- The US Presidential debate and the first round of the French general elections are just starters for the political trends impacting the west.

- In contrast, the President of South Africa appointed its national unity government, which is likely to lead to positive policy developments, while Mexico’s President-elect appointed market-friendly ministers to her cabinet.

- Sri Lanka agreed a debt restructuring with official creditors and China’s Exim Bank, another important milestone for EM frontier reforms.

- Argentina approved its omnibus reform bill in Congress for the second time, a very positive development.

- Kenya and Bolivia proved to be exceptions, as protests and a failed coup d’etat highlighted the risks of postponing or avoiding structural reforms for too long.

- Both countries face downgrade risks in Ashmore’s latest rating framework piece, where three countries were earmarked for potential downgrade and 14 for potential upgrade within the EM ‘distressed space’.1

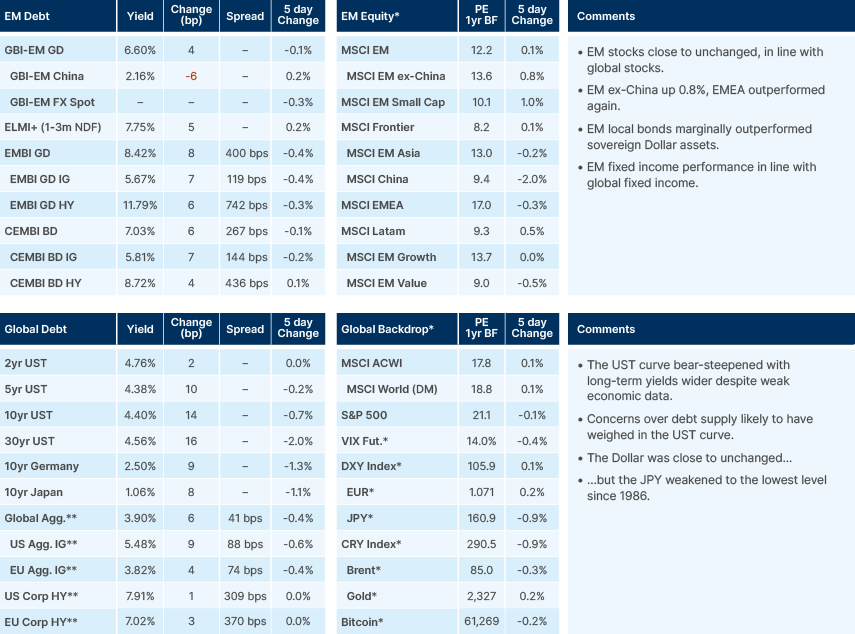

Last week performance and comments

Global Macro

French Elections

Exit polls showed the far-right National Rally (NR) with 33%; the broad left New Popular Front (NPF) alliance led with 28%; the incumbent Ensemble with 21%; centre-right Les Républicains with 10%. Other left-leaning parties received 3% and other parties 5%. The turnout was 67%, the highest in decades. The most likely scenario, if exit polls are right, is a hung parliament.

In terms of the mechanics, only circa 12.5% of the seats won in the first round with a 50% majority or 25% lead. Any candidate who receives at least 12.5% of the registered voters in the constituency qualifies for the second round, meaning there can be three- or even four-way second rounds.

Both incumbent Prime Minister Gabriel Attal and NPF leader Jean-Luc Mélenchon pledged to give up bids for seats they cannot win to campaign against the NR. Traditionally, the largest party is given the choice of forming a government. An NR-led minority government or a coalition including the Les Républicains are the most likely scenarios. This gives the Républicains a lot of power in terms of approval of policies and keeping NR in power (blocking or abstaining from non-confidence votes).

French and European assets traded well following the result, as the scenarios of a majority NR government or the more threatening far-left rise did not materialise. But there is some degree of complacency associated with the squaring of (short) positions. After all, a weaker minority government is unlikely to tackle France’s fiscal situation, albeit a more acute fiscal crisis can probably be avoided.

There is also the risk that the NR government is short-lived (a vote of no confidence). An alternative coalition would be the fragmented NPF led by the far left may have to work with Macron’s weakened Ensemble. This is a recipe for further fiscal slippage and/or chaotic policies that may play into the hands of the NR in 2027.

British elections

The general election takes place on the fourth of July. The base-case scenario is for the Labour Party to return to power and the traditional Conservative Party to suffer a major defeat, squeezed between Labour and Nigel Farage’s far-right Reform UK. Interestingly, markets are likely to welcome a large Labour Party majority. Its leader Sir Keir Starmer has been bringing the party’s policies to the centre, including adopting the budgetary blueprint of the Conservatives. Starmer is also likely to promote a closer rapprochement with the European Union (EU), which is likely to be positive for the British economy. A YouGov poll suggests more than 55% of Britons now believe leaving the EU was a mistake while only c. 30% believe it was the right decision.

