- Brazilian political volatility increased, after Bolsonaro Jr said he would run for president in 2026.

- US data solidifies the (fully priced) fed funds rate cut in December.

- Future rate path will be data and Chair dependent in 2026.

- Commodities could throw a spanner in the works of disinflation.

- The US government talks openly about a Venezuela power transition.

- Lebanon and Israel held first talks since 1993.

- China’s trade surplus continues to increase alongside Korea and Taiwan.

- Fitch downgraded Hungary’s ‘BBB’ rating outlook to negative, as expected.

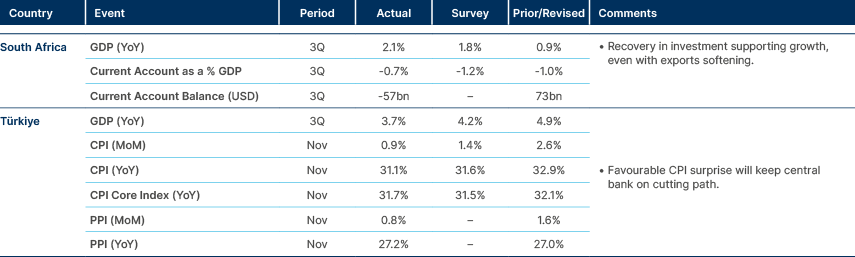

- Inflation coming down fast in Ghana, inching down in Türkiye.

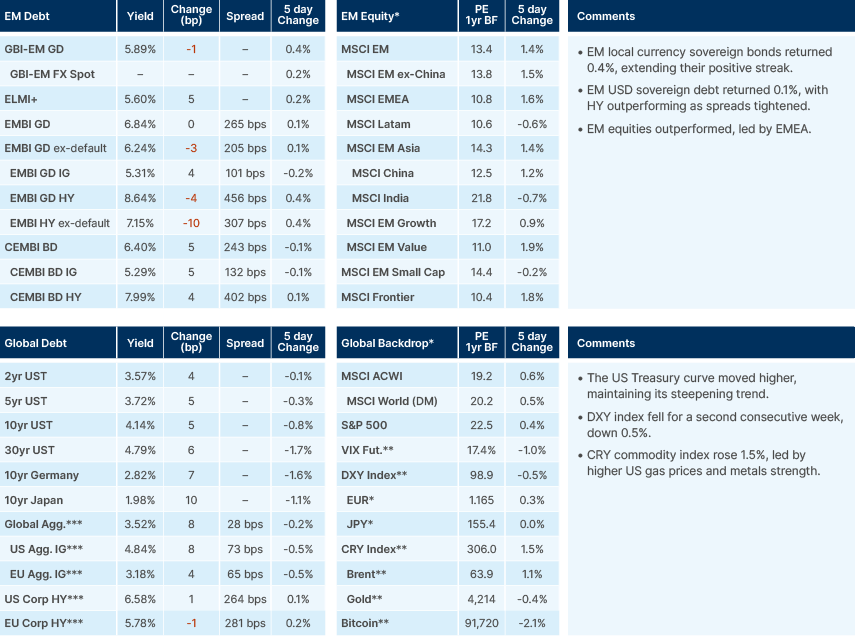

Last week performance and comments

Global Macro

Markets continued to stabilise last week, with the VIX index dropping to levels not seen since 2021, and the MOVE index falling to levels not seen since January. Credit spreads tightened. Emerging markets (EM) benefitted from this drop in volatility, outperforming in a beta recovery in both stocks and high yield (HY) bonds. The USD softening for a second consecutive week also supported returns in EM assets.

All eyes now turn to Wednesday’s Federal Open Market Committee (FOMC) meeting. Markets are expecting a ‘hawkish’ cut, with a 93% chance of a rate cut, but then only a 27% chance of a further cut in January. Employment data last week was mixed, with the ADP private sector payrolls dropping by 32k, with small businesses shedding 120k jobs, the most since the pandemic. Watching SME employment trends is key: between Q1 2021 and Q2 2024, SMEs made up 53% of net job creation. Interestingly, mentions of artificial intelligence (AI) in the S&P SmallCap 600 index rose meaningfully in Q4 this year, suggesting some of the firings may be related to AI-driven efficiency gains, a trend we expect to continue into next year. US jobless claims were better than expected, with 191k new claims vs 220k expected, but this data was likely influenced by Thanksgiving last week. Challengers job cuts mean-reverted from last month’s -153k to -72k, but the three-month moving average remains weak at -93k.

