US stocks and the US dollar underperformed last week as economic activity slows in the US while EM stocks rebounded. China cut lending rates by 20bps. The Ukraine conflict remained at a stalemate as Russia downplayed the importance of Sweden and Finland joining NATO. Polls showed this week’s Presidential election in Colombia has the potential to surprise. Egypt, Uruguay, South Africa, and Philippines hiked policy rates by 200, 75, 50 and 25bps respectively. India restricted exports of wheat due to poorer than expected harvest amidst a global shortage of grains.

Global macro

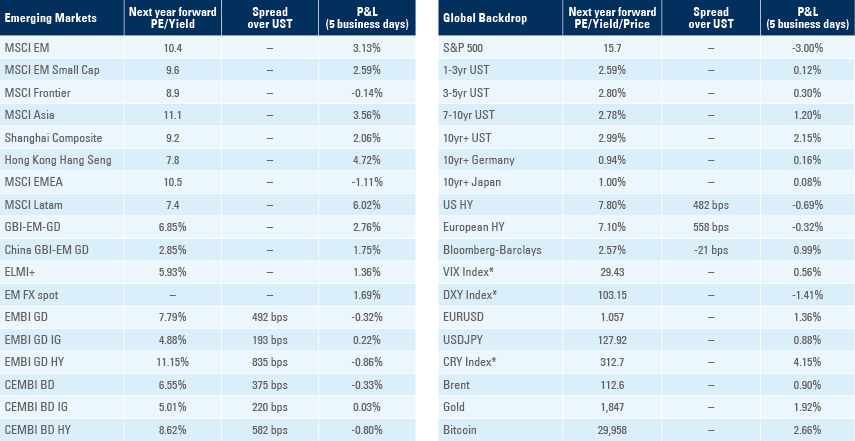

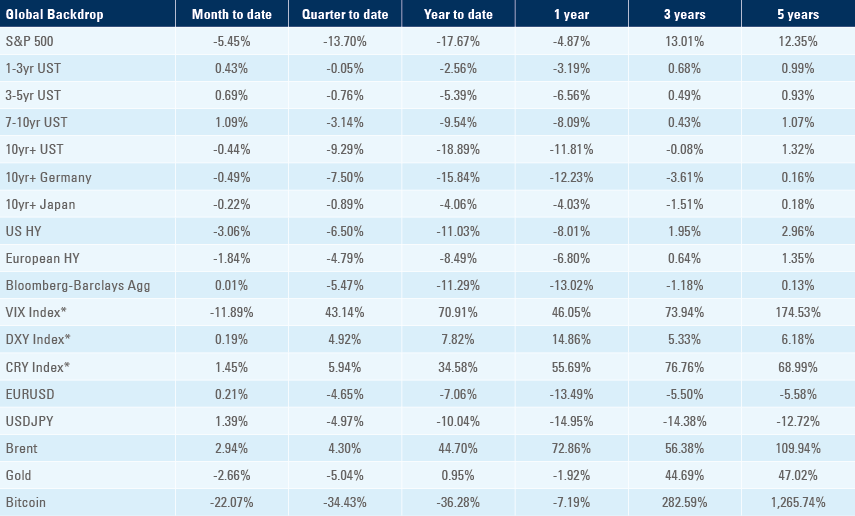

The Chairman of the Federal Reserve Jerome Powell held a hawkish tone in an interview last week even though US high yield credit spreads widened above 500bps over US Treasuries. The more hawkish Fed amidst fears of economic slowdown and poor earnings reported by large retail companies drove the S&P 500 down 3.0% last week, the seventh consecutive weekly decline (longest stream of losses since 2001), and the index is down 18% year-to-date. The Nasdaq was down 4.5% last week and 27.5% year-to-date due to a strong underperformance of overvalued technology stocks.

The median 2022 GDP growth forecast for the US economy was revised to 2.7% last week from 4.0% in December 2021 while CPI forecast increased to 7.0% from 4.4% over the same period. The real interest rate in 5-year forward rates from 2027 (5y5y) declined 17bps from its widest level two weeks ago to 0.56%, as 10-year US Treasury yields rallied 14bps over the last week to 2.78% despite 2-year yields unchanged at 2.58%. The flattening of the US curve is another signal that investors expect further economic slowdown ahead.

