This piece reviews the background and impact of the exclusion of Russia and Belarus from the main Emerging Markets (EM) indices as well as the current market conditions and outlook for Russian and Ukrainian bonds.

1 | Index matters

The Russian invasion of Ukraine in mid-February and the subsequent sanctions levied by the United States, Europe and other countries against Russia and Belarus as well as capital controls imposed on Russian remittances abroad, led the equity index provider MSCI to exclude all Russian equities from its index on the 9 March with a zero value.1 Valuing securities at zero is consistent with the fact that the MOEX Russian stock exchange closed on the 24 February – the day of the invasion – and foreign investors have not been able to sell their positions due to capital controls, despite the exchange reopening for trading on specific stocks since the 25 March.2

Russia and Belarus were excluded from equity and FI main indices at zero

On the fixed income (FI) side, JP Morgan announced on the 7 March the decision to exclude all Russian sovereign and corporate debt across all indices at the end of March. On the 14 March, JP Morgan added Belarus sovereign debt to the exclusion list and indicated both Russian and Belarusian bonds would be marked at zero on the 31 March, the day of index exclusion. Whilst foreign investors could still trade these bonds, JP Morgan’s decision to mark bonds at zero was justified by severe market disruptions, including wide bid-offer spreads in securities, uncertainty, and the fact that prices from JP Morgan sources would not necessarily reflect the market reality should foreign investors decide to sell Russian and Belarussian bonds at market prices.

2 | Impact of index exclusions

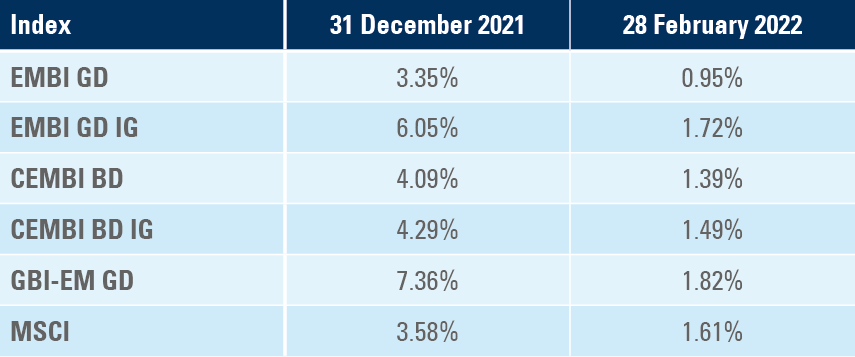

At the end of 2021, Russia represented 3.6% of the MSCI EM and 3.4% to 7.4% of the largest JP Morgan FI indices, as per the second column of Figure 1. Equity investors with an index-weight exposure to Russia would have lost 3.6% by the end of March, considering all Russian assets held by foreign investors are currently marked at near-zero reflecting the significant inherent uncertainty as well as the inability of foreign investors to trade Russian stocks due to capital controls. By the end of February, the Russian weight had already declined significantly, reflecting the shock of the 24 February invasion on asset prices.

Russia was a relatively large constituent across indices, Belarus was small

Belarus was a constituent only in the JP Morgan EMBI GD index with a weight of 0.43% on 31 Dec 2021 and 0.08% on 28 Feb 2022 before these bonds left the index at zero value at the end of March.

