The Fed walked away from cuts early in the summer, while the ECB remained in that camp. The US announced it would re-impose sanctions on Venezuela, but in a weaker format, a reflection of the current political realities. The US House of Representatives passed a USD 95bn aid bill to Ukraine, Israel, and the Indo-Pacific. China’s economic data was mixed. Argentina’s Congress discussed economic reforms as the government pledged to keep its fiscal accounts in surplus. Tens of thousands of protesters took to the street in Colombia. Ecuador suffered energy blackouts as voters endorsed the government’s tough stance on crime. After guaranteeing its external funding, Egypt sought to extend the profile of its local debt.

Global Macro

Monetary Policy

Fed Chair Jerome Powell said it would probably take “longer than expected” for inflation to go down to its 2% target: “The recent data have clearly not given us greater confidence, and instead indicate that it’s likely to take longer than expected to achieve that confidence”. The US economy remains “quite strong”, but the labour market is “moving into better balance” with wage growth “moderating”.1 The Fed’s outlook has been diverging from that of the ECB. ECB Governor Christine Lagarde reiterated on 16 April that a cut is likely by June stating: “If we don’t have a major shock in developments, we are heading towards a moment where we have to moderate the restrictive monetary policy that we have, in reasonably short order”. Indeed, Tuesday 16 April’s data release showed cooling consumer price index (CPI) inflation data, in line with consensus.

In our view, the main reason for the stronger-than-expected US economic activity keeping inflation unanchored has been the large fiscal deficits. Last week, the International Monetary Fund (IMF) corroborated this view, cautioning the US to reduce its unsustainable fiscal deficits. The institution also cautioned other countries, including China, South Africa, and the UK.2 Fiscal consolidation would be supportive of more and faster rate cuts, but remains elusive given the heavy political calendar, pressures to reduce income inequality driving populism, and the low growth environment challenging a sustainable increase in revenues.

Geopolitics

After multiple warnings the US announced it will not renew the General Licence (GL) 44A on Wednesday 18 April, ending the blanket relief of sanctions in place since October 2023. However, the new licence, replacing General Licence 44, is only a superficial reimposition of sanctions designed to “save face” after Venezuela has continuously violated the October agreement for free and fair elections. The Office of Foreign Assets Control (OFAC) explicitly allowed oil and gas companies impacted by the withdrawal of the General Licence to apply for special licences before they must close their operations by 31 May. Furthermore, companies with special licences from 2022, such as Chevron, Eni and Repsol, do not need to reapply for their ventures with state-owned oil company Petróleos de Venezuela (PDVSA). The removal of the General Licence is unlikely to have any real effect on oil and gas production.

The action demonstrates the stated preference of the Biden administration to curb rising gasoline prices and prevent disruption to energy markets ahead of the November presidential election.3 Concerns are particularly heightened with Western countries preparing to step up sanctions on Iran in response to its attack on Israel. According to the Financial Times, Iran’s oil exports are contributing USD 36bn per year to its economy.4 Indeed, oil production and exports are at their highest level in the past six years at 3.2m and 1.5m barrels per day, respectively, according to Bloomberg data. Thus, it is likely that the sanctions against Iran announced last week could have fewer ‘teeth’ than the sanctions imposed during the Trump administration, when Iranian oil production plunged from 3.8m to 2.0m barrels per day and exports from 2.2m to 0.2m barrels per day.5

Israel launched a retaliatory strike against Iran last Friday for last week’s attack.. However, Iran’s media have reportedly downplayed the attack, rejecting reports of any attack from outside the country.6 Meanwhile, countries from the region were vocal last week on limiting escalation. In a joint statement on 17 April, Saudi’s Crown Prince Mohammed Bin Salman and United Arab Emirates President Mohamed Bin Zayed Al Nahyan called for “self-restraint” and to spare the region “from dangers of war and its dire consequences”. The Qatari Sheikh Mohammed bin Abdulrahman al-Thani said he “lamented the political exploitation” of their diplomacy.7 Türkiye’s President Recep Tayyip Erdoğan doubled down on anti-Israel public statements, potentially aimed at gaining popularity within the Arab states. In a meeting with Hamas’ political leader Ismail Haniyeh in Istanbul on Saturday, Erdoğan criticised Israel and likened Hamas to the Kuva-yi Milliye (National Forces) in Türkiye during the “national struggle”. The meeting included discussions on how “adequate” humanitarian aid could reach Gaza and how to achieve “a fair and permanent peace in the region”.

