- Trump shooting changes the dynamics, but not the trends, of the US presidential race.

- EM assets outperformed last week, buoyed by a weaker Dollar.

- China further restricted short selling as data weakened ahead of the Third Plenum.

- South Korea discussed rate cuts.

- Argentina’s Milei postponed utility price hikes.

- Brazil’s Lula pledged to address fiscal concerns.

- Pakistan reached a deal with the IMF.

- Kenya downgraded by Moody's.

- Japan’s Finance Minister intervened in the JPY again.

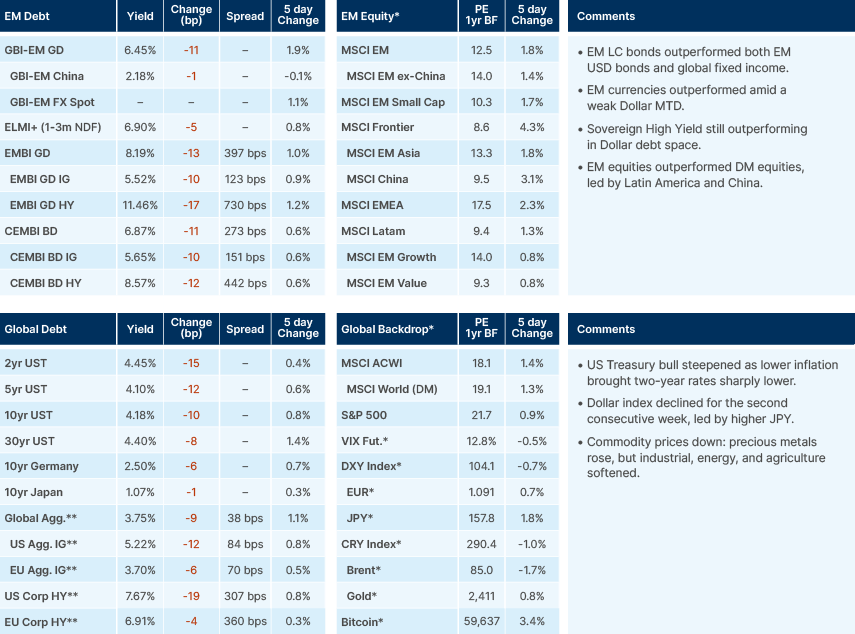

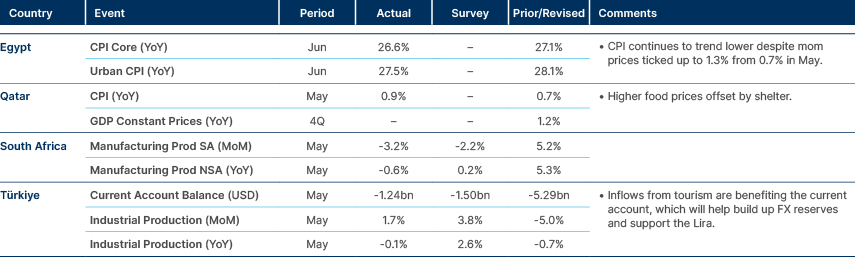

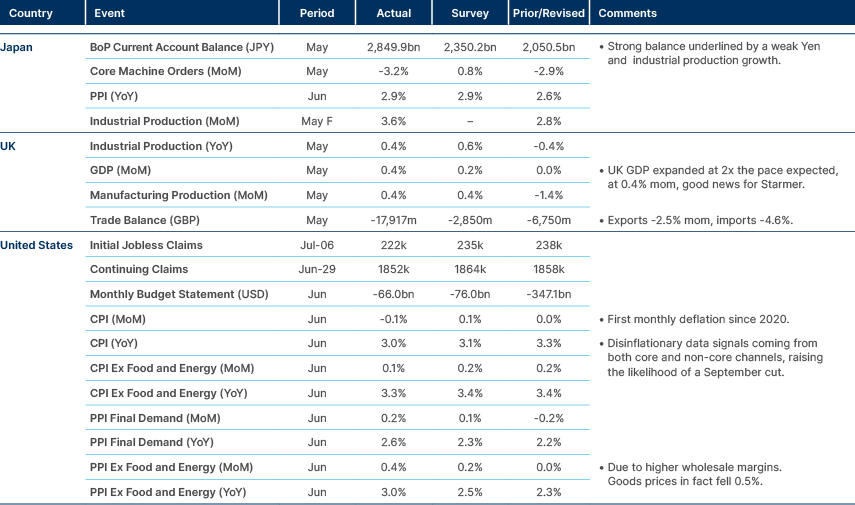

Last week performance and comments

Global Macro

Donald Trump survived an assassination attempt, which will likely strengthen his campaign. The way he handled the event, seeming unshaken, highlighted his vigour, a stark contrast with Joe Biden's frailty. The picture of Trump bloodied up against the blue sky could now become the defining characteristic of his campaign. Furthermore, he is now being portrayed as a victim, a more human person.

Sadly, this event is more common than perceived in America: 15% (seven out 45) US presidents have been victims of assassination plots: Andrew Jackson (1835), Theodore Roosevelt (1912), and Ronald Reagan (1981) survived. Abraham Lincoln (1865), James Garfield (1881), William McKinley (1901), and John Kennedy (1963) didn’t. That’s approximately one attempt every 33.5 years, on average. Trump was the fourth candidate targeted while campaigning: Theodore Roosevelt, Robert Kennedy, and Bill Clinton were also targeted in the past.

Surviving assassination attempts has been historically good for approval ratings. The example of Jair Bolsonaro in Brazil, who won the election after surviving a stab in his stomach, is the freshest in mind. The odds of Trump winning the election surged to 67% this morning from 60% last Friday and 36% one year ago, according to PredictIt.1 However, this boost has been short-lived in some cases. At the time of Ronald Reagan’s attempted assassination in March 1981, his approval rating was at 60%. Three days later, it climbed to 67% before dropping again to 59% by June.