Fig 1: Russian index weight

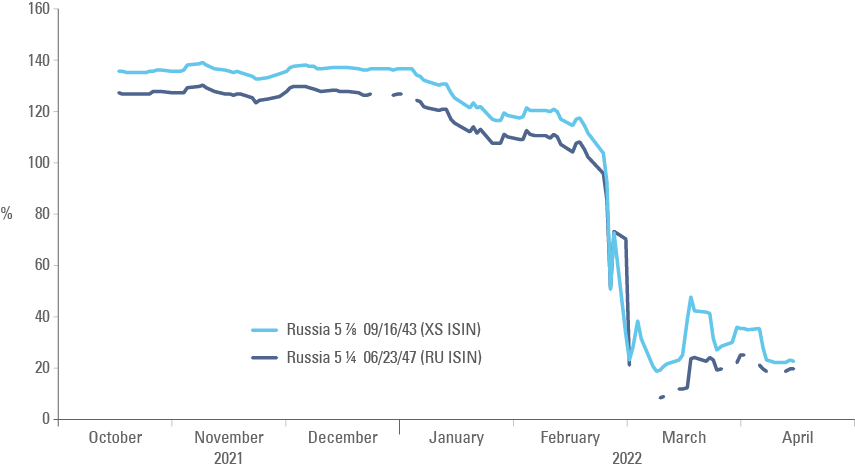

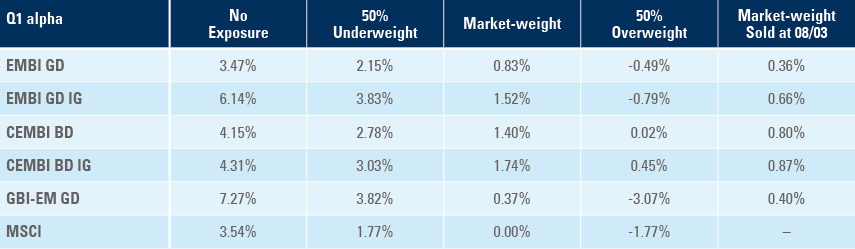

Notwithstanding limited liquidity following the announcement of additional sanctions, FI investors benefited, on a relative basis against the benchmark, from the fact that Russian dollar-denominated debt kept on trading above zero during March as per Figure 2. Counterintuitively, investors that were market weight in Russia going into the conflict and sold bonds right after the index exclusion announcement have outperformed the benchmark as per the last column of Figure 3. Interestingly, even some investors who were slightly overweight generated some alpha from Russia in the month because of index removal at zero value, as per the fourth column of Figure 3. Of course, investors who were underweight or had zero weight generated significantly more alpha, as per the first and second columns of Figure 3.

Removing Russia at zero from the indices added relative performance to FI investors

Fig 2: Selected Russian Sovereign bonds

U/W investors did a much better job preserving capital

Fig 3: Russia performance vs. benchmark for different positions

3 | Current market conditions

Will Russia default on its debt?

So far, Russia remains current on all its obligations on USD-denominated sovereign debt since the US Treasury has granted approvals, on a case-by-case basis, for the correspondent bank and paying agents to settle in Dollars, despite the sanctions, after intense lobbying by US investors. However, these permissions are controversial (a violation of the spirit of the sanctions) and are unlikely to keep occurring now that most US investors have sold their bonds.

In fact, Russia is struggling to settle in full a USD 2bn principal repayment due on the 4 April. More than two-thirds of this bond had been settled between the Russian government and local investors via pre-maturity tender, but foreign investors are yet to receive the repayment after the US Treasury blocked a USD 649m transfer destined to settle the transaction. This means Russia is likely to be effectively in default at the end of the 30-day grace period on the bond. Russia could still repay the principal using resources not frozen by the US Treasury, but the situation is uncertain. Finance Minister Anton Siluanov said it would sue after “taking all necessary steps to make the payment… both in foreign currency and in roubles”.

Russia has pledged to service its obligations in RUB in the event it is unable to use USD reserves to repay the debt. For bonds issued before 2014 (XS ISIN’s), this would constitute an event of default due to forced redenomination of payment obligations, an event that is likely to trigger credit default swap (CDS) provisions. However, the Eurobonds issued after the 2014 (RU ISIN’s) sanctions imposed by the US have fallback provisions allowing settlement in RUB as per the terms of the prospectus, making the status of these bonds less clear, should Russia repay investors in local currency.3 This will be of little help to foreign investors due to the inability to convert RUB received from financial transactions to USD.

Local currency bonds due in March received the RUB proceeds to the National Settlement Depository in Russia, but foreign investors could not receive the payment due to the inability to exchange RUB to USD or EUR due to the sanctions. Euroclear is unable to convert RUB to USD, making the settlement of the bonds difficult.

In regards to Russian corporates, most entities have the ability to service their debts, although the situation is extremely complex. Companies whose main shareholder(s) is (are) prohibited from transacting in the US payment system may not be able to settle their obligations. Russian corporations may use the sanctions as an excuse not to settle their debt, even if legally allowed to keep on servicing it, although the evidence so far is to the contrary.

Liquidity conditions

Liquidity has become increasingly challenging. As previously mentioned, it has been nearly impossible for foreign investors to trade Russian equities since the closing of the stock exchange. Russian local regulators banned foreign investors from selling stocks, while sanctions on large Russian corporations complicates matters further. This means banks underwriting American and global depository receipts (DRs) are likely to unwind these structures and convert DRs into local stocks. In one hand, this should be welcome as local stocks are likely to resume ‘normal’ trading conditions prior to DRs. On the other hand, the valuation on the MOEX will remain elusive for foreign investors, at least while the sanctions and capital controls remains in place.

Liquidity on Russia and Ukraine local assets is very poor

Local bonds trade ‘by appointment’ as Euroclear no longer accepts delivery versus payment, which means bonds are settled ‘free of payment’ – resulting in additional operational complexity. Counterparts willing to pay USD for local bonds have also been rare, despite the deep discount (see below). The market for Ukrainian local currency bonds was already a very small market prior to invasion and have since seen little trading activity.

