Manufacturing PMIs improved in Hungary, Colombia, Mexico and China and remained at solid levels across most countries, standing in contrast with the US and Europe where manufacturing PMIs have declined fast. Russia gains further territory in Ukraine. The IMF disbursed USD 3.9bn to Argentina. The Brazilian president announced further pre-election fiscal spending. Chile announced several tax increases on the mining sector and wealthy individuals. Colombia hiked 150bps as President-elect Gustavo Petro held a cordial meeting with his adversary Alvaro Uribe. The Ecuadorian president survived an impeachment vote. Gabon is working on the world’s largest carbon credit mechanism to protect native forests. Ghana’s president instructed the finance minister to start IMF engagement. Hungary hiked its policy rate by 185bps. India’s monsoons were slightly below normal until last week, but reservoirs stand at healthy levels. Economic data was better than expected in Mexico while South Africa grappled with large energy shortages. South Korea data was better than expected.

Manufacturing PMI’s

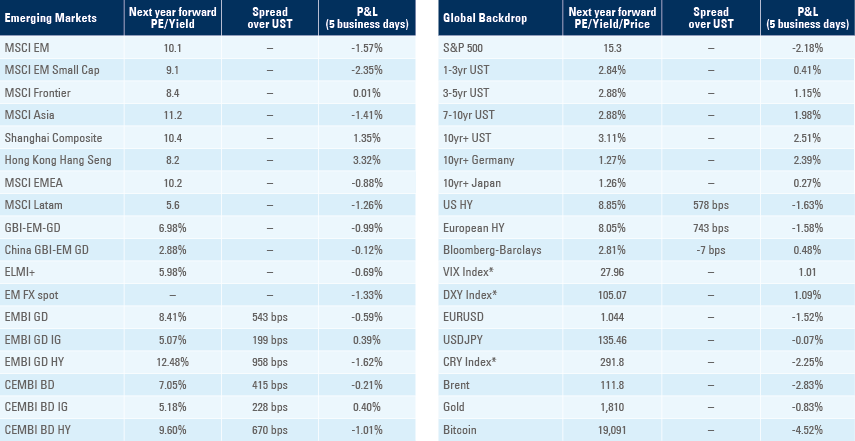

The Purchasing Managers’ Index survey collected by Markit showed a strong improvement in economic activity in Emerging Markets in June as the EM Manufacturing PMI rose 2.2 points to 51.7 while developed world PMIs declined 2.5 points to 52.5 as per Figure 1.

Figure 1: Global Manufacturing PMIs

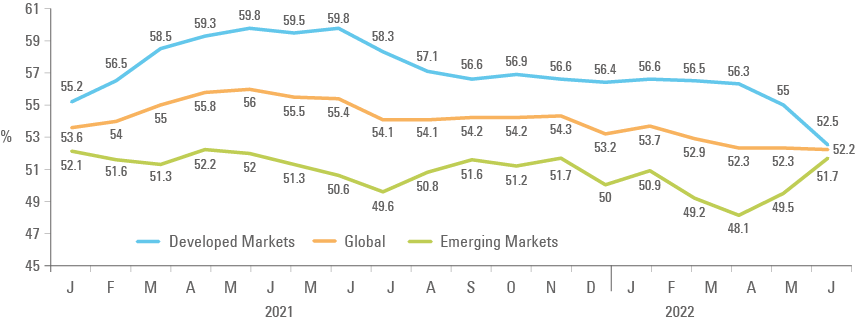

The recovery in EM PMIs was led by an increase of more than 1.5 points in China, Mexico, Colombia and Hungary while PMIs from Brazil, India, Vietnam and Philippines remained at elevated levels around 54.0 as depicted in Figure 2.1 The main declines came from Poland, Czechia and South Africa where the manufacturing PMI dropped more than 2.0 points.

