- Positive news flow on supply-side measures from China supported equity prices.

- Market noise around Trump firing Jerome Powell increased, but volatility was short-lived.

- US earnings off to a strong start.

- Indonesia confirmed a 19% tariff level with the US, negotiations on exemptions ongoing.

- Strong macro data from Malaysia. Thailand proposed a zero-tariff plan for 90% of US imports.

- Moody’s upgraded Argentina’s credit rating by two notches to ‘Caa1’.

- Colombia held rates, Colombian Peso strongest LatAm performer in ytd.

- Ukraine’s parliament confirmed Yulia Svyrydenko as prime minister.

- Egypt expanded VAT coverage.

- Fitch noted a credit upgrade possible for Zambia once more than 90% of commercial creditors agree terms on bonds still in technical default.

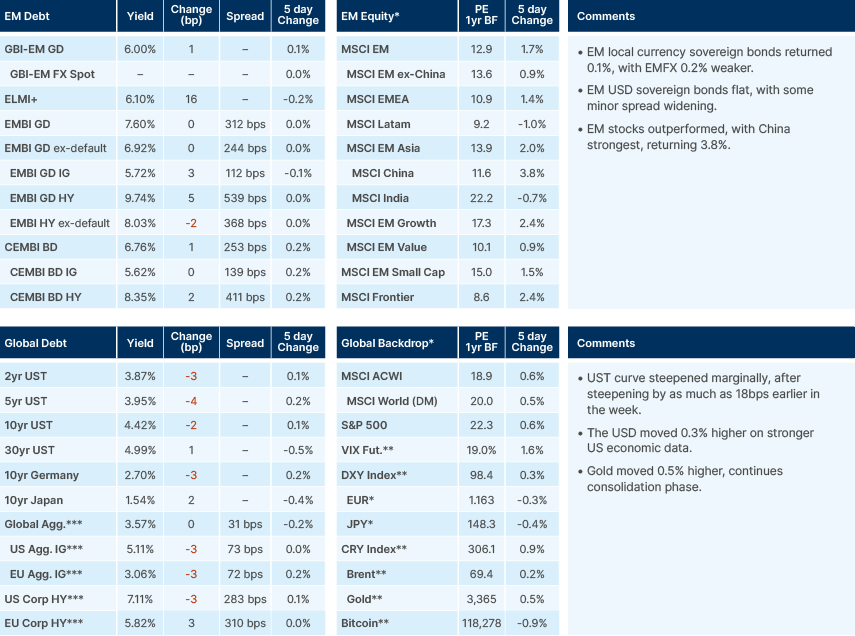

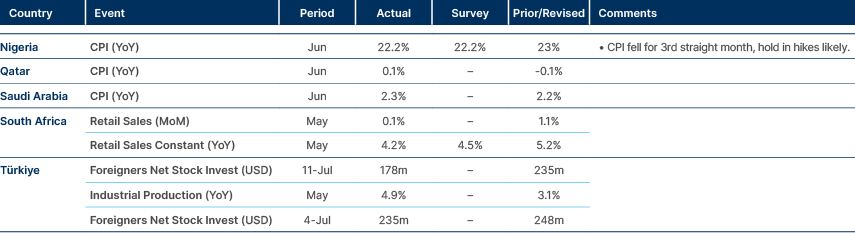

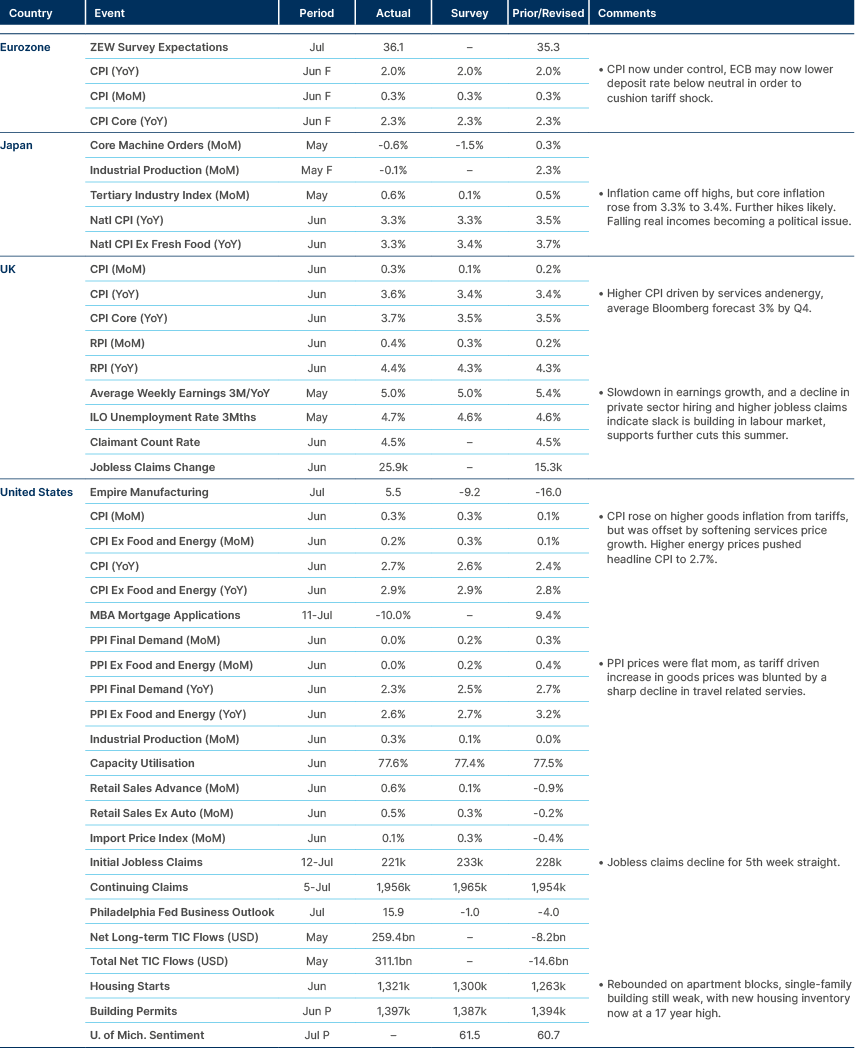

Last week performance and comments

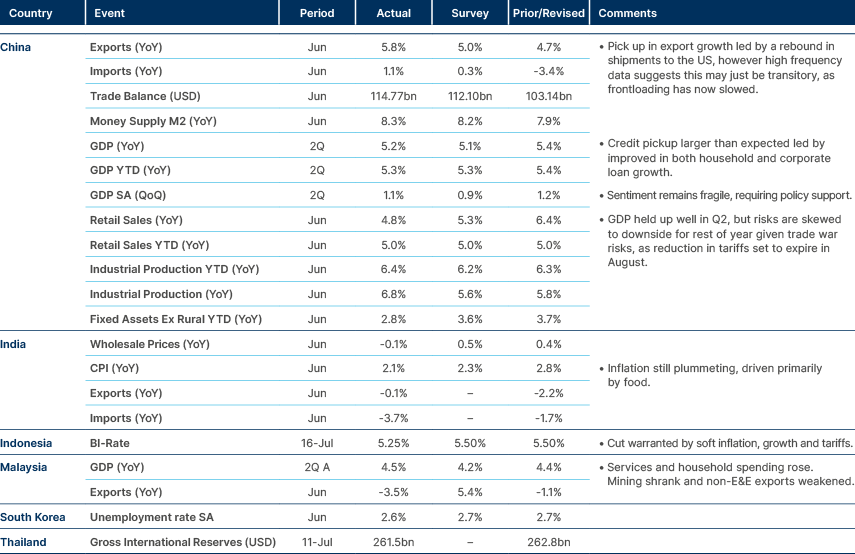

Global Macro

Markets have reacted positively to three topics in China last week, with Chinese stocks 3.8% higher. Firstly, policymakers are now explicitly focused on dealing with industrial over-capacity to end predatory price wars in key sectors. Known as ‘involution’ this race to the bottom is negatively impacting margins of innovative industries such as Electric Vehicles (EV) and solar panels and has contributed to the Producer Price index being in deflation for three years.

President Xi and the Politburo have previously identified ‘involution’ as a national risk, urging a shift in focus from output growth to industrial efficiency and quality. We flagged a change of language from Chinese policymakers earlier this month on industrial overcapacity, that indicated dealing with the issue had become a ‘top priority.’ Industry groups are already responding, solar-glass manufacturers announced plans to cut output by 30% at the end of June, and steel producers are scaling back capacity. Spot prices in coking coal, iron, and steel have risen on expectations of more disciplined supply. Now, the State Council have announced measures to directly curb ‘irrational competition’ in the EV sector, including tighter price monitoring, more emphasis on safety controls, improved supplier payment terms, and government coordination on production levels.

Secondly, there are signs emerging that there will be a broader rapprochement in US-China trade relations. The US government deciding to allow NVIDIA to sell advanced semiconductors to China is very significant and may have contributed to rumours of an incoming meeting between Trump and Xi Jinping, which would signal a grand accord on tariffs and US-China relations.

