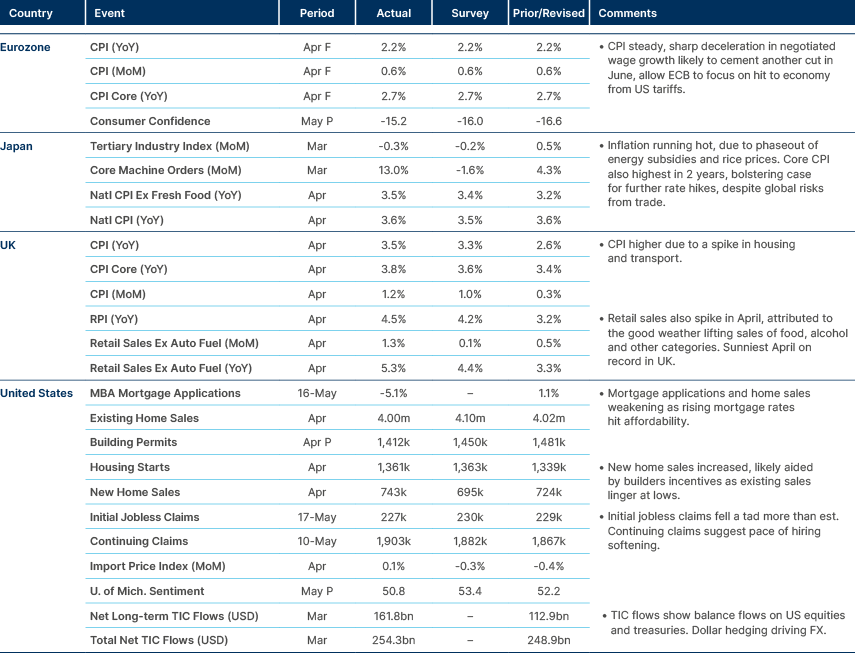

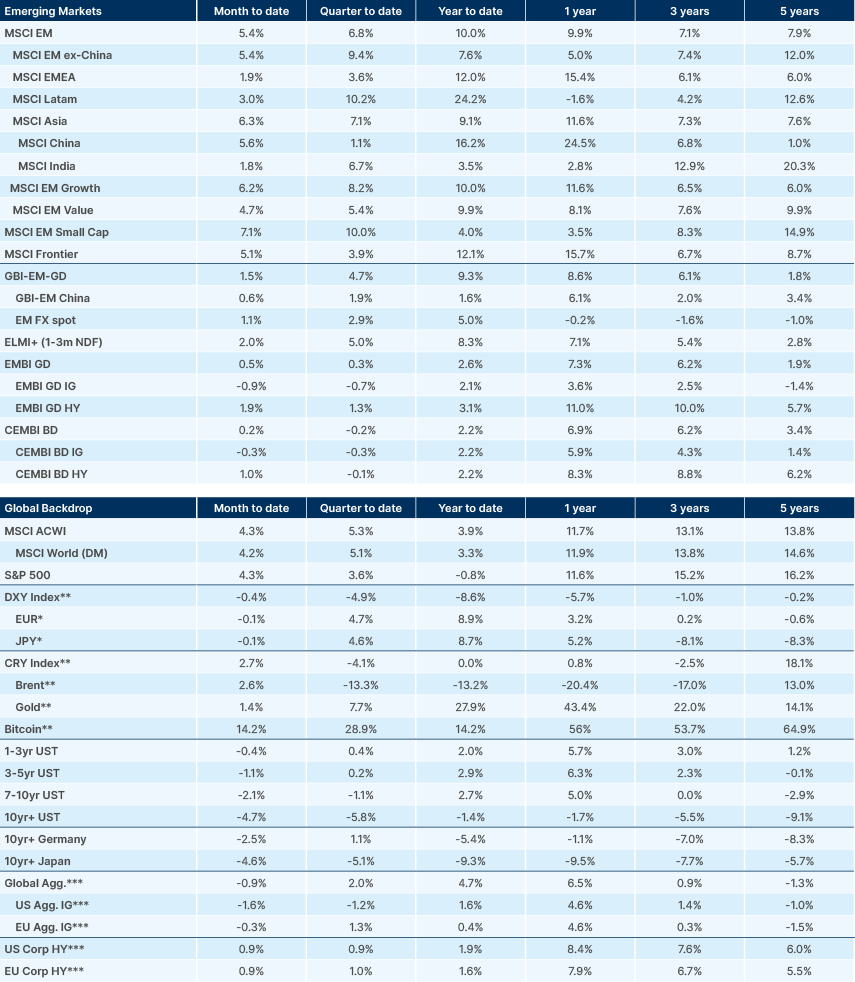

Strong EM outperformance year-to-date across equity, FX and fixed income

- EM outperformance YTD in equities, local currency debt, HY and IG bonds.

- Muted volatility in US equity markets not reflecting rising risks.

- Indonesia’s Finance Minister presented the 2026 macroeconomic framework.

- South Korean exports during the first 20 days of May fell 2.4% year-on-year.

- Argentina cut more capital restrictions, will issue first peso-denominated bonds in a decade on Wednesday.

- Brazil cancelled an attempt to raise revenue via a financial transaction tax but announced BRL31bn in expenditure savings.

- Trump’s meeting with South Africa’s Ramaphosa was very strange, but reportedly “productive”.

- South Africa Finance Minister announced updated budget plan; market digested it well.

- Türkiye posted its best April for foreign tourism since 2006.

