The risk of an energy crisis in Europe increased further as the G7 discussed a price cap on imports of oil from Russia and economic activity surprised to the downside in both Europe and the United States, led by very poor flash PMI surveys. Chinese President Xi Jinping pledged to achieve the 5.5% GDP growth target. Chile announced it will sell USD 5bn to lower CLP volatility. Colombia’s president elect said he is looking to reopen the border with Venezuela. Ecuador faced another week of protests as the National Assembly approved a motion to impeach the president. The World Bank pledged USD 2.3bn in assistance to African countries to avoid food crisis and the IMF reached an agreement to re-establish its loan programme with Pakistan. CPI inflation dropped marginally in Brazil but rose in Mexico. Mexico hiked policy rate by 75bps to 7.75% and Czech hiked 125bps to 7.0%. Saudi injected liquidity in the banking system and South Korea’s exports remained resilient, despite poor leading indicators from DM.

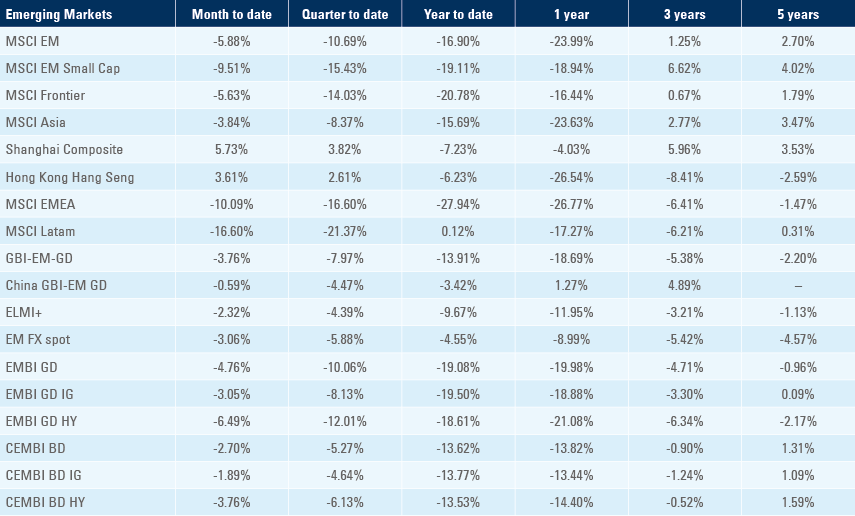

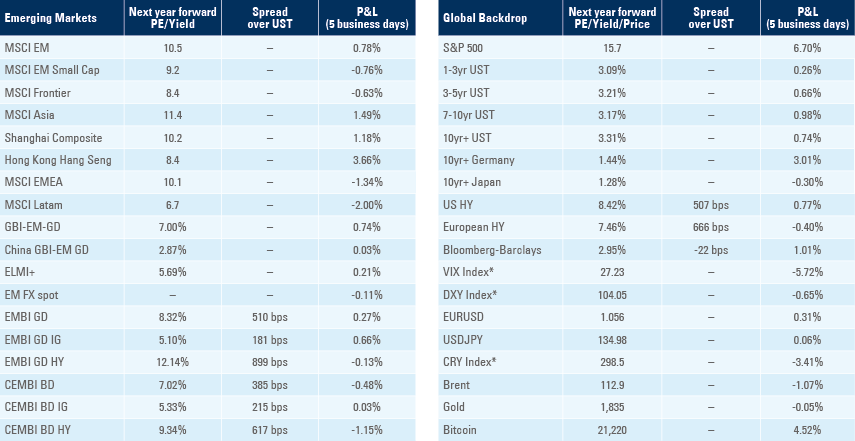

Emerging markets

Russia-Ukraine: The situation on the ground remains treacherous. Ukraine appears to be making progress in a counterattack to retake the city of Izyum, and claimed Russian military were withdrawing from areas near Kharkiv, Ukraine’s second biggest city in the northeast of the country. Russia hit Kyiv with missiles over the weekend. The attacks came a few days after the European Union (EU) made Ukraine and Moldova official candidates to join the block.