Over the weekend, the US Congress approved a USD 95bn aid package with USD 60.8bn earmarked for Ukraine, USD 26.4bn for Israel, and USD 8.1bn to the Indo-Pacific region, including Taiwan. The bill passed by 311 votes to 112, with 100% support from 210 House Democrats and 50% support from 112 House Republicans.

- Ukraine aid breakdown:8

- USD 23bn to replenish US weapons, stocks, and facilities

- USD 14bn Ukraine Security Assistance Initiative, a US Department of State-led funding programme that helps train Ukraine’s military and provides equipment and advisory initiatives

- >USD 11bn to fund current US military operations in the region, enhance the capabilities of the Ukrainian military, and boost intelligence collaboration between Kyiv and Washington

- USD 8bn in non-military assistance, including paying Ukraine salaries

- Israel aid breakdown:

- USD 5.2bn to replenish and expand Israel’s missile and rocket defence system

- USD 3.5bn for advanced weapons systems and USD 1bn to boost weapon production

- USD 4.4bn for other supplies and services to Israel

- USD 9.2bn for humanitarian purposes including in the Gaza Strip and the West Bank

In other news, German Chancellor Olaf Scholz warned Chinese officials: “We want a level playing field” and voiced concerns identifying dumping, overproduction, and copyright infringement. This mirrors US Treasury Secretary Janet Yellen’s concerns on China’s unfair business practices. President Joe Biden has called for tariffs on Chinese steel, which may be part of an attempt to win over the swing states for the presidential election. US Trade Representative Katherine Tai has called for tripling the existing 7.5% (average) tariffs and investigating potential unfair trade practices by China’s shipbuilding, maritime and logistics sectors. The US will also work with Mexico to prevent China exporting to the US through the southern border.9

The announcement came alongside a Biden campaign rally in Pittsburgh, in the key swing state of Pennsylvania.10 Both Trump and Biden oppose Nippon Steel’s proposed USD 14bn buyout of US Steel. Biden stated it should “remain an American steel company that is domestically owned and operated”. This shows both leading candidates have broadly converged regarding trade policies. The main difference remains in energy policy. Biden is still advocating a more aggressive approach towards the energy transition, while Trump would promote traditional energy investments, a policy that proved popular in key swing states, including Pennsylvania, in 2016. Trump is likely to take a more aggressive stance towards Iran as well.

Global Macro, technical views and week ahead

Oil prices imply a significant escalation is unlikely, at least in the short term. Lower prices last week coincided with the above-mentioned US government actions to keep ample supply in the market. Gold prices and US Treasury yields moving higher reflect higher military and social spending for longer, keeping inflation elevated. In our view, stocks sold off over the last three weeks because of the impact of higher rates on companies with lower profitability and higher leverage (i.e., US small caps) amid profit-taking on the artificial intelligence stocks that kept the overall US stock indices buoyed until recently.

In our view, Investors with cash on the sidelines may potentially get a buying opportunity over the coming weeks. The S&P500 declined 6% from the top over the last three weeks. If we are in for a broader correction, the S&P may have another c. 5% to decline before testing the current 200-day moving average or c. -11% to close the gap opened on 14 November 2023, when softer-than-expected inflation brought interest rates sharply lower. Thus, unless a meaningful event allows for the 50-day moving average clearance to the upside, the S&P500 may be looking for a sell-off to close two gaps slightly above 4,200 to 4,400 levels, in our view.

This week, around one-third of S&P500 companies report earnings, including four of the largest seven companies in the index. The most relevant economic data points are tomorrow’s Developed Market flash Purchasing Managers’ Indices (PMIs), GDP and core Personal Consumption Expenditures (PCE) in the US, and the Bank of Japan decision following Tokyo CPI at the end of the week. Next week, the quarterly refunding announcement on 1 May will be monitored to gauge the supply of US Treasuries.

