Economic data suggests the global economy is slowing, not plunging into recession, as EM growth rebounds

The European Union announced most countries will cut oil imports from Russia by the end of 2022. Ukraine grain exports dropped more than 60% from a year ago due to logistical constraints. Global PMIs declined with EM PMIs improving and DM deteriorating, suggesting an economic slowdown, rather than recession. Chinese stocks performed well as Shanghai reopens and big tech regulations abate. EM economic data was generally better than consensus, even if inflation still surprised to the upside in most places. Polls suggest Rodolfo Hernandez leads the presidential run-off race in Colombia while the ruling Morena party won four out of six local government elections in Mexico.

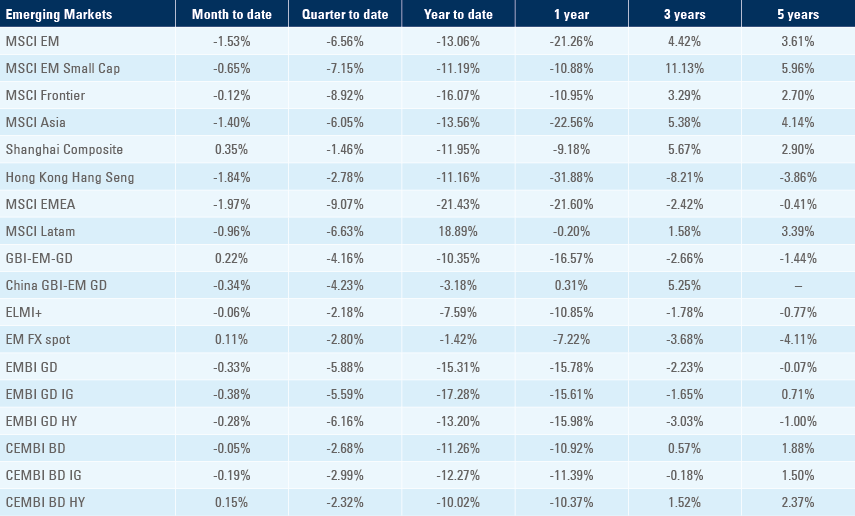

Emerging markets

Russia-Ukraine: The European Union announced the 6th sanction package against Russia where most countries agreed to significantly reduce or ban oil imports from Russia by the end of 2022. If fully implemented, it will potentially cut between half to two-thirds Russian revenues from energy exports to Europe.

Landlocked countries with challenges to source oil from other sources, including Hungary, Bulgaria and Czech Republic, were granted an exemption from the embargo. Poland and Germany agreed to curb oil imports also from their oil pipeline. The measures will obviously increase the cost of energy across Europe and risk an energy crisis given the tight conditions of global oil markets today. Europe also announced that from February 2024 there should be a full embargo on oil, coal and gas imported from Russia. The key question is whether Russia will retaliate against oil exports restriction by blocking exports of gas, starving Germany and other countries of their main energy source?

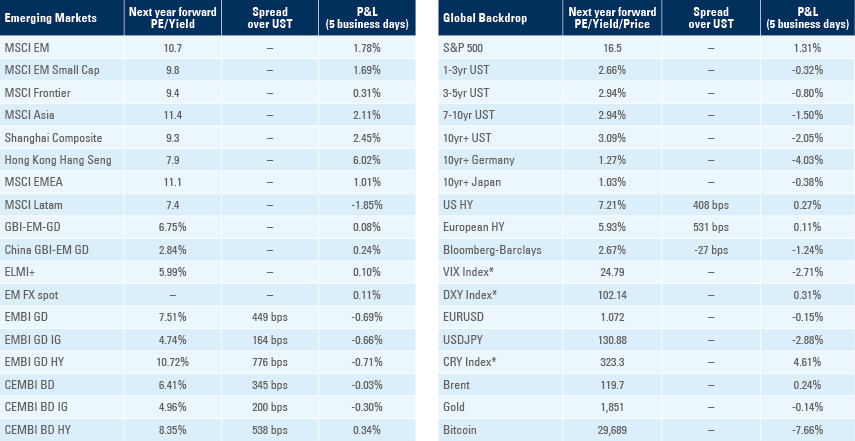

In other energy news, OPEC announced an increase in oil production target by 648k barrels per day in July and August (from 400k per month previously). In practice only Saudi Arabia seems to be capable of increasing oil production meaningfully as several members, including Nigeria, have been producing less than their quotas. The OPEC pledge did not stop oil to keep rallying towards USD 120 per barrel last week. More concerning is the tightness in refined markets. Last week gasoline inventories declined to the lowest level since 2015 as the shortage in refined products is even more acute than in crude markets.

