Emerging markets upgrades marching on amidst high global macro uncertainty

- Fed Governor Christopher Waller published an extended statement on the US economy.

- China continued its drip-feed of positive policy news.

- Oil sold off after weaker Q3 growth data and downward revisions to IEA and OPEC demand forecasts.

- Israel killed Hamas leader, Yahya Sinwar.

- Sri Mulyani reappointed as Indonesia’s Finance Minister in Prabowo’s cabinet.

- Dominican Republic withdrew its fiscal reform after pushback from private sector.

- Ratings upgrades for Albania, Belize, Barbados, Ivory Coast. S&P maintained its positive outlook for Egypt.

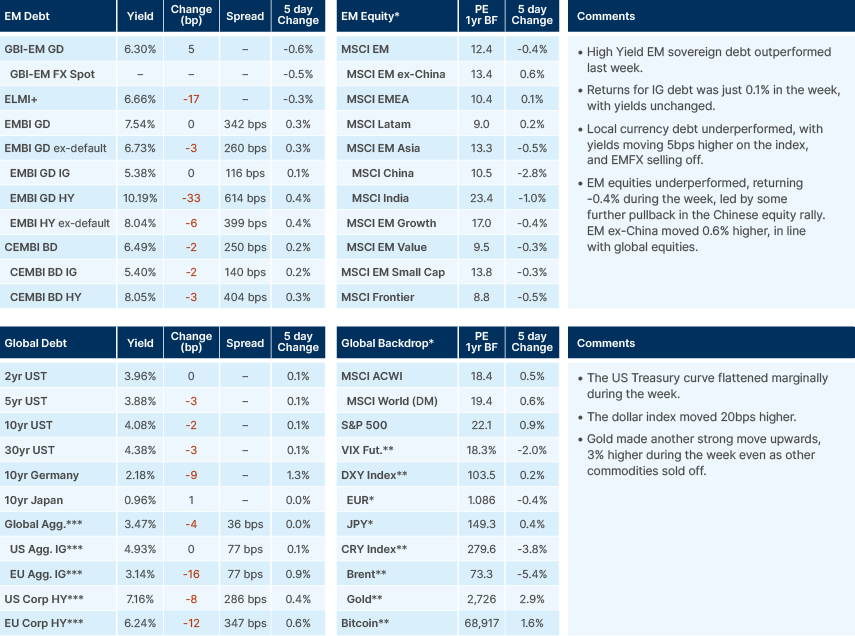

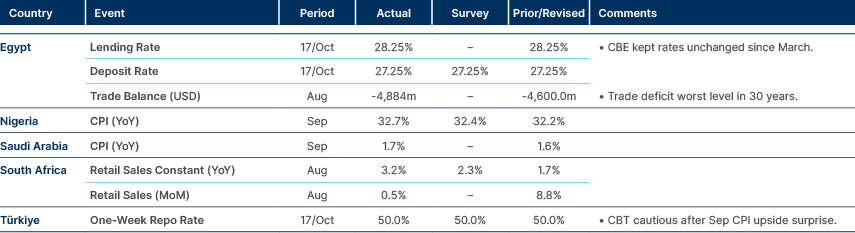

Last week performance and comments

Global Macro

A statement from US Federal Reserve (Fed) Governor Christopher Waller said the labour market “remains quite healthy”. He pointed to the ratio of job vacancies to unemployed people, which is now at 1.2. This ratio has only been above 1 three times since 1960. Waller said he does not acknowledge a “deterioration,” only a “gradual moderation” in labour demand relative to supply, based on payrolls and the unemployment rate.

Labour market data will be more difficult to interpret this month, after two recent hurricanes and a major strike at Boeing. Waller expects these to reduce employment growth by more than 100k in October. Regardless of the election outcome, his “baseline calls for reducing the policy rate gradually over the next year.” So, 2x25bps in 2024 is now almost a given. But after that?

