The results of the leading e-commerce Chinese companies highlight the importance of active management in EM equities. Argentina and the IMF sent positive signals towards a new agreement. Brazilian economic growth and inflation weakened in contrast with the positive performance from Andean countries. Chile’s first round of presidential elections had a more balanced result than expected. China’s activity was stronger than expected. Hungary, Iceland, Pakistan and South Africa hiked their policy rates, while Russia’s Nabiullina was more hawkish. Turkey cut its policy rates, undermining the Lira. The Supreme Court of India mandated coal power plant shutdowns in order to lower pollution. The European Court of Justice ruled against Poland’s interference in its judicial system.

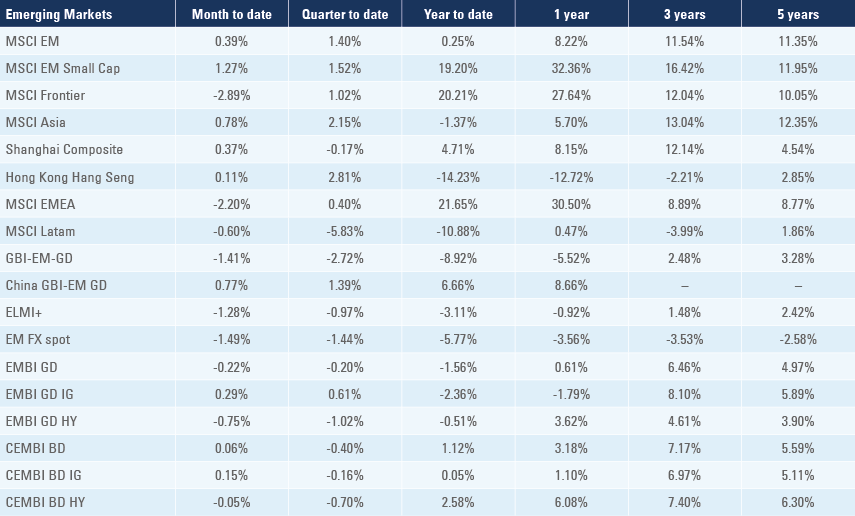

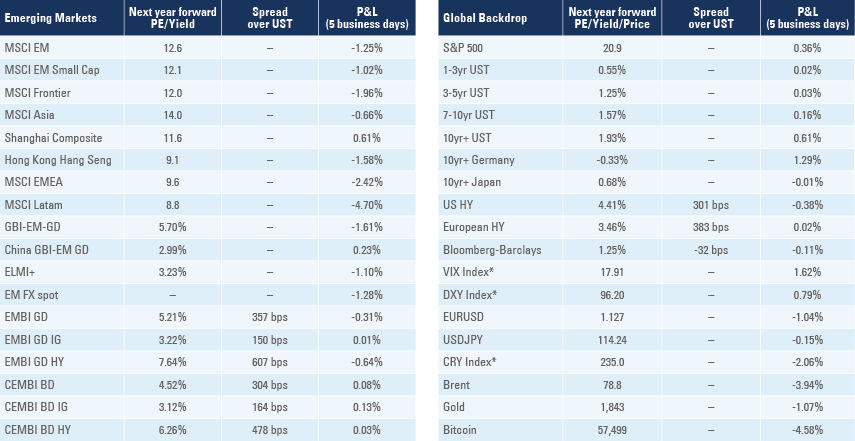

Emerging markets

The importance of differentiation and active management in EM

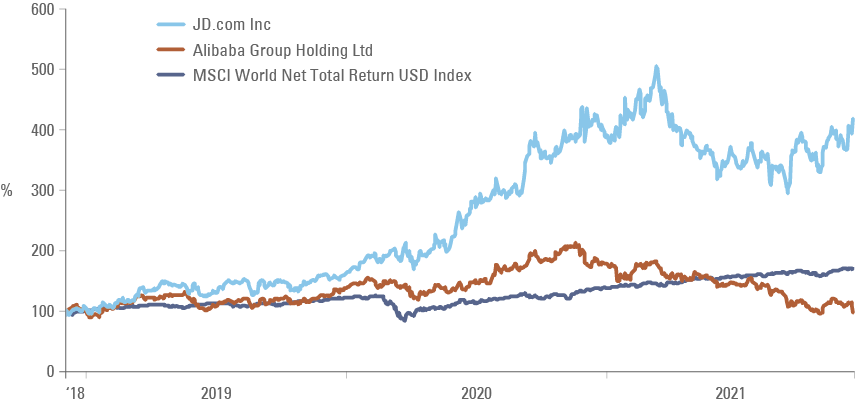

Last week the two largest e-commerce platforms in China, Ali Baba and JD.com, reported results. Ali Baba had a 50.1% market share at the end of 2019, while JD.com had 26.5%.1 Ali Baba shares declined 11% post-results after its earnings missed consensus expectations, but mostly due to it lowering revenue guidance for 2022 to a yoy growth rate of 20%-23% from 30% previously. In contrast, the share price of its main competitor, JD.com, rose 9% due to higher than expected revenues after investing to gain users from its rivals. The anti-trust regulations introduced earlier in the year also played a significant role. Ali Baba had a policy of demanding exclusivity from vendors selling on its platform during seasonally strong periods, like the singles’ day (Chinese equivalent of Black Friday). Ali Baba’s market dominance and practices forced most vendors to sell their products only at Ali Baba. After the anti-trust regulations, vendors are free to list their products on multiple e-commerce platforms, leveling up the playing field and creating opportunities for other companies, such as JD.com. Furthermore, JD.com is aligned with the common prosperity motto of the current Chinese leadership, as the company has better policies across stakeholders, including directly hiring all delivery employees and having a larger regional distribution network for items like supermarket sales, which is a more costly model, but translates into a more sustainable business. A 20% relative performance gap, in one day, between the first and second largest companies in the largest e-commerce market in the world is impressive, but the long-term performance differentiation is truly astonishing. JD.com rose 317% over the past three years, outperforming the MSCI World (+69%) by a wide margin, while its larger competitor declined 4% over the same period as per Figure 1.

Figure 1: JD.com, Ali Baba and MSCI World

