Weak leading manufacturing indicators globally. Another bank bites the dust in the United States (US), where negotiations over raising the debt ceiling call for political compromise. Good news from Indonesian politics. Gustavo Petro reshuffled his cabinet in Colombia. Nigeria suspended plans to remove fuel subsidies. Türkiye’s presidential elections in less than two weeks will have important domestic and geopolitical ramifications, while Thai presidential elections on the same day are unlikely to change the country’s macroeconomic stability. In Argentina, Cristina Kircher reiterated she will not run for president, while Paraguay’s ruling party won last weekend’s presidential elections.

Global Macro

Leading indicators, including the Institute for Supply Management (ISM) Manufacturing Index, China, Korea and Taiwan Purchasing Manager Indices (PMIs) and Korean exports confirmed the manufacturing sector remained weak, despite the strength in the service sector keeping core inflation measures under pressure. However, the PMIs in India, Indonesia and Thailand were surprisingly positive. This week, the US Federal Reserve (Fed) and the European Central Bank (ECB) will probably strike a more hawkish tone, with Fed Chair Jerome Powell keeping the door open for another hike in June (20% odds priced today) and pushing out the single rate cut that is priced in December. Two-year US Treasuries are wrapped around 4.0% down almost 90 basis points (bps) from the highs in March, but up 40bps from the lows post Silicon Valley Bank receivership on the same month.

Against that backdrop, First Republic Bank was acquired by JP Morgan after suffering USD 100bn of deposit outflows during the first quarter, mostly from affluent clients in San Francisco. The Federal Deposit Insurance Corporation estimates its loss on the deal will be USD 13bn, taking total losses to USD 35.5bn (c. 27.5% of the fund) bringing the fund to less than 1.0% of insured deposits.1 Even if these losses are overestimated, the fund has already accumulated a significant shortfall relative to its minimum size of 1.35% of deposits and a 2.0% long-term target.

The Congressional Budget Office said there is greater risk that the US Treasury will run out of funds in early June, a scenario echoed by Treasury Secretary Janet Yellen, albeit there is considerable uncertainty over the actual date, which is likely to be at least a few weeks after 1 June as the Treasury General Account now has nearly USD 300bn after April tax receipts.2 It took six weeks for the US Treasury to spend this amount from 8 February. President Joe Biden invited Republican House Speaker Kevin McCarthy, House Democratic leader Hakeem Jeffries, Senate Majority Leader Chuck Schumer and Republican leader Mitch McConnell to negotiations next Tuesday (9 May). Biden will have less than ten days to break the deadlock and avoid negotiations going to the brink as he is attending the G-7 Summit in Hiroshima on 19-21 May and the Quad Summit in Sydney on 24 May.

Emerging Markets

Indonesia: Presidential elections take place on 10 February 2024, with a possible run-off on 26 June if no candidate attains a simple majority of votes. The three main candidates are Central Java Governor Ganjar Pranowo, the current Defence Minister and Head of the Gerindra Party, Prabowo Subianto, and the former Governor of Jakarta Anies Baswedan. Ganjar is widely viewed as the reformist candidate which will preserve current President Joko “Jokowi" Widodo’s legacy, Prabowo is the Nationalist candidate who became part of the government after losing the election to Jokowi in 2019, and Anies is the more unpredictable candidate who previously was part of Jokowi’s government. Last weekend. the Indonesian Democratic Party of Struggle (PDI-P) nominated Prabowo for president. The PDI-P has more than 20% of parliamentary seats, enough to nominate a candidate without a coalition. Interestingly, Prabowo opened the possibility of working with the PDI-P, a coalition that Jokowi is very likely to be actively working to put together. Should Prabowo run as Ganjar’s Vice President, the political risks would significantly decline as Anies would struggle to compete against a unified ticket from the leaders of Indonesia’s two largest parties. Anies was initially part of the Jokowi administration, and had similar reformist ideas, but fell out with the President after failing to deliver on the administration’s promises and has since became more populist and flirted with religious extremism, albeit he is a believer in economic orthodoxy and is in favour of attracting foreign investment. Anies is being investigated by the Anti-Corruption Commission (KPK) for misconduct related to the Jakarta E-Prix electric vehicle race in June 2022. In economic news, the year-on-year (yoy) rate of Consumer Price Index (CPI) inflation declined 70bps to 4.3% and core CPI dropped 10bps to 2.8% yoy, remaining at very comfortable levels and marginally below consensus.