A former Minister of Foreign Affairs and Defence of Lithuania, Linas Linkevičius, said Kaliningrad is not under blockade as most goods and people can move, clarifying that Lithuania is simply implementing the ban on trading a list of EU sanctioned goods transported to Kaliningrad, including coal, metals, construction materials and advanced technology. The list of goods under blockade is scheduled to increase until year end. Russia, Belarus, the US, and the EU exchanged inflamed threats, including the possibility of enacting NATO’s Article 5, where all countries would support Lithuania in the event of a Russian attack. Russia said it would retaliate against the restrictions and the Russian Deputy Foreign Minister Sergei Ryabkov warned Europeans against “dangerous rhetorical games”.

The International Energy Agency (IEA) warned Europe to prepare for total shutdown of Russian gas exports. The German Economy Minister Robert Habeck said Germany should brace for a further reduction in Russian gas flows. Haveck said Moscow’s decision to slash supplies risked sparking a collapse in energy markets, drawing a parallel to the role of Lehman Brothers in triggering the financial crisis.1

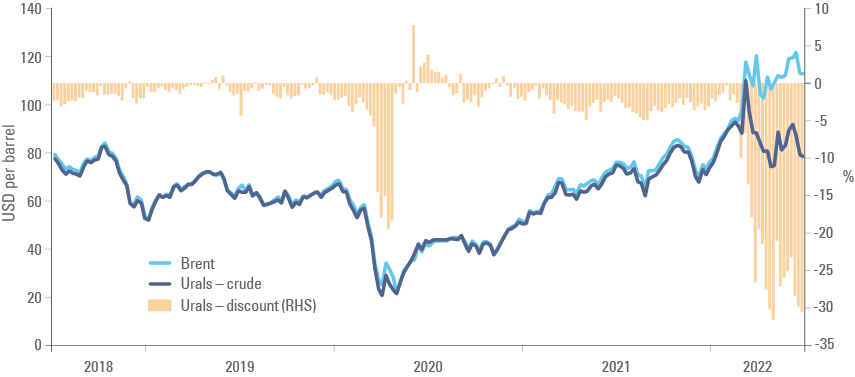

Europe and the US are still taking more measures aimed at Russia’s economy and foreign currency availability. Joe Biden said the G7 would announce a ban on imports of Russian gold. The G7 also debated a price cap scheme on imports of Russian oil. The scheme would block shipping and insurance companies from enabling Russian oil exports if the price is above a certain level. The measure is likely to have little practical effect, since Russian Urals oil has already been trading at a steep discount to Brent contracts as per Figure 1, denoting the higher cost of shipping and challenge in insuring cargoes from Russia since the inception of the war.

Figure 1: Crude prices Urals vs. Brent

Gas flows from the Nord Stream (NS1) pipeline to Germany remained 60% below one month ago, leading to increased risks of energy shortages as prices are likely to keep rising within the next weeks. According to BNP, a persistent drop of 50% of flows via NS1 could reduce up to 35% of gas flows from Russia to EU (12% of total gas imports), considering the patterns in supply during Q2 2022. Germany moved to the second stage of a 3-stage emergency plan to avoid shortages where most manufacturing companies will need to buy energy via auctions, which may lift gas prices, leading to energy source substitution and help to avoid shortages. Italy moved to a state of alert allowing measures which may include rationing. At the same time, Germany, Austria, and some Central Europe countries are reportedly reigniting coal power plants to cope with shortages of gas.

Meanwhile, Qatar is demanding that Europe signs 20-year contracts to increase the supply of natural gas, while Europe is dragging its feet asking for a shorter commitment. Qatar demands make sense from an economic perspective, since gas fields and logistics are very capital intensive, demanding long term contracts to be economically viable.