China also announced the commencement of the construction of Yarlung Tsangpo Dam on Xi Zang Plateau with planned capacity of 300bn kWh of electricity. This is the equivalent of 3x the Three Gorges Dam, currently the largest hydroelectric in the world in terms of generating power. The project is expected to cost Rmb1.2tn. Such projects are expected to support demand and generate spillover benefits across materials, construction, and engineering industries.

US President Donald Trump stirred up markets early last week with fresh reports he was asking Republican senators about the prospect of firing US Federal Reserve (Fed) Chair Jerome Powell. The news sent the USD index 1% lower and led to 18 basis points (bps) of steepening in the 2y10y Treasury curve. Later on Tuesday, Trump retracted his comments and said he discussed “the concept” with the GOP.1 Markets retraced the moves, but the signal from markets was clear; firing Powell would be bad. It is worth highlighting there is nothing in US legislation impeding Trump from replacing the Fed Chair, but removing Powell from the Fed board entirely would be another matter, as governors can only be removed for a legally valid reason.

A Wall Street Journal article since reported that US Treasury Secretary Scott Bessent persuaded Trump that firing Powell was unnecessary and would do more harm than good both in terms of capital market volatility and legal headaches. Also, the Fed is already moving towards cutting rates later this year. Trump denied these reports on his social media platform Truth Social, reiterating that he understands the market dynamics “better than anyone.”

In any case, as Bessent (reportedly), pointed out to the president, Trump is already well on his way to bringing the Fed closer to the MAGA2 orbit. Fed Governor Adriana Kugler’s term ends on 31 January 2026, and Powell’s term ends on 15 May 2026. Trump can replace Kugler with a more aligned candidate who would be set to become the next Fed Chair. The main candidates today are Kevin Hasset, Kevin Warsh, Scott Bessent, and Fed Governor Christopher Waller.

Markets would likely not take well to Hasset, due to fears of the loss of Fed independence and his lack of monetary policy experience. Bessent is more trusted as an operator, but he is unlikely to become the next Fed Chair, as it would blur the lines between the Treasury and the Fed. In our view, both Kevin Warsh and Christopher Waller are good candidates. Both are currently making the case that the Fed should accelerate the pace of balance sheet reduction, which would allow for lower fed fund rates.

Last week, Waller openly supported a 25bps cut in July. He claims the Fed can’t afford to wait any longer, given softness of private sector hiring, and likely negative revisions to payrolls imply the labour market is softer than thought. When asked about immigration, he correctly points out that there has been 10m net immigrants coming to the US between 2022-2024, which is 3x higher than the pre-pandemic period. A more important signal for labour markets, he points out, is that college graduate unemployment is rising and sits at elevated 7%.

Waller also argues that tariffs are a one-off price shock, and that only around a third of the price increase should be expected to be passed through to consumers, given long-supply chains where the tariff will be absorbed by margins in various stages, (tariff is paid once, by the importer). Furthermore, if price increase remains contained to goods, it should be irrelevant for policymakers. What monetary policy can control is aggregate demand, which is not growing anywhere near the 2020-2022 period, making any wages-prices spiral unlikely. Therefore, if tariffs are passed through to consumer goods prices, this will cut the disposable income available for the services sector, which is a far bigger part of the US consumer price index (CPI) basket, around 75%. This could potentially have a net deflationary impact, as Bessent has argued.

Governor Mary Daly (non-voter) had similar arguments to make the case for two 25bps cuts in 2025, as a base case. She mentioned that effective tariffs are already at 16%, but revenues at 8% suggests supply chain absorbing. Daly added that “if we wait until inflation gets to 2% before cutting”, then "we've lost" as likely to have "injured the economy" unnecessarily.

Japan’s Prime Minister Shigeru Ishiba refused to step down despite losing his majority in the Senate in elections over the weekend, having already lost control of the Lower House in October 2024. His Liberal Democratic Party secured 47 seats, falling three short of the threshold. In the lead-up to the vote, markets had already priced in a significant defeat, with risk assets softening and the Yen weakening modestly as investors grew concerned about political uncertainty. However, the actual result was less negative than expected. The main concern was the possibility of a change in Prime Minister, so Ishiba’s signal at today’s press conference that he intends to remain in office was viewed positively. Attention now turns to tariff negotiations. The probability of an early election or a no-confidence vote is seen as low, with the next scheduled general election not due until 2028.

Emerging Markets

Asia

Good data from China. Low inflation in India. Indonesia cut 25bps with more to come.

