Since early June, Trump has been polling as the most likely candidate to win the 2024 presidency. After a disastrous July, Biden dropping out of the Presidential race is a boost for the Democrats. Kamala Harris is a better candidate and may gather momentum. However, the statistical likelihood of a Trump presidency has changed little. Thus, the key question for Emerging Market (EM) investors remains: What are the consequences of a second Trump presidency for EM assets?

The consensus, and lazy answer is that Trump’s policies will involve increased fiscal profligacy via tax cuts, alongside disruptively large import tariffs and a draconian immigration stance. This scenario would be inflationary, leading to tighter monetary policy, higher long-term rates and a stronger Dollar - a difficult backdrop for EM.

But this consensus view is incoherent. Firstly, Trump’s policy preferences will face significant financial, macroeconomic and political constraints if he returns to office. These will make any fiscal expansion very difficult, in our view. 2024 is a totally different macro environment to 2016. Then, Obama left office with a consolidated budget deficit and an economy in early-cycle. This year, Biden will do the opposite. Deficits and debt have ballooned, and the economy is slowing down.

Furthermore, recent interviews demonstrate that Trump does not have as stubborn a view on tariffs as many believed. Instead, it is becoming clear that Trump views tariffs primarily as a tool to negotiate deals. Compelling countries to appreciate their currencies to rebalance bilateral trade deficits will be at the top of the list, as he expressed in a Bloomberg interview in mid-July. Also, the US electorates exhaustion with rising prices means he will be cautious on policies that drive inflation higher.

Therefore, the outlook is more nuanced than the prevailing narrative. All things considered, our base case is that US fiscal accounts will tighten in 2025, allowing for looser monetary policy and a weaker dollar, even without intervention, which may play a role later. This scenario would have more positive implications for EM markets, bringing attention to several EM countries currently benefitting from structural reforms, higher GDP growth, macro stability and credit rating upgrades.

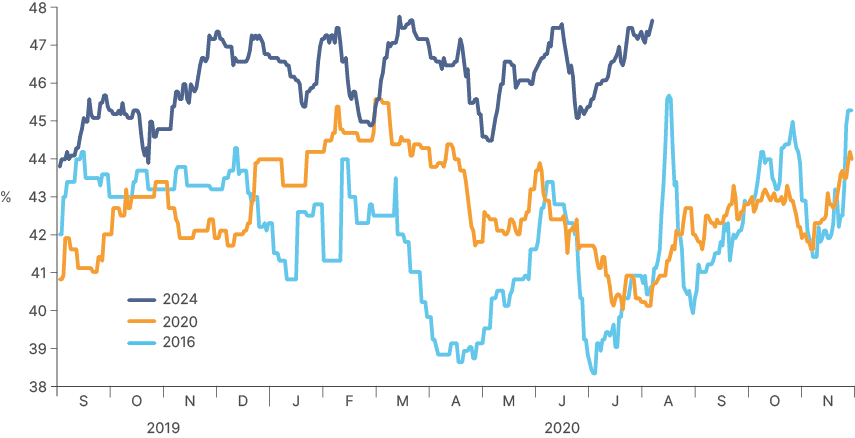

Election is still Trump’s to lose

The last few weeks have showed anything can happen when it comes to this presidential election. However, Trump was already favourite before the assassination attempt. Now, he has a new dimension to his appeal, humanised as ‘the victim of the radical left and political violence’. Already he is using this to his advantage. Fig. 1 shows Trump’s average polling is higher now than at any point in the previous two elections. Strong polling numbers and the upper hand on key issues facing the nation (immigration, cost of living) will make him a difficult candidate to defeat. Trump is also popular with American labour, crucial in the six or seven swing states that will define the US election.1

Fig 1: Trump’s Average Polling: 2024 vs. 2020 and 2016

The appointment of J.D. Vance, a populist hawk, as his running mate is unlikely to change the race. Vance’s anti-China stance, alongside his wishes to weaken the Dollar, end support for Ukraine, and toughen border control for immigration, may embolden Trump’s core populist views. Furthermore, Vance has a cynical stance towards the big US monopolies. Some CEOs are reportedly more worried about him in the VP seat than about Lina Khan as Chair of the Federal Trade Commission (FTC).

Kamala Harris has a better shot against Trump than Biden did, in our view. As a prosecutor with a solid career, she will pose as tough on crime and try to rally women and younger people to vote for her. Social media may be her ally. If Kamala is confirmed and eventually wins the race, her policy preferences will remain aligned with the Democratic Party. However, she would most likely struggle to win both Houses of Congress and to achieve the same coordination within the party that Biden did, meaning fewer progressive reforms. Importantly, an alternative candidate in the Democratic Party makes it is less likely that the Republicans take both houses of congress if Trump wins.