This is not to say that Ali Baba is not a good long-term investment. Its dominant position in e-commerce and cloud business in China, positions the company to be a potential winner of China’s new development model, which focuses on lowering inequality, boosting fertility rates and investing in innovative technology development. Instead, the large divergence illustrates the importance of actively considering both top-down and bottom-up drivers when investing in EM, in our view.

Argentina: The International Monetary Fund (IMF) spokesperson Gerry Rice said in a statement “…it is important that this plan has broad political and societal support”, adding, “Our goal remains to help Argentina and its people”. The opposition coalition Juntos por el Cambio agreed on the IMF programme under re-negotiation. Last week President Alberto Fernandez said he would send a multi-year plan to Congress in December.

Brazil: Economic activity declined 0.3% in September after contracting by a similar magnitude in August. Wholesale price inflation in the first 10 days of November rose 1.2% (consensus 1.6%), after -0.3% in the same period in October. In political news, the primaries of the Social Democratic (PSDB) Party were disrupted by technical problems after the voting app did not support the 44k voters over the weekend. The incident discredits the main centre-left party, which has struggled to compete with the far left and right since 2008.

Chile: The first round of the presidential election had no outright winner with far-right Jose Antonio Kast getting 27.9% vs. 25.8% of far-left candidate Gabriel Borich, with the run-off on 19 December. The results of the congressional election (both Senate and Congress) suggests centre and right parties have increased their position across houses, resulting in a more balanced legislature than expected, which is positive for stability.

China: The yoy rate of industrial production rose 0.4% to 3.5% in October while retail sales rose 0.5% to 4.9% yoy, both above consensus. In other news, the PBoC assessed that global inflation could last longer and changed the language in its latest statement suggesting more concerns about local inflation. The PBoC still deems the property sector risks as “generally stable” and reassured market participants stating “the overall healthy development of China’s real estate sectors would not change”. Lastly, the PBoC removed the sentences “strictly control the overall water gate of monetary policy" and “avoid flood-like stimulus" in its Q3 2021 report, for the first time since Q2 2020. Regulators are working to unfreeze the asset-backed securities (ABS) market for property developers and to relax a rule limiting the size of new interbank bond issuance to 85% of their outstanding interbank debt for high quality issuers. Developers had CNY 973bn (USD 152bn) of outstanding ABS as of April, according to GF Securities Co and no developers have issued any ABS since August.