The US stock market is now close to pricing a recession, since the median S&P 500 correction around recessions since World War II was 24% (-14% in 1960 to -57% in 2008). Hence long-term interest rates are likely to move lower if the Fed attempts to be more hawkish, pushing equities lower, like Greenspan’s conundrum. At the same time, the Chinese economy is showing the first attempts of bouncing after the lockdown in Shanghai drove economic activity sharply weaker, prompting memories of the 2020 “V-shape” rebound.

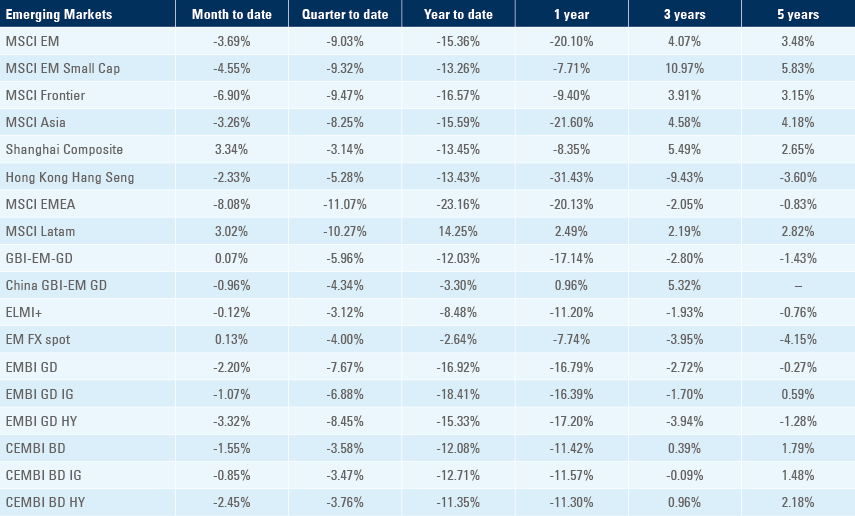

EM stocks rose 3.1% last week, buoyed by a strong recovery in Chinese stocks (A shares +2.1%; Hong Kong +4.7%) as well as MSCI Latin America surging 6.0%. Shanghai covid-19 cases declined to 588 on 23 May from 868 cases on 13 May, allowing the city to remain on course to return to normal activity gradually by the end of June. Four of the 20 subway lines are working, and convenience stores and wholesale markets are gradually allowed to open. On the other hand, Beijing reported an increase in cases to 99 yesterday, from 61 on 21 May leading the authorities to ask six districts – including the Chaoyang central business district – to work from home until 28 May, which means half of the city’s 22m population has mobility restrictions. Despite the still uncertain situation coming from zero-covid policy, regulators announced measures to stimulate the economy, which led to a strong improvement in sentiment. After a 42% sell-off since January 2021 Chinese stocks trade at only 10.6 price to earnings, down from 16.8 in January 2021 and much cheaper than US stocks. Market dynamics improved markedly with strong performance in EM stocks during Asian hours, while markets would sell-off during US trading hours.

The underperformance of US stocks and lower interest rates in US bonds due to fears of economic slowdown drove the Dollar Index down 1.4% last week. In our view, the USD is peaking as both important short- and long-term catalysts for a decline on the greenback are in place, as highlighted in April’s Emerging View.1

Emerging markets

Russia-Ukraine: The conflict in Ukraine remained in a deadlock, with Russia failing to make meaningful progress in Donbass, while Ukrainian President Volodymir Zelensky said the situation in the region is very tough, he also added Ukraine is losing close to 100 soldiers per day.

In a rare display of bipartisanship, the United States Senate approved a USD 40bn aid package bill to Ukraine on an 86 to 11 vote, a significantly larger package than the USD 33bn requested by President Joe Biden last month. The package is equivalent to 0.2% of US GDP (no funding assigned), but likely to be more than 40% of Ukraine’s GDP, after incorporating nearly 50% contraction due to the war. The bill includes USD 20bn for defence and USD 9bn in direct economic support, including funds to repair the US Embassy in Kyiv as well as USD 4bn for food and humanitarian aid. Despite the generous package, the rating agency Moody’s downgraded Ukraine`s sovereign rating to `Caa3` with a negative outlook.

