Emerging Markets (EM) Manufacturing PMI converged towards Developed Markets (DM). Brazilian exporters are hoarding US Dollars abroad due to political uncertainty. Chile’s Lower House approved another redemption from the pension system. The People’s Bank of China pledged to safeguard homebuyers’ rights. Colombia, Czech Republic and Mexico hiked their policy rates, while Thailand’s rate was unchanged. The Peruvian government ratified Julio Velarde for another term at the helm of the central bank. South Korea industrial production and exports remains at solid levels.

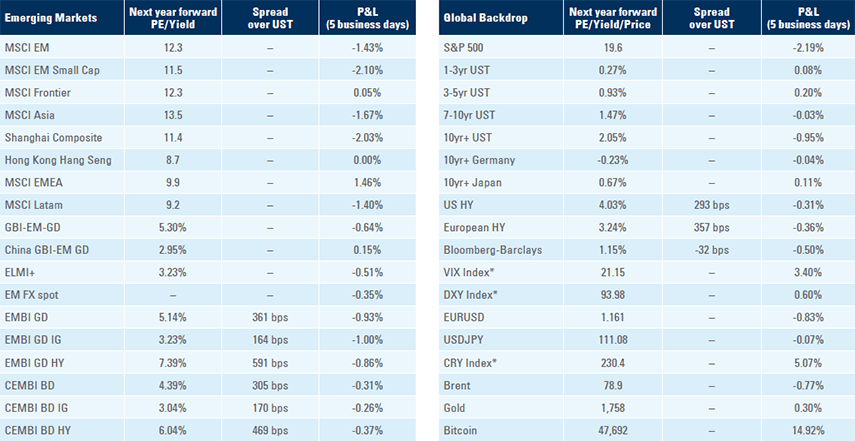

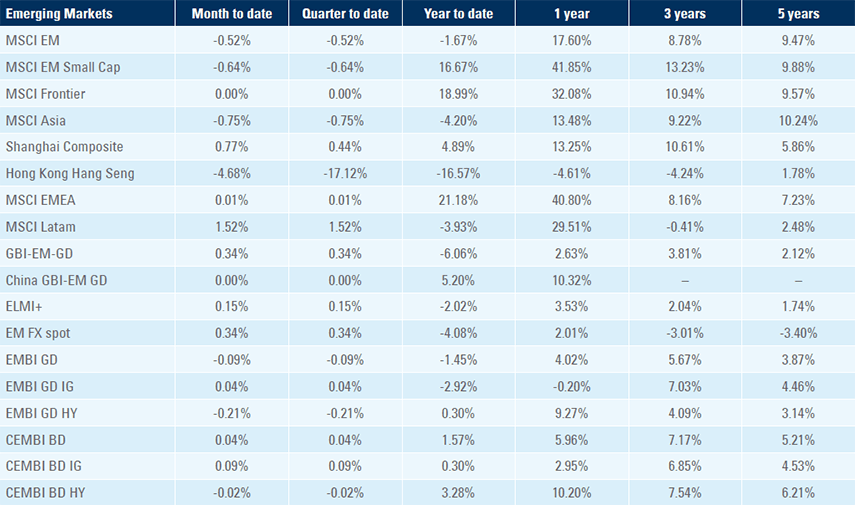

Manufacturing PMIs: Global manufacturing PMI survey was stable at 54.1 as EM manufacturing PMIs improved 1.2 to 50.8 while DM manufacturing PMI deteriorated 1.2 to 57.1. Figure 1 shows twelve out of seventeen EM countries saw an expansion in their manufacturing PMI with the PMI of five countries rising more than 2.0 points: Indonesia (+8.5 to 52.2), Malaysia (+4.7 to 48.1), Philippines (+4.5 to 50.9), Russia (+3.3 to 49.8) and Colombia (+2.3 to 55.5). Nine countries had their manufacturing index above 52 in September. Only five countries saw a drop on the manufacturing PMI with Taiwan (-3.8 to 54.7), Czech Republic (-3.0 to 58.0) and Poland (-2.6 to 53.4) declining more than 2.0, but remaining in expansionary territory above 50. Only four countries had their manufacturing PMI below 50, a line that for EM countries suggests lower than potential GDP (not contraction). The only country with the PMI below 48 is Vietnam (40).1

