Emerging Markets (EM) have demonstrated their resilience during the greatest economic shock since the Global Financial Crisis. This was contrary to market expectations and through 2021 EM stock markets suffered several pullbacks and saw their earnings multiple de-rated.

We highlighted in last year’s outlook that ‘EM have undergone their most meaningful and abrupt stress test in recent history and passed… testimony to their greater resilience and maturity’. 2021 saw EM demonstrate similar characteristics. This time, in the face of a virulent Delta variant of Covid-19, tighter domestic liquidity conditions, and their largest economy, China, abruptly reviewing several of its regulatory frameworks.

2022 should see many of these headwinds fade, if not reverse. Investor expectations towards EM remain low and, taken in combination with a record valuation discounts compared to developed markets, EM can surprise positively.

The Pandemic Part III

As 2021 ends, we find ourselves heading into familiar territory given the identification of a new, and likely not the last, pandemic variant. It remains too early for the science to accurately assess its transmissibility and virulence. The hope is that the former is high and the latter low, and hence the variant serves to accelerate us towards natural global immunisation. This trajectory would be welcome on several fronts, and likely positive for risk sentiment and EM stock markets.

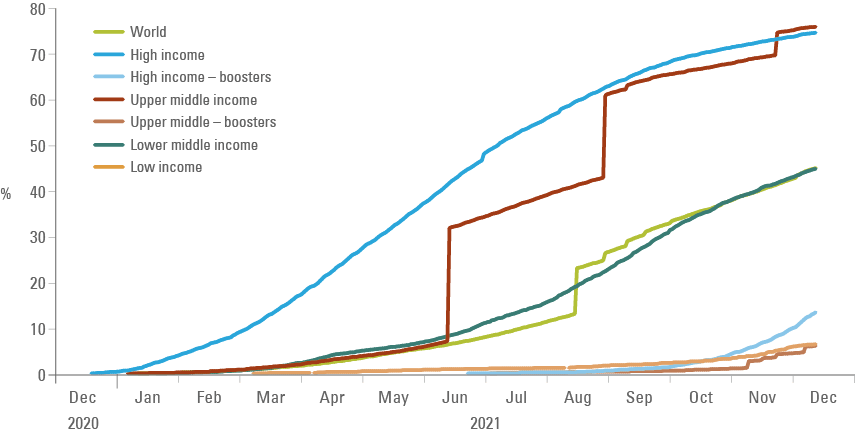

To date, global immunisation has been undermined by several factors, not least inequality. Lower income countries (as defined by the World Bank1) have only managed to vaccinate around 6% of their population with one dose. In contrast, the UK, for example, is fast deploying booster vaccines for a population that has already had access to two doses. Consequently, the risk of further variant mutations remains high.

Fig 1: Inequality: Percentage of population vaccinated with at least one dose – by income group

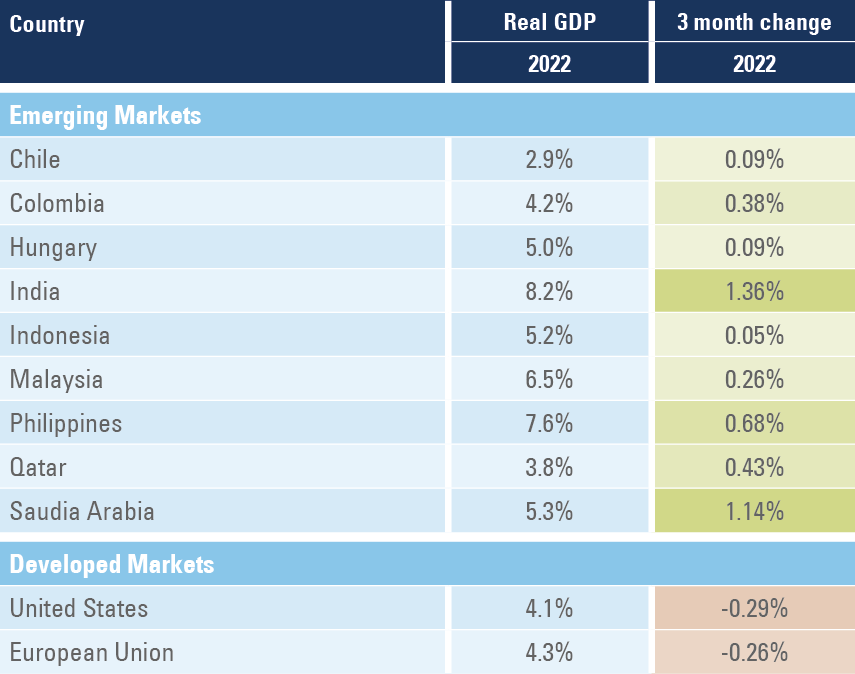

Importantly, should the pandemic backdrop turn more difficult, EM have proven their resilience and policy orthodoxy in the face of variants. EM have double vaccinated around 70% of their populations, which is similar to developed markets, although their deployment programs have generally lagged. This means 2022 should see several economies continue to reopen and normalise from low levels. This will buoy operating environments and earnings visibility, and in turn broaden the investment opportunity. The rate of improvement is most evident in certain countries in SE Asia, EMEA and Latin America, as seen through positive revisions to GDP growth.