The current “Trump Trade” consensus

A global managers survey by Bank of America from mid-July 2024 showed most investors think trade policies will be the area most impacted by the elections. The same survey shows three-quarters of investors see higher bond yields in case of an election sweep (Republicans winning the presidential race and both houses of congress). The logic is, higher tariffs and fiscal expansion would raise inflation and lead to higher rates, potentially with the long end of the curve selling-off more (‘bear-steepening’). A tariff induced inflation reaction would also make it more difficult to have a proper rate cutting cycle in 2025.

In this scenario, the impact on currency markets, all else constant, would be a stronger Dollar. This would be a challenging environment for EM currencies. Weaker currencies would force EM central banks to keep monetary policy tight, which would be a headwind for EM equity markets.

However, Trump’s policy preferences are incongruent, both in and of themselves, and with the 2024 economic reality. He may want higher tariffs and tax cuts, but he also wants lower rates and a weaker Dollar. It is unlikely he can have his cake and eat it.

An agnostic analysis of Trump’s likely policy direction (Section 5) suggests that, out of the gates, the US will see fiscal consolidation (not expansion) as the global economy slows down. This will be supported by automatic stabilisers, an unwind of the costly Inflation Reduction Act (IRA), and tariff revenues, amongst other factors (section 5b). Tighter fiscal policy and looser monetary policy slowing growth would most likely drive rates and the dollar lower, even if tariffs support a narrower trade deficit.