The median rate for FOMC participants at the end of 2025 is 3.4 percent, so most of my colleagues likewise expect to reduce policy over the next year. There is less certainty about the final destination. The median estimated longer-run level of the federal funds rate in the Committee's Summary of Economic Projections (SEP) is 2.9 percent, but with quite a wide dispersion, ranging from 2.4 percent to 3.8 percent. While much attention is given to the size of cuts over the next meeting or two, I think the larger message of the SEP is that there is a considerable extent of policy restrictiveness to remove, and if the economy continues in its current sweet spot, this will happen gradually.

Bonds

US government spending was USD 4.5trn in 2019. Bank of America Merrill Lynch (BAML) analysts expect it to reach USD 6.9tn in 2024. This will take US debt to USD 35.4tn, vs USD 23.2tn in 2019. This level of supply points towards a structural dollar bear market, especially if the next administration does not make any significant fiscal adjustments. A BAML fund manager survey showed 85% of FMS investors expect yield curves to steepen in 2025, near the record of 90% reached in the September survey.

The fiscal deficit in the US for the fiscal year 2024 was USD1.8tn, equivalent to 6.4% of GDP. Deutsche Bank US economists believe the deficit will be between 7 to 9% from 2026-2028, whatever political configuration. In a blue or red wave scenario, estimates are closer to 9% and are nearer 7% in a split congress. With little to split the candidates in the polls two weeks out from the election, a divided congress seems more likely, which would make it more difficult to implement further fiscal expansion. But in our view, bond markets and inflation will also act as significant constraints to a further widening of the deficit, especially with interest costs already so high. We laid out our views on these dynamics in a piece published in July.1 These still stand.

Geopolitics

Israel killed Yahya Sinwar, the leader of Hamas seen as responsible for the 7 October 2023 attack. Renewed hopes of a victory declaration and ceasefire may be frustrated. Even with the assassination of Sinwar, Netanyahu’s political dynamics haven’t shifted: his power remains dependent on the support of the far right, who still think a ceasefire now would be premature.

In Lebanon, the UN Security Council voted unanimously against Israel’s demand that the UN Peace Keepers in Southern Lebanon (UNIFIL) make way for the IDF.2 North Korea blew segments of the road link to South Korea after accusing its southern neighbour of flights over Pyongyang. It also sent 12k troops to Russia.

Commodities

Oil prices dropped more than 6% during the week, on slackening demand from China, and a lower perceived probability of an Israeli attack on Iranian oil infrastructure. Although economic data in China beat forecasts during the week, the world’s top importer still registered the slowest quarterly gross domestic product (GDP) growth since early 2023. Also, refinery output declined for a third straight month. On the supply side, The Washington Post also cited two official sources during the week who indicated Israel’s Prime Minister Benjamin Netanyahu had told the US he was willing to strike military rather than oil or nuclear facilities in Iran, suggesting a more limited counterstrike and prevention of full-scale war.