Indonesia: A trade deal was agreed with the US reducing the ‘reciprocal’ tariff of 32% to 19%. Details are still being negotiated, with Indonesia pushing for exemptions for key exports including palm oil and nickel.

Malaysia: GDP growth rose 4.5% yoy, driven by a broad-based expansion in services, particularly retail, finance and tourism, while resilient household spending offset a 7% contraction in mining. Net exports detracted from growth amid a soft global electronics cycle, although electrical and electronics (E&E) volumes remained above pre-COVID trends, suggesting continued benefits from supply-chain ‘friend-shoring’. In response to an expected weakening in global trade next year, Bank Negara Malaysia delivered a surprise 25bps rate cut in May and rolled out civil-service wage hikes and cash grants to support domestic demand. Fiscal space remains tight, with public debt around 63% of GDP, prompting the government to pursue progressive consumption taxes and subsidy realignment. Implementation risks are increasing ahead of the UMNO3-led coalition convention. Inflation decelerated to 2.1%, creating room for a more dovish policy bias. The Ringgit’s stability now hinges on the outcome of US tariff decisions and the Fed’s monetary path.

Pakistan: Torrential monsoon rains killed over 60 people within 24 hours, prompting ‘exceptionally high’ flood alerts in Rawalpindi, Lahore, and the Jhelum basin. Seven emergency relief camps were opened, and provincial authorities re-activated NDMA4 protocols to respond to the widespread damage. Bridges, feeder roads and power infrastructure were affected, putting wheat transportation to Karachi port at risk. Reconstruction costs could reach 0.4% of GDP. Islamabad plans to request an updated climate-resilient infrastructure facility from the Asian Development Bank (ADB) and World Bank in lieu of ad-hoc support. The disaster has revived the domestic debate around loss-and-damage funding ahead of COP 30 and highlighted a significant insurance gap for sovereign sukuk investors. The broader macro picture remains fragile, and the FY-25 primary surplus target of 0.3% of GDP may slip, complicating the International Monetary Fund’s (IMF) ninth programme review scheduled for September.

Philippines: The June SWS survey showed the net-satisfaction index rose 10ppt to +48, narrowing the gap between President Ferdinand Marcos Junior and Vice President Sara Duterte. The administration signalled that the 28 July State of the Union Address would focus on a rice tariff cap, VAT reform on digital services and new guard-rails for the Maharlika sovereign wealth fund. The fiscal deficit is tracking at 6% of GDP, down from 7.3% in 2024, supported by higher excise revenues and underspending on capital projects. This creates modest room for pre-election fiscal stimulus. The Philippines peso is stable in a PHP57–58/USD band, with the central bank expected to cut rates by 25bps in Q4, only after the Fed moves. Remittance inflows remain solid at 3% yoy. Bond markets are watching a Supreme Court ruling on the Mandanas law, which could reshape the framework for revenue-sharing between the central and local governments.

Thailand: Deputy Prime Minister Pichai Chunhavajira proposed a zero-tariff regime on 90% of US imports while protecting sensitive sectors such as rice, sugar and auto parts. He warned that tariff rates must remain within 10ppt of regional peers to preserve competitiveness. A bilateral US-Thai framework is expected by 1 August, which will influence the pace of supply-chain shifts from China. The SET index rallied 3% on tariff optimism, although the Thai baht underperformed after the Bank of Thailand held rates steady at 2% despite core inflation sitting at 0.9%. The cabinet approved a THB 500bn infrastructure fund for elevated rail and Eastern Economic Corridor (EEC) port projects, signalling confidence in capital inflows despite higher US yields. Domestic political risks remain muted. Talks on Senate reform are ongoing, and early elections are unlikely before succession-related developments become clearer.

Vietnam: Leather and footwear exports totalled USD 14bn in H1 2025, up 10% yoy, with the industry targeting USD 29–30bn in exports this year. The US remains the top market, though firms are increasingly diversifying into Canada and Latin America to pre-empt possible Section-301 trade action, aided by CPTPP5 preferences. The average factory wage remains around USD 190, maintaining Vietnam’s cost advantage over Thailand and Malaysia despite a 9% statutory hike in July. The State Bank stepped up Vietnamese dong liquidity injections to meet seasonal USD demand from apparel importers, keeping the VND stable at 25,200. Environmental, social and governance (ESG) scrutiny is rising, particularly as the EU’s Carbon Border Adjustment Mechanism pilot programme pushes tanneries to adopt wastewater recycling technologies, a capex trend that remains underappreciated by markets.