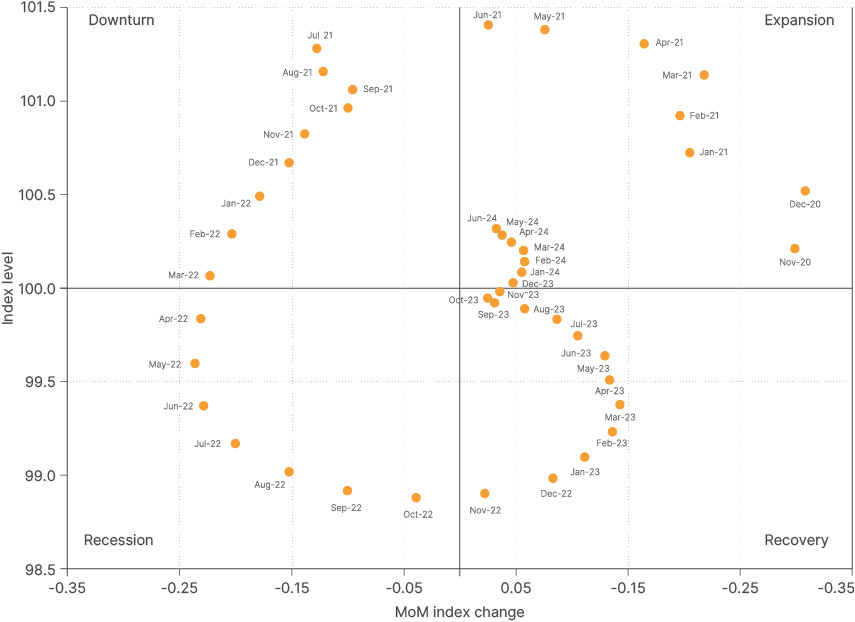

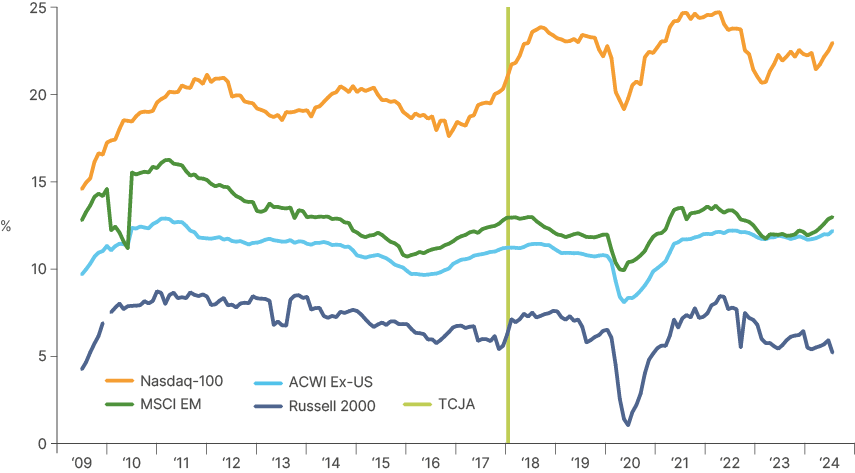

This would deliver a markedly different outcome for EM. Since 2017, procyclical fiscal expansion in the US (Fig. 2) and tight monetary policy has kept the return on equities of monopolistic sectors in the US elevated (Fig. 3). Elevated yields on Dollar deposits have meant EM exporters opted to keep their cash in USD for longer. The combination of these two factors has led to an absorption of international money by US capital markets.

If pro-cyclical fiscal expansion was a key factor leading to the US equity market exceptionalism, fiscal consolidation will lead to unwind of these trends, meaning more capital flows to the rest of world (including EM). This would have a knock-on effect on stronger EM currencies, leading to lower inflationary pressures and allowing EM central banks to lower rates to support growth. This cyclical picture is markedly different to 2016, when Trump first became president, and presents a more benign scenario for EM assets.

Fig 2: Fiscal deficit vs. unemployment

Fig 3: Return on Equity

Cyclical Picture: 2024 vs. 2016

Using Trump 1.0 as a reference point for what may happen in Trump 2.0 is the natural place to start. But the differences in the current environment, compared to 2016 shouldn’t be ignored. Structurally, Developed Markets (DM) have higher debt, and immigration (into DM and the US) is likely to slow down (section 5.a),which will weigh on already flagging GDP growth. The energy transition and artificial intelligence (AI) adoption will keep commodity prices under pressure. Together with geopolitical risk, this will keep inflation volatility more elevated than the post-2008 to COVID-19 era. This backdrop is a stark contrast to the early-stage cycle environment in 2016, where US assets, and the dollar, outperformed while Trump implemented trade restrictions, deregulation, and tax cuts.

At the same time, as the summer goes on, the US economy is exhibiting more late-cycle signals. Disinflation is taking hold globally, driven by tight monetary and tighter fiscal policy in most countries. The fundamental and valuation indicators listed below corroborate this late-cycle scenario, suggesting the likelihood of (marginally) tighter fiscal and looser monetary policies in the US in the coming quarters. At the same time, we see EM fundamentals and valuation indicators positively diverging from DM, rendering EM assets an increasingly attractive investment in relative terms.

US

- Government debt is 18% higher than in 2016 at 123% of GDP.

- The federal deficit is now 6.4% vs. 2.7% in 2016.

- Real GDP growth is slowing vs. accelerating in 2016.

- Both manufacturing and service sector surveys are softer.

- Unemployment is below neutral and rising today vs. above neutral and falling in 2016.

- Inflation remains above targets, but dropping: US core CPI at 3.3% today, vs. 2.1% in 2016.

- US stocks are close to the highest levels in a multi-decade period:

- The S&P500 trades at 23x 12m forward price to earnings (p/e) vs 18x in 2016.

- The Nasdaq trades at 29x 12m forward p/e vs. c. 21x in 2016.

EM

- EM fundamentals are improving today, contrasting with a deteriorating backdrop in 2016:

- EM growth premium was declining in 2016 vs. expanding today.

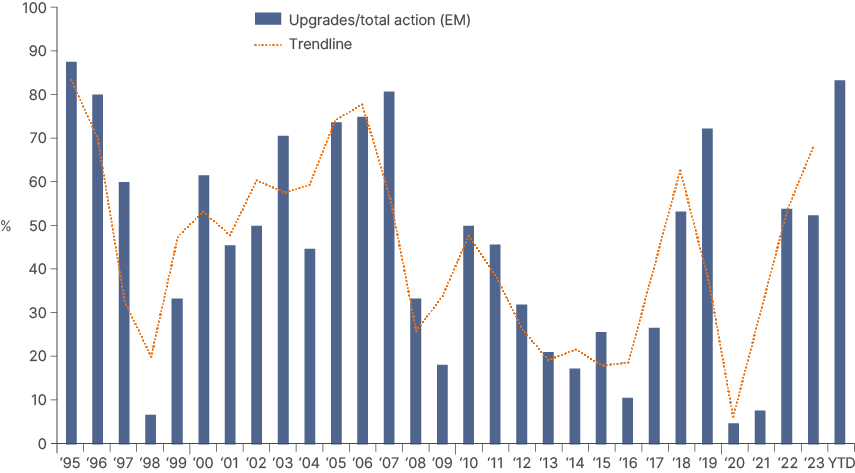

- 80% of EM sovereign rating changes are upgrades YTD. Only 10% in 2016 (Fig. 4).