Emerging Markets

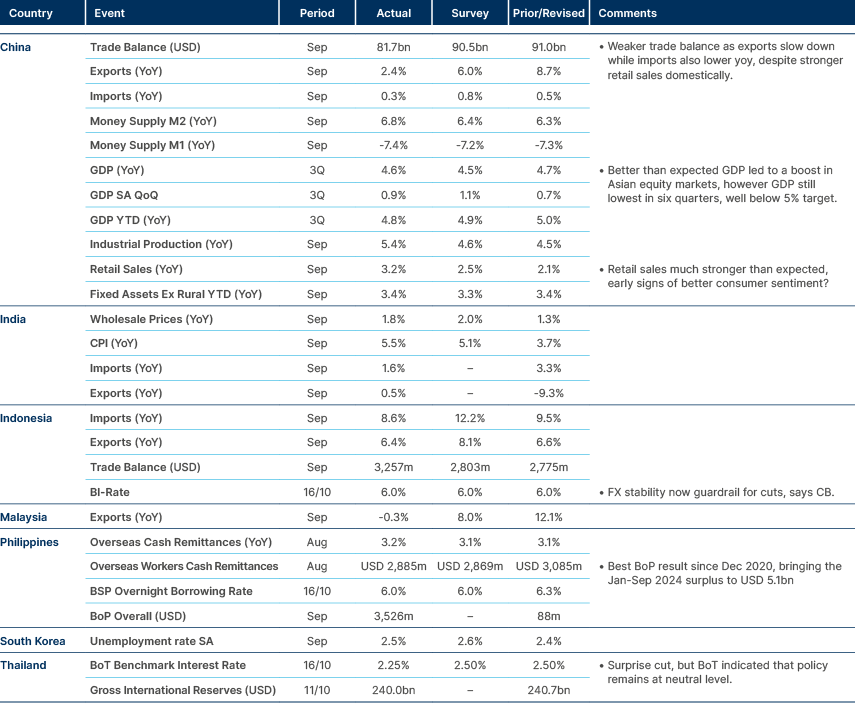

Asia

China’s data better than feared. Solid external account numbers from Philippines and Indonesia. Thailand unexpected cut.

China

Better-than-expected, but still below-par, growth numbers in China indicate that more clarity on fiscal stimulus is needed to improve confidence. Beijing has said it has full confidence in achieving 5.0% growth this year. However, it is likely this will require direct fiscal stimulus, the details of which are likely to come after the outcome of the US election. Sales of the iPhone 16 were 20% higher than for 2023’s model, showing some improving consumer behaviour, and potentially indicating the start of a replacement cycle. The People’s Bank of China (PBoC) cut the 1-year and 5-year loan prime rate (LPR) by 25 basis points (bps) to 3.1% and 3.6%, respectively. Consensus was for a 20bps cuts with a 20-25bps range. In a press conference, the PBoC noted RMB 200bn (USD 28.1bn) of applications for non-bank financial institutions to buy shares, signalling wider corporate and retail interest in longer-term interest in the equity rally. The quota for supporting unfinished residential projects was doubled to RMB 4trn (USD 562bn), not enough to fix the problem, but another step in the right direction.

India

The Reserve Bank of India’s Governor, Shaktikanta Das, said an interest rate cut at this stage would be “premature,” and “very, very risky,” after the latest inflation readings surprised to the upside. He pushed back against any comments that he was behind the curve, saying “we will not miss the party, we do not want to join any party.”

Indonesia

Prabowo Subianto was sworn in as President last week. The key news in his cabinet was the reinstalment of Sri Mulyiani as Finance Minister, as speculated last Monday. Mulyiani is viewed by markets as a pragmatist, so this was a positive surprise. Mulyiani has already publicly questioned some of Prabowo’s policies, such as the expensive (USD 30bn) free school lunches programme over the next five years of his presidential term. Her presence as Finance Minister is likely to balance some of Prabowo’s appetite for fiscal expansion.

Latin America

Better activity across the board. Argentinian imports now above average since 2009.

Barbados

Upgraded by one notch to B+ by Fitch, now two notches above S&P and Moody’s.

Belize

Upgraded to Caa1 from Caa2 by Moody’s.

Dominican Republic

According to a statement over the weekend, President Luis Abinader announced the immediate withdrawal of the fiscal reform proposal he previously submitted to Congress. Abinader explained that the decision was made after concerns were raised by different sectors during the public consultation process organised by Congress. He said that a true democratic government does not fear amending its decisions when it listens to the people, adding that the decision shows the government is in touch with the reality of its citizens. Abinader said the withdrawal of the reform means the government will need to adjust its development plans and create acceptable alternatives.

Abinader's comments come amid widespread discontent in Dominican society following the government's presentation of the fiscal reform in early October. The reform aimed to raise approximately DOP 122bn annually through several channels, which included eliminating certain tax exemptions, reducing taxes for SMEs, and increasing taxes on some basic consumer goods.

Overall, the fiscal reform was one of the most difficult and unpopular structural reforms that Abinader promised to push forward in his second term, after having paused it during his first term due to the economic slowdown and the proximity of the election. Even so, the retreat signals a significant erosion of the government's political capital, as it demonstrates that, like several past administrations, it failed to move forward with the president's main campaign promise. In our view, this also represents a big, missed opportunity to address longstanding issues in the Dominican Republic, like its high debt levels, especially given Abinader's advantage over previous governments due to the ruling PRM's large majority in Congress.

