- UST yields continued to climb higher on economic outperformance and ‘Trump trade.’

- Key Chinese fiscal legislators announced they will meet between the 4-8th of November.

- Oil sold off 5% on Sunday evening, after Israel chose not to strike Iranian oil sites.

- Liberal Democrat Party lost its majority in Japan’s snap election.

- IMF maintained its 2024/2025 GDP forecasts at October meeting: DM growth at 1.8%, EM at 4.2%.

- Upgrades to Nicaragua and Suriname credit ratings.

- The Mexican senate voted through a bill that would impede the judiciary's legislative power.

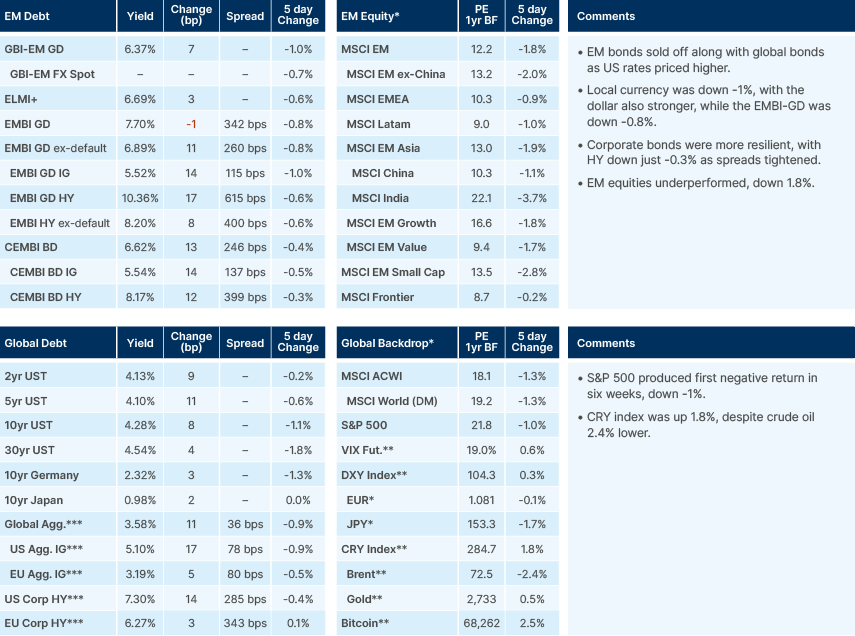

Last week performance and comments

Global Macro

Since 30 September, two-year US Treasury yields have risen 50 basis points (bps), while the broad US dollar index has strengthened 3.4%. This momentum is largely due to upside surprises in economic data during October, despite the effects of Hurricane Beryl. But some of the move upward in both yields and the dollar also likely reflects markets tilting back towards the ‘Trump trade’. Under a second Trump presidency, key concerns remain tariff-induced stagflation and widening fiscal deficits, with both outcomes more likely in a ‘red wave’. This recent movement has reduced the asymmetry in bets on a Trump victory in Asian foreign exchange (FX) markets, particularly after selloffs in the Japanese yen (JPY), South Korean won (KRW), and Chinese yuan (CNH). We continue to believe Trump would be constrained in widening fiscal deficits much further, while tariffs would be incremental and centred around deal-making. Revenue from tariffs, as well savings from Elon Musk’s ‘efficiency’ program are difficult to forecast, but could play a significant role in keeping the deficit contained.