- EM stocks trade at 44% discount to the S&P 500 vs. 33% in 2016 (26% average since 2006).

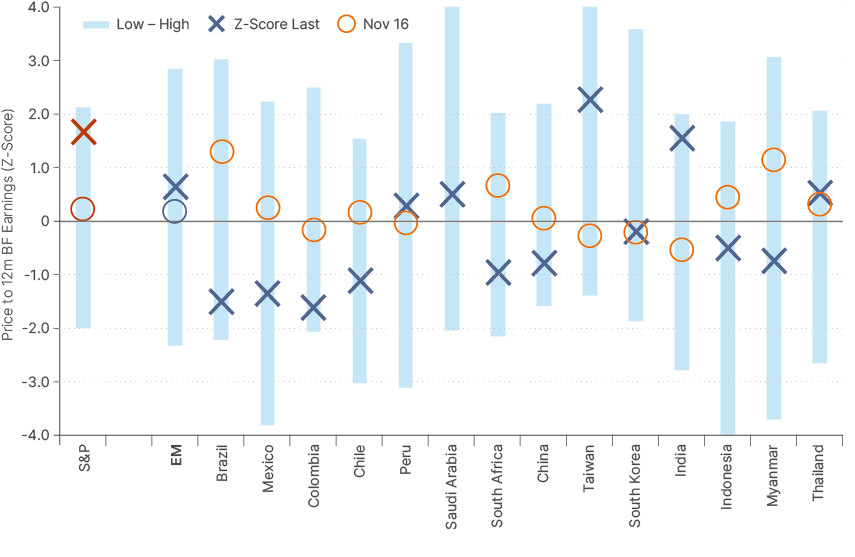

- Only two countries (India and Taiwan) trade at higher levels than 2016 (Fig 5).

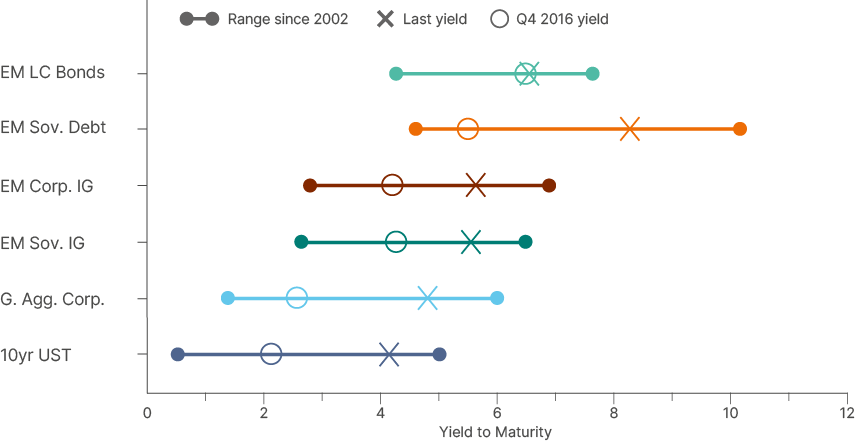

- Yields are wider than 2016 across the board, particularly in EM Sovereign Debt (Fig.6).

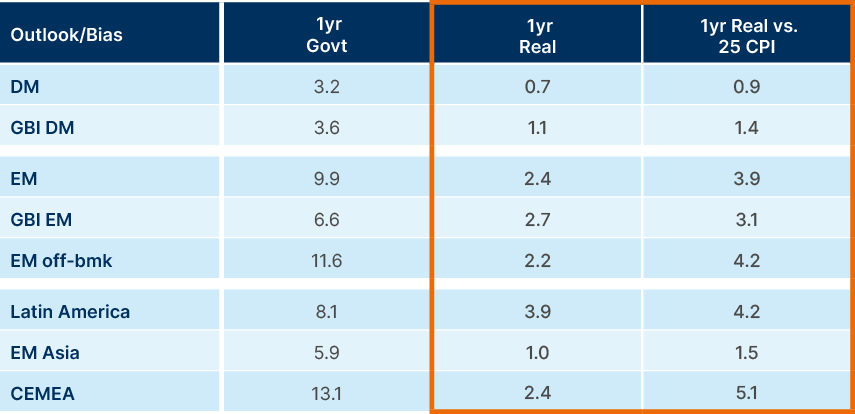

- EM local currency real rates are 50bps higher than 2016 (Fig. 7).