Colombia: President Gustavo Petro re-shuffled his cabinet, including replacing Finance Minister José Antonio Ocampo with his old aide Ricardo Bonilla. The reshuffle came after the ruling coalition struggled to approve the healthcare reform in Congress. Minister Bonilla is a more ideological actor who has been close to Gustavo Petro since he was Mayor of Bogota, but kept an austere fiscal policy in local government. Bonilla pledged to maintain an austere fiscal policy, including the fiscal consolidation programme put in place under Ocampo. Ironically, the current administration is undertaking a more aggressive fiscal consolidation than former President Iván Duque. Like Mexico, Brazil, Chile, and Peru, the leftist administration in Latin America is faced with checks and balances from Congress and the Courts that forces them to implement what appear to be sound economic and fiscal policies. Nevertheless, the political noise is likely to continue as Petro’s approval rate declined to 35% and he adopted a more radical stance in a Labor Day speech. In economic news, the central bank hiked its policy rate by 25bps to 13.25%, in line with consensus.

Türkiye: The opposition candidate Kemal Kilicdaroglu appears likely to win the presidential race after taking 49.4% of the votes in the first round (against 43.7% from incumbent Recep Tayyip Erdogan) and 53.6% in the second round (46.4% to Erdogan), according to pollster Artibir. The incumbent AK Party is likely to receive 32.2% of votes according to the same pollster, down 10.3% from the last elections, while the CHP is seen as receiving 31.4% of the votes (+8.8%). A poll aggregator sees 61% odds of Kilicdaroglu wining the elections, albeit the margin for the projected popular vote is less than 3% and two second-tier pollsters have Erdogan winning by 2%-5%.3 Polls suggests elections may go to a 28 May run-off. Last week, Erdogan joined a videoconference to open Türkiye’s first nuclear power plant and met with election partners at the presidential palace. Erdogan still benefits from being the incumbent candidate with significant powers to influence the vote, including the recent aggressive expansion of credit. This will likely exacerbate the macroeconomic imbalances built up over the last decade, when the de-anchoring of inflation led to large currency depreciation and the depletion of foreign exchange (FX) reserves. In our view, even if the opposition wins the poor institutional environment, low levels of FX reserves and the need to a significant fiscal consolidation will set the scene for a very challenging adjustment. Therefore, asset prices may deteriorate before improving, which could be a problem for the newly-elected president. In economic news, Türkiye’s central bank kept its policy rate unchanged at 8.5%, in line with consensus.

Thailand: The opposition Pheu Thai Party, led by Paetongtarn Shinawatra, is leading the polls for the 14 May General Elections. It is predicted to win close to half of the Lower House seats, putting it on a strong position to form a government. Controversially, incumbent Prime Minister, General Prayut Chan-o-cha, is seeking another term running under the United Thai Nation Party, but suffers from low approval ratings and can only stay in power for another two-years, according to the constitution. The electoral system is complex and evolving.4 Of the 500 seats in the Lower House, 80% are elected by first-past-the post voting for a constituency Member of Parliament, and 20% via a preferred party vote. The Senate is formed of 250 appointed members who were previously appointed by the Military and whose term expires in March 2024. The Prime Minister candidate needs the support of a simple majority across both houses (376 out of 750 seats). The base case scenario is for the Pheu Thai Party to return to form a government anchored on a minority coalition, but there is a small risk it fails to form a coalition leading to a hung parliament which increase the risk of social unrest. Political instability has been a feature after Thai elections over the last decades, but there is a sentiment that following the Covid-19-induced slowdown in tourism activity, most people would rather see order restored and focus on economic development. As a result, major parties have promised cash transfers and/or higher minimum wages to reduce inequality while maintaining a pro-market economic policy approach, increasing the likelihood of a smooth post-election transition. In summary, social, and economic stability are likely to prevail, despite highly contested elections amid a complex political scenario. In economic news, the trade balance surged to a USD 2.7bn surplus in March, surprising consensus expectations for a USD 1.0bn deficit. Exports rose by USD 5.3bn to USD 27.7bn, the highest level in a year as agricultural shipments rose by a yoy rate of 4.2% while industrial products dropped 5.9% yoy, down for the sixth straight month. Imports rose by USD 1.5bn to USD 24.9bn in March. The Chairman of the Thai National Shippers’ Council said the “private sector is satisfied with baht at 34–35 Baht per dollar”.

Nigeria: The ruling APC party won 59 out of 109 seats in the Senate and 175 of 360 seats in the House of Representatives. It is interesting to notice that the APC voting share in Congress was much higher than the executive as Bola Tinubu secured just over one-third of votes and may lead to a challenging implementation of Tinubu’s reforms. Last week, the government postponed cutting energy subsidies, a key reform necessary to stabilise the fiscal and external accounts and anchoring the Naira.

