The US suspended for six months the financial sanctions imposed on Venezuelan oil and gas and secondary market trading of Eurobonds. The sanctions release was motivated by the tight supply on oil markets and the large number of Venezuelan immigrants that crossed the US borders. The situation in Gaza remains fluid. China’s economic data was better than expected and more tit-for-tat technology sanctions were announced. Indonesia hiked its policy rate as the presidential race narrows. Russian President Vladimir Putin and Hungary’s Victor Orban travelled to Beijing for the Belt and Road forum. In global macro matters, yields on US Treasury rose to the highest level since 2007, bringing stocks down. The Chairman of the Federal Reserve acknowledged that the tighter financial conditions due to a steeper yield curve will influence the next policy decisions (equivalent to hiking the Fed Funds rate).

Global Macro & Geopolitics

On Wednesday, President Joe Biden visited Israel to meet with President Benjamin Netanyahu. The visit followed the explosion at the Gaza City hospital with a reported death toll exceeding 500. Biden commenting on the attacks stated it “appears as though was done by the other team, not [Israel]”. The British intelligence said Biden was stating his view, not attributing blame. The statement signals a stronger degree of support for Israel but is also likely to deepen the divide between the Muslim world and US and Israel. As a result of the hospital explosion and his statement, Biden had to cancel his trip to Egypt, the West Bank, and Jordan.

A flurry of world leaders headed to the Middle East towards the end of the week. On Thursday, UK Prime Minister, Rishi Sunak, pledged to support Israel in the war on Hamas; announcing at their meeting that Britain will “stand with [Israel] in solidarity”, condoning the violence, recognising Israel’s “right to self-defence in line with international law”, but also urging restraint on the response against the terrorist attacks.

Yesterday, Israel said Hezbollah risks dragging Lebanon into a wider regional war after another evening of intense cross-border fire. The Israeli Defence Minister, Yoav Gallant, reportedly stated that they intend to remove Israel’s responsibility for the Gaza Strip and the creation of a “new security regime”. This may be Israel’s attempt at preserving its advances achieved by the Abraham Accords by asking key countries in the region (such as Qatar, the UAE, or Saudi Arabia) to support stability in Gaza.

Further international aid is expected into Gaza through the Rafah border point in Egypt on Monday. Two trucks made it across the border over the weekend, however, the UN estimates that at least 100 trucks a day are needed.

King Abdullah II of Jordan announced a “red line” for both Jordan and Egypt stating that they will not take in any Palestinian refugees displaced by the conflict. Jordan is already home to refugees from Syria, Lebanon, and Iraq and was faced with large pro-Palestine protests in the streets and fears the infiltration of radical Hamas Palestinians in the country. Jordan has a long and complicated relationship with Israel.1 With the heightened diplomacy ongoing in the region, Palestine’s Foreign Ambassador, Fariz Mehdawi, and others are calling on China to take a more active role in peace making across the region and discourage other actors involving themselves in the conflict.

Emerging Markets

EM Asia

China: Economic data was significantly better than expected last week. GDP grew 4.9% year on year (yoy) in Q3 2023, down from 6.3% yoy in Q2 2023, but above consensus at 4.5% yoy. Electricity consumption – considered a more reliable measure of economic activity in China – increased by a yoy rate of 9.9% yoy in September, up from 3.9% yoy in August. Industrial production rose 4.5% yoy in September, unchanged from August as retail sales increased by 5.5% yoy in September, from 4.6% yoy in August, above expectations. Economic surprise index increased to +15.7 on Friday from -7.7 the previous week.

There was no respite for troubles in the property sector. New home sales were down -0.3% yoy in September, unchanged versus August. Country Garden, one of the largest builders in China, defaulted on its offshore debt after it failed to pay a USD 15m coupon at the end of the 30-day grace period, leaving it vulnerable to a cross-default on its USD 10bn outstanding bonded debt. The developer joined 40% of all Chinese developers who have defaulted on debts since the beginning of the liquidity crisis in the sector in 2021.