- Foreign investors ownership of local bonds (ex-China) at 12.5% today vs 17.5% in 2016.

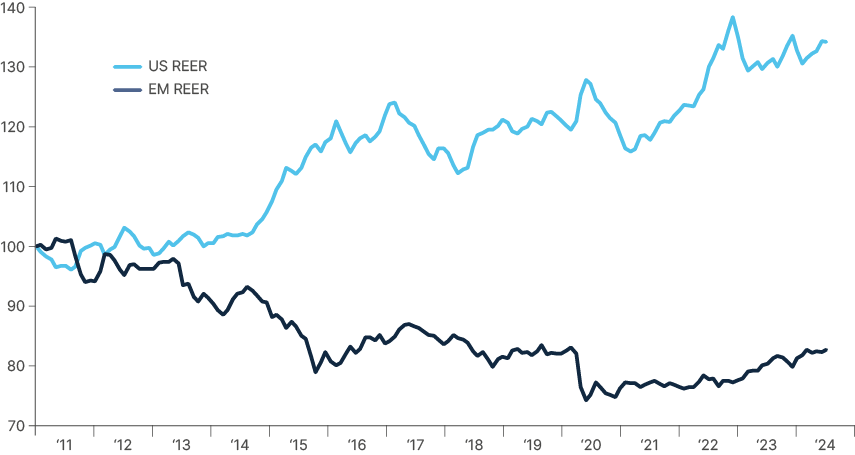

- EM currencies remain at depressed levels as the Dollar rose (Fig. 8).

Fig 4: Net upgrades/downgrades EM sovereign debt

Fig 5: Price to earnings ratio: standard deviations away from mean (2006-2024)

Fig 6: Global Fixed Income Yields (2002-2024)

Fig 7: EM ex-ante LC real yields

Fig 8: EM vs. US: Real Effective Exchange Rate (normalised at 100 in December 2010)

Policy preferences vs Hard Constraints: Trump vs. Democrats

Investors must distinguish what politicians say they will do while campaigning from what they will do when in power. Politicians love to promise the impossible to get elected, but then must deal with the actual constraints in the real world.