Hungary: The National Bank of Hungary (NBP) hiked rates twice last week. On Tuesday, the NBP hiked its policy rate by 30bps to 2.1%, in line with consensus expectations, but guided to a more extensive and longer lasting tightening cycle. Two days later, the NBP increased its 1-week deposit rate to 2.5%, 40bps above its base rate, becoming the relevant interest rate for monetary conditions. In other news, real GDP growth expanded by 0.7% on a qoq basis in Q3 2021 (consensus 1.0% qoq), from 2.0% qoq in Q2 2021 (revised from 2.7%).

Iceland: The Central Bank of Iceland (CBI) hiked its policy rate by 50bps to 2.0% as inflation increased to a yoy rate of 4.5% in October. The CBI expects inflation to peak at 4.7% yoy in Q4 2021 before declining to 2.7% yoy at the end of 2022. Real GDP growth estimate for 2022 rose to 5.1% from 3.9% previously.

India: The Supreme Court demanded authorities to take steps to reduce dangerously high levels of pollution in New Delhi leading authorities to shut down six out of 11 coal-fired power stations in a 300km range around the city. Society may accelerate energy transition in India, which has committed to achieve a net zero emissions target by 2070, which is 10 years after China and 20 years after most other countries’ targets. India needs to carefully balance the speed of its energy transition for its stage of development. In fact, the country seems to be under-promising and over-delivering: India has been expanding renewable capacity faster than most countries in the world.2 In economic news, the trade deficit narrowed to USD 19.7bn in October from USD 22.6bn in September, in line with consensus as the yoy rate of export growth surged to 43.1% (from 22.6% yoy) and imports declined to 62.5% yoy (from 84.8% yoy) over the period. The yoy rate of wholesale prices rose 1.8% to 12.5%, significantly above consensus at 11.1% yoy.

Pakistan: The State Bank of Pakistan hiked its policy rate by 150bps to 8.75%, twice as much as consensus expectations, due to a widening current account deficit (October 2021 deficit of USD 1.7bn vs. 0.45bn surplus in October 2020) and rising inflation (October CPI rose to 9.2% yoy). The IMF has reached a staff-level agreement on the sixth review of its USD 6bn extended funding facility (EFF) programme after important fiscal and institutional reforms were discussed.

Peru: The yoy rate of GDP growth slowed to 9.7% in September from 11.8% yoy in August, but beat consensus expectations of 7.7% yoy. Construction, transportation and hospitality were the strongest sectors. The unemployment rate dropped 0.4% to 9.6% in the city of Lima. In other news, Congress approved economists Diego Macera, Carlos Oliva and Ines Choy as central bank board members, with 76 of 130 congress members voting in favour of the technocrats. In other political news, far-right Congress member Patricia Chirinos presented an official request to impeach President Pedro Castillo. The motion is likely to move forward on the first stage, but unlikely to be approved in its final stage when two-thirds of Congressmen have to approve the impeachment request.

Poland: The European Court of Justice blocked the Minister of Justice prerogative to relocate judges to different local courts. This is yet another escalation of the EU-Poland friction at a time when the Belarus situation offered a rare opportunity to improve the ties. In other news, the current account deficit narrowed to EUR 1.3bn in September 2021 from EUR 1.4bn in the previous month, in line with expectations. The yoy rate of average gross wages declined 0.3% to 8.4%.

Russia: Central Bank Governor Elvira Nabiullina said that inflation should be lowered to the 4.0% target “at all costs” mentioning that the inflationary pressures are becoming sustained. In economic news, the yoy rate of GDP growth declined to 4.3% in Q3 2021 from 10.5% yoy in Q2 2021, broadly in line with consensus. Foreign exchange reserves rose to USD 626.2bn on 12 November from USD 622.1bn in the previous week.