Panama

JP Morgan is lending Panama USD 1.0bn to help it with liquidity needs for its 2024 budget. The three-year loan will carry a rate of 150bps over the six-month secured overnight financing rate (SOFR), and is intended to help Panama meet its USD1.25bn external amortisation due in 2025.

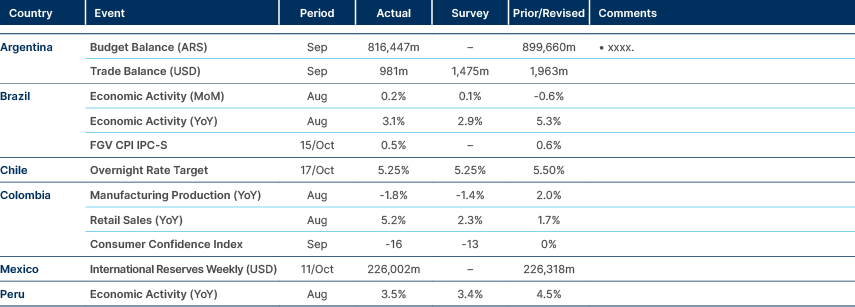

Central and Eastern Europe

Poland core CPI proving stubborn.

Albania

Upgraded to Ba3 from B1 by Moody’s.

Central Asia, Middle East, and Africa

Turkey and Egypt keep rates unchanged.

Egypt

Private sector deals from Saudi Arabia into Egypt are expected to rise to USD 15bn, according to Bandar Al-Amiri, head of the Saudi-Egyptian Business Council.3 The announcement came following a meeting between Crown Prince Mohammed bin Salman and Egypt’s President Abdel Fattah El-Sisi.

President Sisi said the International Monetary Fund (IMF) programme is becoming too hard to bear and must be reviewed. "Egypt is implementing the current economic reform programme amid very difficult regional and international circumstances," Sisi said, adding these challenges may continue for another year, causing economic and social hardships.

Despite these economic difficulties foreseen by Sisi, S&P affirmed Egypt’s B-rating and its positive outlook. S&P still sees potential for further improvements in external and fiscal dynamics. The government is expected to save EGP 27bn (USD 550m) in FY 2024/25 following last week's fuel price hike, Egypt consumes around 18bn litres of diesel annually, and the government is providing around EGP 6.5 subsidy for each litre, according to a government official.

Ivory Coast

S&P upgraded Ivory Coast's credit ratings to BB from BB-, with a stable outlook. S&P said the upgrade reflects the effective policy actions of the regional central bank BCEAO between 2019 and 2024, which supported economic stability and capital market access for all WAEMU members during periods of repeated external shocks, while also ensuring price stability and reserve buffers.

A rating downgrade could materialise if external imbalances persist, if external leverage related to current account receipts does not decline as expected, or if there is a significant increase in domestic political tensions that hinders policymaking. Ratings could be raised if the country’s budget position improves by more than expected or its large external financing needs decline materially. S&P expects GDP growth to stay at c. 6.5% in 2024-2026, before picking up to 7.0% in 2027, while the fiscal deficit is forecast to drop to 4.2% of GDP this year from 5.2% in 2023, and 3.0% in 2025-27.

Kenya

Finance Minister John Mbadi said Kenya is negotiating a USD 1.5bn loan with 8.25% interest with the United Arab Emirates (UAE).4 If confirmed, the transaction would provide significant liquidity relief to the East African powerhouse that had to pay more than 10% yield to borrow the same amount in Eurobonds. The first amortisation of one-third of the principal of the USD 900m May 2027 is due next May.

Türkiye

Central bank committee members published a cautiously optimistic statement as inflation and core goods inflation remained low in Q3 2024, with services inflation improvement expected in Q4 2024. The committee reinforced its view that tight monetary policy and real appreciation of the TRY will sustain a “significant and sustained decline in the underlying trend of monthly inflation, and inflation expectations converge to the projected forecast range”.5 Looking ahead however, the decision to raise the minimum wage and administered prices later this year add uncertainty and are likely to keep policy unchanged at least until 2025.