From the inflation side, US core personal consumption expenditures (PCE) inflation data for September came in at 2.8%, unchanged from August. This data is now relatively stable, however, it showed a decrease in goods price inflation versus August, defying expectations of accelerating tariff-related passthrough. Rental prices remain the largest driver of above-target inflation, running at 3.5%. For more forward-looking data, the ISM survey data came in last week. The services index came in stronger than expected at 52.6, but crucially the prices paid component fell to a seven-month low of 65.4, versus 68.0 expected.

At the margin, inflation data is better than expected, and employment data continues to point to labour market deterioration. This should bring confidence that the Federal Reserve (Fed) will continue a cutting path in the coming months. However, due to the slow deterioration of the jobs market, the delay in data from the government shutdown and the stickiness of above-target inflation, the market’s pricing of the Fed’s next moves – just two cuts priced over the next six months – is probably accurate. The key swing factor here, in our view, would be an appointment of Kevin Hassett as the next Fed Chair, possibly in January, which would likely lead to a faster path of cuts being priced.

In other news, the Supreme Court is due to hear oral arguments in the case determining if President Trump had the authority to dismiss Federal Trade Commissioner Rebecca Kelly Slaughter without cause. A ruling is unlikely until the first half of next year, but the line of questioning around the oral arguments could help shape the market’s assessment of the possible outcome.

Commodities

The Bloomberg Commodity index has broken out of its three-year range, led by surging metals prices and now a very large spike in natural gas prices, with US prices rising over 50% since late October. This is the highest level in nearly three years and has been driven by cold weather in the US and increasing liquified natural gas (LNG) export flows, which are up 40% annually. In other parts of the world, such as Europe and Asia, natural gas prices have continued to fall to multi-year lows over the past month, primarily due to the extra supply from US exporters. US gas prices remain very cheap versus European prices, making it much more lucrative for US producers to export gas.

Copper hit a record high on worries over US tariffs causing a global supply squeeze. The LME benchmark is up over 30% this year, due also to mine outages that have tightened supply. Silver hit multiple record highs last week, reaching nearly USD 59 an ounce on Wednesday amid Fed rate cut expectations, and the strongest exchange-traded fund (ETF) inflows since July, with speculative fervour returning.

Geopolitics

US-Venezuela

The Pentagon has disclosed it has prepared contingency plans should Venezuela’s President Nicolás Maduro go into exile. Pentagon spokeswoman Kingsley Wilson stated that US forces stand "fully at the disposal" of President Trump. US lawmakers are demanding a War Powers vote after Trump's pledges of imminent attacks on Venezuela. Senate Democrats have raised concerns about the constitutional authority for such military operations.

Israel - Lebanon - Palestine

Lebanese and Israeli civilian representatives held their first direct talks in decades on Wednesday, 3 December, at the UN peacekeeping force's headquarters near the Israeli border in Lebanon. It was the first direct public engagement between the two countries since 1993. Israeli government spokeswoman Shosh Bedrosian described the meeting as "an initial attempt to establish a basis for a relationship and economic cooperation." The meeting was conducted under a year-old ceasefire monitoring mechanism. Lebanese Prime Minister Nawaf Salam clarified these were not broader peace talks, but emphasised Lebanon was on track to disarm Hezbollah in the south by the 31 December deadline. However, Israeli military officials warn Lebanon may not meet this US-imposed deadline, risking escalation. Hezbollah has rejected direct talks with Israel and organised protests during the negotiations.

Separately, Qatar said it hopes to push Israel and Hamas to the next phase of Gaza ceasefire negotiations "very soon" following their October agreement. Israel announced it would open the Rafah crossing to allow Palestinians to leave Gaza and awaits the return of the last hostage remains. The Trump administration has been fostering these diplomatic contacts while pressuring Israel to prioritise diplomacy.

Russia-India

Russian President Vladimir Putin arrived in India today for his first visit since the 2022 Ukraine invasion, beginning a two-day state visit with Prime Minister Narendra Modi that tests India's balancing act between Moscow and Washington. The visit aims to deepen defence, energy, and trade ties despite mounting US pressure on India to reduce Russian oil purchases. European envoys have privately urged India to lean on Putin to end the Ukraine war. Ukraine sees the Modi-Putin talks as a test of Russia's oil lifeline. Russia’s Defence Minister Andrei Belousov is part of the delegation to negotiate sales of fighter jets and air defence systems. The countries aim to expand bilateral trade to USD 100bn by 2030 from the current USD 69bn, demonstrating the strength of their relationship despite Western pressure.

