Russia on the backfoot as the plot thickens in Ukraine. The OPEC+ agreed to cut its production quota by 2m barrels of oil per day. The global manufacturing PMI is still on a declining trend, but several EM countries are bucking the trend and outperforming DM peers. Economic data remains solid in Brazil. Foreign exchange reserves declined in Chile, Czechia, South Korea, and Ghana – a concerning trend only for the last country, which is negotiating a debt restructuring and an IMF deal after losing access to foreign funding. Inflation shows signs of moderation in Mexico.

Geopolitics

Russia remains on its backfoot on the ground in Ukraine. A big explosion destroyed the 19km bridge connecting Russia to the island of Crimea in the Black Sea, threatening the supply of fuel, food and weaponry to the peninsula which was annexed by Russia in 2014.

The Russians retaliated with air strikes in civilian areas in the city of Zaporizhzhia as Ukrainian President Volodymir Zelensky asked for anti-aircraft defence systems to avoid similar tragedies. Moscow also seized the Zaporizhzhia atomic plant, a move condemned as illegal by the European Union. Russia’s Defence Minister appointed General Sergey Surovikin as the commander of Russian forces in Ukraine. Surovikin was the previous aerospace forces commander with experience in the Syria, Tajikistan, and Chechnya conflicts.

Ukraine’s main objective appears to be the break down of Russian defence lines and recapture the strategic city of Kherson, thus breaking Russia’s land bridge to Crimea. Vladimir Putin ordered the Russian army to defend Kherson at all costs and forbid any retreat from that area. Another alternative for the Ukrainian army would be to keep pushing from the northeast city of Lyman all the way to the southeast, driving a wedge in the land bridge between Donbass and Kherson. Breaking the Russian lines in two separate and incommunicable groups would make the situation in Kherson more fragile.

Another interesting development was the fact that Elon Musk defended a cease fire via Twitter saying Ukraine should accept a cease fire and cede Crimea and the annexed territories of Donetsk and Luhansk after an election as well as leaving Crimea with Russia. After total of 59% of the 2.75m twitter users rejected the idea, Musk posted another query asking if the people in Crimea and Donbas should decide on whether they are part of Russia or Ukraine. This time, 59% of the 2.43m of users endorsed the (incredibly similar) idea.1 It is not a secret that the population living in these regions are, since 2015, largely Russian or pro-Russian. Musk is the CEO of Tesla which faces the challenge of ramping up production in US, Germany, but also China and was trying to walk away from a pricey acquisition of Twitter. Early in the conflict Musk positioned himself against Russia (despite Tesla’s strategic dependence on China) by allowing Ukraine access to high-speed broadband connection via its Starlink satellite network enabled by Space X.

If Ukraine manages to retake control of the west bank of Kherson or drive a wedge between Donbas and Kherson the risk of Russia retaliating with chemical or nuclear weapons would increase significantly as such a strategic defeat in Ukraine would be a threat to Putin’s regime in Moscow, particularly after the large protests across the country against mass conscriptions.

Alternatively, if Russia manages to hold its current strategic land bridge to Crimea, it is likely it will also increase the economic pressure on Europe via reducing food and energy exports from Ukraine and Russia, thus prolonging the economic damage to bend public opinion against the war. In our view, Europe should be preparing its population for a prolonged conflict with Russia and putting measures in place to incentivise lower energy consumption. For example, instead of throwing hundreds of billions of energy subsidies to protect its population, European countries should offer similar prices as last year only for households that managed to save 25%-30% of energy this winter. Households saving at least 10% also should be offered a discount while households not saving any energy would be charged market prices. Such policies would make the Russian energy threats less effective, but also keep public finances in a reasonable shape, a key pre-condition for withstanding a long conflict against your main energy supplier.

Interestingly, last week the market cap of Exxon Mobil, the most valuable company in the world from 2009 to 2011, exceeded the valuation of Meta. This resonates with a key part of one of Putin’s recent speeches saying: “The economy of imaginary wealth will be inevitably replaced by the economy of real and hard assets”.

Commodities

The OPEC+ announced a 2m barrels per day cut in the production quota for November. Considering several member countries (Nigeria, Libya, etc) are struggling to meet production, the cut is likely to amounts to a 0.7-0.8 million barrels/day cut to actual supply. The quota cut agreement is a clear signal that Saudi Arabia and the group together are willing to stabilize and support oil markets. The price cap on imports of Russian oil was also not viewed favourably by OPEC+ members which saw the measure as an attempt by importers to dictate oil prices to exporters.