South Africa: The yoy rate of CPI and core CPI inflation were unchanged at 5.0% and 3.2% respectively, in line with consensus. In spite of subdued price pressures, the Reserve Bank of South Africa (SARB) hiked its policy rate by 25bps to 3.75% in a split decision where two out of five governors voted to keep rates unchanged. More rate hikes are likely over the next meetings as the SARB sees near and medium term inflation risks skewed to the upside.

Turkey: The Central Bank cut its policy rate by another 100bps to 15% and hinted the end of the easing cycle is near. The cuts were enough to bring policy rates below both headline and core CPI inflation at 19.6% and 17.0% respectively, with the TRY depreciating 11.4% last week, by far the worst result across EM and major currencies, because of the heterodox policies. In other news, the government budget deficit improved to TRY 17.4bn in October from TRY 23.6bn in September as home sales rose at a yoy rate of 14.9% in October from 7.6% yoy in September.

Snippets

Colombia: The trade deficit widened USD 0.1bn to USD 1.7bn in September. Real GDP growth rose to 5.7% qoq in Q3 2021 (13.2% yoy), slightly above consensus of 5.5% qoq. The strong activity number led JP Morgan, a bank, to revise its 2021 and 2022 yoy rate of GDP growth forecasts to 10.0% and 5.5% respectively, from 9.0% and 4.0%.

Czech Republic: The yoy rate of industrial production rose 1.7% to 11.6% in October (10.3% consensus) while the current account deficit narrowed to CZK 10.0bn in September from CZK 37.8bn in August.

Egypt: Remittances from overseas workers reached USD 2.7bn in August, slightly below the USD 2.8bn in July, while the trade deficit narrowed to USD 2.4bn in September from USD 2.9bn in August.

Indonesia: Bank Indonesia kept its 7-day repo policy rate unchanged at 3.5%, in line with consensus. The current account moved to a USD 4.5bn surplus (consensus USD 3.2bn) in Q3 2021 from a USD 2.0bn deficit in Q2 2021 (revised from USD 2.2bn).

Mexico: El Universal, a local newspaper, reported that several legislators from the Institutional Revolutionary Party (PRI ) rejected the electricity reform proposed by the president.

Nigeria: The yoy rate of CPI inflation declined 0.6% to 16.0% in October led by lower food prices.

Philippines: The central bank kept its policy rate unchanged at 2.0%, in line with consensus. In other news, remittances from overseas rose USD 0.1bn to USD 2.7bn in September, the best result for the month of October since the beginning of the series.

Romania: Real GDP growth rose by 0.3% on a qoq basis in Q3 2021 (consensus 0.9%) from 1.5% in Q2 2021 (revised from 1.9%). The current account deficit widened by EUR 1.3bn in September from EUR 1.1bn in August accumulating a deficit of EUR 11.5bn in 2021.

Saudi Arabia: The yoy rate of CPI inflation rose 0.2% to 0.8%.

South Korea: The yoy rates of exports and imports growth decelerated in the first 20 days of November to 27.6% (from 36.1%) and 41.9% (from 48.0%) respectively. After adjusting for working days, the slowdown in exports was more moderate at 23.7% yoy from 25.9% yoy, reflecting Korea’s strong external accounts

Thailand: Real GDP growth contracted by 1.1% on a qoq basis in Q3 2021, significantly better than the -4.0% consensus, from +0.1% in Q2 2021. Trade data was stronger than expected in October as exports rose by a yoy rate of 17.4% and imports rose by 34.6% yoy, bringing the trade balance to a USD 370m deficit from a USD 610m surplus in September.