On the other hand, China’s local government debt issues may experience some short-term respite. The People’s Bank of China (PBOC) reportedly ordered the major state banks to extend terms, adjust repayment plans and reduce interest rates on the outstanding Local Government Financing Vehicle (LGFV) debt. Loans due in 2024 will no longer be categorised as non-performing on the banks’ balance sheets. There was some gentle optimism of a rebound in business confidence, as loans taken out by Shenzhen private enterprises increased +11.6% yoy in September, totalling USD 407bn.

In other news, the Beijing local government issued an action plan for 2023 to 2025 allowing eligible companies in the artificial intelligence (AI) sector to receive up to RMB 2mn worth of coupons in a year. The US government continues to tighten its stance on exports of AI-related products to China, imposing a new ban on selling chips that fall under technical specification thresholds, impacting those under order by Alibaba and NVIDIA. China has retaliated by announcing restrictions on exports of certain types of natural graphite, a key input for electric vehicle batteries, effective from 1 December. China produced around two-thirds of graphite production in 2022 and has a near-monopoly in certain finished graphite products.

India: Wholesale prices declined by a yoy rate of -0.3% in September, up 20 basis points (bps) from August, but below consensus at +0.4% yoy. India, the 2nd largest sugar producer globally, extended its export restrictions in an attempt to protect domestic supplies. India introduced a quota system in 2022-23 of 6m tonnes (11m tonnes in the previous year) after late seasonal rains cut production. White sugar contracts were up +1.4% in London before paring back the gains, while raw sugar futures were down -1.2%.

Indonesia: The Bank of India Indonesia (BoI) surprised the market on Thursday when it raised the policy rate from 5.75% to 6.0%. This marked the first rate hike since January, with Governor Perry Warjiyo citing the need to shore up the Rupiah amid the geopolitical tensions and the higher-for-longer rates in the US. On political news, two presidential candidates have registered their bids for Indonesia’s upcoming elections in February: former Jakarta Governor Anies Baswedan and former Java Governor Ganjar Pranowo. Defence Minister Prabowo Subianto is the other contender, who has yet to announce his running mate or submit a formal bid before registration closes. President Jokowi has yet to formally endorse support for any of the candidates, given the race appears to be neck and neck between Prabowo and Ganjar at the present. With President Jokowi’s ratings at a high, his endorsement will likely propel a frontrunner. On the data front the trade balance increased to USD 3.4bn in September, up from USD 3.1bn in August.

Malaysia: The Ringgit fell to its lowest level since the Asian Financial Crisis in 1998 making it the worst performing currency in Asia year-to-date after the Yen. The move comes after investors bought Dollars as a haven amidst the Israel-Hamas war and the expectation of further hawkishness from the Federal Reserve. Gross domestic product (GDP) grew +3.3% yoy in the 3rd quarter, up from 2.7% in the 2nd quarter of 2023. Consumer price index (CPI) grew by a rate of +1.9% yoy in September, down from +2.0% yoy growth in August. The trade balance grew to MYR 24.52 bn, below the MYR 17.31 bn balance in August, let by the decrease in imports.

South Korea: Daily average exports rose by +8.6% yoy in the first 20 days of October, beating expectations of softness during the first month of each quarter. Exports have strengthened with the increase in semiconductor prices, alongside the initial restocking seen in overall tech products, which should support the Won despite higher oil prices. The Bank of Korea kept its policy rate unchanged at 3.5%, in line with consensus.

Taiwan: The US Senate formally introduced legislation to relieve the double-taxation of investments between the US and Taiwan. The US-Taiwan alliance continues to grow following the approval of a new trade agreement with Taiwan earlier this year.

Latin America

Argentina: At the General Elections on Sunday, with 97% off the vote counted, Sergio Massa held 36.6% of the vote ahead of Javier Milei with 30.0%; and Patricia Bullrich trailing with 23.8%. The result sets the stage for a second round between Argentina’s far right and far left parties on November 19th. The voter turnout was low at 74%, compared with 81% in 2019 elections and 79% in 2015. Milei needs to dissociate himself from currency depreciation and come to the centre. Milei will also need a higher voter turnout outside of the Province of Buenos Aires (PBA), which historically has hurt the Peronist Party. The Peronist Axel Kicillof was re-elected Governor of the Province of Buenos Aires with c. 45% of votes. Massa received 43% of the votes in the PBA. Bullrich said Juntos por Cambio (JxC) would never support communists. Whoever wins will struggle to govern, because the Peronists, albeit losing the majority, still have the largest minorities in both houses. The Senate (72 seats) split has 34 Peronists; 24 JxC; 8 Milei’s party; 6 others. The Lower House (257 seats) has 107 Peronists; 94 JxC; 39 Milei’s; 17 others. On economic data news, Argentina’s trade deficit was unchanged at USD 1.0bn in September, against expectations of a USD 200m surplus.