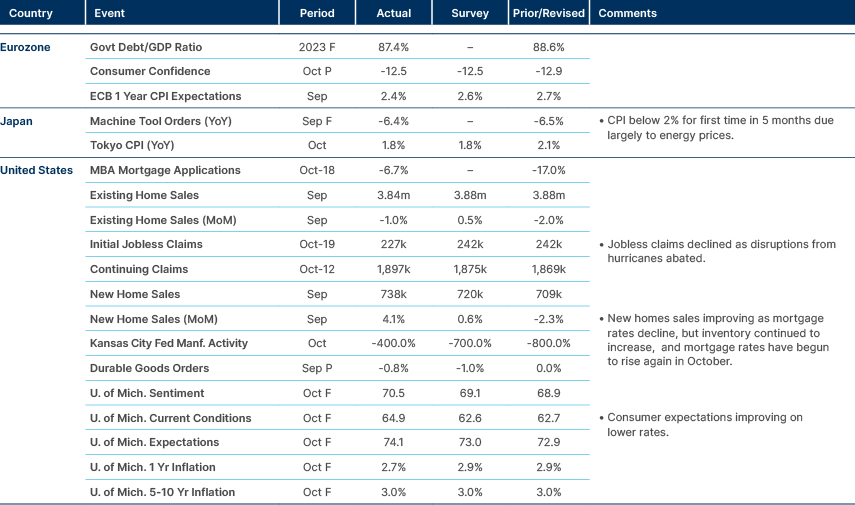

The latest outlook from the International Monetary Fund (IMF) remains steady, projecting global gross domestic product (GDP) growth at 3.2% for both 2024 and 2025, with Developed Markets (DM) growing at 1.8% and Emerging Markets (EM) at 4.2%. While headline Consumer Price Index (CPI) inflation across DMs has converged towards 2%, core inflation remains elevated, close to 3%. Services sector inflation is still between 4% and 5% in major DM economies.

Global public debt currently stands at USD 100tn, or 93% of GDP, and is expected to reach 100% by 2030. Financial stability risks remain a concern, despite market volatility. At the annual IMF conference in Washington, policymakers highlighted active ongoing support for EM reforms, particularly in Angola, Nigeria, Zambia, Ghana, Oman, and Türkiye, with Panama’s Ministry of Finance also drawing positive attention. The IMF is keen to support African nations in particular.

Geopolitics

Israel retaliated against Iran’s earlier missile attack by targeting military bases, launching missiles from Iraq without entering Iranian airspace. Oil infrastructure was untouched. Iran’s Ayatollah Khamenei's response to the attack was measured, while Iran's Chief of General Staff stated the Republic “reserved its legal and legitimate right to respond at an appropriate time.”

In response to these developments, oil prices fell by 5% on Sunday evening, as the market factored out the immediate risk to Iranian oil supply. Meanwhile, on the BRICS1 front, China’s Xi Jinping and India’s Narendra Modi met for the first time in five years, agreeing to resume regular patrols along the contested Line of Actual Control.