Emerging Markets

EM Asia

China: This morning, the People’s Bank of China kept its one- and five-year loan prime rates at 3.95% and 3.45% respectively, in line with consensus. A mixed bag of indicators last week: retail sales, industrial production, property investment and sales were weaker than expected, but the GDP figure beat expectations. GDP growth rose to 5.3% yoy in the first quarter of 2024 from 5.2% in the prior quarter, higher than the consensus of 4.8%. This pick-up is likely to be from public investment. Industrial production slowed to 6.1% yoy in March, compared to 7.0% in February and consensus of 6.6%. Similarly, retail sales slowed to 4.7% yoy in March from 5.5% in February and lower than the 5.4% estimate. Fixed assets ex-rural increased higher than expected to 4.5% yoy from 4.2% previously. China announced it will end live trading data for flows from Hong Kong into Shanghai and Shenzhen in about a month. Instead, turnover details after the daily sessions will be available. Global payments made in Renminbi rose to 4.7% in March from 4.0% in February, ranking it as the fourth-most widely used currency compared to fifth a year earlier.

India: Wholesale prices increased 0.5% yoy in March from 0.2% in February, but marginally lower than consensus of 0.6%. The trade deficit tightened to -USD 15.6bn in March from -USD 18.7bn in February. Exports fell 0.7% yoy to USD 41.7bn and imports fell 6.0% to USD 57.3bn.

Indonesia: External debt increased to USD 407.3bn in February, from USD 406.4bn in January.

Malaysia: GDP was 3.9% yoy in the first quarter from 3.0% prior, in line with consensus. The trade balance was MYR 12.8bn in March, from MYR 11.2bn and higher than the consensus of MYR 12.4bn. Exports increased to MYR 128.6bn from MYR 111.4bn. Imports increased to MYR 115.8bn from MYR 100.1bn.

Philippines: The balance of payments improved to a USD 1.2bn surplus in March from a USD 0.2bn deficit in February.

Thailand: Gross international reserves declined to USD 222.1bn for the week ended 11 April from USD 223.7bn prior.

Singapore: In political news, Prime Minister Lee Hsien Loong will step down on 15 May after a two-decade run. Deputy PM and Finance Minister Lawrence Wong will be the successor. Electronic exports decreased by 9.4% yoy in March compared to an increase of 5.2% in February. Non-oil exports also decreased faster than both consensus (-7.4%) and from February (-0.2%) to -20.7% yoy.

Latin America

Argentina: President Javier Milei requested Argentina join NATO as a global partner. It is unclear if that would have any relevant implications beyond bringing Argentina closer to the US. Congress started debating a new fiscal reform bill that lowers the income tax threshold, establishes a tax amnesty that creates a scheme to regularise undeclared assets and cuts personal asset tax, amongst other changes.11 In the meantime, Finance Minister Luis Caputo pledged to keep achieving a budget surplus, which kept Argentinian bonds well supported again last week. The trade balance was USD 2.1bn in March, above estimates of USD 1.2bn and USD 1.4bn prior. Exports rose to USD 6.4bn from USD 5.5bn. Imports rose to USD 4.3bn from USD 4.1bn.

Brazil: Inflation increased at a faster rate of 0.29% in the week ended 15 April, from -0.18% the week prior. Economic activity slowed to 0.4% yoy (2.6% yoy) in February, from 0.5% mom (3.3% yoy) in January, broadly in line with consensus.

Colombia: Thousands took to the street across Colombia demonstrating against the government due to poor economic performance and appeasement to guerilla groups.12 President Gustavo Petro disapproval rate is close to 60% according to the latest polls. Colombian assets have been supported by the fact that Petro’s low approval rates mean he can’t implement his market unfriendly policies. Nevertheless, the economy continues to struggle due to low private sector confidence driving investment away. Industrial production was 0% yoy in February, higher than the prediction of -0.8% and -1.5% in January. Manufacturing production had a slower decline of 2.2% yoy in February compared to -4.2% in January. Similarly, retail sales declined by -1.8% yoy in February compared to -3.9% in January, stronger than the consensus of -2.7% yoy.