Figure 1: Gasoline, Diesel and WTI 1st future; normalised at 100 on 7 June 2017 when WTI traded at $45.7

In other news, Ukraine’s grains exports dropped 62% yoy in May due to blocked Black Sea ports. The Turkish Foreign Minister Cavusoglu met with Russian Foreign Minister as Turkey tries to broker a grain shipment mechanism with Russia. The Russian newspaper Izvestia reported a deal was reached to ship Ukrainian grain from Odesa while the New York Times accused the Kremlin of looking to profit from stolen grain.

The situation on the ground remains tense with Ukrainians fighting to regain control of some areas in Donbas. Furthermore, Kyiv was attacked by rockets for the first time in a month as Russia claims its missiles destroyed tanks and other armoured vehicles sent by Eastern European allies. The risk of escalation to non-conventional weapons may well rise in the coming weeks as Ukraine receives and deploys more advanced weapons from the US and UK.

In economic news, the Central Bank of Ukraine hiked its policy rate by 1,500 basis points to 25% as it re-engages in monetary policy decisions and said it sold USD 3.4bn in May to anchor the hryvnia after selling USD 2bn in April. Governor Kyrylo Shevchenko added “the inflation development requires the National Bank to return to active interest-rate policy to prevent further deterioration of inflation expectations and dollarisation of economy”.

Markit PMI

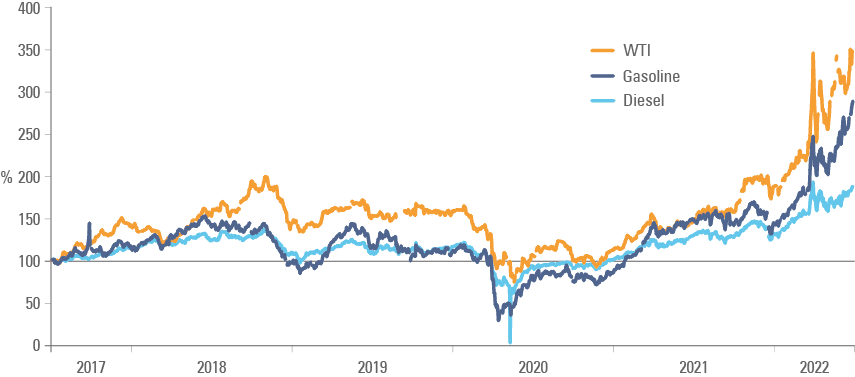

The global manufacturing PMI rose 0.1 to 52.4 as EM PMI rose 1.4 to 49.5 while DM PMI declined 1.3 to 55.0. The latest PMI suggests the global economy is experiencing a slowdown, not a recession and that EM economic activity (anchored in China) may have bottomed while DM economies are still slowing down. New orders, output and stocks of purchases converged (rose in EM and declined in DM). Supply chain disruptions improved significantly across the world as suppliers’ delivery times rose more than eight points in both EM and DM, rising to 44.0 in EM and 32.8 in DM, suggesting severely disrupted supply chains in the second group. The only exception to this trend was the employment component of the survey, which deteriorated in EM (mostly in Asia) and rose in DM.