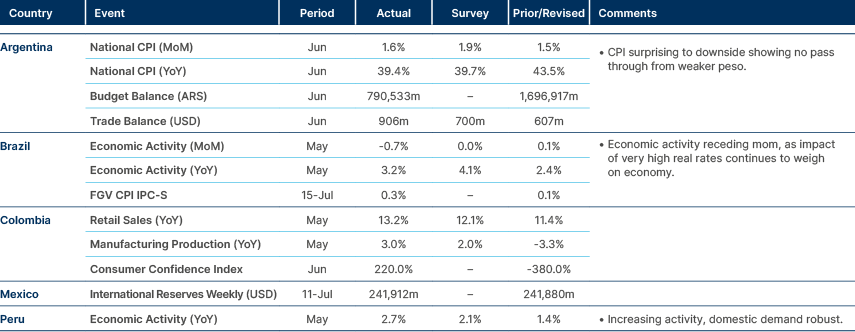

Latin America

Argentina CPI and Brazil activity surprised to the downside.

Argentina: Moody’s upgraded Argentina by two notches following the easing of capital controls and the IMF board’s approval of a combined USD 10bn augmentation to the Extended Fund Facility. The rapid float of the Peso has helped narrow the parallel market spread to 12%, reducing pressure on central bank reserves. However, inflation expectations remain entrenched, with one-year breakeven rates hovering near 40%. The trade surplus narrowed to 1.6% of GDP as fertiliser and capital-goods imports rebounded. Analysts now forecast a current account deficit of 3–4% in 2025. President Javier Milei reiterated his intention to veto any “populist” spending bills, reaffirming the government’s 2% GDP primary-surplus target. A fiscal showdown is building around a proposed provincial revenue-sharing bill. Meanwhile, the T-bill curve steepened 250bps month-to-date as investors shifted towards USD-linked instruments to hedge against ongoing FX volatility.

Brazil: The Supreme Court froze competing IOF tax on financial transaction proposals worth BRL 11.5bn (0.1% of GDP) and scheduled a mediation hearing for 15 July, underscoring its increasing influence over the fiscal outlook. President Lula’s approval ratings edged up following the Trump tariff threat, though 68% of voters remain undecided ahead of the 2026 elections, limiting political space for new spending initiatives. Congressional dissent blocked a proposal to expand the Lower House to 531 seats on fiscal grounds, though a renewed push is expected in October. A constitutional amendment to spread precatório (court-ordered debt) repayments over 2027–29 was well received by markets. The Finance Ministry set up an intellectual property retaliation taskforce but continues to lobby Washington to delay tariff implementation, attempting to balance diplomacy with domestic industrial concerns.

Colombia: The central bank held its policy rate at 9.25% with a 4–2–1 vote split, as board member Laura Moísá joined the gradual cutting camp. A more accommodative stance remains conditional on core inflation falling below 5% by Q4. The government proposed lifting the 70% cap on foreign assets held by private pension funds, potentially repatriating COP 150tn (around 11% of GDP) over two to five months. Legislative support for the measure is uncertain. Fiscal pressures are rising as only six of 29 health insurers (EPS) remain solvent, with COP 33trn in arrears prompting an emergency decree. The Peso remains LatAm’s best performer year-to-date (+7%), but could weaken if pension fund inflows crowd out sovereign external issuance. Hydrocarbon royalties fell 22% yoy as the licensing pause continued, putting pressure on regional budgets to comply with fiscal rules.

Mexico: President Claudia Sheinbaum met Prime Minister of Canada Mark Carney to prepare for potential US protectionist moves under USMCA.6 Pemex is targeting over USD 8bn in private asset sales, including at Ixachi and Quesqui fields, to ease its amortisation hump. Fitch, however, flagged covenant risks if oil prices remain below USD 70. A dovish shift at Banxico and a headline CPI inflation reading of 4.1% have led the market to expect a 25bps rate cut on 7 August, which would lower the policy rate to 7.75%. After the US Trade Representative imposed a 17.1% anti-dumping duty on Mexican tomatoes; the Foreign Ministry called the action “electoral theatre” and pledged to escalate the dispute at the World Trade Organization. The 2025 budget draft keeps the fiscal deficit near 4.5% of GDP. Oil price hedges resumed after a one-year pause, with a floor price set at USD 67/bbl.

Panama:Teachers unions reached a deal with the government on the pay scale and school-repair schedule, allowing classes to resume on 22 July and limiting the learning gap. The administration pledged to accelerate canal dredging and expand port capacity following a 25% drop in transit slots during H1 due to El Niño-related drought. Moody’s retained a negative outlook on the sovereign (Baa3), though the resolution of the strike removed a key short-term downgrade trigger. The pension bill was shelved until after the October municipal elections, reducing the risk of fresh protests. Balboa bonds remain cheap versus regional peers, despite IMF praise for Panama’s medium-term plan targeting a 2.5% primary surplus.