South Korea: The yoy rate of CPI inflation declined 50bps to 3.7% in April, but core CPI dropped only 20bps to 4.6%, both in line with consensus. Exports declined by a yoy rate of 14.2% in April, 200bps lower than consensus, from 13.6% yoy in March. Korean exports are a key leading indicator to manufacturing due to their importance across durable good supply chains, and confirms the manufacturing slowdown pointed to by the surveys.

Argentina: Vice-President Cristina Fernández de Kirchner (CFK) reiterated she does not want to run for president. Most likely Economy Minister Sergio Massa will be the Peronist candidate. CFK focused on attacking far-right candidate Javier Milei, potentially a strategy to drain support for the main opposition party Juntos por el Cambio. The Central Bank of Argentina hiked its policy rate by 1,000bps to 91% as CPI inflation entered three-digit territory, led by large monetary expansion to finance the debt.

Paraguay: The ruling Colorado Party candidate Santiago Peña won the presidential elections last weekend with 42% of the votes, a positive result for macroeconomic stability in the country.

Brazil: Economic activity was better than expected. CPI inflation declined to 0.6% month-on-month (mom) in the first 15 days of April and 4.2% yoy, down from 5.4% yoy in March. Inflation downside momentum is likely to continue as the producer price index (PPI) posted a 1.0% mom deflation in April bringing the yoy rate to -2.2%. Petrobras announced it would cut diesel prices to BRL 3.46 per litre from BRL 3.84. The job market was stronger than expected with 195k new formal jobs created in March, 100k above consensus and down only marginally from 242k in February. The current account moved to a USD 0.3bn surplus in March from a USD 3.0bn deficit in February, below consensus for a USD 2.1bn surplus, while foreign direct investment increased by USD 1.1bn to USD 7.7bn, also below consensus for USD 9.9bn. The fiscal balance improved by less than expected as the primary deficit narrowed to BRL 14.2bn from 26.5bn (1.1bn surplus expected), but largely due to lower non-recurring revenues.

Snippets

- Bolivia: S&P downgraded Bolivia’s credit rating from ‘B’ to ‘B-’ with a negative outlook as FX reserves declined almost in a straight line from USD 13.6bn in November 2014 to USD 0.4bn in January 2023. The current account moved to a deficit for the first time since 2014, suggesting the Boliviano currency (pegged at BOB 6.91 to the Dollar since 2008) may be overvalued.

- China: Automaker BYD has overtaken Volkswagen as the largest seller of cars in China, highlighting China’s leapfrogging to electric vehicles is putting its car industry at a massive competitive advantage against European and American car makers. A survey showed Chinese travellers have no plans to travel abroad due to security concerns. China’s manufacturing PMI declined 2.7 points to 49.2 in April, more than two points below consensus, led by poor external demand.

- Chile: Copper production rose to 440k long tons in March from 385k in February, in line with seasonal patterns but remaining at the lowest levels in five years. The proposal to not renew the contracts with the private lithium miners faced significant resistance in Congress.

- Ecuador: Ecuador announced a USD 800m debt buyback led by Credit Suisse, part of a broader structure where the country would issue a ‘blue bond’ with the proceeds used to protect the marine reserve around the Galapagos.

- Hungary: The central bank kept its policy rate unchanged at 13.0%, in line with consensus.

- Mexico: The yoy rate of gross domestic product (GDP) growth rose by 3.9% in Q1 2023, from 3.6% in Q4 2022 and 60bps better than consensus. The yoy rate of CPI inflation dropped by 35bps to 6.2% in the first two weeks of April as core CPI dropped 25bps to 7.75%, both slightly better than consensus.

- Poland: The yoy rate of CPI inflation dropped 140pbs to 14.7% in April, 30bps below consensus.

- Singapore: The government doubled the stamp duty levy on property purchases from foreigners to a whopping 60% to cool an overheating market driven by demand from Chinese investors.

- Thailand: Manufacturing PMI surged seven points to 60.4, significantly above consensus and contrasting with poor readings from China, Korea, and Taiwan.

- Uruguay: S&P upgraded Uruguay’s sovereign credit rating by one notch to ‘BBB+’ and the government approved a pension plan reform that increases the retirement age from 60 to 65 years old. Uruguay remains an island of political stability and economic reforms in Latin America.

- Vietnam: The yoy rate of CPI inflation dropped by 55bps to 2.8% in April, 60bps below consensus.