Ecuador: Ecuador President Daniel Noboa ordered businesses and government offices to shut down last Thursday and Friday, due to lack of electricity, blamed on drought and sabotage, ahead of the referendum on Sunday. The population voted for the government’s proposals in nine out of 11 questions, in line with pollsters’ expectations. All questions passed focused on security, suggesting strong support for Noboa’s hard-line approach towards crime. Focus will now turn to whether the country manages to secure an IMF agreement which would potentially postpone the repayment of up to USD 3bn due by the end of 2026. An agreement would potentially open the door for up to USD 1.3bn on resilience and stability funds (RSF). Ecuador has negligible market debt service until 2026 when repayments rise above USD 1bn.

Mexico: International reserves stood at USD 217.2bn for the week ended 12 April, broadly unchanged from the previous week. Retail sales increased to 0.4% mom (3.0% yoy) in February from -0.6% mom (-0.8% yoy) in January, above consensus.

Peru: Economic activity was stronger than expected at 2.9% yoy in February compared to 1.4% in January and the 2.1% estimate.

Central and Eastern Europe

Poland: CPI inflation was 0.2% mom in March, unchanged from February. CPI inflation in yoy terms also remained broadly at the same level of 2.0%. Core CPI inflation remained at 0.5% mom in the same period, in line with consensus. The budget deficit widened significantly to -PLN 24.5bn in March, from -PLN 7.8bn in February. Expenditures rose 25% yoy to PLN 171.0bn. The budget performance stood at 13.3% of the 2024 plan. Consumer confidence in April rose to -11.5 from -12.3 and above consensus of -12.0.

Romania: Industrial sales rose to 8.2% yoy (11.7% mom) in February from 2.5% yoy (1.2% mom) in January.

Central Asia, Middle East, and Africa

Angola: CPI inflation accelerated to 26.1% in March from 24.1% in February.

Dubai: CPI inflation slowed marginally to 3.3% in March from 3.4% in February. Dubai experienced its heaviest rains in 75 years, leading to flight cancellations. Authorities are increasingly concerned about the effect of severe weather due to a lack of sufficient drainage systems.13

Egypt: Finance Minister Mohamed Maait stated at the IMF spring meeting that Egypt is in talks with domestic public entities, such as pension and insurance funds as well as Egypt’s central bank, to extend the maturities of domestic obligations owed to them.14 Egypt has a large stock of short-term debt in local currency. As per Bloomberg data, of the USD 114bn of domestic debt (USD 73bn T-bills and USD 40bn bonds), USD 93bn expires before the end of 2025 and another USD 12bn in 2026. The trade deficit widened to -USD 2.0bn in February from -USD 2.1bn prior. Imports rose to USD 6.1bn from USD 5.5bn. Exports declined to USD 3.4bn from USD 3.5bn.

Israel: The unemployment rate remained unchanged at 3.3% in March from the previous month. CPI inflation rose to 0.6% mom (2.7% yoy) in March from 0.4% mom (2.5% yoy) in February, slightly above consensus. Inflation decelerated due to the consumption slump in the war against Hamas. Economists predict monetary easing starting next month. GDP annualised was -21.0% in the fourth quarter of 2023 from -20.7% in the prior quarter. S&P downgraded Israel to ‘A+’ from ‘AA’, with the outlook remaining negative due to heightened geopolitical risk.

Kenya: Overseas remittances slowed to 14% yoy in March from 25% in February.

Nigeria: CPI inflation was at 33.2% yoy in March, higher than both estimates of 32.9% and 31.7% in the prior month. Headline CPI increased by 3.0% mom in March. Annual food inflation increased to 40.0% in March from 37.9% in February. Core inflation increased to 25.4% yoy in March from 24.7% in February.

Oman: CPI inflation increased to 0.2% yoy in March from 0.0% in February.

Qatar: CPI inflation slowed to 1.0% in March from 2.7% in February.

Saudi Arabia: CPI inflation declined to 1.7% yoy in March from 1.8% in February.

South Africa: CPI inflation slowed to 0.8% mom (5.3% yoy) in March from 1.0% mom (5.6% yoy) in February, more than consensus at 0.9% mom (5.4% yoy). Core CPI inflation was at 0.7% mom (4.9% yoy) in March from 1.2% mom (5.0% yoy). Retail sales increased to 0.4% mom in February from -3.2% in January, slower than the consensus of 1.2%.