Brazil: Retail sales increased +2.3% yoy in August, beating expectations of +1.2% yoy growth, slightly lower than the reported +2.4% yoy growth reported in July. Economic activity in August grew by +1.26% up from the 0.83% in July.

Colombia: Shell and Ecopetrol discovered a new natural gas accumulation 75km off the coast, forming part of the Col-5 block in which Ecopetrol holds a 50% stake in alongside Shell. In data, economic activity grew 0.2% in August, from +1.0% in July, 0.5% expected.

Venezuela: The US Treasury Office of Foreign Assets Control (OFAC) announced the suspension of sanctions in “most oil and gas operations” in Venezuela authorising US entities to work with Venezuela’s national oil company Petroleos de Venezuela (PDVSA) including the production and sale of oil and gas. The relaxation of the sanctions comes after the formalisation of an agreement depicting a “path” promoting the “authorisation of all presidential candidates” in so long as they meet the participatory requirements. The announcement marks a thawing of the political front against Venezuela with renewed optimism for its reintegration into the global financial system.

OFAC also removed the ban on trading Venezuelan sovereign bonds and PDVSA securities in the secondary markets. The sanctions on the transactions in the primary markets (new issuances) remains in place. Nevertheless, the relaxation of the sanctions brings optimism to the prospect of a successful restructuring in the medium term. The election date is yet to be announced but will be in the 2nd half of 2024. The ban on the sale of US refinery CITGO stock remains – preventing the PDVSA 2020 bondholders from foreclosing on its collateral for another 3 months, but a court decision to auction the shares of PDV Holding by July 2024 will likely drive a payout for PDVSA 2020 holders. Bond prices surged on Thursday with the VENZ 11.95% 2031 rising to USD 18c at the end of the week from c. USD 10c on Wednesday. The PDVSA 8.5% 2020 guaranteed by 50.1% of CITGO rose 20 points to USD 72c while the remainder of the PDVSA curve more than doubled from c. USD 6c to USD 13c.

Primary elections were held over the weekend, which saw candidate, Maria Corina Machado, declaring a victory in opposition primary votes. With just over a quarter of ballot boxes counted, Machado had 93% of the votes. Voter turnout has decreased compared to past primaries at around 2mio. As Machado is still barred from taking office in Venezuela, her nomination will be a first test to the relaxation of the sanctions regime.

Central and Eastern Europe

Czechia: The yoy rate of Producer price index (PPI) inflation declined by 100bps to 0.8% yoy in September, 1.0% expected.

Hungary: Viktor Orban met with President Vladmir Putin at the sidelines of the Belt and Road forum in Beijing, making him the first Western leader to meet with President Putin since his indictment for alleged war crimes. At the meeting, Orban reiterated his call to Russia to end the conflict but pledged to maintain ties with Russia due to lack of alternative sources of energy.

Poland: The yoy rate of CPI inflation declined by 160bps to 8.4% in September, below consensus expectations. Industrial output fell to -3.1% yoy in September from -1.9% yoy in August and 40bps below consensus. The decline was mostly driven by lower manufacturing production, which fell by -3.7% yoy while electricity and gas output rose +3.7% yoy. The yoy rate of PPI was unchanged at -2.8% yoy (deflation) in September. Retail sales in September declined by -0.3% yoy from -2.7% in August, above expectations of a -2.0% yoy decline.