In other news, the yield curve bull steepened last week post soft consumer price index (CPI) data, with the front end rallying. Prices declined -0.1% mom, the first negative monthly CPI reading since the early months of the pandemic. The decline was broad-based, helped by lower fuel and transport prices. However, it was also driven by housing (owners’ equivalent rent (OER) dropping. Producer price index (PPI) inflation ticked up slightly, due to higher margins at wholesalers and retailers, and this is likely to weigh on core PCE. But higher PPI is likely to weigh on the core Personal Consumption Expenditures (PCE) index. Core services ex-rents inflation is expected to rise 0.07% in June.

The yield curve is likely to steepen pricing in higher odds of Trump winning the election as he will likely be willing to renew the tax cuts on his Tax Cuts and Jobs Act (TCJA), expiring at the end of 2025. However, a serious fiscal expansion faces two main hurdles. The first is for Trump to win the election and carry alongside him a majority in both Houses of Congress. The second is the market discipline factor. Debt and deficit levels are far more elevated today than at the time of the TCJA approval in 2017. The bear steepening itself is a sign of market-imposed restrictions to a more profligate policy. Overall, the main impact of the pre-election violence is to increase uncertainties.

Commodities

Commodity prices closed the week lower, even though oil prices rose on Thursday and Friday, as slowing inflation and a higher likelihood of a September rate cut fuelled hopes of stronger economic activity. The CPI data also pulled the greenback lower, which should support oil prices, as oil trades in dollars in the international markets. While higher oil prices could make disinflation more difficult, weaker consumption from China should counteract higher US demand.

Geopolitics

China/NATO

Beijing lashed out on Thursday at NATO’s accusation that China had become a “decisive enabler” of Russia’s war against Ukraine. NATO’s 32 leaders demanded on Wednesday that China “cease all material and political support to Russia’s war effort” in its strongest-ever condemnation of Beijing’s Russian relations. Beijing responded aggressively, saying that these comments were ‘biased, slanderous and provocative,’ dismissing the alliance (NATO) as a ‘relic of the Cold War.’

Taiwan

Taiwan’s government is working to prepare public services and infrastructure to function in wartime, as China’s increasingly aggressive stance fuels concerns. Taiwan this week detected the most Chinese warplanes in its airspace within a 24-hour window so far this year.