Purchasing Managers’ Index (PMI)

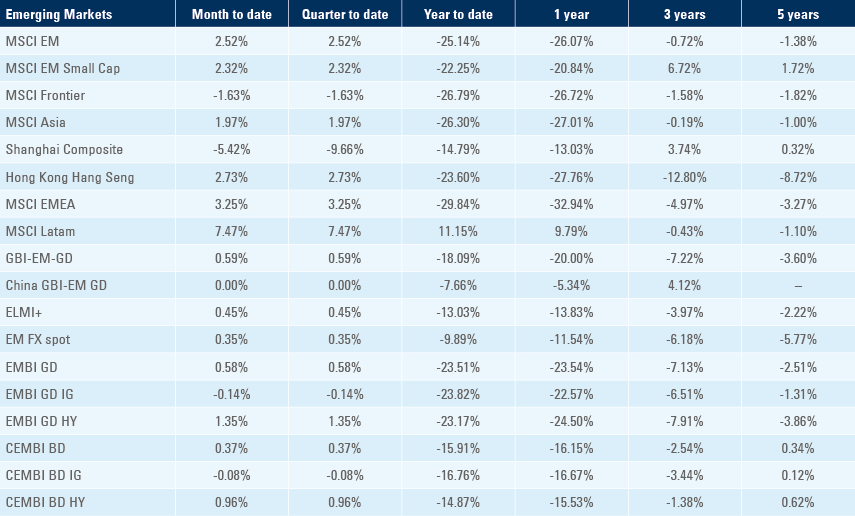

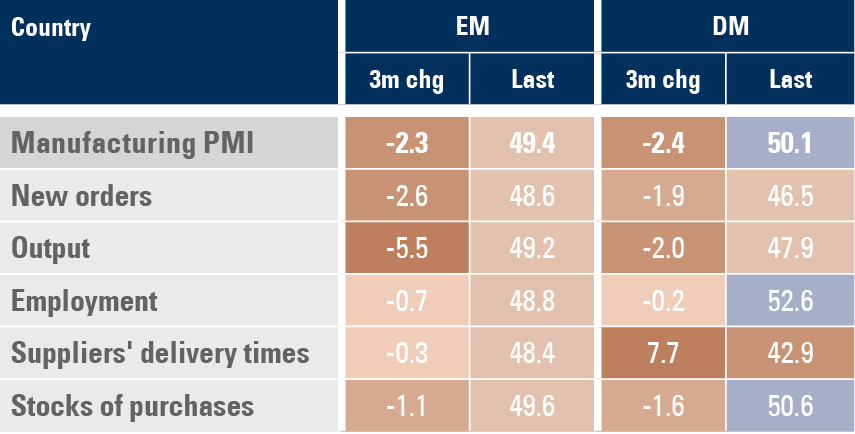

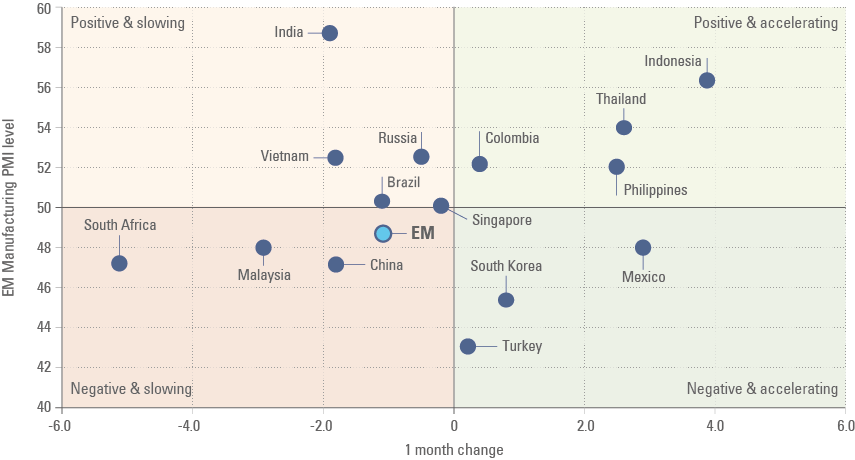

The global manufacturing PMI declined 0.5 to 49.8 as DM dropped 0.2 to 50.1 and EM declined 0.8 to 49.4. The breakdown is still showing a declining trend for new orders and output as suppliers’ delivery times improve in DM, as the normalisation of activity in the service sector and slower demand allows for the normalisation of supply chain disruptions prevailing since the pandemic as per figure 1.