Fig 1: EM Manufacturing PMI: September 2021

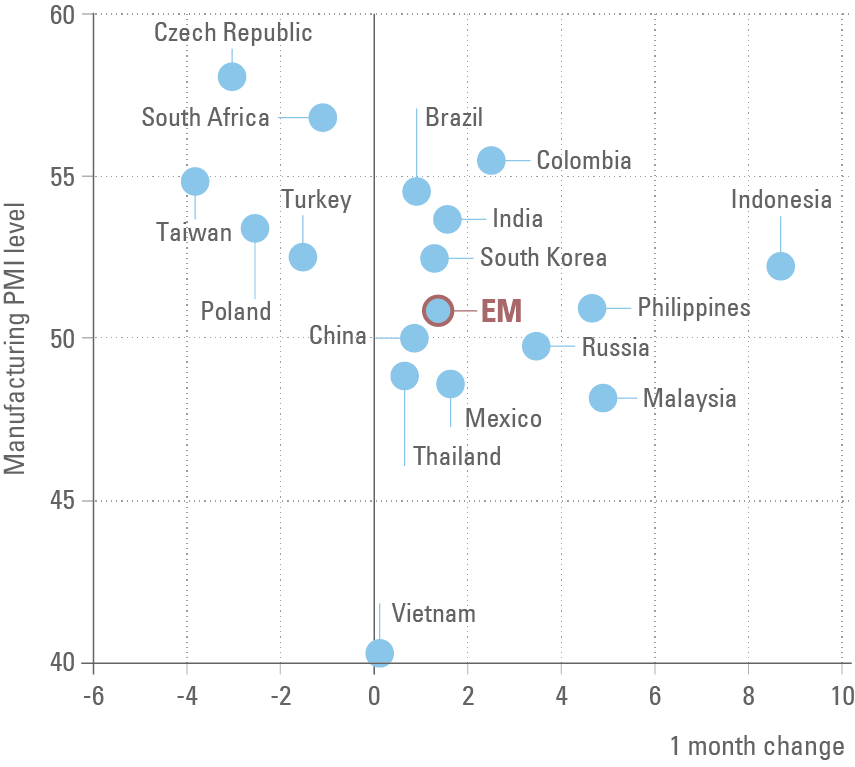

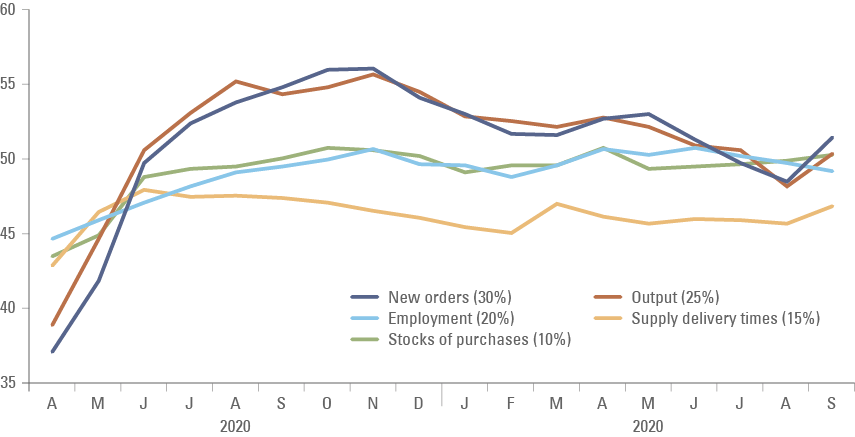

EM Manufacturing PMI’s improved across four out of five of the major subcategories of the index, except for employment as per figure 2, whilst DM levels declined in all subcategories as depicted in figure 3.2 EM new orders increased 3.0 to 51.4 while DM’s declined 2.2 to 55.9. Output rose 2.2 in EM to 50.3 and declined 1.7 in DM to 53.4. In the employment sub-index, both EM and DM declined 0.6 to 49.1 and 53.3 respectively. EM delivery times improved 1.2 to 46.8, but declined 0.5 in DM to 25.5, representing a larger scale of supply disruptions experienced in DM. The last sub-item, stock of purchases index, EM improved 0.4 to 50.2 while DM declined 0.7 to 51.3.