Israel

Israel’s Defence Minister Yoav Gallant said that 60% of Hamas fighters had been “eliminated or wounded” since 7 October, equating to 14k terrorists. As of 12 July, a total of 39k were killed (36.5k Palestinians, 1.5k Israelis) and over 89k were injured.2

Emerging Markets

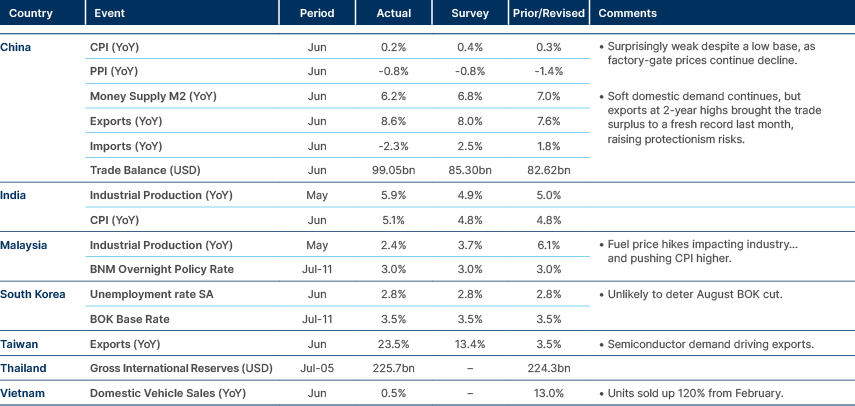

Asia

China: Regulators took more steps to restrict short selling and quantitative strategies, seeking to support its stock market. These included raising margin requirements for short selling, making trades more expensive for hedge funds and other investors. Premier LI Qiang said that no shock therapy would be forthcoming: “According to Chinese medical theory, at this time we cannot use strong medicine. We should precisely adjust and slowly nurture the economy, allowing it to gradually recover.”

In the same week, China posted a record USD 99bn (GBP 76.4bn) trade surplus last month, amid signs of importers bringing forward orders to beat higher tariffs on goods from the world’s second-biggest economy. Economic data released overnight shows weaker-than-expected GDP growth and retail sales. The data increases the importance of the Third Plenum policy debate, taking place between today and Thursday. China needs to announce measures to increase consumption and rekindle investment sentiment via more market-oriented policies and less interventions. On the other hand, the government needs to announce more support to the property sector that requires policies to stabilise the impaired supply dynamics (i.e., sold houses with severe delivery delays) that have contaminated demand.

Indonesia: Rumours circulated again this week that Prabowo’s teams are considering raising Indonesia’s 3% budget deficit and 40% government debt caps, which have been in place since 2003. However, Sufmi Dasco Ahmad, who leads the synchronisation team, reiterated that the incoming government would “adhere to the 3% budget limit and maintain the status quo”. Prabowo said in May that Indonesia needs to be “more daring” with spending. This growing narrative has led to foreign fund outflows and pressured the Rupiah. However, with a strong growth profile, the World Bank has given assurance that even if the debt ratio were to rise to 50%, the state finances would still be prudent, and remain within investment grade territory.

South Korea: Bank of Korea Governor Rhee Chang-yong said market pricing for a cut was excessive and the board was more concerned about house prices now than in May. Nevertheless, the Governor noted that the board is now considering rate cuts, a meaningful change from the last meeting’s policy. While the lower inflation rate in the US, and the higher likelihood of the starting of rate cuts in September, will not directly influence Emerging Market (EM) central bank decisions, it certainly allows policymakers in low interest rate countries to lower rates without fearing the impact on weaker currencies.