Figure 2: EM Manufacturing PMIs: June vs. 1-month change

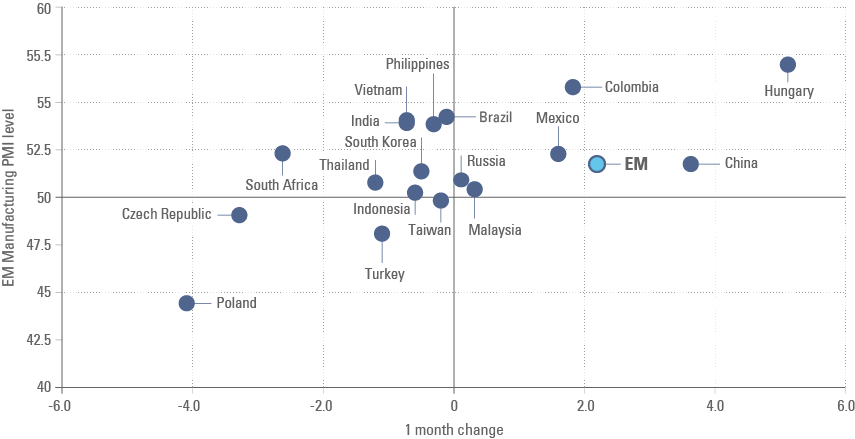

Importantly, leading indicators of economic activity within the PMI, including new orders and output, improved sharply in EM countries as per Figure 3. The improvement in current and future economic activity in EM is led by China, which has a large weight in EM GDP, and stands in sharp contrast with new orders and output indicators from the United States and Europe where the leading indicators are below 50-levels.2

Figure 3: EM Manufacturing PMIs: subcomponents breakdown

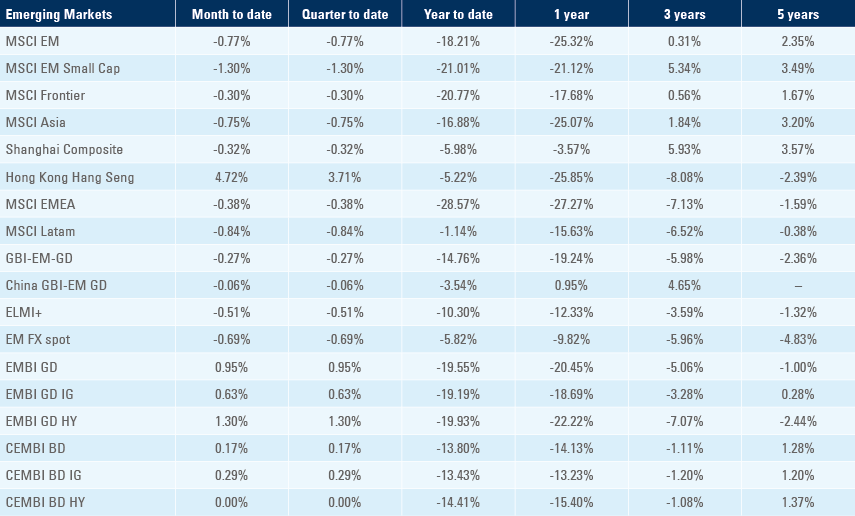

Emerging markets

<Russia-Ukraine: Russia took Lysychansk, the last large city on the border of the Luhansk region, after Ukrainian troops withdrew to avoid severe casualties from heavy Russian artillery. President Volodymir Zelensky pledged to regain the territory after heavier weapons are delivered to Ukraine.3 Russia will now focus on the cities of Sloviansk and Kramatorsk in the Donetsk region where large areas remain under Ukrainian control. Heavy Russian shelling also hit Kharkiv, Odesa and other cities where civilian targets were hit by imprecise weaponry. The shelling of civilian areas may have been designed to intimidate global leaders in the wake of the G-7 and North Atlantic Treaty Organisation (NATO) meetings where support for Ukraine was on top of the agenda.