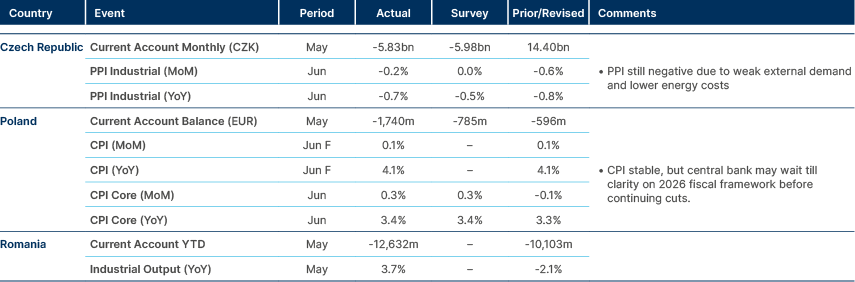

Central and Eastern Europe

Czech PPI remains in deflation, Poland CPI stable.

Poland: The latest CBOS (Centre for Public Opinion Research) poll showed 27% of voters support a Civic Coalition–Third Way government after 2027, ahead of 23% for the PiS–Konfederacja bloc, despite the persistent EU rule-of-law premium. The Tusk government is prioritising EU fund disbursements and judiciary reform, with a draft bill to limit Supreme Court powers now under consideration. However, President Andrzej Duda may veto the measure. Inflation declined to 2.6%, and the National Bank of Poland indicated a 50bps rate cut is possible in September if the Zloty remains below 4.5 per Euro. The fiscal deficit is forecast at 5.1% of GDP, mainly due to elevated military spending.

Romania: Brussels has proposed EUR 60.2bn for Romania under the 2028–34 Multiannual Financial Framework. The Agriculture Ministry opposes a merger of CAP and cohesion funds, despite the overall fiscal windfall. Industrial production rebounded strongly in May, rising 11.6% yoy on the back of strength in autos and machinery following a weak Q1. However, persistently high energy costs raise concerns about the durability of the recovery. Fitch is scheduled to review Romania on 15 August. The government’s consolidation bill aims for a one percentage point deficit reduction per year, targeting 3% of GDP by 2027. Policy continuity is clouded by a rotation agreement under which the PSD will assume the premiership in 2027. The RON remains quasi-pegged to the euro through FX-swap tightening; high carry continues to attract foreign interest, particularly from Swiss-based funds.

Türkiye: Istanbul’s mayor received a 20-month sentence for “insulting” a prosecutor. While appeals could drag beyond 2026, a final conviction would disqualify him from office. Talks have resumed with the US over a potential CAATSA7 waiver and Patriot missile sale, offering a secondary tailwind for capital inflows.

Ukraine: Parliament confirmed 39-year-old Yulia Svyrydenko as Prime Minister (PM), consolidating the economy, agriculture and environment portfolios into a new super-ministry. Outgoing PM Denys Shmyhal has been appointed Defence Minister, placing him in charge of 36% of GDP allocated to war-related spending and domestic arms production. Grain exports have fallen 69% so far this season following the lapse of the EU’s tariff-free regime. A poor harvest outlook is adding further FX pressure. The US has approved delivery of three Patriot batteries from Germany and Norway, funded by the EU, improving Ukraine’s air-defence credibility. The IMF projects GDP growth of 4% in 2025, contingent on reopening maritime trade corridors, a key upside swing factor for the Hryvnia.

Central Asia, Middle East, and Africa

Nigerian CPI fell again.

Egypt: Parliament expanded VAT coverage to include fuel, alcohol, cigarettes and crude, aiming to generate EGP 200bn (approximately 1% of GDP) in FY-26. Cairo repaid USD 1bn in arrears to international oil companies, reducing the backlog to USD 2.5bn, with a full clearance target set for September. Disbursement of the next IMF tranche remains conditional on implementation of energy-price pass-through measures. The official exchange rate is 50.5/USD, while the parallel rate remains 15% weaker. Remittances have stabilised after two years of declines. A diaspora sukuk offering was 3.2× oversubscribed. Wheat buffer stocks stand at 5.1 months, softening the near-term food-price impact.