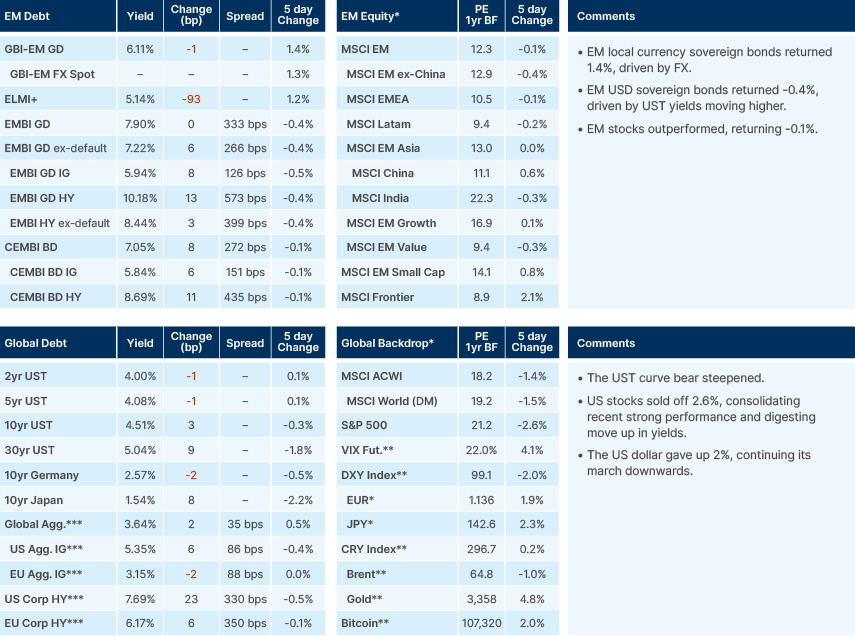

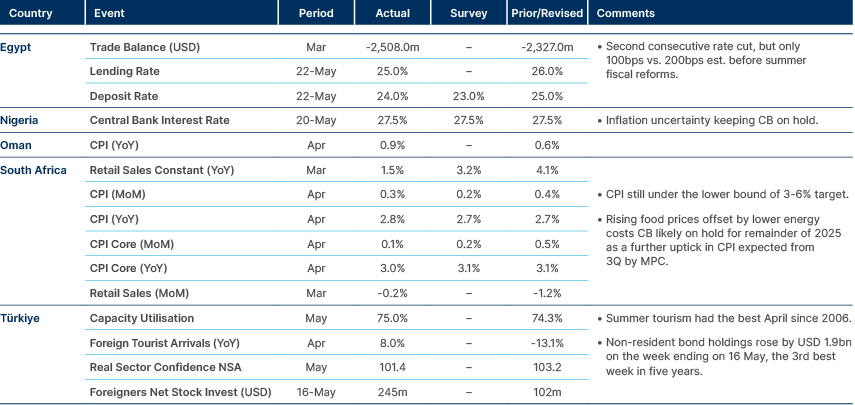

Last week performance and comments

Global Macro

Developed market bond yields settled last week, after Donald Trump’s “Big Beautiful Bill” passed through the House of Representatives and sent 30-year US Treasury (UST) yields above 5%. The 30-year is now trading at just under 5%, while Japanese Government Bonds (JGBs) are trading back at 2.8%, having risen to 3.15% last week. Yield consolidation may have been helped by commentary from US Treasury Secretary Scott Bessent, who is still promising a fiscal adjustment. He reiterated that a 3% deficit is a four-year target, but tariffs and stronger growth can help bring the deficit down to a 5%-handle in 2025. Deregulation remains the lever to supercharging growth, which will allow the US to diminish its deficit and debt as a percentage of GDP. Bessent also mentioned that a change in the supplementary leverage ratio for banks could bring UST yields down by “tens of basis points”.

In our view, higher US bond yields are leading to yet another shift in the market narrative. Markets’ digestion of the prospect of further fiscal stimulus in the US has driven long-end led curve-steepening but also supported lower equity volatility in May. The VIX index, a market proxy for volatility which measures the prices of call and put options on the S&P 500, traded at levels in May consistent with a risk environment more benign than the one US investors find themselves in today. In our view, investors are underestimating the negative impact of higher long-term yields