Earlier in the week, the Russian Defence Ministry said it withdrew troops from the small Snake Island south of Odesa, an important area in the Black Sea for logistical matters, after a counter-offensive by Ukraine. The island has little natural defences and remained an open target. Russia claimed its exit was proof that they were not preventing exports of grains out of Ukraine, but the claim was contradicted by the shelling of Odesa later in the week. Ukrainian authorities said that removing mines from around the port of Odesa would take at least three weeks and could leave the city exposed to attacks. The Ukrainian ambassador to Turkey said the Turkish customs authority detained a Russian cargo ship carrying allegedly stolen grain from Ukraine.

The G7 failed to agree on a price cap mechanism to disrupt supply of Russian oil, whilst NATO agreed to admit Finland and Sweden to an accession path after Turkey changed its position. NATO also discussed a large increase in permanent troops in the Baltic countries as well as a permanent US base in Poland.

In other news, Russia officially defaulted last Monday after the end of the grace period for USD 71m and EUR 29m of coupon payments, leaving all bonds exposed to cross default if more than a quarter of all bondholders of USD 38bn worth of Russian debt call redemptions. Russia did not recognise the default, claiming it has tried to settle the debt. Last week, Finance Minister Siluanov said Russia is considering buying currencies from “friendly” countries with extra revenues from oil and gas to cap Ruble strength. The RUB has appreciated by 45% against the USD year-to-date as the trade surplus ballooned.

Argentina: Finance Minister Martin Guzman resigned last Saturday via Twitter. Guzman has been under severe pressure from Vice President Cristina Fernandes de Kirchner. President Alberto Fernandes met with the two factions of the Peronist party led by CFK and Massa and appointed Silvina Batakis, the former economy minister of Buenos Aires province from 2011 to 2015 under then-governor Daniel Scioli (current production minister), to the position. Guzman failed to rein in subsidies and central bank funding of the treasury, which is exacerbating severe inflationary pressures and increasing the risk of debt rollover. In other news, the IMF disbursed USD 3.9bn to Argentina as part of its assistance programme and the current account surplus rose to USD 0.5bn in May.

Brazil: A constitutional amendment was proposed in the Senate to increase the cash transfer scheme from BRL 400 to BRL 600 and provide vouchers for cooking gas and diesel for low-income families and truck drivers. The bill includes a state of emergency declaration, which is the only way tax can be increased during an election year, which would allow for BRL 38.8bn (c. USD 7.4bn) spending increase to be allocated outside the constitutional fiscal spending cap. The central government posted a BRL 39.4bn deficit in May, leading to a cumulative deficit of BRL 15.1bn (0.2% of GDP) in the first five months of the year, slightly worse than consensus expectations. Concerns over populist policies deteriorating the fiscal accounts are likely to keep Brazilian markets volatile until elections in October, in our view. The manufacturing PMI was broadly unchanged at 54.1. PPI inflation rose 0.6% mom in June from 0.5% in May but coming 10bps below consensus.

Chile: Economic data was better than expected as the unemployment rate rose 10bps to 7.8% in May, which was 30bps better than consensus. Economic activity contracted 0.1% mom in seasonally adjusted terms, translating into a mild 50bps slowdown in the yoy activity to 6.4% in May. Mining activity rebounded led by copper production rising to 480k tons in May from 422k tons in April, thus recovering to the average of the past 10 years for the period. In other news, the finance minister announced several measures aimed at increasing taxes, including extra royalties from copper mines with an output above 50k tons, a 22% tax on profit paid on dividends and an increase on the top income tax rate to 43% (from 41%) as well as a wealth tax of 1.8% on assets over USD 14.7m. The minister said it expects to raise close to 1.0% of GDP in royalties assuming copper prices at USD 4.2 per pound.