Figure 2: Markit Manufacturing PMI

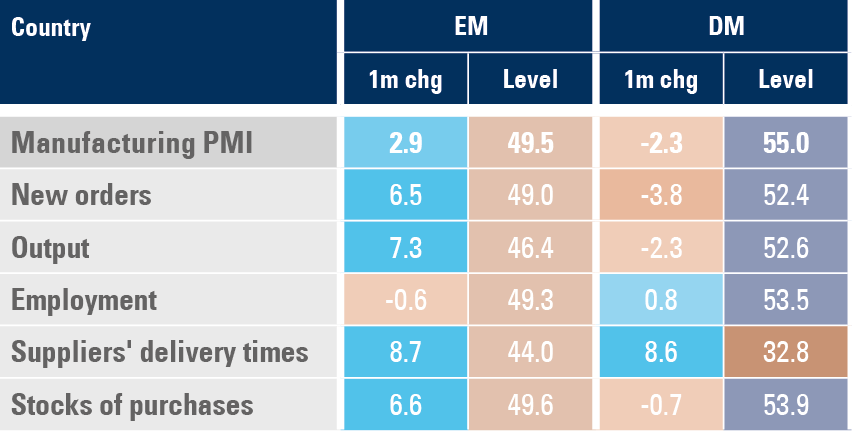

The manufacturing PMI remained above 50 across three quarters of EM countries, increasing the most in South Africa, Vietnam, Russia and Brazil, while declining in Hungary, Poland and Czech Republic as per Figure 3. Only four EM counties had PMI marginally below 50 (China, Poland, Turkey, and Malaysia) with the large weight of China in the overall EM PMI dragging the headline index below 50. Gasoline Diesel WTI 200 150 % 50 100 250 300 350 4000 2017 2018 2019 2020 2021 2022

New orders rose the most in China, Vietnam, Russia, Mexico, and Brazil and declined the most in Poland, Malaysia, Czech Republic and Thailand. Output rose the most in China, Brazil, Vietnam, and Russia and declined in Poland, Taiwan, Malaysia, and Indonesia. Employment remained above 50 in most EM countries, but declined in China, Malaysia, Thailand, South Korea, and Indonesia dragging the EM employment component lower. Delivery times improved mostly in countries where economic activity has slowed down (China, Poland, Turkey, Taiwan) and remained at distressed levels in economies impacted by mobility or supply chain disruptions (South Korea, Czech Republic and Russia), while stock purchased improved across most countries.

Fig 3: Markit Manufacturing PMI: Breakdown by Country

Angola: The central bank kept policy rate unchanged at 20% as inflation declined to 25.8% yoy in April from 27.7% yoy in January. Angola recorded a current account surplus equivalent to 12.4% of GDP in 2021 and a fiscal surplus of 3.5% of GDP over the same period. As a result of the sharp fiscal consolidation and higher oil prices, Angola’s debt to GDP ratio declined from 131% of GDP in 2020 to 75% of GDP in 2021.

Brazil: The yoy rate of real GDP growth rose to 1.7% in Q1 2022, 40bps below consensus and 10bps higher than the previous quarter. Industrial production rose 0.1% mom (-0.5% yoy) in April after increasing 0.6% mom (-2.1% yoy) in March, slightly better than consensus. The unemployment rate declined to 10.5% in April from 11.1% in March and the public sector posted a primary surplus of BRL 39bn in April. The Markit PMI rose to 54.2 in May from 51.8 in April, signalling stronger economic activity in Q2 2022. The latest economic data led BNP Paribas and Morgan Stanley to revise their 2022 GDP growth forecasts from -0.5% and +0.5% to +1.5% and +1.4% respectively, albeit both institutions revised their 2023 growth forecasts lower.1

China: The economy recovered faster than expected in May as the official Manufacturing PMI rose to 49.6 from 47.4 in April (49.0 consensus) and the non-manufacturing (including construction) PMI surged to 47.8 (45.5 consensus) from 41.9 over the same period. The official PMI is more geared towards large companies so the more balanced Markit PMI will probably show worse numbers reflecting the lockdowns in Shanghai and Beijing. Property sales declined further in April, driven by weak homebuyer confidence and mobility restrictions. On the other hand, Chinese stocks continued to recover last week. This morning, Didi Global share price surged more than 40% after a report indicated Chinese regulators are about to conclude a probe into ride hailing giant and restore its apps to mobile stores. Big tech companies’ results were positive overall, allowing tech-heavy Shenzhen stocks to outperform the broader A-shares month-to-date.

Colombia: The current account deficit narrowed to USD 5.4bn in Q1 2022 from USD 5.9bn in Q4 2021, in line with consensus. The yoy rate of CPI inflation declined 10bps to 9.1% in May while core CPI rose 60bps to 6.5% yoy over the same period, both significantly above consensus. High inflation and strong economic activity are likely to bring the central bank to accelerate its hikes from 100bps in the last meeting to 150bps in June, bringing the policy rate to 7.5% and close to double-digit levels by the end of the cycle. In political news, the first polls following the first round of presidential election shows a mixed picture with two polls suggesting Rodolfo Hernandez leads the run-off by a narrow margin after gaining support of important centrist candidates and two polls showing Gustavo Petro ahead.