Türkiye: The unemployment rate slowed slightly to 8.7% in February from 9.0% in January. The Central Government Budget deficit widened to -TRY 209.0bn in March from -TRY 153.8bn in February. Home sales rose to 105.4k in March, from 93.9k prior.

Developed Markets

United States: Retail sales rose above the consensus of 0.4% mom to 0.7% mom in March, suggesting momentum in consumer spending heading for the second quarter. However, this was lower than 0.9% mom in February. Housing starts declined to 1,321k in March from 1,549k in February and lower than consensus of 1,485k. Industrial production increased at the same rate of 0.4% in March from February, as expected. Initial jobless claims were subdued at 212k for the week ended 13 April, unchanged from prior and below consensus of 215k. Continuing claims increased to 1,812k for the week ended 6 April from 1,810k prior. Existing home sales decreased to 4.19m in March from 4.38m prior, marginally below consensus.

Europe: The ECB’s Chief Economist Philip Lane said on 15 April that “the current phase of disinflation is necessarily bumpy” and “headline inflation is expected to fluctuate around current levels in the near term on account of base effects in the energy component and the reversal of the upward effect of the early timing of Easter on services inflation in March”. The Eurozone trade balance declined to EUR 17.9bn in February from EUR 27.1bn prior, and lower than EUR 21.8bn estimates. Industrial production came in line with consensus at 0.8% mom in February from -3.0% in January.

United Kingdom: CPI inflation was 0.6% mom (3.2% yoy) in March from 0.6% mom (3.4% yoy) in February, slightly above consensus. Core CPI inflation was 4.2% yoy in March from 4.1% in February. Retail sales excluding auto fuel declined by 0.3% mom, compared with an increase of 0.3% in February.

Japan: Core Machine Orders increased to 7.7% mom in February from -1.7% in January and significantly above estimates of 0.8%. National CPI inflation was slightly subdued in March, at 2.7%, down from 2.8% in February and estimates.

1. See – https://www.ft.com/content/3d0ddbe1-4637-4262-ba40-934015606166

2. See – https://www.imf.org/en/Publications/FM/Issues/2024/04/17/fiscal-monitor-april-2024?cid=bl-com-SM2024-FMOEA2024001&utm_medium=email&utm_source=govdelivery

3. See – https://www.wsj.com/world/americas/u-s-says-oil-companies-in-venezuela-can-still-operate-despite-regime-oppression-551d62b0?mod=world_lead_pos1

4. See – https://www.ft.com/content/00bb5653-e9aa-4af1-8f9e-705137947b32

5. Periods: August 2016 to July 2018 and November 2020 to February 2022. Sanctions were imposed on 6 August 2018 as per Executive Order 13846. https://iranprimer.usip.org/resource/timeline-us-sanctions

6. See – https://www.ft.com/content/7c6ac9ed-f2b6-401e-8aa5-75b9a3616c17

7. See – https://www.ft.com/content/007b0cce-1778-4ba8-a3c0-0879e8492292

8. See – https://aje.io/ygfkcu

9. See – https://blinks.bloomberg.com/news/stories/SC2X19073NCW

10. See – https://time.com/6968357/biden-china-xenophobia-2024-campaign

11. See – https://buenosairesherald.com/politics/commission-debates-mileis-new-bill-on-tax-amnesty-lower-income-tax-threshold

12. See – https://www.lemonde.fr/en/international/article/2024/04/21/colombia-hundreds-of-thousands-protest-president-gustavo-petro_6669101_4.html

