A different macro regime: DM central banks no longer chasing weaker currencies

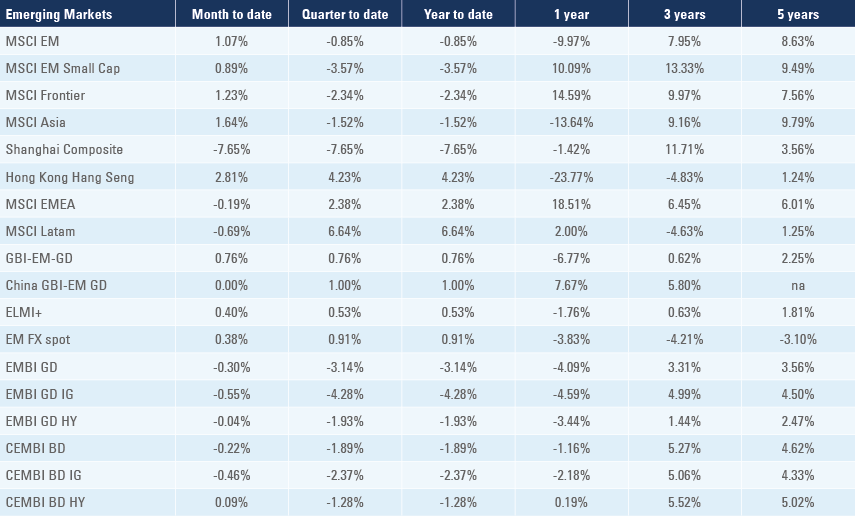

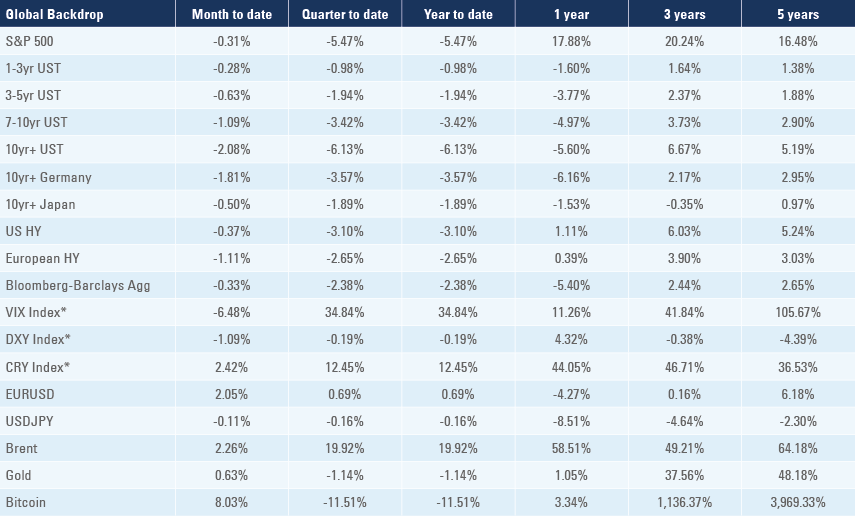

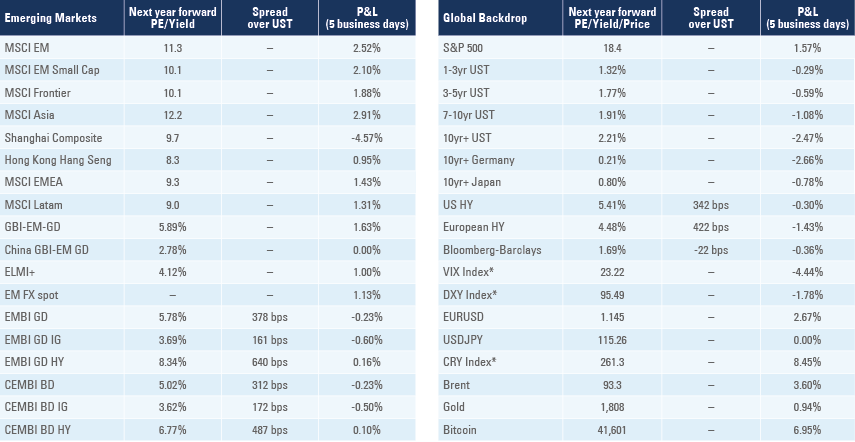

The Bank of England (BOE) and the European Central Bank (ECB) decisions were in line with consensus, but the tone was significantly more hawkish than consensus. Global PMIs declined with EM outperforming on service sectors, but underperforming in Manufacturing. Brazil hiked policy rate by 150bps and is close to the end of the hiking cycle. Czech Republic hiked by 75bps. Peru had its third cabinet reshuffle in six months. Egypt’s external accounts improved marginally. El Salvador insists on using Bitcoin in lieu of a much needed serious fiscal adjustment and IMF programme. S&P upgraded Angola to ‘B-‘, while Moody’s downgraded Ghana to Caa1. Turkey’s data deteriorated further.

Global macro

In both our 2021 and 2022 outlook pieces, we said inflation was likely to surprise to the upside. While we believe inflation will decline over the course of 2022, inflation is likely to remain too elevated vis-à-vis central banks’ targets, particularly in the first half of the year. A different macroeconomic regime, from deflation to inflation will lead to significant shifts in asset prices with important impacts on asset allocation.1

We may have experienced the first notable impact in the reaction function of the ECB and the BOE last week. In the aftermath of the 2008 financial crisis, central banks have engaged in beggar-thy-neighbour currency devaluations (so-called currency wars) via ultra-dovish monetary policy aimed at gaining competitiveness against trading partners. The fundamental backdrop was a shy fiscal response to the 2008 US housing/banking crisis and the 2011/12 European sovereign/banking crisis, leading to sluggish GDP growth and deflationary pressures for over a decade.

Today, central banks face the opposite problem. The fiscal response to the pandemic was too aggressive, particularly in the largest economy in the world, the United States (US), which alongside the supply shock associated with lockdowns and the shift in consumption patterns from services to durable goods led to significant inflationary pressures. At the same time, the government responses to the pandemic shifted long-term deflationary pressures to inflationary:

- Demographics: Aging populations is a deflationary force. However, this is not a linear relationship: there are some signs that Baby Boomers anticipated their retirement during the pandemic. They will sell financial assets (bonds and equities) to boost consumption, lowering demand from financial assets and increasing demand for goods.

- The reversal of inequality will lead to lower demand for financial assets (the rich tend to save more) in favour of consumption, as the poor have a higher marginal propensity to spend income on commodities and goods.

- Finally, low investments in commodities (including energy) over the last decade and the accelerated roadmap to energy transition is likely to keep price pressures high in the near future. Last week oil rose above USD 90 per barrel despite a calmer geopolitical situation as commodity prices rose another 8.5%.

This backdrop explains the significant shift in the policy stance by global central banks. Inflation became a massive political headache playing against the objective of lowering inequality. The BOE and the ECB finally understood that their first task was to shift their monetary policy stance. The ECB moving rates to positive levels will strengthen the Euro, potentially by more than 10%, in our view. This is particularly important, as most current inflationary pressures in the Euro Area are exogenous. A simple example illustrates this point: if energy prices increase by another 20% in Dollar terms over the next year, but the EUR rises by 10%, energy prices would increase by only 10%, in Euro terms, leading to lesser inflationary pressures across the economy.

Of course, the flipside of the strong EUR is a weaker USD. A testimony to overvalued asset prices was the price action of US mega-cap stocks last week, displaying some of the highest volatility in the absence of an economic recession. Meta (former Facebook) dropped more than 20% in a single day, losing more than USD 200bn of market cap. US stocks rose 1.6% last week, as broad results were better than expected, but have again underperformed the MSCI EM, which rose 2.5%. In our view, the environment for US stocks will remain choppy over the next months, due to concomitant monetary policy tightening and declining economic growth (PMIs are already declining) while US stocks remain at overvalued levels.