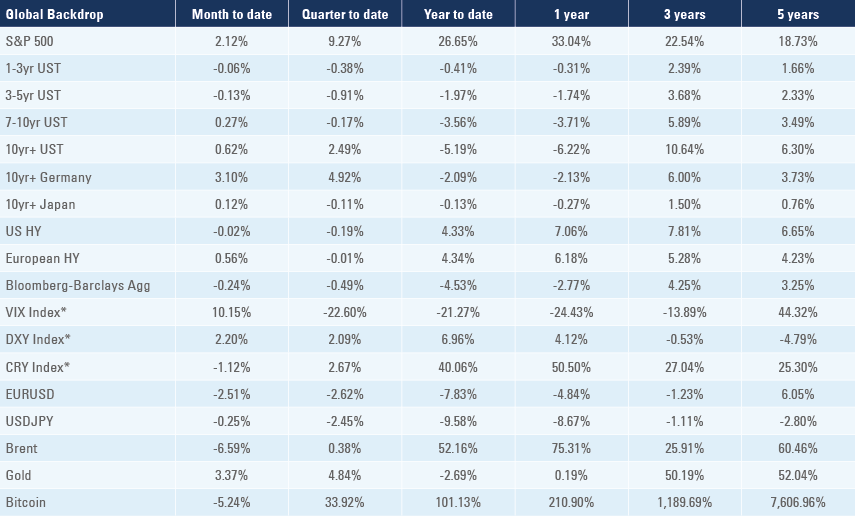

Global backdrop

Covid-19: Austria announced a full lockdown, for at least 10 days but is predicted to remain until 12 December, starting today, despite protests against mobility restrictions. Protests also took place in Brussels and several cities in the Netherlands with the French island protectorate of Guadeloupe suffering three days of riots after mandating healthcare workers to vaccinate (and higher fuel prices). Last week Austria was the first country to attempt to make vaccination a legal requirement as the government pledged to submit legislation by February 2022. Cases have increased to more than 1k per 1m people in Slovakia, Slovenia, Austria, Czech Republic, Netherlands, Belgium, Liechtenstein, Croatia, and Georgia as the average daily cases across the European Union (EU) reached 492 cases per 1m, the highest level since the beginning of the pandemic. Cases have also started to increase since the first week of November in the United States.

Commodities: Oil prices declined last week with Brent -3.9% to USD 78.8 per barrel as the market digested the lockdown measures adopted in Europe and the US attempt at coordinating a release of strategic oil reserves with China and other oil-importing nations to ease price pressures. Last week, the Rosneft Vice President Otabek Karimov said oil prices might reach up to USD 120 per barrel by the end of H1 2022, as OPEC+ countries are unable to increase production to meet demand.3

United States (US): A number of Fed board members adopted a more hawkish tone last week with Vice Chair Richard Clarida saying the US economy is in “a very strong position” and that it “may be appropriate to have a discussion about increasing the pace” (of tapering). Cleveland Fed Governor Christopher Waller said “The rapid improvement in the labour market and the deteriorating inflation data have pushed me towards favouring a faster pace of tapering and a more rapid removal of accommodation in 2022”. President Joe Biden is expected to announce his nomination for the Fed ahead of the Thanksgiving holiday. The odds of Lael Brainard’s appointment fluctuated between 33% and 41% last week according to predictit.com.4 In other political news, the Lower House approved the USD 1.9trn Build Back Better bill. The CBO released an estimate of the legislation passed by the House that, along with the legislated Bipartisan Infrastructure Package, puts additional net spending over the next five years at about USD180bn per year.

Economic data surprised to the upside with the Citibank Surprise index rising 22 to 32, the highest level in six months. Retail sales rose 1.7% in October from 0.8% in September, and industrial production rose 1.6% from -1.3% over the same period. Empire manufacturing improved 10.1 to 30.9 in November and the Philadelphia Fed Business Outlook improved to 39.0 from 23.8 over the same period. Capacity utilisation increased to 76.4% in October from 75.2% in September, very close to the average of the past 20 years.

United Kingdom (UK): The yoy rate of CPI inflation rose 1.1% to 4.2% in October (3.9% consensus) while core CPI rose 0.5% to 3.4% yoy (3.1% consensus).

Europe: The European Union trade surplus narrowed to EUR 6.1bn in September (consensus EUR 11.5bn) from EUR 9.7bn in August (revised from EUR 11.1bn), while the current account surplus rose EUR 1.6bn to EUR 18.7bn over the same period. President Emmanuel Macron announced the re-launch of investments in nuclear energy, a policy defended by the right and far right, but opposed by the left and green parties.

Australia: Reserve Bank of Australia Governor Lowy made the case that the country is going through a different cycle than its developed market peers and pushed back against market expectations of interest rate hikes in 2022.