on risky assets and the economy. Equity investors see high deficits as positive for growth, but high multiple stocks are acutely exposed to higher real interest rates. The surge in bond yields is a threat to market stability. It represents declining confidence in fiscal trajectories, exacerbated by a greater interest expense due to a rising debt stock. Furthermore, tariff risk remains high and the impact of tariffs on the economy has yet to show up in the data. With significant progress on trade deals not yet evident, US equity markets trading as though we are out of the woods on tariffs seems premature.

The dollar continued to sell off last week, falling 2%. While US ‘TIC’ data, which shows net-flows into US assets, has not yet been released for April or May, February and March data showed that flows remain positive at the margin, even as the dollar declined significantly (-4.5%) over the period. Proxy flows from equity and fixed income funds over this period and since have shown much higher allocation to Europe in lieu of the US, but still no significant outflows from US assets. Therefore, it seems evident to us that dollar weakness so far has been driven by FX hedging flows, rather than any widespread liquidation of US assets. If this liquidation does come, the moves could be more aggressive than what we have seen so far, both in terms of the dollar and in terms of outperformance of EM assets.

Emerging Markets

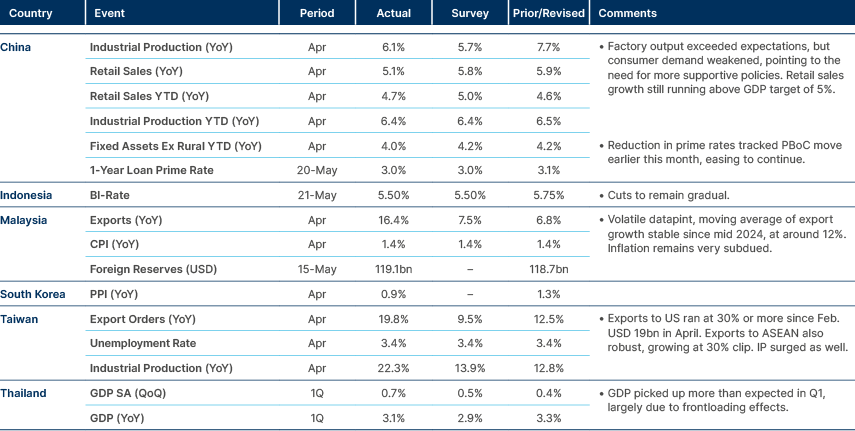

Asia

Taiwan exports and industrial production surge, probably due to rush to stock up during 90-day tariff pause.