Fig 2: EM continue to play catch up

Policy overreaction risk is high

There has been greater acknowledgement of the endemic nature of Covid-19. This has led most countries that first employed a ‘zero tolerance approach’ to seek greater herd immunisation. This has not been the case for China, which poses both a support, and a risk, for 2022.

Should variants trigger greater lockdowns around the world, China has comparably less social and economic disruption to bear. More tightening conditions should not be necessary. All else equal, this is good news for global manufacturing and hence global GDP. However, China’s path to immunisation is not clear, which is fraught with potential challenges. This means their domestic consumption and allocation of resources will continue to suffer in the interim.

Vietnam is a good case study of policy transition away from ‘zero tolerance’. In their experience, pandemic cases sharply increased, although to still comparatively low levels. Meanwhile, manufacturing hubs were successfully prioritised and protected, in turn limiting supply chain disruption. The headwind to sentiment, consumption and earnings visibility have also proven temporary.

‘Fear the policy response not the pandemic,’ could hold some truth in 2022. Policy overreaction risk is high, in particular in developed markets, where social pressure on policy makers is highest.

The value of active management

The dynamic nature of the pandemic can mean its impact on macroeconomics is challenging to disentangle and to quantify. This may trigger episodes of excessive investor caution, as well as exuberance, and in turn market volatility. This is good news for active managers. During the period of Covid-19 to date, the average outperformance of active EM managers vs. the MSCI EM has been more than 200% higher than the average over the last five years.2

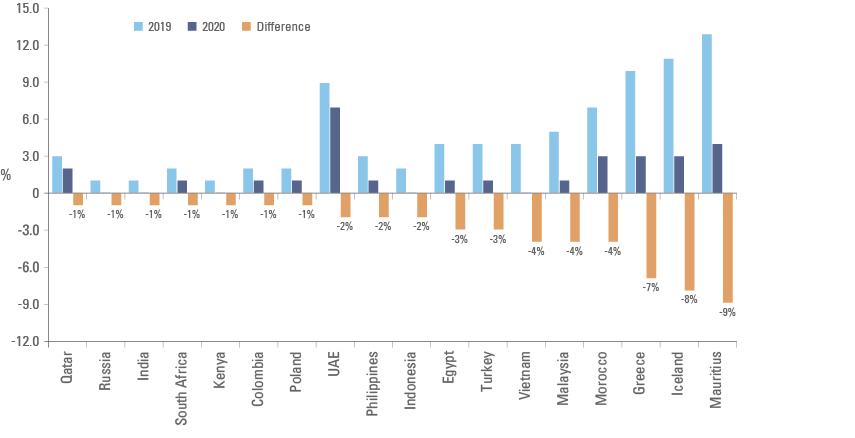

Performance differential amongst EM is likely to remain significant. Overall, our expectations are for energy prices to be higher for longer, given supply constraints exacerbated by policy directives. This is good news for some but less for others.3 EM’s sensitivity to a return to global travel, in particular tourism, also varies (see Figure 3).

Fig 3: Tourism

MSCI EM: Travel receipts as % of GDP

EM, in the most part, have spent 2021 in monetary tightening mode. This should help them to anchor inflation expectations, and insulate them from a less accommodative US dollar liquidity backdrop. 2022 should see domestic monetary tightening in EM peak and the headwind to local activity diminish.

Meanwhile, the US Federal Reserve will continue to walk the tightrope of promoting a steady macroeconomic environment whilst simultaneously seeking to normalise policy. We expect on balance for policy to remain accommodative facilitated by the Reserve’s new policy framework and lessons learnt from previous destabilising tapering. EM’s fundamentals are much stronger now compared to 2013. They manage current account surpluses, their FX is competitive, and commodity prices are supportive. Consequently, any associated market volatility may provide investment opportunities.