Figure 1: Manufacturing PMI: EM and DM

The leading indicator ‘new orders’ either remained above 50 or improved across most EM as only China, Malaysia, South Africa, and Singapore declined below 50 last month as per figure 2:

Figure 2: EM manufacturing PMI: new orders

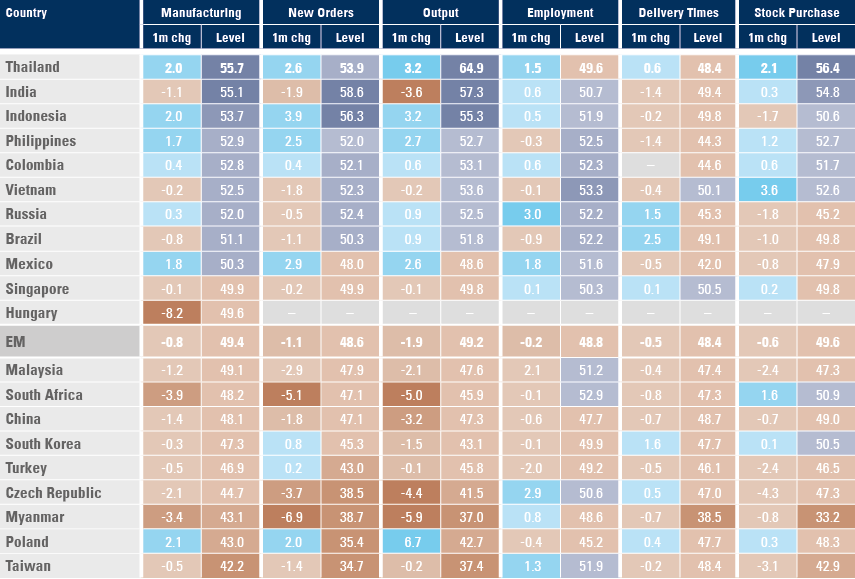

In DM, the manufacturing PMI improved the most in Australia (+3.4 to 55.6) and Denmark (+1.9 to 49.8) and declined the most in France (-2.9 to 47.7) and Netherlands (-3.6 to 49.0), most likely due to the energy crisis. In EM Thailand (+2.0 to 55.7), Indonesia (+2.0 to 53.7) and Mexico (+1.8 to 50.3) improved the most, while Hungary (-8.2 to 49.6), South Africa (-3.9 to 48.2), and Malaysia (-3.4 to 43.1) declined the most. China PMI declined 1.4 to 48.1, dragging the overall EM PMI below 50 for the first time in three months.

Figure 3: EM manufacturing PMI breakdown by country

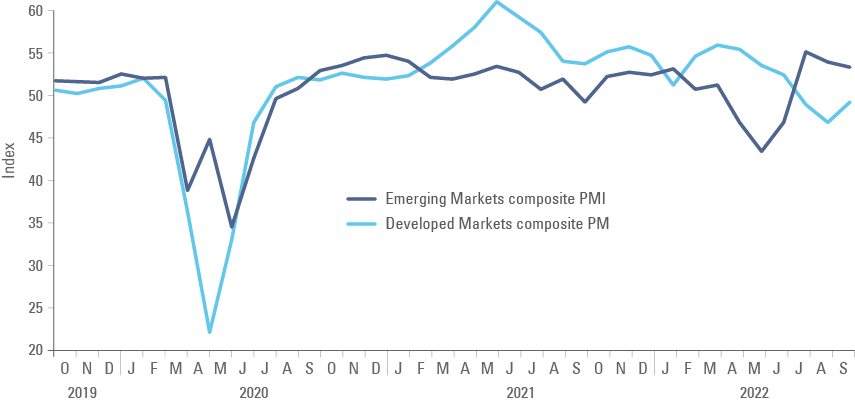

The composite PMI (combined services and manufacturing activity) remained significantly better in EM (-0.6 to 53.4) than DM (+2.4 to 49.3) as per figure 4. The services PMI improved 0.7 to 50.0 as EM declined 0.6 to 54.9 and DM rose 2.8 to 49. Despite the small rebound in DM composite PMI, the trend is likely to remain on a downward path over the next months and quarters, in our view.