Fig 2: EM Manufacturing PMI subcomponents

Fig 3: DM Manufacturing PMI subcomponents

Within DM, manufacturing declined the most in New Zealand (-22.1 to 40.1), UK (-3.2 to 57.1) and the Eurozone (-2.8 to 58.6) and improved the most in Australia (+6.1 to 58.6). The US manufacturing PMI declined 0.4 to 60.7.

Brazil: Exporters did not convert USD 46.2bn of foreign receipts to BRL in the past 12 months, according to Estado de São Paulo – a Brazilian newspaper. Political uncertainty, the weak performance of the BRL and low interest rates differential are factors behind the increase. In political news, the moderate PSDB party primaries will be disputed between Governors Eduardo Leite (Rio Grande do Sul) and Joao Doria after Tasso Jereissati stepped away from the dispute on 21 November. Eduardo Leite has the lowest level of rejection among the politicians and stands a better chance of consolidating other political parties to launch a single centrist candidate. In corporate news, Petrobras announced a BRL 300m gas subsidy for low-income families, an inexpensive solution to hedge against the risk of social unrest. In other news, Brazil is experiencing the worst drought in 90 years, threatening the 2022 food crops. In economic news, the primary deficit improved to BRL 9.9bn in August (consensus BRL 14.0bn) from BRL 19.8bn in July while net debt declined 1.0% to 59.3% of GDP of the same period.

Chile: The Lower House approved the 4th pension fund withdrawal by a tight margin (94 votes in favour only one vote above the minimum required). Previous withdrawal bills gathered larger support in congress (122 votes in favour on average). The bill will now move to the Senate where it should face more opposition, hence the outcome is still a close call. Economic activity improved 1.0% in August to a yoy rate of 19.1% (consensus 16.5%) as the unemployment rate dropped 0.4% to 8.5%. Copper production declined 0.7% to 466k tons in August, the weakest result for the month since 2018.

China: The People’s Bank of China said it will work to safeguard the healthy development of the property market and rights of home buyers – the first mention of the property industry since 2009. In economic news, the yoy rate of industrial profits deteriorated to 10.1% in August from 16.4% yoy in the previous month, while the current account surplus improved USD 0.5bn to USD 53.3bn in Q2 2021. The China Federation of Logistics Composite PMI rose 2.8 to 51.7 with manufacturing dropping 0.5 to 49.6 while services rebounded 5.7 to 53.2.

Colombia: The central bank hiked its policy rate by 25bps to 2.0%, in line with consensus, but three out of seven directors voted for a 50bps hike. The board highlighted that its staff forecast suggests the output gap will close faster than initial expectations after revising GDP growth forecasts to 8.6% (from 7.5%) in 2021 and 3.9% in 2022 while inflation was revised to 4.5% by end 2021 and 3.5% in 2022. The national unemployment rate dropped 2.0% to 12.3% in August.

Czech Republic: The Czech National Bank hiked its policy rate by 75bps to 1.5%, 25bps above consensus, but two out of seven members voted to keep the policy rate unchanged. The meeting’s statement held a hawkish tone highlighting higher than expected inflation demanded a faster tightening than initially forecasted. The yoy rate of real GDP growth declined 0.1% to 8.1% in Q2 2021 according to preliminary estimates, but remains 4.9% below the pre-pandemic peak in Q4 2019.

Mexico: The central bank hiked its policy rate by 25bps to 4.75%, in line with consensus as only one of five members voted to keep policy unchanged (from two members in the previous decision) and continued to highlight they see inflationary pressures as temporary, with higher policy rates needed to anchor expectations. Foreign exchange remittances of Mexicans living abroad rose to USD 4.7bn in August from USD 4.5bn in July, but the trade deficit narrowed only USD 0.2bn to USD 3.9bn in August, significantly above the USD 1.1bn deficit predicted by median Bloomberg survey of analysts.