Taiwan: Exports and industrial production surged, perhaps due to a front-loading of orders during the 90-day tariff pause, as buyers sought to avoid future levies.

India: The Reserve Bank of India transferred a record dividend of INR 2.7trn (0.75% of GDP) to the central government for FY25, compared with INR 2.1trn (0.64% of GDP) last year. This was boosted by higher dollar sales and exceeded the government's budget estimate of around INR 2.3trn by 0.12% of GDP. The surplus should help meet the fiscal deficit target of 4.4% of GDP for FY26, however, markets were unfazed, as higher dividends were already widely expected.

Indonesia: Finance Minister Sri Mulyani Indrawati presented the 2026 Macroeconomic Framework and Fiscal Policy Guidelines (KEM-PPKF) during a plenary session of the House of Representatives. The government projects state revenue of 11.7% to 12.2% of GDP, and state expenditure of 14.2% to 14.8% of GDP, resulting in a budget deficit of around 2.5% of GDP. GDP growth is targeted at 5.2% to 5.8%, with inflation in the 1.5% to 3.5% range and the rupiah at IDR 16,500–16,900 per USD. Socioeconomic targets include reducing the poverty rate to 6.5%–7.5%, lowering unemployment to 4.4%–5.0%, decreasing the Gini ratio to 0.38, and raising the Human Capital Index from 0.56 to 0.57.

South Korea: Exports during the first 20 days of May fell 2.4% year-on-year, compared with a 3.7% increase in April. On a per-day basis, exports rose to USD 2.6bn versus USD 2.2bn in April. However, daily export momentum weakened, especially to the US, probably reflecting tariff effects. Exports to the US fell 14.6% year-on-year, compared with -14.4% previously, while exports to China declined 7.2% and to the EU by 2.6%, following two months of double-digit growth. Exports to Vietnam rose by 3.0%. In terms of product categories, exports to the US declined in autos (-6.3%), auto parts (-10.7%), and steel (-12.1%). Other weak sectors included phones and computers (-6.0%) and household appliances (-19.7%). Semiconductor exports, however, rose 17.3% year-on-year, up from 10.7%, probably due to rush orders during the tariff pause.

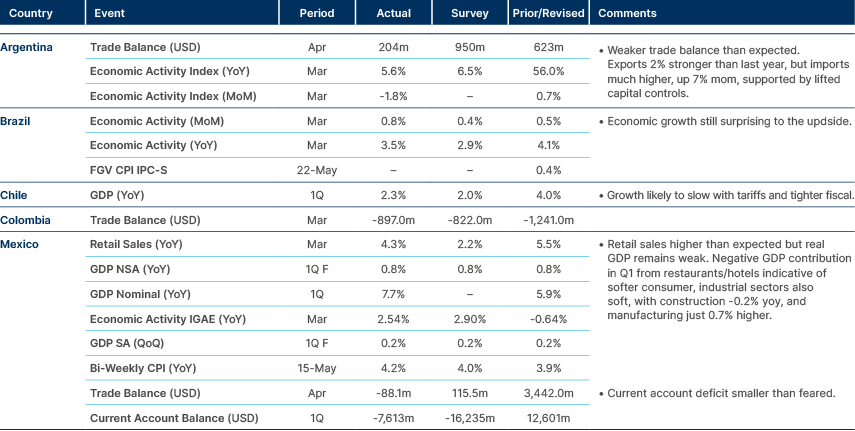

Latin America

Weaker trade surplus in Argentina and the economy remains soft in Mexico.