Romania: The Constitutional Court cleared the government’s fiscal bill aimed at increasing taxes and reducing spending by USD 128m by the end of 2023. The bill proposed a 2% tax on banks’ total revenue; 1% tax on turnover of large companies; higher VAT imposed on sugary products; the elimination of tax waivers for the IT industry; with hundreds of state jobs to be cut. Industrial sales in September declined by -1.9% yoy, up from -2.1% in August.

Russia: President Vladimir Putin met with Chinese President Xi Jinping in Beijing. The visit marked President Putin’s first meeting outside of Russia since being indicted for war crimes. Bilateral trade between the two nations has reached close to USD200bn. China has attracted criticism from other Western nations citing that its increasing trade with Russia is indirectly financing the conflict in Ukraine.

Central Asia, Middle East, and Africa

South Africa: The yoy rate of CPI rose by 60bps to +5.4% yoy in September, in line with consensus. The yoy rate of retail sales recovered to -0.5% yoy in August, -1.2% yoy expected yoy in August.

Developed Markets

United States: US stocks dropped, and yields rose with the 10-year US Treasury reaching 4.99% on Thursday – the highest since 2007. In economic news, retail sales rose 0.7% month on month (mom) in September, from 0.8% in August, 40bps above consensus. Initial Jobless Claims came in lower than expected at 198k vs 211k in the prior week, below expectations of a moderate increase to 210k. However, continuing claims rose to 1,734k, higher than the prior week at 1,702k, beating expectations of a rise to 1,705k. In politics, Jim Jordan has announced that he will endorse Patrick McHenry as a temporary Speaker of House through January. The move is within the wider context of empowering the former Ohio congressman as the White House prepares to approve further national security packages to include billions of dollars in foreign aid destined for Ukraine and Israel.

Eurozone: Italy’s government committed to an agenda of modest tax cuts in 2023 and 2024. However, against the sluggish GDP growth backdrop (+0.7% yoy in 2023 and +0.6% yoy growth in 2024), the government has committed to financing these through additional borrowing, increasing the likelihood of fiscal slippage. The headline debt target was revised upwards from 3.7% of GDP in 2024 to 4.3% of GDP. In data, Eurozone CPI grew +4.3% in September, in line with expectations, and unchanged from the +4.3% yoy growth observed in August.

United Kingdom: On Thursday, Prime Minister Rishi Sunak arrived in Israel on his two-day trip to the region to try and curb the risk of contagion of the conflict throughout the region, and to further existing efforts allowing aid to the two million civilians in Gaza. In local politics, the Labour party overturned large majorities in both Tamworth and Mid-Bedfordshire (a rare event in byelections) in the latest blow to Rishi Sunak’s Conservative Party ahead of the General Election expected next year. In economic news, the yoy rate of CPI inflation rose +6.7% yoy in September, and Retail price index (RPI) declined marginally to +8.9% yoy, both 10bps above consensus. PPI declined by 0.1% in September, in line with consensus. House prices declined in October by -0.8% yoy, a further decline from the -0.4% yoy in September; however, representing a +0.5% mom increase, up from the +0.4% mom increase observed in September.

Japan: The yoy rate of core CPI inflation declined by 30bps +2.8% yoy in September, 10bps above consensus, but dropping below 3.0% for the first time in a year, while CPI inflation declined by 20bps to 3.0% (in line with consensus). The decline was mostly driven by gas and electricity prices. Japan industrial production declined -4.4% yoy in August, down from -3.8% yoy in July. The trade deficit shrank to JPY 434.1 bn on a seasonally adjusted basis, up from a revised JPY 553 bn in August, consensus forecast was for the deficit to remain unchanged, mostly driven by exports increasing +4.3% yoy in September – led by the shipments of cars and medical supplies. Imports reduced -16.3% yoy in September, with the decline led by energy imports. Notably, exports to China fell by -6.3% yoy while exports to Europe and the US in September both gained +13% yoy.