Emerging Markets

Asia

Asian exports remain solid. The Reserve Bank of India cut its policy rate by 25bps to 5.25%.

China: The trade surplus hit a USD 1trn record for the year to November. Exports grew 5.9% yoy in November (4% consensus) after a 1.1% decline in October. Exports to the US fell 29% during the month, the biggest drop since August. In other news, the Politburo released a statement saying China will continue to adopt a more active fiscal stance and a moderately loose monetary policy in the coming year. Key priorities include boosting domestic demand, accelerating innovation to foster new growth drivers, and deepening reforms for high-quality development.

Thailand: Consumer confidence rose for a third month to a six-month high of 53.2%, supported by government stimulus. Sentiment nevertheless remains fragile as high living costs, flooding, and tensions on the Cambodian border weigh on households. Improvements were seen across economic expectations, job prospects, and income outlooks, but conditions remain far from neutral levels.

Vietnam: The central bank raised its open market operations (OMO) rate by 50bps to 4.5%, the first increase since September 2024, as liquidity tightened and interbank rates rose above 7.0%. A USD 500m swap was announced to ease pressures, with spot–forward operations designed to inject short-term FX liquidity. OMO activity expanded materially, resulting in a net VND 3.2trn liquidity injection for the week. The moves underscore the central bank’s effort to stabilise funding conditions while maintaining a cautious policy stance amid tightening liquidity.

Latin America

Brazil PPI inflation dropped more than expected; Chilean activity remains supported.

Argentina: The October current account deficit of USD 2.6bn was partially offset by a USD 1.2bn financial account surplus. Year-to-date, Argentina continues to run a small external surplus of 0.1% of GDP, which in our view does not suggest an overvalued currency despite recent market concerns. Macro stabilisation remains on track: GDP growth is around 3.8%, inflation has fallen from above 200% to 32% yoy, and both fiscal and external positions are in surplus.

Economic Minister Luis Caputo announced the issuance of a new dollar-denominated BONAR bond maturing in November 2029 with a 6.5% coupon, paid semi-annually. The operation is designed to secure financing for the USD 4.2bn due in January and reduce pressure on central bank reserves. Caputo reiterated the government’s commitment to maintaining the FX band and highlighted USD 30bn in central bank debt repayments this year and USD 50bn in total debt reduction. Strong demand for the bonds would ease concerns around reserve stability and likely compress sovereign spreads.

President Javier Milei’s approval rating recovered to 42.6% in November as disapproval fell from October highs, though net approval remains slightly negative. Consumer confidence is still weak, as perceptions of current economic and labour conditions remain depressed, albeit expectations marginally improved.

Brazil: Markets experienced significant volatility last Friday as Senator Flavio Bolsonaro, the elder son of former president Jair Bolsonaro, announced his presidential candidacy with his jailed father's blessing. However, Flavio subsequently indicated he could abandon his presidential bid for a "price", namely a bill granting amnesty to those convicted for 8 January coup riots, which would benefit his father. The former president remains ineligible while in jail, with limited pathways for political return. A Supreme Court release appears unlikely. The Congressional amnesty vote requested by Flavio is possible but won’t be easy, despite his attempts. This leaves a potential pardon from São Paulo Governor Tarcísio de Freitas if he wins the presidency. The fact that the Governor will play a pivotal role in the amnesty deal and a pardon scenario, and that Flavio’s candidacy is a bargaining tactic, means Tarcisio remains the most likely candidate of the centre right, in our view.

The political volatility may delay central bank rate cuts, initially expected in January, to March. If Flavio formally enters the race, Tarcisio won’t run, and the odds of President Lula being re-elected will increase. The data makes a case for a December cut; last November, producer price index (PPI) inflation fell to -0.44% yoy from +0.73% in October, well below expectations. The sharp decline reinforces the disinflation trend across tradable goods and supports expectations that headline inflation will continue to soften into early 2026.