Peru: Prime Minister Bellido threatened to nationalise the gas projects operated by Camisea. President Pedro Castillo said any renegotiation would follow the rule of law while Justice Minister affirmed that the government does not have the ability to unilaterally nationalise the gas fields, and this has not been discussed. In economic news, the yoy rate of CPI inflation rose 0.2% to 5.2% in September while core CPI rose to a more modest 2.6% yoy.

South Korea: The trade surplus rose to USD 4.2bn in September from USD 1.6bn in August as the business-day adjusted exports rose at a yoy rate of 27.9% from 29.0% yoy over the same period, still a strong result despite ongoing supply chain disruptions. The Bank of Korea business manufacturing survey inched 3-points lower 93 in October, but remained at the highest levels in 10-years while the non-manufacturing survey was stable at 81. The yoy rate of IP rose to 9.6% in August from 7.7% yoy in July, or 5.9% above the August 2019 levels.

Thailand: The Bank of Thailand kept its policy rate unchanged at 0.5%. The current account deficit widened to USD 2.5bn in August from USD 0.5bn in July as export growth slowed to 8.2% on a yoy basis from 21.7% yoy in July while imports accelerated 3.0% to 39.6% yoy over the same period. Business sentiment improved 2.6 to 42.6 in September, but remains depressed by the tourism and mobility restrictions imposed by the government.

Snippets:

- Argentina: The economic activity index improved 0.8% in July to a yoy rate of 11.7%, from 10.8% in June and significantly above 8.5% yoy consensus. Economic confidence rose 0.7 to 40.5 in September.

- Ecuador: The IMF concluded the second and third reviews of its Extended Fund Facility, allowing for a USD 0.8bn immediate disbursement.3 The economy expanded by a yoy rate of 8.4% 2Q 2021, recovering from a 5.6% contraction in Q1 2021.

- Hungary: The yoy rate of PPI inflation declined 0.4% to 14.4% in August and the unemployment rate rose 0.1% to 4.0%. Business confidence rose 0.4 to 6.5 in September, but consumer confidence declined 0.6 to -20.3.

- India: The fiscal deficit widened to INR 147bn (USD 2.0bn) in August from INR 47bn (USD 0.6bn) in the previous month while the current account moved to a USD 6.5bn surplus in Q2 2021 from a USD 8.1bn deficit in the previous quarter.

- Indonesia: The yoy rate of CPI and core CPI inflation were unchanged at 1.6% and 1.3% respectively in September.

- Malaysia: The trade surplus rose to MYR 21.4bn in August from MYR 13.7bn in July, or MYR 10.4bn above consensus expectations. The yoy rate of export growth rose 18.4% in August from 5.0% yoy in July while imports declined to 12.5% yoy from 24.0% yoy over the same period.

- Oman: The ratings agency S&P raised Oman’s ‘B+’ sovereign rating outlook to positive on the back of a fiscal reform programme and higher oil prices. Moody’s and Fitch hold Oman sovereign rating at ’BB-‘ or equivalent.

- Philippines: The unemployment rate rose to 8.1% in August from 6.9% in July.

- Poland: The yoy rate of CPI inflation rose to 5.8% in September from 5.5% in August. Next week the National Bank of Poland holds its monetary policy committee where the consensus expects policy rate unchanged at 0.1%.

- Romania: The unemployment rate rose to 5.2% in August from 5.1% in July. The yoy rate of PPI inflation rose to 15.9% in August from 14.0% in July.

- Russia: The yoy rate of real GDP growth was unchanged at 10.5% in Q2 2021, in line with consensus. The yoy rate of retail sales rose 0.6% to 5.3% and the unemployment rate declined 0.1% to 4.4% in August but real wages declined to 2.2% yoy in July (from 4.9% yoy in June).