Figure 4: Composite PMI

Emerging markets

Brazil: The unemployment rate dropped to 8.9% in August, the lowest level since 2015. Industrial production declined 0.6% mom in August after rising 0.6% in July – in line with consensus. The trade surplus declined USD 0.1bn to USD 4.0bn in September, USD 0.5bn below consensus as exports slowed USD 1.8bn to USD 29.0bn and imports slowed USD 1.7bn to USD 25.0bn. PPI inflation declined 1.2% mom in September after dropping 0.6% in August, bringing the yoy rate down 170bps to 7.9%. Vehicle production dropped by 30k to 208k in September. Retail sales declined 0.1% in August from -0.5% in July taking the yoy up to +1.6% from -5.3% over the same period. The service PMI slowed 2.0 points to 51.9 in September, bringing the composite PMI down 1.3 points to 51.9.

Chile: Economic activity rose by 0.6% mom in August after declining 1.1% in July, but the yoy rate slowed by 100bps to 0.0%. Vehicle sales rose 1.7k to 36.7k in September as the yoy rate of nominal wages increased by 11.1% in August from 9.8% in July. CPI inflation rose 0.9% mom in September from 1.2% in August, bringing the yoy rate down by 40bps to 13.7%, 10bps below consensus. Foreign exchange reserves declined to USD 37.8bn in September from USD 41.5bn in August as the trade deficit narrowed to USD 513m in September from USD 990m in August as exports declined by USD 0.3bn to USD 7.6bn and imports dropped USD 0.8bn to USD 8.1bn.

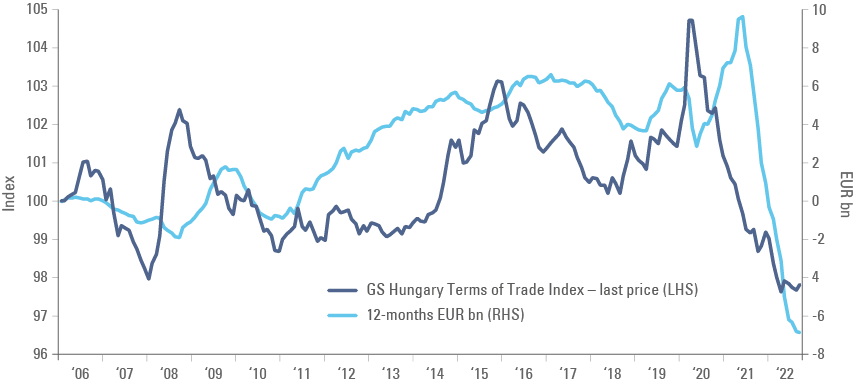

Czechia: Foreign exchange (FX) reserves declined by EUR 2.0bn to EUR 139.4bn in September from a peak of EUR 160.4bn in April. The Czech National Bank sold the equivalent of USD 2.4bn in August and the decline in FX reserves suggests it kept intervening in September. The intervention is designed to keep the Koruna strong against the Euro to keep inflation from imported goods from spiralling - a risky strategy considering Czechia is running the largest trade deficit in 20 years, driven by terms of trade as per figure 5. The trade deficit widened to EUR 1.2bn in August from EUR 0.9bn in July, taking the cumulative 12-months deficit to EUR 7.0bn in August 2022 from a EUR 9.5bn surplus in May 2021. Retail sales ex-auto contracted by a yoy rate of 8.8% in August (-6.5% consensus and -7.9% in July), but industrial output recovered to 108 in August from 99.7 in July.

Figure 5: Czechia trade balance in EUR

Hungary: The trade deficit widened to EUR 1.3bn in August from EUR 0.4bn in July, bringing the cumulative 12-month deficit to EUR 5.1bn in August from a surplus of EUR 7.3bn in April 2021 also led by terms of trade, the same dynamics as Czechia. Industrial production rose 0.1% mom in August, 6.9% above August 2019 and retail sales slowed to 2.4% yoy in August from 4.3% yoy in July.

South Korea: CPI inflation dose 0.3% mom in September from -0.1% mom in August, taking the yoy rate down 10bps to 5.6%, but core CPI rose by 10bps to 4.5%. Foreign exchange reserves declined to USD 416.8bn in September from USD 436.4bn in August and USD 469.2bn in October 2021 as the current account moved to a USD 3.0bn deficit in August from a USD 0.8bn surplus in July led by a USD 4.5bn trade deficit in August from USD 1.4bn deficit in July.

Ghana: Foreign exchange reserves declined USD 0.4bn to USD 6.6bn, equivalent to 5.4 months of imports. Most of the pressure comes from interest payment to foreign creditors, which remains elevated due to high interest rates in local debt and a growing dependence on Eurobond borrowing in recent years. The central bank hiked its policy rate by 250bps to 24.5%, 100bps more than consensus as the central bank aims to anchor inflation expectations.