In financial market matters, today is the end of the 30-day grace period for USD 71m and EUR29m of unpaid coupons due on 27 May. If Russia fails to find a mechanism to settle the coupons a default event will be triggered. Russian Eurobonds were excluded from the EMBI GD with a zero weight at the end of March.2

In other news, last week the leaders of Brazil, Russia, India, China, and South Africa met virtually for the BRICS conference, when President Vladimir Putin said the countries are working on a basket-based reserve currency to dispute the US dollar hegemony. Considering the current global macro environment, a commodity backed currency could be an interesting instrument to diversify global FX reserves, in our view. Russia, Brazil, and South Africa are large producers of food, energy and metals while China holds large (undisclosed) commodity reserves.

China: President Xi Jinping pledged to boost economic controls to meet the annual GDP target of 5.5% and approved a plan to promote healthy platform and fintech development. The growth target stands at odds with consensus expectations for GDP growth around 4.0% in 2022. China announced further tax incentives to the auto industry, intended to boost auto consumption by RMB 200bn, which would be equivalent to 1.5 months of sales considering an average price of RMB 66.6k. In other news, several tier 2 and tier 3 cities introduced policies including housing vouchers to households that agree to have their old homes demolished as compensation to be used for future home purchases to boost local housing markets. The crisis in real estate companies and weakness in local government accounts may prevent conservative individuals from swapping their homes for a voucher and paying rent in the meantime. The real estate company Country Gardens bought back USD 441m Eurobonds expiring in July after the ratings agency Moody’s lowered its credit rating to Ba1, below investment grade level. COGARD has USD 272m outstanding to repay on 25 July and USD 617m on 17 January 2023.

Chile: The local newspaper Diario Financiero reported that Chile’s Finance Ministry would sell up to USD 5bn over the next two months in response to a sharp depreciation of the CLP due to speculative outflows. In corporate news, Codelco workers staged a brief strike, lasting less than a week, against the planned closure of Ventana’s foundry which would result in 350 people made reduntant. Coldelco labour action has historically been mostly short-lived. The Chairman of the board Maximo Pacheco said the supply-demand balance remains very favourable to companies with large copper reserves and suggested the 30% tax on profit recently imposed by the government may motivate the company to increase capex with profit re-investments in lieu of new debt and depreciation.

Colombia: President elect Gustavo Petro said he spoke to the Venezuelan government on the possibility of reopening the country’s borders. Petro also announced an alliance with the Liberal Party, which will have some 15 out of 102 seats in the Senate and 32 seats in the Lower House, an important step to guarantee governability.

Ecuador: The leader of the Conaie Leonidas Iza movement called for protests to resume after a truce over the weekend to pressure government to meet a list of demands. The protests have been much smaller than 2019. President Guillermo Lasso announced a cut in fuel prices costing USD 500m to appease protesters as a recovery in the country’s oil production should allow plenty of excess in the budget for concessions. On related news, the National Assembly has started to discuss an impeachment motion presented by the Correistas UNES party. The bar to impeach President Guillermo Lasso is high with two-thirds (92) votes required, which the opposition doesn’t seem to have at the moment.

Ethiopia & Africa: The World Bank pledged USD2.3bn to tackle food insecurity in Africa. Ethiopia and Madagascar are likely to benefit in the first phase with USD790m approved and expected to benefit 2.3 million people. Other countries expected to participate in the programme in later phases, include Comoros, Democratic Republic of Congo, Lesotho, Malawi, Mozambique, South Sudan, Tanzania, Zambia, and Zimbabwe

Pakistan: The International Monetary Fund (IMF) concluded a visit and is reportedly close to an agreement with Pakistan on the 2022-23 budget after the finance minister committed to increase several taxes and levies to restore the budget balance at a faster pace. The agreement will give Pakistan immediate access to USD 1bn from a stalled USD 6bn facility approved in 2019 and may have its size increased and maturity extended by 1-year until July 2024. In parallel, both China and Saudi Arabia are also negotiating bilateral lending to Pakistan.3