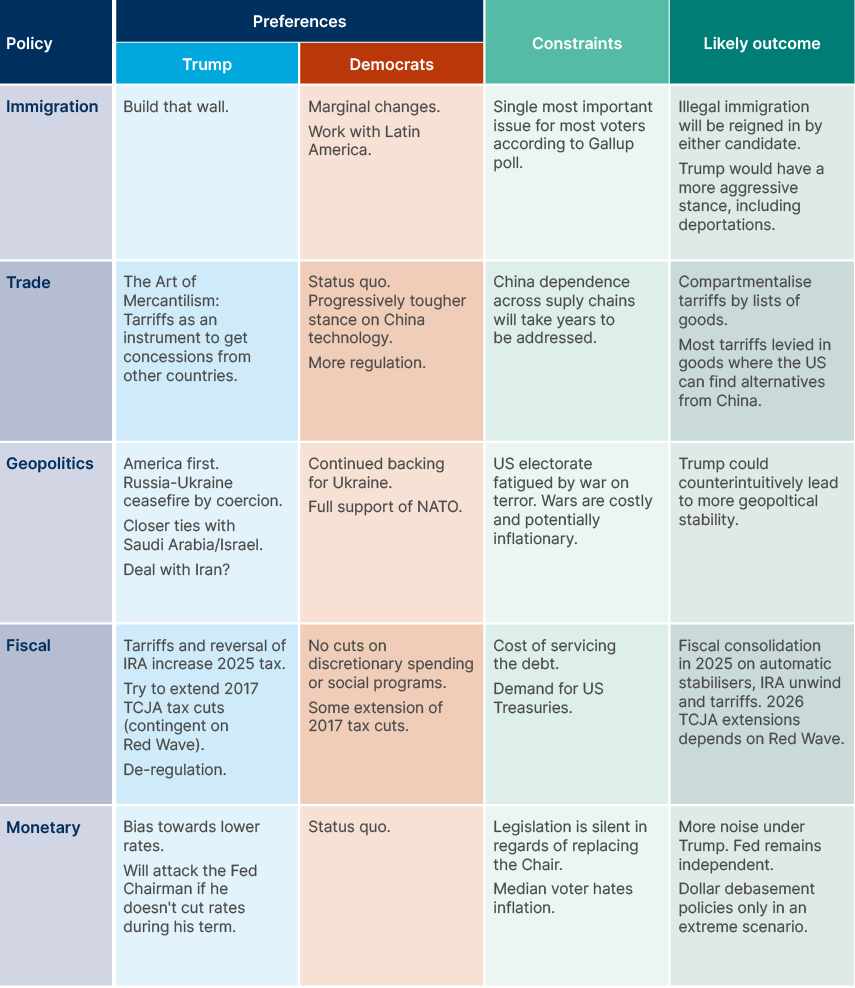

The main roadblocks faced by politicians are public opinion and geopolitical, economic, and institutional limitations. Politicians who fail to “read the room” and align with the median voter expose themselves to losing power. That was Trump's biggest mistake during the pandemic. Whether lockdowns were the right policy or not was irrelevant. The median population and businesses decided it was the only way. Trump fought the median voter and lost, losing popularity in the process. Bolsonaro suffered the same fate in Brazil. Fig. 9 highlights the main preferences of both political sides against likely outcomes given hard constraints.

Fig 9: Policy Preferences vs. constraints

a) Immigration and other societal issues

The median voter in the US cares mostly about immigration, cost of living, poor governance and the “economy in general”.2 The Democrats carry the burden of the surge in illegal immigration and inflation over the last four years, leaving an uphill battle faced by Harris or anyone replacing Biden.3 Thus, the next president will have to be more careful about macro stability from 2025 onwards, and lower immigration. Nevertheless, the policy implementation is likely to be very different between the parties. Trump is likely to have a more aggressive approach, which comes with risks to social stability and economic performance. His immigration policy may impact relations with Mexico and other Latin American countries. The Mexican government knows this story well and is well equipped to deal with Trump. The Mexican minister who re-negotiated the North American trade deal will be part of the cabinet of the next Mexican President.

Other societal issues that matter are safety (advantage Trump) and reproductive rights (advantage Democrats). Trump is very vulnerable on the latter post the Supreme Court’s Roe vs Wade decision but understands the median voter dynamics and has positioned himself against a national ban on abortion, passing the problem to individual states. Lower immigration would limit potential GDP growth in the US, but Trump is not oblivious to this, and has signalled more thoughtful policies for legal skilled immigration.

b) Fiscal Policy

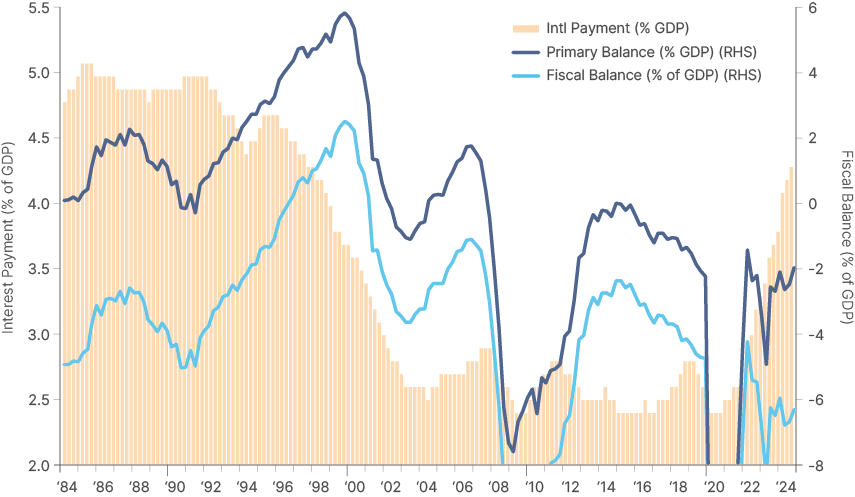

In our view, US exceptionalism has been anchored, since 2017, on pro-cyclical fiscal expansion that boosted US companies’ return on equity and, more recently, the yield on fixed income assets (Fig. 2 and 3). US outperformance has been a headwind for EM economies, overshadowing structural reforms and improving fundamentals.4 Most analysts believe the new President, whether Republican or Democrat, will keep on driving for ongoing large fiscal deficits. In our view, this conclusion is lazy, as it is solely based on preferences and ignores the constraints they will face.

Debt sustainability is the first. A large fiscal deficit alongside debt/GDP above 120% makes debt dynamics unsustainable, unless nominal GDP growth rises from the current 4% (2% real growth + 2% inflation) towards 6%-7%, the current level of fiscal deficit. Real GDP growth is unlikely to pick up the baton, in our view. While AI is generating excitement and froth in markets, its adoption is unlikely to make a difference on the macro level for the foreseeable future. Professor Daren Acemoglu estimates AI productivity gains to be between 0.05% and 0.07% per year over the next decade.5 Lower immigration will also reduce potential real GDP growth.