China: Both Beijing and Shanghai reported zero locally transmitted covid-19 cases last Tuesday for the first time since February. The Ministry of Industry and Information Technology (MIIT) announced measures including halving quarantine requirements for international travelers in both Hong Kong and mainland China and completely lifting restrictions to travel within provinces. President Xi Jinping travelled to Hong Kong to celebrate the 25th anniversary of the return of the island to Chinese control, his first trip outside of Mainland China since the start of the pandemic. On the other hand, covid-19 cases increased in the provinces of Anhui and Jiangsu. Economic data surprised to the upside with China’s composite PMI surging 5.7 to 54.1 with manufacturing rising 0.6 to 50.2 and non-manufacturing +6.9 to 54.7 reflecting the reopening of the local economy and stimulus. The breakdown is also positive with suppliers' delivery time new orders & output rising above 50 in manufacturing PMIs while non-manufacturing PMIs saw new orders surging nine points to 53.2 and business activity expectations rising 5.7 points to 55.6. The Caixin Manufacturing PMI rose 3.6 points to 51.7, higher than consensus.

Colombia: The Central Bank of Republic of Colombia hiked its policy rate by 150bps to 7.5%, in line with consensus, and signalled more hikes are likely. President-elect Gustavo Petro appointed Jose Antonio Ocampo as Finance Minister. Ocampo is a former Agriculture and Finance Minister and held a position as Co-director at the Central Bank. Last week, Petro met with his nemesis, former President Alvaro Uribe. Both parties said the meeting was respectful and fruitful as Uribe argued some of the President-elect policies including pension plan reform and excessive taxes on the private sector would be counterproductive to fight poverty. Last week the Liberal Party joined the government block, a move followed by some members of the Conservative Party. A broad alliance will support the Petro administration`s legitimacy but will likely be increasingly hard to conciliate the group’s diverse interests and agendas.

Ecuador: President Guillermo Lasso survived an impeachment vote against him started by opposition Correistas party members. The constitution stipulates the National Assembly may vote for impeachment only once during the legislative period, suggesting an impeachment process cannot be used until the end of Lasso’s mandate. Conaie’s Leonidas Iza and Minister Francisco Jiménez signed yesterday an agreement to lift the strike after the government agreed to cut fuel prices by 15 cents, a compromise between the USD 10c proposed by the government and USD 40c requested by Conaie.

Gabon: The government is working with the United Nations REDD+ to put together a mechanism and create 187 million carbon credits, almost half of which may be sold on the offsets market before COP27.4 This would be worth USD 291m today, the single largest issuance in history to be sold in a USD 1bn market. Gabon is the second most forested country in the world with 88% of its territory covered in rain forest.

Ghana: President Akufo-Addo directed the Finance Minister Ken Ofori-Atta to start a formal engagement with the International Monetary Fund (IMF) seeking a balance of payment support as part of the broader effort to quicken Ghana’s build back in the face of challenges induced by the covid-19 pandemic and the Russia-Ukraine war.5 Ghana has failed to enact satisfactory fiscal policy consolidations over the last decade, except for a period when oil production increased significantly, but fiscal consolidation momentum stalled when production increases on the Ten and Jubilee oil fields stalled as the country increased expenditure prior to general elections in December 2020.

Hungary: The National Bank of Hungary raised its policy rate by 185bps to 7.75%, significantly higher than consensus expectations for 50bps hike, taking its policy rate above the 1-week repo rate for the first time. PPI inflation rose +2.6% mom in May, down for the second month, but still at elevated levels. The manufacturing PMI surged to 57.0 in June from 51.9 in May.

India: Manufacturing PMI declined 0.7 to 53.9. Indian monsoons are 8% below normal for this time of the year with 55% of geographical subdivisions receiving deficient rainfall. The month of July will a key period for the monsoon season, when sowing activity across crops should ramp up. Encouragingly for irrigated crops, the level of water reservoirs is elevated at 118% of the 10-year average for the current period.

Mexico: The unemployment rate rose by 30bps to 3.3% in May. Remittances from Mexican workers living abroad rose to USD 5.2bn in May from USD 4.7bn in April, the highest level since the inception of the series, partially compensated by the trade deficit which widened to USD 2.2bn in May from USD 1.9bn in April. The fiscal deficit accumulated MXN 58.5bn in the first five months of 2022, MXN 156bn below the budget as revenues rose above budget (4.0% in yoy real terms) and expenditure rose less than planned, by 0.5% yoy in real terms. The manufacturing PMI rose 1.6 points to 52.2.

