- Fed cut 25bps and announced USD 40bn T-bills monthly purchases to support bank reserves.

- BOE to cut and the BOJ to hike by 25bps this week, but real action is in MPCs across various EM countries.

- Global tech companies announced USD 52bn of investments in India.

- IMF approved the release of USD 1.2bn in Pakistan deal.

- Chile elects Kast as president, marking the country’s shift to the right.

- Vietnam's implemented FDI reaches five-year high, reinforcing position as key regional production hub.

- Fitch upgrades Ivory Coast from ‘BB-’ to ‘BB’ with stable outlook.

- Fitch upgrades Oman from ‘BB+’ to ‘BBB-’ with stable outlook.

- S&P affirms Azerbaijan’s ‘BB+’ rating with outlook improved from stable to positive.

- Fitch affirms Hungary’s ‘BBB’ rating with outlook lowered from stable to negative.

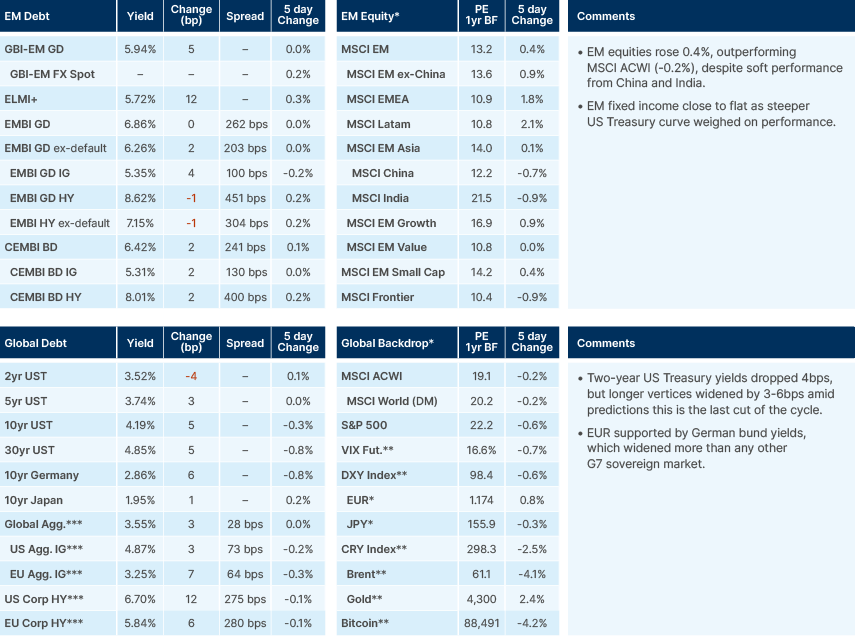

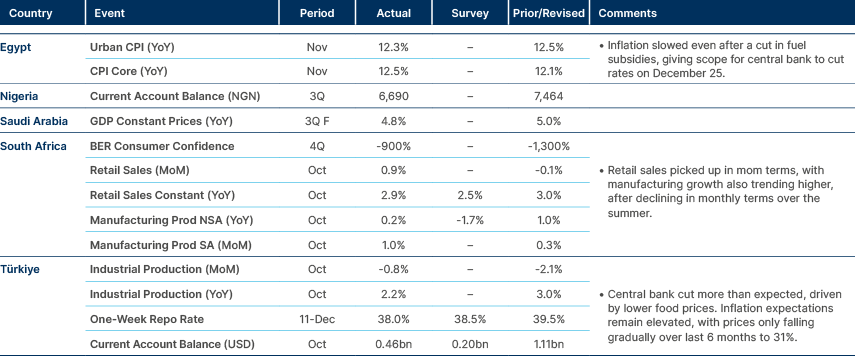

Last week performance and comments

Global Macro

The Federal Open Market Committee (FOMC) cut its policy rate by 25 basis points (bps) to 3.5%-3.75% as broadly expected, with two dissenting members voting for no cut (Kansas City’s Jeff Schmid and Chicago’s Austan Goolsbee) and one for a 50bps cut (Governor Stephen Miran). The most significant new information was the US Federal Reserve (Fed) estimates that payroll growth is currently overstated by 60k per month, more than most market estimates, bringing payrolls to negative levels. Fed Chair Jerome Powell said that “a world where job creation is negative” is a situation the FOMC needs to watch “very carefully.” The dot plot kept one cut expected in 2026 and the economic projections were little changed. The JOLTS report showed job openings more resilient than expected, but the quits rate dropped further, now at the lowest level since the pandemic at 1.9%. Quits rate is a key leading indicator to wage inflation as people tend to quit their jobs after receiving a better offer elsewhere.