Mexico: CPI inflation declined to 0.6% mom in September form 0.7% in August keeping the yoy rate unchanged at 8.7% while core CPI declined to 0.7% mom from 0.8% over the same period, but the yoy rose to 8.3%. The bi-weekly CPI from the second half of September showed inflation declining in sequential terms, following a similar pattern from 2021. Vehicle production declined to 273k in September from 317k in August, but exports rose by 11k to 260k over the same period. Consumer confidence rose 0.1 to 41.0 in September, 0.9 above consensus, remaining above the average of the last 10 years and closer to the highest level of 48.6 from February 2019 than the lowest 28.6 of January 2017.

Snippets

- Angola: Foreign exchange reserves declined by USD 0.2bn to USD 13.6bn in September, down from USD 16.2bn in January to the lowest level in five years

- Argentina: Tax revenues rose to ARS 2.1trn in September from ARS 1.7trn in August as the yoy rate of construction activity and industrial production rose to 7.3% and 7.6% respectively, both reaching the highest level since 2008.

- Colombia: CPI inflation rose 0.9% mom in September to 11.4% from 10.8% in August and core CPI rose by 50bps to 8.3% yoy over the same period. Food prices were the main culprit for elevated inflation. Exports declined to USD 4.6bn in August from USD 5.9bn in July, but remained on an upward trend.

- Ecuador: CPI inflation rose 0.4% mom in September after remaining unchanged in August, taking the yoy rate up 30bps to 4.1%.

- Peru: CPI inflation declined to 0.5% mom in September from 0.7% in the city of Lima, taking the yoy rate up 10bps to 8.5%, in line with consensus. The central bank hiked its policy rate by 25bps to 7.0%, in line with consensus.

- Philippines: The yoy rate of CPI inflation rose 60bps to 6.9%, in line with consensus as the unemployment rate rose 10bps to 5.3%.

- Poland: The National Bank of Poland kept its policy rate unchanged at 6.75% against consensus for a 25bps increase. Foreign exchange reserves declined by USD 2.9bn to USD 151.6bn in September.

- Romania: The central bank hiked its policy rate by 75bps to 6.25%, 25bps above consensus as PPI inflation rose 1.9% mom in August taking the yoy rate down 80bps to 53.0%. Retail sales rose 0.6% mom in August from 0.5% in July, leaving the yoy rate unchanged at 3.7%.

- Russia: The services PMI improved 1.2 points to 51.1 in September, taking the composite PMI up 1.1 points to 51.5 over the same period.

- Serbia: The central bank hiked its repurchase policy rate by 50bps to 4.0%, 25bps above consensus.

- Taiwan: The trade surplus rose to USD 5bn in September from USD 3bn in August, surprising to the upside, but both exports and imports declined in yoy terms. The yoy rate of CPI inflation rose 10bps to 2.8%, in line with consensus as core CPI rose 10bps also to 2.8% yoy, 20bps above consensus.

- Thailand: CPI inflation rose by 0.2% mom in September from 0.1% in August, taking the yoy rate down 150bps to 6.4% as core CPI was unchanged at 3.1% yoy – 10bps below consensus.

- Turkey: The ratings agency S&P downgraded Turkey’s sovereign credit rating to `B` from `B+`, with a stable outlook, citing loose monetary policy against a backdrop of inflation around 80%.

- Uganda: The central bank hiked its policy rate by 100bps to 10.0%.

- Ukraine: Foreign exchange reserves dropped USD 1.5bn to USD 23.9bn in September.

- Uruguay: The central bank hiked its policy rate by 50bps to 10.75%.

Developed markets

United States: Most FOMC members speaking last week gave a hawkish tone with Williams saying rates would have to go even higher, Kashkari expecting to see cracks in US financial markets, and Mester said “the US is in an unacceptably high inflation environment”. Boston Fed Raphael Bostic said he is purposeful and resolute in seeing inflation lowered, adding that he would like to see the Fed fund rates reaching between 4.0% and 4.5% by year-end, but that the Fed should then “wait to see how the economy reacts”. The Fed should stop now to observe the impact of all the hikes in the economy, in our view, considering the meaningful lags of monetary policy and the elevated levels of debt in both public and private sectors.