Hungary: The yoy rate of GDP growth was unchanged at 8.2% in Q1 2022. PPI inflation rose to a yoy rate of 28.8% in April from 25.9% yoy in March as retail sales rose to 15.8% yoy (from 16.7% yoy) over the same period. The central bank hiked its 1-week deposit rate by 30bps to 6.75% and its policy rate by 50bps to 5.9%, both in line with consensus. Deputy Governor Virag said the 1-week repo rate could reach 7%, implying another rate hike in the coming weeks and said policy will remain in tightening mode during 2H 2022, albeit the bulk of rate hikes is likely to be done.

India: The Markit Manufacturing PMI survey was virtually unchanged at 54.6 and the service PMI rose 1.0 to 58.9 in May, suggesting the economy remained buoyant. The yoy rate of real GDP growth slowed to 4.1% in Q1 2022 from 5.4% yoy in Q4 2021, slightly better than consensus as agriculture and service sectors surprised to the upside. Leading indicators such as energy consumption are still increasing at a relatively fast pace suggesting a strong performance despite energy cost pressures.

Mexico: Foreign exchange remittances from abroad was unchanged at USD 4.7bn in April, significantly better than consensus. Domestic vehicle sales increased to 91.2k in May from 83.5k in April, in line with seasonal pattern and the average sales since 2010. The ruling Morena party won four out of six gubernatorial elections this weekend (Oaxaca, Quintana Roo, Hidalgo and Tamaulipas), increasing its footprint across local governments as the PAN and PRI parties won only in the states of Durango and Aguascalientes.

South Korea: Economic data was overall better than expected. The yoy rate of retail sales rose 10.6% in April from 7.1% yoy in March and department sales rose 19.1% yoy from 7.8% yoy. Industrial production (IP) dropped 3.3% mom in April after rising 1.1% mom in March, significantly below -1.2% consensus as the lockdowns in China hit electronics and chemical sectors, bringing the seasonally adjusted level of IP back to its trend level. The service volume index expanded 1.4% mom in April after expanding 1.5% mom in March as lower social distancing led to a pickup in travel. The yoy rate of CPI inflation rose 60bps to 5.4% in May while core CPI rose 50bps to 4.1% yoy over the same period, both significantly above consensus. In other news, the trade deficit narrowed to USD 1.7bn in May from USD 2.5bn in April, better than consensus as the yoy rate of exports growth rose to 21.3% (from 12.9%) and imports increased to 32.0% (from 18.6%) over the same period.

Snippets

- Argentina: Tax revenue rose to ARS 1.6trn in May from ARS 1.3trn in April. The government reached an agreement with the Paris Club to defer payments until September 2024 and continued to negotiate a new repayment schedule.

- Chile: The yoy rate of economic activity improved 50bps to 6.9% in April, below median expectations for an increase to 8.5% yoy. The unemployment rate declined 10bps to 7.7% in April, 20bps lower than consensus.

- Czech Republic: The yoy rate of real GDP growth rose to 4.8% in Q1 2022, 20bps above consensus, while Q4 2021 GDP was revised 100bps lower to 3.6% yoy.

- El Salvador: The ratings agency S&P Global downgraded El Salvador sovereign credit rating to `CCC+` from `B-` and maintained a negative outlook signalling another downgrade in the coming months "if the government does not make adequate progress in filling its substantial financial gap".

- Indonesia: The yoy rate of CPI inflation rose 10bps to 3.6% while core CPI inflation was unchanged at 2.6% yoy in May, both lower than consensus expectations.

- Kenya: The central bank hiked its policy rate by 50bps to 7.5%, in line with consensus, after CPI inflation rose to 7.1% yoy in May.

- Lebanon: Nabih Berri was re-elected as speaker of the House of Parliament for the seventh consecutive term with 65 out votes out of 128, a significant reduction from the 98 votes secured in 2018. Nevertheless, his election shows the Hezbollah still holds a tight grip in government, challenging any structural reforms.

- Malaysia: The yoy rate of CPI inflation rose by 10bps to 3.6% in May while core CPI was unchanged at 2.6%, both slightly lower than consensus.