The other relevant news is that the Fed announced it will be increasing its balance sheet by USD 40bn per month via T-bill purchases to support bank reserves and avoid a liquidity crunch. Yes, this resembles Quantitative Easing (QE), but it's more like the 2009-2014 period when higher bank reserves stayed within the banking system rather than feeding into the broader economy. This differs from pandemic-era QE, which financed large-scale government deficits and directly increased liquidity throughout the economy. It should also have a smaller impact on asset prices than the 2009-2014 period, as T-bill purchases have a lower impact on the duration exposure of the bank system.

This week, the Bank of England (BoE) is also likely to cut rates by 25bps to 3.75%, while the Bank of Japan (BoJ) should hike 25bps to 0.75%. The BoJ hike will be historic, marking the first 50bps yearly rate hike in three decades. But the real action is in emerging markets (EM) with monetary policy committee (MPC) meetings taking place in Hungary, Chile, Thailand, Indonesia, Czech Rupblic, Mexico, and Taiwan. Across most of these decisions, the risk tilts toward more easing – or signals of further easing in 2026 – than currently expected.

Despite the market-friendly Fed decision, risk assets were on the back foot due to concerns over artificial intelligence (AI) investment, after Oracle published results showing an expansion of cloud business capex. The latest fund manager survey by Bank of America showed a positioning overhang – with investors exceptionally long US equities – is partially to blame and potentially the actual source of the negative narrative on AI. Indeed, a report from the Bank of International Settlements (BIS) shows that most of the recent inflows to US equity markets have been driven by retail investors as institutions sold US equities over the past two quarters.

In other AI-related news, US President Donald Trump granted Nvidia permission to ship its H200 AI chip to China in exchange for a 25% surcharge. Trump added that shipments would go only to “approved customers,” and that chipmakers such as Intel and Advanced Micro Devices would also be eligible. “We will protect National Security, create American Jobs, and keep America’s lead in AI,” Trump said in a social media post.

On the geopolitical front, Ukraine President Volodymyr Zelenskyy reiterated that Ukraine will not surrender territory despite ongoing discussions around a US-backed peace framework and parallel talks with European leaders. Key disagreements remain over security guarantees and the Zaporizhzhia nuclear plant, while European financing initiatives fall far short of replacing halted US military aid. The lack of progress leaves Kyiv facing increasingly difficult choices over sustaining defence efforts into 2026.

Emerging Markets

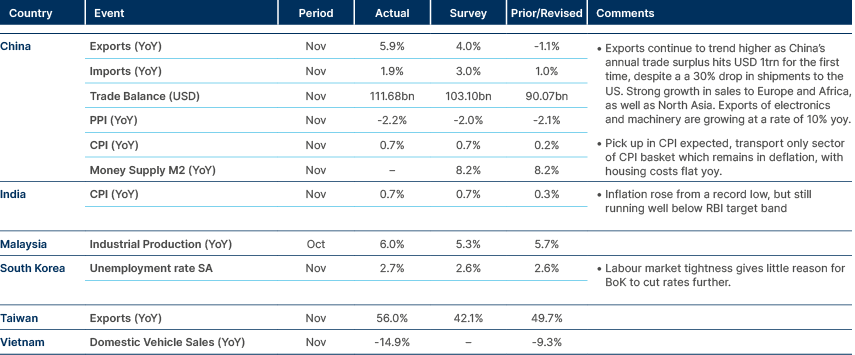

Asia

China and Taiwan trade surpluses increased further.

India: Global technology firms announced more than USD 52bn in new investment commitments focused on AI, cloud infrastructure and data centres. The scale of planned investment reinforces India’s position as a global digital hub and should support services exports and productivity over time, though the growth impact is likely to be gradual given execution and skills constraints.

Indonesia: The government rejected reports that trade negotiations with the US are close to collapse, emphasising that talks remain ongoing despite media claims of backtracking on earlier commitments. While risks remain around tariff exemptions for key exports, official messaging suggests both sides are still engaged.

Pakistan: The International Monetary Fund (IMF) approved the release of USD 1.2bn under its Extended Fund Facility (EFF) and Resilience and Sustainability facility (RSF) programmes, supporting reserves and reaffirming confidence in policy implementation despite recent floods. The IMF reiterated the need for a tight monetary stance to anchor inflation and confirmed commitment to a FY26 primary surplus, reinforcing macro stability at the cost of limited fiscal space.

Thailand: Border fighting with Cambodia intensified, with significant casualties reported on both sides and more than 220,000 civilians evacuated. The conflict currently appears militarily favourable to Thailand due to its air power advantage, though prolonged hostilities risk regional instability and could prompt external diplomatic intervention.