If GDP growth remains around historical levels, maintaining debt sustainability would require inflation closer to 4-5% than 2%, which would be politically unpalatable. This is one hard economic constraint pointing towards the inevitability of a fiscal consolidation. Another is the demand for US Treasuries. The US will need to issue c. USD 9.9trn over the next 12 months, comprising USD 8.8trn of expiring T-bills (USD 6.1trn) and short-dated US Treasuries (USD 2.7trn) and the current USD 1.6trn deficit. It is very likely buyers would be rattled if the next administration tries to cut taxes without cutting expenditures or entitlements.

Above all, the consensus for a wider fiscal deficit also clashes with the Congressional Budget Office (CBO) forecast for a 0.8% GDP reduction of the primary deficit in 2025 and another 0.5% of GDP in 20266. The CBO only projects three rate cuts by the Fed. More cuts would lower interest costs and tighten the fiscal deficit further. Lastly, Trump is likely to start his mandate enacting policies (tariffs and repeal of the Inflation Reduction Act) that will raise government tax windfalls. As we have outlined, fiscal consolidation will allow for lower rates and a weaker Dollar at the margin, supporting EM currencies and taking the air out of the overinflated US economy. This will lead to more flows to EM economies with stronger growth dynamics

Fig 10: Interest payments surpassing 4% of GDP by December

c )Trade Policy

Another policy area breeding fear among investors focused on policy preferences is trade. Trump’s 50% tariffs on China and 10% tariffs across the board would be very disruptive for the global economy, and initially bullish for the Dollar. But this policy preference ignores another key constraint. China is by far the largest manufacturer in the world. Its production capacity is larger than the combined capacity of the next nine countries. The US dependence on China across supply chains is understated by both Republicans and Democrats and will put a cap on Trump’s tariffs.7 During the first trade war in 2018-19, former US Trade Representative Robert Lighthizer and Trump carefully chose to increase tariffs in a phased manner, first on products where the US could find replacements. They’ve concomitantly threatened tariffs on strategic products where replacements were difficult.8

Despite Sinophobia brewing across America, ripping off the band-aid with disruptive tariffs could induce a stagflation environment with lower productivity and higher prices. A more considered and negotiation-oriented approach is likely. Trump has recently said that tariffs are “good economically, but great for negotiation.” Therefore, it is likely he will use threats of unilateral tariffs as a tool for leverage, like during the first trade war, rather than as a hard rule.

d) Foreign Policy

A Trump presidency would bring more upside than downside when it comes to disruptive global conflicts, in our view. Any country thinking about starting a war will be wary that Trump can be unpredictable, decisive, and even reckless. Trump is always looking for a deal. In his interview with Businessweek, his comment on Iran was: "I would have made a great deal with them – no nuclear weapons." He is more Saudi-friendly than Biden and is likely to build on the 2020 Abraham Accords that reshuffled the relationships and balance of power in the region. The fact that Iran and Saudi have reestablished foreign relations and that Iran now has a president who won the election advocating for another nuclear agreement makes a second nuclear deal more likely.

Trump has also famously pledged to end the war in Ukraine. His plans are not entirely clear, but he may gain leverage by threatening both parties: the Russians, by arming Kyiv to the teeth, and the Ukrainians by stopping support.

Trump also seems to understand the dynamics and risks around Taiwan. Strategic ambiguity has been a successful policy. His recent comment on asking Taiwan to pay for the weapons they buy from the US is not a change in policy per se. It is also an ambiguous statement. The US continues to supply weapons to Taiwan, however Trump acknowledged that it would be difficult to defend the nation, given the proximity to China and distance from the US. This ambiguity will keep Trump from crossing Beijing’s red lines.

Finally, European states will be worried about Trump’s attitude to NATO, but the reality is that most countries are now spending more than the 2% of GDP threshold that initially sparked Trump’s anti-NATO outburst.

The 2025 Trump Tower Accord

Trump will likely raise multilateral tariffs to some extent if he comes into power and be more aggressive towards China. However, Trump, JD Vance and Robert Lighthizer believe that Dollar strength after the first round of tariffs in 2018 undermined the envisaged trade rebalance. They will, therefore, likely keep tariffs contained at first, and threaten Europe, Japan, and China with higher tariffs unless they strengthen their currencies against the Dollar.