Ghana: Producer-price inflation dropped to 6.8% yoy in June from 11.6% in May, driven by fuel-tax holidays and a firmer Cedi. Headline CPI inflation is likely to enter single digits by Q4. The Bank of Ghana is preparing a 300bps rate-cut cycle if the fiscal trajectory remains stable. The Eurobond curve flattened following cocoa-windfall hedging, while domestic T-bill demand remains robust after the IMF board’s recent approval. Energy-sector arrears of USD 1.8bn persist, but a World Bank development policy operation tranche is earmarked for implementing a new cash-waterfall system. Political noise remains limited ahead of the 2026 elections, and a constitutional review to cap central bank overdrafts has gained broad support.

Kazakhstan: Fitch highlighted that sovereign assets stand at 36% of GDP while debt remains around 25%, giving the government space to absorb commodity shocks. Authorities funnelled excess oil revenues into the National Fund, resulting in a 12-month rolling fiscal surplus of 2.2% of GDP despite front-loaded capital expenditure in H2. The Tengizchevroil expansion is now 92% complete, with peak output delayed to 2026 but still underpinning medium-term growth. The banking sector clean-up continues, with non-performing loans down to 4.8%. However, corporate governance reform for quasi-state entities remains slow. Tenge volatility has been modest (-3% YTD) due to the development of onshore derivatives. Sanctions spill-overs on transit trade remain a key risk to watch.

Morocco: The 2025 fiscal deficit is projected at 3.5% of GDP and expected to decline to 3% by 2027 as energy subsidies are gradually removed. Public debt is forecast to remain under 66% of GDP. The ONCF8 bond buyback programme eliminated a near-term technical-default risk, tightening sovereign spreads by 30bps. The Dirham is trading near the top of its band, supported by an 18% yoy increase in tourism revenue and continued diaspora inflows. An agricultural rebound following the 2024 drought is supporting the balance of payments, although rising water stress is accelerating demand for desalination projects. A memorandum of understanding with the EU on green hydrogen could provide further upside to the foreign direct investment pipeline.

Nigeria: Crude oil production in June reached 1.55mbd, just meeting the OPEC quota but still well below the 2025 budget assumption of 2.06mbd. New fiscal terms under the Petroleum Industry Act have attracted interest in Shell’s asset sales, although timelines for final investment decisions remain uncertain due to insecurity in the Niger Delta. Headline inflation remains elevated at 28%, though food inflation is easing. The Central Bank of Nigeria’s unified FX window has stabilised the naira at NGN1,150/USD following record diaspora-bond inflows. A 50% electricity-tariff hike for Band A customers is essential to improving power-sector viability, although union opposition is mounting. The 2032 Eurobond is yielding 11%, making it one of the cheapest in high-beta Africa. A new oil-backed facility could provide a near-term rally catalyst.

Qatar: Hydrocarbon revenue fell 17% yoy, but a 37% increase in non-oil receipts limited the fiscal deficit to QAR 0.8bn. The full-year shortfall is expected to stay below 2% of GDP. The budget targets a 4.6% spending increase focused on education and healthcare. Public debt remains comfortable at 45% of GDP. The liquified natural gas (LNG) expansion at North Field South is on schedule, with first gas expected in 2026, adding 16mtpa and supporting sovereign-wealth inflows. An MSCI classification review in August may lift foreign ownership limits, offering a potential near-term equity-market catalyst. The riyal peg remains firmly backed, with FX reserves covering over 55 months of imports.

Saudi Arabia: A USD 10bn lease-back deal led by BlackRock will finance gas-processing and pipeline infrastructure at Jafurah while keeping Aramco ownership intact. The investment supports the goal of raising gas output by 60% by 2030, essential for blue-hydrogen development and reducing oil use in power generation. The fiscal breakeven oil price has declined to USD 75/bbl due to the gas-revenue offset. The 2025 budget projects a 1% GDP deficit. The Public Investment Fund is accelerating its IPO pipeline—including Riyadh Air and NEOM utilities—to recycle capital into Vision 2030 projects. Geopolitical risk remains low, with a ceasefire holding in Gaza and progress continuing in Yemen peace talks, keeping sovereign spreads tight.

Senegal: The government renegotiated the ACWA desalination project, doubling solar generation to 300MW, cutting water tariffs by 9%, and securing state equity, improving project affordability. S&P downgraded the sovereign as debt rose to 118% of GDP. The 2025 Eurobond maturity may require IMF augmentation if fiscal consolidation falters. President Bassirou Faye met Benin’s President Patrice Talon and reaffirmed that WAEMU9 reserve pools are not to be used for sovereign bailouts. A review of the mining code aims to capture upside from lithium exports while maintaining investor certainty. The CFA Franc (FCFA) peg remains credible, with the spread to Côte d’Ivoire narrowing on improved political sentiment.