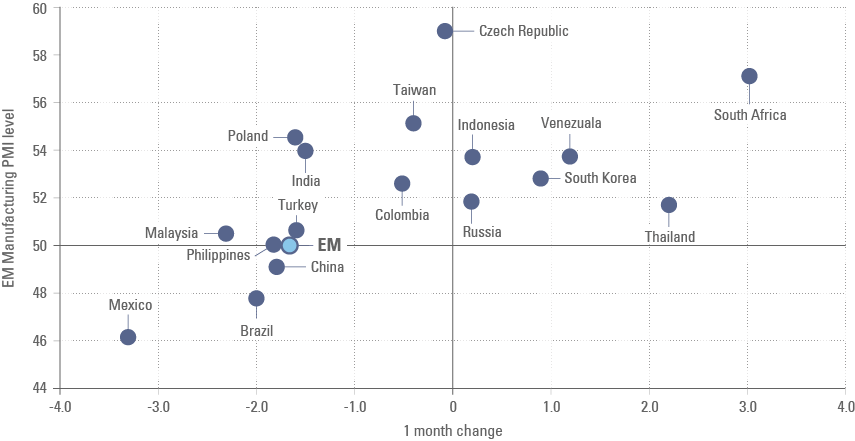

Markit Purchasing Managers Index (PMI)

The global manufacturing PMI dropped 1.1 to 53.2 with developed markets (DM) dropping 0.3 to 56.3 and EM dropping 1.7 to 50.0. The biggest drops in EM came from Mexico (-3.3 to 46.1), Malaysia (-2.3 to 50.5), Brazil (-2.0 to 47.8) and China (-1.8 to 49.1) while South Africa (+3.0 to 57.1), Thailand (+2.2 to 51.7) and Vietnam (+1.2 to 53.7) outperformed. In DM, Australia (-13.2 to 47.0), Italy (-3.7 to 58.3) and Denmark (-3.0 to 60.9) dropped the most while Austria (+2.8 to 61.5), New Zealand (+2.5 to 53.7) and Germany (+2.4 to 59.8) rose the most.

The large weight of China in the EM PMI weighed on the index as only six EM countries had manufacturing PMIs below 50 while 11 countries posted manufacturing PMIs above 50 as per Figure 1. All EM sub-indices were softer in January as the bulk of the decline is explained by the output subindex (25%) which declined 3.4 to 49.7, mostly due to China (4.3 to 48.4).

Figure 1: EM Manufacturing PMIs: Jan-2022 vs. 1m change

The global services PMI dropped 3.4 to 51.3 as EM services PMI rose 0.3 to 53.4 while DM services dropped 4.3 to 50.8. Within EM, the services PMI dropped in India (-4.0 to 51.5) and Brazil (-0.8 to 52.8) and rose in Russia (+0.3 to 49.8) and China (+1.0 to 53.1). In DM, the Eurozone Services PMI dropped 2.0 to 51.2, the Japan Services PMI dropped 4.5 to 47.6 and the US services PMI dropped 3.0 to 51.2, while only three countries posted an increase: Germany (+3.5 to 52.2), Ireland (0.8 to 56.2) and UK (+0.5 to 54.1).

Emerging markets

Brazil: The central bank hiked its Selic rate by 150bps to 10.75%, in line with consensus and signalled fewer hikes over the next meetings. The market now prices a terminal rate of 12.25% in May 2022. Brazilian rates are extremely attractive in an environment where the BRL strengthens, catching up with higher commodity prices and inflation starts declining from Q1 2022. In other news, December payrolls dropped 266k (estimated -175k previous +324k) and the primary budget surplus narrowed to BRL 0.1bn in December from BRL 15.0bn in November (BRL 10.0bn consensus).

Czech Republic: The central bank hiked its policy rate by 75bps to 4.5%, in line with consensus. The yoy rate of real GDP growth rose to 3.6% in Q4 2021 from 3.3% yoy in Q3 2021.