The real economy is performing well. Oil production also continues to rise, surpassing 4m barrels a day as Petrobras ramps up output at the world’s largest deep-water field. National production is up 24% this year, and Petrobras has raised its short-term production target by 100k barrels a day to 2.5m next year. Combined with rising supply from OPEC+ and non-OPEC producers, the International Energy Agency (IEA) now expects a record global surplus in 2026. TikTok announced a USD 37.7bn investment to build its first Latin American data centre in Ceará, in partnership with Omnia and renewable-energy provider Casa dos Ventos. The project will run entirely on clean energy. Brazil continues to dominate the region in data centre buildout, with 195 operating or announced facilities, far ahead of Chile (67), Mexico (63), Colombia (42), and Argentina (42).

El Salvador: Remittances rose to 27.7% of GDP in Q2, the highest share since 1991 and now the economy’s main FX source, surpassing exports, foreign direct investment (FDI), and tourism. The increase comes despite elevated uncertainty given US plans for large-scale deportations, highlighting structural dependence on migrant income flows.

Mexico: President Trump suggested the US might let the USMCA expire and negotiate “another deal”, though markets showed no concern and the MXN strengthened modestly. The reaction signals investors perceive the comments as rhetorical rather than signalling intent, which we agree. Still, negotiations in 2026 are likely to be volatile given the US administration’s preference for maximalist opening positions.

Central Eastern Europe

Poland cut its policy rate by 25bps. Downside surprise in Czech inflation.

Hungary: Fitch revised Hungary’s ‘BBB’ rating outlook to negative on fiscal slippage. The negative outlook is not a surprise, as S&P and Moody’s both already have negative outlooks for Hungary, with Moody’s ‘Baa2’ rating in line with that of Fitch, while S&P is one notch lower at ‘BBB-’. Last week, Moody’s maintained the ‘Baa2’ rating with a negative outlook, noting that fiscal consolidation after the April 2026 elections and cheaper EU funding via SAFE could stabilise debt affordability, though governance issues, high deficits, and suspended EU funds continue to constrain the outlook. Growth expectations were revised down to 0.5% in 2025 and 2.3% in 2026, as weak German activity and lower public investment persist.

Kazakhstan: The Tenge’s appreciation to below 500 per USD reflects stabilising oil prices, strong foreign portfolio inflows, and confidence in the government’s medium-term macro framework. Central bank NBK sees no speculative distortions and has refrained from intervention but expects the stronger currency to aid disinflation. The policy rate was held at 18%, with no easing expected in H1 2026 as inflation risks remain skewed upward due to domestic demand, fiscal impulse, and second-round effects from tariff and fuel liberalisation. Forecasts for 2025 GDP growth were raised to 6.0–6.5%, though the 2026 outlook is softer at 3.5–4.5%.

Middle East & Africa

Türkiye’s disinflation gained momentum, driven by lower unprocessed food.

Angola: The World Bank underscored Angola’s increasing debt vulnerability, noting one of the world’s highest ratios of interest payments to gross national income and persistent pressure from costly market borrowing, with recent Eurobond issuance near 10% and 1-year local government bonds around 16%. Despite a successful October Eurobond placement, reliance on higher cost domestic financing has grown due to tighter global conditions. The World Bank warns EMs should not view improving sentiment as a green light for rapid market re-entry, stressing that multilaterals remain the only stable source of affordable capital.

Ghana: Headline inflation eased sharply to 6.3% yoy in November from 8.0% in October, significantly below the central bank’s target of 8.0%, driven by a significant fall in food inflation (6.6% yoy vs. 9.5% previously). The decline reflects Cedi strength, lower global food prices, and favourable base effects. Sequentially, headline consumer price index (CPI) inflation slowed to 0.2% mom from 0.3% mom, while core inflation rose modestly to 0.4% mom.

Saudi Arabia: Aramco is expected to cut the January oil price premium for Asia for a second consecutive month, narrowing premiums to the lowest level since early 2021. The adjustment reflects abundant supply and softer demand growth, even as OPEC+ pauses further production increases in Q1 2026 to mitigate downward pressure on crude prices.

Türkiye: Disinflation gained traction in November as headline CPI inflation fell to 31.1% yoy, driven by a sharp correction in unprocessed food and a further loss of momentum in processed food prices. Core inflation eased, services inflation was seasonally flat, and underlying trend measures returned to their May levels after a temporary September rise. Mild increases in core goods and higher fuel prices prevented a steeper deceleration, but overall, the configuration confirms that the autumn inflation spike was transient.

Developed Markets

Mixed US labour market data.

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.