South Africa: A leaked report implicated a Democratic Alliance Member of Parliament in alleged US-linked disinformation about tariffs, prompting the party to seek assurances from President Cyril Ramaphosa on due process and cabinet balance. The Government of National Unity (GNU) has not yet agreed on who will lead National Treasury beyond 2026. Eskom’s debt relief plan remains stalled in a parliamentary committee. The June PMI declined to 47.5 due to load-shedding, although private sector capital expenditure continues to rise in battery storage and green hydrogen. The South African Reserve Bank held rates at 8.25%, with the first cut expected in November if wage negotiations remain contained. The South African rand’s correlation with copper prices strengthened (0.78), reinforcing its role as a global commodity proxy.

Zambia: Fitch noted that a credit upgrade is possible once more than 90% of commercial creditors agree on comparable terms. Currently, 27% remain in technical default following the Eurobond swap. China holds over USD 6bn in claims, and progress on comparable treatment remains slow. The kwacha has appreciated 12% since December, helped by a rally in copper prices and recent export-tax reforms. The 2026 draft budget includes a proposed VAT hike from 16% to 18% and a reduction in fuel subsidies. The IMF has urged the government to sequence reforms carefully to avoid backlash. Authorities are overhauling the mining licence cadastre to encourage junior exploration and expand long-run FX inflows.

Developed Markets

Eurozone CPI stable at target, tariffs related goods inflation rising in US.

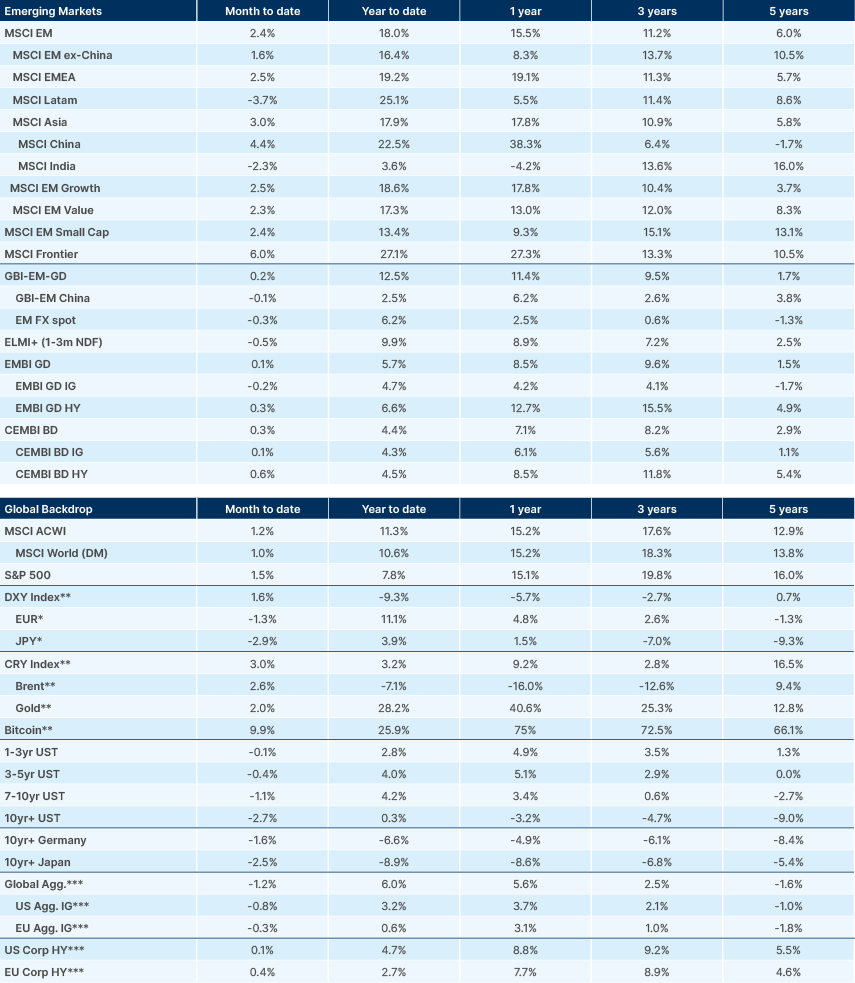

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

1. GOP: Grand Old Party.

2. MAGA: Make America Great Again.

3. United Malays National Organisation.

4. National Disaster Management Authority.

5. The Comprehensive and Progressive Agreement for Trans-Pacific Partnership.

6. The United States-Mexico-Canada-Agreement.

7. Countering America’s Adversaries Through Sanctions Act.

8. Morocco’s national railway operator.

9. West African Economic and Monetary Union.