The large USD 40bn package is testament to the significant influence the US holds over Ukraine’s future. The West would do well to change its approach to Ukraine. In simple terms, any individual that comes under threat from a powerful enemy would either get ready to fight hard or flight fast. The current half-hearted approach only created significant problems (namely energy and food shortages) for the entire world and a humanitarian tragedy for Ukraine. In our view, the West lacks strategic direction even after the war. The European dependence on the US for defence and on Russia for energy was a strategic mistake and it now appears the US is trying to compound this mistake by making the EU reliable on the US for both energy and security.2

Putin’s economic adviser Maxim Oreshkin expects a famine to unfold on a global scale by the end of this year. The pragmatic economist noted that Russia had started preparing for a potential shortage of food since the end of last year. This year's harvest will be crucial in many countries after most of Ukraine’s crop was lost either due to the inability to harvest or logistic disruptions. Several countries have been relying on food imports, particularly from Ukraine, including Egypt, Lebanon, Turkey, Bangladesh, Morocco, and Indonesia.

Food security will become a larger concern across large producers as well. Last week India restricted exports of wheat, claiming production estimates for 2022 dropped after a record 109m tonnes harvest in 2021. India is the second largest producer in the world, with China the largest and Russia the third largest. However, India was only the 10th largest exporter of wheat (3.1% of total in 2021), while Russia was the largest (13.1% of global exports) and Ukraine the fifth (8.5%) largest.3 In the previous week Indonesia restricted exports of palm oil.

In other news, Turkey is still challenging Sweden and Finland accession to the North Atlantic Treaty Organisation (NATO) as President Recep Tayyip Erdogan accuses the Scandinavian countries of supporting the PKK party, which is deemed a terrorist organisation. Russian President Vladimir Putin noted at the Russian Security Council meeting that Finland and Sweden joining NATO was not a threat to Russia, while saying if NATO extends its military infrastructure in Scandinavia, Russia will retaliate accordingly. His comments were less hawkish than expected, signalling Russia will be careful not to fight NATO directly.

China: The People’s Bank of China (PBoC) cut its 5-year loan prime rate (LPR) by 15bps to 4.45% to help boost investment in the country and kept the 1-year LPR unchanged at 3.70%. The move follows the PBoC reduction of the mortgage rates for first time buyers by 20bps to 4.05%. The rate cut will allow for lower mortgage rates and is the second move by central authorities to backstop the real estate market as poor home sales dragged local government fiscal revenues. In other news, the International Monetary Fund raised the RMB weight in its Special Drawing Reserve (SDR) basket to 12.28% from 10.92%. It was the first review of the SDR since the RMB was included in the basket in 2016. The weighting of the US dollar rose to 43.38% from 41.73%, while those of euro, Japanese yen and British pound declined.

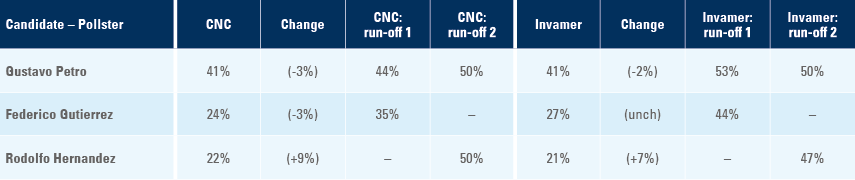

Colombia: CNC and Invamer published their latest poll results, both showing a strong rise from Rodolfo Hernandez (Independent) this Sunday the 29 May (Figure 1). The numbers suggest Gustavo Petro is likely to have to dispute a run-off with either Gutierrez or Hernandes. Colombian assets will perform well if Hernandez gets to dispute the run-off on 19 June with Petro, as Hernandez, the former mayor of Bucaramanga and a businessman from the construction sector, is running as an independent and stands a better change to defeat Petro than Gutierrez, who is supported by the unpopular former president Alvaro Uribe. In a simulation for the run-off, Petro would defeat Gutieres by 53% against 44%, but his margin is much narrower against Hernandez (50% vs 47%). The presidential candidate Ingrid Betancourt quit the race and declared support for Hernandez.4 In other news, the yoy rate of real GDP growth rose 8.5% in Q1 2022, stronger than the 7.7% yoy consensus expectations.