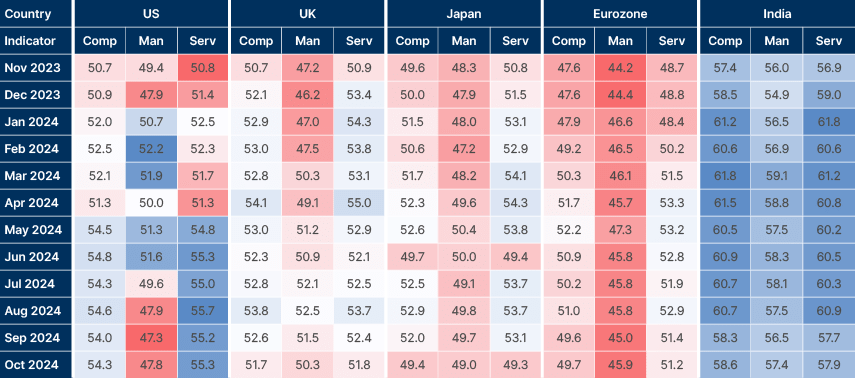

Fig 1: Flash PMI: US and India speed up, Japan slows markedly in services

Emerging Markets

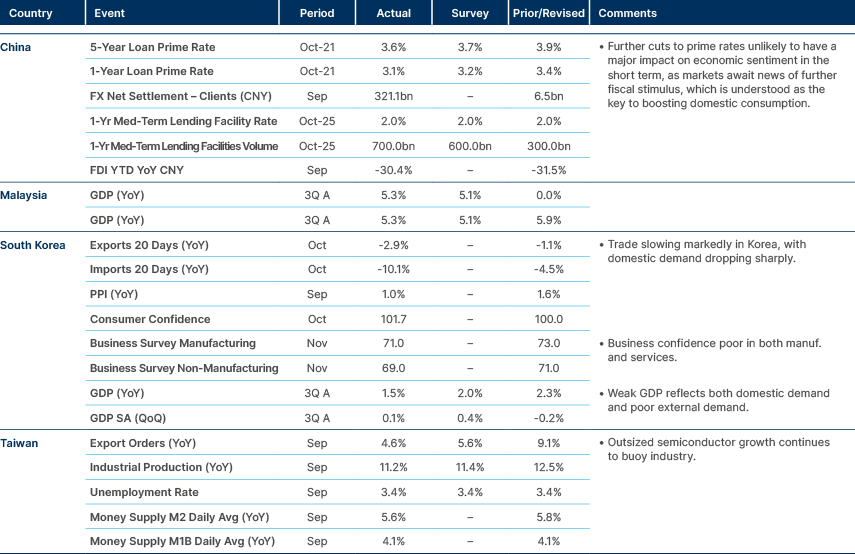

EM Asia

Another cut to prime rates in China, trade slowing in South Korea.

China

Top legislators announced they will meet between the 4-8 of November, sparking hopes that more fiscal stimulus announcements may materialise after the US election.

At the IMF conference in Washington, US Treasury Secretary Janet Yellen criticised China’s stimulus package so far for failing to address the central issues of overcapacity and weak domestic demand. Haibin Zhu, Chief China Economist at JP Morgan predicted Xi will continue to focus on advanced manufacturing to propel the economy, a strategy that relies on robust demand from the rest of the world, as long as domestic consumption remains weak. In our view, continued investment in manufacturing capacity at the expense of direct fiscal stimulus, could now exacerbate domestic deflation problems, fuelling the ‘debt-deflation’ loop.

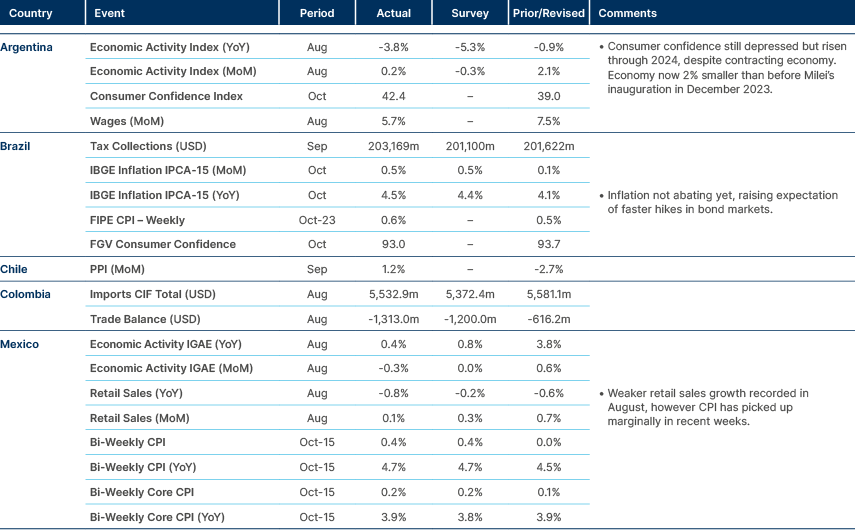

Latin America

Brazil inflation not abating.

Brazil

The government agreed to accept a USD 30bn settlement from Vale SA and BHP in reparations for a 2015 mining disaster at their Amazonian joint venture. The settlement funds will be paid over two decades to Brazil’s federal government and the affected states.

Mexico

President Claudia Sheinbaum said the Finance Ministry is putting together a deal to try to prevent the price of the basic food basket from increasing, as inflation rose in the first two weeks of October. Sheinbaum also said the government will commit to not increasing fuel prices. Congress voted through a bill which would remove the Supreme Court’s right to declare a bill unconstitutional, in the Morena Party’s latest move to consolidate power. The amendment will now be sent to the lower house of Congress, where Morena has a majority.