US Elections

The Democratic Party is in disarray after President Joe Biden’s performance in the first presidential debate intensified worries over his ability to take office again. While presidential debates are normally relatively inconsequential for elections, Biden’s performance highlighted the heavy toll of the presidency, and the fact that Biden is likely to look, act, sound and feel much worse at 86, after five more years. Even before the debate, Biden had the worst approval rate for all presidents since 1945.2

In terms of the process, Biden does not officially become the Democrat nominee until endorsed at the 2024 Democratic National Convention, which takes place in Chicago between 19-22 August. As a presumptive nominee, were he to be replaced before then, it would be the first time a party has done so at this stage in modern history. This could, in theory, happen in two ways. First, Biden could step aside as a candidate and nominate someone as a preferred alternative. The second option would be to resign as President and let Vice-President Kamala Harris take over. Still, this would not automatically make Harris the Democrat nominee for 2024. The party would have to complete an open convention, with around 700 party members choosing another candidate.

Emerging Markets

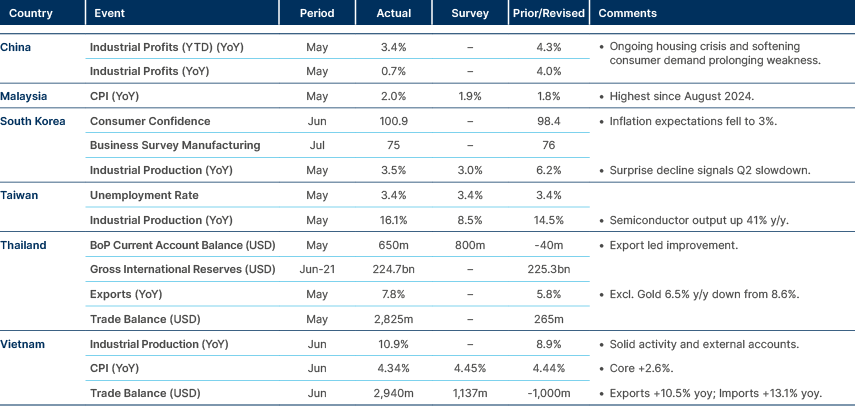

Asia

Industrial production in Korea and Taiwan buoyed by semiconductors. Good data in Vietnam.

China

As part of Xi Jinping’s common prosperity plan, senior financiers will be forced to forgo deferred bonuses and repay pay more than USD 400k from previous years. All eyes will be on the third plenum and the Politburo meetings this month, when policymakers will debate economic and social policies for the next years.

Sri Lanka

Sri Lanka finalised restructuring agreements for USD 10bn in debt, including deals with an Official Creditor Committee and China’s Exim Bank. The agreements include USD 5.8bn with bilateral lenders (including India, France, and Japan) and USD 4.2bn with China’s Exim Bank. These will allow Sri Lanka to delay debt payments until 2028, with repayments on concessional terms until 2043. The debt overhaul enables Sri Lanka to allocate funds to essential public services and reopens the doors to further bilateral transactions and financing for development. Progress in debt restructuring is crucial for maintaining International Monetary Fund (IMF) support. Earlier this month, the IMF authorised disbursement of the latest USD 336m tranche but called for the “transparent and timely completion” of talks with private creditors.

The Sri Lankan government still needs to restructure USD 13bn of dollar debt with bondholders, and around USD 2.1bn with the China Development bank. So far, in return for a roughly 35% haircut, international bondholders have proposed converting debt into a macro-linked bond, which would offer larger payouts should Sri Lanka outperform IMF economic targets. In a national address on Wednesday, Sri Lanka’s president Ranil Wickremesinghe said the country’s external debt payments would fall from 9% of GDP in 2022 to 4.5% by 2043, under the deal.