Peru: President Pedro Castillo reshuffled his cabinet for the third time in six months after Prime Minister Mitha Vasquez resigned from government due to disagreements with the president. Castillo appointed Hector Valer (a moderate) as Premier and Oscar Graham (a technocrat) to the Ministry of Finance alongside seven other ministers. Overall, five parties are now represented in the government, giving Castillo 48 of 130 seats, which should be enough for him to fence further impeachment attacks. The new Premier Valer said a "constitution moment" would take place no less than four years from now, which would leave behind any attempt by President Castillo to amend the constitution. Nevertheless, the infighting between Congress and Executive, a staple of Peruvian politics, is likely to remain in place. In fact, six parties have voiced opposition to Valer due to domestic violence accusations, forcing him to resign only four days after accepting the job. Castillo is due to appoint a new Premier this week.

Egypt: External accounts improved at the margin. The current account deficit narrowed to USD 4.0bn in Q3 2021 from USD 5.1bn in Q2 2021 and the capital account surplus was broadly unchanged at USD 6.1bn. The trade deficit narrowed to USD 11.1bn from USD 11.5bn while the service surplus widened to USD 2.9bn from USD 1.9bn over the same period. Revenues from the Suez Canal (a key source of service inflows alongside tourism) were USD 550m in January expanding at a yoy rate of 10%. Authorities expect another record year after revenues reached a record USD 6.3bn in 2021 as transit fees increased by 6% at the start of February.

El Salvador: The Minister of Finance Zelaya said the government is finalising the rules to issue bitcoin bonds in March and suggested keeping Bitcoin as legal tender would not depend on an IMF deal. The IMF is concerned that using cryptocurrencies as legal tender could lead to an increase in financial instability due to the risk of financial outflows and the large effects of crypto volatility.

Ghana: The rating agency Moody’s downgraded Ghana to ‘Caa1’ from ‘B3’ and changed the outlook to stable from negative. Ghana is rated ‘B-‘ by S&P and Fitch, but the latter rating agency holds a negative outlook. The slow fiscal adjustment anchored by very high revenues expectations led to a marked deterioration on the ability of Ghana to access capital markets, leading to increased liquidity pressures in 2022.

Angola: The ratings agency S&P upgraded Angola’s sovereign rating to ‘B-‘ with a stable outlook. All three rating agencies have now upgraded the country from CCC levels. Angola has been implementing a multi-year thorough fiscal consolidation.

Turkey: Economic data deteriorated in line with consensus expectations. The yoy rate of CPI inflation rose to 48.7% in January from 36.1% in December, as core CPI rose to 39.5% from 31.9% over the same period. The trade deficit widened to USD 6.8bn in December from USD 5.4bn November. Tourism arrivals was the silver lining, rising +170.6% yoy in December from 111.5% yoy in November.

Snippets

- Chile: The unemployment rate declined to 7.2% in December from 7.5% in November, in line with consensus as retail sales rose 15.3% yoy, below consensus of 20.5% yoy.

- Colombia: The yoy rate of CPI inflation rose to 6.9% in January from 5.6% yoy in December, 0.5% above consensus. Unemployment rate declined to 11.6% in December from 12.2% in November.

- Dominican Republic: The central bank hiked its policy rate by 50bps to 5.0%, slowing down the pace after a 100bps hike in December as it expects inflation to converge towards the 3.0% - 5.0% target band from 8.5% (headline) and 6.9% (core) inflation in 2021.

- Indonesia: The yoy rate of CPI inflation rose to 2.2% in January from 1.9% yoy in December, in line with consensus.

- Kenya: The yoy rate of CPI inflation declined 0.3% to 5.4% in January, in line with consensus.

- Mexico: The yoy rate of real GDP growth declined to 1.0% in Q4 2021 from 4.5% yoy from Q3 2021.

- Mongolia: The central bank hiked its policy rate by 50bps to 6.5% and increased the reserve requirement by 200bps to 8.0%

- Philippines: The yoy rate of CPI inflation declined to 3.0% in January from 3.2% in December, slightly above consensus.