Nicaragua

S&P upgraded Nicaragua to B+, on strong remittances and improved fiscal discipline. The outlook remained stable. Remittances reached 26% of GDP in 2023, nearly double the level seen in 2021. This was driven largely by US humanitarian immigration programmes and has helped mitigate declining demand for exports. FX reserves improved from USD 4bn at the start of 2023 to USD 6bn today, equivalent to 32% of GDP. Access to external funding is still challenged, however, as international sanctions limit the country’s ability to tap multilateral lenders, following violent crackdowns by the government on political dissidents.

Suriname

Moody’s upgraded Suriname two notches, from Caa3 to Caa1, after major drillers approved projects to develop the first oil discoveries off the coast.

Major economic and fiscal windfalls are expected from the offshore oil projects, which hold recoverable reserves of over 750mn barrels. The daily capacity will rise to 220k barrels a day, with the first oil production slated for 2028. Once oil production starts, most net income is expected to go to the state, between USD 16-26bn over the estimated life of the production field.

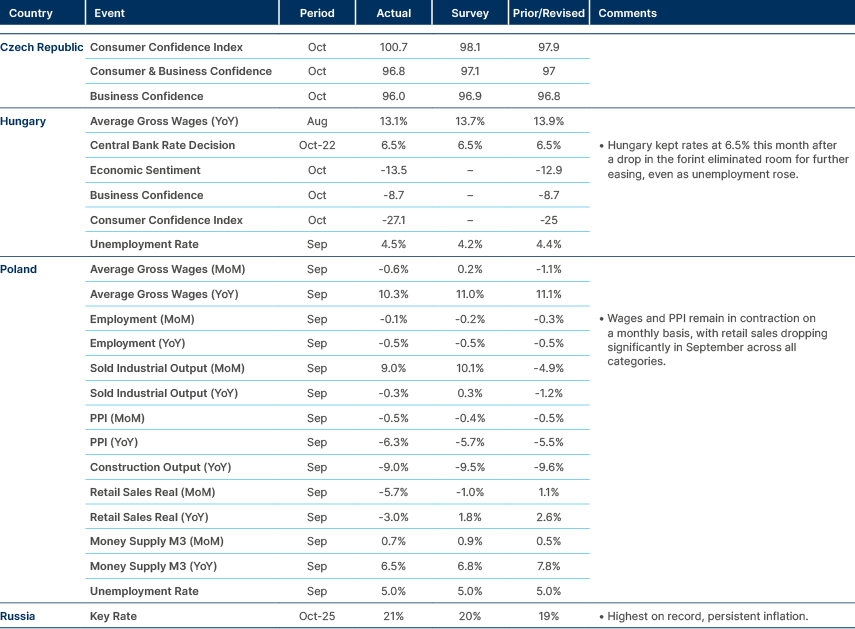

Central and Eastern Europe

Poland slowing more sharply, Hungary holds rates.

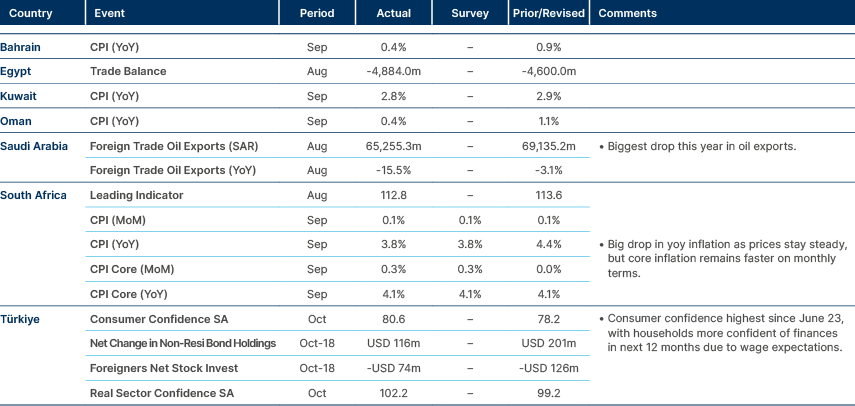

Central Asia, Middle East, and Africa

South Africa inflation behaving, Turkish consumers more confident.