South Korea: Prime Minister Kim Min-seok called for close coordination between the government and the Bank of Korea (BoK) on stabilising inflation and FX, during a meeting with BoK Governor Rhee Chang Yong. South Korea’s potential growth rate appears to have fallen to below 2% recently from ~5% in the early 2000s. If the current trend continues, growth will flatline by the 2040s. At a joint policy symposium between the BoK and the Korea Money & Finance Association, Governor Rhee attributed the weakening growth outlook to lack of corporate investment and productivity innovation needed to offset the shrinking workforce caused by rapidly falling birth rates and an aging population.

Vietnam: Registered foreign direct investment (FDI) rose 7.4% yoy in the first 11 months of 2025, driven by a sharp rebound in merger and acquisition (M&A) activity and strong manufacturing disbursements. Implemented FDI reached a five-year high, signalling robust capital absorption and reinforcing Vietnam’s position as a key regional production hub, despite the absence of new flagship projects.

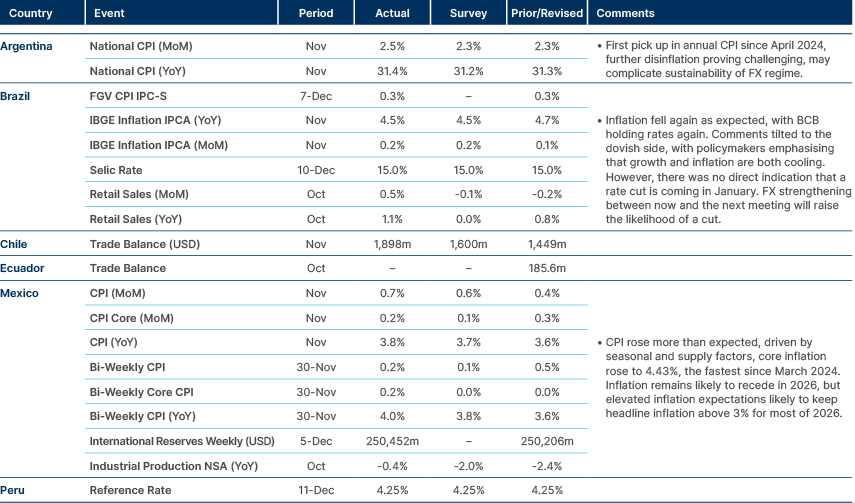

Latin America

Inflation flatlined in Brazil, inched up in Argentina and Mexico.

Argentina: The Treasury raised USD 910m at a 9.26% yield in its first USD bond issuance under President Javier Milei, marking a symbolic return to FX market funding. While pricing was below secondary market comparables and demand was strong, the deal likely relied on institutional support and underscores that refinancing FX obligations at sustainably lower yields remains a medium-term challenge.

Brazil: Brazil’s central bank committee, Copom, unanimously held the Selic at 15.00% and maintained a hawkish stance, stressing that de-anchored expectations, resilient activity and labour market pressures require restrictive policy for an extended period. Although inflation forecasts were revised down and now sit below the tolerance band ceiling, the committee offered no guidance on the timing of rate cuts, reinforcing expectations that easing will begin only once fiscal risks and external uncertainties become clearer.

Chile: Chile’s presidential runoff election on Sunday resulted in ultra-conservative Jose Antonio Kast winning 58.2% of the vote, defeating his leftist rival Jeannette Jara (41.8%). This marks Chile’s most right-wing president in 35 years of democracy. Kast had centred his campaign on restoring public security, promising to clamp down on crime, illegal immigration, vowing to cut USD 6bn in spending by shrinking public payroll and dismantling ministries, and reducing corporate tax. Kast will take office on 11 March 2026.

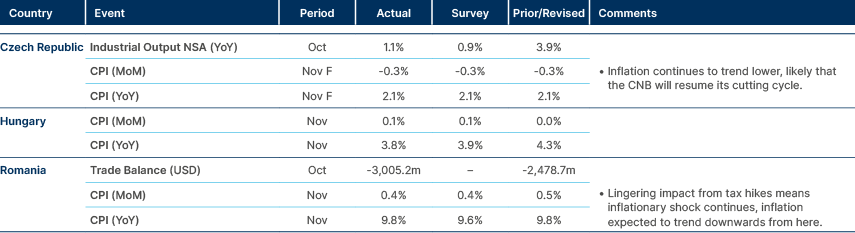

Central Eastern Europe

Mixed inflation prints in Romania, Czech Republic and Hungary.