Latin America

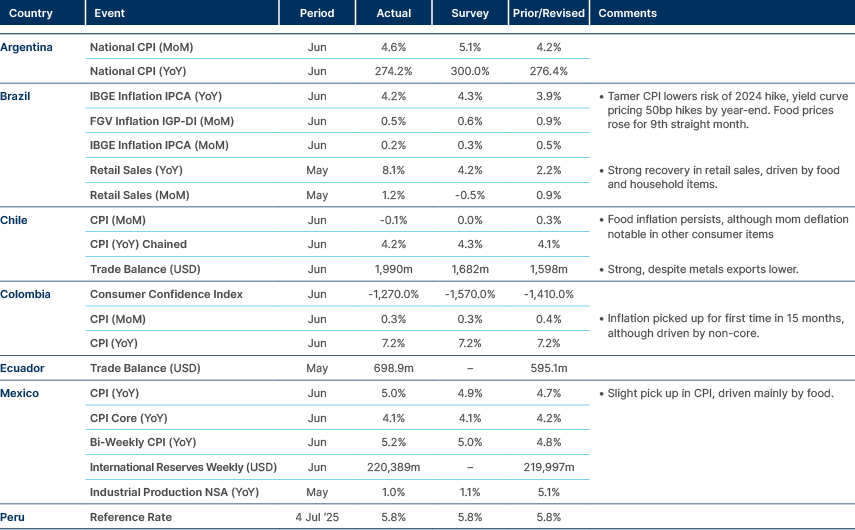

Argentina: President Javier Milei postponed increases to fuel taxes and utility prices that would have added 1.2% to monthly inflation. Argentina has been running a budget surplus over the first five months of the year, reducing the urgency of increasing tax revenues and allowing the President to eliminate economic distortions at a more cautious pace. Last Thursday, Finance Minister Luis Caputo said “energy tariffs are a fine harmony between reducing subsides and inflation… but the priority is to lower inflation.” He reiterated that Argentina would not devalue the peso again.

Brazil: President Luis Inácio ‘Lula’ da Silva again stated his “commitment” to reducing fiscal deficit without affecting public investment. Exactly how he will balance this act is still unclear, but Minister of Finance Fernando Haddad has been pushing for higher tax revenues instead of lower expenditures, a challenging mix considering the already elevated tax burden in Brazil.

Lula’s approval ratings hit their highest level so far in 2024, according to Quaest/Genial, rising to 54% from 50% on 8 May. This suggests Lula has bucked a declining popularity trend since being elected. Among voters with a family income of up to two minimum wages (c. USD 261), approval rose from 62% to 69%, and disapproval dropped from 35% to 26%. The margin of error in this group is 4%.

Central and Eastern Europe

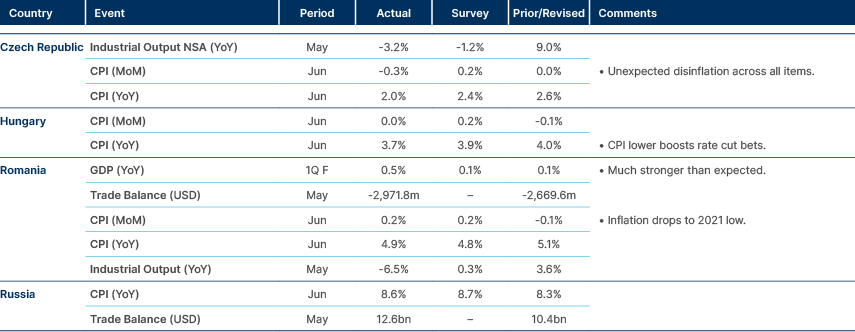

Pakistan: The International Monetary Fund (IMF) reached a staff-level agreement on a new 37-month financing of SDR 5.32 bn (c. USD 7bn). This deal builds on the USD 3bn stand-by arrangement which ended in April. It aims to consolidate the fiscal and structural reforms started during the SBA, including broadening the tax base, strengthening the fiscal and monetary policy frameworks, lowering inflation, deepening financial access, and reforming the energy sector and state-owned companies. It remains subject to board approval, which is likely to take place within the next month, bar any major surprises.

Central Asia, Middle East & Africa

Kenya: President William Ruto dismissed most of his Cabinet today, with just the Deputy President and Prime Cabinet Secretary to be retained. Ruto said the move came after “reflection, listening to Kenya and after holistic appraisal of my cabinet.” The country faces a large interest burden, but addressing these problems via austerity or tax rises has so far proved politically challenging amid elevated cost-of-living pressures. The Cabinet shake-up follows deadly protests over the government’s plans to implement new taxes, which have now been put on hold. The tax rollback means Kenya is likely to miss IMF targets, although the government does not have any significant debts due this year.

