EM elections: good result in Thailand, poor results in Türkiye

It was a good outcome in the Thai presidential elections in terms of fostering liberal economic reforms. In Türkiye, Erdogan won most votes but fell short of the 50% mark, leading to a 28 May run-off. Argentina’s inflation rose further. In Colombia, the President’s approval rating plunged to 30%. Pakistan’s former President Imran Khan was arrested and then bailed by the Supreme Court. Egypt’s credit rating was downgraded to ‘B’ with a negative outlook. China’s inflation and credit creation surprised to the downside. Mexican inflation declined further.

Emerging Markets

Thailand: In what will likely be seen as a good outcome in Thailand by markets, with 99% of the votes counted, the Move Forward and Pheu Thai parties are projected to win 287 out of 500 of seats in parliament, putting them in position to form a liberal-democratic alliance. The 42-year-old Harvard-educated Move Forward leader Pita Limjaroenrat extended invitations to five political parties to form a coalition, pledging to be a “prime minister for all”. The Pheu Party leader Cholnan Srikaew “congratulated and accepted the fact that the Move Forward Party proposed to lead the formation of a new government”. Incumbent General Prayuth from the United Thai Nation Party pledged to “respect democracy and elections”. Voter turnout was at a record high at 75% and with around 39 million votes counted. However, despite the majority in parliament, it is unclear whether Move Forward and Pheu Thai will be able to form a coalition as they don’t have enough seats in the Senate, which will force them to bring traditional parties supporting the military and the royalists to government.1 All parties have promised large increases in minimum wages and cash handouts, standing in contrast with the need to consolidate the fiscal deficit, of around 3.5% of gross domestic product (GDP) in Q1 2023 to put the debt/GDP ratio on a more sustainable path. The more market-friendly coalition is likely to be in a better position to balance Thai citizens’ calls for an improved social safety net with higher private investment that would boost economic growth and tax revenues. Bank of Thailand Governor Sethaput Suthiwartnarueput is confident the economic recovery, buoyed by consumption, is likely to remain solid, lowering the need for fiscal and monetary stimulus. Q1 2023 GDP growth rose to 2.7% year-on-year (yoy) from 1.4% in Q4 2022, 40 basis points (bps) above consensus as private consumption expanded by 5.4% yoy (5.6% prior). The industry breakdown saw agriculture growth increas to 7.2% yoy (from 3.4%), services rose 0.9% to 5.2% yoy and industrial sector improved 1.6% to -3.0% yoy.

Türkiye: At the time of writing, with 99% of the ballots counted, incumbent President Reccep Tayyip Erdogan had 49.4% of popular votes, with rival Kemal Kilicdaroglu at around 45.0%. The far-right candidate Sinan Ogan had 5.3% of the votes, hence taking the race to a runoff on 28 May. It will be very hard for the opposition to get Sinan’s votes given their support to the Kurdish Party. Even if the opposition gets circa 80% of the votes, they will still need some Erdogan voters to change their minds before the runoff. Erdogan’s AK Party is estimated to have won 320 seats of the 600 disputed, and Erdogan will certainly use that on the campaign trail over the next two weeks. The participation rate was 89% according to state-run Anadolu Agency. Kilicdaroglu’s only chance (if he has one) is if Türkiye’s macro situation deteriorates very fast, frightening some Erdogan voters to swing the balance in his favour. The bar for a turnaround is very high, however, given Erdogan’s incumbency advantage and religious appeal, and the possibility of the elections being unfair. Last week, Erdogan kept a defiant tone in one of his final rallies, accusing US President Biden of having given orders to topple him from power and saying the opposition would sanction Russia on US orders. Erdogan also said he accepts orders only from Allah and the “West gone crazy when Hagia Sophia turned to a mosque”. He also increased wages by 45% for 700k public servants. The minimum monthly wage for public workers will be TRY 15k (c. USD 770).