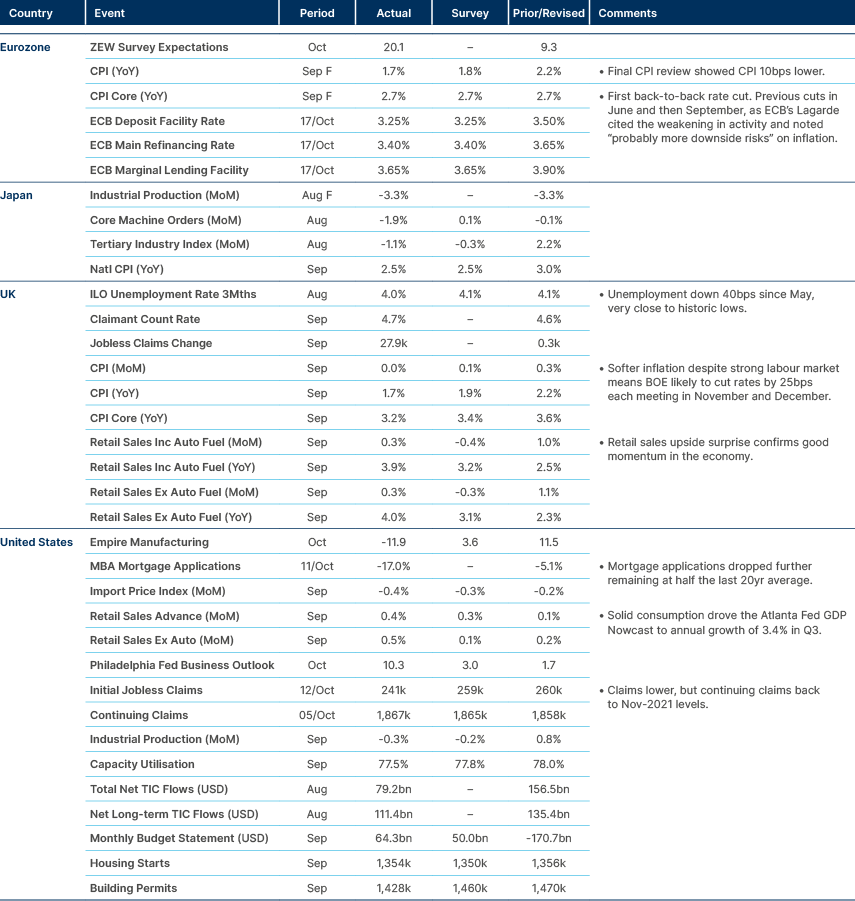

Developed Markets

ECB cut 25bps with dovish press conference. US data stronger again, but housing remains feeble

Europe

European Central Bank (ECB) President Christine Lagarde did not push back on expectations of consecutive rate cuts in November and December, although her statement maintained that policy rates would be “sufficiently restrictive for as long as necessary.” Lagarde did acknowledge weaker activity and noted that there was now more downside risk to inflation. Some economists, such as BAML, interpreted this as a pivot to an accelerated easing cycle, with back-to-back 25bps cuts until policy rates reach the 2-2.5% neutral range.

United Kingdom

Payrolls surged to 373k over the last three months to August, the fastest pace since the inception of the series in 2011, albeit wage growth declined by 20bps to 4.8% over the same period, leaving further Bank of England interest rate cuts in play.

United States

Solid retail sales are helping keep labour market dynamics positive. However, the housing market remains tepid with existing home sales at 4m per month over the last 12 months, levels only seen before in 2008-2009, and 22% below the average levels over the last 20 years, a period when the population has grown from 294m to 342m, or around 16%. Mortgage rates play a big role in house ownership; the 30-year mortgage rate declined from the 8.1% high in October 2023 to 6.6% in mid-September but is now back to 7.0%. This suggests houses remain largely unaffordable which, alongside higher price levels across the economy, is keeping anxiety levels high, despite full employment.