Ruto will now embark on the process of setting up a “broad-based government,” which he says could be made up of members across different sectors and political formations, both public and private. A newspaper reported on the same day that Ruto had held meetings with the opposition leader Raila Odinga about the possibility of forming a unity government. After the protests, Moody’s downgraded Kenya’s credit rating to CAA1, with the negative outlook attributed to the risks on the government liquidity. We highlighted this risk in our May Emerging View, Post-COVID, Kenya’s GDP has grown at a Compound Annual Growth Rate of just 0.7%, while debt has been rising. Gross debt to GDP in Kenya is now 73%, versus 59% in 2019.

Developed Markets

Japan: The Yen hit an almost four-week high against the US dollar on Friday, raising speculation that Japanese authorities may have intervened to prop up the currency. The rebound in the Yen, which has been languishing at around 38-year lows, began on Thursday, just after data showed US consumer prices for June eased, boosting the odds of the Federal Reserve cutting rates as soon as September.

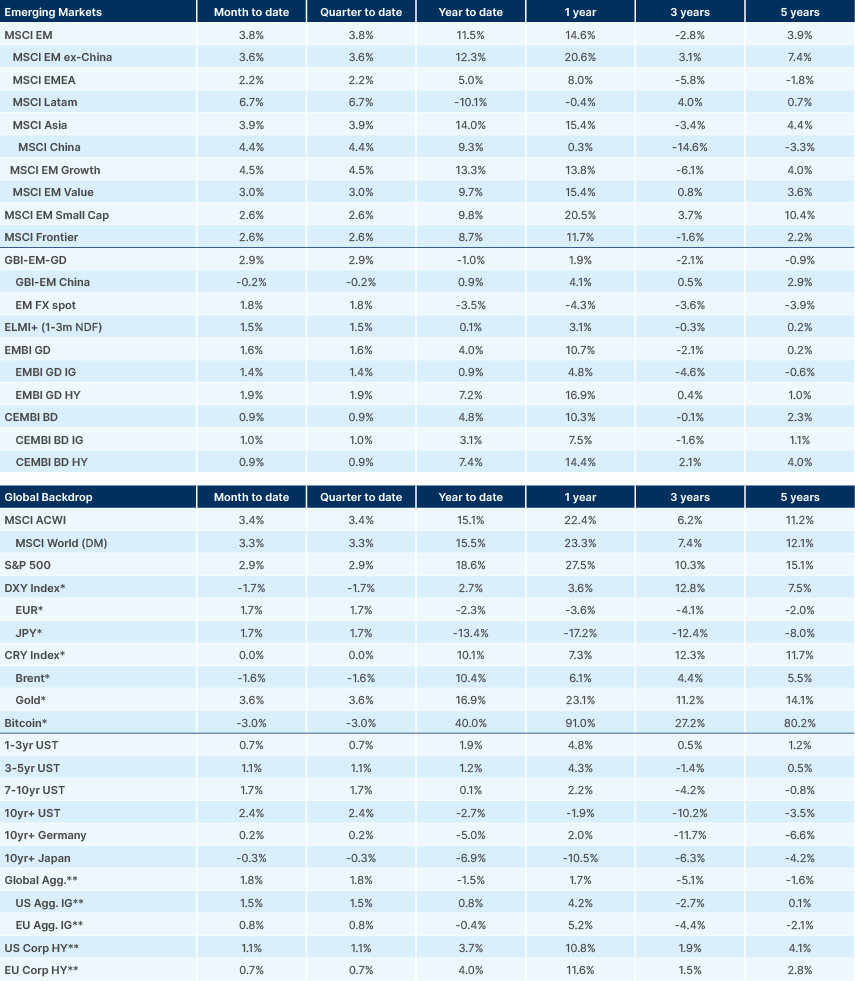

Benchmark performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

1. See – https://www.predictit.org

2. See – https://en.wikipedia.org/wiki/Casualties_of_the_Israel%E2%80%93Hamas_war