1. See – https://www.aljazeera.com/news/2023/10/18/why-has-jordan-cancelled-biden-visit-after-israel-bombing-of-gaza-hospital#:~:text=By%20the%20end%20of%20the,then%2DPresident%20

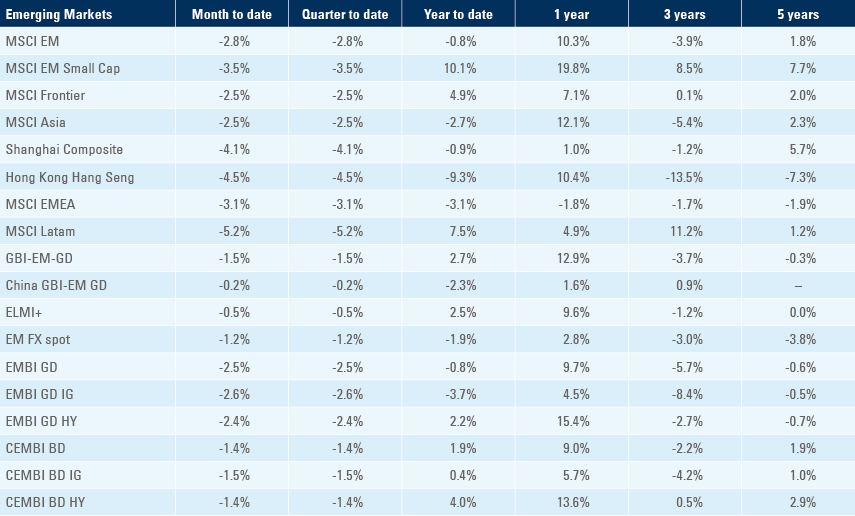

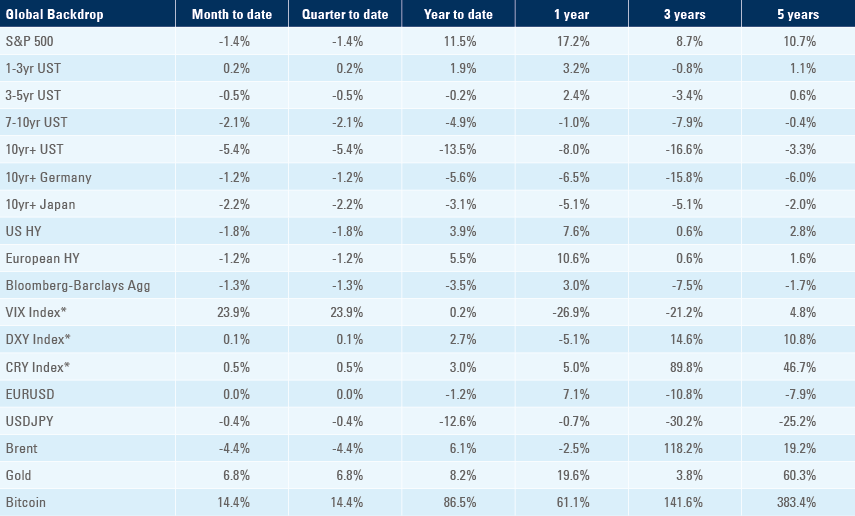

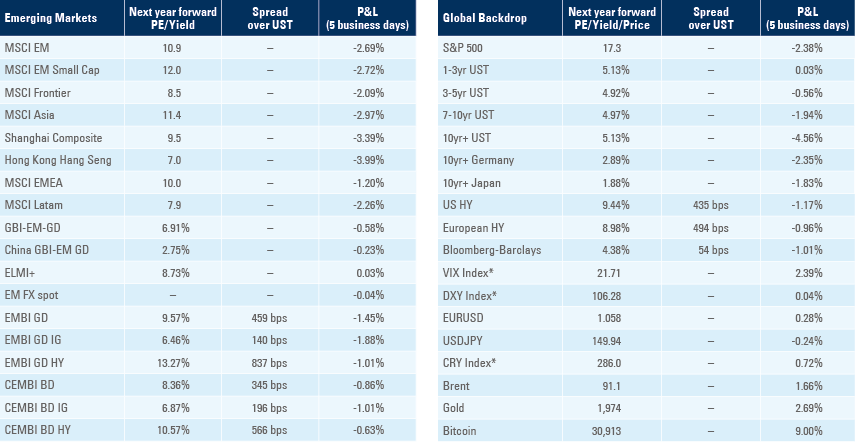

Benchmark performance