Developed Markets

United States: Initial jobless claims declined 16k to 230k on 22 April while continuing claims were unchanged at 1.86m in the previous week. GDP growth declined to 1.1% in annualised quarter-on-quarter (qoq) terms in Q1 2023 from 2.6% in Q4 2022, 80bps below consensus, but the details were more positive as consumption had good performance. The ISM Manufacturing survey rose only 0.8 points to 47.1 in April, much softer than the S&P PMI survey, and with much poorer internals as more industries reported paying higher prices (index up four points to 53.2), as suppliers’ delivery times deteriorated again (-0.2 to 44.6), despite normal inventory levels (+2.4 to 51.3), while production and new orders remained at low levels at 48.9 and 45.7, respectively. Durable goods orders rose 3.2% mom in March after declining 1.2% in February, but the internals were softer as it was mostly led by lumpy sales of aircrafts.

The Dallas Fed and National Federation of Independent Business (NFIB) surveys as well as the Beige Book suggests lending standards have tightened significantly. Tightening on lending standards feeds through the economy via constraining private money creation at a time that public money will be contractionary due to quantitative tightening and the need to replenish the exhausted Treasury General Account. The impact on the economy will likely be felt as the weakest links – companies and banks with questionable balance sheets and cash flows – struggle to raise liquidity and potentially eventually default. The First Republic Bank is symptomatic of the current crisis, which is happening ahead of an expected decline on the quality of regional banks assets. Commercial real estate borrowers are struggling with high vacancy rates on offices, affordability issues on multifamily housing units, and the decline of market share from high street retail compared with online. Analysis focusing on regional banks deposits – rather than broader results and the easiness for any investor to redeem their money via their online banks – may exacerbate the issue.

The Conference Board Consumer Survey showed US consumers are feeling “very good” about the economy today, with the indicator one standard deviation above its mean, but feeling “very bad” about the future, with expectations more than one standard deviation below its mean (on a three-month average z-score basis that reduces the excessive volatility from the series).

Durable goods orders rose by 3.2% mom in March, significantly above consensus of 0.7%, after declining 1.2% mom in February (revised from -1.0%). Most of the upside surprise was in volatile non-defensive aircrafts (Boeing) as core capital good shipments declined 0.4% mom in March, unchanged from February.

Japan: Bank of Japan Governor Ueda said he will review the Bank of Japan (BOJ) decisions since 1998, coinciding with the start of the deflation period. The review will take 12-18 months, but the BOJ will conduct monetary policy normally during the period. Ueda also maintained the BOJ’s dovish stance, keeping previous Governor Haruhiko Kuroda's language that "permanent easing" is necessary. His tone overall was dovish but kept the door open for action: “We’re not starting the review with the aim of normalising,” Ueda said. “But it’s not zero chance we begin normalising during the review period”. Just before the BOJ meeting, the yoy rate of CPI inflation rose 20bps to 3.5%, and CPI ex-food and energy (core-core CPI) +40bps to 3.8%, despite large energy subsidies granted by government, while retail sales rose +0.6% mom in March after +2.7% mom in February, keeping the yoy rate at +7.2% yoy. Japan only had sharp spikes in retail sales like that ahead of the 2014 and 2019 value-added tax hikes, but this time, it is likely to be tourism season and inflationary mindset deterring shoppers.

The BOJ has some difficult decisions ahead. It would appear that it needs inflation to remain between 1.5%-3.0% to stabilise the ratio of debt/GDP, a necessary target no policy maker is likely to admit. Should inflation run out of control and it is forced to raise rates fast, then the debt dynamics will quickly turn unsustainable. In the Kuroda era, the Japanese Treasury benefited from higher growth and lower interest payments on debt stock due to negative interest rates and quantitative easing. Yet, Japan’s fiscal deficit surged to 9.0% in 2020 and dropped only slowly to 6.7% in 2022, and is estimated to decline to 5.3% and 4.0% GDP in 2023 and 2024. As a result, debt/GDP surged from 238% in 2019 to 263% in 2022.

Compensating for this large net debt is Japan’s large ownership of assets abroad, which amounted to USD 3.2trn as of December 2022, nearly 61% of its own GDP. It is precisely this reversal of large net assets abroad that could prove disruptive to financial markets, as Japanese investors would be tempted to reduce their exposure to US Treasuries and other securities to buy Japanese Government Bonds again, should the BOJ let policy normalise to what are considered by us to be the right levels.

To credibly lower its debt levels, Japan needs its economy to grow. Yet the country’s weak demographics profile means it is likely the economy will contract going forward, unless it can either boost productivity significantly via automation or open its borders for foreign workers. That is precisely what Japan is set to do with its new immigration law which promotes highly-skilled immigration.5 But with higher immigration comes higher growth and inflation. This direction of travel means monetary policy will therefore have to adjust, it appears to be only a matter of time as to when this will occur.