Malaysia: The Prime Minister Sabri Yaakob announced another round of cash transfer to low-income households. Up to MYR 100 of aid will be given to 8.6 million recipients, at a cost of MYR 630m, bringing the total cash handout to MYR 500 to compensate for higher cost of living. Malaysia banned chicken exports to improve local supplies and imposed price caps on staple foods which will be valid until the end of June. The yoy rate of CPI inflation rose to 2.8% in May from 2.3% in April, 10bps above consensus, as food inflation increased 90bps to 5.2% yoy and transport inflation rose 3.9%.

Brazil: The minutes of the Brazilian Central Bank meeting suggest another 50bps hike in July (to 13.75%) to keep monetary policy on contractionary territory for an elevated period to bring inflation down towards the 3.75% target. CPI inflation rose by 0.7% mom in first fortnight of June, in line with consensus and 10bps above May, taking the yoy rate down 20bps to 12.0%. The FGV consumer confidence survey improved 3.5 to 79.0 but remained at relatively depressed levels standing closer to its lows in April 2020 at 58.2 than to its highest levels in April 2012 at 128.7. In political news, a poll by Datafolha shows former president Luis Inacio Lula da Silva with 47% of vote intentions (from 48%), incumbent Jair Bolsonaro with 28% (from 27%) and Ciro Gomes with 8% (from 7%).

Mexico: CPI inflation rose by 0.5% mom in first fortnight of June, 20bps above consensus, taking the yoy rate to 7.9%. Core CPI also rose by 20bps to 0.5% mom lifting the yoy rate to 7.5%. In response to higher inflation, the central bank hiked its policy rate by 75bps to 7.75%, in line with consensus, and adjusted its forecasts for CPI from 6.4% to 7.5% and core CPI from 5.9% to 6.8%. The statement left the door open for further hikes in the coming meetings. The economic activity index rose 1.1% mom in April from 0.3% in March, leading to an increase in the yoy rate to 1.3% from 0.4% over the same period.

Czech Republic: The Czech National Bank hiked its policy rate by 125bps to 7.0%, whilst consensus had 112.5bps, but market priced closer to 150bps hikes.

Saudi Arabia: The Saudi Arabia Monetary Authority deposited USD 10bn across financial institutions to reduce the liquidity crunch in the system as the gap between the 3m Saudi interbank rate and 3m US interbank rates widened to 1.5% this month, levels achieved only in 2008 and 2016 on the back of oil price collapses. Tight liquidity conditions have been a result of large credit creation, primarily via mortgages by the banking system and high oil prices resulting from the war leading to more capital absorbed by the oil and gas value chain. A series of liquidity injections and the recent USD 10bn deposit narrowed spreads to 106bps at the end of last week.

South Korea: Exports declined by a yoy rate of 3.4% in June (from 24.1% yoy in May) as imports rose 21.1% yoy (from 37.8% yoy in May), however June had two business days fewer than June last year. After adjusting for business days, exports rose by 11.0% yoy in June (vs 10.7% yoy in May) as semi-conductors’ exports rose by 17.0% yoy. There was broad weakness across export groups, suggesting exports may soften further over the next months. In other news, Bank of Korea Governor Rhee pledged to conduct monetary policy emphasising inflation until price increases decelerate. He declined to answer if policy rates could reach 2.75% to 3.0% by year end and if the BoK would hike policy rates by 50bps should CPI inflation rise to high 5.0% levels in yoy terms. The yoy rate of PPI inflation was unchanged at 9.7% in May.

Snippets

- Argentina: The yoy rate of real GDP growth slowed to 6.0% in Q1 2022 from 8.9% in Q4 2021 as the unemployment rate was unchanged at 7.0%. The trade surplus narrowed to USD 0.4bn in May from USD 1.4bn in April, significantly below consensus.