China: Differentiated not different

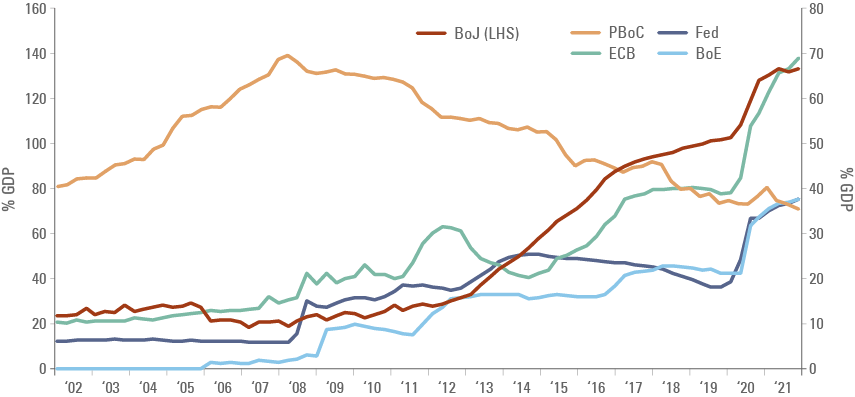

China was the only significant global economy to deliver positive economic growth in 2020, which enabled it to implement countercyclical policy tightening in 2020-21. This position of strength means China can now deploy policy easing, while developed markets need to do the opposite.

Fig 4: Global Central Bank balance sheets

The directed nature of the Chinese economy means a shift in policy tone can have direct ramifications. December’s Central Economic Work Conference was the clearest sign yet of the government’s intent to refocus on supporting domestic growth in 2022. Nevertheless, investors expecting broad based policy stimulus are likely to be disappointed. Policy discipline has also shown that no company is too big to fail so stock selection will remain key.

The abrupt and prolonged nature of China’s 2021 ‘regulatory-reset’ caused its equity risk premium to increase. Now that the dust has settled, it has become clearer that policy intentions are not dissimilar to other countries, in particular in the enforcement of antitrust, data privacy and protection regulations. Even ‘Common Prosperity’ is beginning to sound a lot like ‘Build Back Better’. Both China and US share the common challenge of their wealth (around 70%) being concentrated in the hands of a few (around 10%). We expect similar equality initiatives to be implemented around the world, thereby reducing China’s uniqueness and their equity risk premium.

The episode highlights the importance of dynamic allocation towards, and stock selection within, EM’s largest economy and market. For example, the second largest e-commerce provider, JD.Com, outperformed the largest, Alibaba, by over 40%.4

Duo ecosystems

We highlighted in last year’s outlook the establishment of dual Sino-US ecosystems vying for demand globally. One likely area of focus in 2022 is the treatment of the 279 Chinese American Depository Receipts (ADRs) that comprise ~USD 900bn market capitalisation. Nineteen ADRs already have fully fungible dual listings in Hong Kong and a further ~100 can potentially qualify for Hong Kong listing. The remainder do not currently qualify, in part given their VIE (variable interest entity) structures which require special government approval.

Chinese policymakers are cognisant that the equity market remains a key vehicle to achieve their deleveraging goals and we expect them to foster a broader and deeper capital market. Whether this means there is a ‘welcome home’ party for ADRs, it remains to be seen.

Meanwhile, China is re-shoring advanced manufacturing, for example in industries that automate, and promote industries in the renewable energy supply chain, where it already holds global dominance.

Frontier Markets: An attractive liquid alternative

The Covid-19 period has seen Frontier Markets (FM) and smaller EM also in general behave admirably. This is true whether from a pro-active policy response, or an orthodoxy of capital markets, perspective. Interestingly, liquidity and market breadth have only generally improved as retail participation has increased and there have been several new listings bringing greater industry and geographic opportunity.

This has been in spite of low investor expectations. Consequently, a re-rating in FM, has been overdue. FM played catch up and outperformed EM in 2021. FM continue to demonstrate strong value, not least given the structurally higher returning nature of its companies.