Figure 1: Colombia’s latest presidential election polls:

Egypt: The Central Bank of Egypt hiked its benchmark deposit and lending rates by 200bps to 11.25% and 12.25% respectively, 100bps more than consensus expectations. The government said it is exempt from India’s wheat export ban. Prime Minister Madbouly said an agreement with the International Montary Fund would be reached “within months” and announced plans to privatise state assets and boost private investment, targeting USD 40bn in private sector investments over the next four years.5 Remittances rose to USD 8.0bn in Q1 2022 from USD 7.7bn in Q4 2021. The oil minister El Molla said the country’s hydrocarbon position is balanced, thanks to natural gas exports compensating for oil imports.

South Africa: The Reserve Bank of South Africa hiked its policy rate by 50bps to 4.75%, in line with consensus as one dissenter voted for a 25bps hike. CPI inflation dropped to 0.6% mom in April from 1.0% mom in March leaving the yoy rate unchanged at 5.9% while core CPI declined to 0.4% mom from 0.8% mom over the same period and the yoy core CPI rose by 10bps to 3.9% yoy, both in line with consensus. Retail sales dropped by 0.3% mom in March after declining 2.0% mom in February, taking the yoy rate to 1.3%, a slight miss versus consensus. In other news, the ratings agency S&P upgraded South Africa’s BB- sovereign debt rating outlook to positive from stable, reflecting the “expectation that favourable terms of trade, a path toward contained fiscal expenditure, and the implementation of some structural reforms could lead to a continued easing of fiscal and external pressures”.

Philippines: The central bank hiked its policy rate by 25bps to 2.25%, in line with a narrow consensus (13 out of 21) of economists surveyed by Bloomberg. The central bank increased its 2022 inflation forecast by 30bps to 4.6% (target range 2.0% to 4.0%) based on a USD 100 per barrel oil price and sees risks tilted to the upside as inflation will rise above 5.0% over the next months – mild inflationary pressures compared to both EM and DM countries in the West.

Uruguay: The central bank hiked its policy rate by 75bps to 9.25% and signalled at least another two 50bps hikes, reaffirming its willingness to bring inflation to the 3.0% to 6.0% target range by setting the policy rate in restrictive mode to lower pass-through from exogenous supply shocks to inflation.

India: The yoy rate of wholesale price index rose to 15.1% in April from 14.6% in March. Higher prices prompted the government to restrict exports of wheat and impose measures to lower prices. Excise duty on petrol and diesel was cut by INR 8 and INR 6 per litre respectively, allowing for a 7-8% reduction in prices at the pump, at a cost of INR 1trn (c. 0.4% of GDP) for the fiscal accounts. The government also increased subsidies on fertiliser by another INR 1.1tn, doubling the budgeted subsidy. The import duty on coal was cut to zero (from 2.5%) and reduced on raw materials imports.

Snippets

- Argentina: The population seem to largely blame Vice President Cristina Kirchner for divisions within the ruling coalition as polls published by La Nacion suggest there is support for a fiscal adjustment.6

- Brazil: The Director of Monetary Policy of the Brazilian Central Bank, Bruno Serra Fernandes, said he would prefer to have lower interest rate volatility, but high inflation forced the institution to move more forcefully than previously expected. He added that the monetary tightening would have an impact in the second half of 2022 and that the BCB is currently focused on achieving its 2023 inflation target.

- Chile: The rating agency Fitch reaffirmed Chile’s sovereign rating at ‘A’ supported by “relatively strong sovereign balance sheet, solid governance indicators and a track record of credible macroeconomic policies”. The rating agency is monitoring whether expenditure increases are matched by tax revenues.

- Ghana: The yoy rate of CPI inflation surged 420bps to 23.6% in April, the highest level in 18 years as PPI inflation increased by 190bps to 31.2% yoy.

- Indonesia: The trade surplus surged to USD 7.6bn in April from USD 4.5bn in March, significantly above consensus of USD4.0bn as exports rose 47.8% yoy and imports rose 22.0%.

- Kenya: Vice President William Ruto picked Rigathi Gachagua while Raila Odinga named Martha Karua as running mate. Both candidates come from the largest ethnic group in the country (Kikyu) and are tied with 42% vote intentions on elections set for 9 August. Both candidates intend to revise the current budget, adding fiscal risks for the coming years.

- Morocco: The yoy rate of CPI inflation rose 60bps to 5.9% in April.