In economic news, factory orders were unchanged in August after declining 1.0% mom in July. The job market remained stubbornly heated with non-farm payrolls increasing by 263k in September from 315k in August, broadly in line with consensus. The unemployment rate declined by 20bps to 3.5% (as labour force participation dropped 10bps to 62.3%) and the yoy rate of average hourly earnings declined 20bps to 5.0% yoy. The ADP employment rose 208k in September from 185k in August (revised from 132k) and the JOLTS report showed job openings softening to 10.05m in August from 11.17m in July as initial jobless claims rose to 219k in the week ending on 1 October from 190k in the previous week. Mortgage applications collapsed 14.2% in the week ending on 30 September. The trade deficit narrowed to USD 67.4bn in August from USD 70.5bn in July, remaining at elevated levels. The ISM manufacturing survey focused on large companies slowed by 1.9 points to 50.9 in September, 1.1 points below consensus as new orders dropped 4.2 to 47.1, and employment declined 5.5 to 48.7. The ISM services slowed by only 0.2 to 56.7, further evidence of a rebalancing from consumption of goods to services across the economy.

Australia: The Reserve Bank of Australia (RBA) hiked its policy rate by 25bps to 2.6%, lower than the previous four increases of 50bps and consensus. The more cautious approach is justified by Australia’s 118% household debt to GDP, most of it in the format of variable-rate mortgages. The board “expects to increase rates further over the period ahead” suggesting a terminal rate around 3.0% by year end.

New Zealand: The Reserve Bank of New Zealand hiked its policy rate by 50bps to 3.0%, in line with expectations, keeping a more hawkish tone in contrast with the more cautious approach from the RBA.

Japan: The yoy rate of CPI inflation declined 10bps to 2.8%, in line with consensus, but CPI ex-fresh food and energy rose 30bps to 1.7% yoy, 10bps ahead of consensus.

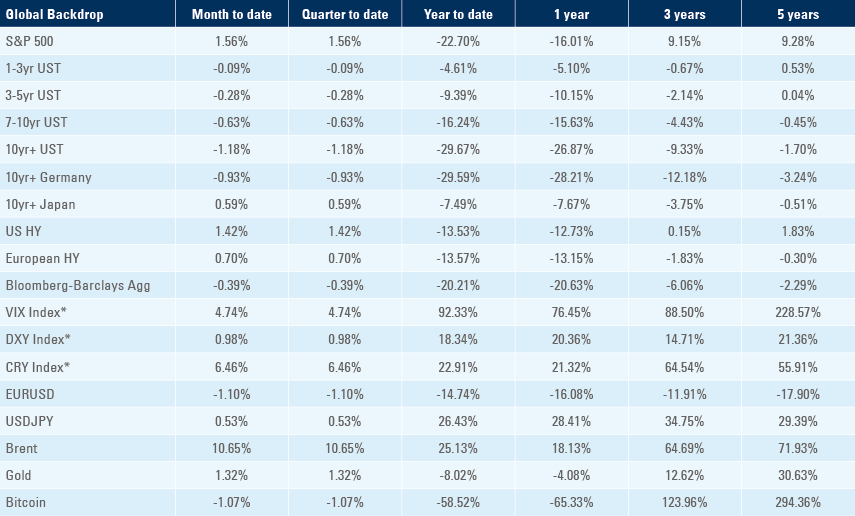

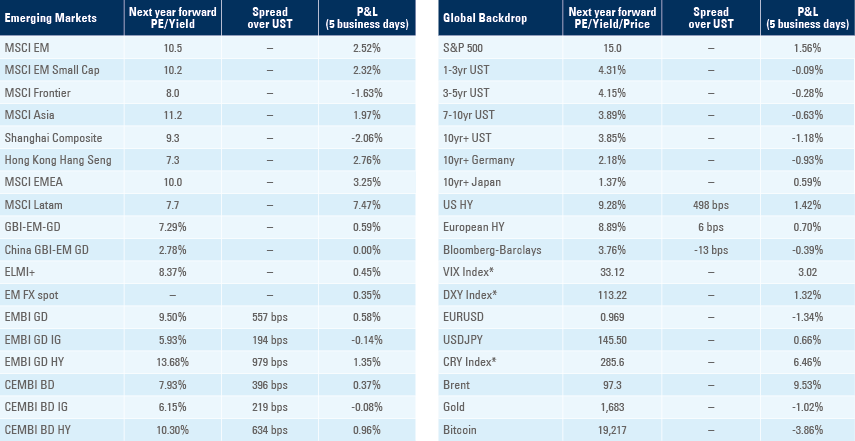

Benchmark performance