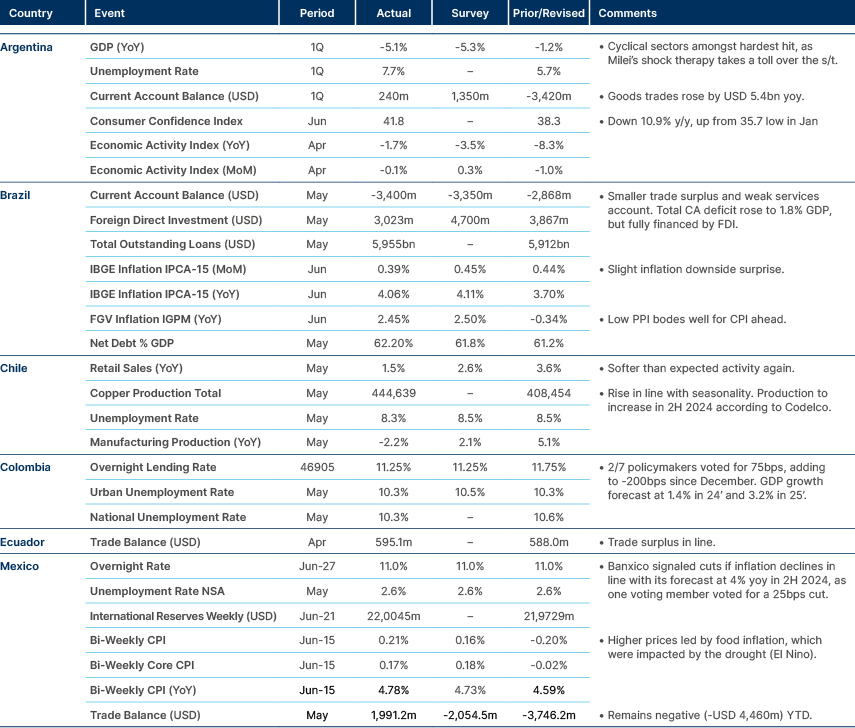

Latin America

Brazil’s inflation lower, fiscal deficit wider than expected. Colombia cut by 50bps with split vote. Banxico unchanged with a split vote.

Argentina: Argentina’s Congress approved President Javier Milei’s signature pro-business reforms, marking an inflection point for the outsider to govern with a hostile political class he continues to rail against. The Chamber of Deputies passed a sweeping bill, known in Spanish as the Ley de Bases, early Friday in a final 147 to 107 vote. The biggest victory came minutes later, however, when lawmakers also approved the return of income taxes in the accompanying fiscal package by a narrower 136-116 margin, reversing the Senate’s bid to undo the measure.

Bolivia: In a dramatic turn of events, rebel soldiers drove a tank into Bolivia’s presidential palace in a failed coup attempt against President Luis Arce’s socialist government, resulting in celebrations by his supporters. This development comes as Arce’s popularity has declined due to a significant drop in natural gas exports and the depletion of central bank reserves, which has hampered the government's ability to maintain food and diesel subsidies. The administration is struggling with broader economic issues, including fuel shortages and a lack of hard currency. Compounding these challenges are internal political dynamics, as Arce faces competition from former President Evo Morales for control of the ruling party, straining the government's finances and eroding its majority in congress. Some local news have claimed the coup d’etat to be “staged”.

Brazil: The central bank raised GDP growth estimates to 2.3% for 2024, up from 1.9% previously, citing tight labour market to contribute to a strong growth momentum.

Mexico: President-elect Claudia Sheinbaum announced key appointments to her upcoming administration. Luz Elena Gonzalez, formerly the finance chief for Mexico City and a close ally of Sheinbaum, was named the new Energy Minister. Gonzalez's experience includes overseeing an expansion of the tax base and improving revenue collection in Mexico City. Raquel Buenrostro, the current Economy Minister, was appointed the new Federal Comptroller, reflecting Sheinbaum's focus on financial oversight. Additionally, David Kershenobich was selected as new Health Minister.

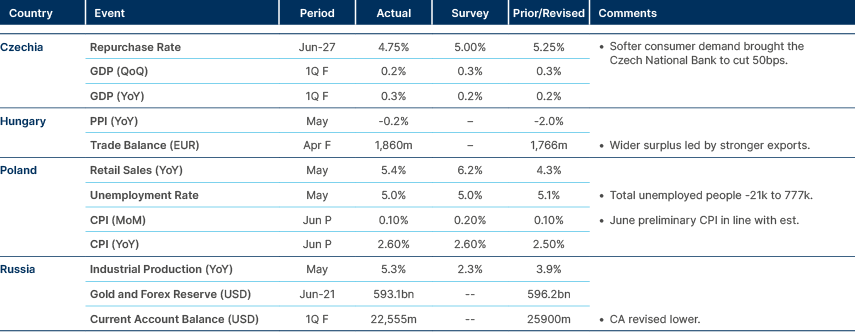

Central and Eastern Europe

Czechia cut the policy rate by 50bps - more than expected.