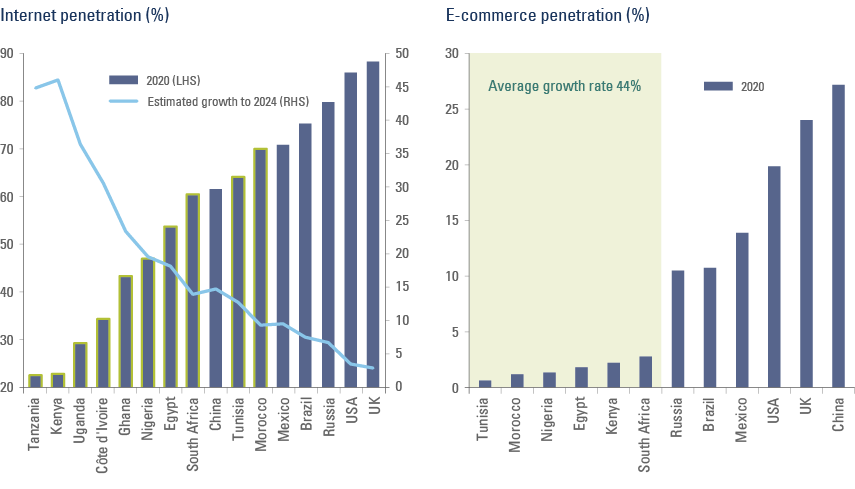

As we move through 2022, we expect earnings to take over as the primary driver of market returns. FM continue to offer investors access to established companies that operate in traditional yet burgeoning industries, such as infrastructure and consumption. FM also, increasingly, offer exposure to the latest and fastest growing global technology themes, such as digital payments, outsourcing, hardware and e-commerce. In FM’s case, the structural drivers of technology can be more powerful compared to their developed peers given a combination of: their lower penetration; lower complexity; faster growth; and more domestic orientation. They serve the locals rather than global supply chains.

Mobile money in Africa has been well established for some time now, although the number of subscribers and the value of transactions continues to boom. In cash-based economies such as Egypt, digital payment providers, some with direct government backing, look set to transform the fiat money system. The advantage of starting later means FM can in some cases ‘leap-frog’ the developed world, yet investors are asked to pay much lower multiples.

Fig 5: The digital age

The balance of risk is in EM’s favour

A function of the world reopening at the same time as supply disruption, means input costs are higher and bottleneck risk greater. Companies with strong margins and dominant market positions, and hence pricing power, are best placed to be resilient. They should either be able to absorb higher costs or be able to pass them on.

As we move through 2022, we expect shortages and bottlenecks to fade and for earnings visibility to improve. Following a period of underinvestment, we think there is also scope for capital expenditure to recover supported by strong free cash flow generation. Banks may also be better able, and more willing, to demonstrate their profitability by reducing prudent provisioning.

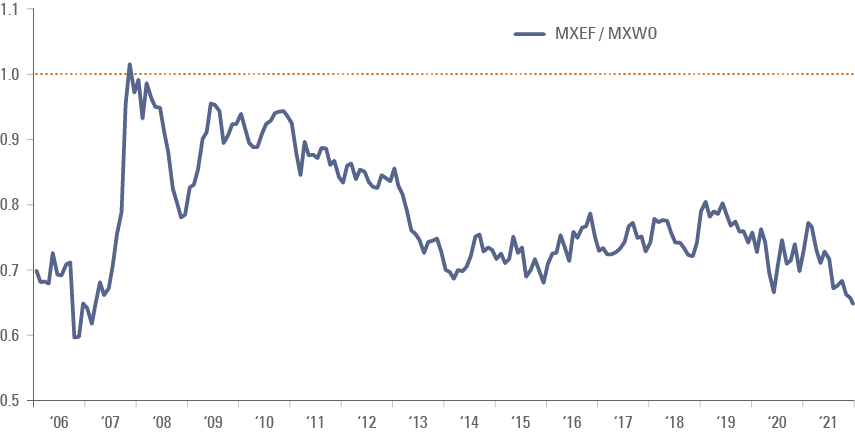

This is a different backdrop compared to 2021, which saw EM deliver over 50% year-on-year earnings growth. However, this was not rewarded and EM were de-rated given the uncertain global backdrop. The MSCI EM index trades around its long-term valuation level of 12x forward price-to-earnings.

Such undemanding valuations mean EM stock prices have reasonable downside protection. Conversely, should the backdrop and investor sentiment improve both EM earnings and their price multiples are well placed to surprise positively.

Fig 6: EM trade at historic lows compared to developed markets

MSCI EM / MSCI World forward price to earnings ratio

1. Income levels by GNI per capita: https://blogs.worldbank.org/opendata/new-world-bank-country-classifications-income-level-2021-2022

High income countries: above USD 12,695

Upper-middle income: from USD 4,096 to USD 12,695

Lower-middle income: from USD 1,046 to USD 4,095

Low-income countries: below USD 1,045

2. Source: Ashmore, Evestment. Data reflects returns from March 2020 to September 2021 for Evestment’s Emerging Market All Cap Equity Universe compared to the average alpha for outperforming managers over the 5 year period ending September 2021.

3. See: ‘EM is no longer a commodity play‘, The Emerging View, 16 February 2021.

4. See: ‘Differentiation is the name of the game‘, Weekly research, 22 November 2021.