-to-GDP ratio tends to increase as countries get richer. It also tends to be labour-intensive, which could help to create jobs. Chinese sectors going global is the only clear solution given China’s huge capacity and trade tensions that arise from too many exports. Property market will continue to struggle to find a bottom on incremental measures.

In other news, China issued a dual-tranche 3- and 5-years (USD 2bn each) at 3.65% and 3.77% yields, coming flat and +2 basis points (bps) over US Treasuries, respectively. Interestingly, both issuances now trade some 20bps lower than US Treasuries. The premium in Chinese bonds reflects technicals. China has only USD 11.5bn of outstanding USD-denominated Eurobonds, compared with USD 30.3trn of outstanding T-bills and US Treasuries, according to Bloomberg. This is an argument that can be made for the entire EM debt investment grade asset class, which is c. USD 650bn distributed across 28 countries. The other reason is that the US Treasury is no longer an accurate benchmark for the cost of funding. The 5-year overnight indexed swap spread (interbank funding cost) is currently some 30bps below the equivalent US Treasury maturity. If these dynamics remain in place, it is entirely possible that more high-quality sporadic issuers come to trade flat or even tight to US Treasuries in the future.

Laos: The ‘CCC+’ rated country issued a USD 300m 5-year Eurobond at 11.2% yield, destining the use of proceeds to debt repayment. The bonds are not eligible for inclusion in the JP Morgan EMBI GD, the most-followed EM fixed income benchmark, which only includes Eurobonds above USD 500m.

Malaysia: The government plans to rationalise subsidies on sugar, rice, and cooking oil in gradual phases, following earlier cuts to diesel, electricity, and chicken subsidies. Deputy Finance Minister Lim Hui Ying said the reform aims to reduce fiscal leakage and better target lower-income groups. The programme is expected to yield significant savings; prior subsidy reforms generated MYR 15.5bn annually.

South Korea: Industry Minister Kim Jung-kwan said the USD 200bn of Korean investments in the US will prioritise Korean firms, structured via a joint investment committee co-chaired by US Commerce Secretary Howard Lutnick and Minister Kim. The investment will fund agreed bilateral projects and favour companies generating steady cashflow. The initiative is part of the broader USD 350bn Korea–US trade and investment framework signed in October, with USD 200bn in direct investments and USD 150bn for shipbuilding cooperation. Kim reiterated that Korea would continue its “mother factory” strategy, focusing on high-value domestic production while expanding overseas manufacturing.

Sri Lanka: Inflation remains stable amid improving GDP growth, lower oil prices, and modest rupee depreciation with expectations at c.2 % for 2025. The Central Bank of Sri Lanka (CBSL) has indicated room to ease policy further if needed to sustain growth. This is also supported by its reduced US tariff rate to 20% (down from initial 44% reciprocal).

Vietnam: Vietnam adopted new regulations to remove the state monopoly on gold. Initially imposed in 2012, the State Bank of Vietnam became the only legal importer of gold to reduce people hoarding gold as a hedge against inflation. The new regulations aim to narrow the gap between domestic and global gold prices, which often trade at a 10%-15% premium locally. While the new regulations undo those controls, the change is expected to be gradual with central bank still controlling how much gold can enters the country.