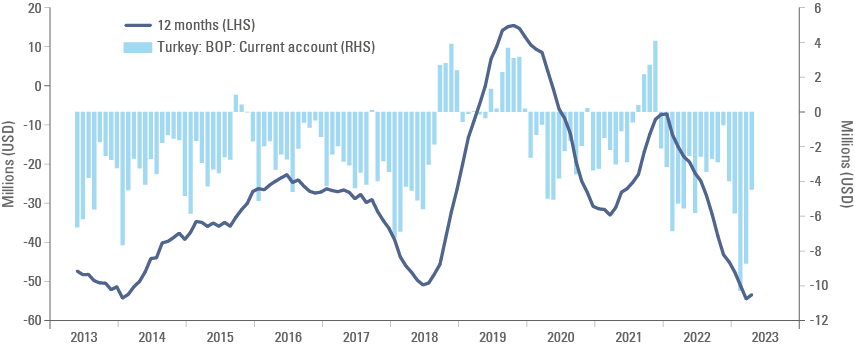

Türkiye’s five-year credit default swaps (CDS) widened to 600bps this morning after trading as low as 480bps last Thursday, when most polls showed the opposition candidate ahead. In the absence of key structural reforms – including central bank independence – it is very likely Türkiye’s CDS will move past its widest level of 900bps in July 2022. The large pre-election credit expansion kept the current account deficit at the widest levels in ten years (as per Figure 1), despite the recent improvement in terms of trade as oil prices declined. If the real effective exchange rate of the Lira would depreciate to the same level as last July (when CDS were at 900bps), the TRY would have to move towards 30-31. The odds of capital controls being imposed will significantly increase if Türkiye’s central bank doesn’t allow the currency to depreciate in line with fundamentals.

There is little risk of contagion across Emerging Markets (EM) as most investors have been defensively positioned for some time. Türkiye is a small part of the EM universe, accounting for only 0.63% of the MSCI EM equity benchmark, 0.95% of the GBI-EM GD (local currency bonds), 3.75% in the main corporate debt and 4.58% in the sovereign debt benchmarks, albeit it is 5.19% of the iShares JP Morgan EMB, the largest EM exchange-traded fund (ETF) with USD 14.5bn. Ashmore has zero exposure to local currency bonds and equities and a defensive position across USD-denominated debt across portfolios.

Figure 1: Türkiye Current Account balance: Monthly and 12-month

In economic news, industrial production rose 5.5% month-on-month (mom) in March after declining 5.9% in February, as the yoy rate improved to -0.1% from -8.2% over the same period. The current account deficit narrowed to USD 4.5bn in March from USD 8.8bn in February.

Argentina: Consumer Price Index (CPI) inflation rose by 8.4% mom in April after 7.7% mom in March, lifting the yoy rate to 108.4%. The parallel ARS exchange rate declined further to 460, compared to 229 for the official rate. In the previous week, three provinces held elections with the candidates supported by far-right presidential candidate Milei underperforming, highlighting his poor national infrastructure. The Chilean state-owned company ENAP signed a contract with YPF to import crude oil from Argentina – the volume of crude exports to Chile is set to increase significantly now that key infrastructure issues such as pipeline and storage have been fixed.

Colombia: The approval rate of President Gustavo Petro plunged 8% to 30% and his disapproval rate increased by 9% to 61%. In most countries, presidents without a solid majority on Congress that suffered approval rates of around 10%-20% would be threatened by impeachment. However, the bar for president removal is higher in Colombia than in most other Latin American countries. Moreover, the failed attempt to impeach President Samper in 1995-96 following accusations of receiving money from the Cali Cartel for the presidential election suggests it is very hard indeed to remove a president from office. The Colombian Constitution states that if the president is impeached for “crimes committed in the exercise of his/her functions” or “unworthiness to serve because of a misdemeanor” the Lower House can investigate and submit the impeachment to the Senate, which will run the final trial for removal with a two-third vote threshold needed to remove the president. But where a president is impeached for a common crime, the final trial instead occurs before the Criminal Chamber of the Supreme Court.2 In economic news, consumer confidence was stable at -28.8 in April, remaining at one of the most depressed levels in 20 years. The yoy rate of retail sales contracted by 7.1%, significantly below consensus. Manufacturing and industrial production dropped 2.0% yoy and 0.4% yoy respectively, significantly lower than consensus.