- Saudi Arabia: The unemployment rate declined 0.4% to 11.3% in Q2 2021 while the current account surplus rose USD 3.3bn to USD 12.0bn over the same period.

- South Africa: The trade surplus improved to ZAR 42.4bn in August from ZAR 37.0bn in July, and the fiscal deficit improved to ZAR 39.3bn from ZAR 133.2bn over the same period. The yoy rate of PPI inflation rose 0.1% to 7.2% in August.

- Taiwan: The yoy rate of IP declined to 13.7% in August from 14.4% in July.

- Turkey: The trade deficit was unchanged at USD 4.3bn in August in line with consensus. The yoy rate of CPI inflation rose 0.3% to 19.5% in September, slightly better than consensus.

- Venezuela: The EU will send a mission of 116 electoral observers to monitor regional and local elections in November at the request of the opposition. This is likely to allow for a victory for President Nicolas Maduro if it allows for any legitimisation of his mandate, assuming turnout is likely to be low in line with other elections.

- Vietnam: Real GDP growth contracted by 6.2% on a yoy basis in Q3 2021 down from +6.6% yoy in Q2 2021 and lower than 2.0% yoy consensus. Exports declined by a yoy rate of only 0.6% in September from -5.4% in August, better than consensus at -7.4%, but domestic activity disappointed as retail sales dropped 7.1% yoy in September from -4.7% yoy in August and -4.0% yoy consensus. The yoy rate of CPI inflation declined to 2.1% in September from 2.8% in August, 1.0% below consensus.

Global backdrop

United States (US): The risk around unexpected outcomes for both monetary and fiscal policies increased last week. Yellen said her department will effectively run out of cash around Oct. 18 unless Congress suspends or increases the debt limit, putting pressure on lawmakers to avert a default. Congress has approved neither a continuing provision allowing the government to fund is expenses after the end of the fiscal year in 30 September nor an increase in the debt ceiling. Senator Elizabeth Warren, pressed the Federal Reserve Chairman Powell in the financial regulation probe, saying Powell is a “dangerous man to head up the Fed” and she will oppose his nomination for another term as Chairman. Powell’s first term expires in February 2022. Last week the Dallas and Boston Fed Presidents Robert Kaplan and Eric Rosengreen resigned from their posts after annual financial disclosure revealed large personal account dealings during their mandate, raising ethical concerns from the Fed’s helm.

In economic news, the ISM manufacturing rose 0.2 to 61.1 in September (59.5 consensus), with the ISM prices paid rising further 1.8 points to 81.2. The yoy rate of PCE deflator rose 0.1% to 4.3% in August wile core PCE deflator was unchanged at 3.5% yoy, both 0.1% above consensus. Other economic surveys suggested economic activity remains buoyed: The University of Michigan sentiment improved 1.8 to 72.8, the Dallas Fed of manufacturing survey rose 2.0 to 11.0 and the Conference Board consumer confidence down only 0.2 to 115.0. Labour market indicators were soft as initial jobless claims rose to 362k in the week ending on 25 September against 330k median consensus and 351k in the previous week. Continuing claims was unchanged at 2.8 million on the week ending on 18 September.

Eurozone: The yoy rate of CPI inflation rose 0.4% to 3.4% in September while core CPI rose 0.3% to 1.9% yoy. Economic confidence rose 0.3 to 117.8 remaining at the highest levels in 20 years. The unemployment rate dropped 0.1% to 7.5% in August, which is only 0.1% above the August 2019 level.

Japan: Industrial production declined 3.2% in August after dropping 1.5% in July, a larger drop than consensus and 4.1% below the levels in January 2020. On the other hand, the Tankan large manufacturing business conditions rose 4 points to 18 in Q3 2021, the highest level since 2018, while non-manufacturing business inched 1 point higher to two.