Central Asia, Middle East, and Africa

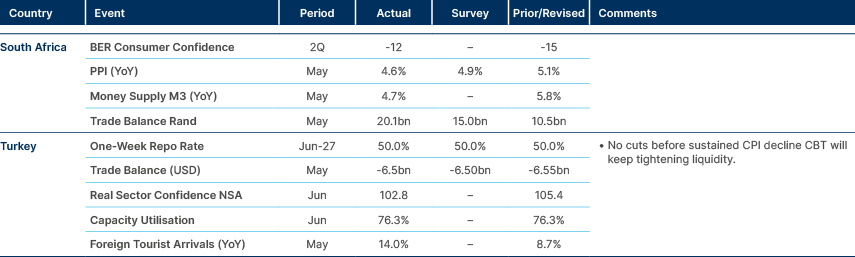

CBT pledged to keep tightening policy via “other tools”.

Kenya: President William Ruto withdrew a bill to raise taxes after violent protests erupted around the country following its approval in Parliament. In his first public response following the protests, Ruto said he would not pull back the bill, arguing the new taxes were essential to control Kenya’s debt, which stands at USD 80bn and costs the country over 50% of its annual tax revenue to service. However, as violence intensified, Ruto addressed the nation again, and said he “conceded” to the protestors. The protests were largely organised by young people via social media. At least 22 protesters were killed, and around 200 wounded by the police and military, after thousands of demonstrators stormed Parliament and set parts of the building on fire. The use of live ammunition by security forces has been widely condemned, including by United Nations Secretary General, António Guterres.

South Africa: President Cyril Ramaphosa announced the National Unity cabinet, a positive catalyst for South African assets after last week’s delays. Finance Minister Enoch Godongwana was re-appointed, signalling fiscal policy continuity. It is likely that Godongwana will press for an increase in the primary surplus, from 0.5% in FY23/24. Parties composing the coalition with the ruling African National Congress (ANC) now hold 12 out of 32 ministerial posts, of which six are held by the centre-right Democratic Alliance (DA), including Home Affairs and Agriculture. The DA also holds six Deputy Minister positions, including at the key economic ministries of Finance, Trade & Industry and Energy & Electricity. The cabinet means potential upside reform scenarios are materialising. Risks are protests, particularly in Kwa Zulu Natal province, and either the ANC itself or the coalition breaking down due to policy disagreements.

Türkiye: A global financial watchdog removed Türkiye from its "grey list" of countries with lapses in anti-money laundering and counterterrorism financing policies, marking a significant achievement for Ankara's efforts in financial regulation.

Developed Markets

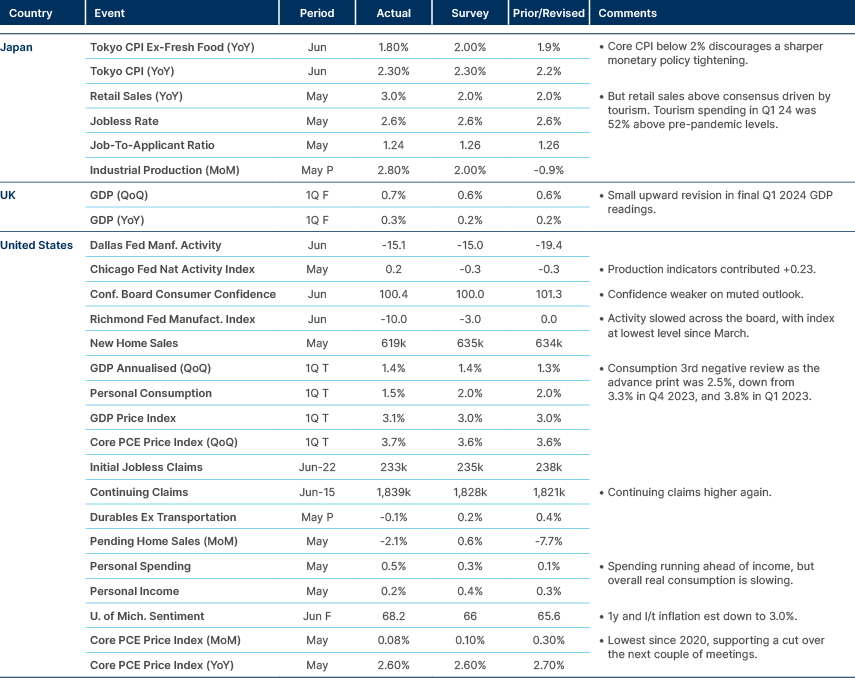

Economic data remains weak. US Q1 GDP consumption revised lower for third time. Claims increasing. Core Personal Consumption Expenditures (PCE) down 10bps to lowest in four years.