Pakistan: Former Premier Imran Khan was arrested and then granted a two-week bail by the Islamabad High Court over a land corruption case. The Supreme Court ordered Khan’s release on Thursday describing his arrest as “illegal”. Several people were killed, and hundreds arrested in clashes between the police and Khan’s supporters last week, as the government called on the military to restore order. Pakistan has USD 2.2bn in debt payments until June 2024 and holds USD 4.5bn of foreign exchange (FX) reserves. It ran a USD 5bn current account deficit in 2021, but lower oil prices and a decline in economic growth drove it to a balance in Q1 2023. Should oil prices remain subdued due to softer manufacturing activity the country’s main risk for a default next fiscal year will be related to capital outflows and the inability to access funding from international financial institutions (IFIs).

Egypt: Ratings agency Fitch downgraded Egypt's credit rating by one notch to ‘B’ with a negative outlook, citing high external financing requirements amid tighter international liquidity and lower availability of concessional funding from IFIs such as the International Monetary Fund. In economic news, CPI inflation rose 1.7% mom in April after increasing 2.7% mom in March, the yoy rate declined 200bps to 30.6% and core CPI declined 90bps to 38.5%, the first meaningful decline since the beginning of the currency depreciation process in Q1 2022. Nevertheless, foreign currency remains scarce as the parallel rate hit EGP 45 last week, compared with EGP 30.9 official rate.3 Egypt sold a 9.5% stake in state-run Telecom Egypt Co., raising more than EGP 3.7bn (USD 121 million). While the amount is small when compared to the USD 2bn target set for end of June, it is certainly good news in terms of signalling Egypt’s commitment and reiterating its plans to privatise.

China: The yoy rate of CPI inflation declined to 0.1% in April, 20bps below consensus, while Producer Price Inflation (PPI) posted a 3.6% yoy deflation, 30bps below consensus. Aggregate financing plunged to RMB 1.2trn in April from RMB 5.4trn in March, below consensus at RMB 2.0trn, as new loans declined to RMB 700bn (RMB 1.4trn consensus, RMB 3.9trn March) – the lowest levels of lending for the month of April in ten years except for 2022.

Mexico: CPI inflation was unchanged in April after rising 0.3% mom in March, while core CPI increased by 0.4% after 0.5% mom over the same period. The yoy rate of headline inflation declined 60bps to 6.3% and core inflation declined by 50bps to 7.7% yoy. Vehicle production declined to 295k units in April after 346k in March, and exports dropped 20k units to 253k over the same period. The yoy rates of industrial and manufacturing production declined to 1.6% and 1.1% respectively in March, both more than 100bps below consensus, with non-oil activity the main drag, albeit construction output posted the first increase in 2023.

Snippets

- Brazil: CPI inflation dropped to 0.6% mom in April from 0.7% in March, bringing the yoy rate down by 50bps to 4.2%, the lowest levels since December 2019. The average of the main core CPI measures declined by 50bps to 7.3%.

- Belarus: President Alexander Lukashenko was not present in public events for nearly a week, leading to rumours he is seriously ill. If Lukashenko is unable to remain in power, in theory the country should go through fresh elections. Western observers said the previous elections were rigged to avoid a reformist new government taking place.

- Chile: The central bank kept its policy rate unchanged at 11.25%, in line with consensus.

- Czechia: CPI inflation declined 0.2% mom in April after rising 0.1% in March, bringing the yoy rate down 230bps to 12.7% over the same period, 60bps below consensus. The current account surplus narrowed only marginally to CZK 11.3bn in March from CZK 13.3bn in February.