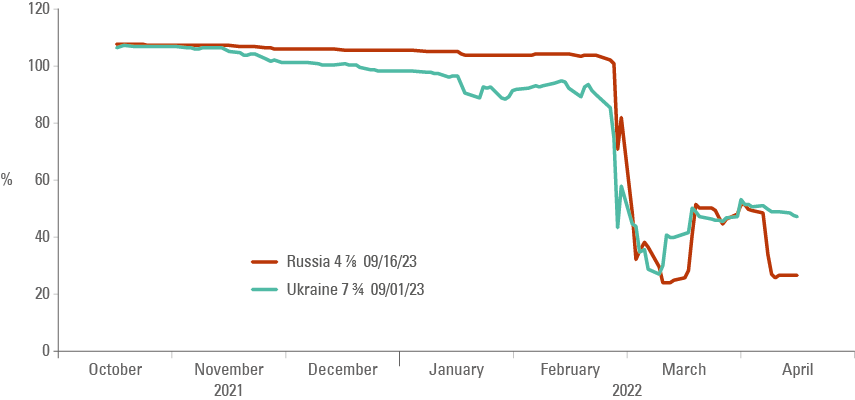

In the Eurobond market, there was a lot of activity in Russian bonds in March as long-term ‘real money’ investors squared positions against short-term speculators. However, liquidity conditions have steadily deteriorated after most real money investors either reduced their exposure to zero or decided to hold assets for the long term. The bid-offer spread in Russian sovereign bonds has oscillated between USD 5-10c per Dollar, a very elevated cost of trading. In comparison, Ukrainian Eurobonds retained a better price and liquidity profile since the invasion. First Ukrainian bonds dropped less in price and the rebound has so far, been more sustained as per Figure 4. Furthermore, the bid-offer spread in Ukrainian bonds has been around USD 2-3c per Dollar, much better than Russian bonds.

Ukrainian Eurobonds have better liquidity and valuation than Russia’s

Fig 4: Russia 23s vs. Ukraine 23s

Of course, marking asset prices to market continues based on normal data pricing providers, particularly in Eurobond assets, although equities left the indices at zero and have not traded offshore since then and local currency bonds are close to that. Given the severity of the situation, most investors should value assets at a conservative level. As per previous crises, there have been no restrictions on subscriptions or redemptions across any funds that Ashmore manages.

4 | Outlook

Overall, Ashmore believes that Russian and Belarussian bonds will be hard to trade assets while their existing regimes facilitate the war against Ukraine. This is unlikely to change over the short term, in our view, as the reported situation on the ground has not improved. Russia has also stated that it is unlikely to disengage in Ukraine before achieving their objectives. Hence, the value of Russian sovereign assets will remain stranded, in our view. Arguably, assets trading in the ‘teens’ and below – such as Russian local currency bonds – are worth keeping due to their optionality value. In that sense, the cost of holding Russian equities marked at near zero is even lower.

Russia and Belarus assets are likely to remain ‘stranded’ for longer

The situation is similar in Russian corporates, albeit the situation for these assets is complicated by the detail of the sanctions imposed on individuals and corporations. Overall, we believe there will be limited value in the short to medium term across most Russian corporate bonds, until they are secure in their ability to service debt in USD.

The situation in Ukrainian debt is different. Whilst it has become difficult to assign a fair value to bonds today, given the uncertainty about the duration of the war and the final impact on the country’s gross domestic product, it is very likely that western countries will invest significantly in the reconstruction of Ukraine. Therefore, it is in the West’s interest that Ukraine retains a favorable relationship with foreign investors. Ukraine will also have a strategic interest to keep a good relationship with creditors, a situation that leads to higher recovery value in debt restructuring.

Ukraine is likely to benefit from significant post-war reconstruction capital flows

Conclusion

The war caused a severe market disruption across Russian, Belarussian and Ukrainian assets.

Mechanically, Russian assets were excluded from the MSCI and JP Morgan indices at zero value, allowing many fixed income investors to book a relative gain versus the benchmark, although those underweight or holding no exposure to Russia of course generated the biggest and very significant alpha. Liquidity remains patchy across all assets directly exposed to the war, albeit valuation and liquidity in Ukrainian Eurobonds is better than Russia.

In our view, notwithstanding the disruption caused by the war in the Ukrainian economy, the prospects of its bonds are better than Russia and Belarus considering the strong support large developed countries are likely to provide to the former contrasting with financial sanctions in the latter.

1. MSCI announced the exclusion of Russia on the 3 March. For sanctions, see https://graphics.reuters.com/UKRAINE-CRISIS/SANCTIONS/byvrjenzmve/ and https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=OJ:L:2022:082:FULL&from=EN

2. See https://fs.moex.com/f/16301/spisok-akciy-24.xlsx

3. See https://minfin.gov.ru/common/upload/library/2018/12/main/Russia-2027_2047_Prospectus-Final.pdf “...if, for reasons beyond its control, the Russian Federation is unable to make payments of principal or interest (in whole or in part) in respect of the New Bonds in U.S. dollars, the Russian Federation shall make such payments (in whole or in part) in euros, Pound sterling or Swiss francs or, if for reasons beyond its control the Russian Federation is unable to make payments of principal or interest (in whole or in part) in respect of the New Bonds in any of these currencies, in Russian roubles on the due date at the Alternative Payment Currency Equivalent...”