United Kingdom: The yoy rate of real GDP growth rose to 23.6% in Q2 2021 from 22.2% in Q1 2021, but real GDP remains 3.3% below Q4 2019. Sterling was one of the worst performing currencies last week as Bank of England Governor Andrew Bailey suggested higher inflation does not necessarily merit a fast normalisation of monetary policy, while the market prices a 15bps increase in policy rate already in Feb 2022. In Bailey’s words: “The shocks are restricting supply in the economy relative to the recovery of demand. Moreover, tightening monetary policy could make things worse in this situation by putting more downward pressure on a weakening recovery of the economy.”

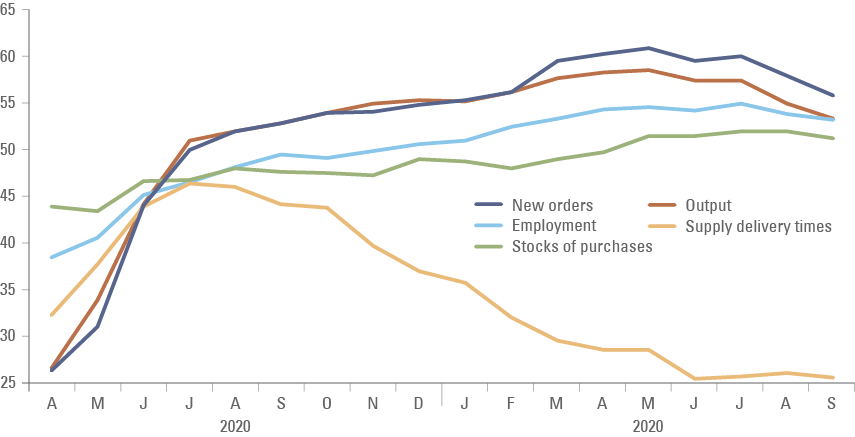

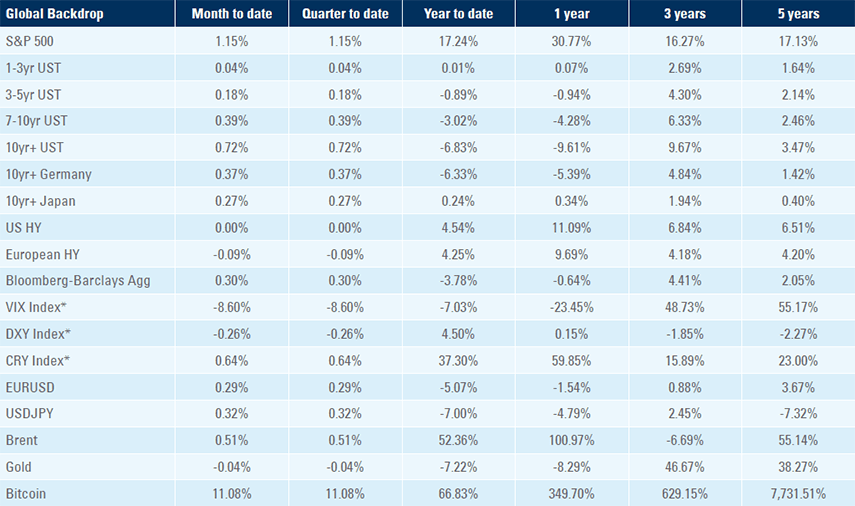

*VIX Index = Chicago Board Options Exchange SPX Volatility Index. *DXY Index = The Dollar Index. *CRY Index = Thomson Reuters / CoreCommodity CRM Commodity Index.

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI, total returns.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

1. The IHS Manufacturing PMI is a diffusion index resulting from surveying the purchasing managers of small, medium and large companies, and is designed to capture real-time changes in economic activity. The diffusion index has its centre point at 50. In developed economies, results above 50 usually indicates economic expansion while below 50 represents economic contraction. However, a reading of 50 in EM countries mostly represents the economy expanding in line their potential GDP growth. For example, over the last 10-15 years a 50 reading in China was consistent with a GDP expansion of around 7% while a 50 reading in India was equivalent to 6% GDP growth, according to IHS Markit.

2. The IHS Markit Manufacturing PMI is a weighted average of the following five indices: Output (25%), New Orders (30%), Employment (20%), Delivery Times (15%) and Stocks of Purchases (10%).