- Hungary: CPI inflation slowed to 0.7% mom in April from 0.8% mom in March, as base effects brought the yoy rate down by 120bps to 24.0% over the same period, in line with consensus.

- India: The yoy rate of industrial production declined from 5.6% yoy in February to 1.1% yoy in March, while CPI inflation dropped by 100bps to 4.7% yoy in April.

- Malaysia: GDP growth expanded by 0.9% quarter-on-quarter (qoq) in Q1 2023 after contracting 1.7% in Q4 2022, while the yoy rate slowed by 150bps to 5.6%, 50bps above consensus. The yoy rate of industrial production declined 40bps to 3.1% in March as manufacturing sales volume declined 230bps to 8.0%. The current account surplus narrowed to MYR 4.3bn in Q1 2023 from MYR 27.5bn in Q4 2022.

- Peru: The central bank kept its policy rate unchanged at 7.75%, in line with consensus.

- Philippines: Real GDP growth expanded 1.1% qoq in Q1 2023 (0.7% consensus) and the yoy rate slowed 70bps to 6.4% over the same period.

- Poland: The central bank kept its policy rate unchanged at 6.75%, in line with consensus.

- Romania: The central bank kept its policy rate unchanged at 7.0%, in line with consensus as CPI inflation rose 0.8% mom in April from 1.0% mom in March and the yoy rate plunged 330bps to 11.2% over the same period. The yoy rate of wage growth rose 90bps to 15.7% in March and the trade deficit widened to EUR 2.4bn in March from EUR 2.0bn in February but remains on an improving trend after averaging EUR 3.1bn in H2 2022.

- South Africa: The yoy rate of mining production improved from -7.6% in February to -2.6% in March as gold production rose by a yoy rate of 21.6%, while platinum declined by 9.1% yoy. Manufacturing production rose by 4.0% mom in seasonally-adjusted terms in March after declining 1.3% in February.

- South Korea: The current account posted a small USD 270m surplus in March after a USD 520m deficit in February and the unemployment rate declined 10bps to 2.6% (consensus 2.9%). Loans to households declined 0.7% yoy and have been unchanged since Q4 2021 after rising by 2x from Dec 2013 to Dec 2021 (9.2% yoy).

- Venezuela: Reuters reported Chevron will increase oil production in June to recover debt owed by the country, planning to reach 160k barrels of oil per day (bpd) this year and about 200k bpd in 2024. Chevron aims to recover around USD 750m in unpaid debts and dividends by end of 2023 and USD 3.0bn outstanding by the end of 2025.

Developed Markets

United States: CPI and core CPI inflation rose 0.4% mom in April and the yoy rate declined by 10bps to 4.9% and 5.5% respectively, both in line with consensus. However, service sector inflation ex-housing (one of US Federal Reserve (Fed) Chair Powell’s most often-quoted metrics) dropped to 0.1% mom in April from 0.4% mom in March. Bloomberg Intelligence Nowcast forecasts CPI inflation to decline to 4.1% yoy in May. PPI inflation rose 0.2% in April from -0.4% mom in March and the yoy declined 40bps to 2.3%, 20bps below consensus, and the PPI ex-food and energy index declined 20bps to 3.2%. Jobless claims rose by 22k to higher at 264k on the week of 6 May, up by 82k from its lowest levels in September 2022. For comparison, claims rose by 368k in the 98 weeks from May 2007 to March 2009 during the Global Financial Crisis. In 2008, equities tumbled and credit spreads widened when claims increased by +100k above 400k levels. Continuing claims rose by 12k to 1.81m, slightly less than consensus.