13. See – https://www.ft.com/content/3b1fa9d7-9151-4d0a-a94f-e3c16af4138b

14. See – https://blinks.bloomberg.com/news/stories/SC3ARBDWLU68

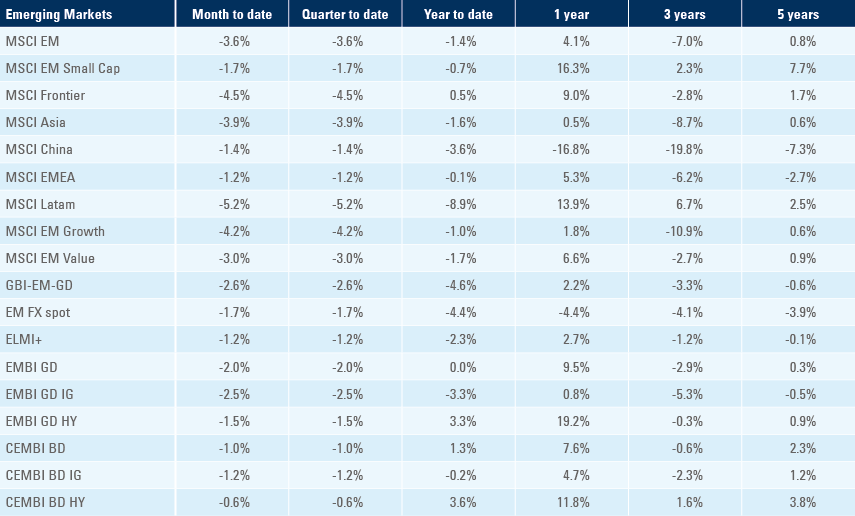

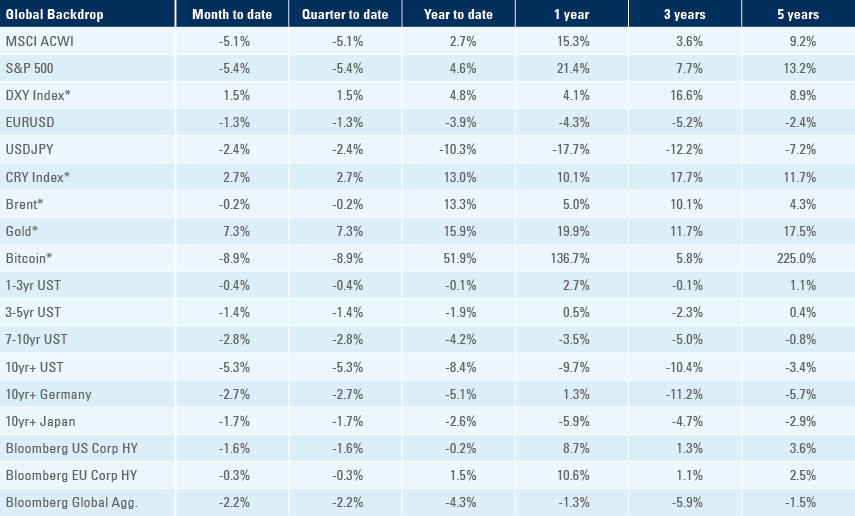

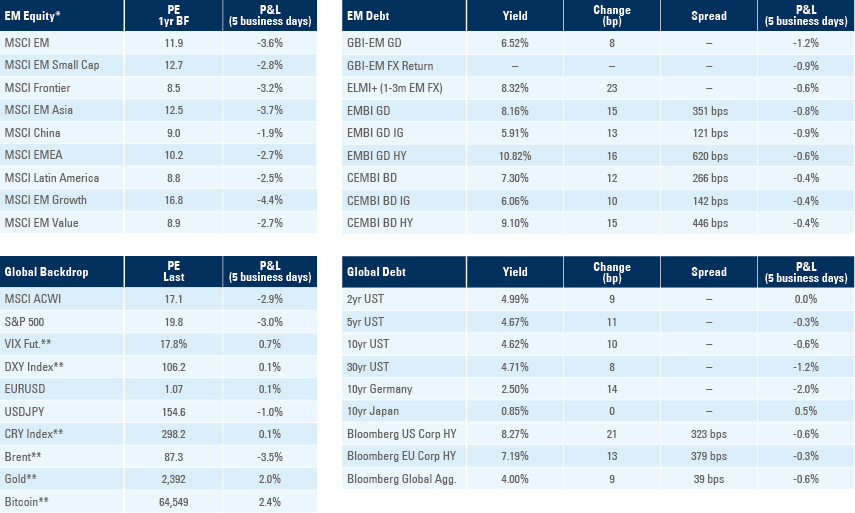

Benchmark performance