- Egypt: Saudi Arabia announced USD 7.7bn investments in Egypt during the visit of Crown Prince Mohammed bin Salman to Cairo, likely part of the USD 10bn investment pledged a few weeks ago.

- Czech Republic: The central bank hiked its policy rate by 125bps to 7.0%, in line with pricing by market participants, but 12.5bps above consensus expectations by economists surveyed by Bloomberg.

- Egypt: The central bank kept its deposit and lending policy rates unchanged at 11.25% and 12.25%, respectively, while consensus expected a 100bps hike.

- Indonesia: Bank Indonesia (BI) kept its policy rate unchanged at 3.5%, in line with consensus, even though CPI inflation is now marginally above the 2.0% - 4.0% inflation target range. The BI is trying to address inflationary risks via tightening liquidity conditions.

- Poland: PPI inflation dropped to 1.3% mom in May from 2.5% mom in April (revised from 1.9% mom) as the yoy rate increased 60bps to 24.7%. Gross wages declined 3.4% mom after dropping 0.6% mom in April, leading to a 60bps decline in the yoy rate to 13.5%. Sold industrial output rose 1.4% mom in May after plummeting 11.7% in April while the yoy rate of retail sales declined to 23.6% in May from 33.4% in April.

- Philippines: The central bank hiked its policy rate by 25bps to 2.5%, in line with consensus.

- Singapore: The yoy rate of CPI inflation rose 20bps to 5.6% and core CPI inflation rose 30bps to 3.6% in May. Inflation is likely to keep increasing in the coming months, in our view, led by higher food prices and stronger demand led by wage growth.

- South Africa: The yoy rate of CPI inflation rose 60bps to 6.5%, 40bps ahead of consensus, led by higher food prices, while core CPI rose 20bps to 4.1%, in line with consensus. The headline index breached the target for the first time in five years, while core inflation remained well within the 3% - 6% target range.

- Taiwan: Export orders rose by 6.0% in yoy terms in May from -5.5% in April, 300bps above consensus as industrial production slowed to 4.5% yoy from 6.4% over the same period, slightly below consensus.

- Turkey: The Central Bank of Turkey kept its policy rate unchanged at 14.0%, in line with consensus.