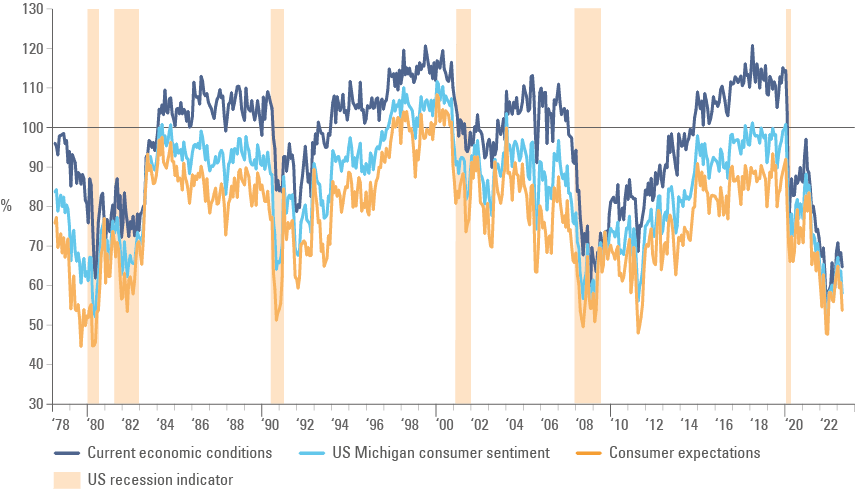

The University of Michigan Consumer Sentiment survey declined to 57.5 in April from 63.5 in March as expectations dropped seven points to 53.4, while current conditions declined four points to 64.5. One-year inflation expectations declined only 10bps to 4.5% (consensus 4.4%) and long-term expectations rose 20bps to 3.2% (30bps above consensus). The long-term inflation expectation is a very volatile and erratic series, and, in our view, the Fed should take comfort in seeing producer inflation and core services declining faster than expected. On the other hand, the sentiment survey levels are yet another indicator that suggests the economy is likely to enter a recession over the next few quarters as per Figure 2:

Figure 2: University of Michigan Survey

The Congressional Budget Office (CBO) increased its 2023 budget deficit estimate by USD 0.1trn to USD 1.5trn and said there was a “significant risk” the US would run out of cash by early June.4 Lael Brainard, Director of the National Economic Council, said debt limit talks had been “constructive”, albeit she did not clarify what it meant. A Gallup poll showed close to two-thirds of Americans have low confidence in President Joe Biden, Fed Chair Jerome Powell, and Treasury Secretary Janet Yellen. The curiosity is that the President and his economic team have very low confidence with US citizens, despite the historical lowest level of unemployment rate and relatively elevated wage inflation.5 Powell has the lowest confidence (36%) since the beginning of the polls 20 years ago.6 Last week, Biden nominated Philip Jefferson for Vice Chair of the Fed and Adriana Kugler to serve as a Member of the Board of Governors, and renominated Lisa Cook for another term as a Member. The new members will bring labour market expertise and diversity to the Board.

United Kingdom: The Bank of England hiked its policy rate by 25bps to 4.5%, in line with consensus.

1. See https://www.ashmoregroup.com/en-gb/insights/lets-talk-about-politics

2. See https://chicagounbound.uchicago.edu/cgi/viewcontent.cgi?article=13973&context=journal_articles and https://www.jstor.org/stable/20202766?seq=22 and https://www.idea.int/sites/default/files/publications/removal-of-presidents.pdf and https://www.constituteproject.org/constitution/Colombia_2015.pdf?lang=en

3. Parallel foreign exchange rate implied by the difference between offshore and onshore listings of shares from the Commercial International Bank Egypt in the local exchange to the London depositary exchange.