South Africa: Eskom announced a Stage 6 load shedding due to workers striking, a marked deterioration in the supply of energy, which threatens to derail the solid economic performance buoyed by strong terms of trade. The trade surplus rose to ZAR 28.3bn in May from ZAR 16.0bn in April, slightly higher than consensus.

South Korea: The yoy rate of retail sales slowed to 10.1% in May from 10.6% in April, remaining at a strong pace. The yoy rate of export growth increased to 15.0% in June from 10.7% in May on a working-day adjusted basis as demand from China rebounded. Manufacturing PMI declined 0.5 to 51.3.

Snippets

- Czechia: Manufacturing PMI dropped 3.3 points to 49.0 in June.

- Dominican Republic: The central bank hiked its policy rate by 75bps to 7.25%, following a 100bps hike in the previous meeting.

- Egypt: The World Bank approved a USD 500m loan for Egypt to finance the public procurement of imported wheat and is equivalent to one month of supply for the bread subsidy programme supporting 70m low-income Egyptians.6

- Indonesia: Manufacturing PMI declined 0.7 to 53.9. The yoy rate of CPI inflation rose to 4.4% in June from 3.6% in May, 20bps above consensus, but core CPI was unchanged at 2.6% yoy, 10bps below consensus.

- Kenya: The yoy rate of PCI inflation rose to 7.9% in June from 7.1% in May, breaching the 7.5% upper limit under the inflation target regime for the first time in five years. The current account deficit narrowed to 5.1% of GDP in April from 5.3% of GDP in March.

- Poland: The Central Bank Director Kotecki said Poland should hike policy rate by at least 100bps in July. Inflation increased by another 1.5% mom in June (unchanged) driving the yoy rate 170bps higher to 15.6%, or 10bps above consensus.

- Russia: Manufacturing PMI was unchanged at 50.9. The unemployment rate declined 10bps to 3.9% in May, 30bps better than consensus.

- Saudi Arabia: The current account surplus surged to USD 37.4bn in Q1 2022 from USD 20.7bn in Q4 2021 on the back of a sharp increase in oil prices leading to higher exports.

- Thailand: The current account deficit widened to USD 3.7bn in May from USD 3.1bn in April.

- Turkey: The current account deficit widened to USD 10.6bn in May leading to a USD 43.2bn deficit year-to-date, 136% higher than the same period in 2021. Exports rose by 15.3% in May from a year earlier to USD 19.0 billion while imports rose by 43.5% to USD 29.6 billion. Manufacturing PMI declined 0.9 to 48.1 in June.

- Uruguay: The ratings agency Fitch affirmed Uruguay rating at 'BBB-' with a stable outlook. The trade surplus rose to USD 515m in May with exports surging 48.4% from the previous year and imports rising 22.4% yoy.

- Zambia: The yoy rate of CPI inflation dropped 50bps to 9.7% in June, a significant decline from 24.9% yoy just one year ago as the strong Kwacha stability anchored prices across categories.