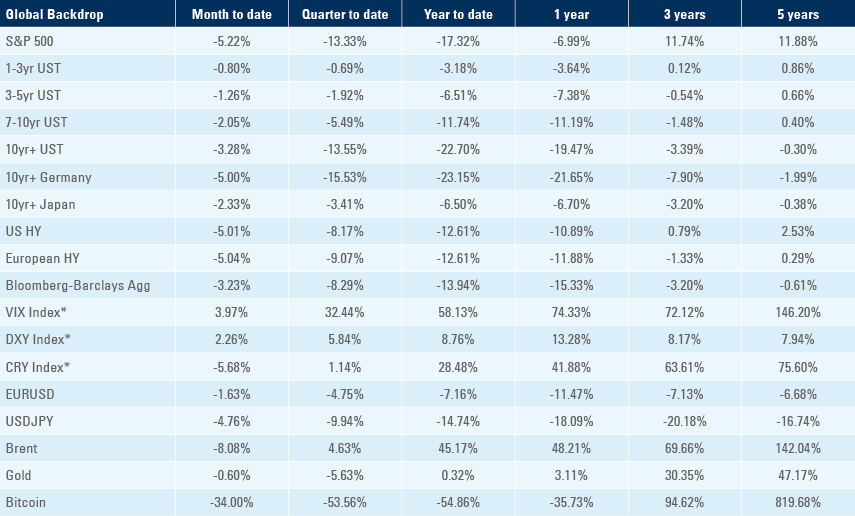

Global backdrop

United States: Economic data surprised to the downside for the 10th consecutive week as the Citibank surprise index dropped another 6.7 points to -71.7. The Markit manufacturing PMI dropped to 52.4 in June from 57.0 in May, significantly underperforming consensus. The breakdown showed new orders and output dropping below 50, suggesting a recession. In fact, the headline index only stayed above 50 since delivery times is an inverted index which hit 33.0, driving the PMI higher (as Markit assumes pent up demand for undelivered goods in the future), but the low delivery times reading has been a reality since the pandemic due to a structural disruption in global supply chains. Most companies already adapted to this situation and in fact have built excessive inventories (Target, Wall Mart, Amazon), suggesting either lower prices or weak activity are likely depending on whether companies decide to lower prices to reduce inventories or simply purchase less goods over the next months. In other economic news, existing home sales declined to 5.4m in May from 5.6m in April, as expected, but down to pre-pandemic levels. Higher housing prices and 30-year mortgage rates above 6.0% suggests house sales are likely to slow down further, in our view. Initial jobless claims were unchanged at 229k in the week of 18 June, hovering above the 203k average year-to-date. The current account deficit widened to USD 291.4bn in Q1 2022 from USD 224.8bn in Q4 2021. The University of Michigan sentiment survey remained at record low levels, but 5-10 year inflation expectations dropped 20bps to 3.1%, leading to the acceleration of the relief rally in US stocks last week.

The wealth effect is also likely to have a negative impact in the economy as JP Morgan estimates US equities and bonds suffered USD 15.5trn (60% of GDP) of losses on its latest peak-to-trough drawdown, the largest both in nominal and % of GDP terms, surpassing 2002, 2008 (c. 48% of GDP) and covid (c 59% of GDP). In a testimony to congress, the Chairman of the Federal Reserve Jerome Powell acknowledged the economy is likely to slow down significantly, cutting a fine balance between containing inflation expectations and generating a recession. Congress was polarised in its questions, either attacking Powell for his poor track record on inflation or praising the US Treasury and the Fed for the economic stimulus that allowed for a much faster post-pandemic recovery.

In other news, the Supreme Court overturned the 1973 decision on Wade v. Roe, in practice making abortion illegal in many states after nearly half a decade. The controversial decision was precipitated by a much more conservative Supreme Court with several judges appointed by former President Donald Trump. The highly polarising decision is another blow to society cohesion. President Biden lamented the decision while Trump celebrated it.

Europe: The German and French manufacturing PMI declined 3.6 and 2.8 to 51.0 and 52.0, respectively, getting close to recessionary levels. The breakdown of PMI subcomponents shows a bleaker picture with leading indicators (new orders) dropping close to five points in both countries to 42.2 in Germany and 45.9 in France and current output at 49.0 and 45.7 respectively, while lagging indicators (employment) remained above 50. The IFO business expectations survey dropped 0.8 to 85.8, not far from the lowest levels achieved in the 2008 crisis (79.2), while IFO current assessment remained elevated at 99.0, down 0.6, the largest divergence between expectations and current conditions since the beginning of the series in 2005.

United Kingdom: The train and metro unions held a weeklong intermittent strike asking for higher pay despite Transport for London results being still deeply negative due to the slow return of commuting to central London post pandemic. In economic news, the yoy rate of CPI inflation rose 10bps to 9.1% yoy, in line with consensus, while core CPI dropped 30bps to 5.9% yoy (better than consensus), but retail price index (RPI) rose 60bps to 11.7% yoy, and producer price inflation jumped 100bps to 15.7% yoy, both significantly above consensus.

Canada: The yoy rate of CPI inflation rose 90bps to 7.7% yoy in May, 40bps above consensus as all measures of core inflation rose further.

Norway: The Norges Bank hiked its policy rate by 50bps to 1.5%, 25bps more than consensus and signalled 25bps was the base case for August hike but did not rule out larger rate increases. Finally, Norges increased its terminal rate forecast to slightly above 3.0% by Q3 2023, from 2.5% by Q3 2024.

Benchmark performance