Japan does not want a strong Yen but will have little choice. In June, the JPY was trading at the weakest levels since 1987 and is already strengthening since Trump’s Bloomberg interview. Europe will be reluctant, even though a stronger EUR would increase purchasing power of Europeans and thus increase the appeal of the EU to its population. China would love to have a marginally stronger RMB, but it will be harder to achieve given its current macro situation. Perhaps by 2025 the housing market will have finally turned, as the more aggressive measures announced since Q1 2024 take effect.

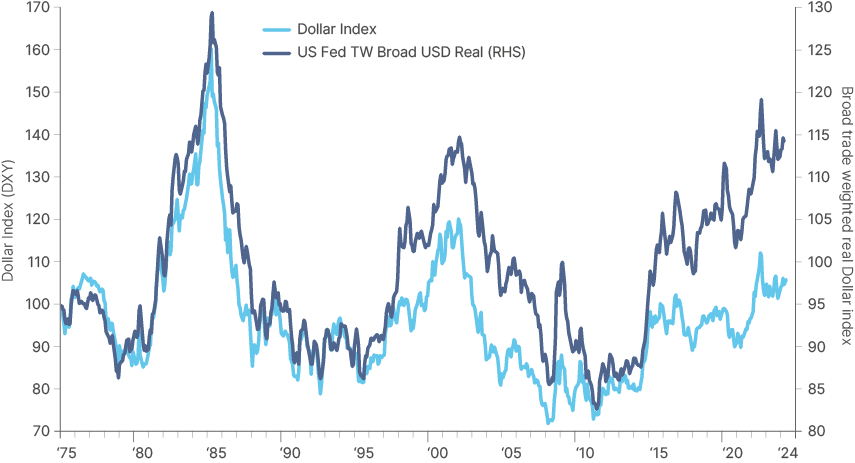

The 1985 Plaza Accord occurred when, like today, the Dollar was at historical highs (the last US Dollar peak was only c. 10% lower than 1985) and the JPY was at the lows. Like today, this was underpinned by loose fiscal and tight monetary policy in the US, while US trade partners were working to boost their exports through weak exchange rates. Just like today, aggressive monetary policy tightening in the US weighed dangerously on regional banks. History never repeats itself, but it rhymes. Trump always wanted the Plaza Hotel. He bought the property in 1988, five years after Trump Tower opened just three blocks down the street and three years after the Plaza Accord. A similar deal in his own hotel 40 years later would certainly appeal to his ego. It would also be a relief for many EM countries that have had to navigate a strengthening dollar over the last 12 years.

Fig 11: US Dollar Trade Weighted Real Exchange Rate

Summary and conclusion

Investors have come to associate the US election with a continuation of the current trends. No party will consolidate the fiscal deficits and the Dollar will continue rising, boosted further by tariffs. As a result, most investors are still positioned for another four years of US exceptionalism, regardless of the election outcome.

This is shortsighted, in our view. Trump’s policy preferences are not only inconsistent from a macro perspective but will be checked by several constraints that will make their implementation much harder. Furthermore, the US economy currently displays several late-cycle signals, so even if the policies of Trump’s first presidency were replicated, it is unlikely they would have the same benign impact today.

On the other hand, EM economies have proved resilient to external shocks in recent years. Growth has surprised to the upside, even as inflation declined faster than in DM. However, lower valuations mean EM assets, particularly equities are both a safer destination in a market correction and provide more upside if the Dollar does start weakening. Thus, in our view, the trade with the best risk reward is also the one very few investors have in their books today.

1. See – https://www.ft.com/content/2247f279-522e-4c5c-a7e8-6c99aed5d5ef The swing states are Pennsylvania, Wisconsin, Michigan, Arizona, Georgia, Ohio, and North Carolina.

2. See – https://news.gallup.com/poll/1675/most-important-problem.aspx

3. See – https://www.economist.com/graphic-detail/2024/01/24/americas-border-crisis-summarised-in-ten-charts

4. See – 'The untold story of improving EM fundamentals’, The Emerging View, 27 June 2024.

5. See – https://economics.mit.edu/sites/default/files/2024-04/The%20Simple%20Macroeconomics%20of%20AI.pdf

6. See – https://www.cbo.gov/publication/60039#section1

7. See - https://www.csis.org/blogs/perspectives-innovation/us-china-relationship-amid-chinas-economic-woes and https://www.washingtonpost.com/business/2023/09/04/china-global-economy/

8. See - https://taxfoundation.org/research/all/federal/tariffs-trump-trade-war/#main