- Peru: The yoy rate of CPI inflation in Lima rose 10bps to 8.1%, 20bps below consensus.

- Poland: The yoy rate of CPI inflation rose by 150bps to 13.9% in May, 30bps above consensus.

- Romania: PPI inflation dropped 1.9% mom in April after increasing 6.9% in March, bringing the yoy rate down 450bps to 47.1% over the same period. Retail sales rose 0.3% mom in April, after increasing 0.5% in March, bringing the yoy rate down to 3.7% from 5.6% yoy over the same period.

- Russia: Economic activity was better than expected as the service PMI rose 4.0 to 48.5 in May, and the unemployment rate declined 10bps to 4.0% in April. Construction grew at a yoy rate of 7.9% in May from 5.9% yoy in April and real wages increased by a yoy rate of 3.6% in March from 2.6% yoy in February. On the negative side, retail sales dropped 9.7% yoy in April after rising 2.2% yoy in March and industrial production dropped 1.6% yoy from 3.0% yoy over the same period.

- South Africa: The unemployment rate dropped 80bps to 34.5% in Q1 2022 as the labour force increased by 60bps to 56.9% of the population, both pointing towards much higher employment levels. The yoy rate of electricity consumption and production dropped 2.0% and 3.7% respectively in April, but there are signs that lower production rate is not impacting the economy as Eskom disconnects customers not paying for energy from the grid.

- Sri Lanka: The yoy rate of CPI inflation rose 410bps to 39.1% in May as the economy grapples with shortages of energy and staple goods.

- Thailand: The yoy rate of CPI inflation surged to 7.1% in May from 4.7% yoy in April, 120bps above consensus, but core CPI was much more subdued at 2.3% yoy, only 30bps above April’s and 10bps above consensus. The inflationary pressure is down to higher energy prices as food price pressure remains subdued. Foreign arrivals increased to 293k in April from 211k in March and 153k in February, the highest number since April 2020, but still only close to 10% of normal pre-covid levels.

- Turkey: The yoy rate of real GDP growth was unchanged at 7.3% in Q1 2021 as the trade deficit narrowed from USD 8.2bn in March to USD 6.1bn in April, with both data points coming in line with consensus. CPI inflation rose 3.0% mom in May from 7.3% mom in April, pushing the yoy rate to 73.5%, while PPI inflation rose 8.8% mom from 8.7% mom, taking the yoy rate to 132.2% over the same period.

- Uruguay: The central government fiscal balance tightened to 3.3% of GDP in the 12 months to April from 4.3% of GDP 12 months ago and 5.8% of GDP in April 2020. CPI inflation rose by 0.5% in May keeping the yoy rate unchanged at 9.4%.