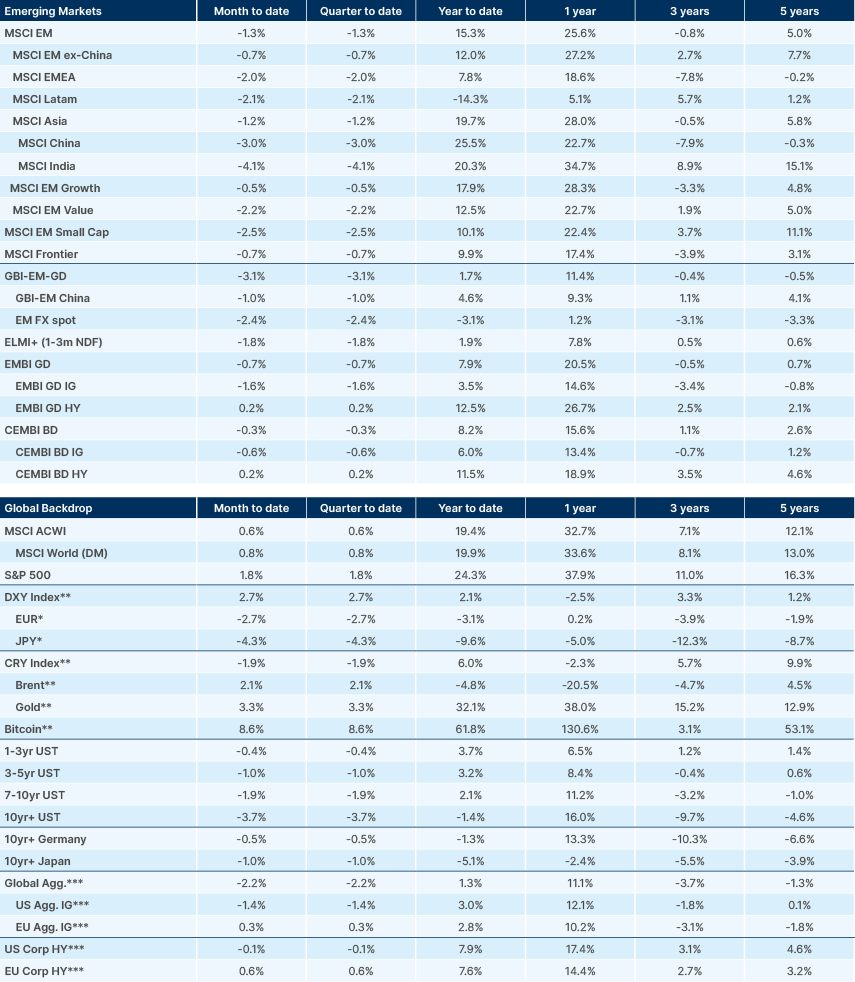

Benchmark performance

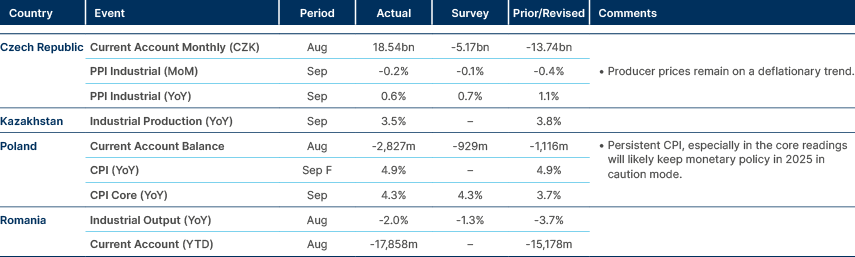

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

1. https://www.ashmoregroup.com/en-gb/insights/us-elections-impact-emerging-markets

2. UNSC’s five permanent members are China, France, Russia, UK, and the US. The non-permanent members are currently Algeria, Ecuador, Guyana, Japan, Malta, Mozambique, South Korea, Sierra Leone, Slovenia, and Switzerland. https://main.un.org/securitycouncil/en/content/current-members

3. See https://www.egypttoday.com/Article/3/135421/Saudi-Arabian-Egyptian-private-sector-deals-will-inject-15B-into

4. See https://www.reuters.com/world/africa/kenya-talks-15-bln-commercial-loan-with-uae-finance-minister-says-2024-10-16/

5. See https://www.tcmb.gov.tr/wps/wcm/connect/EN/TCMB+EN/Main+Menu/Announcements/Press+Releases/2024/ANO2024-56