4. See https://www.cbo.gov/publication/59159

5. See https://edition.cnn.com/2023/05/09/economy/gallup-poll-americans-confidence-in-biden-powell-yellen/index.html

6. See https://t.co/33MD9WUXyx

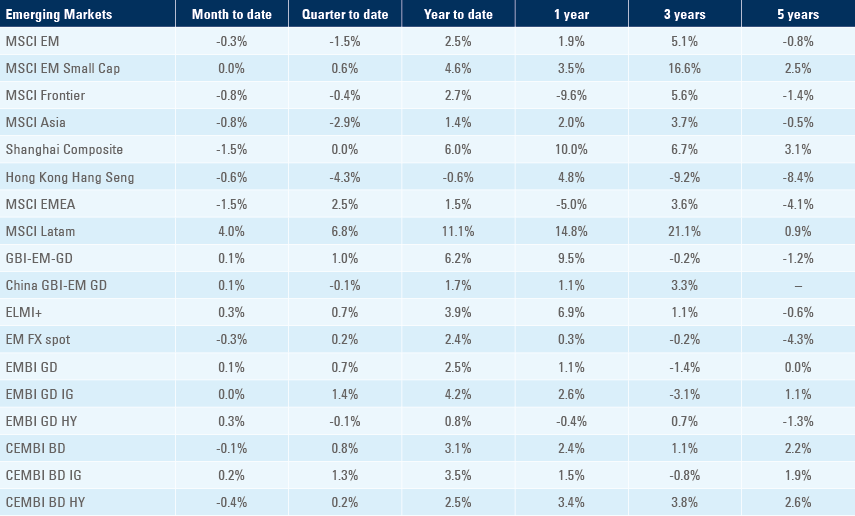

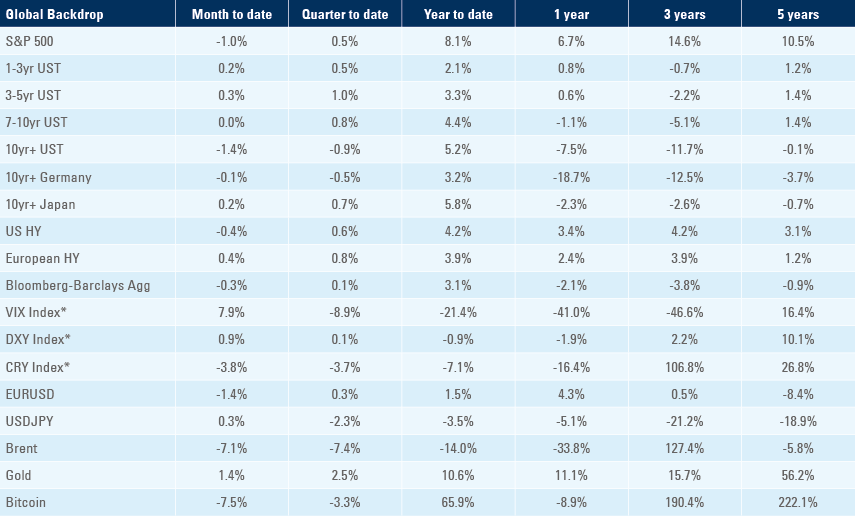

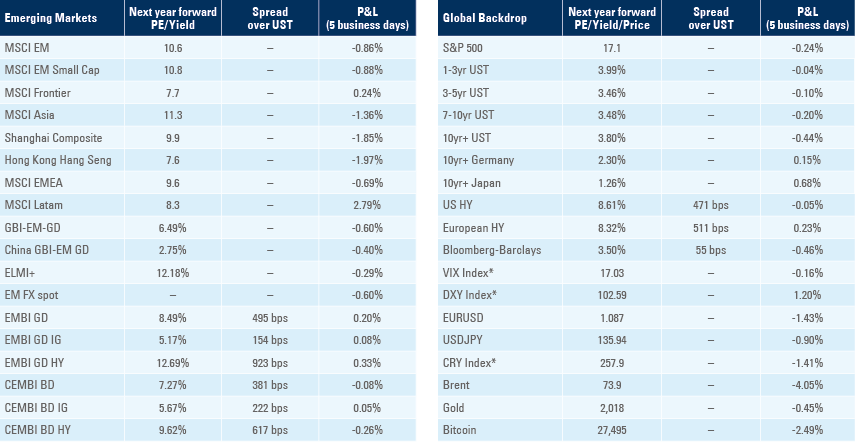

Benchmark performance