Azerbaijan: S&P affirmed its ‘BB+’ rating and revised the outlook to positive, reflecting exceptionally strong fiscal and external buffers, including large sovereign wealth assets and low public debt. Easing tensions with Armenia and expected defence spending cuts further reduce tail risks and should support investor confidence and medium-term growth. S&P’s decision to withdraw ratings at the issuer’s request introduces some uncertainty but does not detract from underlying credit strength.

Hungary: President Trump confirmed there is no agreement on a US-backed “financial shield” for Hungary, contradicting earlier statements by Prime Minister Viktor Orbán and underlining that discussions remain preliminary. Separately, Fitch maintained its ‘BBB’ rating, but downgraded the outlook to negative, citing repeated upward revisions to deficit targets and deteriorating fiscal credibility. Growth is expected to remain weak at 0.3% in 2025 before recovering to 2.3% in 2026 on fiscal stimulus and investment, inflation should remain above target and policy easing is expected to be gradual.

Poland: MPC member Ludwik Kotecki signalled limited scope for further rate cuts, confirming a shift to a wait-and-see stance after cumulative easing earlier this year. With inflation now at target and expected to remain around 2.5–3.0%, the MPC is likely to pause until at least spring, suggesting any additional easing will be pushed into Q2.

Romania: Prime Minister Ilie Bolojan is reportedly considering freezing the minimum wage in 2026 amid concerns over labour costs and weak productivity growth. While unions and the Social Democratic Party (PSD) favour another hike, the latter’s heavy electoral loss in Bucharest may soften resistance. The debate highlights tensions between fiscal discipline, competitiveness and social pressures ahead of key policy decisions.

Middle East & Africa

South African data picking up. Türkiye cut rates by 150bps.

Angola: The government launched a National Financial Inclusion Strategy targeting an increase in inclusion to 65% by 2027 from around 49%. The plan focuses on expanding microcredit, digital banking and financial literacy, framed as a structural reform to reduce regional disparities. Execution risks remain elevated given infrastructure gaps and low baseline financial awareness.

Ghana: Q3 GDP rose 5.5% yoy, slowing down from 6.3% in Q2. The deceleration was driven by an 18.2% contraction in the oil and gas sector, while agriculture grew 8.6%. Non-oil GDP rose 6.8%, and the services sector (accounting for about 40% of GDP) expanded by 7.6%.

Ivory Coast: Fitch upgraded its rating from ‘BB-‘ to ‘BB’ with a stable outlook. The country now has a BB rating with all three ratings agencies.

Kenya: Use of cryptocurrencies, particularly USD-pegged stablecoins, is increasing for remittances as households seek lower costs and faster settlement amid past currency pressures. Kenya’s large and growing crypto user base places it among global leaders in adoption, while forthcoming regulation is expected to improve oversight, taxation and investor protection.

Oman: Fitch upgraded Oman to ‘BBB-’ with a stable outlook, citing sustained improvements in fiscal and external balances and confidence that prudent policy will be maintained in a lower oil price environment. Government debt has fallen sharply since 2020, while non-oil growth above 3.5% is expected to underpin medium-term expansion. Hydrocarbon dependence remains a constraint, but sizable sovereign assets and reform momentum support the investment grade status.

Saudi Arabia: Aramco is expected to cut January official selling prices (OSPs) for Asia for a second consecutive month, narrowing premiums to the lowest level since early 2021. The adjustment reflects abundant supply.

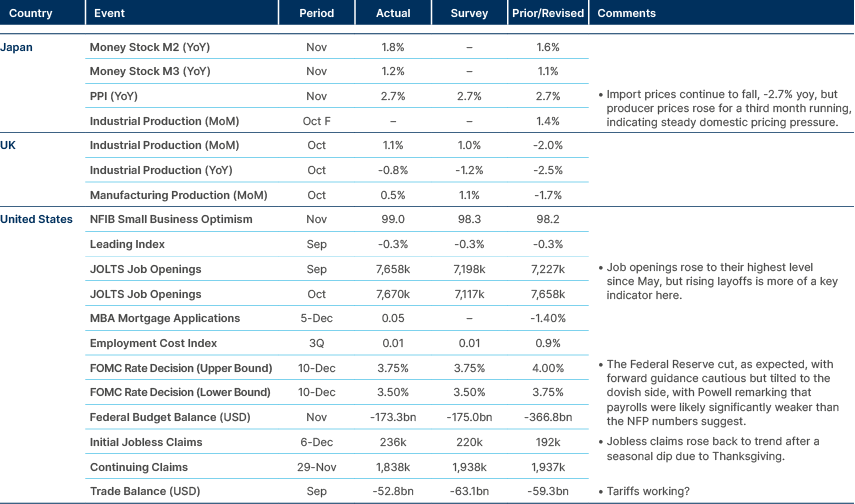

Developed Markets

US soft labour data patch brings the Fed to cut another 25bps.