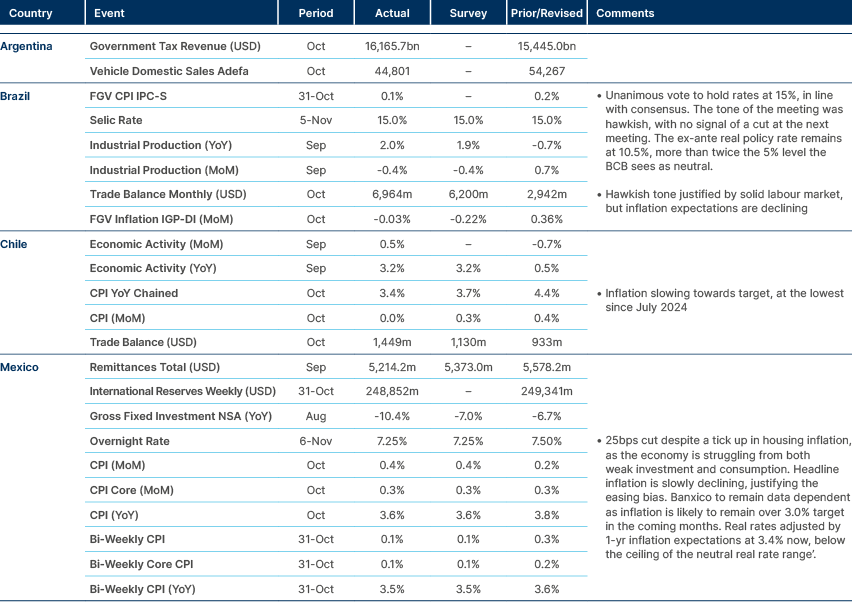

Latin America

Ongoing disinflation in Brazil, Chile, and Mexico, but COPOM kept a hawkish stance.

Argentina: President Javier Milei confirmed the currency-band FX regime will remain in place through the 2027 elections, noting that the gradual widening mechanism supports stability and dismissing overvaluation concerns. Milei said Argentina aims to re-enter bond markets in 2026, as the USD 20bn US Treasury swap provides as a liquidity backstop. Separately, Milei will again convene provincial governors ahead of the December reform push on tax, labour, and criminal law, leveraging post-midterm momentum. Meanwhile, the Central Bank of Argentina cut the overnight rate by 300bps to 22%, turning it to negative, in ex-post real terms, to support Treasury auctions and re-monetisation.

Brazil: The Senate unanimously approved the income tax reform raising the exemption threshold to BRL 5,000/month and introduced a minimum tax for those earning above BRL 50,000. President Lula is expected to sign the bill after COP30 in mid-November. The reform was presented as budget neutral but may add some BRL 1bn to BRL 4bn to the deficit next year. The measure can potentially delay rate cuts as the tax cut is likely to drive consumption higher. Lula also criticised a Rio de Janeiro police raid that killed 121 people, calling it “disastrous,” a remark that could weaken his standing as security rises to a key 2026 campaign theme.

In other news, Brazil issued USD 1.5bn in a 7-year sustainability bond at 5.75% and re-offered USD 750m of its 6.625% March 2035 at 6.2% yield, bringing the total outstanding 10-year benchmark to USD 4.5bn. Brazil has been increasing the amount of Dollar-denominated debt to diversify its borrowing, but will hold a very small amount of foreign currency debt compared to the country’s reserves.

Chile: Codelco expects it will take three years to restore production at El Teniente after July’s tunnel collapse. Copper output fell 10.4% yoy in Q3 and is expected to drop by 5.4% in Q4.

Colombia: A Cifras & Conceptos poll showed President Gustavo Petro’s approval at 44%, with 50% unfavourable and only 38% of voters committed to a candidate for the 2026 race. Voter indecision and fatigue dominate, reflecting growing centrist alignment and declining party identification. The data suggest a fluid and sceptical electorate as campaigning intensifies.

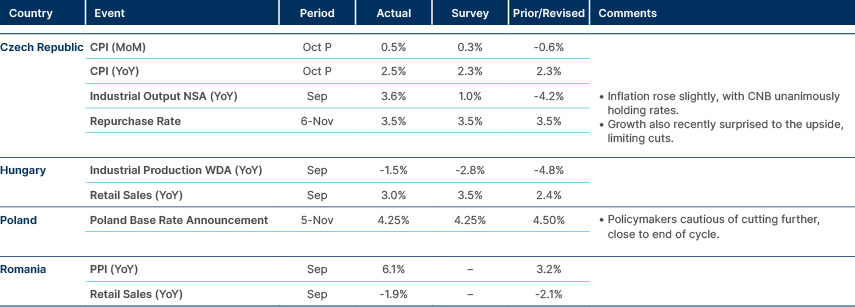

Central and Eastern Europe

Czech activity remains resilient

Kazakhstan: The National Bank of Kazakhstan (NBK) expects FX sales from the sovereign fund to remain steady at USD 600m to USD 700m in November, close to October’s USD 660m. The NBK made no direct interventions and did not buy FX for the pension fund. October sales represented 11% of market trades, averaging USD 30m per day, while quasi-sovereigns sold USD 279m as part of obligatory requirements. The NBK continues to monitor exchange rate dynamics, citing tax payments, market developments, and geopolitical factors as short-term drivers.