- Peru: Economic activity dropped 1.3% mom in March and slowed to 1.2% qoq in Q1 2021 from 2.6% qoq in Q4 2021

- Romania: The yoy rate of GDP growth accelerated to 6.5% in Q1 2022 from 2.4% yoy in Q4 2022.

- Singapore: The yoy rate of core CPI inflation was unchanged at 5.4% in April and core CPI rose 40bps to 3.3% yoy, both slightly below consensus.

- South Korea: The yoy rate of export growth rose 24.1% in the first 20 days of May from 16.9% yoy in the previous month as imports rose by 37.8% yoy from 25.5% yoy, leaving the trade deficit broadly unchanged at USD 4.8bn from USD 5.2bn over the same period.

- Thailand: The qoq rate of real GDP growth rose 1.1% in Q1 2022 from 1.8% qoq in Q4 2021, 20bps above consensus.

- Tunisia: The central bank hiked its policy rate by 75bps to 7.0%, the first hike since 2019 after headline inflation hit 7.5% yoy in April.

- Venezuela: President Nicolas Maduro said the government intends to offer 5% to 10% stakes in companies ranging from telephone and internet providers to a petrochemical company, a sharp shift from the nationalist policies pursued by his predecessor Hugo Chavez who nationalised most of the country’s productive assets. Nevertheless, the details of the scheme remain unclear.

- Zambia: The Bank of Zambia kept its policy rate unchanged at 9.0% as the committee expects inflation to return to the 6% to 8% target by the end of 2023.

Global backdrop

United States: Economic activity surprised to the downside for the fifth consecutive week as the Citibank surprise index dropped to -14.8 on 20 May from +12.8 in the previous week. Industrial production rose 1.1% mom in April from 0.9% in March and retail sales rose 0.9% mom from 1.4% over the same period. The resilience in retail sales is mostly explained by higher inflation rates, leaving volumes traded at a more subdued level. Indeed, April data is at odds with leading indicators such as the University of Michigan and Empire manufacturing survey which suggests a slowdown in the economy. In the housing market, the National Association of Home Builders Index declined to 69 in May from 84 in Dec 2021 (still elevated levels considering readings above 50 indicate more builders view conditions as good than poor) while housing starts and building permits were broadly stable at 1.7m and 1.8m respectively in April. The average house price increased to USD 524k in April 2022 from USD 402k in January 2021, while 30-year mortgage rates rose to 5.3% from 2.65% over the same period, leading to an 80% increase in the monthly payment for the average American.

United Kingdom: CPI inflation rose to 2.5% mom in April from 1.1% mom in March, lifting the yoy rate by 200bps to 9.0%, in line with consensus. The yoy rate of PPI output rose by 210bps to 14.0%, while PPI input was unchanged at 18.6% yoy, suggesting a higher pass-through from input to output prices.

Australia: After 8.5 years in opposition, the Labour Party secured a larger proportion of seats in the Parliamentary election last weekend, electing Anthony Albanese as Prime Minister, in line with the trends depicted by polls. Climate change was an important driver of the election result and major parties lost significant votes to smaller and independent parties.

Japan: The yoy rate of CPI inflation rose to 2.5% in April from 1.2% yoy in March, rising above 2.0% for the first time since 2008 as CPI ex-food and energy rose to 0.8% yoy in April from -0.7% yoy in March

Benchmark performance

1. See https://www.ashmoregroup.com/insights/the-USD-bull-trap-and-EM-USD-debt

2. See https://www.politico.eu/article/ukraine-russia-war-nato-eu-us-alliance-solidarity/

3. See https://www.atlasbig.com/en-gb/countries-by-wheat-production and https://www.worldstopexports.com/wheat-exports-country/

4. See https://www.bluradio.com/nacion/elecciones/presidenciales/encuesta-invamer-petro-logra-el-40-6-fico-el-27-1-hernandez-pasa-a-fajardo-y-alcanza-el-20-9-rg10 and https://www.elcolombiano.com/colombia/politica/gustavo-petro-y-rodolfo-hernandez-quedarian-empatados-en-segunda-vuelta-segun-encuesta-de-cnc-BH17543882

5. See https://enterprise.press/stories/2022/05/16/madbouly-announces-plans-to-privatize-state-assets-boost-private-investment-71163/

6. See https://www.lanacion.com.ar/opinion/la-pugna-alberto-fernandez-cristina-kirchner-que-dicen-las-encuestas-nid17052022/