Japan: Markets anticipate a hike by the BoJ. The policy rate will be increased by only 25bps to a meagre 0.75%, but that’s the highest level in three decades. The 50bps cumulative hike in 2025 is the largest in 35 years. Markets are pricing another full hike by September 2026, but with the 10-year Japanese Government Bond nearing 2.0% and the 30-year above 3.3%, there is a case to be made for faster hikes to stop the curve steepening further. Hence, the BoJ’s communication on its future rate-hike strategy will be a key focus at the December meeting

UK: GDP contracted by 0.1% mom for the second consecutive month in October, the third 0.1% mom contraction in four months, against expectations of a rebound to +0.1% mom. This should have sealed the deal for a 25bps cut by the BoE this week. The MPC will pay close attention to the November consumer price index (CPI) inflation print, which is expected to have declined from 3.4% to 3.2%. Any signs of further disinflation are likely to sway Governor Andew Bailey to vote for a 25bps cut, which would swing the committee to follow his lead, considering the last vote for a hold was a 5-4 call. In the absence of a larger rise in joblessness, forward-looking wage indicators will be closely watched to gauge inflation progress. Model-based estimates of average earnings growth currently hover just above 3%, only marginally higher than levels needed to meet the inflation target, and recent private sector wage data have converged closer to these estimates. Key surveys, including the DMP, Agents survey and Brightmine, suggest pay growth settling in the 3.0-3.6% range in 2026, indicating moderating wage pressures.

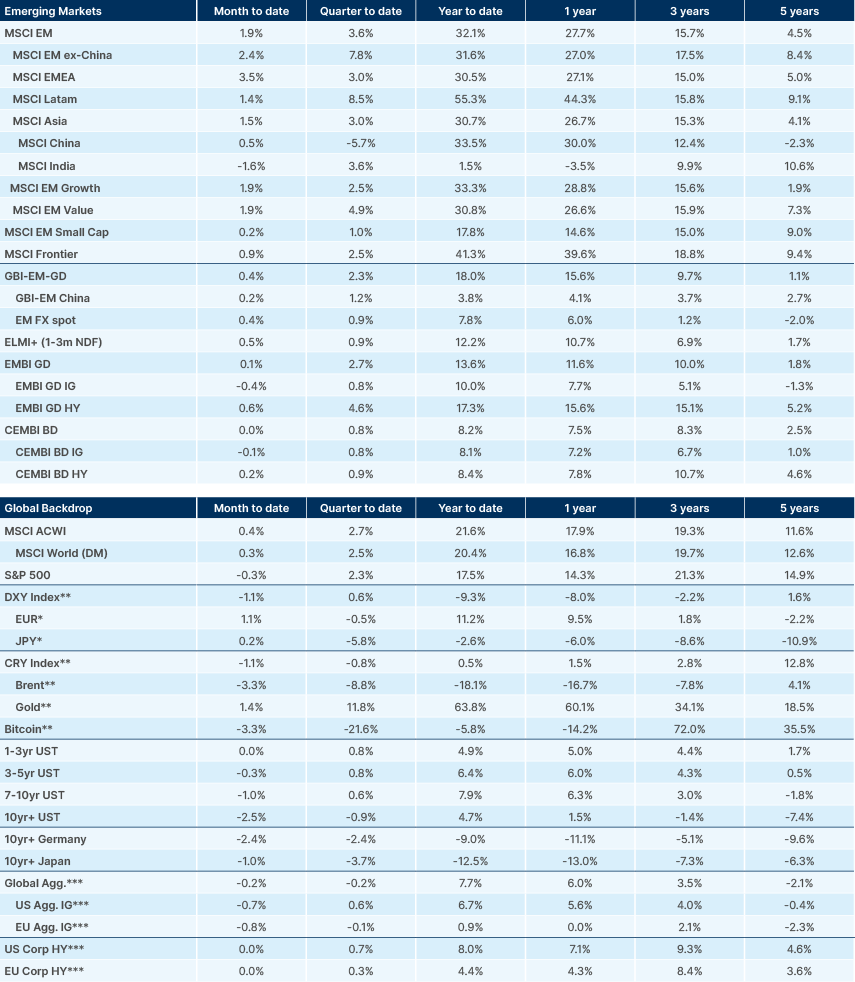

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.