Middle East, and Africa

Inflation dropping faster amid reforms. Africa spread-to-worst down by 275bps since April to 385bps.

Republic of Congo: The government tapped the international market for the first time in nearly two decades. The ‘CCC+’ rated sovereign issued USD 670m in an amortising 7-year bond at a 9.875% coupon, but with a USD 86.728 cash price which translates into a yield of 13.7%. The use of proceeds is destined for amortisation of bonds issued under the local market of the Central Africa Economic and Monetary Community (CEMAC).

Egypt: The deposit dollarisation rate fell to 25% in September (from 25.6% in August), driven by declining FX deposits and an appreciating Pound. Total deposits excluding government and foreign-sector accounts rose 23.1% yoy to EGP 12.2trn, with a stable loan-to-deposit ratio near 50%. The Central Bank of Egypt expects further improvement as remittance inflows and foreign direct investment (FD) strengthens FX liquidity.

Ghana: Consumer Price Index (CPI) inflation fell sharply to 8.0% yoy in October, reaching the Bank of Ghana’s target for the first time since 2021. Base effects, pass-through from Cedi strength and a decrease in core inflation drove the decline. The Cedi’s 35% rally this year has been supported by high gold prices. Lower food inflation (9.4% yoy vs 10.7% in September) and lower utility prices (1.9% yoy vs 15.7% in Sep) were the largest contributors to disinflation. Disinflation could allow a gradual easing cycle, albeit policy normalisation remains measured. S&P Ratings raised its sovereign credit ratings a to 'B-' from 'CCC+' with a stable outlook.

The upgrade reflects Ghana's gradually strengthening balance of payments and fiscal positions, supported by resilient growth of the domestic economy as well as favourable terms of trade, including prices for gold and cocoa, which together account for over 60% of goods' exports. S&P sees gross reserves rising to USD 10.4bn (9% of GDP) at the end of 2025 from USD 6.8bn a year earlier.

Nigeria: The country issued USD 2.35bn in a dual-tranche Eurobond which attracted USD 13bn in bids despite US political tensions. The Debt Management Office said this was Nigeria’s largest orderbook to date, with strong participation from global fund managers and banks. The USD 1.2bn (10-year, 8.625%) and USD 1.1bn (20-year, 9.125%) bonds will finance the 2025 fiscal deficit and refinance USD 1.1bn in maturing debt.

Qatar: S&P affirmed Qatar’s sovereign rating at ‘AA/A-1+’ (stable), citing strong fiscal and external buffers. It projects GDP growth near 3% in 2025, rising to 5% by 2028 as liquified natural gas (LNG) capacity expands to 126m. Despite regional tensions, LNG operations and infrastructure remain unaffected.

Türkiye: Finance Minister Mehmet Simsek reaffirmed the disinflation trajectory and fiscal discipline, noting that FX-protected deposit (KKM) balances had plunged to TRY 171 billion and would fall below TRY 5bn by year-end. Headline inflation slowed sharply to 32.9% yoy in October, (-15.7% yoy), underpinned by tight policy and controlled tariff adjustments. New legislation to strengthen public procurement, state-owned enterprise (SOE) governance, and fiscal rules for local administrations is under review. Simsek said new manufacturing-support packages were being finalised and emphasised broadening the direct tax base, given low OECD comparatives.

Uganda: S&P Global Ratings revised its outlook on Uganda’s ‘B-‘ credit rating to positive from stable. The better outlook reflects the potential for stronger growth and per capita income than forecast, given the favourable terms of trade and key oil projects that are set to commence operations in the next 12-18 months. Such a scenario could, in our view, help partially offset Uganda's still elevated fiscal risks.

Developed Markets

Bank of England dovish hold signals more cuts than priced into 2026.

Australia: The Reserve Bank of Australia held rates at 3.6%, in line with expectations. The board unanimously agreed it was better to remain cautious after stronger than expected inflation.

United States: The University of Michigan’s consumer sentiment index, both current conditions (52.3 vs. 58.6 previously) and expectations (49.0 vs. 50.3 previously), deteriorated. This has already begun to materialise in the consumer sector with salad chain, Sweetgreen’s stock plunging, citing lower foot traffic and consumers opting for cheaper options. Consumer discretionary names like Lulu Lemon also plunged.