- Romania: The yoy rate of retail sales rose to 7.0% in December from 6.2% yoy in November.

- Russia: The yoy rate of industrial production declined to 6.1% in December from 7.6% yoy in November, 1.6% above consensus expectations.

- South Africa: Trade surplus narrowed to ZAR 30.1bn from ZAR 35.8bn in December, in line with consensus.

- South Korea: Exports rose by a yoy rate of 15.2% in January from 18.3% yoy in December while imports grew by 35.5% yoy outpacing export growth due to higher commodity prices, resulting in a trade deficit of USD 4.9bn. The yoy rate of CPI inflation dropped 0.1% to 3.6% in January, slightly above consensus.

- Thailand: The yoy rate of CPI inflation rose to 3.2% in January from 2.2% yoy in December (consensus 2.5%).

Global backdrop

United States (US)

Economic data was soft as the Citibank Surprise Index declined to -4.6, from -2.7 last week. However, the jobs report showed pent up wage pressure, as labour market remained tight. Average hourly earnings rose by a yoy rate of 5.7% in January, significantly higher than the 5.2% yoy consensus and the 4.9% yoy in December (revised from 4.7% yoy). Non-farm payrolls increased by 467k in January (125k consensus) after a 510k increase in December (revised from 199k). The unemployment rate rose 0.1% to 4.0% due to a 0.3% increase in the labour force participation to 62.2% (61.9% consensus and prior), not far from the pre-pandemic high of 63.5%. The ISM manufacturing declined 1.2 to 57.6 with prices paid rising 7.9 to 76.1 and new orders declining 2.5 to 57.9. Factory orders dropped 0.4% mom in December after rising 1.8% in November while durable good orders dropped 0.7% mom from -0.9% mom over the same period.

Last week a number of Fed speakers added colour on the direction of monetary policy. The tone was slightly different to Powell's press conference, with San Francisco Fed Mary Daly and Atlanta Fed Raphael Bostic still seeing 3-4 hikes this year with Daly using the word "gradual", and George suggesting balance sheet reduction makes for a shallower hiking path. Richmond Fed Tom Barkin (centrist) said the labour market is "as tight as you can imagine" seeing “very strong underlying demand in the economy". Bostic tried to clarify his comments regarding the potential for a 50bp hike, saying it was not his preferred action for March. Bostic also said that the risk that Fed policy will contract the economy is “far off", that the Fed can “be more robust on balance sheet" and move as soon as possible, and that he would like to see the response of rate hikes before undergoing balance sheet reduction. He reiterated that he still expects three 25bp hikes in 2022.

Eurozone

The Euro Area unemployment rate declined 0.1% to 7.0%, slightly better than consensus. The Eurozone CPI rose 0.1% to 5.1% in January, 0.7% higher than consensus as core CPI declined 0.3% to 2.3%, but were 0.4% above consensus expectations. The ECB kept policy rates unchanged, with the deposit rate at -0.5%. Importantly, the Governing Council signalled they are concerned about the upside surprise in inflation, signalling a faster pace of monetary policy tightening than expected. Inflation expectations implied in 2-year German bund surged to around 2.5% last week from less than 1.0% in mid-2021. If confirmed, rates will move from negative levels for the first time since 2014. This is likely to have several implications for the European banking system, the economy as well as the EUR itself. Whereas last year the US economy outperformed due to a short-term stimulus focused on paychecks to its population, a larger part of the European fiscal stimulus focuses on infrastructure, energy transition with several disbursements starting from 2022.

United Kingdom

The Bank of England hiked its policy rate by 25bps to 0.5%, started quantitative tightening (QT) by not re-investing expiring UK Gilts and committed to sell its GBP 20bn corporate bonds by the end of 2023. Four out of nine members voted for a 50bps hike, signalling a faster pace of hikes ahead. The overnight interest swap curve prices another five hikes until December 2022.

Japan

The unemployment rate fell to 2.7% in December from 2.8% in November.