Argentina: The government announced the easing of capital restrictions from 1 June to encourage the formalisation of undeclared savings held in pesos or US dollars. Authorities estimate that Argentines hold between USD 160bn and USD 320bn outside the financial system, consistent with the international investment position data from INDEC, which reported USD 193bn held offshore or under the mattress. The intent is to liberalise “repressed consumption” by incentivising savers previously unwilling to declare their wealth. The policy will be introduced initially via presidential decree and later sent to Congress as draft legislation to avoid reversal by future administrations. It may be passed after the new Congress is installed on 10 December 2025.

Argentina also announced the first sale of peso-denominated debt in nearly 10 years. Wednesday’s auction will be for a maximum of USD 1bn of 2030 peso treasury notes, which can also be bought in dollars. Demand for the bonds will be a fascinating barometer of investor confidence in Javier Milei’s economic regime.

Brazil: The government’s announcement of BRL 31.3bn in expenditure restraint was well received by markets, initially strengthening the BRL to below 5.60 per USD. However, just over an hour later, a decree increasing the IOF (financial transactions tax) reversed sentiment, sending the BRL above 5.70 as some panic dollar buying occurred. After market close, the government reversed the IOF increase, stating after “dialogue and technical evaluation” that the tax would return to zero, abandoning the previously announced 3.5% rate. Other measures announced—such as a higher tax on remittances—remain in place. New taxes on credit will increase corporate funding costs, amounting to an effective hike in the Selic rate. Finance Minister Fernando Haddad said further tax measures would be announced by the end of the week. He also noted the government is trying to move past a structural primary deficit of 2% of GDP inherited from the previous administration. Brazil reportedly has BRL 800bn in tax exemptions, described by the ministry as a “black box” in the budget.

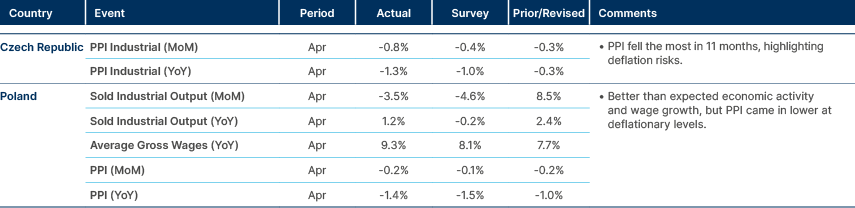

Central and Eastern Europe

Producer prices in deflation across Czech and Poland.

Central Asia, Middle East, and Africa

Türkiye’s tourism numbers and non-resident inflows increase.

South Africa: The Oval Office meeting between presidents Donald Trump and Cyril Ramaphosa was tense. Trump made controversial claims about a “white genocide” in South Africa, sharing images and videos alleging targeted attacks on white farmers. One such image, allegedly of mass graves, was later found to originate from the Democratic Republic of Congo. Despite the clash, both leaders called the meeting “productive.” South Africa proposed purchasing 75–100 million cubic metres of US liquefied natural gas annually for ten years, potentially totalling USD 12bn. The proposal also included duty-free vehicle export quotas and large shipments of steel and aluminium. Finance Minister Enoch Godongwana presented a revised budget on 21 May, projecting a deficit of 4.8% of GDP, up from the previous 4.6%, following the cancellation of a planned VAT hike. Gross debt is expected to stabilise at 77.4% of GDP in 2025/26, up from the earlier estimate of 76.2%. GDP growth for 2025 has been revised down to 1.4% from 1.9% due to weaker global conditions. More than ZAR 1trn is allocated for infrastructure over the medium term, and 61% of non-interest spending will go toward the social wage, including health, education, and grants. Additional funds include ZAR 3bn for troop withdrawal from the DRC and ZAR 1.4bn for local elections. The market reaction was muted, with the rand and bond yields largely stable.

Türkiye: Despite reports of high prices since last year, foreign tourism in Türkiye posted its best April since 2006. Visitor numbers are expected to rise sharply in the coming months as momentum builds.

Developed Markets

Softer wages in Europe. Hotter CPI in Japan and UK. US housing very weak.

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.