Japan: The Yen weakened to its lowest level against the Dollar since 1986, prompting concerns from Japanese officials about potential market intervention to stabilise the currency. The decline is attributed to the wide interest rate gap between the US and Japan, despite Japan's previous efforts to bolster the yen through selling dollars in the foreign exchange (FX) market. The Japanese government may hesitate to intervene again due to the limited success of previous interventions, and may wait for strategic moments, such as post-election periods or dollar-bearish US economic data releases, to act. A USD/JPY 165 level is currently seen as the next “line in the sand” leading to intervention. For now, the Yen carry trade is back on, which has the potential to put further downwards pressure on the currency with negative implications for EM Asian currencies but positive implications for higher-yielding currencies. The trend is ultimately unsustainable. Prime Minister Kishida’s approval rating has declined to only 25%, while his disapproval rating is close to 67% according to Nikkei.3 While voters attribute their disapproval to poor policy reform perspective, the policy angle is likely to be just a channel to vent frustration from lower purchasing power because of the currency. The policy is also eventually self-defeating. Tourism is surging with 14.5 million people travelling to Japan in the first five months of the year, 70% above 2023, as arrivals are likely to surpass 2019’s record 32 million.4

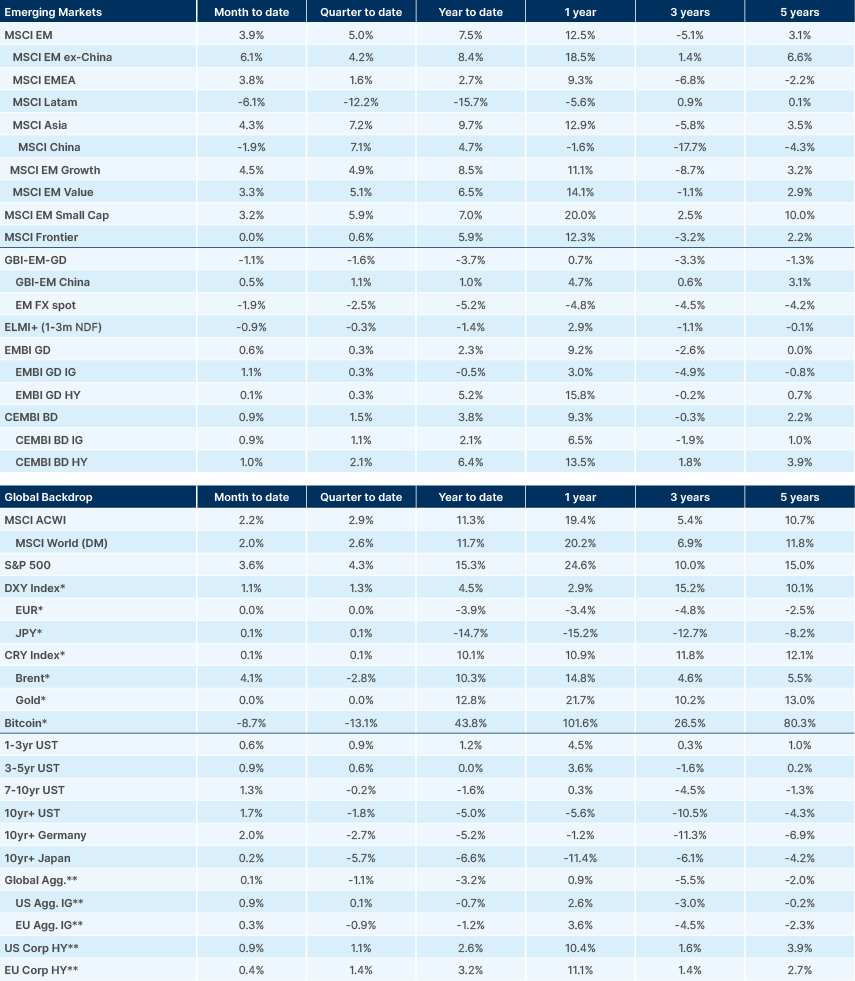

Benchmark performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

1. See – See – “The untold story of improving EM fundamentals”, The Emerging View, 27 June 2024.

2. See – https://news.gallup.com/interactives/507569/presidential-job-approval-center.aspx

3. See – https://asia.nikkei.com/Politics/Japan-s-Kishida-approval-rating-sinks-to-new-low-of-25-Nikkei-survey#:~:text=TOKYO%20%2D%2D%20Support%20for%20Japanese,that%20launched%20in%20October%202021

4. See – https://www.bloomberg.com/news/articles/2024-06-28/why-it-feels-like-everyone-in-the-world-s-heading-to-japan-right-now?embedded-checkout=true