Sweden: The Riksbank hiked its policy rate by 50bps to 3.5% and said it was nearly done hiking its policy rates.

Eurozone: The yoy rate of CPI inflation rose by 80bps to 4.1% in Spain in April, 30bps below consensus. Eurozone GDP growth increased by a yoy rate of 1.3% in Q1 2023 after 1.8% in Q4 2022, 10bps below consensus.

Australia: The Reserve Bank of Australia hiked its policy rate by 15bps to 3.85%, surprising consensus expectations for the policy rate to remain unchanged after pausing in April.

1. See https://www.fdic.gov/news/press-releases/2023/pr23034.html

2. See https://www.cbo.gov/publication/59119?utm_source=feedblitz&utm_medium=FeedBlitzEmail&utm_content=855024&utm_campaign=Once a day_2023-05-02_01:30:00&utm_medium=FeedBlitzEmail&utm_content=855024&utm_campaign=Once a day_2023-05-02_01:30:00 and https://www.nytimes.com/2023/05/01/us/politics/debt-limit-date-janet-yellen.html

3. See https://600vekil.com/en

4. See https://en.wikipedia.org/wiki/2023_Thai_general_election and https://www.thaienquirer.com/49098/the-thai-enquirer-voter-guide-2023-general-election/

5. See https://www.japantimes.co.jp/news/2023/02/17/national/new-visa-categories-graduates-high-earners/

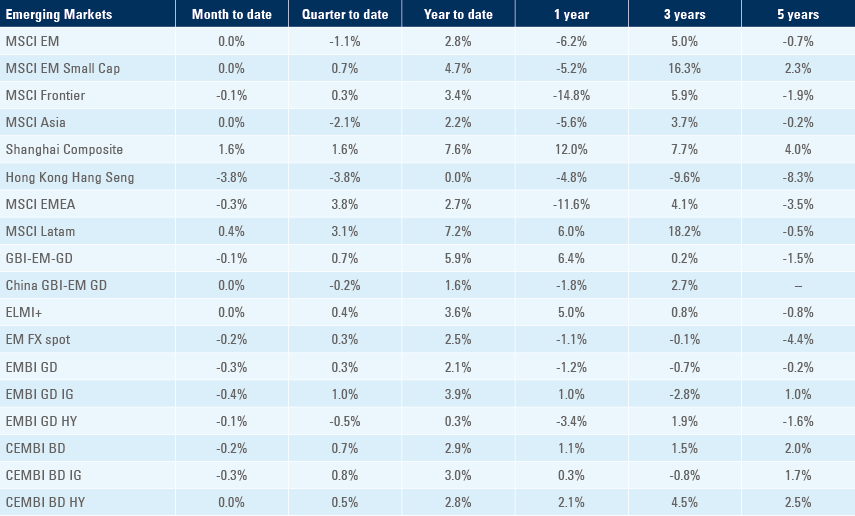

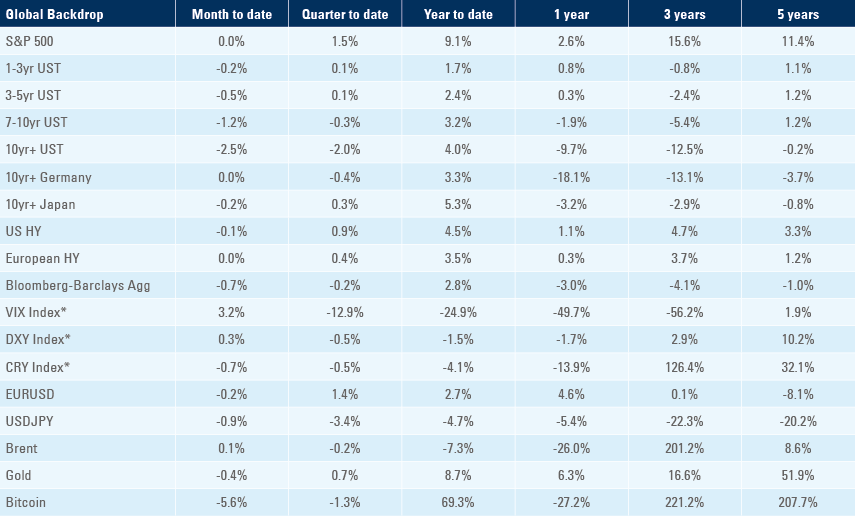

Benchmark performance