United Kingdom: Bank of England (BoE) Governor Andrew Bailey struck a cautiously optimistic tone, noting that the latest inflation data is “encouraging” but requiring confirmation of a sustained downward trend. The Q4 inflation print, and 26 November Budget will be key markers for the pace of disinflation and growth momentum.

The overall policy tone from the BoE was dovish, suggesting the hurdle for a December rate cut is low. Bailey signalled preference for three additional cuts, while markets currently price in only two. Goldman Sachs expects a path of cuts in Dec-25, Feb-26, Apr-26, and Jul-26, bringing the policy rate to 3.0%, consistent with a neutral rate near 2.75%. Risks remain skewed to the downside, as a faster-than-expected decline in inflation could justify an extra easing. Headline CPI inflation is expected to decline through H1 2026 on energy base effects, tax relief in the Budget, and softer rent and wage growth.

On the fiscal side, the Budget outlook is likely to be Gilt-friendly. Chancellor Rachel Reeves is expected to focus primarily on targeted tax adjustments (such as threshold extensions, gambling and council levies). Overall, a benign fiscal backdrop and moderating inflation support a dovish BoE trajectory, with room for policy easing to continue into mid-2026.

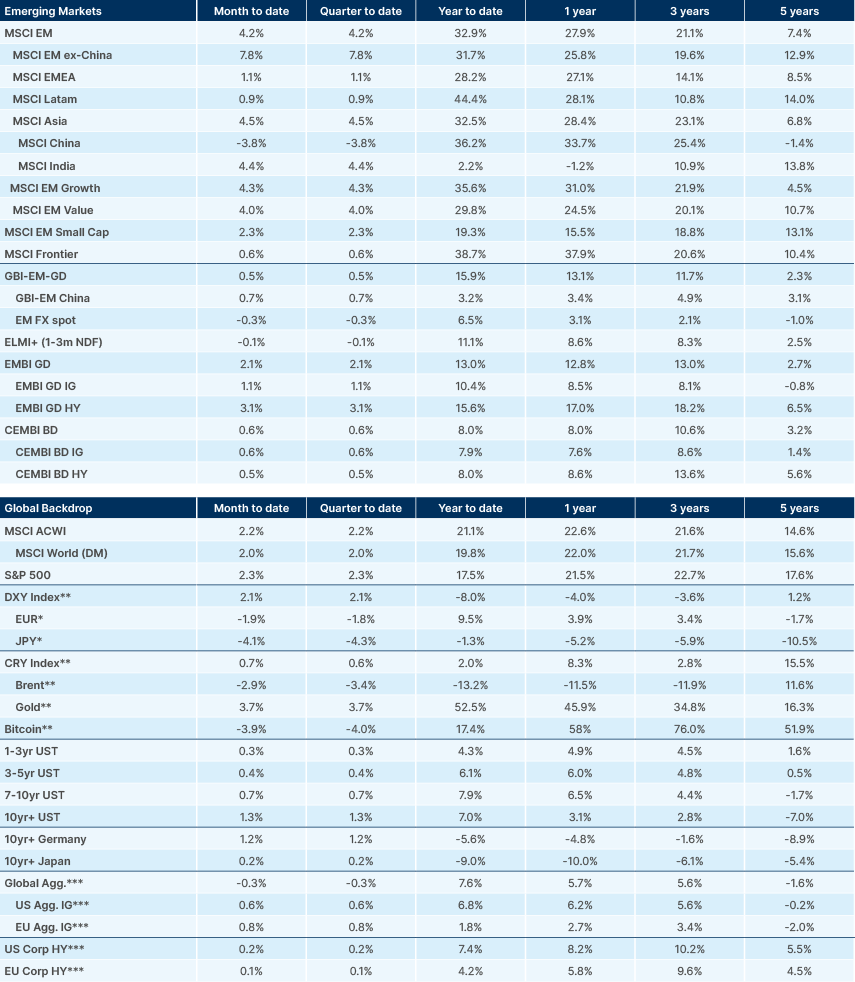

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

1. International Emergency Economic Powers Act.

2. Department of Government Efficiency.