Developed Markets

Japan CPI below 2% again, US sentiment better.

Japan

In a snap election over the weekend, the Liberal Democratic Party (LDP) lost its majority in parliament for the first time in 15 years. Whilst political analysts had expected the Prime Minister Shigeru Ishiba to resign following the result, he has vowed to stay on as the nations leader. While many assumed that the LDP would now need to form a coalition to continue to govern, the Prime Minister Shigeru Ishiba dismissed the idea of a new formal alliance. Instead, he suggested consulting with other parties and incorporating alternative policies to benefit the nation. Analysts interpreted his remarks as an indication that the LDP now could seek to govern through temporary voting agreements on specific issues rather than formally expanding the coalition. The JPY weakened to a three-month low with speculation of tax cuts and a slower normalisation of the Bank of Japan towards higher rates. Japenese stocks were up 1.8% as a result of the weaker yen and expectations of fiscal largesse ahead of an upper house election next year.

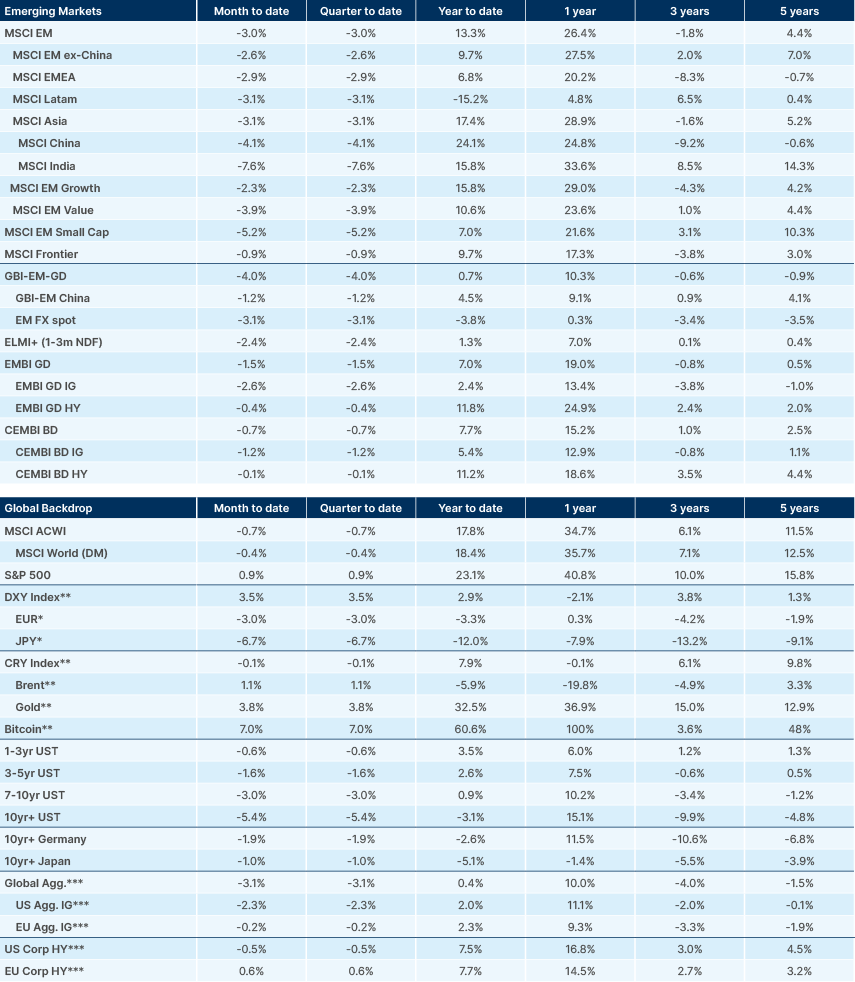

Benchmark performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

1. BRICS: Brazil, India, China, South Africa.