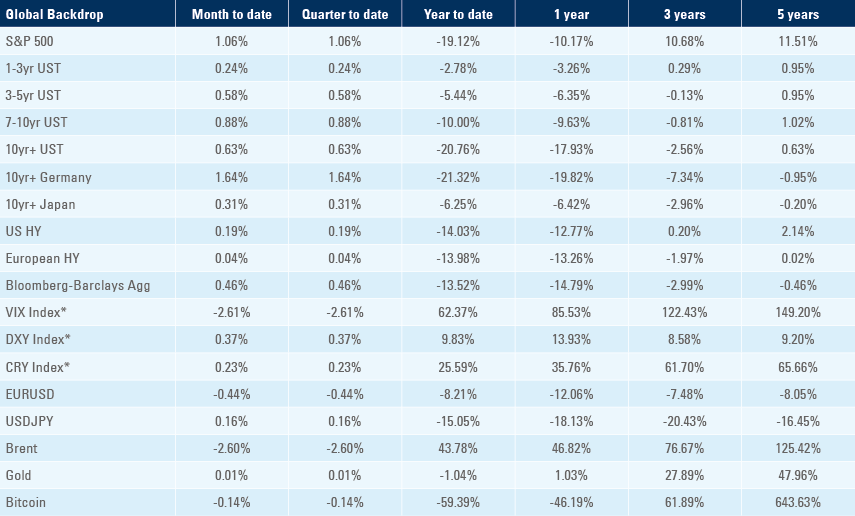

Global backdrop

United States: The ISM Manufacturing dropped to 53.0 in June from 56.1 in May, 1.5 points below consensus as prices paid declined 3.8 points to 78.5 (80.0 consensus), new orders dropped to 49.2 (52.0 consensus and 55.1 prior), and employment to 47.3 (50 consensus and 49.6 prior). Real GDP growth contracted 1.6% in annualised qoq terms in Q1 2022, in line with consensus. Durable goods rose 0.7% mom in May from 0.4% in April. Core PCE was unchanged at 0.3% mom in May, 10bps below consensus.

Europe: CPI inflation rose 0.8% mom in June taking the yoy rate up 50bps to 8.6%, which was 10bps above consensus, while core CPI declined 10bps to 3.7% yoy over the same period, 20bps below consensus. High levels of inflation are likely to keep the European Central Bank on the path of hiking policy rate above zero within the current quarter.

Japan: Industrial production dropped 7.2% mom in May after declining 1.5% in April, significantly below -0.3% consensus. The weak JPY is doing nothing to support economic activity as Japan is part of the Asian supply chain rather than a competitor, which means the weak JPY policy undermines the population’s purchasing power but does not support growth. The yoy rate of CPI ex-food rose 20bps to 2.1% in June and ex-food and energy rose 10bps to 1.0% in the city of Tokyo, a level that is likely to keep the Bank of Japan monetary policy unchanged, at least until parliament elections on 10 July.

United Kingdom: The current account deficit widened to GBP 51bn in Q1 2022, the widest level since 1951.

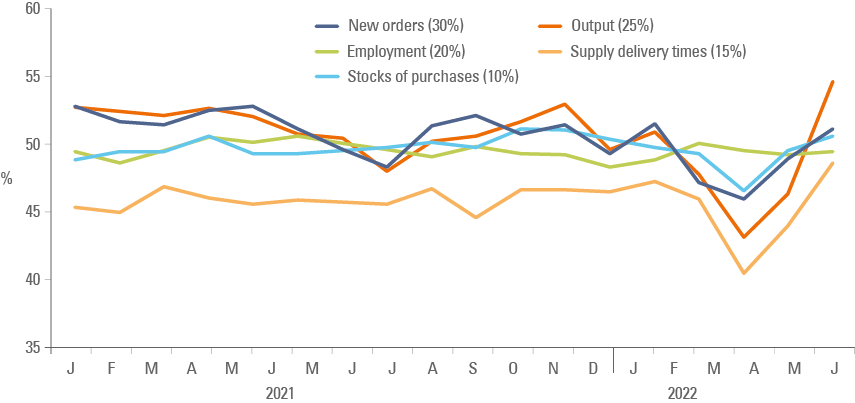

Benchmark performance

1. Colombia and South Africa PMIs are sponsored by Davivienda and ABSA

2. See https://www.ashmoregroup.com/insights/hike-while-you-can-flash-pmis-in-europe-and-us-declined-fast

3. See https://www.reuters.com/world/europe/zelenskiy-adviser-concedes-key-bastion-could-fall-eastern-ukraine-2022-07-03/

4. See https://carboncredits.com/gabon-carbon-credits-biggest-issuance/

5. See https://www.myjoyonline.com/akufo-addo-directs-finance-minister-to-engage-imf-for-an-economic-support/

6. See https://www.worldbank.org/en/news/press-release/2022/06/28/us-500-million-project-will-help-to-strengthen-egypt-food-and-nutrition-security