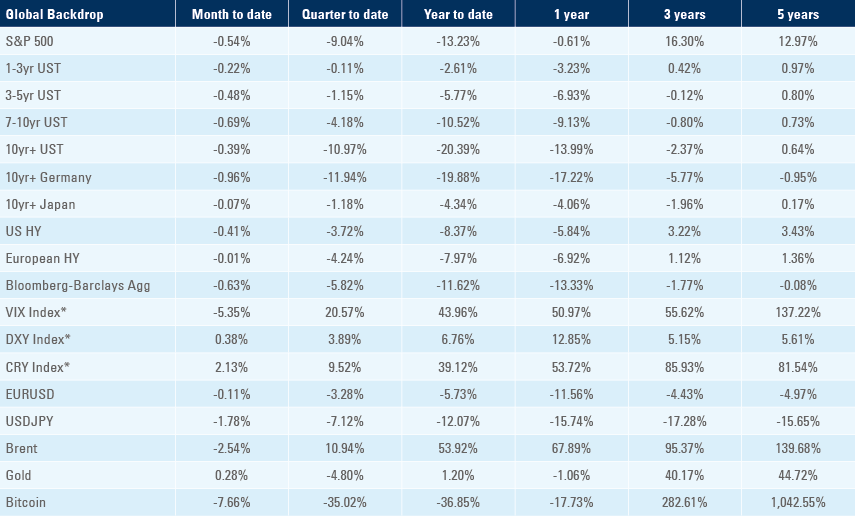

Global backdrop

United States: Economic data was weaker than expected for the seventh consecutive week as the Citibank Economic Surprise Index dropped another 5.7 to -45.60. Labour market data was mixed with a week ADP report contrasting with firm nonfarm payrolls which declined only 46k to 390k in May (318k consensus) from 436k in April as the unemployment rate was unchanged at 3.6% (thanks to a 10bps increase in the labour force participation to a rate of 62.3%) and average hourly earnings declined 30bps to 5.2% yoy. Factory orders rose 0.3% mom in April, 40bps below consensus, from 1.8% mom in March (revised from 2.2%) and durable goods orders increased to 0.5% mom from 0.4% mom over the same period (in line). Vehicle sales dropped to 12.7m in May from 14.3m in April, the lowest level in a decade (close to May 2020 levels).

Housing data was also soft and leading indicators were mixed as the ISM manufacturing rose 70bps to 56.1, prices paid declined 2.5 to 82.2 and new orders rose 1.6 to 55.1 while consumer confidence and the Chicago PMI rose more than consensus. The Dallas Fed survey of manufacturing activity dropped to -7.3 in May from 1.1 in April and the services PMI declined 1.2 to 55.9.

In other news, the Fed Vice Chairman Lael Brainard said it was “very hard to see the case” for pausing the hiking cycle in September as suggested last week by Atlanta Fed Raphael Bostic. The fact that the Fed moved from discussing an acceleration of the pace of hikes to when the institution could pause the hiking cycle has been sufficient to restrain US Treasury yields from making new highs, in line with our view that peak Fed hawkishness is already behind us.2

Europe: Economic data in Europe reinforced the case for the European Central Bank (ECB) to exit negative monetary policy sooner rather than later. Inflation rose sharply in Germany as the yoy rate of EU-harmonised CPI inflation rose to 8.7% in May from 7.8% yoy in April, 60bps above consensus, while the overall Eurozone CPI rose 60bps to a yoy rate of 8.1% in May and core CPI went 30bps higher to 3.8% yoy, both above consensus expectations. The Eurozone manufacturing PMI rose 0.2 to 54.6 in May, slightly better than expected. Retail sales dropped 1.3% mom in April (median estimate +0.1% mom) after rising 0.3% mom in March (revised from -0.4% mom), bringing the yoy rate up to 3.9% in April from 1.6% yoy in March. Bank of America now expects the ECB to hike policy rate by 50bps three times in 2022.

Canada: The Bank of Canada hiked its policy rate by 50bpt to 1.5% in June, in line with consensus.

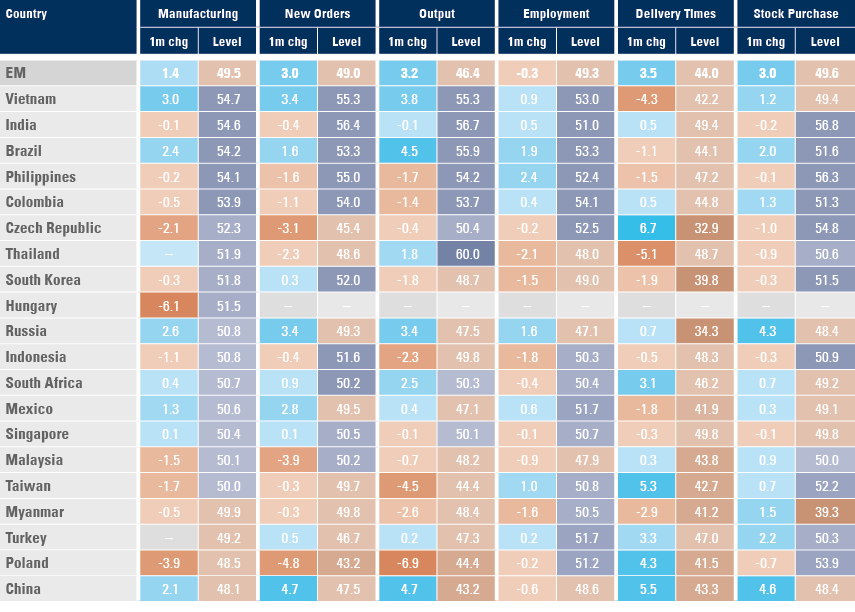

Benchmark performance

1. Sources: Angola Ministry of Finance, Banco Nacional de Angola, S&P Global Ratings.

2. See The USD Bull Trap and EM USD Debt